12-1: LG Innotek will shut down its high density interconnection (HDI) business; Samsung has applied for a new trademark called “Bright Night Sensor”; etc.

Chipsets

MediaTek’s first 5G SoC chip, Dimensity 1000 (MT6885), allegedly costs up to USD70, and the price of the same overclocked version of the MT6889 is USD70~80. (Laoyaoba, Sohu, UDN)

Intel EVP and General Counsel Steven R. Rodgers says that Intel has suffered the brunt of Qualcomm’s anticompetitive behaviour, is denied opportunities in the modem market, is prevented from making sales to customers and was forced to sell at prices artificially skewed by Qualcomm. It also specifically notes that it counts itself among the list of “competitors Qualcomm has forced out of the modem chip market. (Intel, Intel, TechCrunch, Leiphone)

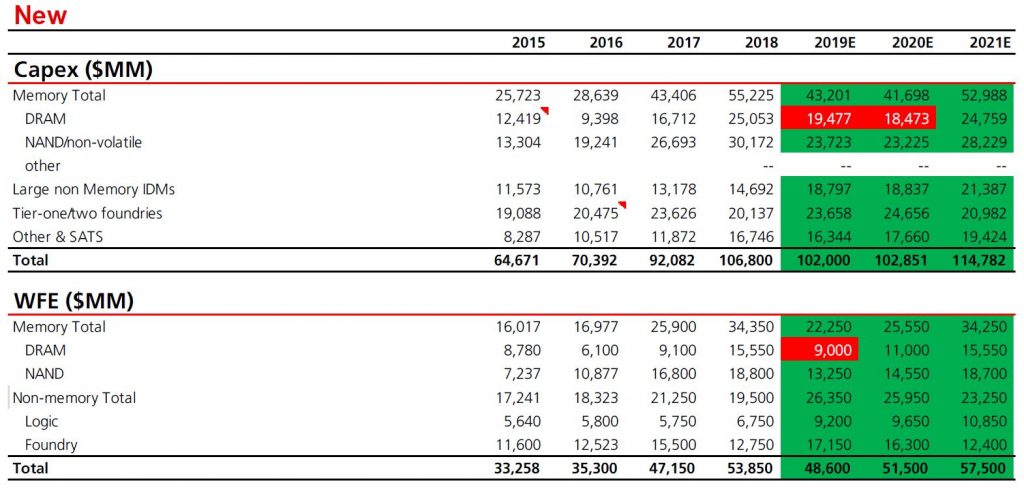

Based on capex commentary + SPE company guidance for 4Q19, UBS has updated global capex / WFE model. They now see 2019 WFE ~USD48.6B, or down ~10% Y/Y from ~USD53.9B. UBS now sees 2020 WFE ~USD51.5B or up ~6% Y/Y with memory up ~15% Y/Y and foundry / logic about flat. UBS is also initiating a 2021 WFE estimate of USD57.5B, or up another ~12% Y/Y comprised of ~35% Y/Y growth in memory and ~10% Y/Y decline in foundry / logic. (UBS report)

LG Innotek will shut down its high density interconnection (HDI) business and transfer its workforce and resources to semiconductor substrate production. The PCB business belongs to the HDI business, accounting for 3.1% of the company’s total sales. The company is expected to wrap up PCB production within this year and stop selling PCBs in Jun 2020. (Laoyaoba, Business Korea, CN Beta)

AI unicorn Cambricon undergoes industrial and commercial changes, and its registered capital is increased from CNY500M to CNY800M, an increase of 60%. (CN Beta, JRJ)

Camera

Samsung has applied for a new trademark called “Bright Night Sensor”, which refers to the hardware photosensitive element. It implies that Galaxy S11 would feature an advanced photography function for low light environment. (CN Beta, GizChina, LetsGoDigital)

Memory

Samsung’s mid-range A-series phones in 2020 are going to come with up to 128GB storage. The base variants of most A-series phones in 2020 will include 64GB storage. Thus, Samsung Galaxy A11, A31 and A41 will all start at 64GB of onboard storage. (GSM Arena, My Smart Price, CN Beta)

Connectivity

Indoniesia’s Association of Indonesian Cellular Operators (ATSI) chairman Ririek Adriansyah has revealed that they will be able to implement 5G services no later than 2022. Local cellular operators have been conducting 5G network trials since 2017, but most of them are directed at industrial rather than commercial users. To set up 5G networks in 2022, ATSI aims to hold frequency auctions in 2020. (Laoyaoba, Money DJ, The Jakarta Post, TechNews, Money DJ)

Phone

Huawei’s SVP of public affairs, Joy Tan, has indicated that Huawei’s Harmony OS code has fewer lines of code and higher security. She has further said that the Harmony operating system should become more popular than Linux by the end of 2020. (GizChina, My Drivers, Sina)

Huawei reportedly sought loan financing equivalent to USD1.5B. Huawei has successfully secured USD3.5B in financing in the loan market in less than a year. (Laoyaoba, Huawei Update)

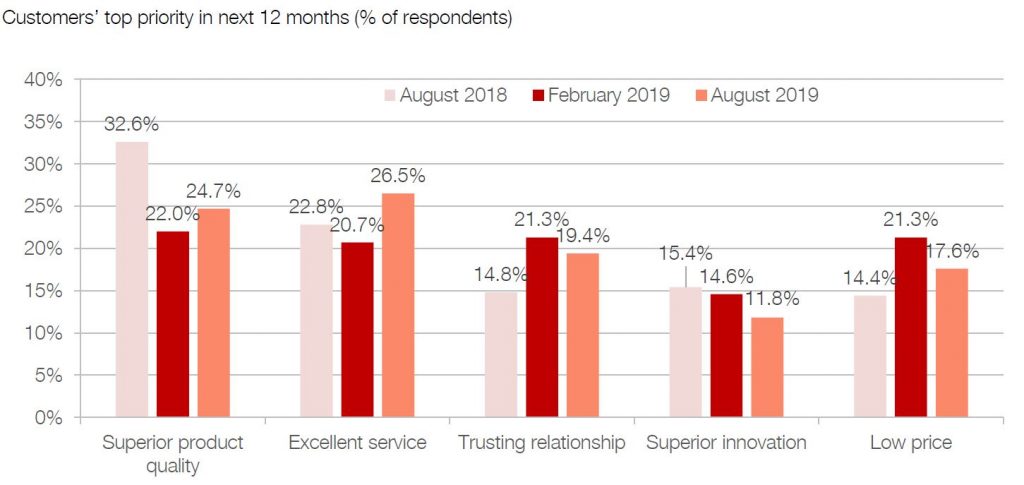

Based on Deloitte’s CMO survey in Nov 2019, marketers expect customers to place a stronger emphasis on excellent service (28% increase) and superior product quality (12% increase), while pressures for low price have dropped by 17% since the last CMO Survey. (Deloitte report)

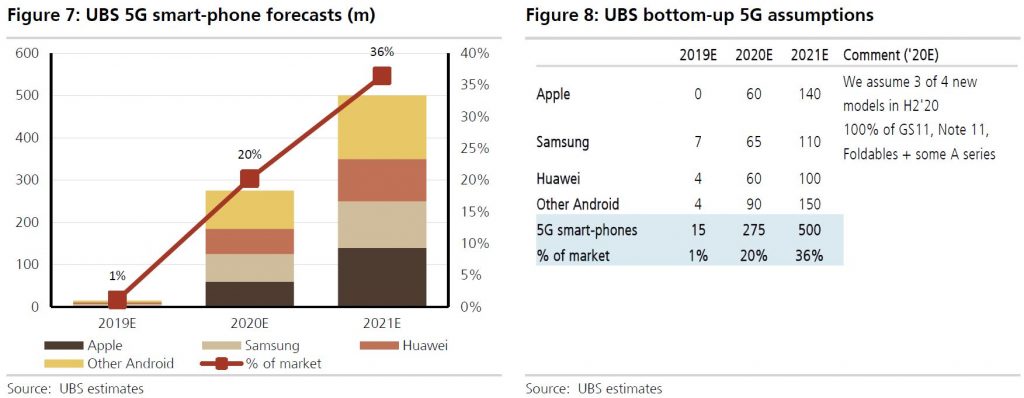

UBS expects to see quite strong growth in 5G unit shipments into 2020 (275M smartphones Sell In units) and 2021 (500M units or 36% of smartphone sales). There is still much uncertainty around this but UBS expects most flagship launches in 2020 to be largely 5G capable. Key variables include: (1) how may 5G models will Apple launch in 2H20 (it could be up to 3 out of 4 new iPhone SKUs) and mmWave portion; (2) 5G penetration of Samsung Galaxy S11 / Note 11 and foldables 2020 line-up (it could reach 100%); (3) capability of Huawei to procure enough 5G RF key components (power amplifiers in particular). (UBS report)

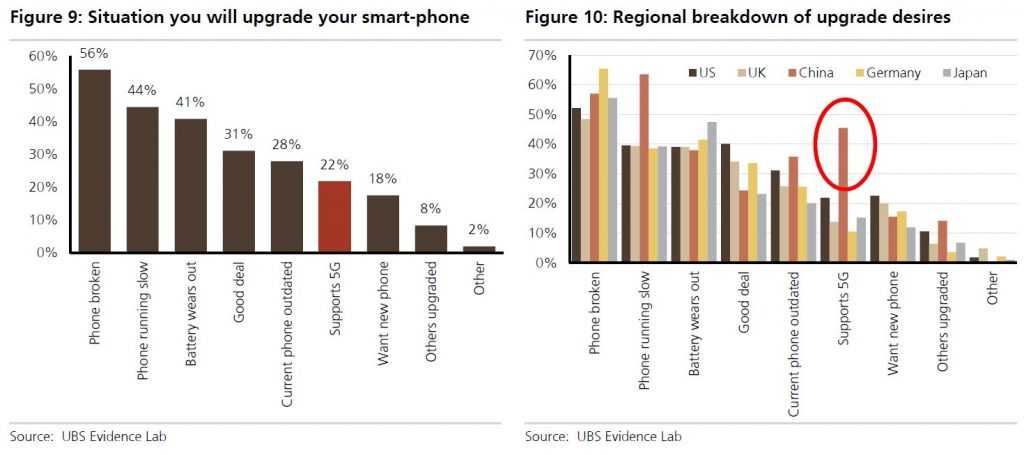

The option of desiring a phone that supports 5G was added to the question of what situation you will upgrade your phone. The responses shows that on a global basis 5G still has low importance among consumers in driving the upgrade cycle with only 20% of consumers stating it. Now clearly the availability of 5G is still quite limited among many of the regions but in many cases networks are live and consumers appear not overly interested. The main exception is in China with 45% of consumers stating desire for 5G as the situation in which they will upgrade their phone. (UBS report)

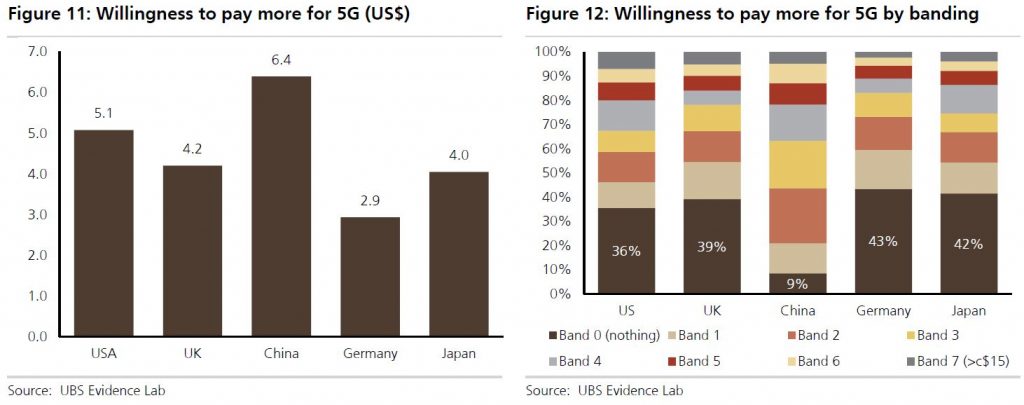

UBS has asked consumers what the maximum amount more they would be willing to pay for a 5G service. The results show quite significant divergence by region with China showing the strongest at USD6.4 more on average but most interestingly also having the lowest response in users not willing to pay more (<10%). Elsewhere 40% of consumers were unwilling to pay more for a 5G service. (UBS report)

UBS forecasts for the smartphone market have been relatively cautious based on both the relatively weak smart-phone market outlook and the challenges that Huawei was facing – leading up to forecast a 5% decline. Given how well Huawei has been managing the supply chain issues that it has been facing since its addition to the US Entity List coupled with some stabilization in the outlook and signs from the supply chain that demand is improving into 2H19, UBS increases forecasts for the 2019 to -2% y-o-y for smartphone units from -5%. (UBS report)

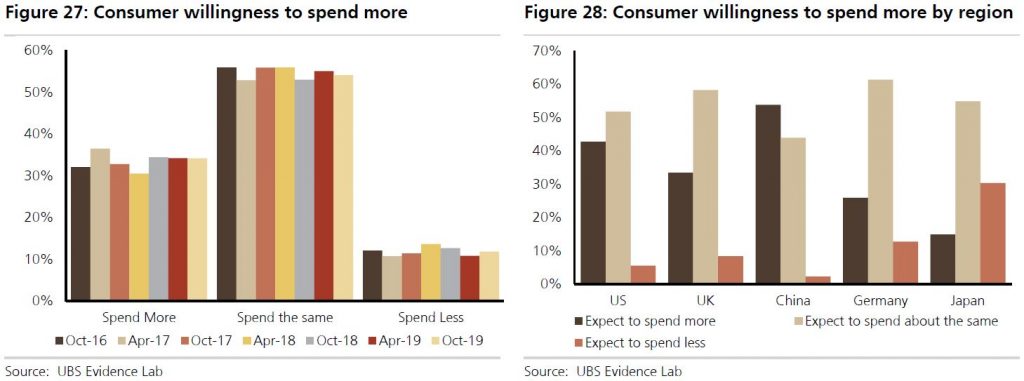

UBS continues to see stable and positive pricing expectations among consumers. As few as 10% of survey respondents expect to spend less on their next smart-phone while over 30% expect to spend more. Looking at the spend indications by OEM consumers who plan to purchase a Samsung device next show the strongest intent for higher spending. (UBS report)

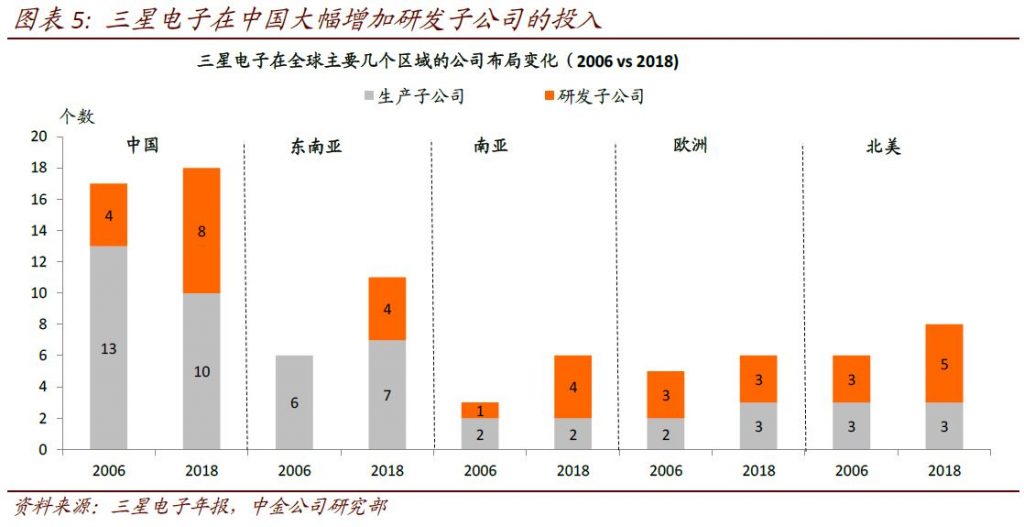

According to CICC, compared with 2006, Samsung Electronics’ production subsidiaries in China have been shrinking, yet R&D subsidiaries have increased significantly from 4 to 8. China has become Samsung’s largest R&D centers in addition to South Korea. From the perspective of production, the 14 factories in the peak period of 2005 mainly focus on communication equipment such as televisions and household appliances, mobile phones and other hardware equipment such as printers and displays; while the 10 factories at the end of 2018 mainly for semiconductor-based memory, LED products and computers. (CICC report)

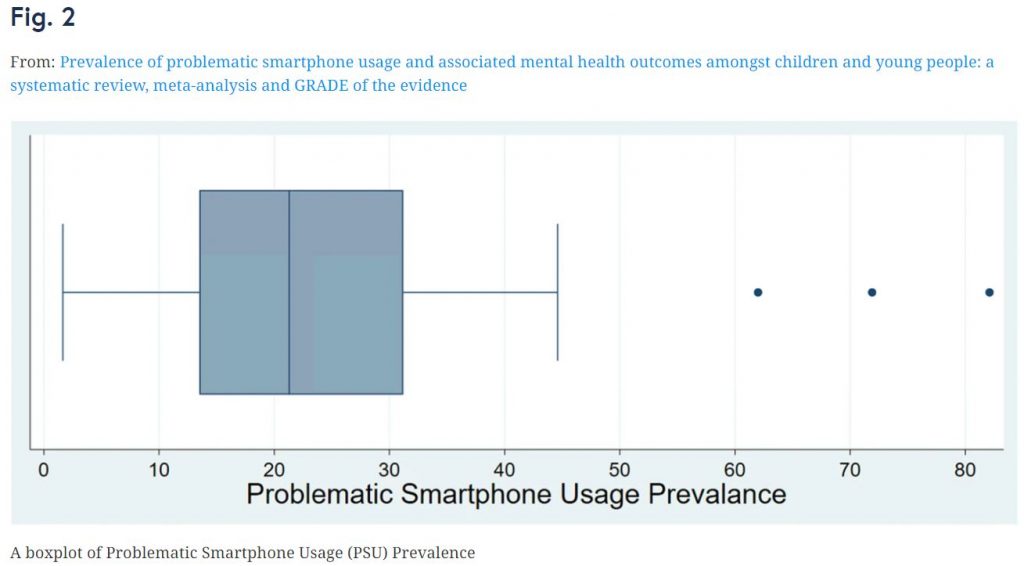

According to research conducted by King’s College London, one in four children and young people have a problematic relationship with smartphones. It concludes that 10%~30% of children and young people use their phones in a dysfunctional way, meaning that on average 23% are showing “problematic smartphone usage” (PSU). (Telegraph, Mobile Marketing, BMC, CN Beta)

Fintech

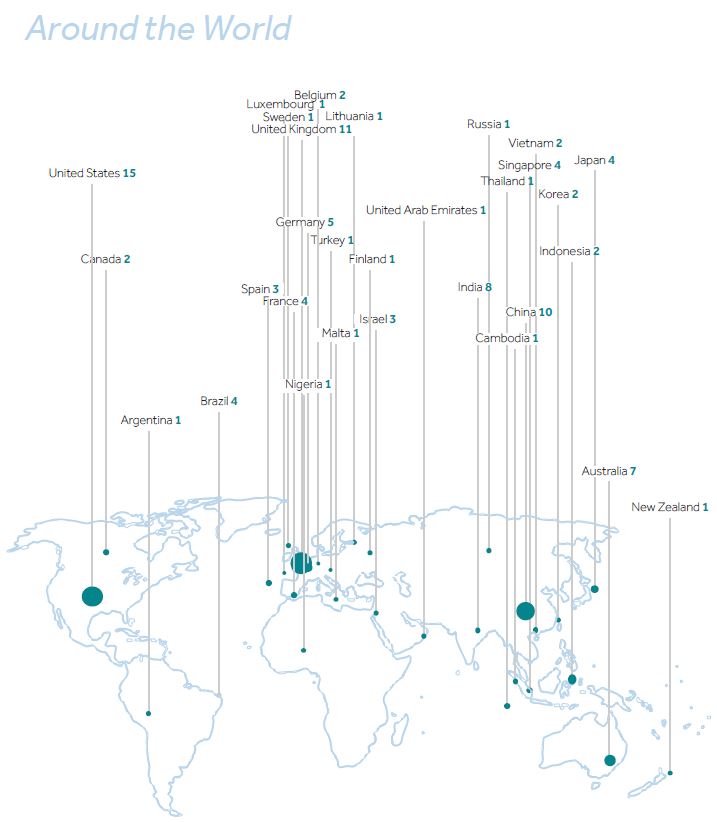

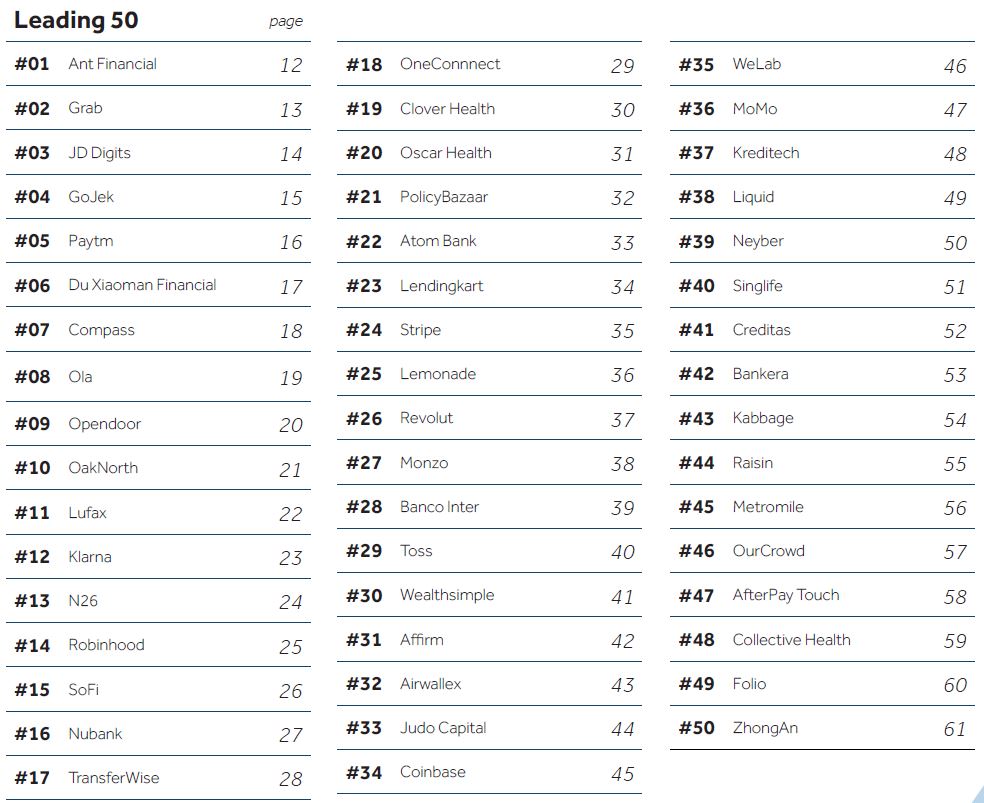

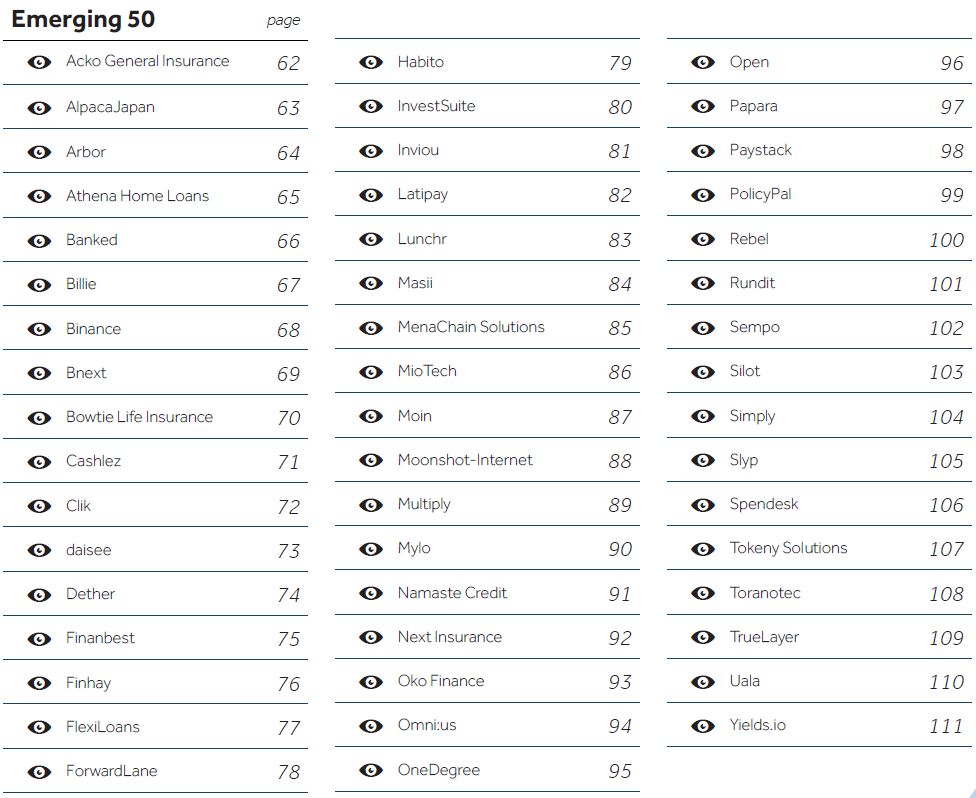

China has led the Fintech 100 for the past 3 years and 2019 is no different with 3 Chinese fintechs in the Top 10. However, do not ignore India with 583M people living in urban cities and with 23% of the global middle class population. India has 900M mobile phone users but only 271M bank accounts, this country is primed to leverage fintech in a way that no other developed country can contemplate. KPMG has identified 8 Indian fintechs 2019 list with 2 companies (Paytm Communications and Ola) making the top 10. (KPMG report)

According to KPMG, 32 companies on the Fintech 100 have raised at least USD100M in the last 12 months alone (up from 26 in 2018 and 12 in 2017). Notably, the average capital raised by the top 10 companies in the past 12 months is over USD1.25B. Significant Venture investors in Fintech companies include Sequoia Capital and SoftBank, together with strategic investors such as Alphabet (Google’s Holding Company), BBVA and Tencent Holdings. (KPMG report)

Economy

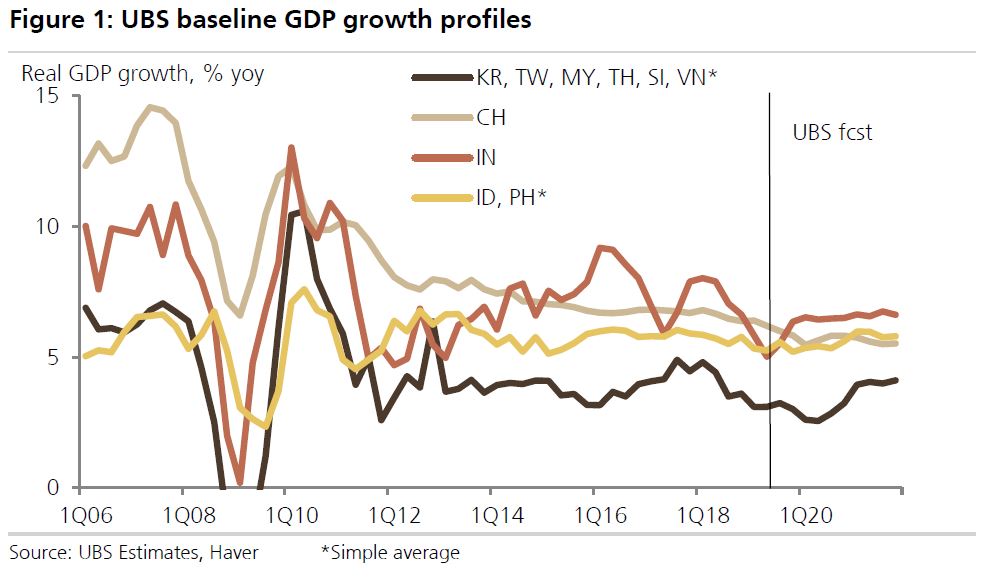

UBS projects real GDP growth in EM Asia to average 5.4% in both 2019 and 2020 before rising to 5.6% in 2021 – despite stable Chinese growth in 2021. Their 2020 projections are 20bps below consensus. With the exception of India, HK and Philippines, where growth may have bottomed already for domestic reasons, four quarter growth rates for the remaining economies should trough in late 2019 or 1H20. (UBS report)