01-03: SK Innovation will showcase a key material for flexible displays; Meizu is allegedly on the way to receive a CNY100M fund injection; etc.

Chipsets

Samsung Electronics will supply its latest 8nm processors for Audi’s next-generation in-vehicle infotainment system. Samsung Exynos Auto V9 packs eight ARM Cortex-A76 cores — which has a max speed of 2.1GHz — and will be used to power the German automobile manufacturer’s new infotainment system that is set to debut in 2021. (CN Beta, ZDNet)

Touch Display

SK Innovation will showcase a key material for flexible displays. It will introduce its flexible cover window (FCW), a core material for flexible displays. SK Innovation has developed the FCW based on its polyimide (PI) film technology. SK Innovation has announced that it will invest KRW40B (USD35.8M) to build a production line for flexible cover windows in South Korea, which is anticipated to start its operation in 2H19. (CN Beta, Business Korea, The Investor, Korea Herald)

Camera

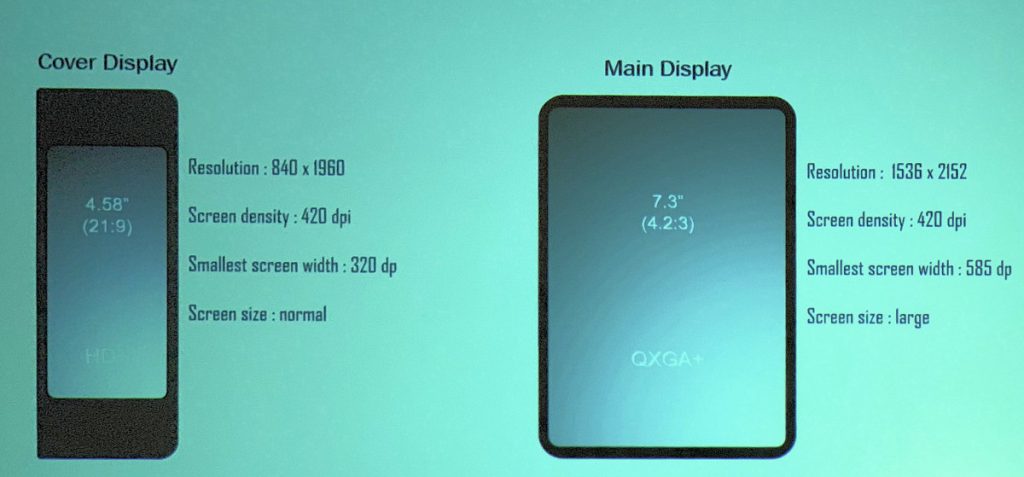

Samsung’s foldable smartphone, rumored to launch as the Galaxy Fold, will reportedly sport a triple-camera setup on the back. Samsung will reportedly go with the Galaxy A7 formula, which is also the rumored setup on Galaxy S10, for the upcoming foldable smartphone. (GSM Arena, ET News, Sam Mobile, CN Beta, MS Poweruser)

Huawei has filed a patent with CNIPA (China National Intellectual Property Administration) for a smartphone case with a large camera cut-out, that seems to be meant for a penta-camera. It seems the patented smartphone case offers space to five cameras and a flash. (Android Headlines, GizChina, LetsGoDigital, Mobiel Kopen, IT Home, Sina)

Memory

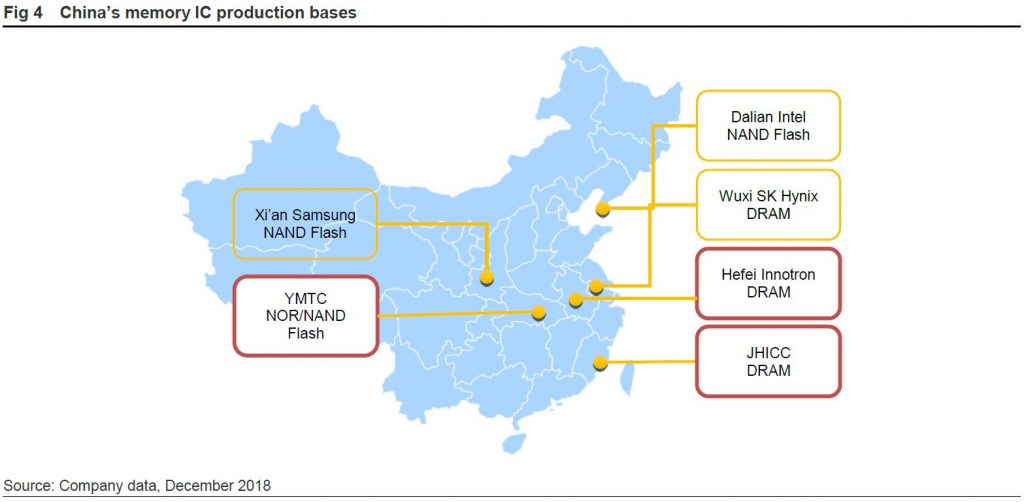

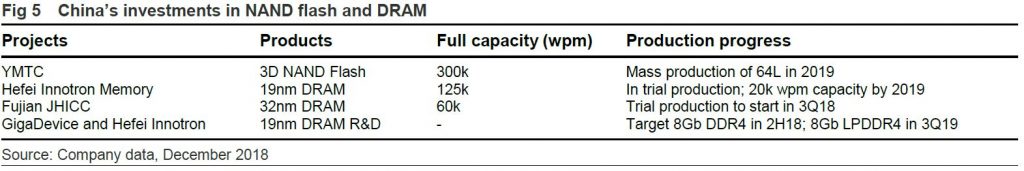

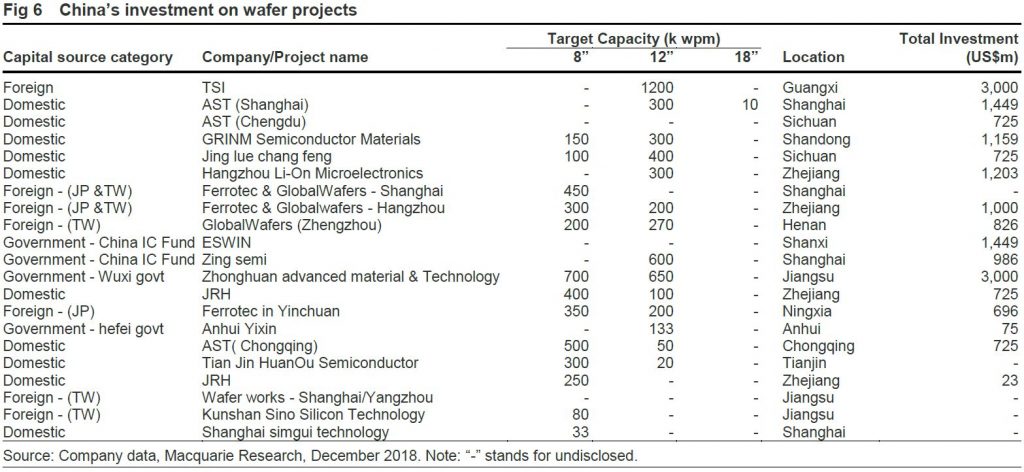

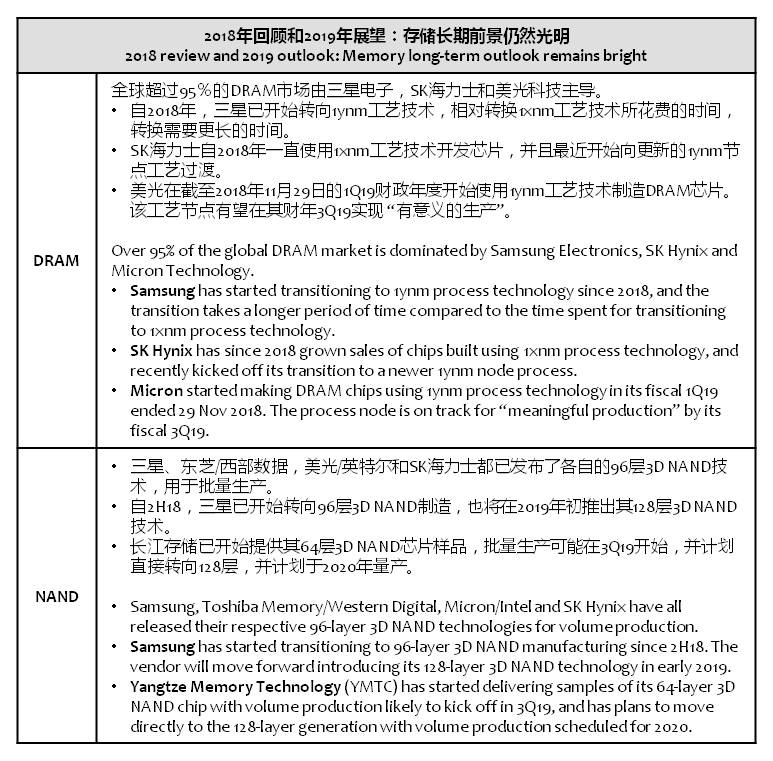

According to Macquiarie Research, while the US ban on Jinhua has reportedly led it to halt operations, GigaDevice (兆易创新) has indicated its own 19nm DRAM progress with Innotron remain on track for 8Gb DDR4 small volume production by end of 2018 and 8Gb LPDDR4 mass production in 3Q19. YMTC, Innotron, and Jinhua are China’s key memory ventures with strong government support. (Macquarie Research report)

Memory chipmakers had a good year in 2018, but the outlook for 2019 is marred by uncertainties arising from the US-China trade war and concerns about over-supply. Samsung Electronics and SK Hynix have already made moves to avoid over-reliance on the memory market, eyeing new business opportunities for growth in the non-memory sector which accounts for over 50% of the overall semiconductor market. (Digitimes, press, Digitimes, press)

After contract prices of DRAM products turned downward sharply in 4Q18 by 10% QoQ, major DRAM manufacturers have tried to offset fall in prices by slowing down capacity expansion in 2019, as the demand outlook for PCs, servers, smartphones, and other end consumer products remains weak, reports TrendForce. Manufacturers’ capex plans are normally the most relevant indicators for their actual bit output. In 2019, the total capital expenditure for DRAM production is forecast at about USD18B, down 10% YoY. This CAPEX is at the most conservative investment level in recent years. (TrendForce, press, TrendForce[cn], ET Today)

Sensory

Alphabet’s Google unit has won approval from US regulators to deploy a miniature radar-based motion sensing device known as Project Soli, intended to herald touchless control of technology. The Federal Communications Commission (FCC) would grant Google a waiver to operate the Soli sensors at higher power levels than currently allowed. The FCC said the sensors can also be operated aboard aircraft. (CN Beta, SCMP, Reuters)

Phone

Wistron has increased the authorized capital of its subsidiary in India, Wistron InfoComm Manufacturing (India), to INR30B (USD430.62M) to meet its future development in the country, according to a company filing with the Taiwan Stock Exchange (TWSE). (Apple Insider, Digitimes, press, UDN, Apple Daily)

LG will reportedly unveil its first 5G handset under a different brand. LG is currently in talks with carriers in South Korea, Europe and the United States regarding its 5G handset, and the company plans to release it in those three markets after the LG G8 is out. (Gizmo China, Android Headlines, ET News, iFeng)

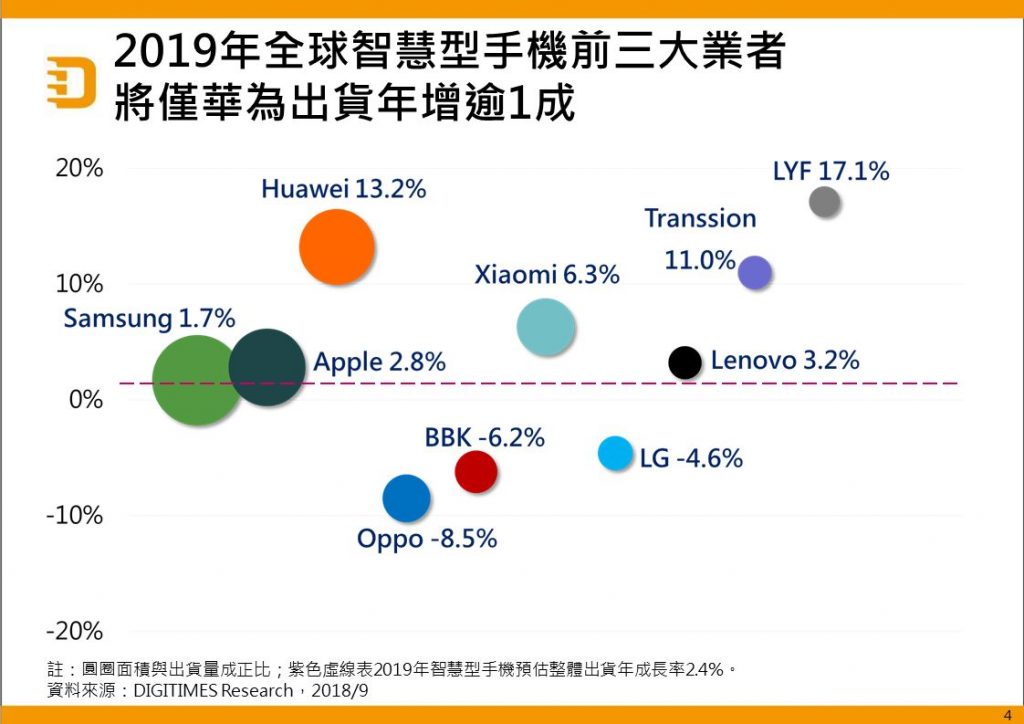

China’s top-4 leading smartphone vendors – Huawei, Xiaomi, OPPO and vivo – are expected to be able to maintain their leaderships in their domestic market in 2019, as they will continue to enhance their competitiveness in the mid-tier to high-end smartphone segments. Globally, Samsung, Apple, Huawei and Xiaomi are likely to become the top-four smartphone vendors in 2019, with each one shipping over 100M units in the year, according to Digitimes Research. (Digitimes, press, CN Beta)

Meizu is allegedly on the way to receive a CNY100M fund injection. The report succeeds other reports that the Zhuhai Municipal Government would be investing in the domestic smartphone maker. (CN Beta, Tencent, CS, Zhicheng, GizChina)

Xiaomi has announced to make ‘Redmi’ an independent brand. Xiaomi CEO Lei Jun explains that the primary reason behind separating both Mi and Redmi brands is the focus. The Redmi devices are primarily sold through e-commerce platforms while Mi devices are not e-commerce focused. (CN Beta, Gizmo China)

Realme, a subsidy brand of OPPO, has announced that the company has reached 4M users in 7 months. (GSM Arena, Twitter, ZOL)

Huawei Y5 Lite with Android Oreo (Go Edition) is launched in Pakistan – 5.45” 1440×720 HD+ IPS, MediaTek MT6739, rear 8MP + front 5MP, 1+16GB, Android Oreo (Go Edition), 3020mAh, PKR16,500 (about EUR100). (GSM Arena, GizChina, Huawei)

Augmented / Virtual Reality

Taiwan government-sponsored Information Industry Institute (III) has developed AR-enabled smart glasses for use by local steel maker CSC for inspecting equipment at factories. Equipped with low-light lenses, gas sensors, GPS-based inertia sensors and wireless communication modules, the AR-enabled smart glasses are used in combination with safety helmets that the inspectors wear, said III’s Smart System Institute (SSI), which developed the device. (Digitimes, press, Digitimes)

Following the release of an enterprise version of Blade in 2017, a pair of augmented reality smart glasses that resemble traditional sunglasses, Vuzix has confirmed dates and pricing for its consumer model. Previously referred to as “Blade General,” the retail version of Blade is available for preorder at USD1,000 and is shipping in 4-6 weeks. (CN Beta, Engadget, VentureBeat, The Verge)

Automotive

Chinese electric vehicle developer Faraday Future has signed a new restructuring agreement with a unit of its main investor, Evergrande Health Industry Group, ending a bitter legal fight and clearing the path for raising funds. Season Smart, which has agreed to be bought by China’s Evergrande Health, will now own 32% preference shares, down from a previous 45%, according to filings. (My Drivers, Leiphone, Sina, Yicai, Reuters, Engadget)