10-27: TSMC has raised its capital expenditure for 2019, reaching USD14B-15B; Micron has its first 3D Xpoint product X100 SSD; etc.

Chipsets

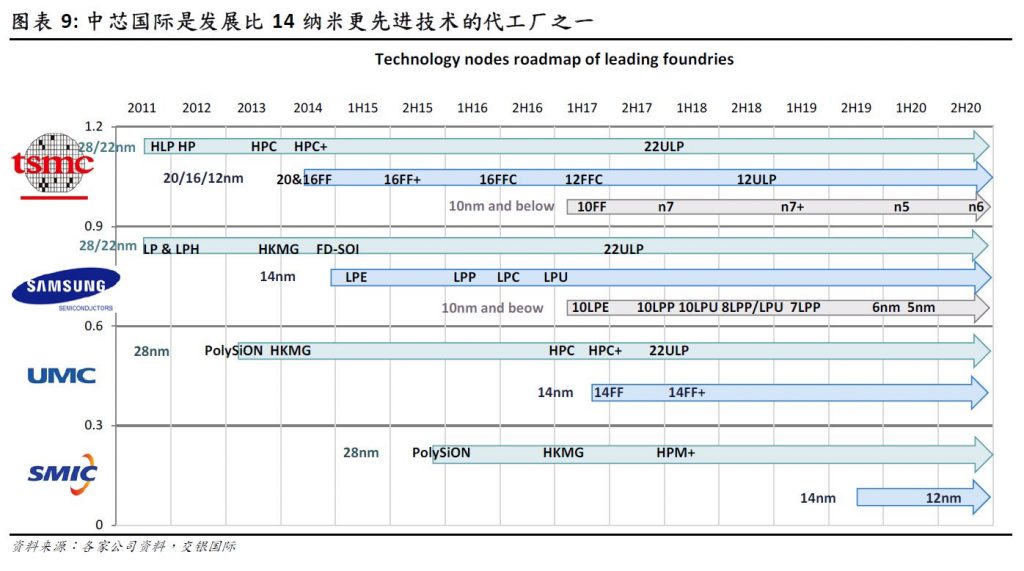

TSMC has raised its capital expenditure for 2019, reaching USD14B-15B, and expects to maintain similar levels in 2020, due to the accelerated growth of 5G phones and the adoption of 7nm / 5nm. Both SMIC and Huahong will increase capacity in 2020. Due to the expansion plans of major foundries (TSMC, SMIC and Huahong) and Samsung’s relatively aggressive OEM strategy, BOCOM International expects a share consolidation in the semiconductor foundry industry in 2020. VIS will stimulate growth in 2020 after acquiring Globalfoundries’3E plant in Singapore in early 2019 (25,000 units of 8” capacity). (BOCOM International report)

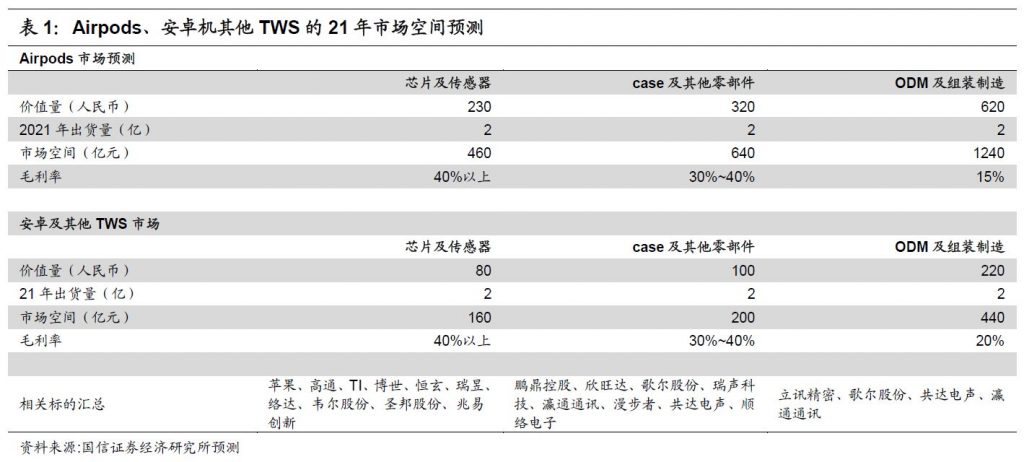

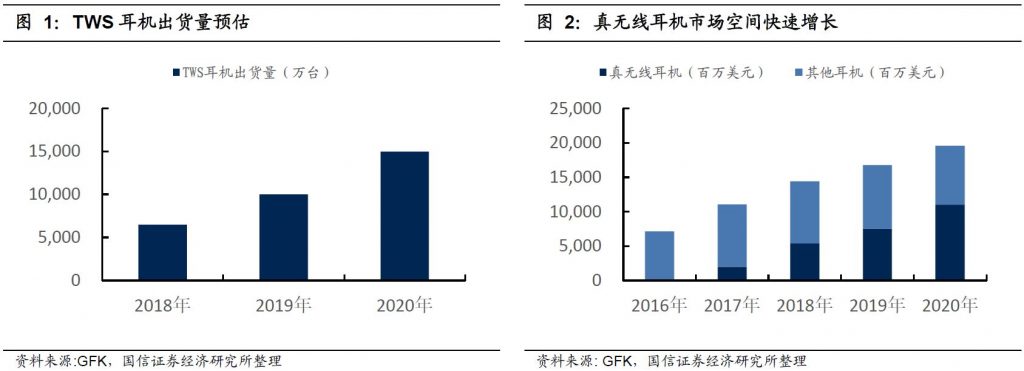

From the upstream, mid-stream and down-stream of the industrial chain, the upstream is mainly chip and solution manufacturers, the main components of the mid-stream such as PCB, battery, speaker, cable, antenna, etc., the downstream is mainly the whole machine assembly or foundry. In terms of output value division, as the upstream chip manufacturers accelerate the exit from low-cost mature solutions, the price of True Wireless Stereo (TSW) chips continues to decline, and the profit margin of the upstream TWS chip industry has been compressed, but the overall market space is expanding rapidly. Guosen Securities believes that downstream machine assembly is the fastest growing value in the TWS industry. (Guosen Securities report)

The True Wireless Stereo (TSW) industry chain is divided into 3 types according to the output value structure: chips and sensors, exterior structural components and other components, and ODM assembly and manufacturing. Guosen Securities estimates its overall market space in 2021. Due to the large number of upstream chips, parts and other manufacturers involved, in addition to the core chip, the value of a single component is not high, although the market space is large, but it is divided by many manufacturers, the overall performance of the components and components manufacturers are not strong. (Guosen Securities report)

HiSilicon Technologies is expected to see its shipments of application processors continue to grow in 2019 with its chips powering nearly 70% of handsets shipped by its parent company Huawei in 2019, according to Digitimes Research. Overall, HiSilicon’s AP shipments will account for 20% of total handset AP demand in China in 2019, excluding those used by Samsung Electronics. (Digitimes, press, Digitimes, My Drivers)

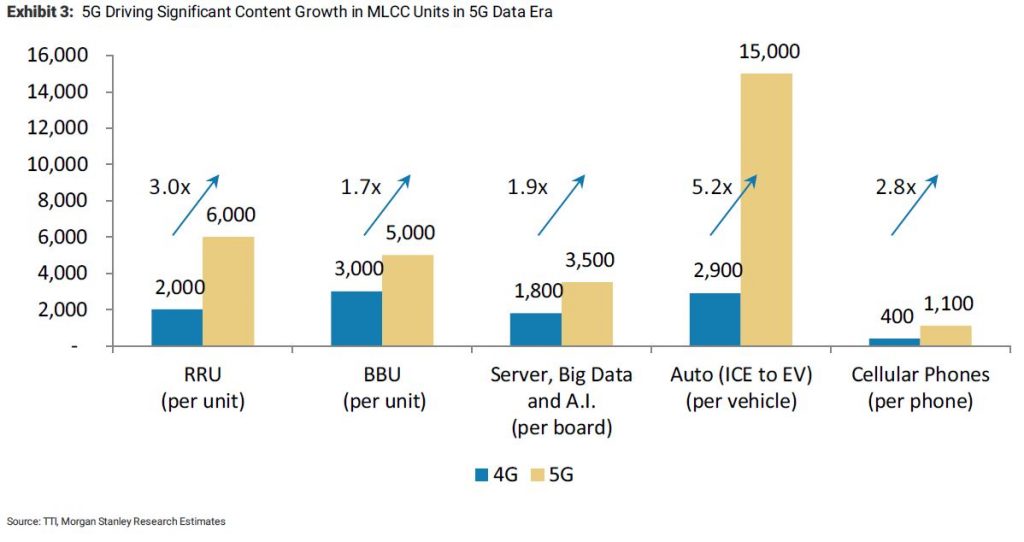

Compared with LTE base stations, Morgan Stanley expects sub-6 5G base stations to need more MLCCs, and in many cases they look for the main MLCCs to be used to be of 3225 size, 47μF, and 125-ready. They expect sub-6 5G smartphones to have more MLCCs inside than LTE handsets, to newly adopt LC filters, for diversity modules to have not only reception but also transmission functionality added, increasing the use of duplexers, increased use of RX modules, and in addition, possibly the use of PAMiFs (power amplifier with integrated filters). (Morgan Stanley report)

Touch Display

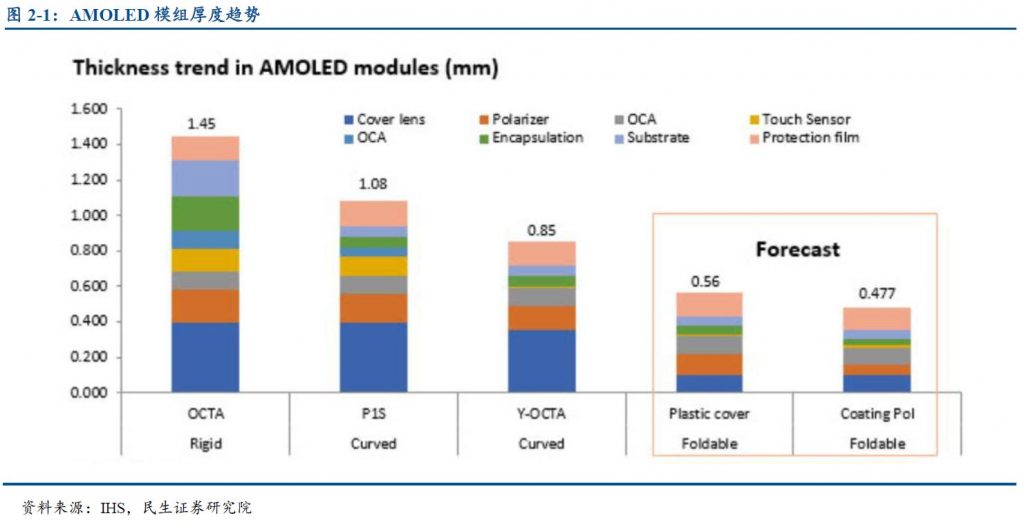

Currently the smartphone display cover mainly adopts Corning Gorilla cover glass, which is easy to break even if it can achieve a certain degree of curvature. The foldable display needs to handle repeated bending. It is impossible to use glass as a protective layer, and the thickness should be less than 0.5cm. The cover glass could be 0.35mm, but only a certain shape can be bent, and it cannot be completely foldable. Thus new flexible materials are needed. The thickness of the AMOLED display module will drop from 1.45mm for hard display to 0.56mm for flexible foldable display. (Minsheng Securities report)

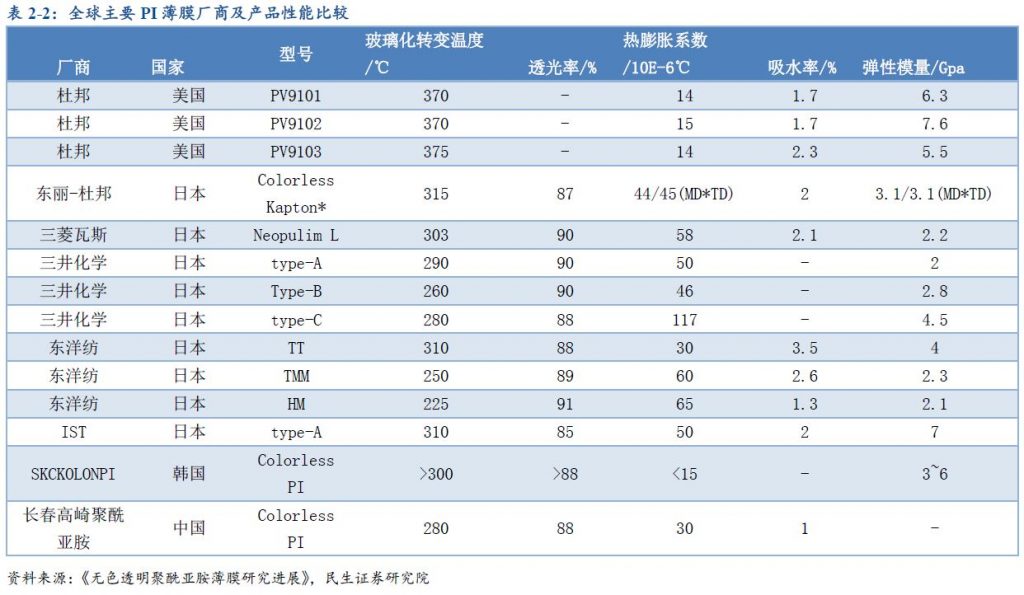

The market of transparent polyimide film (PI film) is dominated by the United States, Japan and South Korea. The main manufacturers include DuPont, CEN Electronic Material, Changchun Gao Qi, Japan’s Mitsubishi Gas Chemical, Toray DuPont, Toyobo, Mitsui Chemicals, and Korea’s KOLON. Japan accounts for 95% of the global production of transparent PI films. MGC is an important producer of transparent PI films in Japan. It is the first to commercialize PI films. SKC and KOLON are also actively developing transparent polyimide film, SKC plans to mass production in 2Q17, KOLON plans to mass production in 1Q18. (Minsheng Securities report)

More than 80% of the demands for polarizers come from TFT-LCDs. According to IHS, the shipment area of AMOLED polarizers is 9.5Mm2 in 2018. It is expected to increase to 13.9Mm2 in 2019. The folding display phone will become a new growth driver of OLED polarizers due to the increase of display area by more than 70%. Polarizers are currently monopolized by Japan, South Korea, United States, and Taiwan. The United States vendors are mainly DuPont, 3M, and Japan vendors are Nitto Denko, Sumitomo Chemical, Japan Synthetic Chemical, etc. (Minsheng Securities report)

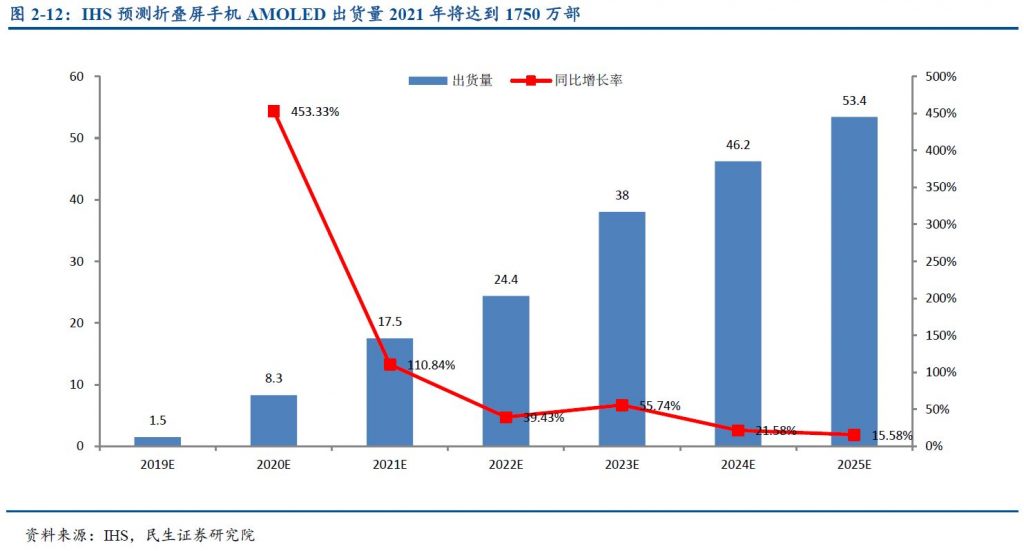

According to IHS forecasts, shipments of foldable phones will reach 150M, 830M, and 17.5M units in 2019-2021. By 2025, shipments will climb to 53.4M units, CAGR will reach 81%, and penetration rate will be 3.4%. (Minsheng Securities report)

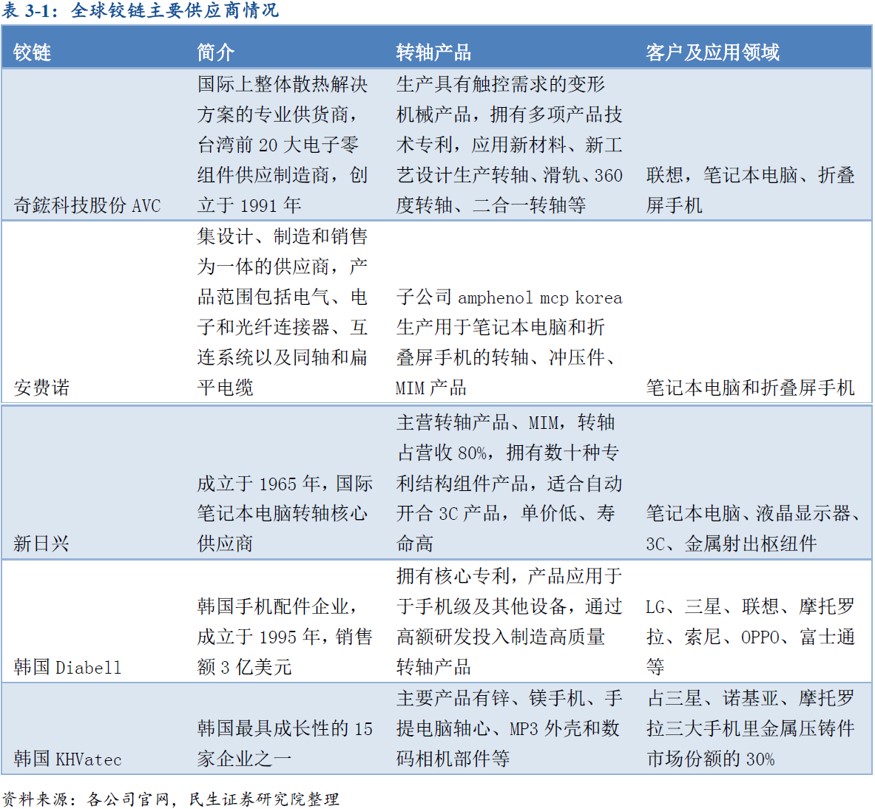

Korean manufacturer KHVatec is reportedly the exclusive supplier of hinges for Samsung Galaxy Fold. Guangdong Jinli then has supplied miniature transmission structure for the Samsung Galaxy Fold. Taiwan Asia Vital Components (AVC) provides hinges for Huawei Mate X. As the folding display hinge technology matures and the yield increases, the hinge cost is expected to continue to decline. (Minsheng Securities report)

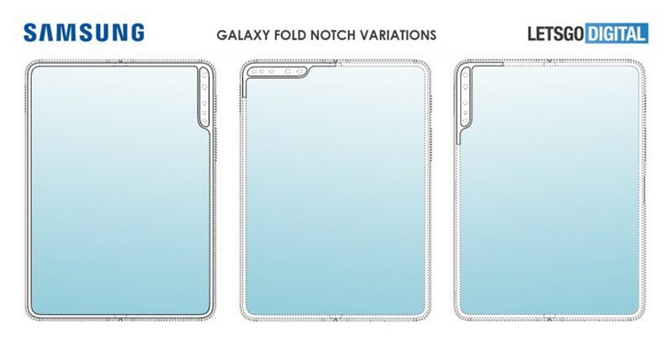

Samsung’s new patent shows that the camera position of the ‘Galaxy Fold 2’ has changed. The patent shows that the notch at the top of the inner display greatly reduced, and the camera gap will be at the center of the screen. The patent shows another design, the location of the camera and the sensor in different locations, which are located at the upper left and upper right sides of the mobile phone. (Laoyaoba, BGR, The Bell, The South African, LetsGoDigital)

Camera

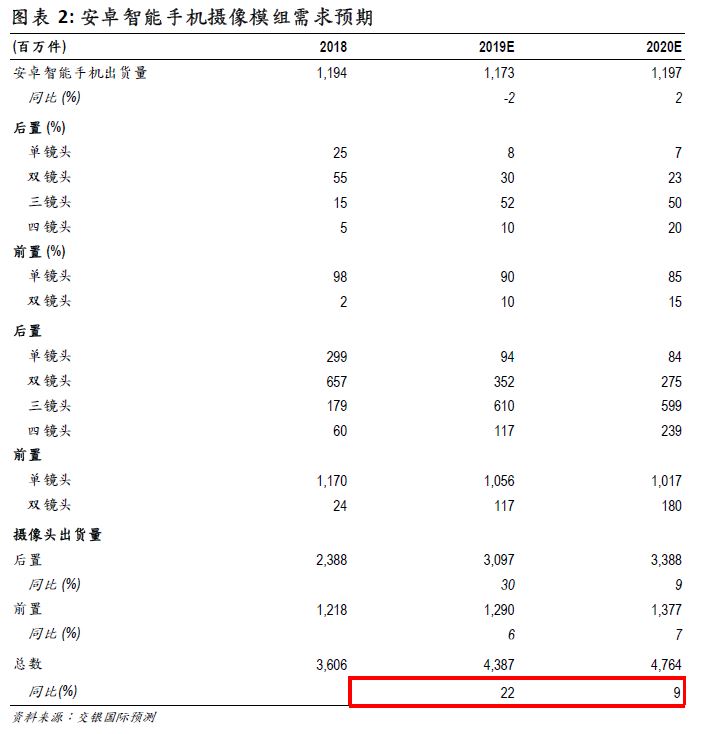

With the penetration rate of the triple camera smartphone in 2019 reaching 60%, BOCOM International expects shipment growth in the Android camera module industry to decline to 9% year-on-year in 2020. Mid-range camera module manufacturers will be the most affected. The recent release of pop-up phones has decreased, and they believes this trend will continue. The cost of this camera module is high (about USD5 for the entire mechanical component) and the size is larger (thicker than the average front camera), which they think is the reason why it is not comparable to other full-screen camera solutions. (BOCOM International report)

According to DIGITIMES Research, CMOS Image Sensor (CIS) has entered a white-hot stage in mobile phone applications. High-pixel specifications are still the focus of the competition and one of the reasons for consumers to choose the phone. Sony and Samsung Electronics have their own advantages in the CIS field. Sony currently accounts for more than half of the market. In recent years, it has released several CISs that have exceeded 40MP resolution and won many flagship mobile phones. Samsung has worked closely with Xiaomi to launch the 64MP CIS for the first time, and it is expected to launch 100MP products in the future. (Digitimes)

Memory

Micron and Intel have co-developed 3D XPoint memory as a high-performance alternative to flash, but so far only Intel has brought products to market, under their Optane brand. Micron has its first 3D Xpoint product X100 SSD with 9GB/s of sequential performance in both read, write, and mixed workloads, and up to 2.5M random IOPS. (My Drivers, EXP Review, AnandTech, Micron, Forbes, Tom’s Hardware)

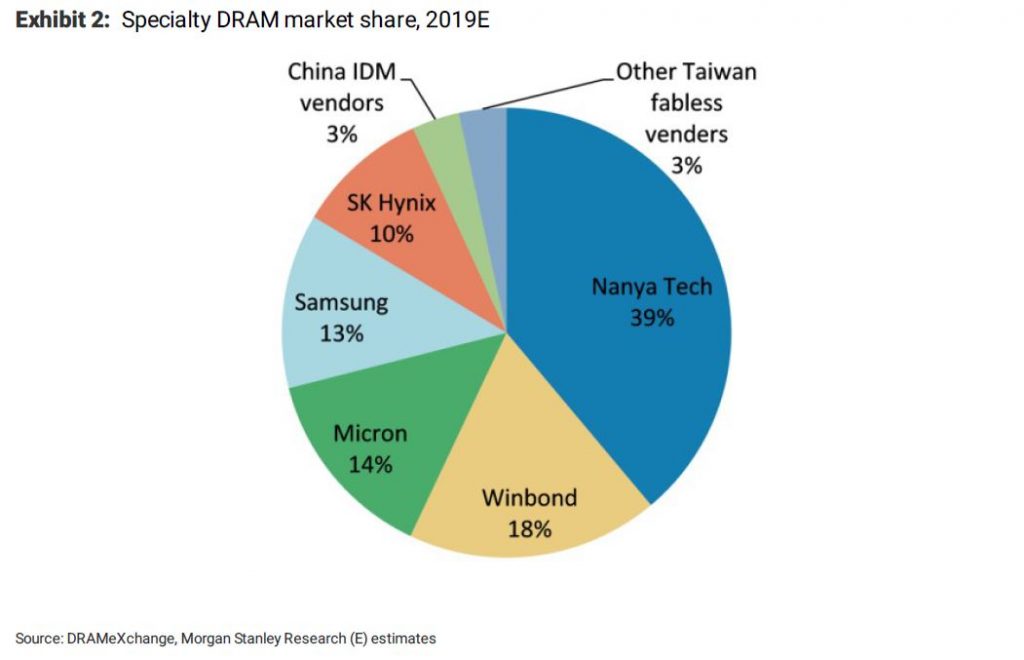

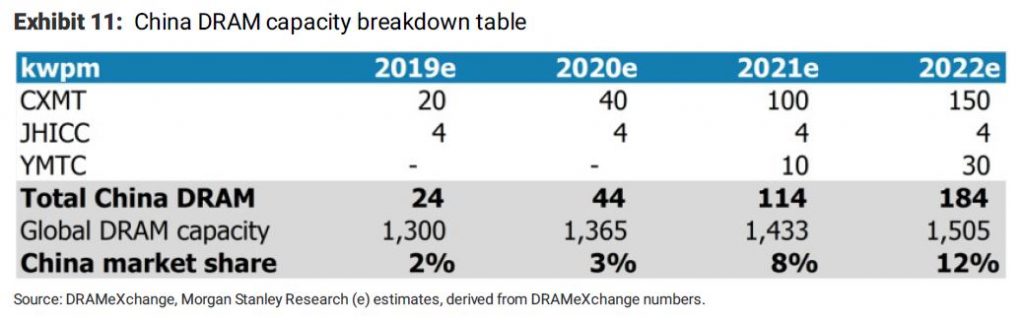

In specialty DRAM, ChangXin Memory Technologies (CXMT) is by far the most advanced DRAM IDM, according to Morgan Stanley. Today Taiwanese vendors such as Nanya and Winbond account for 70% of specialty DRAM global market share. However, with the emergence of competition from CXMT, Morgan Stanley thinks Nanya will be impacted the most given its technology and end-market overlaps. (Morgan Stanley report)

According to Morgan Stanley’s checks with equipment vendors, ChangXin Memory Technologies (CXMT) will ramp its capacity to 40k wafers per month in 1H20. They think in 1H20 CXMT will still try to improve its production yield, but if yield can get to 60% in 2H20, they think mass production is possible. They do not think China’s DRAM capacity will be relevant to the mainstream DRAM cycle in the coming 2 years. However, if CXMT does advance its process to 1ynm (e.g., 17nm) by 2020, competition may emerge earlier. (Morgan Stanley report)

Phone

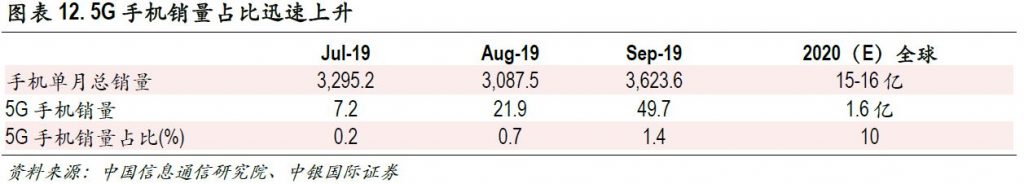

According to China Academy of Information and Communications Technology (CAICT), in Jul, Aug and Sept 2019, China domestic 5G mobile phone sales are 72K, 219K and 497K, accounting for 0.2%, 0.7% and 1.4% of total phone sales. It is estimated that the global sales of 5G mobile phones will reach 160M units in 2020, accounting for about 10% of total mobile phone sales. (BOC International report)

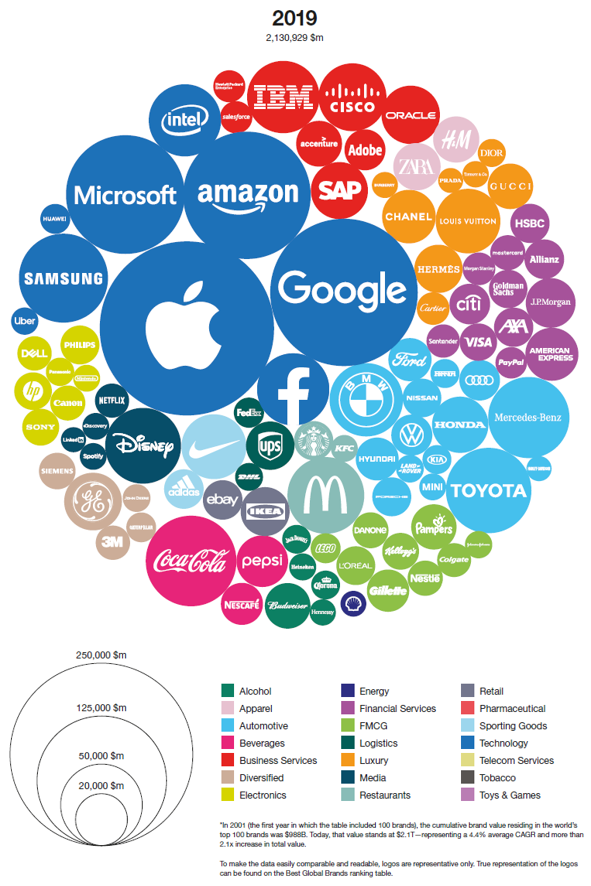

Twenty years of brand valuation data has many stories to tell. Only 31 brands (e.g. Disney, Nike, and Gucci) from the 2000 ranking remain on the table today; 137 brands (e.g. Nokia and MTV) have come and gone in the intervening years. Coca-Cola and Microsoft are the only brands to have retained top 10 spots on the Interbrand’s Global Brands. In 2001 (the first year in which the table included 100 brands), the cumulative brand value residing in the world’s top 100 brands was USD988B. Today, that value stands at USD2.1T— representing a 4.4% average CAGR and more than 2.1x increase in total value. (Interbrand report)

HTC has been keen to make efforts to advance both of its handset and VR businesses after Yves Maitre took the reins as CEO at the Taiwan-based smartphone vendor in mid-Sept 2019. It has launched an entry-level blockchain-enabled smartphone, Exdous 1s. It is also teaming up with Louvre Museum and France-based VR content developer Emmissive to create a VR work: Mona Lisa: Beyond the Glass. (Digitimes, press, Digitimes)

Wearables

According to GFK, the shipment of True Wireless Stereo (TWS) headsets reaches 65M units in 2018, and 17.5M TWS headsets in 1Q19, 27M in 2Q19. It expected to be more than 100M units in 2019, and 150M units in 2020. The entire TWS headset market will grow from USD200M in 2017 to more than USD11B in 2020. Even with the average unit price of USD200 for TWS headsets, based on the annual shipment of 1.5B smartphones worldwide, the average penetration rate of TWS headsets would be 50B or more, if the average penetration rate of TWS reaches 50%. (Guosen Securities report)

Automotive

Toyota’s CTO Shigeki Terashi has revealed that the company will unveil a vehicle powered by solid state batteries at the 2020 Olympics as a means of showcasing its battery capability. He has also indicated that the solid state battery technology, which promises the potential for longer range in smaller and potentially cheaper battery packs, and take charge faster, will not reach mass production until the middle of the decade. (My Drivers, CNET, Auto Car, Live Mint)

E-Commerce

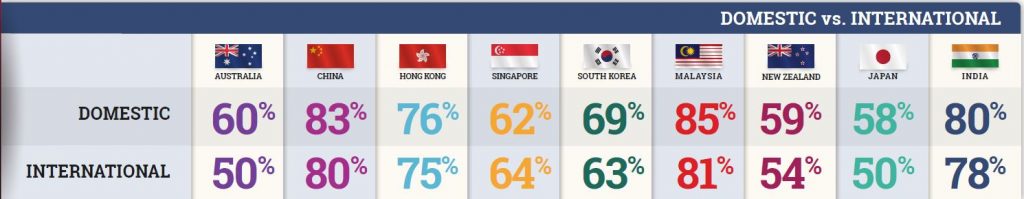

According to Rakuten, consumers throughout Asia-Pacific have higher engagement with local brands than international brands, with most engagement being via social media. Groceries & Household Goods and Travel are the most consistently popular categories across APAC for consumers shopping online. Overall, shoppers in Hong Kong and Singapore show a stronger preference to shop internationally compared to other APAC countries. (Rakuten report)