06-26: ZTE has paid a fine in the amount of USD1B, ZTE will also put USD400M into an escrow account; etc.

Chipsets

By 2021, Morningstar projects the AI accelerator chip market will be USD20B, with a 93% CAGR over the next 5 years, as customers purchase more accelerators in lieu of basic server CPUs. However, the ever-increasing size of this market, the huge investment in chip R&D has discouraged companies that are not strong enough to capitalize in this market. Most of the companies are still Qualcomm, Google, Nvidia and Huawei. (EEO, East Money, Laoyaoba)

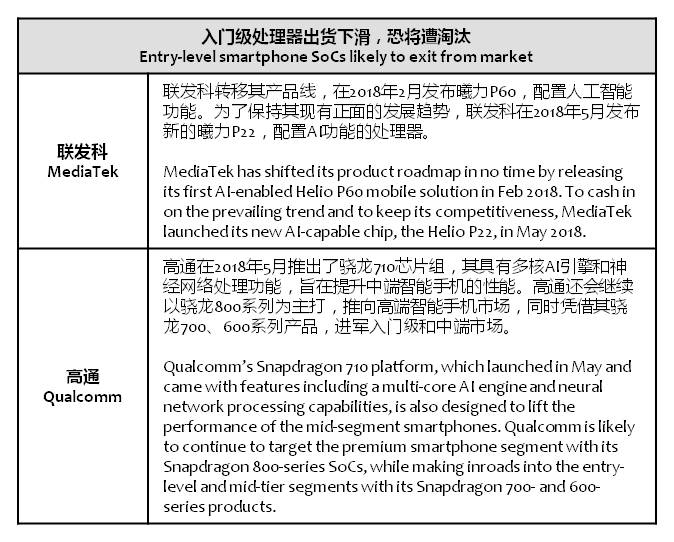

Entry-level smartphone SoC solutions are likely to see their shipments continue declining, with prospect of being driven out of the market, as chipset suppliers are shifting their focus to the mid-tier to high-end solutions to meet smartphone vendors’ strategy of launching new models with high price / performance ratios, according to Digitimes. Qualcomm and MediaTek are launching AI-enabled chips to lure orders from smartphone vendors so as to maintain the ASPs of their mobile solutions and to sustain continued profit growth. (Phone Arena, Digitimes, press, Sohu)

Samsung is allegedly developing at full throttles InFO packaging technology and it has also claimed to outpace TSMC in kicking off official production of EUV 7nm+ process, set for the second half of 2018, seeking to win back orders from Apple in 2019. Samsung has even dropped its order quotes for EUV by 20%, hoping to attract business from a variety of companies. (Apple Insider, Laoyaoba, Digitimes, press)

Taiwan Semiconductor Manufacturing Company (TSMC) is enjoying a sweeping dominance in the 7nm process space, as it has entered volume production of APs for Apple’s new iPhone using the advanced node and in-house developed InFO packaging process, and will also ramp up 7nm production to fulfill robust orders from more than 10 clients including HiSilicon, Qualcomm, AMD and Nvidia in 2H18. (CN Beta, Digitimes, press)

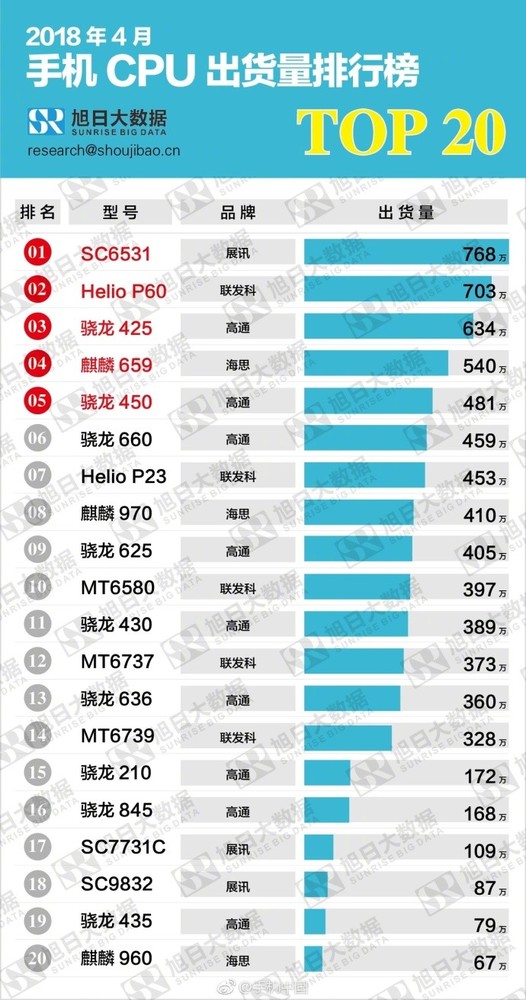

According to Sunrise Big Data’s top 20 SoC shipment (including smartphone and feature phone) in Apr 2018, the top 1 is Spreadtrum SC6531, with monthly shipment reaching 7.68M units. It is aiming for low end multimedia phone market, specifically for elderly phone, backup phone, rugged phone, and only support GSM and GPRS. (CN Beta, Sohu, Laoyaoba)

Touch Display

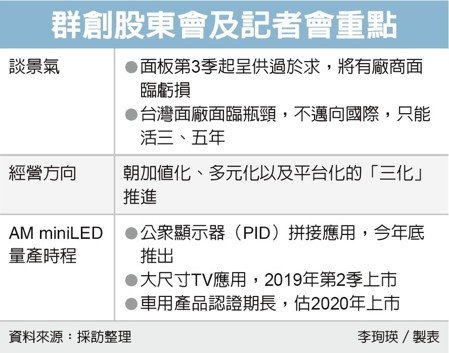

Zhi-Chao Wang, Former CEO of Innolux, as well as a key figure for panel business in Foxconn group indicates that because of the new production emerge in Mainland China, in 3Q18 the panel industry might be facing over-supply issue, which will causes a number of vendors facing loss. From 2H18 till 2019, the whole panel industry will fall into a tough period. (Laoyaoba, UDN, Semi Insights)

Innolux aims to make AM mini LED, which the company calls Pixin LED, the next mainstream technology for the flat panel industry, taking on the prevailing OLED technology dominated by LG Display (LGD) and QLED by Samsung Display (SCD) in the global TV market, the company SVP Ting Chin-lung contended. Taking plasma TV for example, the plasma-based TVs were popular around 2004 but they disappeared completely in about 10 years; the OLED TVs, which have gained popularity in recent 2-3 years, will also disappear in about 10 years, Ting asserted. (My Drivers, Digitimes, press, China Times)

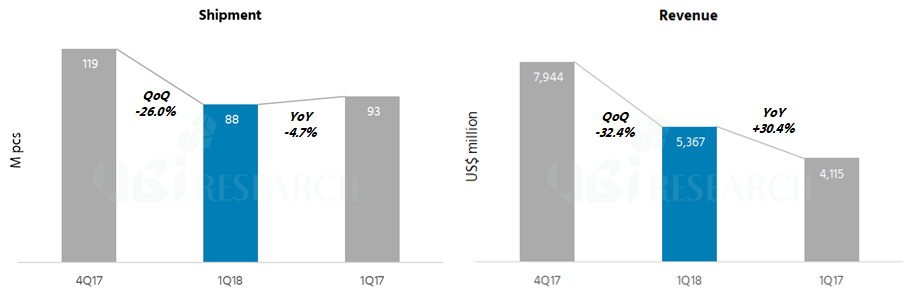

According to UBI Research’s 1Q18 display market track, Samsung Display (SCD)’s OLED shipments for smart phones dropped to 88M units, down 26% from the previous quarter, and 4.7% year-on-year decrease. On the other hand, the sales revenue was USD5.37B, down 32.4% from the previous quarter and 30.4% year-on- year increase. UBI says that SCD will hold a market share of 93.4% of the total OLED market in 2018. (OLEDNet, OLED-Info, UBI Research, press)

LG Display (LGD) is close to starting OLED production at a new factory in Guangzhou to sell more of the next-generation screens. LGD will each month manufacture 130,000 OLED plates (which are divided into screens) once it gets China’s go-ahead for the expansion of the plant, according to Kang In-byeong, LGD’s chief technology officer. (CN Beta, Bloomberg, ESM China, 36Kr)

Camera

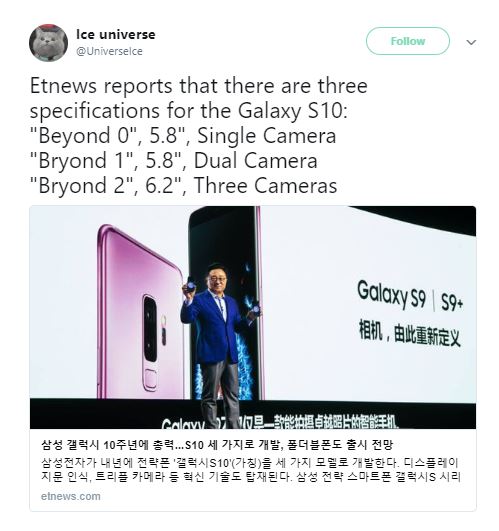

Samsung Galaxy S10 reportedly will launch with 3 models in 1H19 – ‘Beyond 0’ 5.8” with single camera, ‘Beyond 1’ 5.8” with dual camera and ‘Beyond 2’ 6.2” with triple cameras. (Android Authority, ET News, Twitter, TechWeb, IT Home)

Sensory

O-Film forecasts that driven by new innovative smartphone products emerging, in 2018 more vendors will adopt 3D structured light facial recognition in their flagships, and will go mass in 2019. The 3D sensing will drive the related camera components supply chain penetration rate in 5-10 years. (Laoyaoba, JRJ, STCN)

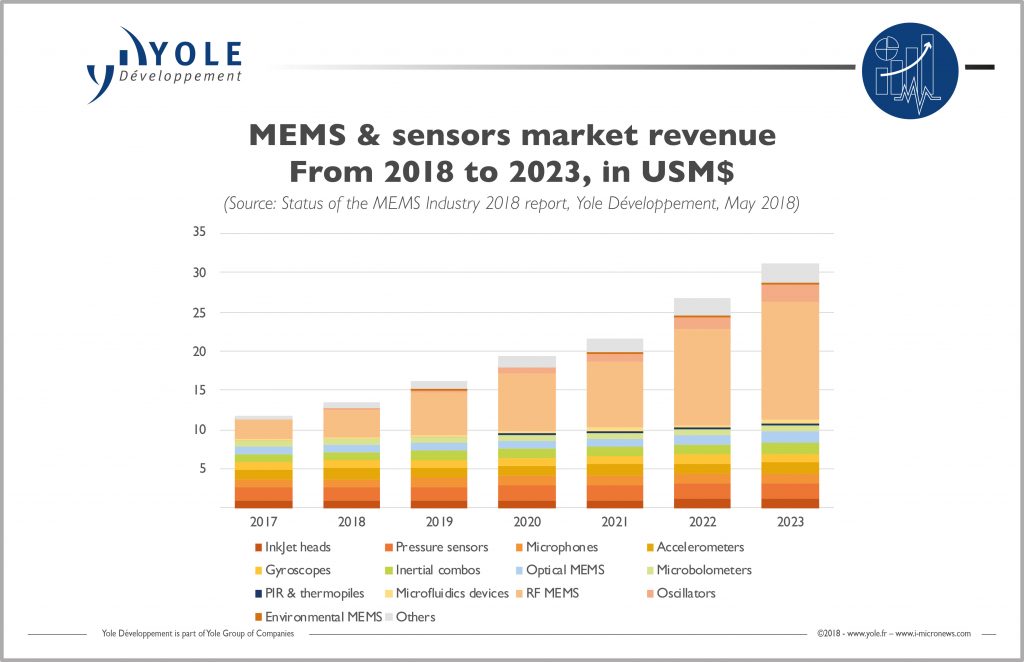

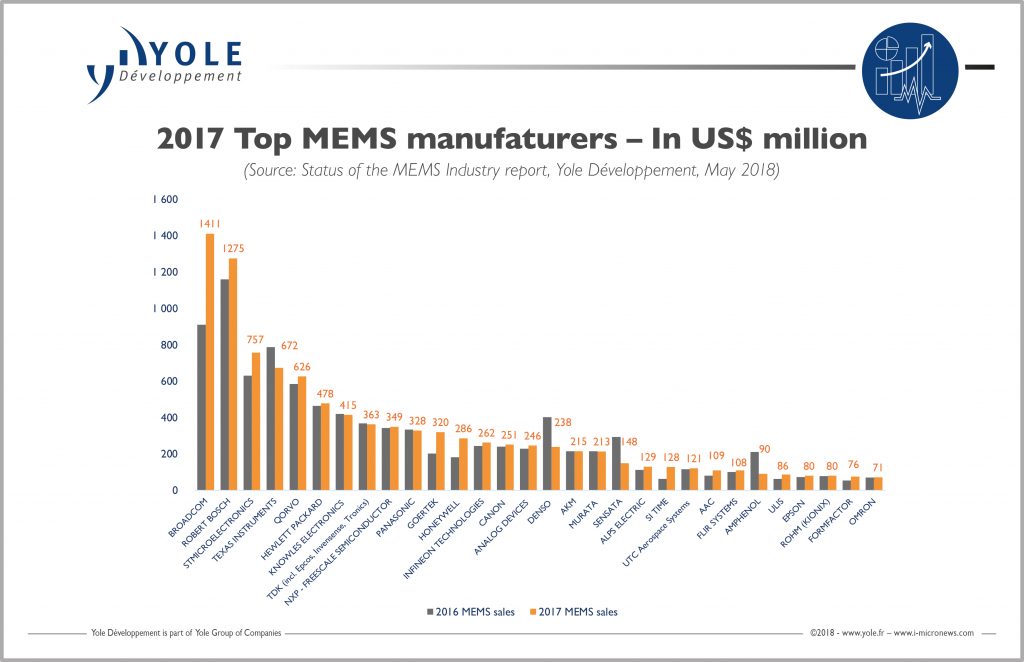

According to Yole Development, MEMS market will experience a 17.5% growth in value between 2018 and 2023, to reach USD31B at the end of the period. The consumer market segment is showing the biggest share, with more than 50% . The good news is that almost all MEMS devices will contribute to this growth. (Laoyaoba, Yole Development, press)

Biometrics

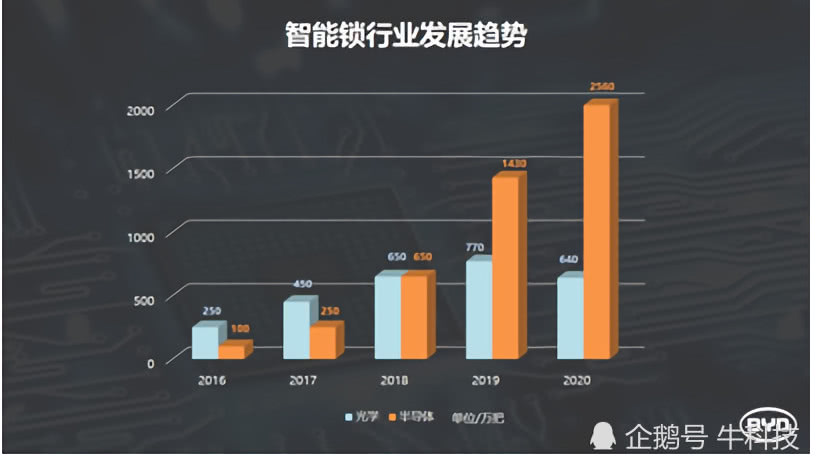

BYD’s fingerprint recognition chipset shipment has exceeded 1M units, owning 60% market share. Since BYD launched its first fingerprint chipset in 2015, aiming for smart lock it has provided a number of solutions for different sizes. In a supply chain, BYD has already formed collaboration with a number of wafer vendors and module makers. The smart lock annual shipment could reach 50M units when it reaches its full capacity. (Laoyaoba, Sohu, Tencent, Chip Hell)

Google is looking to improve biometrics in its upcoming operating system Android P. The company has announced developers can start using the BiometricPrompt API to integrate biometric authentication into their apps. (CN Beta, SDTimes)

Phone

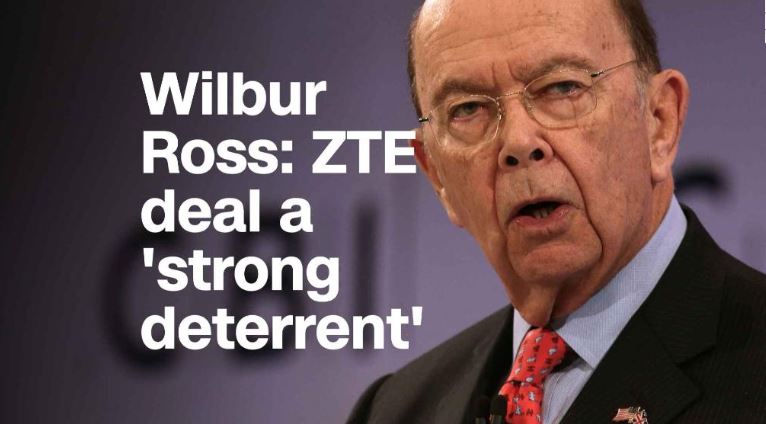

ZTE, which the US government was accused of repeated violations of the sanctions and paid a fine in the amount of USD1B. ZTE will also put USD400M into an escrow account in the coming days. These money are designed to give ZTE the incentive for trade compliance in the future. (Android Headlines, Android Police, CNN Money, Reuters)

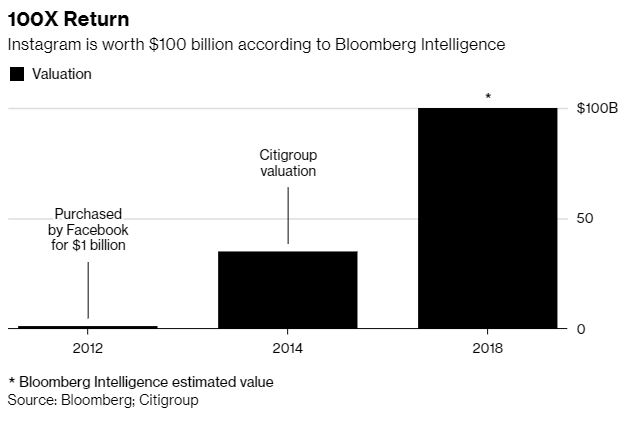

Facebook’s Instagram is estimated to be worth more than USD100B, if it were a stand-alone company, marking a 100-fold return for the app was purchased in 2012, according to Bloomberg Intelligence. (Phone Arena, Bloomberg, Android Headlines, 10JQKA, IT Home, Sina)

Xiaomi Redmi 6 Pro is launched in China – 5.84” 2280×1080 FHD+, Qualcomm Snapdragon 625, rear dual 12MP-5MP + front 5MP, 3 / 4GB + 32 / 64GB, Android 8.1 (MIUI 9), 4000mAh, from CNY999. (Android Authority, Mi.com, GSM Arena)

Samsung Galaxy J3 Star lands at T-Mobile – 5” HD, Samsung Exynos 7 Quad, rear 8MP + front 5MP, 2GB+16GB, Android 8.0, 2600mAh, USD175 or USD7 per month for 2-year contract. (Phone Arena, Sam Mobile, T-Mobile)

Tablet

Xiaomi Mi Pad 4 is launched in China – 8” 1920×1200 FHD+, Qualcomm Snapdragon 660, rear 13MP + front 5MP, 3GB+32GB / 4GB+64GB, Android 8.1 (MIUI 9), 6000mAh, face unlock, from CNY1099. (GizChina, CN Beta, CNET)

Wearables

Apple is allegedly working on new AirPods with noise-cancellation and water resistance. Slated for 2019, the earbuds will likely cost more than the existing USD159 pair. The company has also internally discussed adding biometric sensors to future AirPods, like a heart-rate monitor, to expand its health-related hardware offerings beyond the Apple Watch. (TechCrunch, Bloomberg, The Verge, CN Beta)

Automotive

IBM and Volkswagen (VW) have both set up shop at an IBM office in Berlin to help develop VW’s “We Experience” system, which uses IBM’s cloud services to create a more personalized experience for VW’s digital platform. It is part of a 5-year partnership that was announced Sept 2017. The co-working space uses what is called the “Garage Factory” setting. (CN Beta, CNET)

Artificial Intelligence

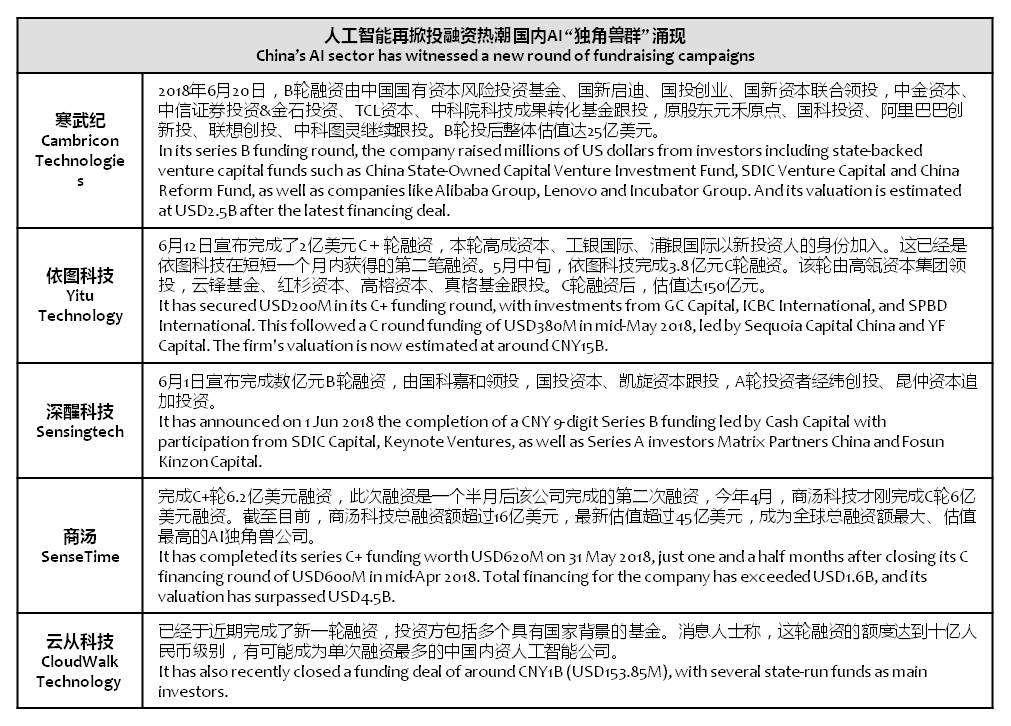

Forrester estimated that the annual global investments in the AI sector shot up over 300% on year in 2017, and the sector will continue to see explosive investment growths in the coming years, including that in China. Statistics showed that aggregate investments in China’s AI sector amounted to CNY131.4B during 2012-2017, almost on a par with the US. But in 2017 alone, such investments in China hit a high of CNY58.2B, surging 65.3% on year , with both the investment numbers and growth rate outstripping those of the US. (Digitimes, press, iFeng)

Fintech

Amsterdam Airport Schiphol announces that it has installed a “BitcoinATM” to let passengers convert euro to Bitcoin and Ethereum. The ATM is installed for a six-month trial period — to gauge demand for the service among passengers. (TechNews, TNW, Schiphol)