3Q18 Smartphone Market

The data used in this report is from Canalys’ 3Q18 smartphone shipment.

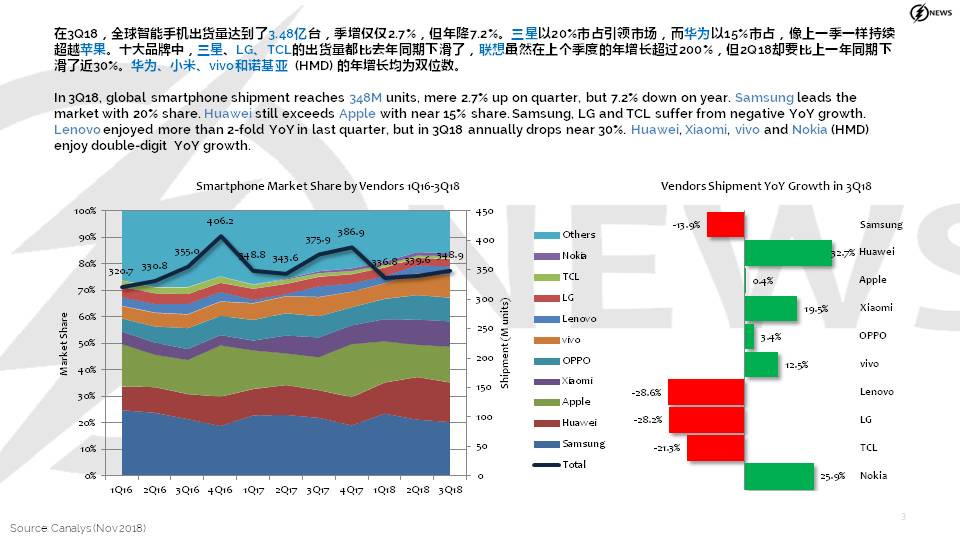

- In 3Q18, global smartphone shipment reaches 348M units, mere 2.7% up on quarter, but 7.2% down on year. Samsung leads the market with 20% share. Huawei still exceeds Apple with near 15% share. Samsung, LG and TCL suffer from negative YoY growth. Lenovo enjoyed more than 2-fold YoY in last quarter, but in 3Q18 annually drops near 30%. Huawei, Xiaomi, vivo and Nokia (HMD) enjoy double-digit YoY growth.

- In 3Q18, Asia Pacific (mainly India) and Greater China still hold the biggest market share, with near 26% and 30% share, respectively. The overall smartphone market in 3Q18 is shrinking globally. Other than Central & Eastern Europe and Africa with minor YoY growth, other regions, especially Greater China, suffer from negative YoY growth.

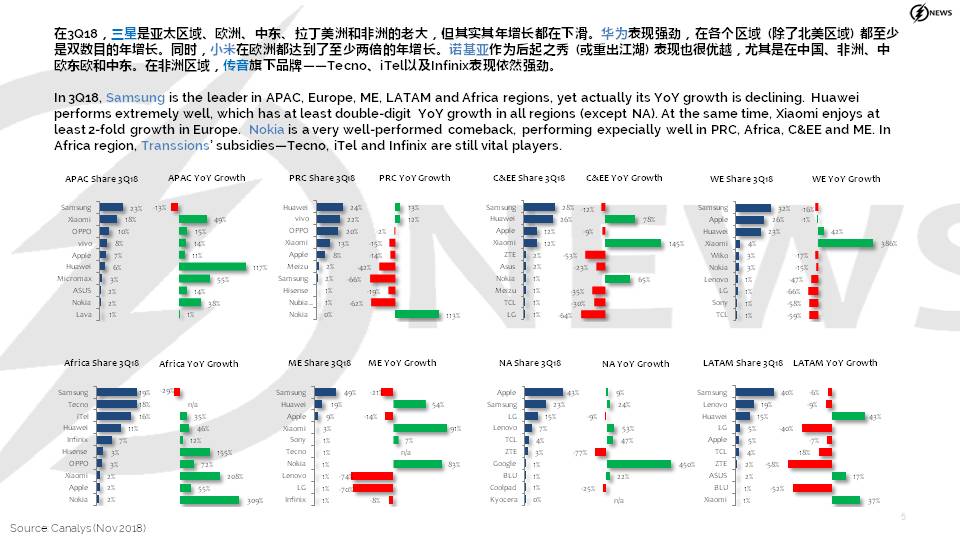

- In 3Q18, Samsung is the leader in APAC, Europe, ME, LATAM and Africa regions, yet actually its YoY growth is declining. Huawei performs extremely well, which has at least double-digit YoY growth in all regions (except NA). At the same time, Xiaomi enjoys at least 2-fold growth in Europe. Nokia is a very well-performed comeback, performing expecially well in PRC, Africa, C&EE and ME. In Africa region, Transsions’ subsidies—Tecno, iTel and Infinix are still vital players.

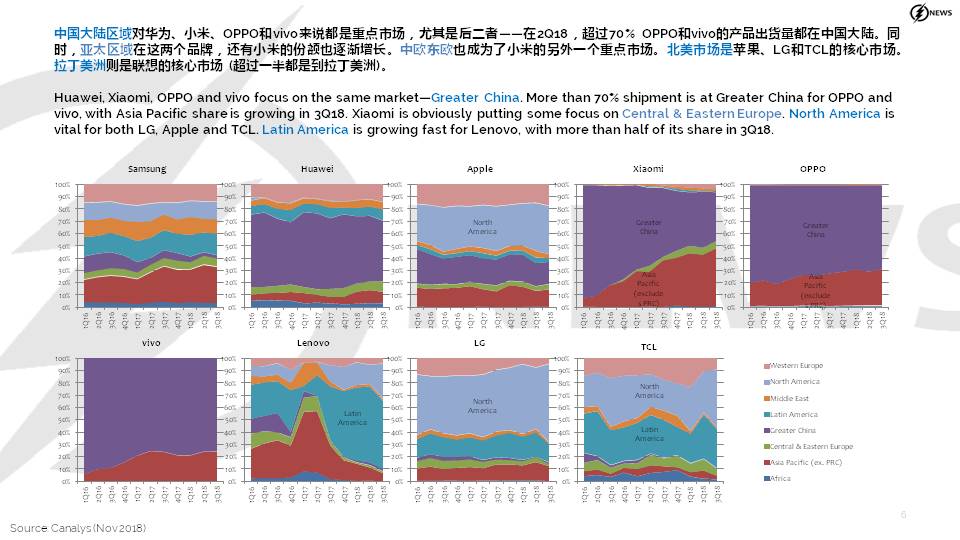

- Huawei, Xiaomi, OPPO and vivo focus on the same market—Greater China. More than 70% shipment is at Greater China for OPPO and vivo, with Asia Pacific share is growing in 3Q18. Xiaomi is obviously putting some focus on Central & Eastern Europe. North America is vital for both LG, Apple and TCL. Latin America is growing fast for Lenovo, with more than half of its share in 3Q18.

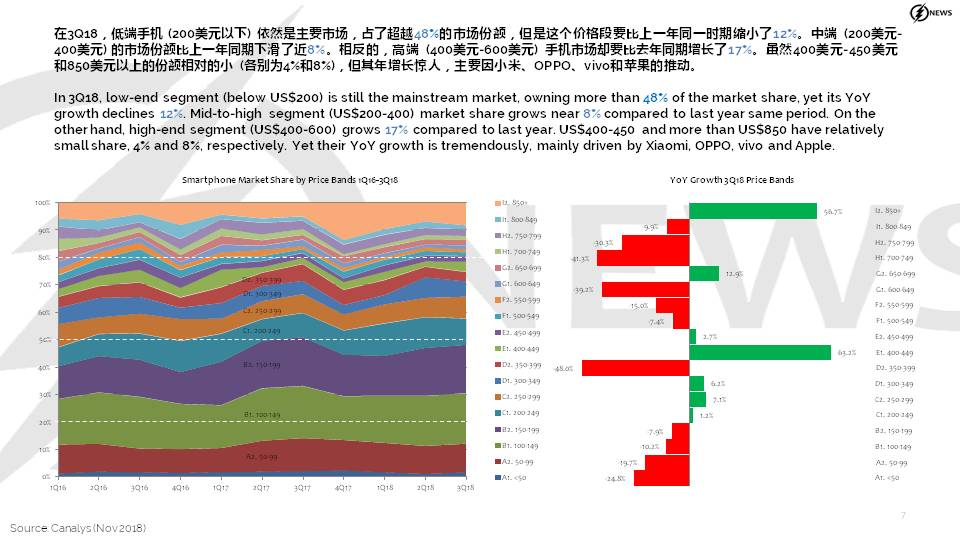

- In 3Q18, low-end segment (below US$200) is still the mainstream market, owning more than 48% of the market share, yet its YoY growth declines 12%. Mid-to-high segment (US$200-400) market share grows near 8% compared to last year same period. On the other hand, high-end segment (US$400-600) grows 17% compared to last year. US$400-450 and more than US$850 have relatively small share, 4% and 8%, respectively. Yet their YoY growth is tremendously, mainly driven by Xiaomi, OPPO, vivo and Apple.

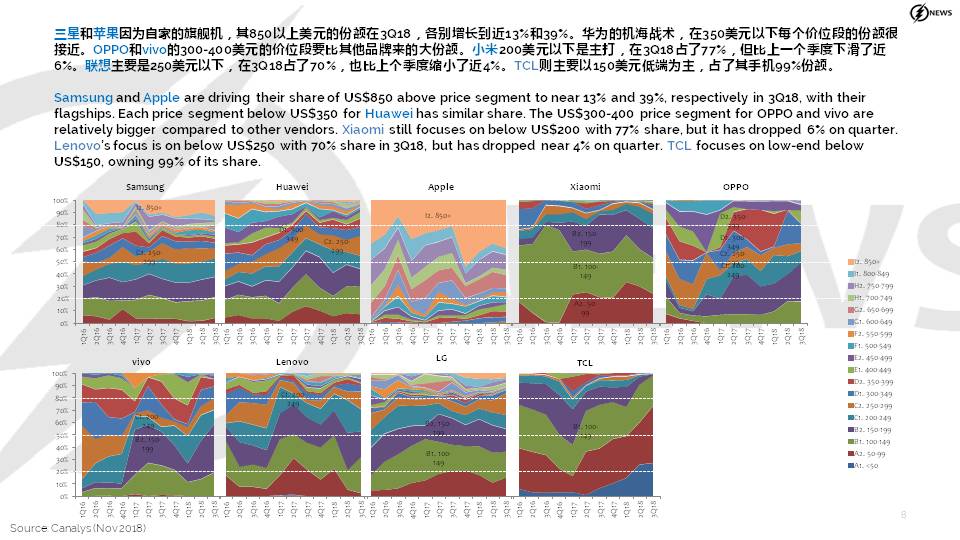

- Samsung and Apple are driving their share of US$850 above price segment to near 13% and 39%, respectively in 3Q18, with their flagships. Each price segment below US$350 for Huawei has similar share. The US$300-400 price segment for OPPO and vivo are relatively bigger compared to other vendors. Xiaomi still focuses on below US$200 with 77% share, but it has dropped 6% on quarter. Lenovo’s focus is on below US$250 with 70% share in 3Q18, but has dropped near 4% on quarter. TCL focuses on low-end below US$150, owning 99% of its share.