02-03: Samsung is reportedly signing a memorandum of understanding (MOU) with NDRC; MediaTek phone SoC share has dropped to share has dropped to 35%~40%; etc.

Chipsets

MediaTek has focused on smartphone SoC in the past but from the latest revenues, its share has dropped to 35%~40%. With the company’s resource for multimedia, IoT and AI getting richer, MediaTek non-smartphone AP share has reached 27%~32%, of which 50% is contributed by IoT, which is equivalent to 15% of the revenues. (Laoyaoba, Wall Street CN, Tencent)

Touch Display

KGI Securities Ming-chi Kuo indicates that Apple new iPhone launched in 2017 has caused the evaluation of LCD supply chain revised. In 2018 its alleged 6.1” LCD panel low-cost iPhone might re-evaluate the LCD supply chain. He also indicates that as aluminium frame shipment will be more than of stainless steel frame, which could help Catcher Technology revenues in 2018. (Laoyaoba, TechNews, UDN, Apple Daily)

Camera

Sony indicates that as the sales of devices equipped with image sensor have decreased, thus the company has revised the image sensor sales target from JPY680B to JPY650B (still a 18.5% increase on year). Sony is Apple iPhone CMOS image sensor supplier, and iPhone X allegedly has reduced production in 1Q18. (Laoyaoba, Sony, TechNews)

Storage

Taiwanese memory maker with the largest market share of NOR flash memory globally Macronix, said that the price of high-capacity NOR Flash will steadily rise in 2018, but the low-order NOR Flash products will have oversupply conditions. In addition, the 3D ROM products are expected to be mass-produced by the end of 2018. (CTIMES, Laoyaoba, Digitimes, press)

The climbing prices of DRAM over the past 6 quarters have added the cost pressures of Chinese smartphone brands. As the result, China’s National Development and Reform Commission (NDRC) has expressed concerns to Samsung at the end of 2017. The intervention is expected to moderate the price increases of mobile DRAM in 1Q18, according to TrendForce. Samsung is reportedly signing a memorandum of understanding (MOU) with NDRC. (TrendForce, TrendForce)

Sensory

Pulse Labs has announced the closure of a USD2.5M seed round led by Madrona Venture Group, with participation from Amazon’s Alexa Fund, TechStars Ventures, and Bezos Expedition, an investment arm of Amazon CEO Jeff Bezos. Pulse Labs matches voice app developers with people from specific demographics to test and improve conversational experiences. (VentureBeat, Sohu)

Phones

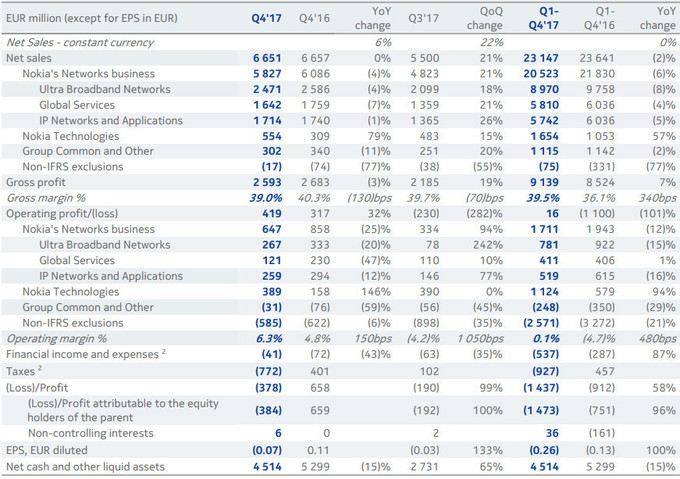

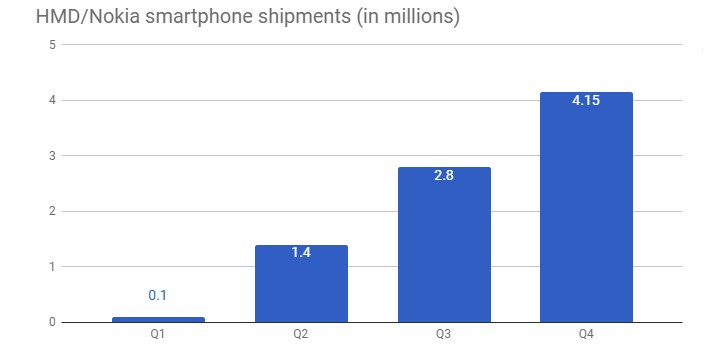

Nokia’s financial results for 4Q17 are out and they are better than the initial predictions. The company has reported USD1.2B operating profit for 4Q17 – up from the USD1.101B forecast. Nokia’s network business profit has fallen a staggering 25% year-on-year (from USD1.064B to USD802.28M). For 2019 and 2020, the company expects market conditions to improve markedly, driven by full-scale rollouts of 5G networks. (GSM Arena, Nokia Mob, Phone Arena, Nokia, CNII, EE Focus, Huanqiu)

According to Sony, the goal is to continue to update its top-shelf smartphones for a 2-year period following the launch of a high-end phone. As for Sony’s mid-range handsets, the company said that it might decide against updating certain models if the hardware cannot provide a stable experience for users. (Phone Arena, Xperia Blog, iFeng, Sohu)

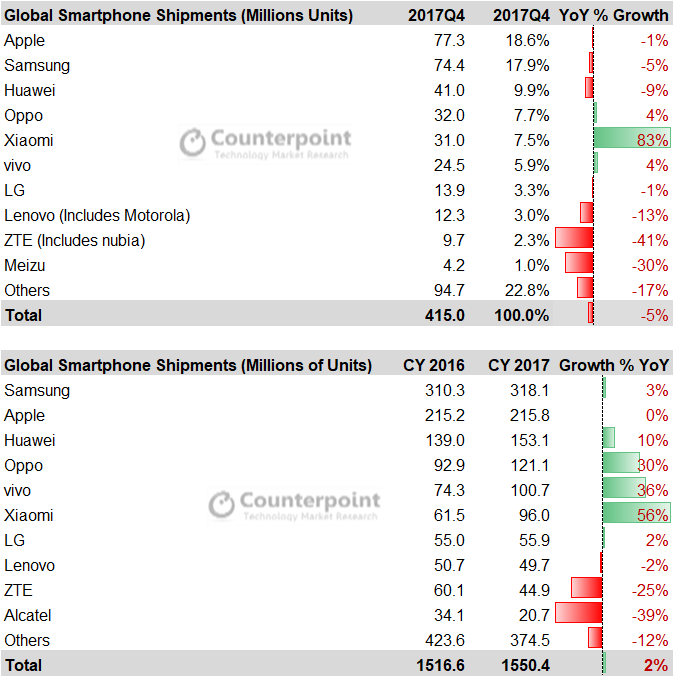

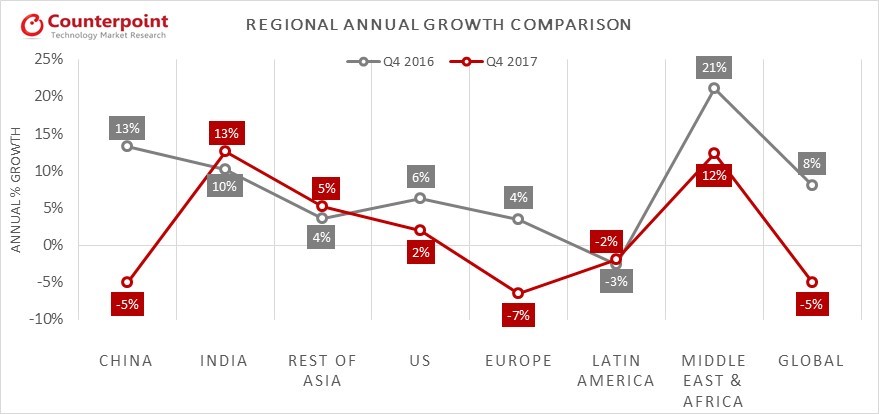

According to Counterpoint Research, smartphone shipments grew 2% annually to reach 1550M units in 2017. In 4Q17, 415M smartphones were shipped, down 5% from a year ago. Top 10 brands account for 77% of the smartphone volumes in 2017. Chinese brands Xiaomi, vivo, OPPO and Huawei remained the fastest growing smartphone brands. (Counterpoint Research, press, Pocket Lint, iMobile)

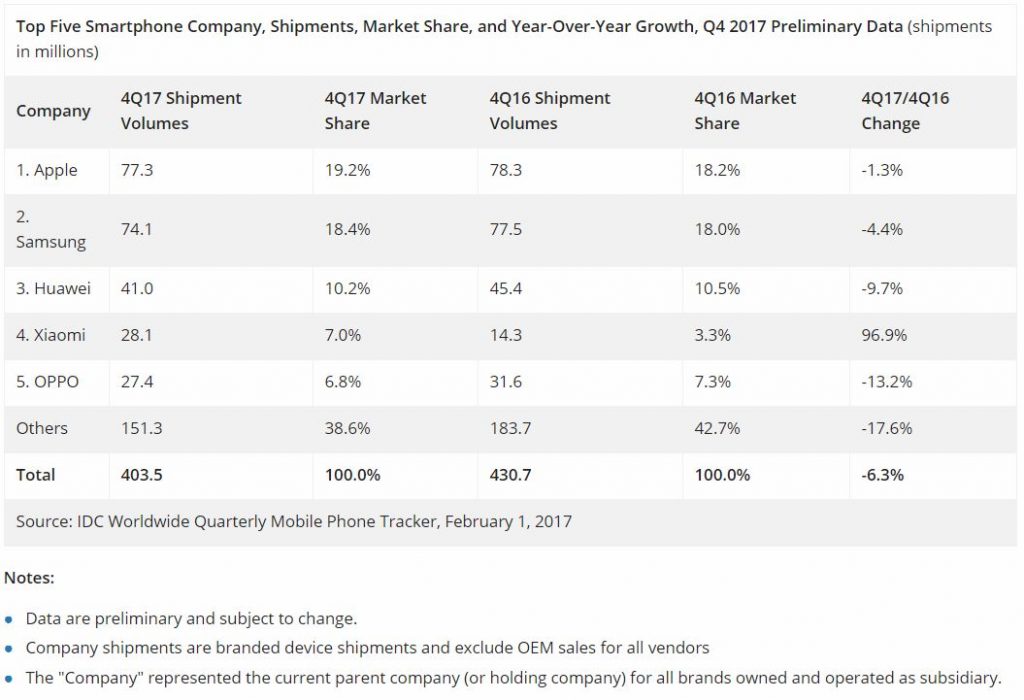

According to IDC, smartphone vendors shipped a total of 403.5M units during 4Q17, a 6.3% decline on year. For the 2017 full year, the worldwide smartphone market saw a total of 1.472B units shipped, declining less than 1% from the 1.473B units shipped in 2016. (IDC, press, CN Beta, Digital Trends)

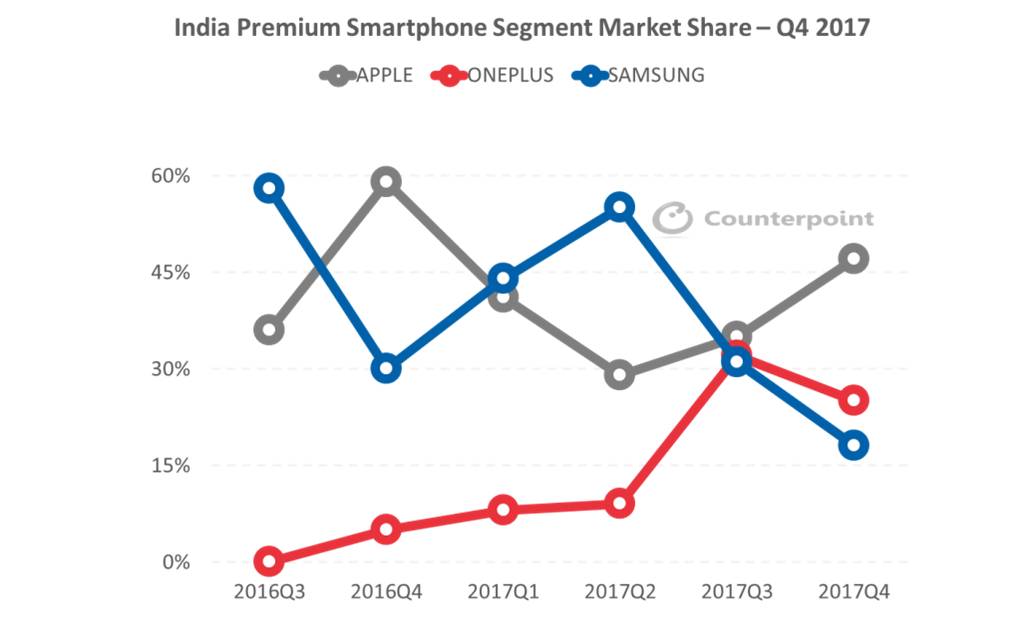

According to Counterpoint Research, the Indian premium smartphone segment grew 20% annually by volume and 28% by value in 2017. Although the segment is more crowded than a year ago, the top 3 brands, Apple, OnePlus and Samsung, still contribute to 94% of the overall premium market segment. Apple is still the leader in the premium segment, capturing 47% share during 4Q17 and 38% during 2017, driven by strong shipments of iPhone X and iPhone 7. (Counterpoint Research, press, Tencent)

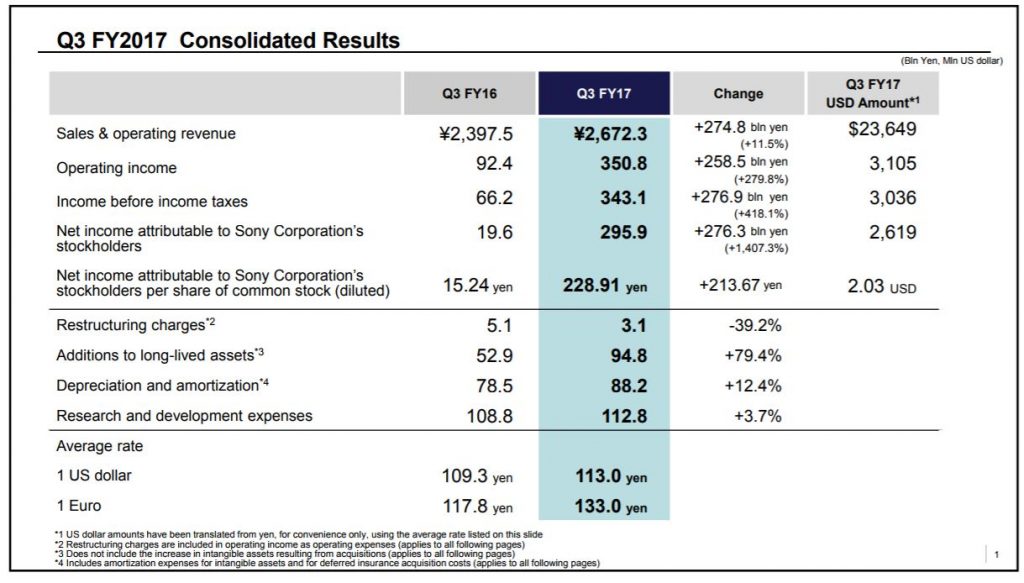

Sony has reported fiscal 3Q17 (Oct~Dec 2017) financial report. Sony’s sales and operating revenues were up an impressive 11.5% year over year to JPY2,672.3B (USD23.6B). Solid growth in the Game and Network Services (G&NS) and Home Entertainment & Sound (HE&S) segments as well as positive effect of foreign currency translation spurred top-line growth. The company witnessed impressive performance across its segments. (Laoyaoba, TechNews, Sony, Sony, Variety, NASDAQ)

Sony will promote Kenichiro Yoshida to chief executive officer. Kazuo Hirai will step down to become chairman of the Tokyo-based company, while Hiroki Totoki will become the new chief financial officer. (Bloomberg, Business Insider, Financial Times, Xinhuanet, Leiphone, WSJ CN)

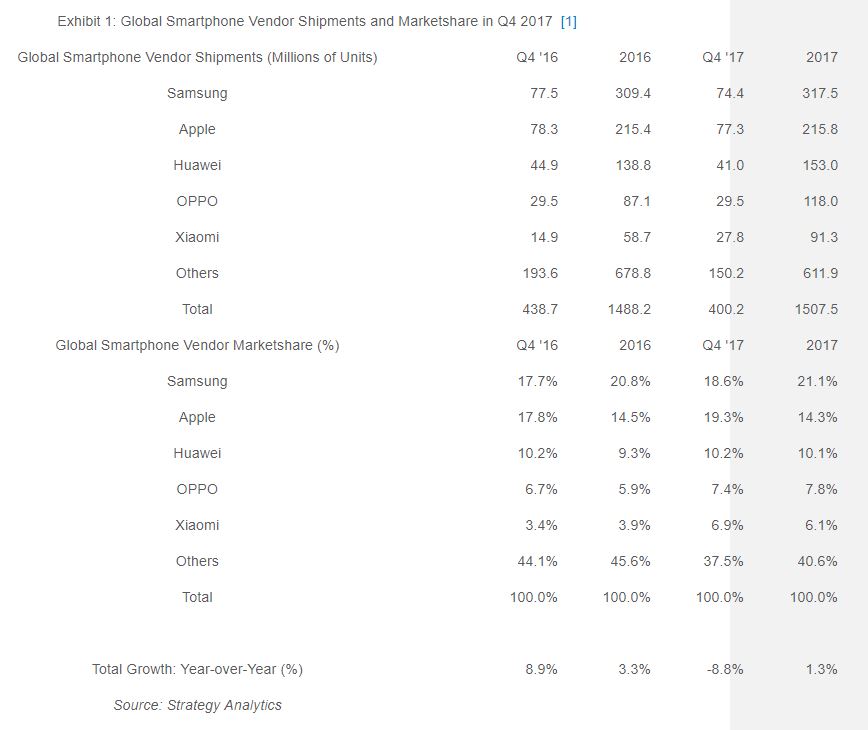

According to Strategy Analytics, global smartphone shipments tumbled 9% annually to reach 400M units in 4Q17. It was the biggest annual fall in smartphone history. Apple captured first place with 19% global market share, nudging Samsung into second position. Xiaomi continued its relentless rise, almost doubling smartphone shipments from a year ago. (Strategy Analytics, press, Apple Insider)

Losing China market is the main reason why LG is losing its growth drier. During 3G and 4G era, LG did not seize the opportunity causing the bad business, losing to the cost-effective smartphone brands in China. The rising cost is also what pressurizing LG. However, LG is still very vital for the whole portfolio, especially for inter-connected cars and other business units. (Laoyaoba, Ping West, iFeng, XCN News)

Internet of Things

Walkie-talkie maker Motorola Solutions said on it would buy Canadian security camera maker Avigilon for CAD1.2B (USD978M) cash. The acquisition would help expand Motorola’s portfolio with new products for commercial customers, as more cameras feed into public safety workflows, Motorola Chief Executive Greg Brown said. (Android Headlines, CN Beta, Financial Post, Reuters)

Hon Hai Precision Industry is planning to invest NTD10B (USD342M) in artificial intelligence (AI) over the next 5 years, Chairman Terry Gou said. Speaking in a technology conference to announce the establishment by Hon Hai of an AI development lab, Gou said the AI investment over the next five years will develop applications, especially for those used in industrial Internet. (UDN, Laoyaoba, TechNews, UDN, Reuters, Focus Taiwan)