3Q17 Smartphones Shipment (IDC)

This is a simple report summarizing the shipment of mobile devices—smartphones, feature phones and tablets—based on IDC’s latest number (3Q17). The reasoning behind some of those numbers cannot be explained in detail here, but will be explored in another report.

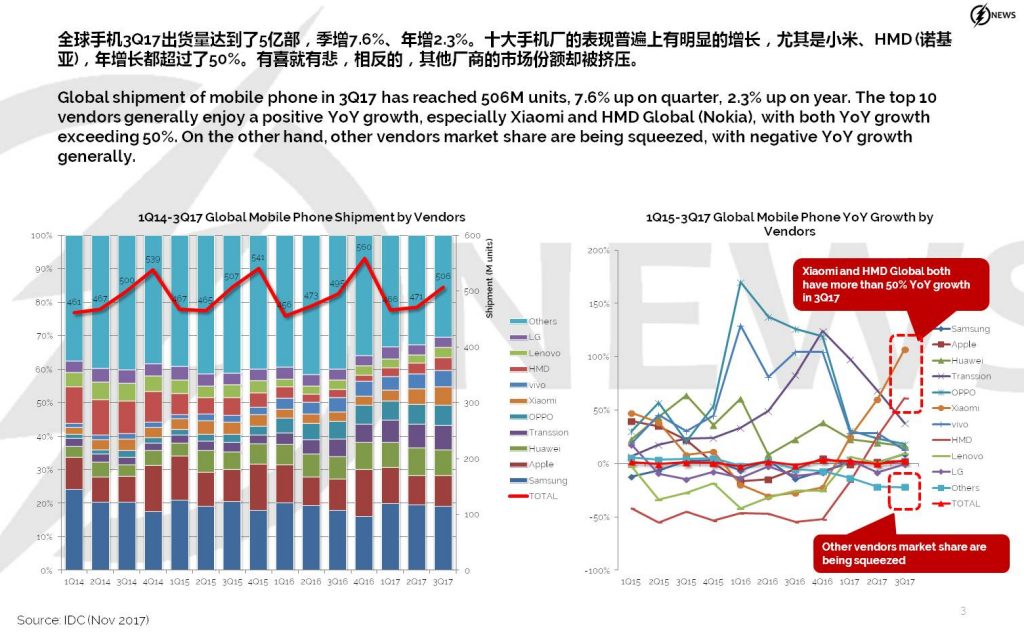

- Global shipment of mobile phone in 3Q17 has reached 506M units, 7.6% up on quarter, 2.3% up on year. The top 10 vendors generally enjoy a positive YoY growth, especially Xiaomi and HMD Global (Nokia), with both YoY growth exceeding 50%. On the other hand, other vendors market share are being squeezed, with negative YoY growth generally.

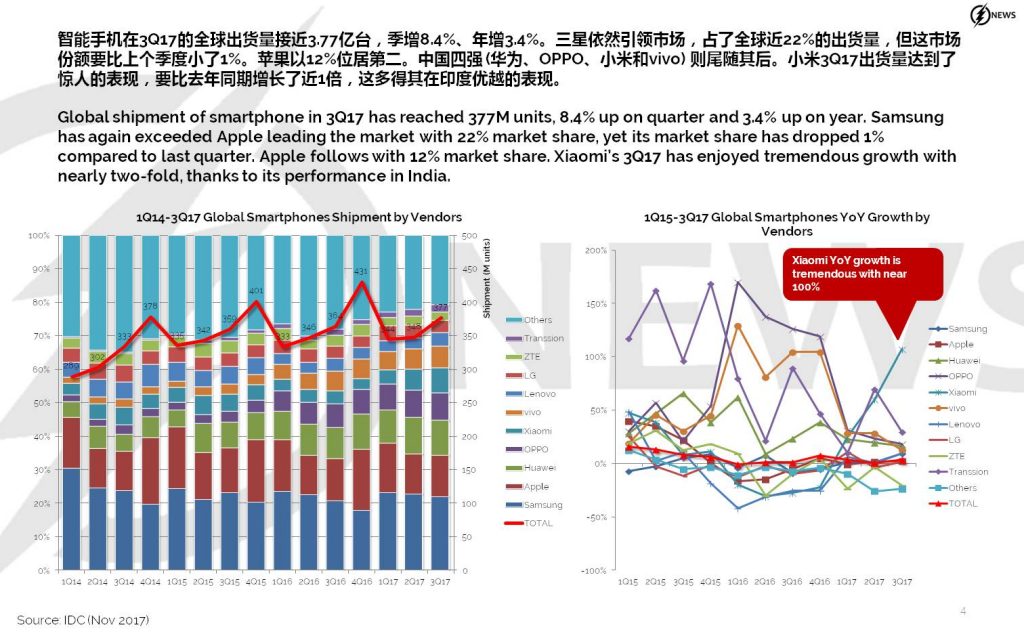

- Global shipment of smartphone in 3Q17 has reached 377M units, 8.4% up on quarter and 3.4% up on year. Samsung has again exceeded Apple leading the market with 22% market share, yet its market share has dropped 1% compared to last quarter. Apple follows with 12% market share. Xiaomi’s 3Q17 has enjoyed tremendous growth with nearly two-fold, thanks to its performance in India.

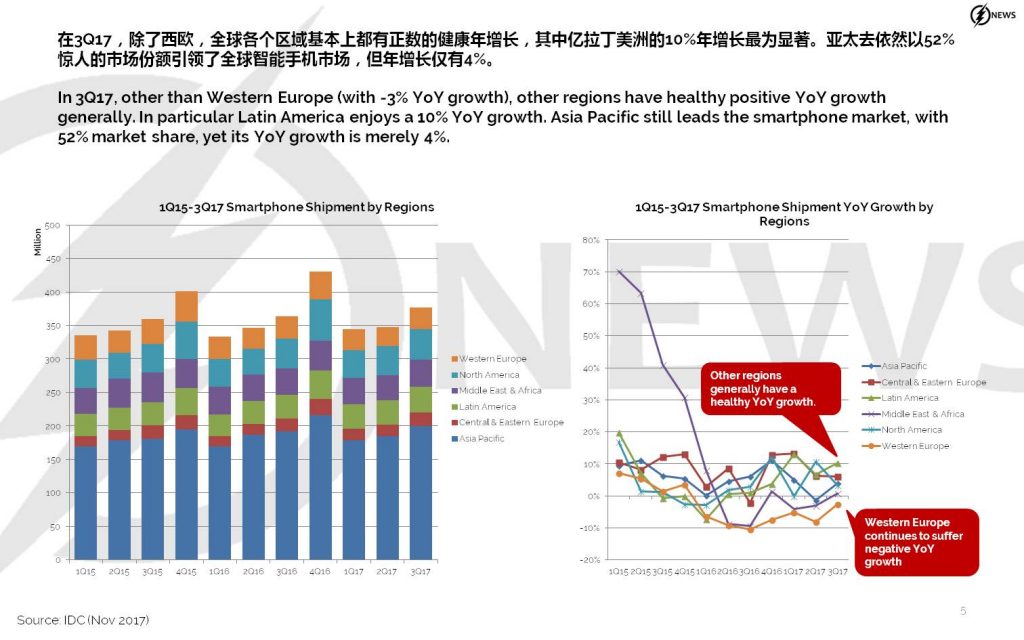

- In 3Q17, other than Western Europe (with -3% YoY growth), other regions have healthy positive YoY growth generally. In particular Latin America enjoys a 10% YoY growth. Asia Pacific still leads the smartphone market, with 52% market share, yet its YoY growth is merely 4%.

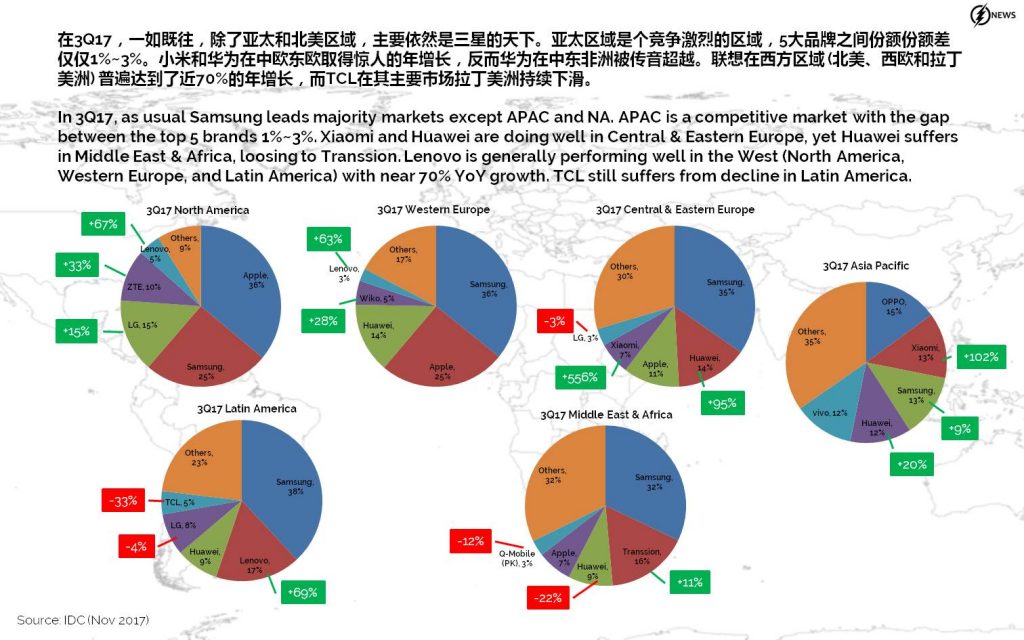

- In 3Q17, as usual Samsung leads majority markets except APAC and NA. APAC is a competitive market with the gap between the top 5 brands 1%~3%. Xiaomi and Huawei are doing well in Central & Eastern Europe, yet Huawei suffers in Middle East & Africa, loosing to Transsion. Lenovo is generally performing well in the West (North America, Western Europe, and Latin America) with near 70% YoY growth. TCL still suffers from decline in Latin America.

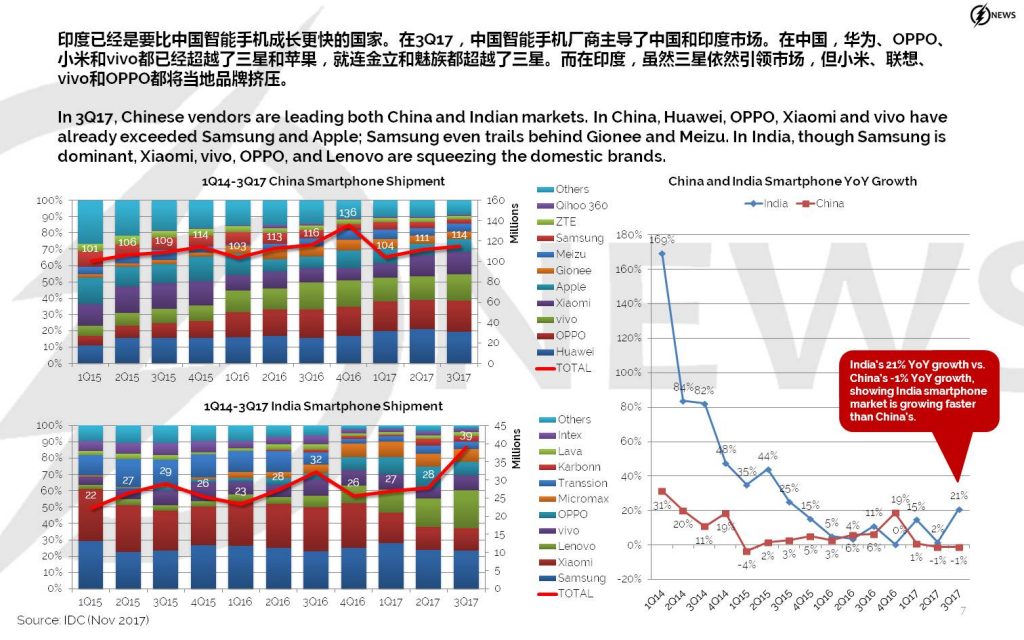

- In 3Q17, Chinese vendors are leading both China and Indian markets. In China, Huawei, OPPO, Xiaomi and vivo have already exceeded Samsung and Apple; Samsung even trails behind Gionee and Meizu. In India, though Samsung is dominant, Xiaomi, vivo, OPPO, and Lenovo are squeezing the domestic brands.

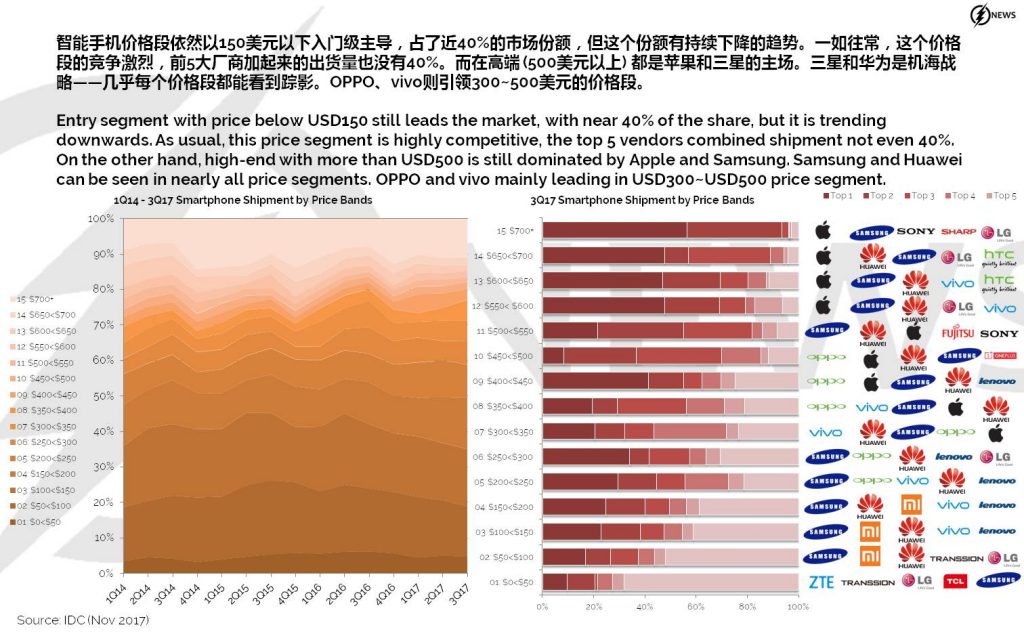

- Entry segment with price below USD150 still leads the market, with near 40% of the share, but it is trending downwards. As usual, this price segment is highly competitive, the top 5 vendors combined shipment not even 40%. On the other hand, high-end with more than USD500 is still dominated by Apple and Samsung. Samsung and Huawei can be seen in nearly all price segments. OPPO and vivo mainly leading in USD300~USD500 price segment.

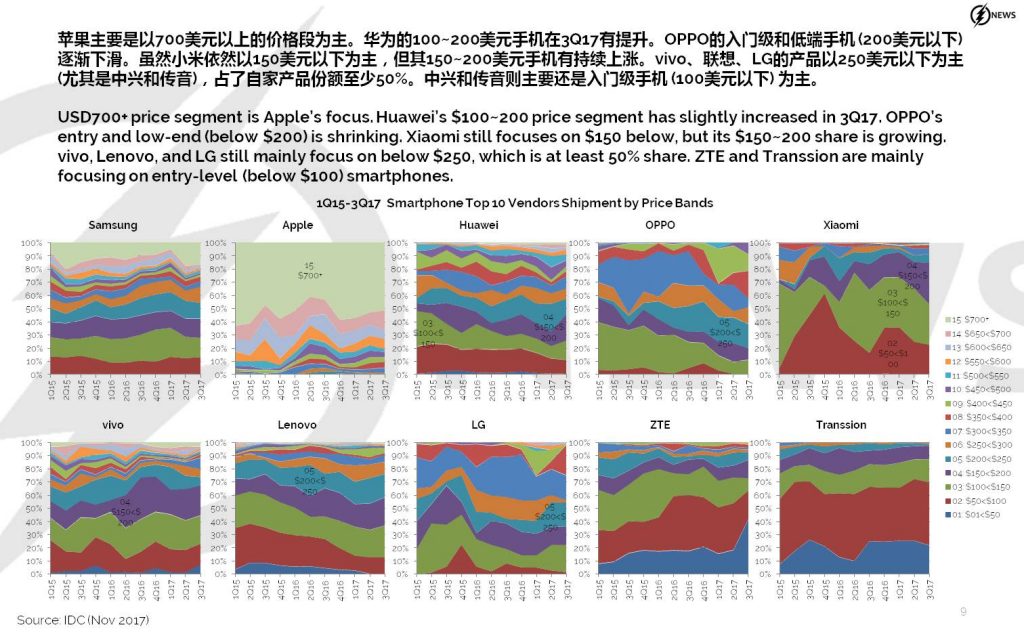

- USD700+ price segment is Apple’s focus. Huawei’s $100~200 price segment has slightly increased in 3Q17. OPPO’s entry and low-end (below $200) is shrinking. Xiaomi still focuses on $150 below, but its $150~200 share is growing. vivo, Lenovo, and LG still mainly focus on below $250, which is at least 50% share. ZTE and Transsion are mainly focusing on entry-level (below $100) smartphones.

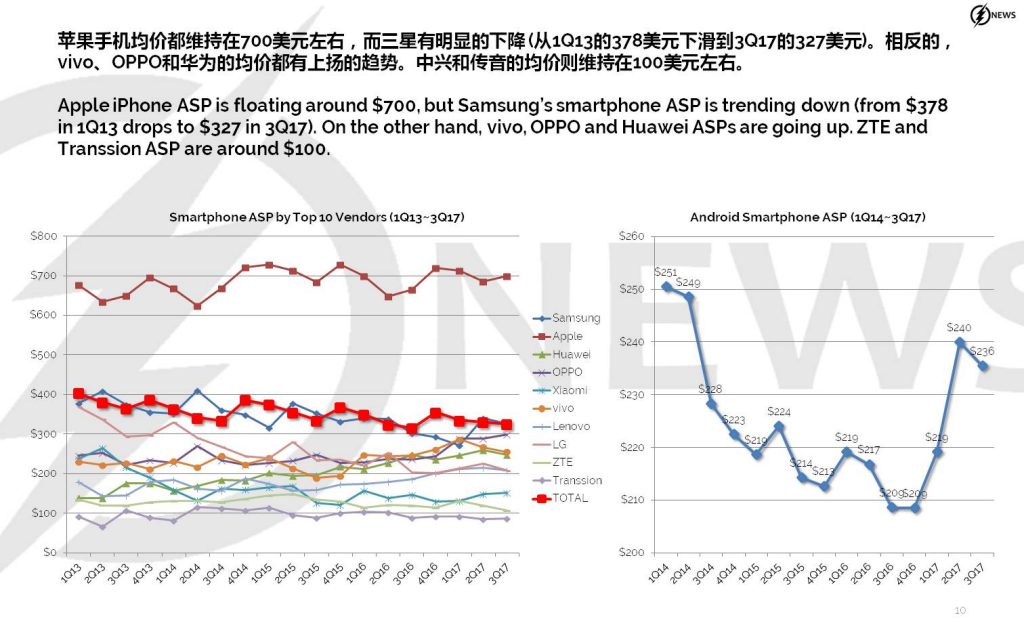

- Apple iPhone ASP is floating around $700, but Samsung’s smartphone ASP is trending down (from $378 in 1Q13 drops to $327 in 3Q17). On the other hand, vivo, OPPO and Huawei ASPs are going up. ZTE and Transsion ASP are around $100.

Pingback:HMD u Q3 2017 prodao 21 milijun Nokia uređaja | NokiaMob.me

Pingback:Xiaomi’s Market Share Nearly Doubled in Q3 2017, Thanks to Sales in India – Community Video and Social News Feeds

Pingback:Xiaomi’s Market Share Nearly Doubled in Q3 2017, Thanks to Sales in India - McfNews

Pingback:Xiaomi’s Market Share Nearly Doubled in Q3 2017, Thanks to Sales in India | Spark Tech