2-12: ARM has announced Cortex-M55 processor and Ethos-U55 micro NPU; Samsung has expanded its The Wall lineup of Micro LED-based displays; etc.

Chipsets

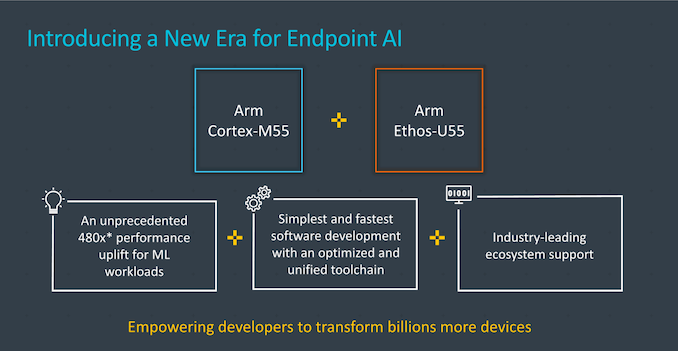

ARM has announced Cortex-M55 processor and Ethos-U55 micro neural processing unit (NPU). ARM’s new IP is meant to advance the machine learning and inferencing capabilities of billions of low-power embedded devices over the next several years, and expand its product portfolio for new use-cases. (TechCrunch, The Verge, AnandTech, CN Beta)

Touch Display

Panel production of China Star Optoelectronics Technology (CSOT) at its plants in Wuhan, the center of the coronavirus outbreak, will be hit hardest by the widespread epidemic. Wuhan is the home to CSOT’s Fab t3, a 6G line for the production of LTPS panels, as well as its Fab t4, which is a 6G OLED line. Fab t3, which has a production capacity of 50,000 substrates a month, had been operating at full capacity before the outbreak. However, affected by the virus, the t3 line is expected to operate at 30% of its capacity in Feb 2020, with prospects to halve its LTPS panel shipments to 6M-7M units in 1Q20, down from the 14M-15M units as planned previously, according to Sigmaintell Consulting. (Digitimes, press, CTEE, Digitimes)

Samsung Electronics aims to ship a total of 2.5M units of its second foldable Galaxy Z Flip phones in 2020. The company is reportedly preparing to roll out an initial batch of 500,000 units of the upcoming Galaxy Z Flip. In order to boost the sales of its foldable lineup, Samsung has set the retail price for Z Flip at around KRW1.5M (USD1,260). (Android Central, Korea Herald, GSM Arena, IT Home)

Samsung has expanded its The Wall lineup of Micro LED-based displays with two models featuring 437” and 583” diagonals. The monitors are intended for commercial use. The new Wall displays from Samsung feature an 8K resolution and are based on new Micro LED modules. Previously, Samsung’s The Wall lineup included 75”, 146”, 219”, and 292” models. (CN Beta, AnandTech, Digital Trends, Samsung)

Memory

Intel’s memory and storage group produced Intel QLC 3D NAND solid-state drive (SSD) number 10M based upon the quadruple-level cell memory (QLC) NAND die built in Dalian, China. Production began in late 2018. Intel QLC 3D NAND is used in the Intel SSD 660p, Intel SSD 665p and Intel Optane Memory H10 storage solutions. (CN Beta, Intel, Tech Powerup)

Samsung has officially announced its LPDDR5 memory. When compared to LPDDR4X memory, the bandwidth increased by 29% and the power consumption reduces by 14%. As early as Jul 2019, Samsung announced the mass production of the world’s first 12Gb LPDDR5 DRAM. (CN Beta, IT Home, GizChina)

SK Hynix has inked a new broad patent and technology licensing agreement with Xperi Corp. The company has licensed the DBI Ultra 2.5D/3D interconnect technology developed by Invensas. The latter is designed to enable building up to 16-Hi chip assemblies, including next-generation memory, and highly-integrated SoCs that feature numerous homogeneous layers. (CN Beta, AnandTech, Xperi)

Phone

Redmi 8A Dual is announced – 6.22” 720×1520 HD+ IPS, Qualcomm Snapdragon 439, rear dual 13MP-2MP depth + front 8MP, 2+32 / 3+32GB, Android 9.0, no fingerprint scanner, 5000mAh 18W, INR6,499 (USD90) / INR6,999 (USD97). (GSM Arena, Android Central)

Samsung Galaxy S20 series is announced, powered by Samsung Exynos 990 / Qualcomm Snapdragon 865, Android 10.0, ultrasonic under display fingerprint scanner, 15W wireless charging, 9W reverse wireless charging: S20 – 6.2” 1400×3200 QHD+ Dynamic AMOLED Infinity-O 120Hz, rear tri 12MP OIS-64MP telephoto OIS-12MP ultrawide video +front 10MP, 12+128GB, 4000mAh 25W, EUR899 (4G) / EUR999 (5G). S20+ – 6.7” 1400×3200 QHD+ Dynamic AMOLED Infinity-O 120Hz, rear quad 12MP OIS-64MP telephoto OIS-12MP ultrawide video-3D ToF + front 10MP, 12+128/512GB, 4500mAh 25W, EUR999 (4G, 128GB) / EUR1,099 (5G, 128GB) / EUR1,249 (5G, 512GB). S20 Ultra – 6.9” 1400×3200 QHD+ Dynamic AMOLED Infinity-O 120Hz, rear quad 108MP OIS-48MP periscope telephoto OIS-12MP ultrawide video-3D ToF + front 40MP, 12+128/512GB, 5000mAh 45W, EUR1,349 (5G, 128GB) / EUR1,549 (5G, 512GB). (GSM Arena, GSM Arena, GSM Arena, Liliputing, Phone Arena)

Samsung Galaxy Z Flip is announced – 6.7” 1080×2636 FHD+ Foldable Dynamic AMOLED + 1.1” 112×300 Super AMOLED cover display, Qualcomm Snapdragon 855+, rear dual 12MP-12MP ultrawide + front 10MP, 8+256GB, Android 10.0, side fingerprint, 3300mAh 15W, USD1,380 / EUR1,480. (Sammy Hub, GSM Arena, Liliputing)

Wearables

Samsung Galaxy Buds+ is announced – upgraded audio experience with 2-way speaker (woofer + tweeter) by AKG, individual buds have 85mAh battery (11 hours of playback), USD150 / EUR170. (GSM Arena, VentureBeat, CN Beta)

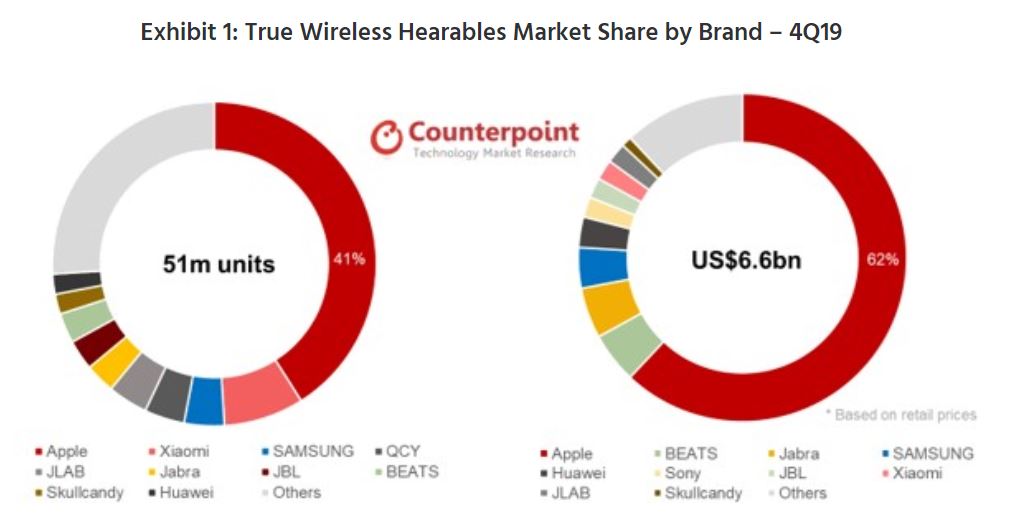

The global market size for true wireless stereo headsets (or TWS) beat expectations, growing more than 50% in 4Q19, this is now more than 50M units a quarter, according to Counterpoint Research. The senior analyst Liz Lee has indicated that they expect Apple to sell more than 100M true wireless hearables in 2020, including AirPods Pros, to maintain their comfortable lead in the market. (Mac Rumors, Counterpoint Research)

Apple is said to be working with supply chain partners in Taiwan on several upcoming products, including a so-called “AirPod Pro Lite”, according to DigiTimes. (Digitimes, Mac Rumors, IT Home)

Automotive

Hyundai and Kia will build new electric vehicles based on the technological platform developed by California EV startup Canoo. This EV platform will power small, “cost-competitive” electric vehicles, as well as “purpose built vehicles,” which would more closely resemble shuttles or even autonomous people-movers. (The Verge, TechCrunch, Forbes, CN Beta)

Home

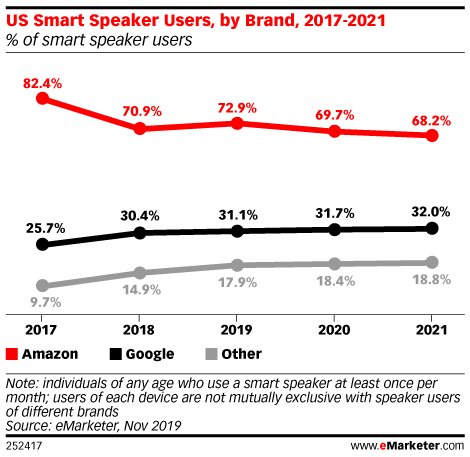

Amazon, which already holds a dominant position in the US smart speaker market, will continue to maintain this leadership through 2021, with approximately 70% of total US smart speaker users expected to use an Amazon Echo device, according to eMarketer. In 2020, 69.7% of US smart speaker users will use an Echo, down slightly from 72.9% in 2019. (Android Headlines, eMarketer)

Payment

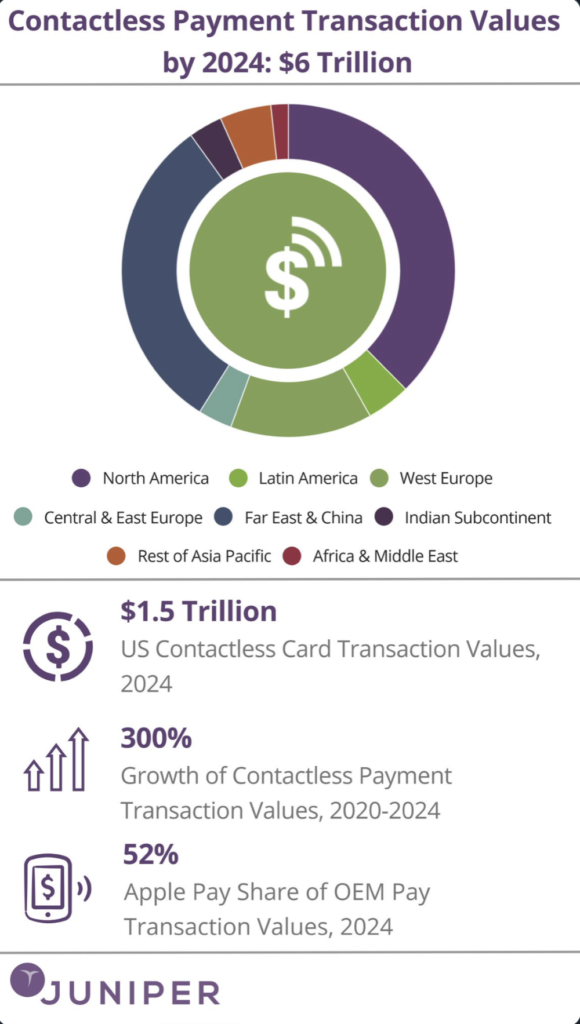

Juniper Research forecasts that global contactless transaction values will reach nearly USD6T in 2024, up from USD2T in 2020. It found that this increase will be driven by significant growth in OEM Pay and contactless card transaction values, especially in the US. It has also found that Apple Pay will account for a 52% share of OEM Pay transaction values, up from 43% in 2020. (CN Beta, Juniper Research)