01-25: The European Union has fined Qualcomm USD1.23B for a violation of antitrust laws; JDI has developed a transparent glass-based capacitive fingerprint sensor; etc.

Chipsets

Taiwan Semiconductor Manufacturing Company (TSMC) is expected to break ground in Jan 2018 for the construction of its new 5nm fab in the Southern Taiwan Science Park (STSP), where its 3nm fab is also slated to see construction start in 2020. TSMC has taken the lead to start 7nm process volume production, captured a 100% market share in 7nm chip fabrication. (CN Beta, Digitimes, press)

The European Union has fined Qualcomm USD1.23B for a violation of antitrust laws. The fine pertains to deals Qualcomm made with Apple for the exclusive use of its modems in iPad and iPhone products. Qualcomm says it is “confident” that its agreements didn’t affect market competition and will appeal immediately. (Android Authority, EU, The Verge, CN Beta, CN Beta)

Samsung Electronics plans to begin selling its in-house developed Exynos mobile processors to other smartphone vendors in order to expand the scale of its smartphone chip platform, according to Digitimes. Samsung move is designed more to boost its own wafer foundry utilization rate and raise its share of the smartphone chip market, especially for midrange models. (Digitimes, press, Sina)

Touch Display

Apple is reportedly meting out display orders for its next-generation iPhone lineup, which is rumored to include 2 OLED versions — 5.8” and 6.5” — and a 6.1” LCD variant. (CN Beta, Apple Insider, China Times)

In Jul 2017, cinema camera maker RED announced the Hydrogen One, its very first Android smartphone. RED has partnered with the startup called Leia to make 5.7” hydrogen holographic display—capable of showing traditional 2D content at full screen resolution and 3D content without the need of 3D glasses; as well as 4-View holographic content. (The Verge, TechCrunch, Red User, IB Times, Tencent)

BOE started to produce flexible OLED displays at its first flexible AMOLED line, the Chengdu B7 6-Gen fab, in Oct 2017. CLSA analysts say that according to their checks, the ramp-up at the B7 is ahead of schedule, and CLSA expects BOE to ship 19M smartphone OLEDs in 2018 and 41M panels in 2019. Major Chinese smartphone makers will launch the first smartphones with BOE’s flexible OLEDs in Feb / Mar 2018. (iFeng, OLED-Info, Laoyaoba)

LG Display (LGD) has reported its net profit for 4Q17 reached KRW44B (USD40.92M), slumping 91% sequentially and 95% on year due to continued declines in panel prices and growing investment in the OLED business expansion. Revenues for 4Q17 increased by 2% to KRW7,126B from KRW6,973B in 3Q17 and decreased by 10% from KRW7,936B in 4Q16. (Digitimes, press, CN Beta, Reuters, LG Display, iFeng, 51Touch, Tencent)

Samsung has 75% of AMOLED IC driver market share, follows by Korea’s Magnachip with 20% market share. The overall AMOLED driver IC sales have reached 160M units. Other vendors include Korea’s Silicon Work (mainly supplying LG), US’ Synaptics, Taiwan’s Raydium Semiconductor, Mainland China’s Sino Wealth, Solomon Systech, Chipone Technology and Jidisi. (ESM China, iFunn, Laoyaoba)

Camera

Optical component fabs Newmax Technology invests in Q Technology (Q-Tech), both companies have been collaborating for new products, including 3D sensing, AR / VR related camera, and will enter mass production in 3Q18. Both companies expect to see profit in 2H18. Q-Tech is 3rd biggest camera module vendor in Mainland China, after Sunny Opitcal and O-Film. (Laoyaoba, CNYES, CNA, UDN)

Sensory

Together with innovation partner pmdtechnologies AG, Infineon has developed a new 3D image sensor in its REAL3 chip family, based on Time-of-flight (ToF) technology. It enables the world’s smallest camera module for integration in smartphones with a footprint of less than 12×8mm, including the receiving optics and VCSEL. (Laoyaoba, MEMS, EET China, Infineon, Infineon)

Biometrics

Japan Display Inc (JDI) has developed a transparent glass-based capacitive fingerprint sensor by applying the company’s capacitive multi-touch technology used in its other liquid crystal displays (LCDs). JDI plans to start commercial shipments within its 2018 fiscal year, which ends Mar 2019. (Android Headlines, Xperia Blog, JDI, GizChina, Nikkei)

Battery

LG Chem and Samsung SDI are also trying to obtain mineral raw materials on their own. LG Chem secured a 10% stake in nickel sulfate producer Kemco in 2017, while Samsung SDI was qualified as one of the seven short-listed bidders for a lithium mining and refining plant construction project hosted by the Chilean state development agency CORFO. (Business Korea, TechNews)

Connectivity

Techno System Research (TSR) is estimating that 5.8M 5G devices will be shipped in 2019. Number of shipments will double every single year followed by 2019. It is estimated 90M 5G smartphones will be shipped in 2020 and this number corresponds to 5% of entire smartphones that will be shipped in 2020 and it will increase to 380M (20%) in 2022. (TechNews, Money DJ, Business Korea, ET News)

Smartphones

Co-founder and senior vice-president of Xiaomi Hong Feng has officially unveiled MIUI 10. MIUI has announced that it successfully upgraded 40 Xiaomi phones to MIUI 9 including the Xiaomi Mi 2, Mi 2s, and Redmi 1s. (Gizmo China, Baijiahao, Sohu, My Drivers)

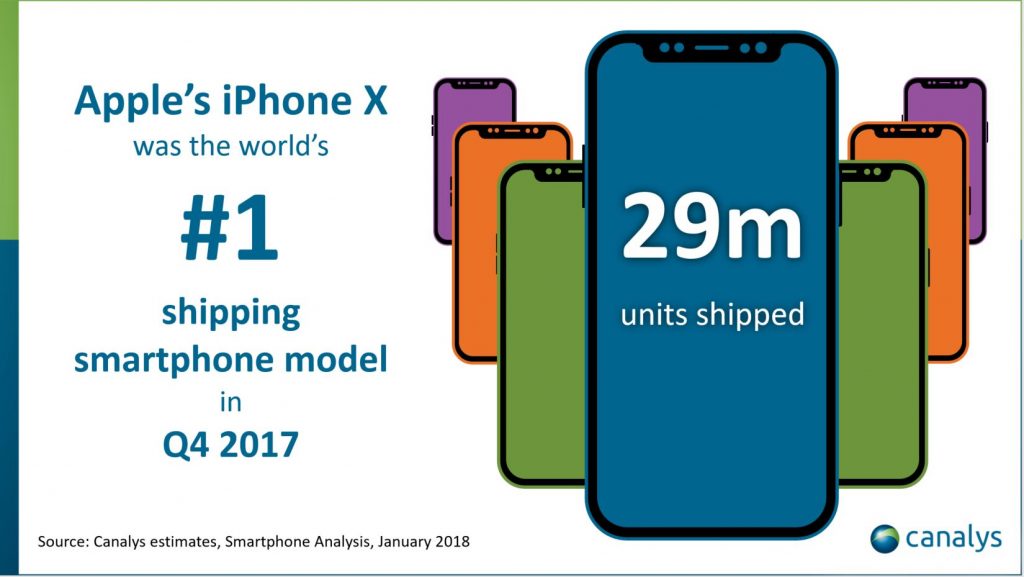

According to Canalys, Apple shipped 29M iPhone Xs in 4Q17. This made it the world’s best-shipping smartphone model over the holiday season. Another notable highlight for the iPhone X is that of the 29M shipped, 7M were in China. (Canalys, VentureBeat, Sina)

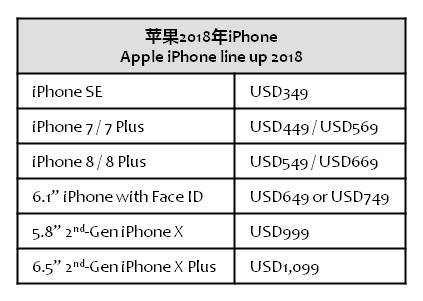

Apple will discontinue the 1st-generation iPhone X when the 2nd-generation model launches later in 2018, rather than bump the device down its smartphone lineup for lower than USD999, according to KGI Securities analyst Ming-Chi Kuo. He thinks that iPhone X would hurt product brand value & lineup of 2H18 new models if it continues to sell at a lower price after 2H18 new models launch. (Phone Arena, Mac Rumors, Apple Insider, Leiphone)

According to KGI Securities analyst Ming-Chi Kuo, Apple will release an updated version of the iPhone X with a 5.8” OLED screen, a larger 6.5” OLED model (iPhone X Plus), and a new mid-range model that will feature a 6.1” display and borrow elements of both the iPhone X and the cheaper iPhone 8 models. (CN Beta, The Verge, Mac Rumors)

J.P. Morgan analyst Narci Chang wrote in a research note that “high-end smartphones are clearly hitting a plateau in 2018”. The note went on to predict that manufacturing of Apple iPhone X — the latest flagship phone — might be down 50% Dec 2017~Mar 2018 quarters. (CN Beta, CNBC, Value Walk, Mac Rumors)

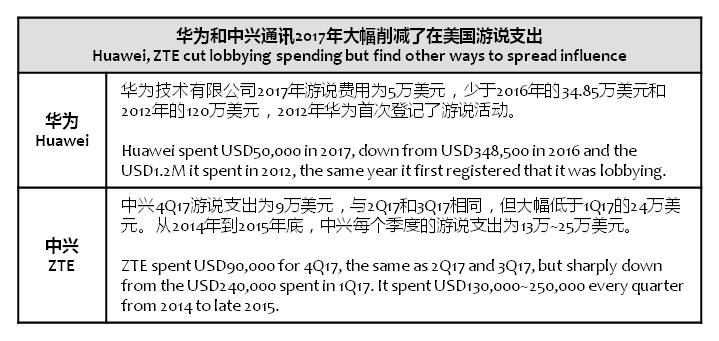

Huawei and ZTE, which face strong political headwinds in the United States, sharply cut lobbying expenditures in 2017, according to 4Q17 spending disclosures. Despite the cuts, Huawei in particular has continued to sponsor telecom conferences and spread money around in other ways they are not required to disclose. (Phone Arena, Reuters, Sohu, TechWeb)

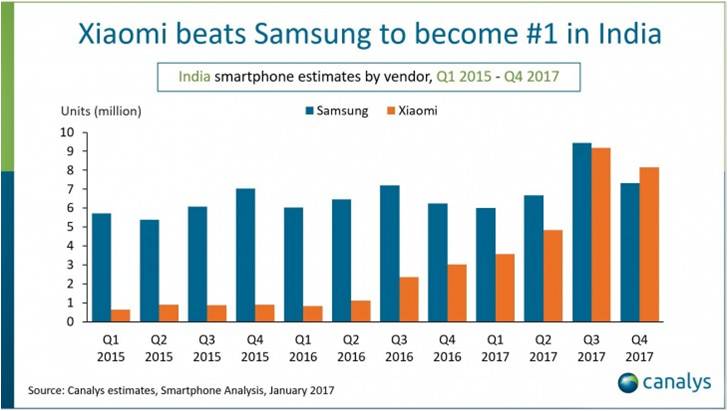

India’s smartphone market has finally seen a change at the top, with Xiaomi now leading with shipments close to 8.2M units in 4Q17. Despite annual growth of 17%, Samsung failed to maintain its lead, shipping just over 7.3M smartphones to take second place. vivo, OPPO and Lenovo rounded out the top 5, while total smartphone shipments were just shy of 30M units. (GSM Arena, Canalys, press, Sina, 10JQKA)

YouTube has announced it is investing USD5M in creators who use the service in “positive ways” to create change and empower young people. The investment is going towards YouTube’s Creators for Change, its two-year old program focused on countering hate and promoting tolerance. (TechCrunch, YouTube)

Infocus M7s is announced in Taiwan – 5.7” 1440×720 HD+ IPS LCD on-cell, MediaTek MT6737H, front 8MP + rear dual 13MP – 5MP, 3GB + 32GB, Android 7.0, rear fingerprint scanner, 4000mAh, NTD4,290 (USD147). (Gizmo China, Infocus, CNMO, My Drivers)

vivo X20 Plus UD is launched with under-display fingerprint scanner – 6.43” 2160×1080 FHD+ AMOLED, Qualcomm Snapdragon 660, front 2×12MP + rear dual 12MP-5MP, 4GB+128GB, Android 7.1.2, 3905mAh, CNY3598. (CN Beta, GSM Arena, vivo)

Wearables

Apple’s ARKit update will enable augmented reality (AR) apps to detect walls and other vertical surfaces, and more accurately map non-linear surfaces like circular tables. The AR experience will also appear more sharp, as the real-world view now supports auto-focus and has 50 percent greater resolution. In big-picture terms, the ARKit update will greatly expand the kind of app experiences that developers can build for iOS. (CN Beta, ZDNet, Silicon Angle, The Verge, Apple)

Media software maker Plex is unveiling its new VR experience, Plex VR. The addition will allow Plex users to not only watch videos in VR, but also co-watch with friends – a social component to media consumption that a number of companies, including Facebook and YouTube, have begun to explore. (Engadget, Plex, The Verge)

After Fitbit acquired smartwatch company Pebble in 2016, the company promised to keep Pebble’s software and services running through the end of 2017. The company says it will continue to support the smartwatch ecosystem through 30 Jun 2018. (Liliputing, Engadget, Fitbit, Pocket-Lint)

Internet of Things

DJI launches ‘ultraportable’ drone Mavic Air, priced at USD799. It has a compact design, folding propeller arms, and a 4K/30fps-shooting camera, weighs 430g. Its camera can capture 1080p/120fps slow-motion footage, along with 12MP HDR stills. The camera has a 1/2.3” CMOS sensor and the equivalent of a 24mm F2.8 lens, and is mounted on a recessed 3-axis mechanical gimbal. (VentureBeat, The Verge, BBC, TechCrunch, DJI, iFeng, Sina)

Apple claims that its digital assistant, which is at the heart of the HomePod’s smart functionalities, is now used by 500M users. (CN Beta, Business Insider, Apple Insider, Apple)

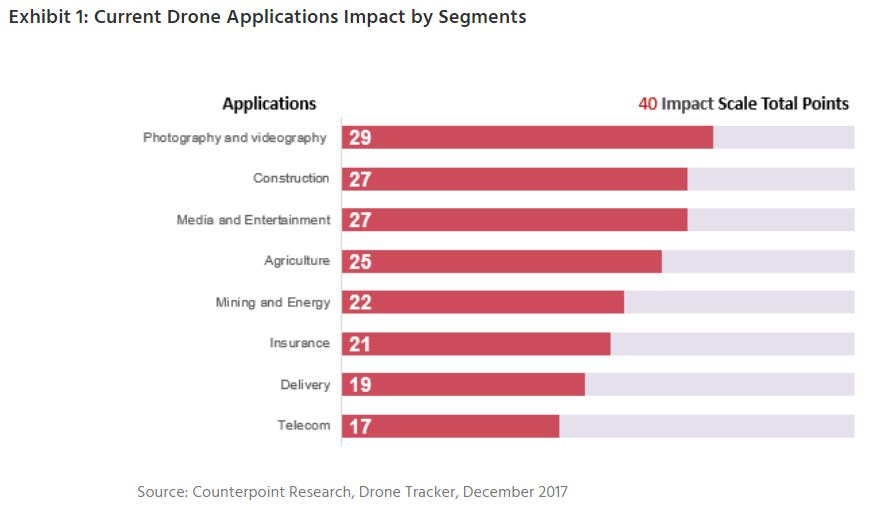

Counterpoint Research estimates in 2018 the drone market will grow by 45% in volume – mainly due to faster growth in the commercial sector. Commercial applications are growing due to falling prices and technological innovations such as collision avoidance, autonomous flight mode, home return and first-person-view (FPV) which have made drone systems relatively easy to use across a wide variety of applications. (Counterpoint Research, blog, Laoyaoba)

Economy

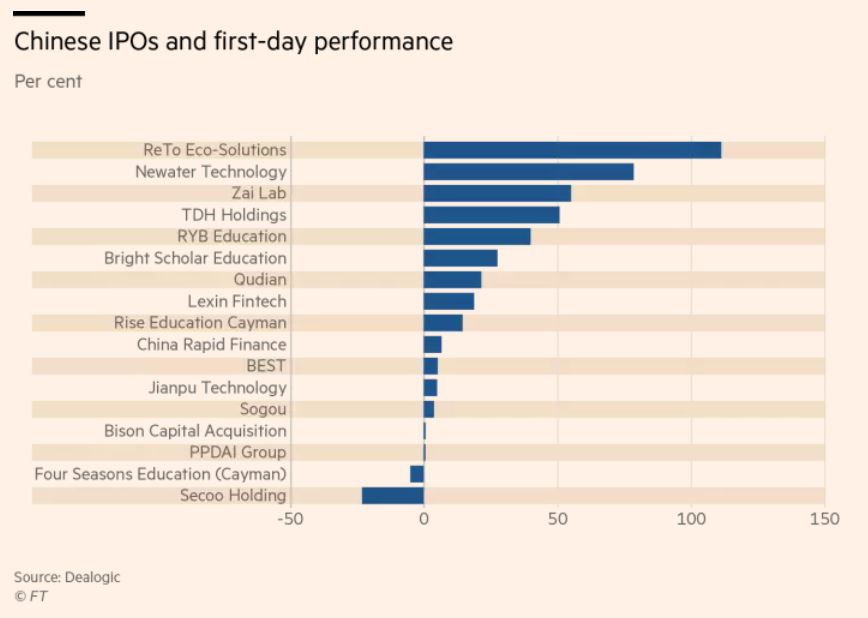

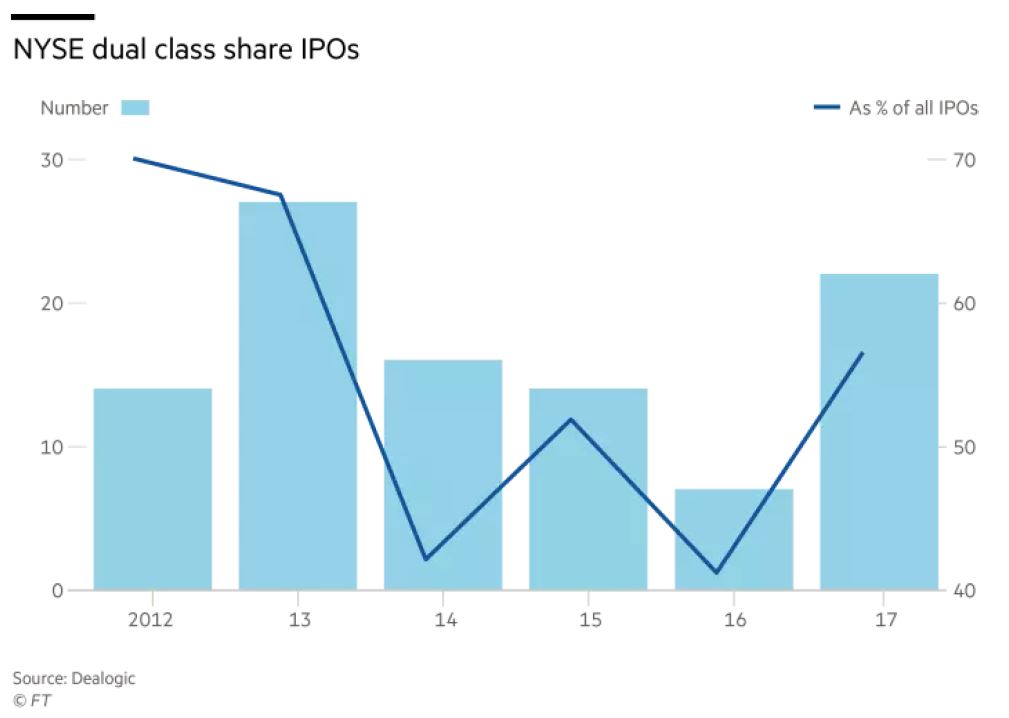

Some companies have performed supremely well after listing but half of 2017 Chinese start-up IPOs are trading below their offer price, according to Dealogic. Please use the sharing tools found via the email icon at the top of articles. Tech is an industry where Chinese regulators are playing catch-up but they carry big sticks when they do. Case in point: payday lenders, which took a hit when Beijing signalled concerns about injudicious lending, usurious interest rates and coercive collection practices. (Fortune, article, Fortune, Laoyaoba, CN Beta)

Alphabet, the parent company of Google, became the second publicly traded U.S. company ever to reach a market value of USD800B, joining Apple. Alphabet’s Class A shares rose 1.8% to USD1,164.00. (WSJ, Fonow, CN Beta)