05-04: A series of data from Xiaomi’s IPO filing; Xiaomi has partnered with CK Hutchinson; etc.

Chipsets

Ministry of Industry and Information Technology of PRC (MIIT) has released electronics manufacturing status. The value-added of electronics manufacturing industry has increased by 12.5% YoY. In 1Q18, the production of basic and emerging products grew at a faster rate, with 39.99B integrated circuits (ICs), an increase of 15.2%; 1127.63B electronic components, an increase of 22.7% YoY; and 2.54B lithium-ion batteries, an increase of 16.0% YoY. There is slowdown in production for traditional products, including production of 420M mobile phones, an increase of 0.5% YoY; 66.271M micro-computers, an increase of 1.3% YoY. (Laoyaoba, My Drivers, MIIT)

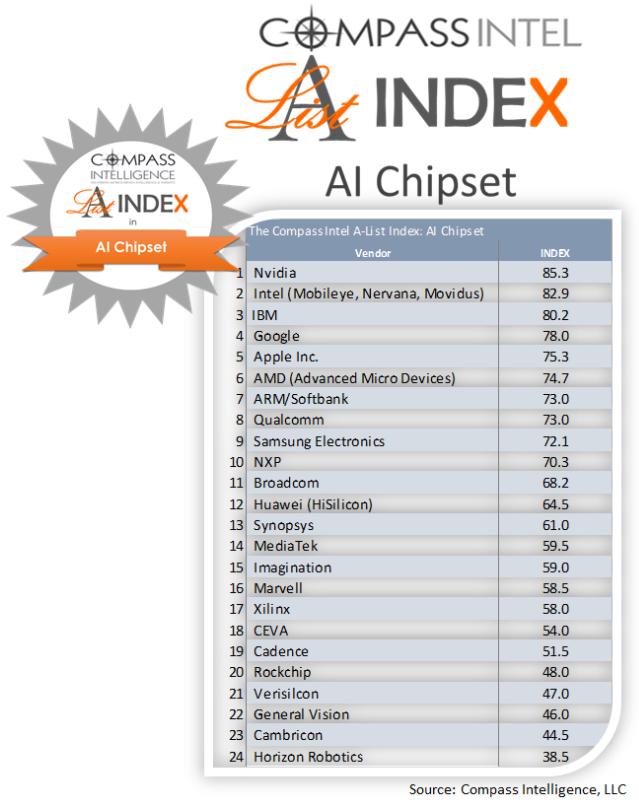

Top 15 big AI chipset ranking “A List” released by Compass Intelligence, the top 3 is NVIDIA, Intel and NXP. Apple is ranked at #8, Samsung #11 and Huawei #12. In the past 3 years, a number of big corps have acquired AI or AI startups, and also conducting RD and investing in AI, which makes AI segment value more than USD60B. (CN Beta, Mobile ID World, Compass Intelligence, brief)

Cambricon Technologies, a Chinese startup specializing in artificial intelligence (AI) chips, unveiled the MLU 100, a cloud-based AI chip. Cambricon also unveiled 1M, its latest generation of terminal processors that can effectively speed up a variety of AI functions embedded in smartphones, speakers, security cameras and cars. (Laoyaoba, Sina, China Times, ECNS)

Touch Display

Samsung’s new foldable phone patent seems to be focused on a ‘deformation sensor’ and a controller which will perform a series of important functions at the time of the bending of the display. The patent also talks about a ‘grip sensor’ configured to sense a user’s hand grip. Users must apparently use specific grip areas to bend the smartphone. (Phone Arena, USPTO, Sam Mobile, Baijiahao)

Connectivity

Recognizing that 5G requires the participation of a slew of industries outside wireless, 26 companies have come together in the 5G Alliance for Connected Industries and Automation (5G-ACIA). It will serve as a central, global forum for addressing, discussing and evaluating relevant technical, regulatory and business aspects with respect to 5G for the industrial domain. (Android Headlines, Huawei, Fierce Wireless, Huawei)

Phone

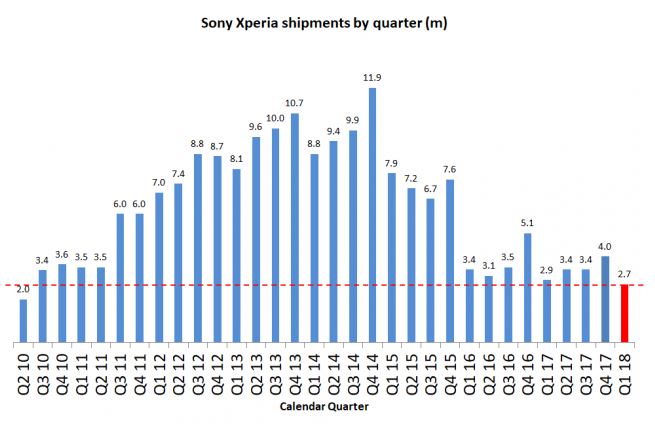

According to CFO Hiroki Totoki, Sony’s continuous commitment to its struggling mobile unit whose Android phone sales have been declining for years now hinges on the advent of 5G. Sony sees the 5G of mobile networks as a technology with “immense potential” due to its versatile nature, Totoki said, adding that Sony Group as a whole is looking to leverage 5G in order to benefit its operations in the future. (Android Headlines, Phone Arena, Xperia Blog, Admin5)

By order of The Pentagon, all retail establishments located on United States military bases must cease selling devices made by both Huawei and ZTE. The Department of Defense reasons that using devices made by those Chinese manufacturers could pose a security risk. (Android Authority, WSJ, Sohu, Epoch Times)

Hulu has announced that it now has over 20M subscribers in the United States. That is up from the 17M that the company reported back in Jan 2018. Hulu still trails Netflix in subscriber count by a wide margin. In its 1Q18 earnings, Netflix tallied 55M US streaming customers. (TechCrunch, Hollywood Reporter, The Verge, CNBC, Sohu)

Spotify has released its first earnings report as a public company, and it contains an updated look at how many people are using the music service. In all, Spotify has 170M monthly active users and 75M paid subscribers. That latter total is up from the 71M marker where Spotify ended 4Q17. (The Verge, Spotify, Sohu, 163)

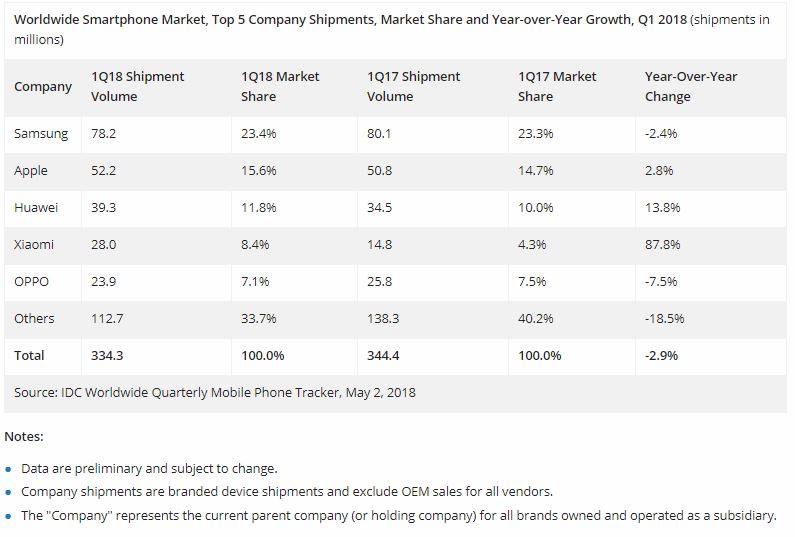

According to IDC, smartphone vendors shipped a total of 334.3M units during 1Q18, resulting in a 2.9% decline when compared to the 344.4M units shipped in 1Q17. The China market was the biggest driver of this decline with shipment volumes dipping below 100M in the quarter, which has not happened since 3Q13. (IDC, press, VentureBeat, Hexun, Tencent)

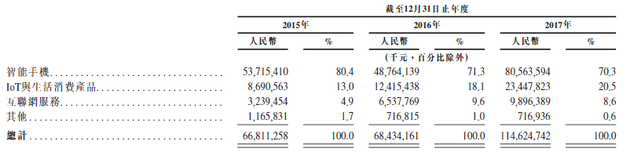

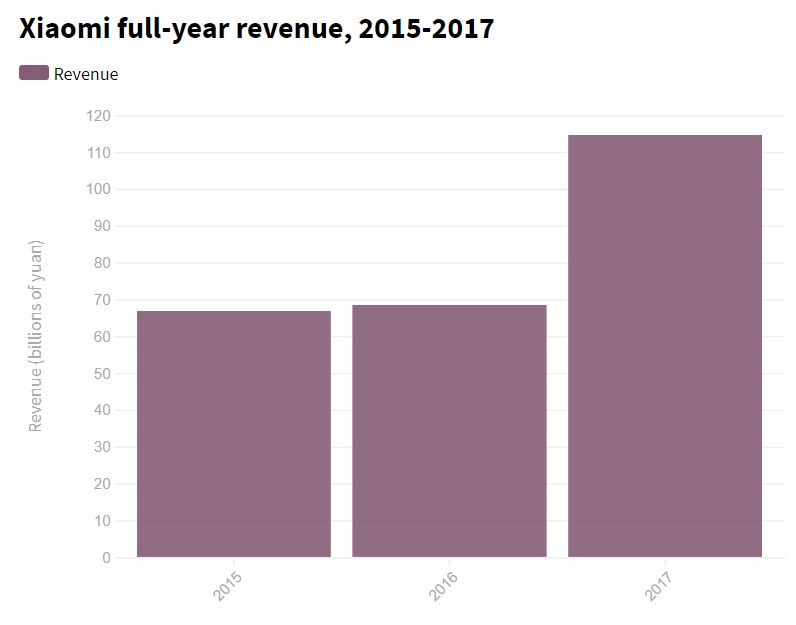

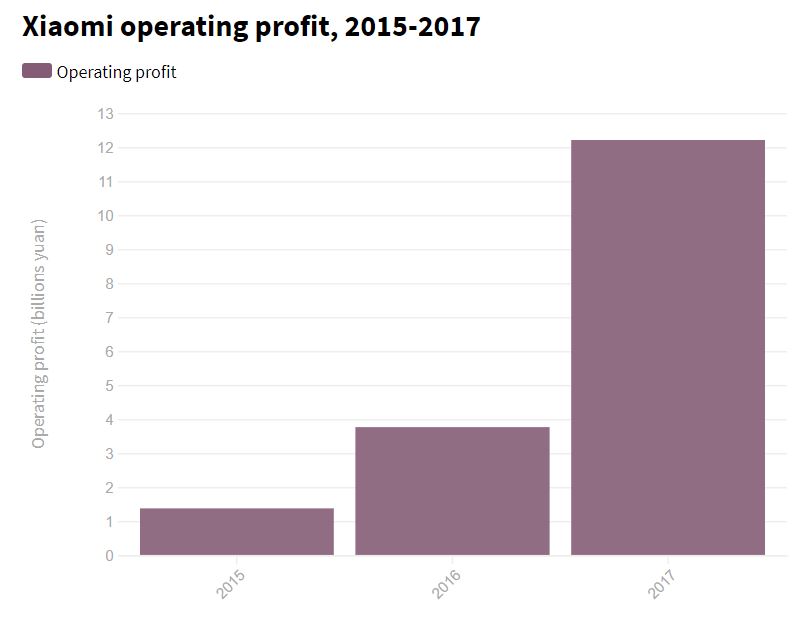

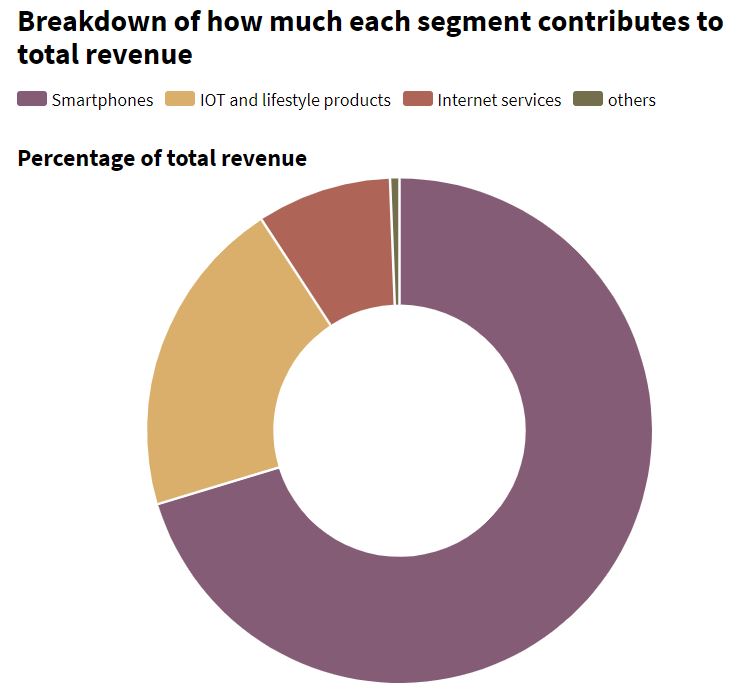

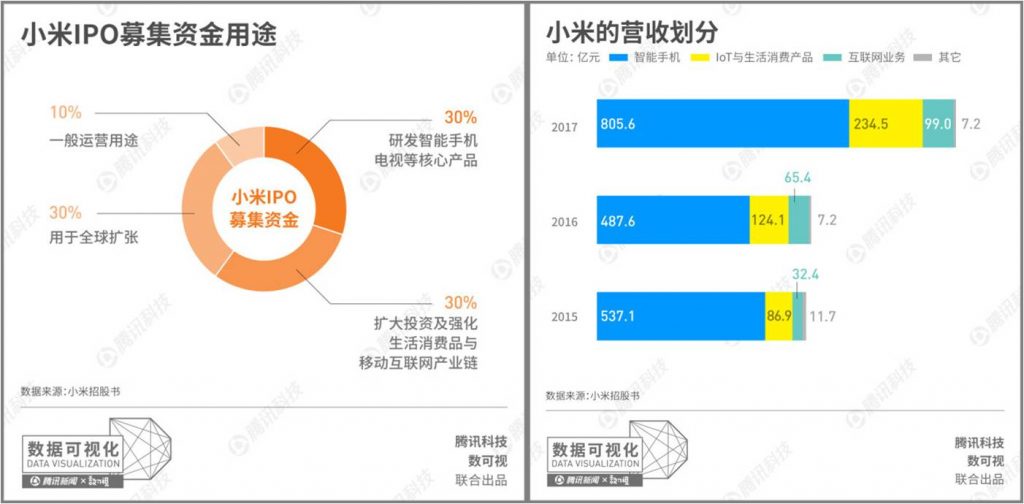

Xiaomi is filing for an initial public offering (IPO), reportedly raising USD10B in Hong Kong. From the filing, Xiaomi overall revenues in 2015 were CNY66.8B, and increased to CNY68.4B in 2016 and CNY114.6B in 2017. Majority income came from the smartphone sales. Up to 2015, 2016 and 2017 (ended Dec 2017), the contribution from smartphone to the revenues were 80.4%, 71.3% and 70.3%, respectively. (CN Beta, CNBC)

According to Xiaomi’s IPO filing, Xiaomi overall revenues in 2015 were CNY66.8B, and increased to CNY68.4B in 2016 and CNY114.6B in 2017. In particular, Internet service revenues have increased from CNY3.2B in 2015 to CNY6.5B in 2016, and further to CNY9.896B in 2017. MIUI OS monthly active user has increased from 112M people in Dec 2015 to 135M people in 2016. (My Drivers, Xinhuanet, Sina, 199IT, Tencent, article)

Xiaomi has partnered with CK Hutchinson to bring its products to 3 Group’s (Three UK’s parent company) stores in Austria, Denmark, Italy, Ireland, Sweden and the UK. Xiaomi products will be sold in CK Hutchinson’s Superdrug stores in the UK. (CN Beta, The Guardian, The Inquirer, Reuters)

The Fair Trade Commission (FTC) named Samsung Electronics vice president Lee Jae-yong as Samsung’s de facto head according to the Fair Trade Act in place of his father, Samsung chairman Lee Kun-hee. (CN Beta, Hankyoreh, The Investor)

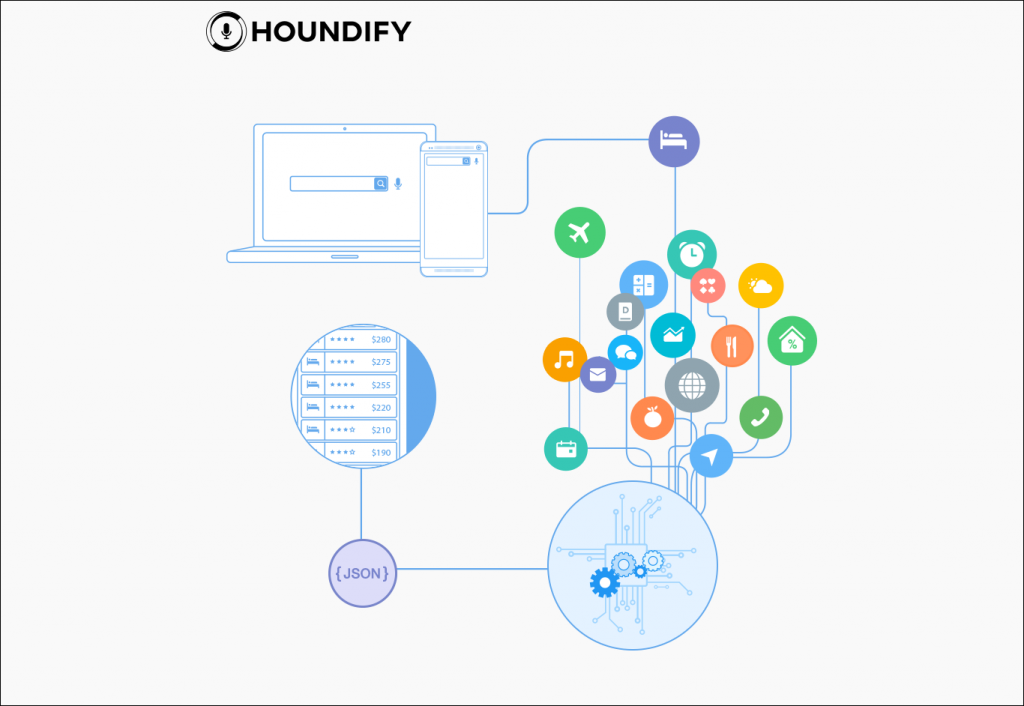

SoundHound, innovator in voice enabled AI and conversational intelligence, i.e., Houndify, has raised another USD100M in its new round of funding from NVIDIA GPU Ventures, Samsung Catalyst Fund, Nomura Holdings, Inc., Sompo Japan Nipponkoa Insurance Inc., and RSI Fund I. Houndify is an AI platform that enables developers and entrepreneurs to deploy it anywhere and retain control of their brand and users. (TechCrunch, Forbes, Financial Express, Sohu)

YouTube CEO Susan Wojcicki says that 1.8B registered users are watching videos on the platform each month, not counting anyone who is watching without an account. (The Verge, CNBC, CNET, AdWeek, iFeng, TechWeb)

Including exports, shipments of smartphones by China-based vendors totaled 141.1M units in 1Q18, decreasing 1.2% from a year earlier, Digitimes Research estimates. With the exception of Xiaomi, all major smartphone vendors in China suffered an over 30% sequential shipment declines in 1Q18 due to seasonal factors and the impact of Lunar New Year holidays, which fell in mid-Feb 2018, Digitimes Research has found. (Digitimes, press, XCN News)

LG G7 ThinQ is announced – 6.1” 3120×1440 LCD FullVision, Qualcomm Snapdragon 845, rear dual 16MP-16MP + front 8MP, 4GB+64GB / 6GB+128GB, a dedicated button for Google Assistant, rear fingerprint scanner, face unlock, IP68 certified, 3000mAh. (Android Central, CN Beta, The Verge, AnandTech, Gizmo China, GSM Arena)

ASUS Zenfone Live L1 Android Go smartphone is launched in Indonesia – 5.45” 720×1440 HD+, Qualcomm Snapdragon 425, rear 13MP + front 5MP, 1 / 2GB+16GB, Android 8.1 (ZenUI 5.0), Face Unlock, 3000mAh. (GizChina, GSM Arena, NDTV)

PC / Tablet

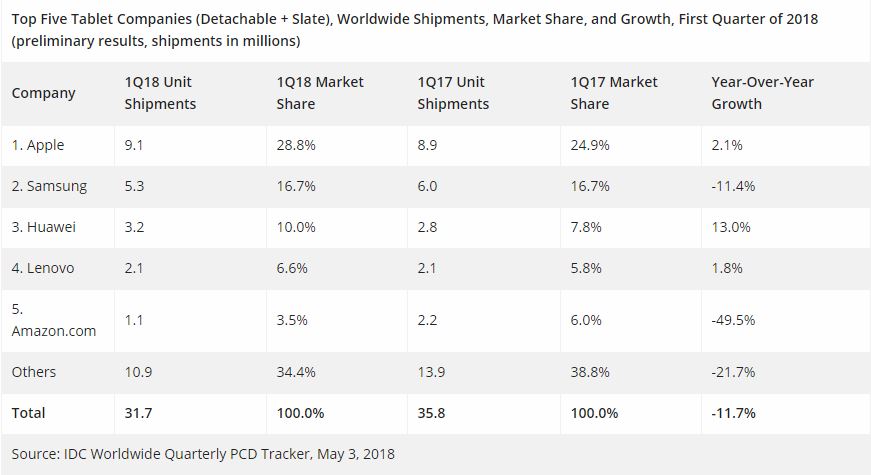

Global tablet shipments in 1Q18 reached 31.7M, declining 11.7% from the prior year, according to IDC. However, the growing niche of detachable tablets like the Microsoft Surface and iPad Pro did experience more than 2.9% year-over-year growth and captured 15.3% share as newer models came into play. (IDC, press, Digital Trends, Sina)

Wearables

Nokia has announced that it has entered into exclusive negotiations to sell the division to Eric Carreel, the co-founder and former chairman of Withings. Withings formed the core of the division after Nokia acquired the French startup in 2016 for EUR170M. (TechCrunch, Nokia, Apple Insider, CN Beta)

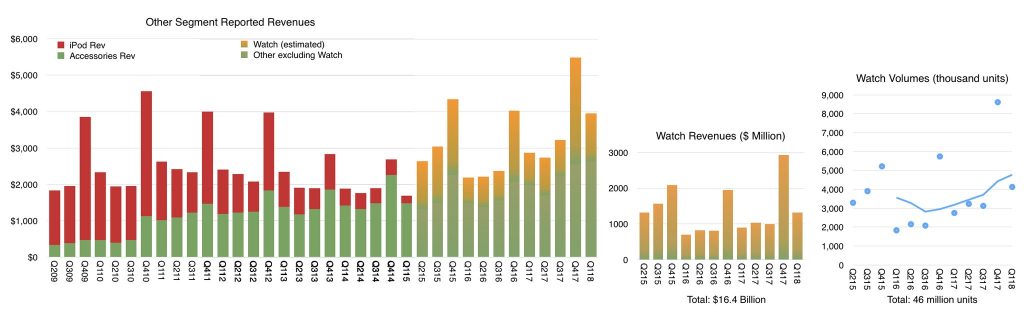

According to analyst Horace Dediu of Asymco, Apple might have sold about 46M Apple Watches to date. Dediu also estimates that the user base is around 40M~43M. Breaking it down further, it is estimated that over 4M Apple Watches were shipped in 1Q18, which is an increase over 1Q17 where it was estimated that just under 3M Apple Watches were sold. (Ubergizmo, Twitter)

Augmented Reality /Virtual Reality

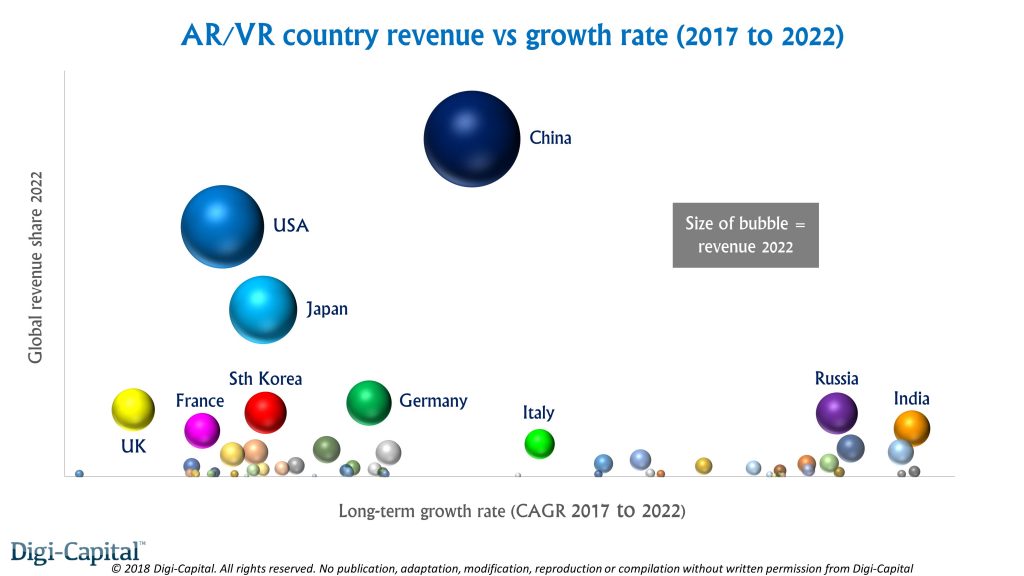

According to Digi-Capital, China has the potential to take more than USD1 of every USD5 spent on AR/VR globally by 2022. The natural advantages of the Chinese AR/VR market are a golden opportunity (or threat) for domestic and international players. Combine China with other major countries in the region, and Asia could deliver around half of AR/VR global revenue in 5 years’ time. (TechCrunch, Digi-Capital, article, Sohu)

Home

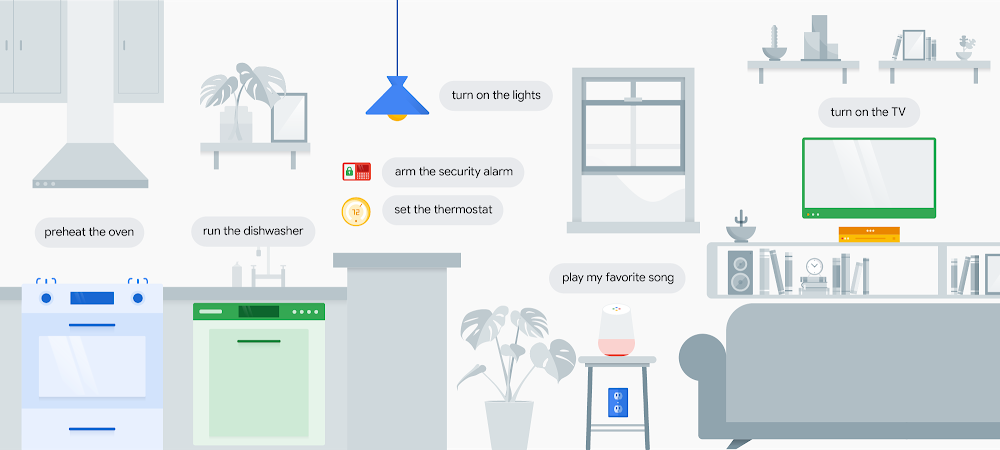

Google has announced that Assistant hit a huge milestone in the smart home: it can now control over 5,000 distinct devices, up dramatically from 1,500 since the start of 2018. (Android Central, Android Headlines, CNET, Google, Sina)

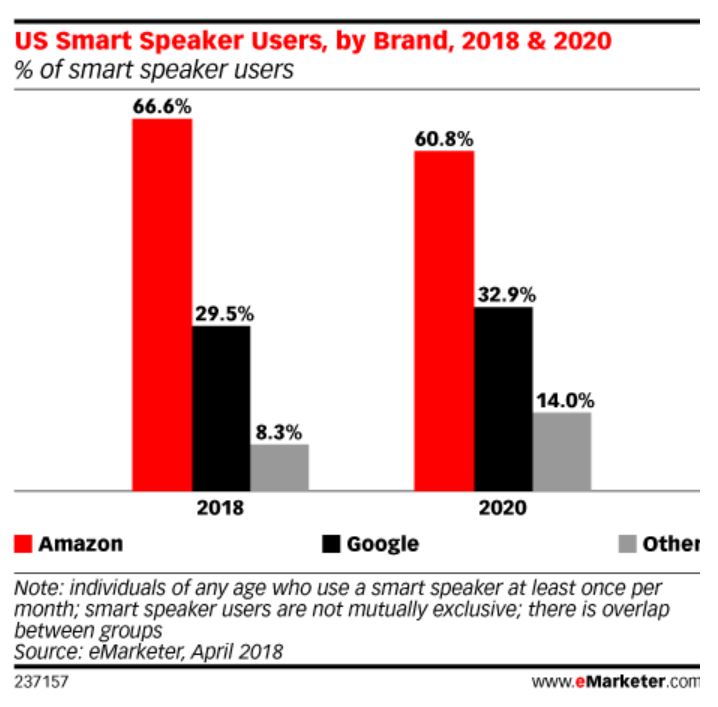

According to eMarketer, in 2017 40.7M people of any age in the US will use an Amazon Echo at least once a month, equating to 2/3 of smart speaker users. However, that share is expected to fall to 60.8% by 2020. Meanwhile, No. 2 player Google Home will have 18.0M users this year. While it will remain a distant second in terms of users during the forecast period, its share is growing. In 2018, it will capture 29.5% of the smart speaker audience, and that figure will grow to nearly 33% by 2020. (Laoyaoba, eMarketer, Mobile Marketing)

Automotive

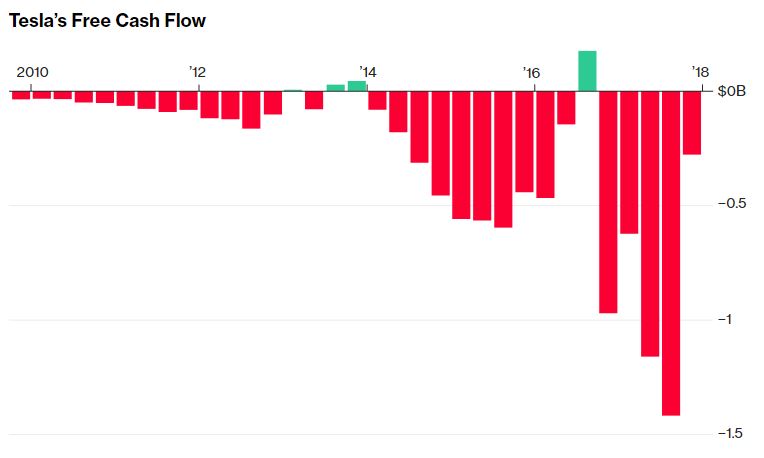

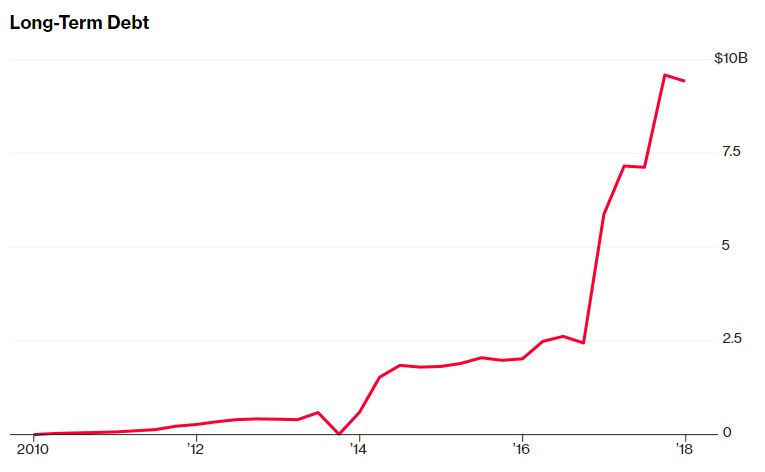

Tesla is going through money so fast that, without additional financing, there is now a genuine risk that the 15-year-old company could run out of cash in 2018. The company burns through more than USD6,500 every minute, according to data compiled by Bloomberg. Free cash flow—the amount of cash a company generates after accounting for capital expenditures—has been negative for five consecutive quarters. (CN Beta, Bloomberg)

Economy

White House trade adviser Peter Navarro will accompany Treasury Secretary Steven Mnuchin visiting China. The U.S. allegedly wants Beijing to scrap the “Made in China 2025” plan. China has presented the Trump administration with plans to boost aircraft, semiconductor and natural gas imports in response to American demands that the country reduce its trade surplus with the U.S. by USD100B. . Beijing is working to open its automotive and financial sectors further as well. (Asia Nikkei, Asia Nikkei, Laoyaoba)