04-29: Huawei has reportedly begun developing its own alternative to Android; ZTE has reportedly held a conference call with more than a dozen members of the Semiconductor Industry Association (SIA); etc.

Chipsets

Startup Innovium announced it secured USD77M in Series D financing, bringing its total to date to a whopping USD160M. The deal shows investors have confidence the designer of Ethernet switch chips will grab sockets away from Broadcom which dominates the field. The round closes as Innovium announced it is sampling its 12.8 and 6.4 Terabit/second switches aimed at large data centers. (ZOL, EE Times)

Touch Display

ZTE has filed a patent application for a smartphone concept that features dual display notches. The patent was filed with China’s State Intellectual Property Office (SIPO) on 13 Sept 2017. (GizChina, Android Headlines, Yesky, Kejixun, Sohu)

Sensory

Goodix CEO Zhang Fan reveals that in 2H18 under-glass fingerprint scanner product would be the new growth driver for the company. Additionally, 3D face recognition solution and NB-IoT 1st gen product would be launched with 1st-gen commercial products by end of 2018. Its 3D face recognition solution would include algorithm optical, image sensor the complete software and hardware solution. (Laoyaoba, Tencent, East Money)

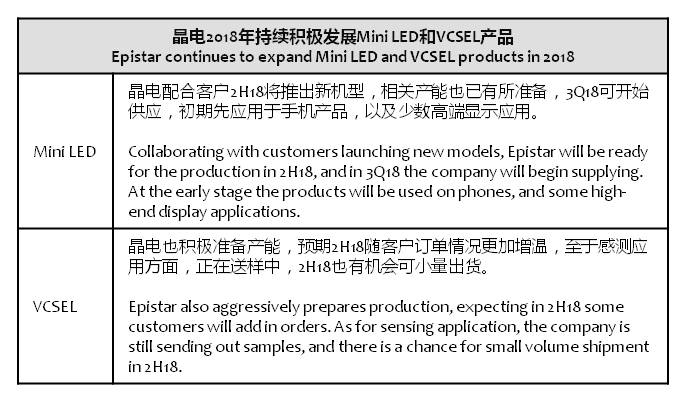

LED vendor Epistar will continue to expand its Mini LED and VCSEL products in 2018, and hoping to contribute to its revenues in 2H18. (Laoyaoba, UDN, Digitimes, press, Solid State Lighting)

Biometrics

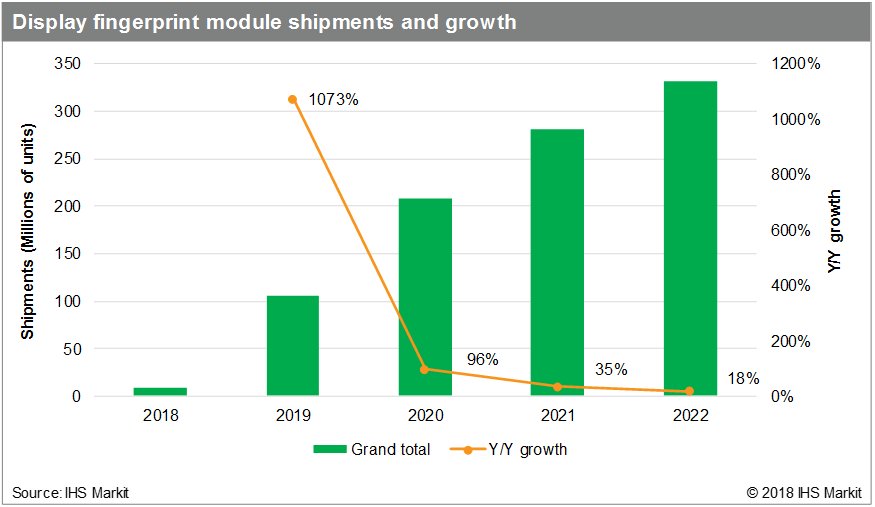

Shipments of smartphones using ‘under-display fingerprint sensor’ is forecast to reach at least 9M units in 2018 and top 100M units by 2019, according to IHS Markit. The market will keep growing remarkably for the next three years, led by Samsung Electronics and Chinese smartphone brands such as vivo, Huawei and Xiaomi. (Laoyaoba, IHS Markit, press)

Battery

The competition among wireless charging standards did not come to an end when Apple decided to choose Qi of the WPC (Wireless Power Consortium) for iPhone X and 8 in 2017. Instead, the move has pushed the member companies in the AFA (AirFuel Alliance) to exert efforts to develop magnetic resonance (MR) and other RF wireless charging solutions in order to win a new round of battle in the mid- and long-distance wireless charging segment, according to Digitimes Research. (CN Beta, Digitimes, press)

Connectivity

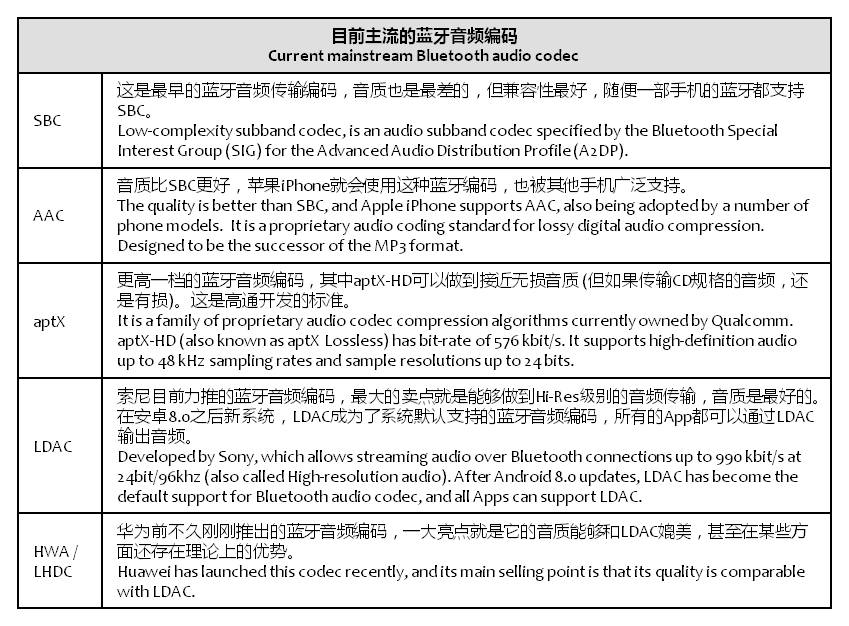

From the audio quality, Bluetooth headsets are limited by the transmission standards or profiles. Different Bleutooth audio codec comes with different audio quality. (Sina, CN Beta)

ZTE Corp spent CNY12.962B on R&D, which is about 11.9% f the company’s revenue. The company will continue to expand investment for its Pre-5G, 5G, high-end router, SDN, OTN, core chipset and other products R&D. The company claims that currently 5G is at standard definition and technology trials phase, and it is rushing to be the pilot of 5G communication. (Laoyaoba, Sohu, Sina, SCMP)

Phones

Huawei has reportedly begun developing its own alternative to Android. The plan is allegedly initiated by Huawei’s founder, Ren Zhengfei, and the company has never given up on it as it is seen as a strategic investment to prepare for “worst-case scenarios”. (Android Headlines, Liliputing, SCMP, Tencent, iFeng)

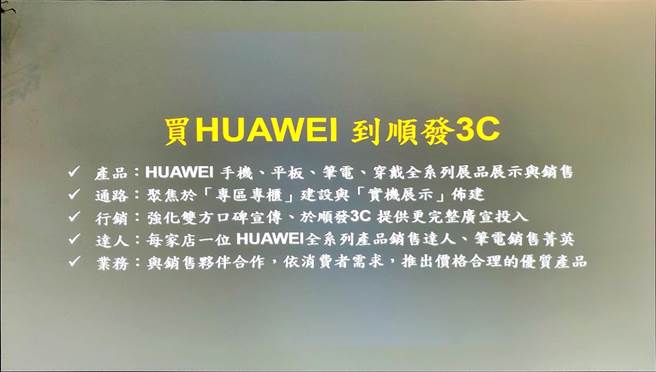

Huawei has announced strategic collaboration with Taiwan-based retailer Sunfar 3C. Huawei’s products will be available from Sunfar 3C for Taiwan consumers. (Laoyaoba, China Times, Mobile01)

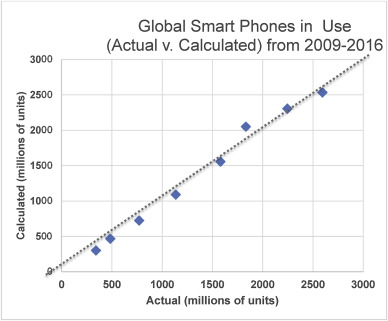

Xiaomi shipped over 70M smartphones in 2017 and is likely to push its shipments to 100M units in 2018, according to Digitimes. (Digitimes, press, Phone Arena)

According to GfK, global smartphone sales in 1Q18 has dropped 2% to 347M units, mainly because of the weak demand from China (-6%) and North America (-5%). The average selling price (AS) has increased 21% on year, driving the sales volume increasing 18% on year reaching USD129.8B. (Laoyaoba, 199IT, GfK, report, Tencent, IT Home)

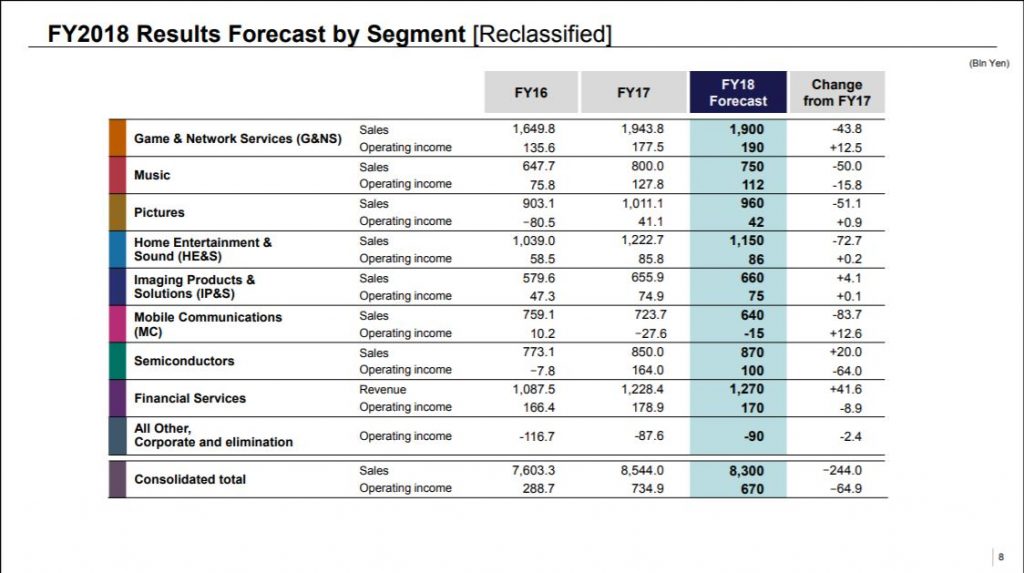

Sony has published its consolidated financial report for the fiscal 2017 ending Mar 2018, revealing USD77B in sales and USD6.6B in operating income. Whereas its turnover improved by 12.4% year-on-year, the company’s cost-cutting and streamlining efforts are now paying dividends, having led to its operating income jumping 154.5% annually. (Android Headlines, Sony, My Drivers)

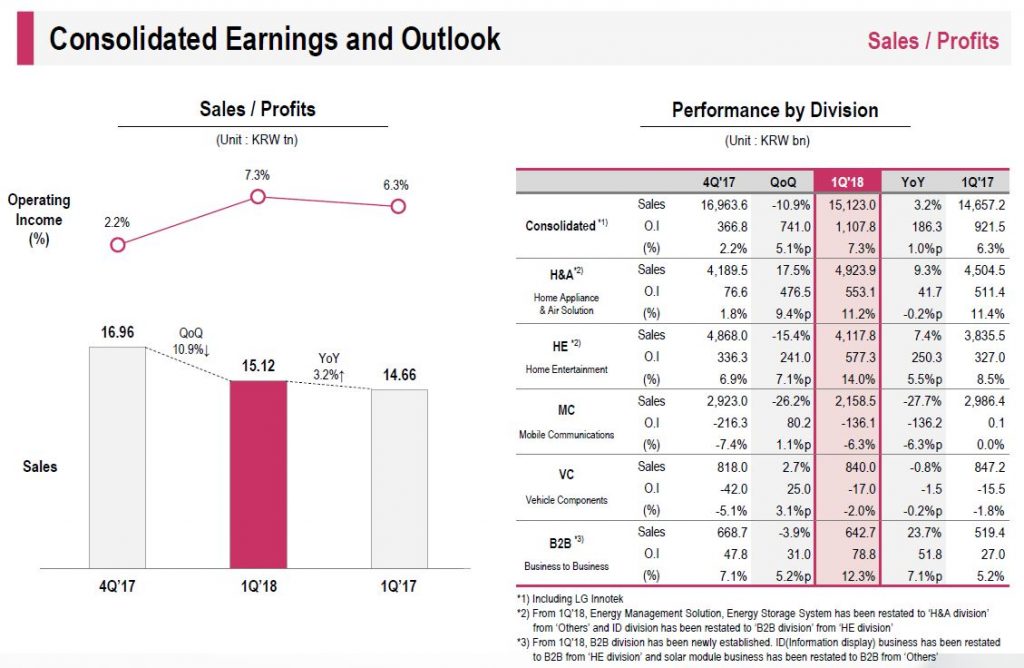

LG Electronics posted its 1Q18 financial results, noting consolidated sales of KRW15.12T (USD14.1B) and operating profit of KRW1.11T (USD1.03B). This is a result of 3.2% sales rise and 20% income jump, marking the highest Q1 profit ever and the highest quarterly profit since the summer of 2009. (GSM Arena, LG, Yesky, EE Focus)

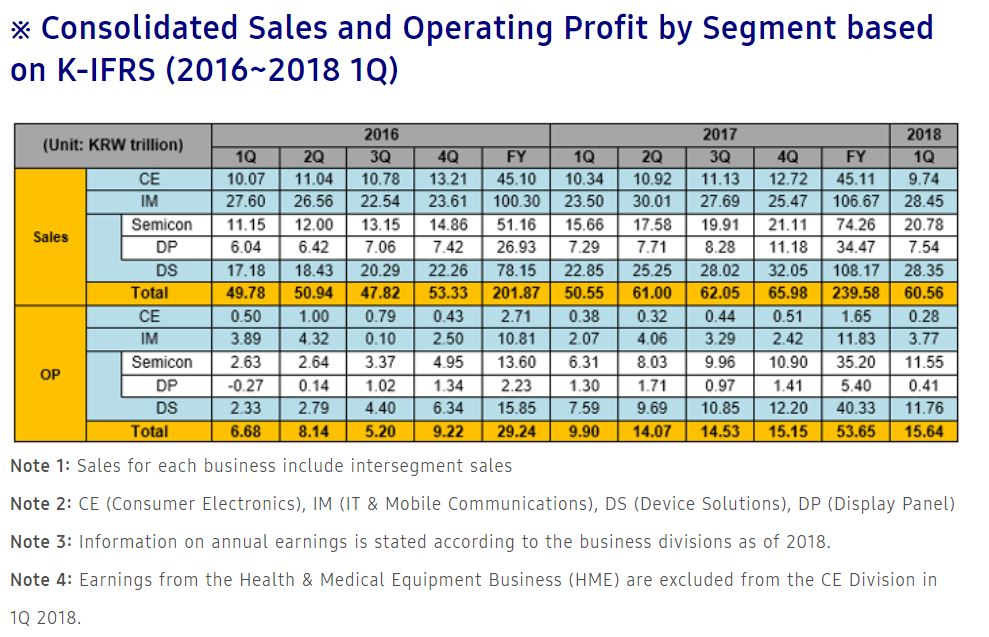

Samsung Electronics posted KRW60.56T in consolidated revenue and KRW15.64T in operating profit for 1Q18. The revenue was primarily led by Samsung’s Memory Business and increased sales of its flagship mobile products, including the Galaxy S9. (Engadget, Samsung, OfWeek, Xinhuanet)

Apple has signed an agreement with Hanwang Technology to pay them USD8M for a non-registered trademark over 6 payment installments. Hanwang has noted that “there are many performance obligations in the Agreement on the transfer of rights and interests, in order to complete the transaction”. (My Drivers, CN Beta, JRJ, Patently Apple)

Apple has allegedly ordered the production of only 8M iPhone X units in 2Q18. Apple reportedly ordered the production of too many units of the iPhone X in 4Q17, and is now trying to “burn off” the inventory that has piled up at its resellers. Above Avalon analyst Neil Cybart says that the X contributed about 35% of total phone sales during 4Q17, which works out to about 27M phones. (CN Beta, Fast Company, Digital Trends)

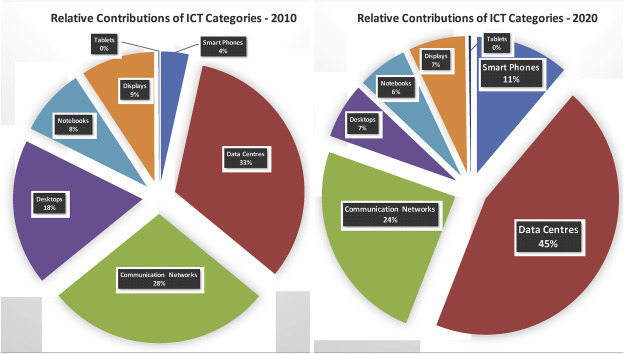

McMaster University in Canada found that whereas IT accounted for about 1% of the world’s carbon footprint in 2007 it has tripled already and will consume about 14% by 2040. A major reason behind this is the mining of rare minerals that are required in the manufacturing a new smartphone. It represents about 85%~95% of the phone’s total CO2 emissions in its average life cycle of 2 years. (LAD Bible, Foss Bytes, Science Direct, CN Beta)

ZTE has reportedly held a conference call with more than a dozen members of the Semiconductor Industry Association (SIA). SIA spokesman indicates that it was a factual update on what happened, what they have done since the order was put in place, and what they are doing to remedy the situation; and, there was no discussion of helping ZTE advocate before the U.S. government. (Laoyaoba, Reuters, The Edge Markets, Reuters)

Coolpad Cool 2 is announced in China – 5.7” 1440×720 HD+, MediaTek MT6750, rear dual 13MP-VGA + front 8MP, 4GB+64GB, Android 7.0, 3200mAh. (GSM Arena, Android Headlines)

Augmented Reality / Virtual Reality

Mozilla has shown off a preview of Hubs, a social WebVR experience that users can dive into with a couple of clicks, share a URL and meet up with other people across platforms, including mobile, desktop and VR. (CN Beta, CNET, TechCrunch)

Artificial Intelligence

Adobe has acquired Uru, a computer vision company that helps marketers understand how they could leverage advertising inside videos. (VentureBeat, Uru Video)

The U.S. government may allegedly start scrutinizing informal partnerships between American and Chinese companies in the field of artificial intelligence (AI), threatening practices that have long been considered garden variety development work for technology companies. Major American technology companies, including Advanced Micro Devices (AMD), Qualcomm, NVIDIA and IBM, have activities in China ranging from research labs to training initiatives, often in collaboration with Chinese companies and institutions who are major customers. (CNBC, The Strait Times, SCMP, Laoyaoba)

SenseTime deputy chief and chairman Zhang Wen indicates that artificial intelligence (AI) has seen breakthrough in surveillance application, and it will be helpful for safety, transportation, medical, politics, agriculture and education applications. He expects next wave of AI application will have another breakthrough at medical, education and finance segments. (Laoyaoba, Digitimes, CTimes)

Fintech

IBM said the TrustChain Initiative, which will use blockchain to trace the provenance of finished pieces of jewelry and provide increased transparency across the supply chain. Asahi Refining (precious metals refiner), Helzberg Diamonds (U.S. jewelry retailer), LeachGarner (precious metals supplier), The Richline Group (global jewelry manufacturer), and UL (independent, third-party verification), are launching the TrustChain Initiative, powered by the IBM Blockchain Platform and delivered via the IBM Cloud. (VentureBeat, TechCrunch, IBM, TrustChain, Sohu)

JP Morgan based on assets joined forces with the National Bank of Canada, among others, to develop an application based on its Quorum technology for debt issuance on the blockchain (corporate bonds, Treasury bonds, etc.) The test involved the issuance of USD150M of a one-year floating rate Yankee CD alongside a “simulation” of the issuance on the blockchain. (TechNews, 36Kr, Coin Telegraph, CCN)