11-17: The 100” 8K LCD screen developed by Chengdu CEC Panda will be mass-produced by the end of 2019; BOM cost of Samsung Galaxy Fold 5G (sub-6GHz) is USD635; etc.

Chipsets

Credit Suisse notes strong momentum in China semi domestic replacement since 2018 due to the ZTE restriction and geopolitical tension, and this momentum has intensified in 2019 due to the Huawei restriction. Despite the excitement of this strong, multi-year momentum, Credit Suisse would also remind that the semiconductor industry has a very long and wide supply chain and that history of this industry has suggested that no single company or country could survive by itself. (Credit Suisse report)

According to Credit Suisse, semis has surpassed crude oil as China’s major import item since 2015, accounting for ~15% of its 2018 total imports. (Credit Suisse report)

According to Founder Securities analysis, from 2Q19, the China mainland’s independent fabs entered the peak of production, and the demand for semiconductor equipment will usher in explosive growth in the next 3 years. According to the statistics of the start-up and commissioning of mainland independent fabs in 2017, the total investment of semiconductor equipment in the future 2019-2022 is estimated to be around USD70B. In 2018, the USD12B has a large room for growth, and the localization rate of the mainland’s independent fabs is much higher than that of the overseas copying line in 2018. The fab’s own expansion has a reduced procurement requirement, which is conducive to the localization rate. Upgrade, the localization rate is less than 5% in 2018, and the room for improvement is huge. (Founder Securities report)

Touch Display

According to UBS’s teardown analysis, the estimated bill of materials (BOM) cost of Samsung Galaxy Fold 5G (sub-6GHz) is USD635. Based on their cost decline projection for each of the key components, they estimate that the average Foldable BOM cost could decline to USD569 in 2020, which could enable product ASP of ~USD1,500. With some spec downgrades vs current Fold, they further assess that Samsung has the ability to bring down BOM cost further and enable a foldable product with ASP of ~USD1,200-1,400. (UBS report)

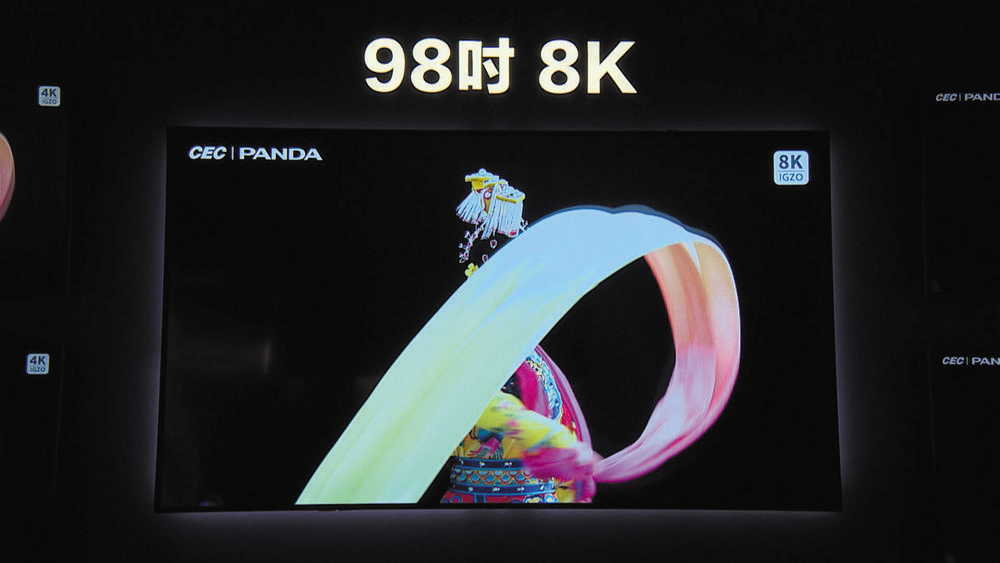

The 100” 8K LCD screen developed by Chengdu CEC Panda will be mass-produced by the end of 2019. There are 33M thin-film transistors (TFTs) on the 8K TV panel. When RGB three colors are used, nearly 100M components are driven at the same time, which can make the pixels small, so the resolution of the picture is very high. (Laoyaoba, East Money)

Camera

Macquarie Research has surveyed a total of 132 smartphones launched in 2019 by the top 6 vendors – Samsung, Huawei, Apple, OPPO / Realme, vivo and Xiaomi. There are 489 cameras in total or an average of 3.7 cameras per device, with 1.0 front camera and 2.7 back cameras. About 45% of the 132 new devices adopted triple cameras, while quad camera penetration reached 18%. (Macquarie Research report)

In 2019 / 2020 / 2021, Macquarie Research forecasts the number of lens set per smartphone will reach 2.9 / 3.3 / 3.8 units and the total market size will increase to 4.10B / 4.85B / 5.62B sets. They forecast overall triple camera penetration will reach 18% / 34% / 45%, while quad camera upgrades will happen in parallel with 1% / 6% / 16% during the period. They forecast smartphone camera content upgrade will drive industry value growth from estimate of USD23.5B in 2019 to USD45.4B by 2023. (Macquarie Research report)

Sensory

According to Yole’s forecast data, the global market for 3D imaging and sensors is 38% CAGR in 2016–2022, with a market size of USD1.83B in 2017 and USD9B in 2022. Among them, consumer electronics is the fastest growing application field, with a CAGR of 160% in 2016–2022, and the consumer electronics market will exceed USD6B by 2022. In terms of shipments, Guosheng Securities predicts that 3D sensing demand for smartphones will increase from 40M in 2017 to more than 200M in 2019. (Guosheng Securities report)

Connectivity

According to GSMA, by the end of 2022, 24% of connections on the North America (NA) will be on 5G networks, rising to 46% by 2025, equivalent to 200M 5G connections. 2019 will be the first year when 5G accounts for more than half of operators’ capex in NA, reflecting the shift from LTE to 5G deployments. This trend will continue through 2020-2025, with 87% of operator capex in NA to be allocated to 5G by the end of the period. (GSMA report)

Phone

With few 5G premium smartphones launched in 2019 and more product and network roll-out announcements expected 2020, Macquarie Research sees 5G smartphone shipments accelerating to 230M, 584M and 860M units in 2020, 2021 and 2022, respectively. They forecast overall smartphone demand in 2019 will decline by 1.7% prior to 5G network readiness and total volume demand will recover by 0.5%, 2.6% and 4.0% to 1.53B, 1.58B and 1.64B units in 2020-2022, respectively, on the 5G upgrade. (Macquarie Research report)

According to Macquarie Research, smartphone ASP has been increasing at an average of 7.3% in the past 3 years to USD302 in 2019 as consumer’s trade up. They think 5G smartphone affordability will not hinder adoption. The initial cost increase from 4G to 5G is about USD65 for premium phones. Blended ASP is expected to reach USD325, USD350 and USD366 over 2020, 2021 and 2022, respectively. They see smartphone industry value witnessing a five-year CAGR of 7.4%, from USD462B in 2019 (ASP USD302×1.53B units) to USD638B in 2023 (ASP USD356×1.68B units). (Macquarie Research report)

Macquarie Research expects 5G demand in China to kick start the global 4G to 5G upgrade cycle with 107M and 326M units in 2020 and 2021, respectively, accounting for over 50% of global 5G smartphone volumes. They forecast 5G smartphones will be fully penetrated in China by 2022. In developed markets, they forecast 5G smartphone adoption will reach over 80% by 2023, while emerging market penetration should lag by about 2 years. (Macquarie Research report)

Wearables

According to TF Securities, Apple Watch Series 5 can be divided into display, straps, chips, batteries, sensors, etc. From the BOM, the estimated price of the whole device is USD145.45, the main control chip accounts for the whole BOM, which is about 46%. Compared to the previous generation, the main upgrade is the display with a 1.57” LTPO OLED Retina display. (TF Securities report)

The true wireless stereo (TWS) headset market is growing rapidly, and before the release of Apple’s AirPods in 2017, TWS headsets had very little market share. According to GFK, the number of wireless headsets shipped in 2016 was only 9.18M units, and the market size was less than USD0.3B. In 2018, the market size exceeded USD5B. It is estimated that by 2020, the market size of wireless headsets will reach USD11B, and the entire smart headset market will be more than USD19.5B. (TF Securities report)

According to TF Securities, the sales volume of smart watches has achieved rapid growth. The market scale has increased from CNY1B in 2014 to CNY18.3B in 2018, with a compound annual growth rate of 106.83%. The sales growth rate of 1Q19-3Q19 smart watches is 48%. 44% and 42% continue to maintain rapid growth. Apple is the leader in smart watches with a market share close to 50%. (TF Securities report)

Augmented / Virtual Reality

According to CITIC Securities, Sony and Oculus-based virtual reality (VR) vendors have been implementing price reduction strategies. Since the product launch, the price cuts ranged from USD100-200, effectively opening up the VR consumer market and anticipating future technology. With the prices down being driven down further, the penetration of VR headsets would be accelerated. According to IDC estimates, VR headset shipments are expected to reach 12.5M units in 2020. (CITIC Securities report)