10-16: General Interface Solution (GIS) has already developed a foldable AMOLED touch panel; BOE’s first customer for its G6 flexible AMOLED is Huawei; etc.

Chipsets

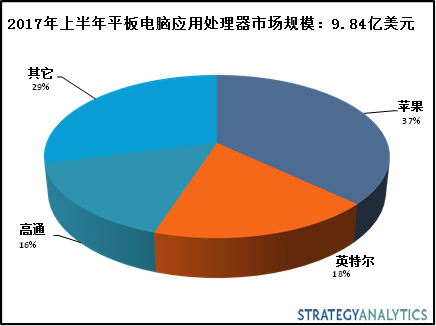

After 2 consecutive years of decline, the global tablet applications processor (AP) market returned to growth and registered a 5% year-over-year growth to reach USD984M in 1H17, according to Strategy Analytics. Apple, Intel, Qualcomm, MediaTek and Samsung LSI captured the top-five revenue share rankings in the tablet AP market in 1H17, said Strategy Analytics. In addition, Strategy Analytics estimated that x86-based tablet AP shipments accounted for 14% of total tablet AP shipments in 1H17, up from 10% a year earlier. (Digitimes, Strategy Analytics, 199IT)

Touch Display

General Interface Solution (GIS) has already developed a foldable AMOLED touch panel that can be folded 200,000 times. Considering GIS-KY has been deeply working with Apple, it is safe to say Apple is likely to develop next generation iPhone with GIS. LG Display (LGD) may start manufacturing foldable OLED display from 2020, and LGD has allegedly finished foldable display prototype in 2, 3 years ago. (China Times, UDN)

BOE is going to start producing flexible OLEDs at its B7 plant in Chengdu, at the end of Oct 2017. It has already secured parts and materials that are needed to manufacture flexible OLEDs and is planning to produce 5.99” flexible OLEDs starting from Nov 2017 after starting off with 5.5” flexible OLEDs. It BOE is going to produce about 10,000 flexible OLEDs per month. Although its output is rather small due to low yield, it is going to supply its flexible OLEDs to Huawei. (CNMO, Laoyaoba, Sina, OLED-Info, ET News)

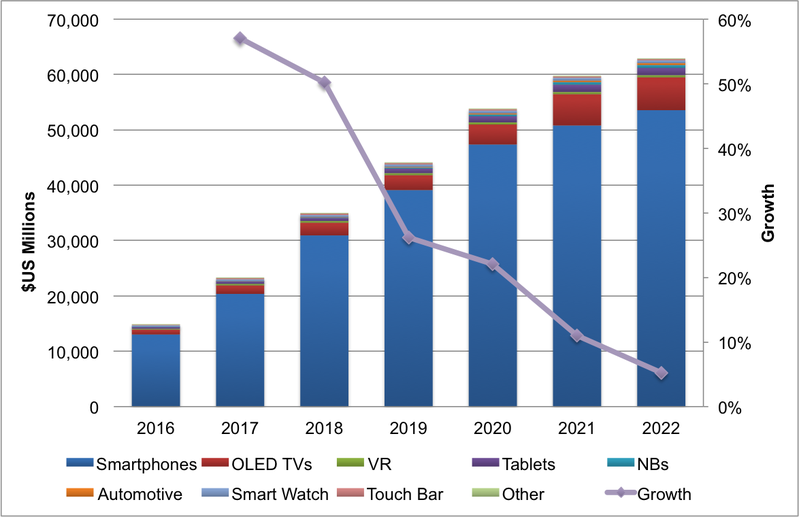

Global shipments of OLED smartphone panels are expected to top 1.37B units in 2019 and surpass the unit shipments of TFT LCD panels in 2020, DSCC (Display Supply Chain Consultants) has estimated. DSCC now sees OLED revenues rising 57% in 2017 to USD23.2B. 2018 growth is also expected to be strong, up 50% to USD34.9B. Double-digit growth is expected to continue through 2021 resulting in 27% 2016~2022 CAGR to USD62.8B. (Digitimes, press, DSCC, press, iFeng)

Camera

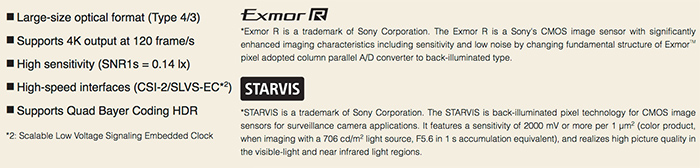

Sony has commercialized the “IMX294CJK” Type 4/3 back-illuminated CMOS image sensor with approximately 10.71M-effective pixels for the expanding security camera market. It is the first in-house image sensor for security cameras to adopt the Type 4/3 format, and realizes output of the number of pixels needed for 4K at 120 frame/s (in ADC 10-bit output mode). (My Drivers, Sony)

Memory

Toshiba allegedly decided to shut down the production of NAND flash for 3~6 weeks to deal with the hacking, but production has now returned to normal, adding that the suspension resulted in reduced NAND flash production nearly 100,000 wafers. The incident could tighten global NAND flash supply. (Digitimes, press, PC Games N, Laoyaoba, My Drivers)

TrendForce points out that the rumour of Toshiba’s NAND Flash production problem of causing wafer loss of up to 100K units is not as severe as the market assumes. The production line did encounter some problems, but the overall impact is much lower than 100K loss, also the factory has not shut down. Toshiba’s orders for its clients in 4Q17 do not have direct impact. (TrendForce[cn])

TrendForce estimates that mobile (LPDDR) DRAM products will see sequentially quarterly price increases in the average range of 10%~15% in 4Q17. This price hike is attributed to DRAM suppliers seeking to correct price differences among various applications as well as the year-end busy season in the smartphone market. The percent of sequential price increase for mobile DRAM in 4Q17 is expected to be the largest when compared with percent increases for DRAM used in other applications. Looking ahead to 1Q18, TrendForce anticipates that the seasonal headwinds of the starting quarter will ease the strain on the DRAM supply, showing a moderation compared with 4Q17. (TrendForce[cn], TrendForce, press)

Biometrics

Huawei France has announced 3 new partnerships. It will work on facial recognition with start-up Chronocam, which specializes in computer vision in the fields of connected devices, autonomous vehicles, and surveillance. It will collaborate with Secure-IC, a spin-off from Telecom ParisTech University, on a project to improve the security of Kirin chipsets. It also plans to develop new projects on 3D mapping with Siradel, a 3D geospatial software company part of the Engie group. (CN Beta, L’usine Nouvelle, Telecom Paper)

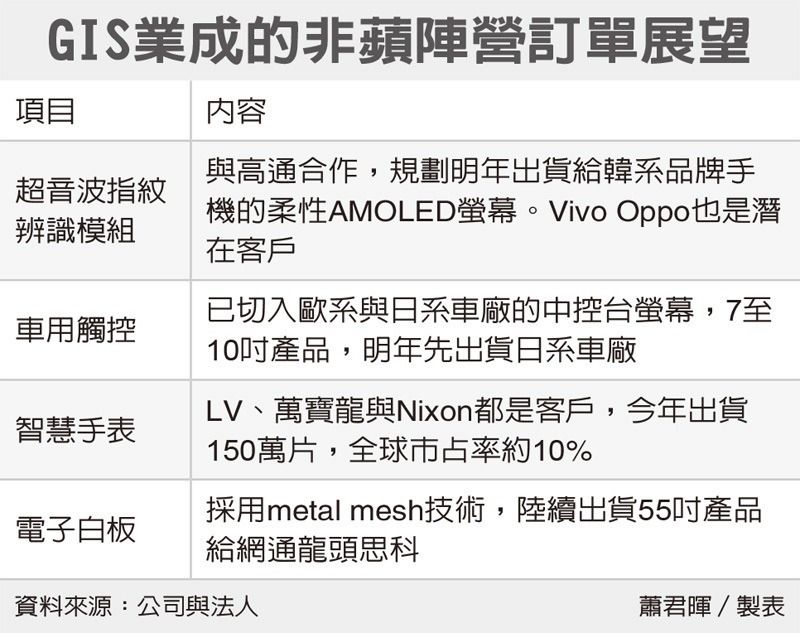

GIS-KY has won fingerprint module orders for Samsung smartphone’s AMOLED display, and they will be shipped in 2018. GIS’s technology leader Chen Bolun indicates the company is working with Qualcomm, successfully developed only 1.3 mm thick of optical ultrasound fingerprint identification module, which will begin shipping in 2018 to Samsung. This 1.3mm product is included with a flexible AMOLED screen plus protective glass. (Laoyaoba, Money Link, UDN)

CrucialTec is supplying its its fingerprint solution Biometric TrackPad to Google Pixel 2 series. The company’s Biometric TrackPad, or BTP, has been used by Huawei, Meizu, OPPO, vivo, Microsoft, Sony, Fujitsu and LG. (Laoyaoba, ET News, Tencent, The Nation)

Smartphones

China Academy of Information and Communications Technology (CAICT) has released a report of “2017 smart device industry development white paper”, showing that current China smartphone market is saturating, showing negative yearly growth. Currently there number of smartphone vendors has decreased to 192, and the top 5 vendors have occupied 70.4% of market share in 2Q17. (CAICT, report, My Driver)

Xiaomi opens up new Mi Store in Malaysia with another to come. The brand new Mi Store is located in Suria KLCC, more well known as the Petronas Twin Towers. (GizChina, Lowyat)

BLU S1 is launched – 5.2” HD display, MediaTek MT6750 processor, 13MP + 5MP cameras, 2GB RAM, 16GB storage, Android 7.0, 2800mAh battery, USD180. (Phone Arena, Amazon, BLU)

Xiaomi Redmi 5A is launched in China – 5” HD display, Qualcomm Snapdragon 425 processor, 13MP f/2.2 + 5MP f/2.0 cameras, 2GB RAM, 16GB storage, 3000mAh battery, CNY599. (Android Headlines, NDTV, Mi.com, GSM Arena)

Huawei Mate 10 and Mate 10 pro are launched, powered by Huawei Kirin 970 processor featuring Neural Processing Unit (NPU), rear dual 20MP + 12MP OIS PDFA + front 8MP cameras, Android 8.0, USB Type-C: Mate 10 – 5.9” 2560×1440 IPS LCD display, 4GB RAM, 64GB storage, front fingerprint, 4000mAh battery, EUR699. Mate 10 Pro – 6” 2160×1080 AMOLED display, 6GB RAM, 128GB storage, IP67 certified, rear fingerprint, 4000mAh battery, EUR799. (Phone Arena, Mashable, The Verge, The Guardian, TechWeb, ZOL, 163)

Internet of Things

In order to make up for and improve the infrastructure support of electric vehicles (EV), by 2040, the world will need to build about 526M recharge units. Morgan Stanley analysts said that the Tesla electric car market size by 2023 will grow to 10 times of end of 2017. However, the lack of infrastructure will become the biggest bottleneck for Tesla’s “take off”. As the world’s largest EV market, China’s investment in EV infrastructure in 2040 will account for about 1/3 of the global total investment. (CN Beta, Jiemian, Sina)

http://www.technoogossip.com/2018/07/samsung-plans-to-release-foldable.html

same this article