01-01 201∞Happy: Huawei’s smartphone shipments in 2017 totaled 153M units; China has revealed that it would temporarily exempt foreign companies from paying tax on their earnings; etc.

Chipsets

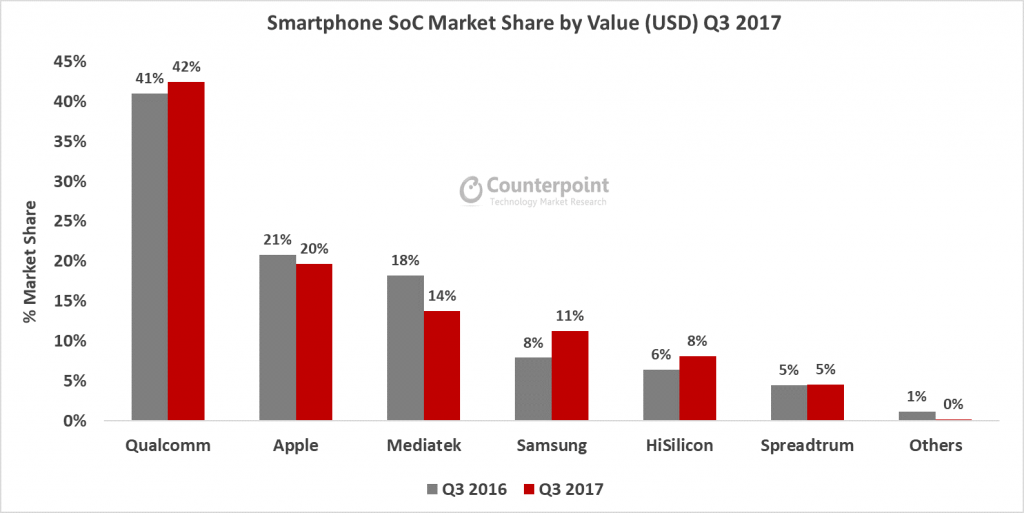

According to Counterpoint Research, the global smartphone System-on-Chip (SoC) market grew 19% annually in 3Q17 crossing USD8B in chipset revenues. Qualcomm led the smartphone SoC market strengthening its position further capturing 42% of the total SoC revenues in 3Q17. (Counterpoint Research, press, EE World)

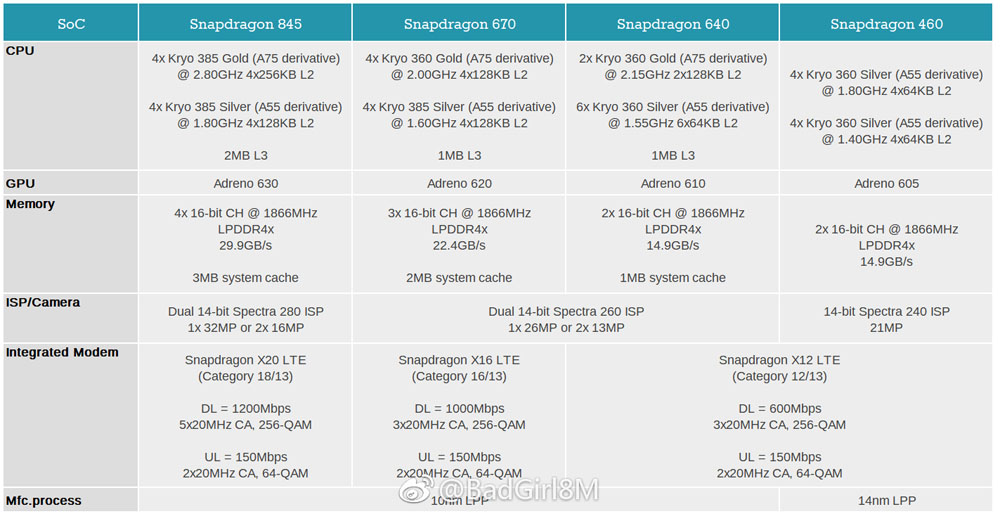

Qualcomm is reportedly preparing 3 more SoC platforms for 2018 – Snapdragon 670, Snapdragon 640 and Snapdragon 460. It will be 10nm so it will be more power-efficient. The CPU will have eight cores – 4x Kryo 360 at 2 GHz and 4x Kryo 385, clocked at 1.6 GHz. The GPU will be Adreno 620 and dual 14-bit Spectra 260 ISP. It will support smartphones with one camera up to 26MP or a dual setup of 13MP + 13MP. (GSM Arena, Dealntech, CN Beta)

MediaTek is reportedly working on 2 SoCs, namely Helio P40 and P70. Both are built at 12nm by TSMC are expected to arrive in 2Q18. (CN Beta, GizChina, Gizmo China)

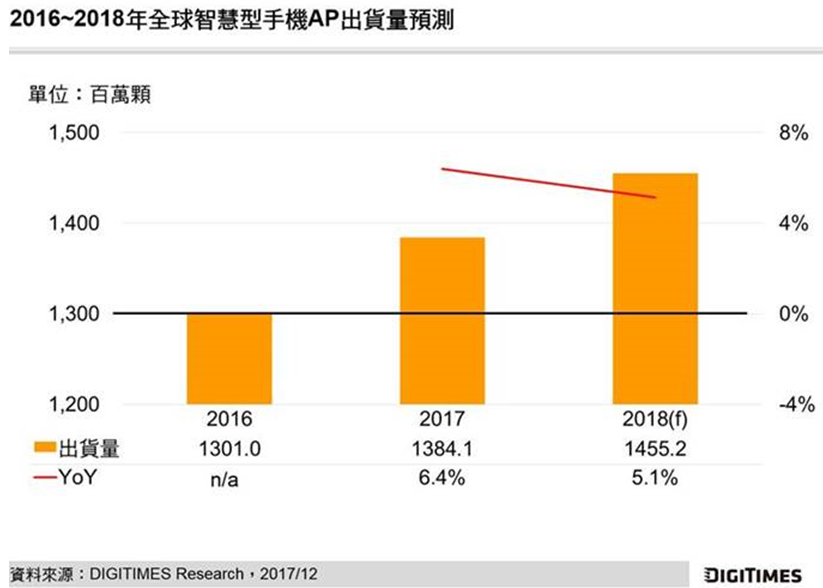

Looking into 2018, Digitimes Research forecasts global smartphone AP shipment would grow 5.1%. Qualcomm will lead the market, follows by MediaTek. However, Apple, Samsung and Huawei’s HiSilicon are using their own AP for their products increasing the penetration, thus in-house AP smartphone shipment would exceed more than 30%. (TTV, Laoyaoba, Digitimes, press)

Touch Display

LG Display (LGD) has claimed it did not supply any organic light-emitting diode (OLED) panels for Apple iPhone X smartphones in 2017. In a regulatory filing, LGD has added that nothing has been decided about future panel supply for the iPhone X model. (Phone Arena, Reuters, CN Beta)

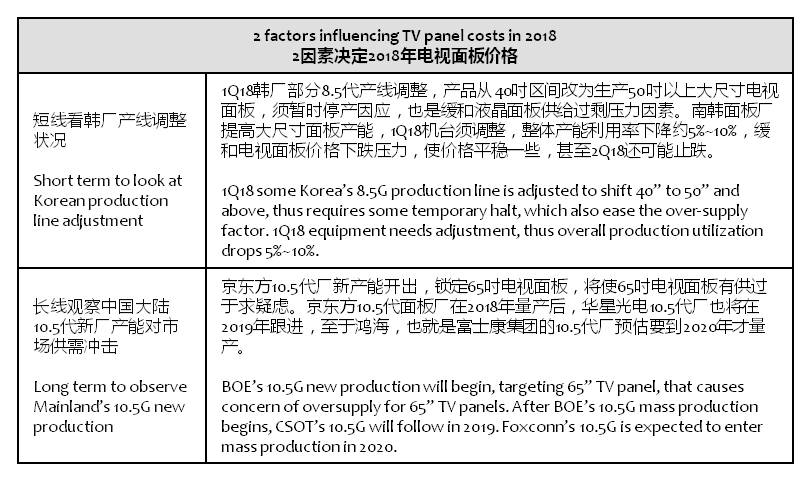

IHS senior analyst director David Hsieh indicates that there are 2 factors influencing TV panel costs in 2018—short term would depend on Korean production line adjustment status; and long term to observe Mainland China’s 10.5G new production impact to the market. (Laoyaoba, CNA, UDN)

Currently there are a number of vendors actively developing Mini LED related applications, chipset vendors including Epistar, Lextar, San’an Optoelectronics, HC SemiTek, etc.; IC design vendors including Everlight, Sunac, Harvatek, Seoul Semiconductor, etc.; panel vendors including AUO, Innolux; display vendors including Leyard, etc. Epistar chairman Li Bingjie believes that Mini LED is likely to become the mainstream for backlit products in the future. Epistar’s R&D will be fruitful in end of 2017 and early 2018, and expects to enter mass production in 2Q18. (CNYES, EE Focus, Laoyaoba)

Battery

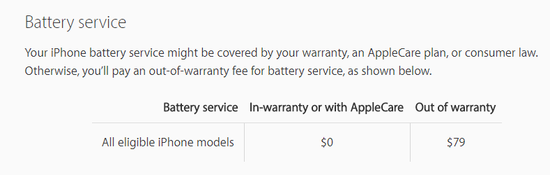

Apple has addressed mounting criticism over the revelation that it slows down iPhones with aging batteries to prevent performance issues. Apple has also lowered the price of out-of-warranty battery replacements to USD29, and will issue a software update in early 2018 to let users find out more information about the health of their device’s battery. (CN Beta, Apple Insider, Apple)

Unlike Apple, neither Motorola nor HTC intentionally slow down processor speeds of their phones as batteries get older. (Android Central, The Verge, eNorth, iFeng)

Samsung and LG have confirmed that they do not slow down phones with older batteries, which Apple has admitted it uses on some iPhones with aging batteries to prevent them from unexpected shutdowns. (Engadget, Phone Arena, Sohu)

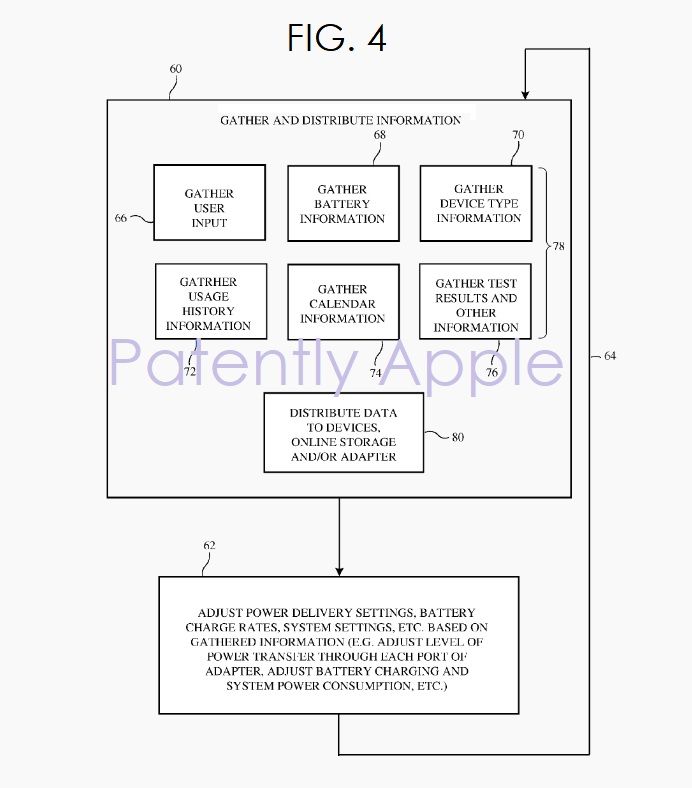

The new patent application by Apple suggests an RF-based long-range wireless charging technology that could be based on the Energous WattUp system which was also recently granted FCC certification. (CN Beta, 9to5Mac, Patently Apple, VentureBeat)

Connectivity

The Korea Transportation Safety Authority (KTSA) and SK Telecom has unveiled the first 5G testing platform for self-driving vehicles in the world, having deployed the experimental infrastructure in K-City, a fake town spanning 79 acres (320,000m2) which was created exclusively for the purpose of testing autonomous driving solutions. (Android Headlines, Business Korea, Pipeline, Tencent, Sohu, East Day)

Smartphones

Huawei Technologies CEO Ken Hu believes the company’s revenue growth slowed down over the course of 2017 and may only be up around 15%. China-based original equipment manufacturer is likely to post a turnover of approximately CNY600B (USD92B) for 2017, according to CEO Ken Hu. Hu said Huawei’s smartphone shipments in 2017 totaled 153M units and its global market share topped 10%. (Android Headlines, Reuters, Financial Express, Tencent)

Xiaomi has made public the total sales amount under MIJIA’s portfolio reached the amount of CNY20B (USD3B) in 2017. (GizChina, CN Beta)

Google has reportedly invested CNY500M (USD76.8M) in Chushou TV in China. Chushou TV, also referred to as “Tentacle Live” is a gaming live streaming platform which operates and caters to Chinese users. (Android Headlines, Sina, Sohu)

China has revealed that it would temporarily exempt foreign companies from paying tax on their earnings, a bid to keep American businesses from taking their profits out of China following Washington’s overhaul of the United States tax code. To be eligible, foreign companies must invest those earnings in sectors encouraged by China’s government — including railways, mining, technology and agriculture — according to the Finance Ministry. (Ubergizmo, NY Times, 9to5Mac, CN NY Times)

Huaqin Telecom has announced it has received CNY870M (USD136M) in a Series A investment co-led by Intel Capital and Hua Capital. Tsinghua Sinoking Capital, SummitView Capital, Walden International, Northern Light Venture Capital and Wise Road Capital also participated in the round. (36Kr, Sohu, JRJ, Intel Capital)

Wearables

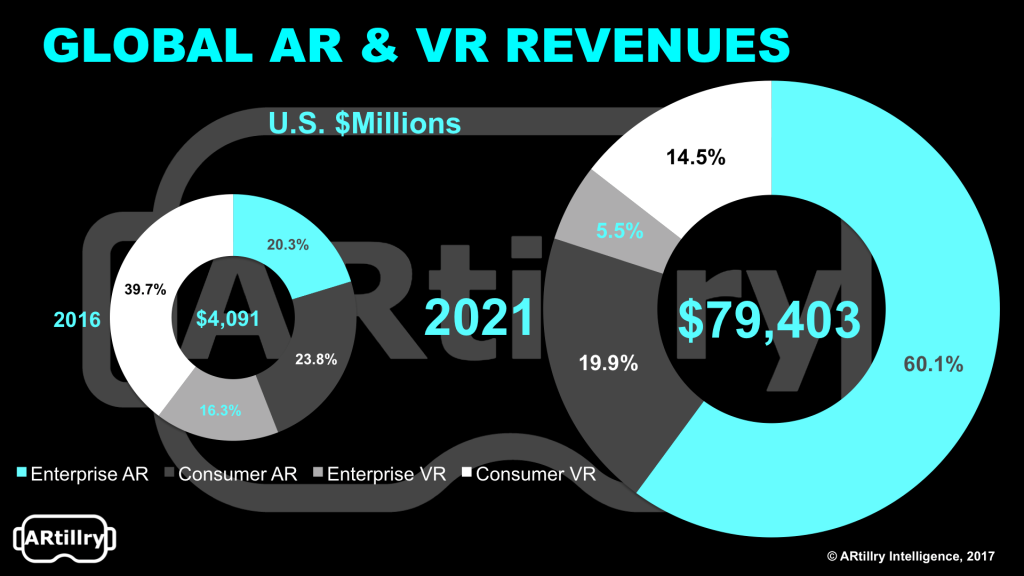

According to ARtillry, global AR / VR revenues will grow from USD4.1B in 2016 to USD79B by 2021. This includes AR, VR and the enterprise and consumer segments of each. Consumer AR will grow from USD975M in 2016 to USD15.8B in 2021. Until the 2020 introduction of Apple’s smart glasses, it will be dominated by the mobile form factor. (Laoyaoba, ARtillry, press, Media Post, Digitimes)

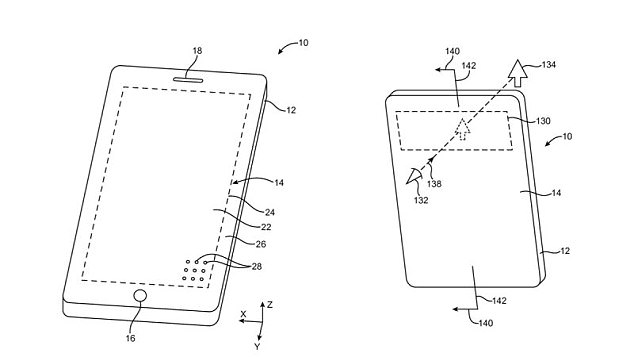

Apple has filed a patent for a iPhone ‘window’ that would sit at the top of a handset. The transparent window would allow users to see the ‘real world’ through the top of their phone. Apple could then project augmented reality figures. (Laoyaoba, Patently Apple, Daily Mail)

Internet of Things

LG ThinQ Speaker is being touted as LG’s “first premium smart AI audio product” that doubles up as a nifty smart home hub. The LG ThinQ Speaker is powered by Google Assistant and LG says it teamed up with Google directly to deliver the full Assistant experience. (GizChina, Android Authority, Qudong, Yesky)

Xiaomi’s subsidiary Yeelight, which is known for making smart home products, has today officially launched a new product — Yeelight Voice Assistant. It comes with four buttons on the top side — an action button, microphone on/off button, volume up button and volume down button. (Gizmo China, My Drivers, PC Pop)

Commerce

MKM Partners analyst Rob Sanderson predicts Alibaba will reach the vaunted USD1T valuation ahead of its internet peers. It seems likely that there will be multiple USD1T valuation companies within the next 1~3 years if the current bull market continues. They examine the pathways of the 6 leading contenders: Apple, Google, Amazon, Facebook, Tencent and Alibaba. (CN Beta, CNBC, NASDAQ, Barron’s)

China’s central bank has announced plans to start regulating payments made by QR codes, barcodes, and other modes of payment via scanning, by keeping an initial payment limit of CNY500 per person, per day. Additional daily limits of CNY1000 and CNY5000 apply to payers who have not completed certain authentication procedures. (Gizmo China, Financial Times, FT Chinese)