10-12: recently started producing OLED displays – low volume production for Apple’s wearables; Shanghai Zhangjiang Hi-Tech Park Development has announced to invest CNY150M (USD21.03M) in Huaqin Telecom; etc.

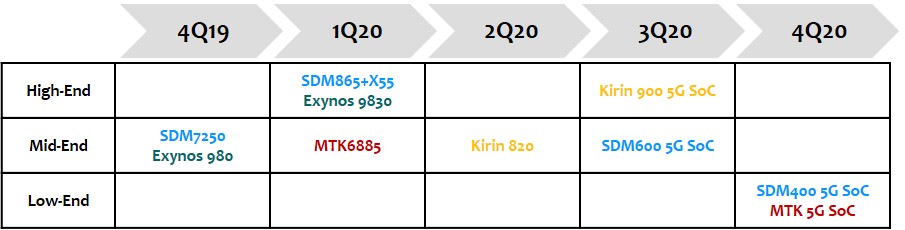

Chipsets

ARM has announced ARM Custom Instructions, a new feature for the Armv8-M architecture. ARM Custom Instructions will initially be implemented in Arm Cortex-M33 CPUs starting in 1H20 at no additional cost to new and existing licensees, enabling SoC designers to add their own instructions for specific embedded and IoT applications without risk of software fragmentation.(CN Beta, TechCrunch, Business Wire)

Qualcomm flagship chipset SDM865 with X55 5G modem will enter mass production in 1Q20, and it will be adopted by Xiaomi, OPPO and vivo. Its mid-to-high end 5G chipset SDM7250 will also be used by OPPO and Xiaomi. MediaTek’s mid-end 5G SOC chipset will enter mass production in 1Q20. (IHS Markit report, IHS Markit report)

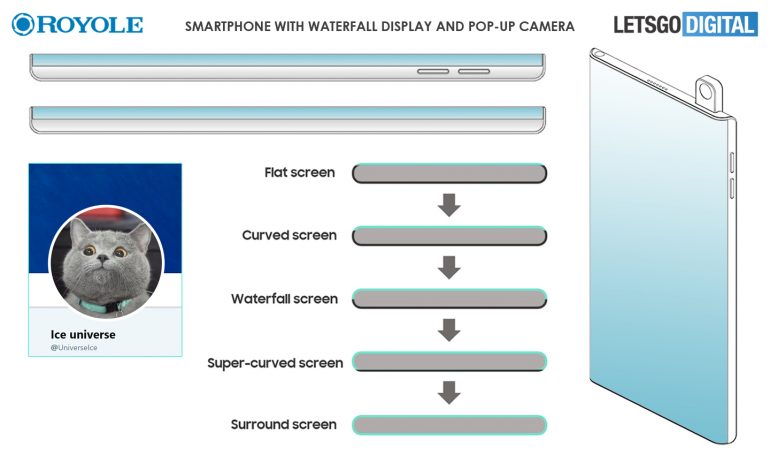

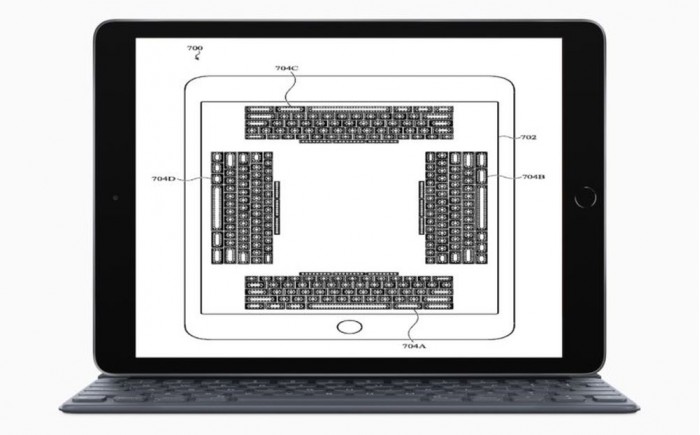

Touch Display

Royole has applied for a design patent from the Japan Patent Office (JPO), indicating that the company is preparing a smartphone with a “waterfall display”. This device achieves a full front screen coverage and covers half of the borders on both sides, with the top and bottom borders barely visible. Royole has also designed a compact camera system for the machine, integrating a camera sensor. (CN Beta, LetsGoDigital, SCMP)

USPTO has published a patent application from Apple that relates to a next generation of haptics known as “Static Pattern Electrostatic Haptic Electrodes” that is designed to make virtual keyboards feel more realistic to the touch. It relates to haptics that use one or more static pattern electrostatic haptic electrodes driven by one or more voltages to provide a variety of haptic output. (CN Beta, iMore, Patently Apple)

In Apr 2019 Japan Display Inc (JDI) signed a deal with Apple to supply it with AMOLED displays for its smartwatches, and JDI’s new CEO Minoru Kikuoka has said that the company recently started producing OLED displays – low volume production for Apple’s wearables. Apple Watch Series 5 features a 324×394 1000-nits always-on LTPO AMOLED display Apple is currently buying these OLED displays exclusively from LG Display (LGD). (CN Beta, Tencent, OLED-Info)

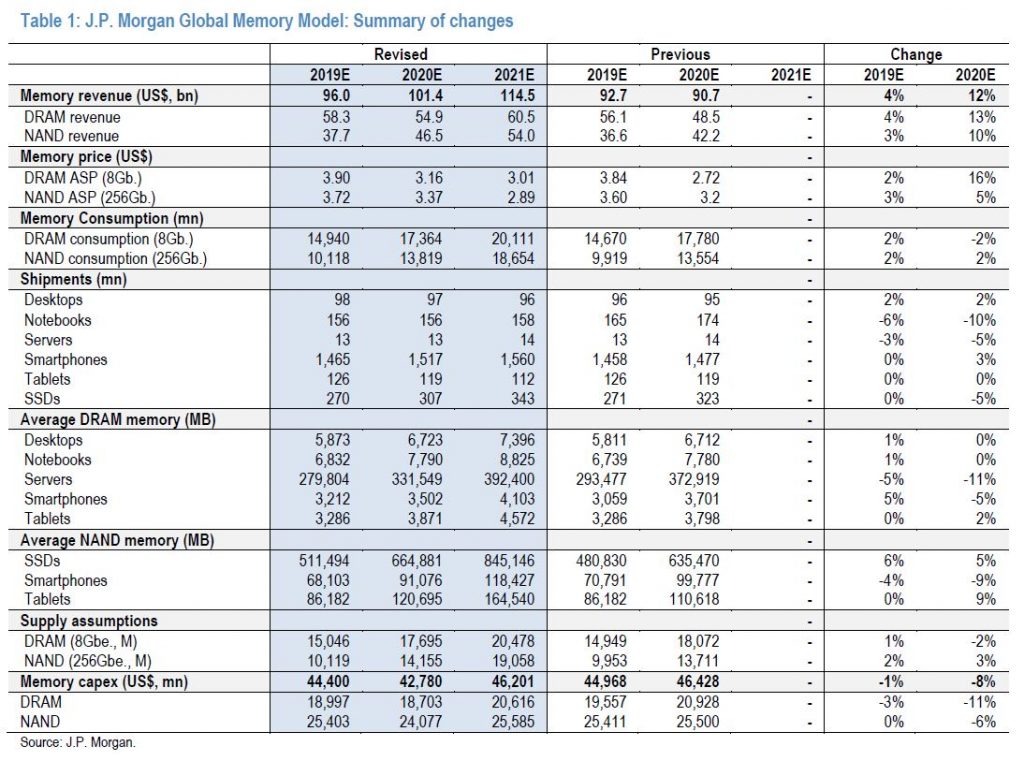

Memory

For 2020, JP Morgan expects the DRAM market to continue to decline until 1Q20 but begin to show a moderate recovery in 2Q20 as DRAM prices stop declining. On the other hand, they believe NAND will show a strong recovery on the back of strong price elastic demand amid significantly reduced ASP declines of 10% Y/Y in 2020 from a 52% decline in 2019. JP Morgan expects both the DRAM and NAND markets to see double digit % revenue growth in 2021 as the price declines slow down. (JP Morgan report)

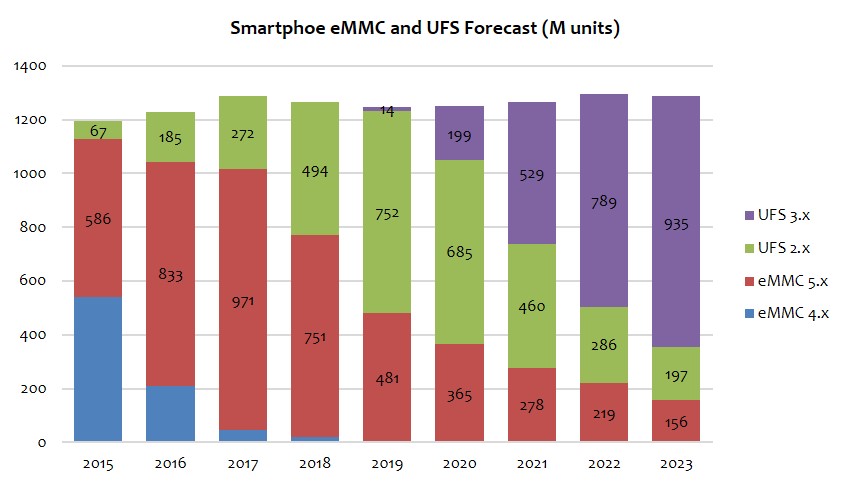

According to IHS Markit, the smartphone industry is experiencing a shift to UFS. The majority of smartphones in 2019 will ship using UFS technology. While eMMC is a sufficient solution for low density smartphones (8GB, 16GB, 32GB), smartphones continue to increase in density, being pulled along by flagship device trends. (IHS Markit report, IHS Markit report)

Camera

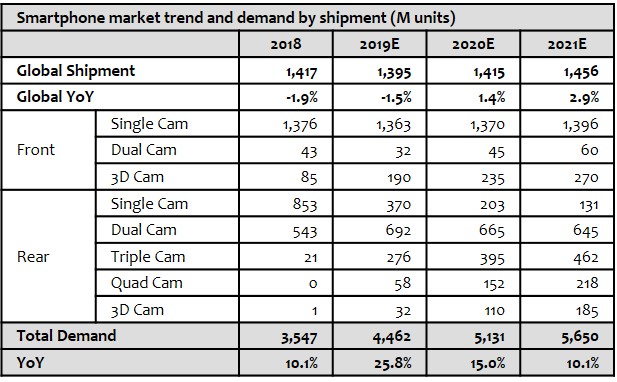

IHS Market states that though global smartphone market declines, yet the camera market is growing in 2019. Considering the image sensor size is increasing 40%~50% while upgrade from 16MP to 48MP or even 64MP, and total wafer demand will increase about 50% in 2019. (IHS Markit report, IHS Markit report)

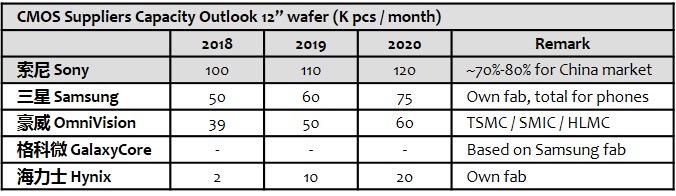

Due to the rapid adoption of triple camera/quad camera solution, the key CIS suppliers Sony, Samsung, OminiVision and Hynix have expanded their production capacity to compete the market share. (IHS Markit report, IHS Markit report)

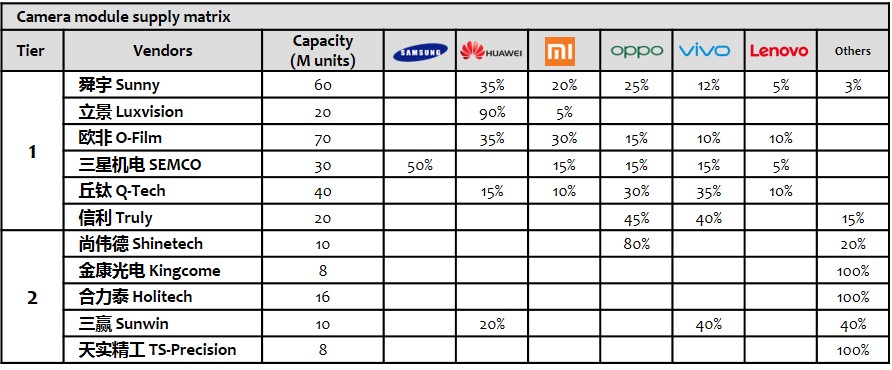

High end camera module supply and capacity concentrate on Sunny, O-Film and Q-Tech, and they are all face the supply risk during 2Q19 / 3Q19. Luxvision plans to expand the camera module capacity in Shang Rao and Ji An, and it will be available in 2020. Additionally AAC Technologies has joined in high end camera module market and it will be available in 2020. (IHS Markit report, IHS Markit report)

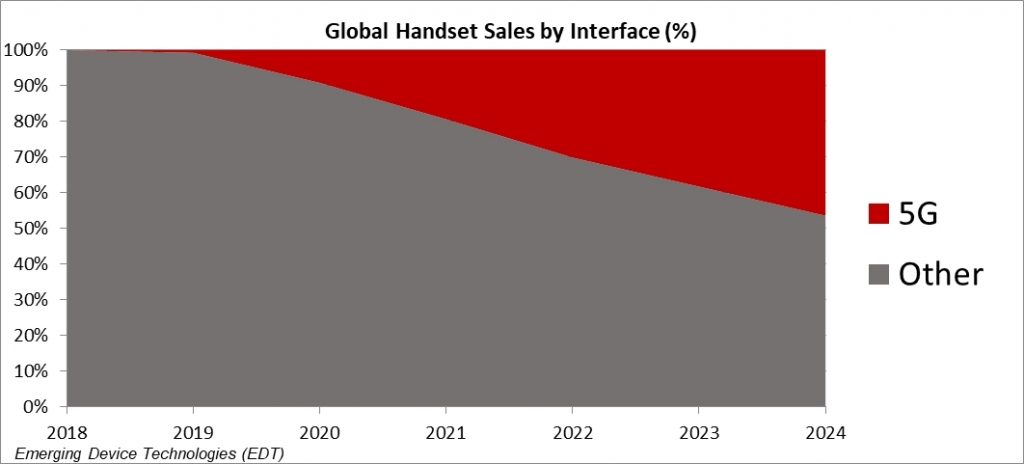

Phone

Strategy Analytics forecasts that 5G devices, from a sluggish start in 2019 will take off in 2020. Strategy Analytics estimates that less than 1% of phones sold in 2019 will be 5G devices, but that share will grow to nearly 10% in 2020. The current 5G smartphone leader is Samsung. LG, Huawei, OPPO, vivo and Xiaomi are also among the first vendors to the market. (Strategy Analytics, press, Gizmo China)

IHS Markit estimates that in 2020 that would be more than 250M units 5G smartphones shipped globally, with Huawei leads the share with 80M units. It is expected that in 2020 Huawei P and Mate series will all upgrade to 5G SoC, and in 2H20 its mid-to-high nova and Honor series would also upgrade to 5G SoC. (IHS Markit report, IHS Markit report)

Shanghai Zhangjiang Hi-Tech Park Development has announced to invest CNY150M (USD21.03M) in Huaqin Telecom. (Laoyaoba, Yicai, Sina, Yahoo)

Wearables

Fitbit is pulling nearly all of its device manufacturing out of China amid a trade war between China and United States. The company has announced that “effectively all trackers and smartwatches” starting in Jan 2020 “will not be of Chinese origin” as a result of US tariffs. (CN Beta, CNN, ABC News)

Augmented / Virtual Reality

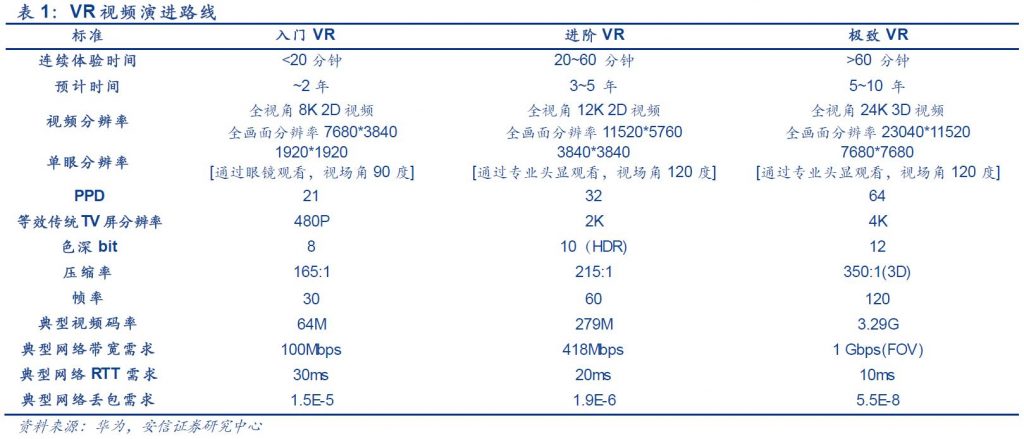

According to Essence Securities, Huawei’s research shows that the ultimate virtual reality (VR) video experience requires a network bandwidth of 1Gbps and a network latency of less than 10ms, otherwise it will be strongly dizzy. According to ITU data, the peak data transmission rate of 5G networks can reach 20Gbps, and the delay does not exceed 1ms. With the commercialization of 5G commercial, 5G cloud virtual reality technology is expected to mature in 2~5 years. (Essence Securities report)

Automotive

Einride has announced it has raised USD25M to continue development of its self-driving electric shipping vehicles and begin targeting international markets. Based in Sweden, the company has developed a software platform and autonomous, electric Einride Pods that are modular and can be adapted to suit various loads. (VentureBeat, WSJ, Einride, NA Incubator)

Uber has acquired a majority stake in the grocery delivery start-up Cornershop. Cornershop is active in Chile, Mexico, Peru and Canada, and Uber plans to add other markets, including the United States. (CN Beta, TechCrunch, Uber, NY Times)

Renault has announced that it is working on launching a self-driving service in the Île-de-France Region as a result of the previously signed collaborative agreement with Waymo and Nissan. (TechNode, TechCrunch, Renault, Neowin)

It has been over 2 years since Dyson’s plans to build an electric car came to light, having collected GBP174M in funding from the UK government in a bid to rid the country of petrol- and diesel-based vehicles by 2040. However the company founder Sir James Dyson has scrapped plans to build an electric car after deciding the project was not commercially viable. (Neowin, Dyson, BBC, The Guardian, Yicai, Sina)

Fintech

Visa, Mastercard, eBay, Stripe, and Mercado Pago have all withdrawn from Facebook’s Libra Association, dealing a major blow to Facebook’s plans for a distributed, global cryptocurrency. The withdrawals leave Libra with no major US payment processor, a serious issue for the fledgling project. (CN Beta, WSJ, The Verge, Financial Times)

The US Securities and Exchange Commission (SEC) has formally instructed Telegram Group, the parent company of the Telegram encrypted messaging service, to halt sales of its cryptocurrency Gram. The SEC says the company, and its crypto-focused subsidiary TON Issuer has failed to register an early sale of USD1.7B of its crypto tokens prior to the 31 Oct 2019 launch of its blockchain network. (CN Beta, SEC, The Verge)

thank you for your infomation