11-07: Broadcom has made an unsolicited offer to buy Qualcomm with USD130B;

Chipsets

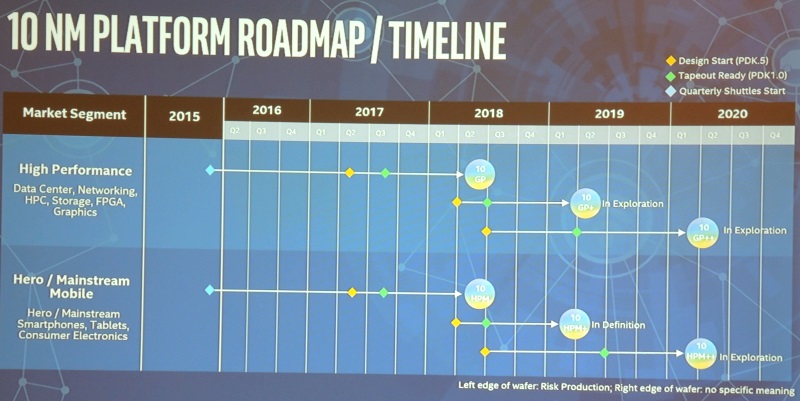

Intel has announced the first fruits of collaboration with ARM may be ready to hit the market as soon as the end of 2017. Their new 10 nm 3.5 GHz processor will feature 100M transistors (twice the density of Samsung’s comparable processor) while still only consuming 0.25 mW/Mhz. (Laoyaoba, Sohu, iFeng, Guru 3D, MS Poweruser)

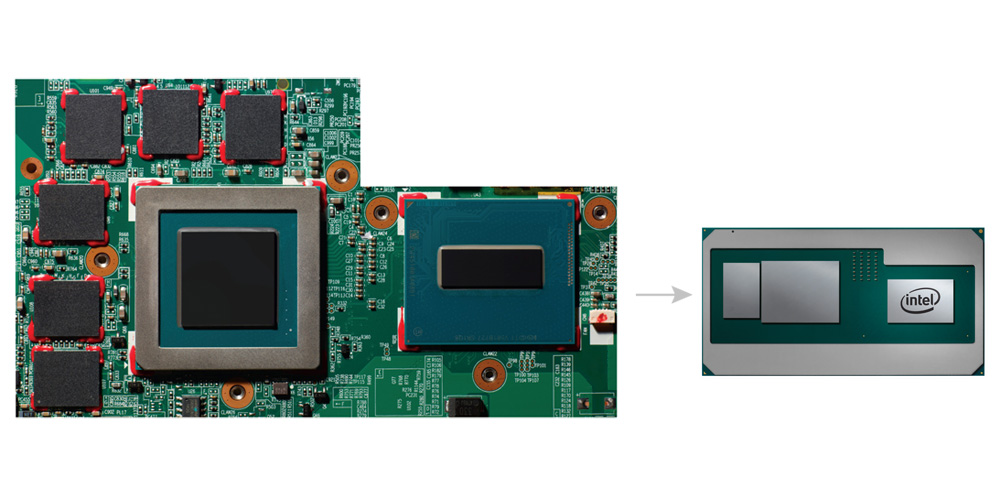

Intel and Advanced Micro Devices (AMD) are teaming up to co-design an Intel Core microprocessor with a custom AMD Radeon graphics core inside the processor package, aimed at bringing top-tier gaming to thin-and-light notebook PCs. (CN Beta, Sohu, WSJ CN, The Street, Ars Technica, The Verge, Intel)

MediaTek subsidy has issued a notice of investment, the originally scheduled for October 30 within 6 months, the company will sell its not more than 5% of the total share capital of Goodix, the company has decided to move to 9 Nov 2017 within 6 months to sell up to 6.27% of the total share capital for profit. MediaTek currently holds about 20.91% of the equity of the share of Goodix. (Laoyaoba, UDN)

Cambricon releases 3 intelligent processor IP products—1H8, low-power processor for vision application; 1H16, aiming for smart driving era; and, 1M, which is more than 10 times the power of Cambricon 1A processor. (CN Beta, JRJ, Sina)

Cambricon founder and CEO Chen Tianshi reveals that the company aims to capture 30% of the high-power intelligent chipset market in China, and to make 1B units of smart devices world-wide to equip with the Cambricon processor. (CN Beta, JRJ, Sina)

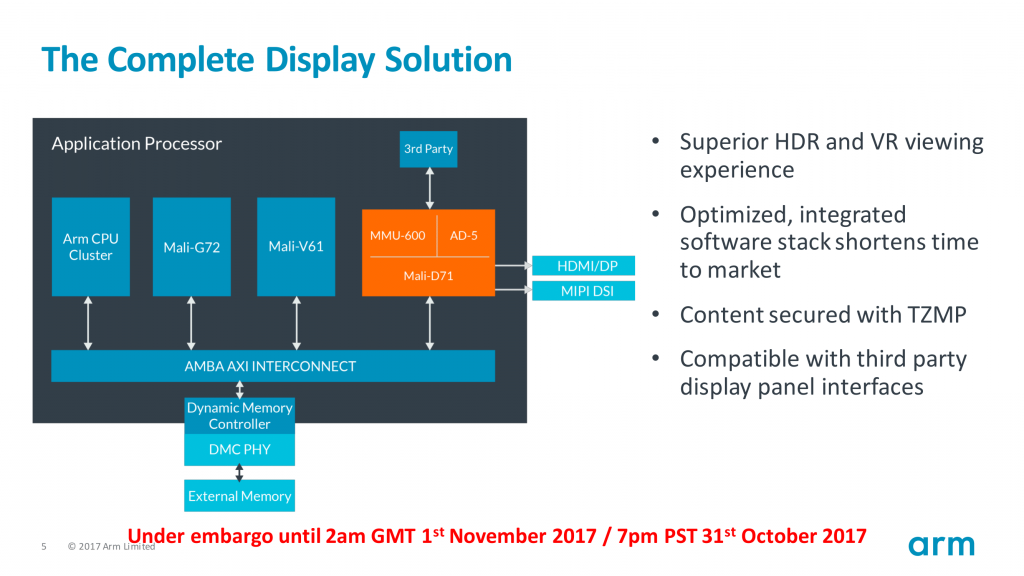

ARM is announcing their Mali-D71 display processor and two closely-related IP blocks, CoreLink MMU-600 and Assertive Display 5, angling for 4K VR and HDR implementations on mobile displays. All three blocks were developed together, and in turn they possess mutual optimizations in order to achieve VR-capable performance and HDR functionality. (Android Authority, Hexus, AnandTech, ARM, Laoyaoba)

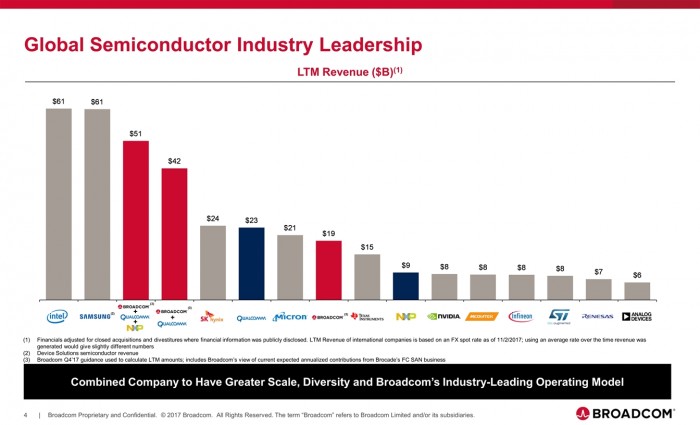

Broadcom has made an unsolicited offer to buy Qualcomm, in a deal that would be the largest technology acquisition ever. The deal’s total value is USD130B when including USD25B in net debt. (Android Authority, CNBC, Apple Insider, Reuters, CN Beta, RBC Capital)

Touch Panel

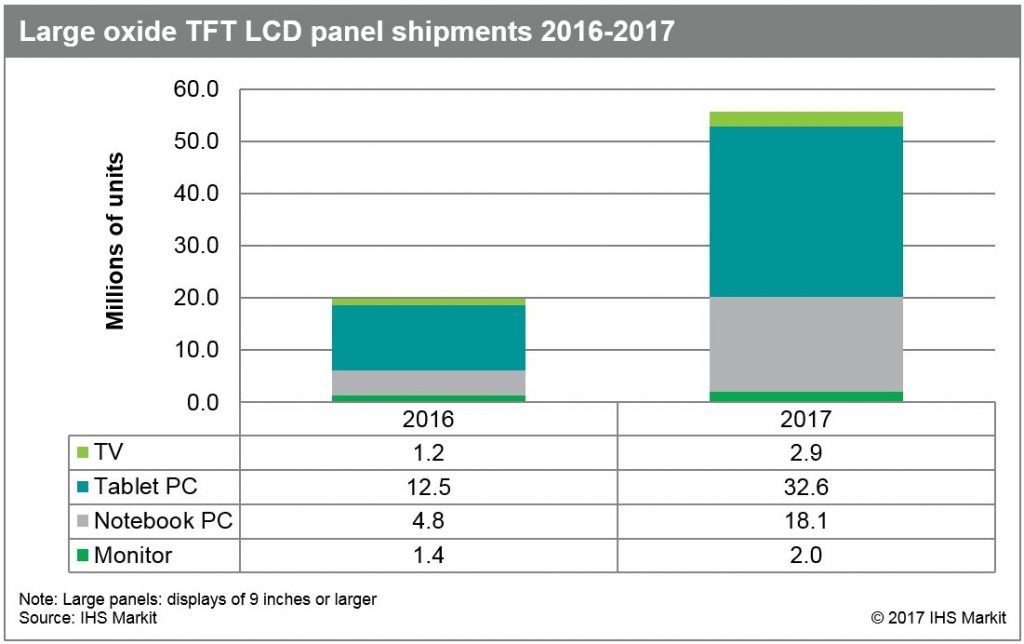

Oxide thin-film transistor (TFT) liquid crystal display (LCD) panels are increasingly adopted in mobile PCs due to their feature of high resolution while consuming low power. Global shipments of large oxide TFT LCD panels of 9” or larger are expected to grow from 20M units in 2016 to 55.6M units in 2017, according to IHS Markit. (IHS Markit, press, OfWeek)

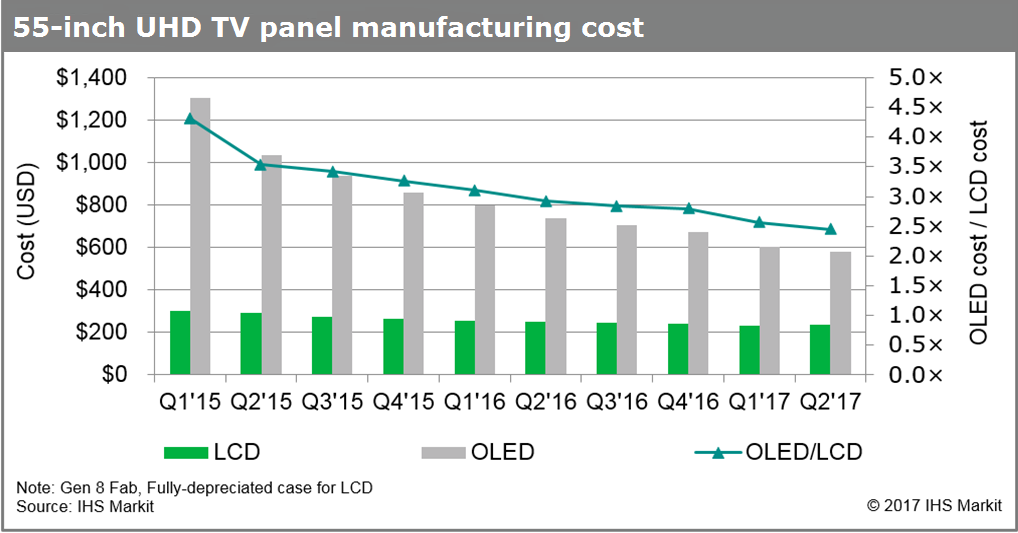

IHS Markit estimates that the total manufacturing cost of a 55” OLED ultra-high definition (UHD) TV panel — at the larger end for OLED TVs — stood at USD582 per unit in 2Q17, a 55% drop from when it was first introduced in 1Q15. The cost is expected to decline further to USD242 by 1Q21. (IHS Markit, press, Laoyaoba)

Memory

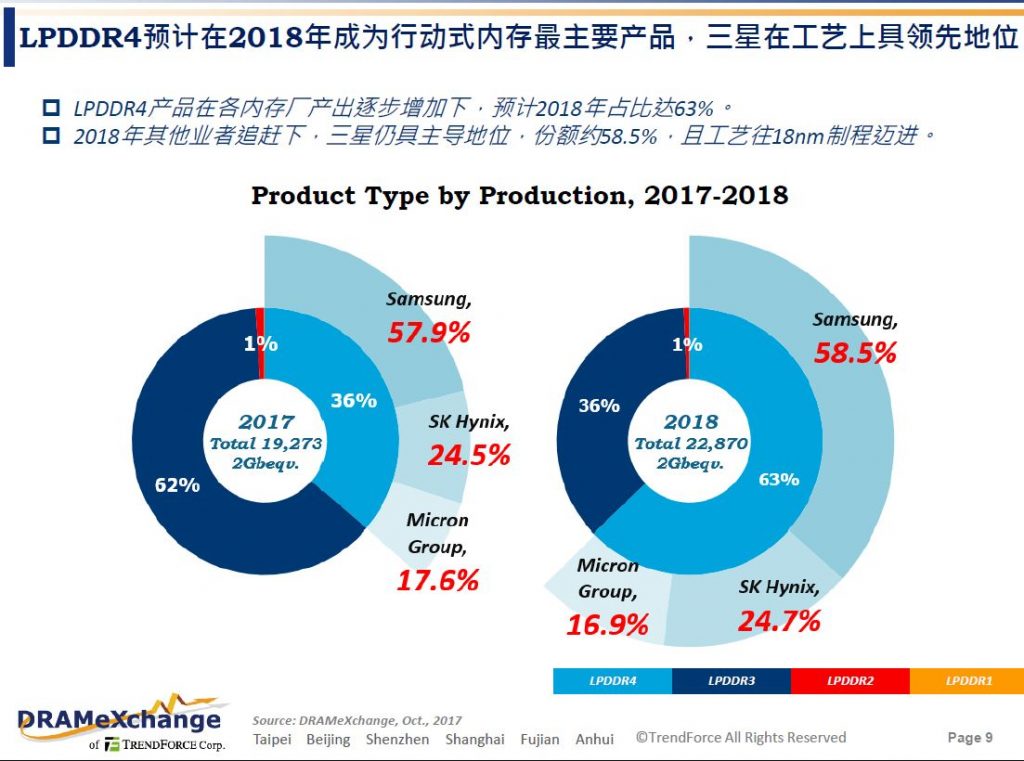

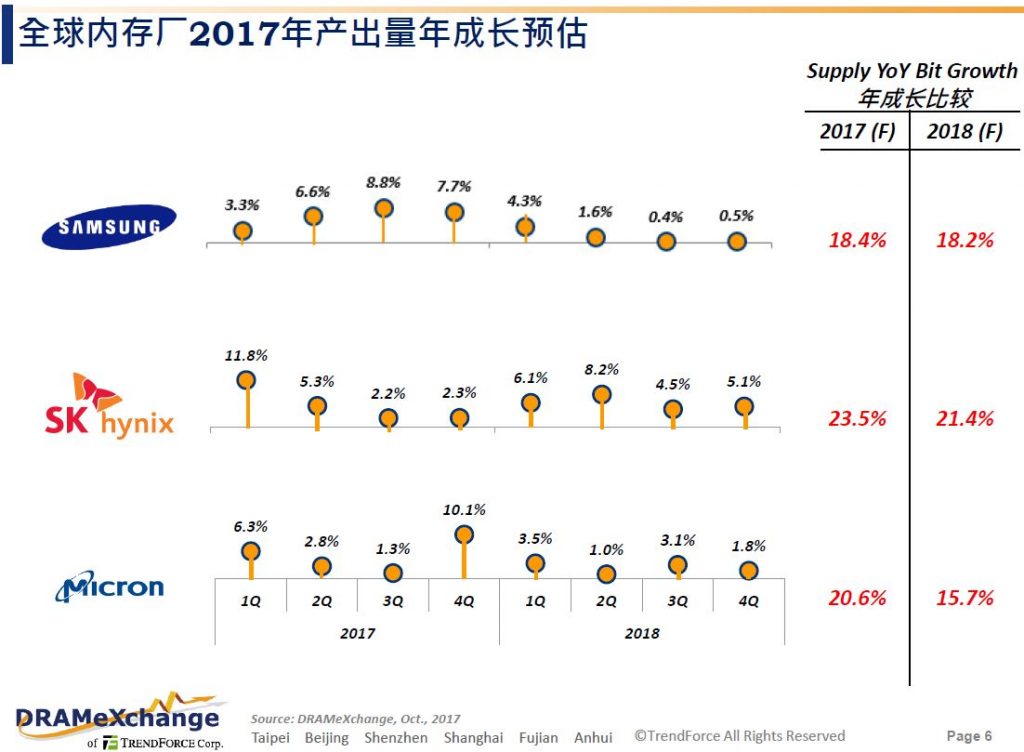

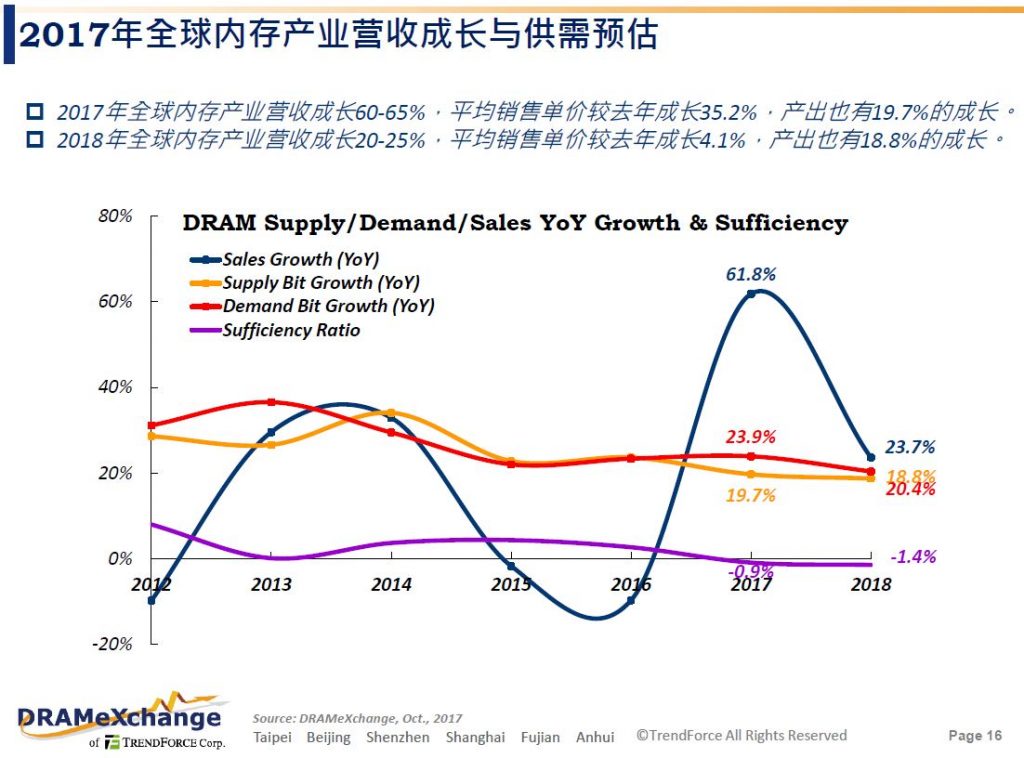

TrendForce analyst Ken Kuo has shared his view on the DRAM market for 2018, with the following key points:

- In 2018 global DRAM growth is believed to be 18.8%.

- Top 3 vendors production are not that positive: 4Q17 overall production is only 1167K units, and by end of 2018 it would be about 1204K units.

- Samsung holds more than half of the DRAM market share: 1H17 overall revenues, Samsung has captured 60.1% market share.

- DRAM supply will be tight in 2018: The under-supply situation is going to continue in 2018, which will cause the cost to increase in 1H18, though the increase rate is not as high as 2017.

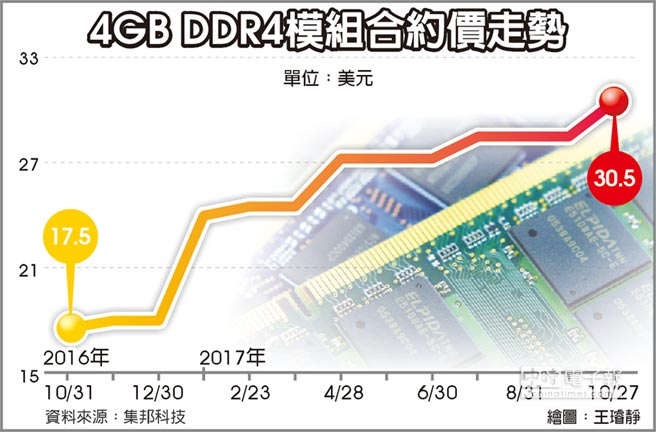

As Apple has already captured Samsung, SK Hynix and Micron 4Q17 mobile DRAM production capacity, the standard, server, niche and other DRAMs continue to be under-supply due to capacity crowding-out effect. The contract price will continue to increase 6%~10% in 4Q17, and there is already consensus in the market that the cost will increase 5% in the off-season 1Q18. Nanya, Winbond and ADATA will be the beneficial parties. (China Times, Laoyaoba)

Smartphones

After announcing 2017 target of 70M units shipment, more than CNY100B revenues in early 2017, now Lei Jun announces another target—2018 shipment 100M units, entering Fortune 500; in 5 years Mijia revenues to reach USD10B, and in 10 years Xiaomi to achieve CNY1000B revenues. (CN Beta, Sina, Sohu)

OPPO SVP Wu Qiang indicates that OPPO will continue its ‘fine products’ roadmap—aiming at consumer’s focus needs, consolidating product portfolio at the same time focusing resource on every products to make them competitive. He also admits that focusing on a few products are risky, yet he also indicates that OPPO never risk following the technical trends or hypes. (CC Stock, JRJ, Laoyaoba)

Samsung Electronics must pay approximately USD120M to Apple for patent infringement, the Supreme Court of the United States effectively ruled on Monday after refusing to hear the South Korean tech giant’s appeal to the fine confirmed by the U.S. Court of Appeals for the Federal Circuit in late 2016. (Apple Insider, Android Headlines, Sina)

Xiaomi reportedly enters the niche of three-rugged-features smartphone, which will be launched in 1H18. (GizChina, Sohu, Sina)

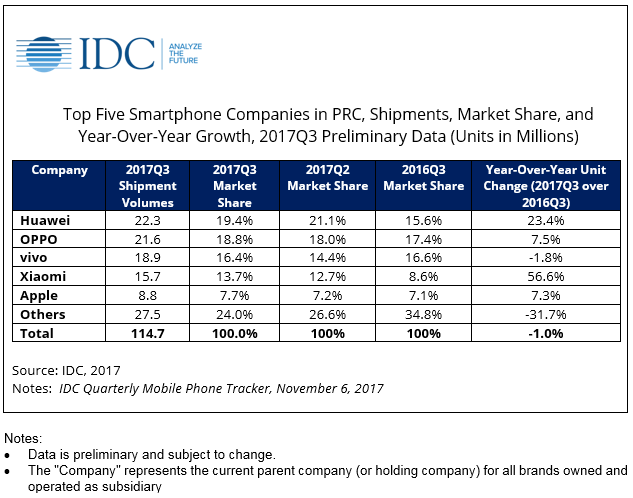

According to IDC, while the smartphone market saw a flat -1% YoY growth in 3Q17 compared to the same period last year, the share of the top 5 smartphone companies grew from 65.2% in 3Q16 to 76.0% in 3Q17. In particular, Xiaomi saw a good YoY growth while Apple finally bounced back after declining YoY for the past six quarters in China. (IDC, press, Laoyaoba)

Apple will reportedly expand its casing business for the 2018 iPhone to Catcher and Casetek, with a new casing required to improve data transmission quality, according to KGI Securities analyst Ming-Chi Kuo. At present Foxconn and Jabil supplies the internal supporting structure. It is not clear if the reported suppliers for 2018 will amplify offerings from the pair, or supplant it. (CN Beta, iDownload Blog, Apple Insider)

KGI Securities’ analyst Ming-Chi Kuo believes that Apple offering two iPhones with OLED displays and stainless steel cases in 2018—a sequel of iPhone X, and a ‘Plus’ variant of that phone. (Phone Arena, 9to5Mac, Sina, Laoyaoba)

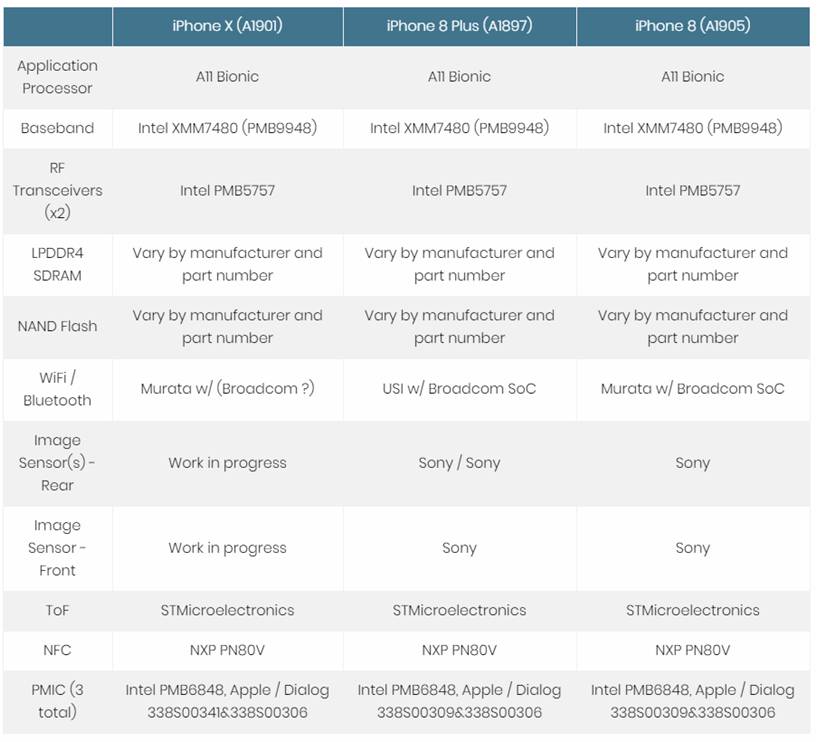

According to Tech Insights with its teardown analysis on Apple iPhone X, the 64GB iPhone X costs about USD357.50 to make, giving Apple a 64% profit margin on a USD999 pricetag. An equivalent iPhone 8 sells for USD699, but is said to have a margin of 59%. The X’s OLED display and linked parts are estimated to cost about USD65.50, versus USD36 for the 4.7” LCD assembly on the iPhone 8. The X’s stainless steel chassis, said to be worth USD36 versus just USD21.50 for the frame on the iPhone 8. (Tencent, iResearch, Mac Rumors, Apple Insider, Tech Insights)

Panasonic Eluga A4 is launched in India – 5.2” HD 2.5D curved display, MediaTek quad-core processor, 13MP + 5MP cameras,3GB RAM, 32GB storage, 5000mAh battery, INR12,490. (Android Headlines, India Today, NDTV, Indian Express)

Wearables

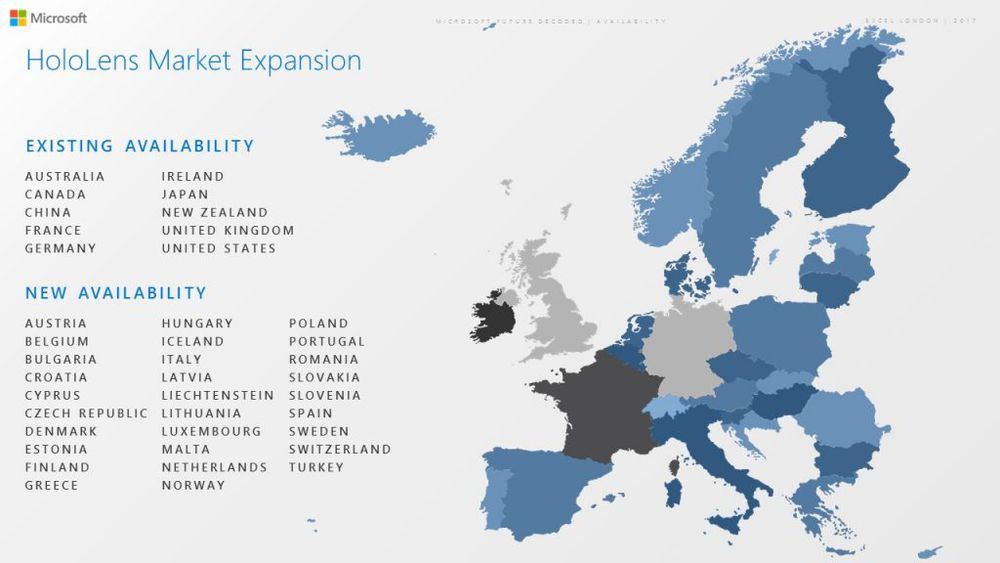

According to Microsoft HoloLens and Windows Experience GM Lorraine Bardeen, Microsoft is now making its HoloLens headset available in 29 new European markets today, bringing the total up to 39 countries. Microsoft already has some big-name customers for the technology. The German industrial conglomerate Thyssenkrupp is using it to speed up the planning and installation of stairlifts, and Ford is using it when designing new cars. (TechNews, The Verge, Fortune, Windows)

ZephVR, created by Weasel Labs, is an add-on accessory using machine learning to blow air on user’s face to simulate real wind and movement in games and experiences. (CN Beta, Upload VR, Digital Trends, Kickstarter)

Internet of Things

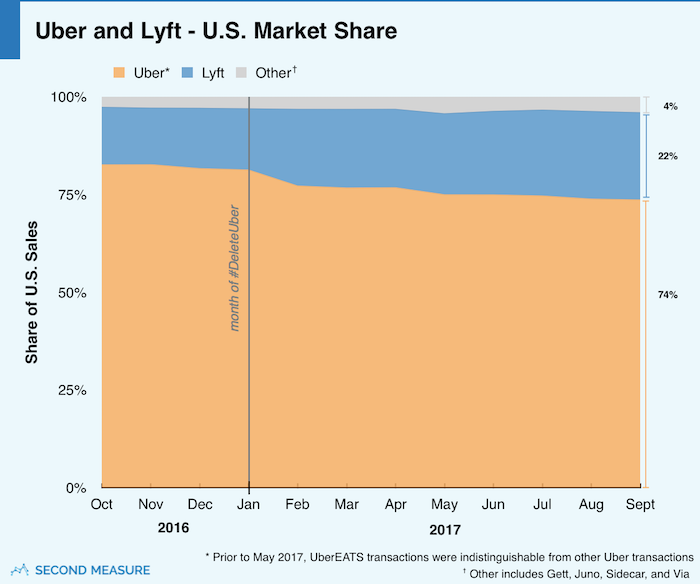

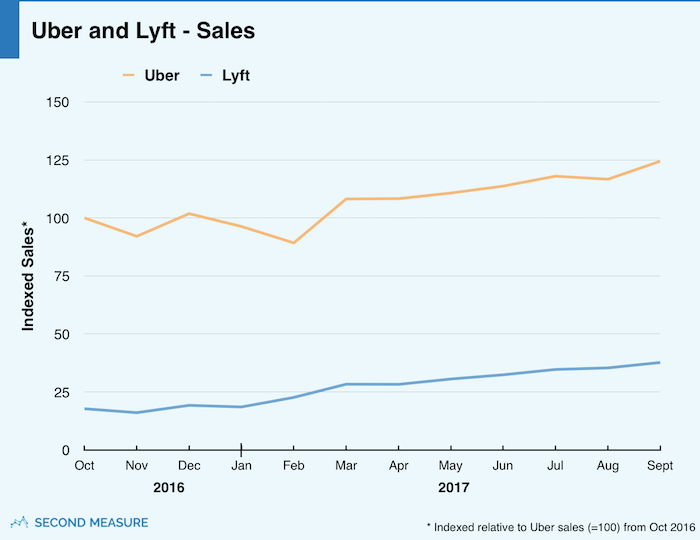

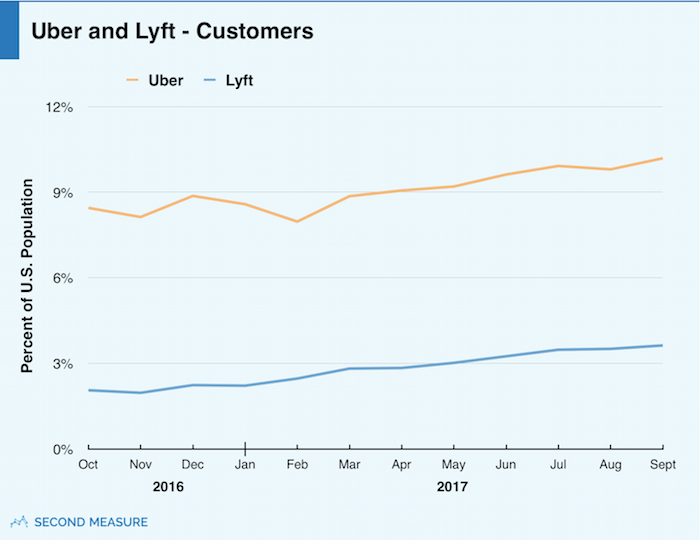

Uber still holds 74% of the ride-hailing market in the United States, Second Measure found earlier Oct 2017. According to the same data collected in Sept 2017, Uber’s main rival Lyft presently has 22% of the market, with the remaining 4% being distributed among all other companies operating in the country. (Android Headlines, Recode, Second Measure, press)