4-25 #Frontlines: TSMC has kicked off its 2nm process R&D; Huawei has allegedly slashed 30% of the supply chain orders in Apr 2020; OnePlus’ regional offices have allegedly been downsized by as much as 80%; etc.

Chipsets

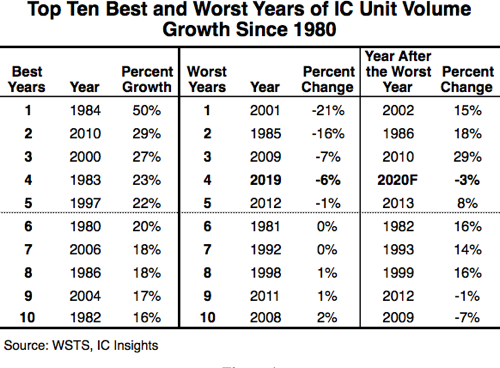

According to IC Insights, in contrast to the double-digit increases in 2017 and 2018, 2019 marked only the fifth time in the history of the IC industry that IC unit shipments registered a decline. IC Insights’ forecast for global IC market growth for 2020 now stands at -4% with total IC unit shipments are expected to decline by 3% in 2020. (Laoyaoba, IC Insights, press)

5G AP price competition between Qualcomm and MediaTek is expected to heat up further in 2Q20 as both chipmakers are gearing up to win more orders from Chinese handset vendors in the upcoming 5G handset replacement boom in China. (Digitimes, CN Beta)

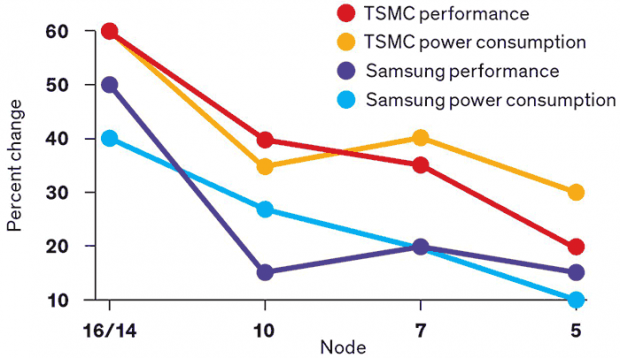

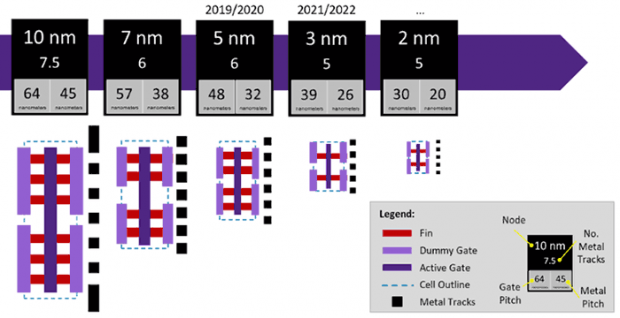

TSMC has kicked off its 2nm process R&D, and is progressing in research and exploratory studies for nodes beyond 2nm. (Digitimes, Tom’s Hardware, Tweak Town, GizChina, IT Home)

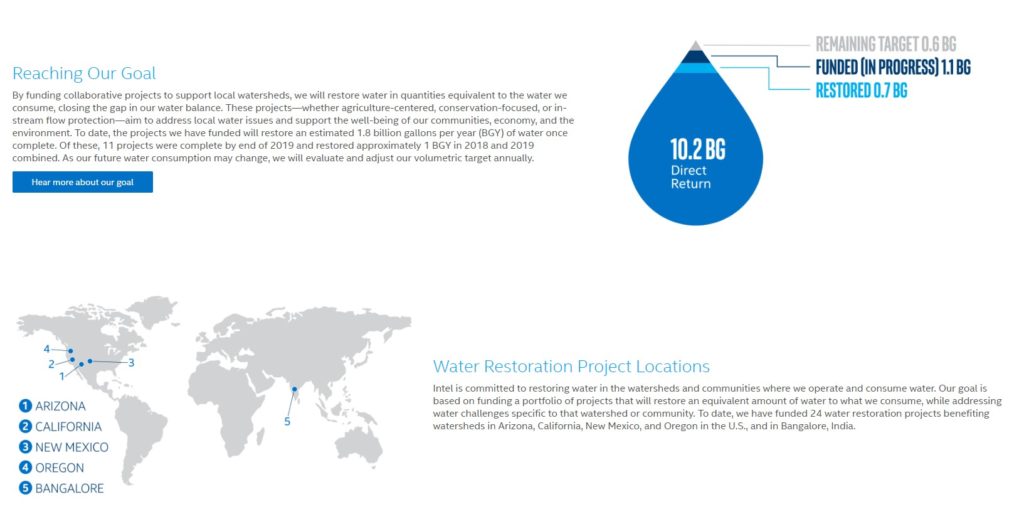

Intel has announced– on Earth Day 22 Apr 2020– that the projects the company has supported have restored approximately 1B gallons of water to our local watersheds in the U.S. over the past 2 years. That is enough water to support more than 9,000 U.S. homes for a year. Intel’s water management practices enable us to return 80% of the water use back to communities each year. The remaining 20% of water use is consumed through evaporation or taken up by plants in irrigation. To advance Intel’s goal, the company has funded 24 water restoration projects. (CN Beta, Intel, Intel)

Touch Display

TCL CSOT’s subsidy TCL Display’s LCD module production line covers a total area of 48,800 square meters, which is mainly a smart factory that produces a new touch-integrated display module. The project will be completed in 2022 and reach annual production capacity of 80M sets of integrated touch display modules. (Xin Cai Liao, Laoyaoba, China Glass)

Huawei has allegedly slashed 30% of the supply chain orders in Apr 2020, which will not only affect the TSMC and Largan, but will also impact Novatek and EMIS. Novatek supplies Huawei AMOLED driver integrated circuits (IC), OLED driver IC and other products. Huawei is Novatek’s main customer. (CN Beta, UDN, UDN, 163)

Sensory

MIT has developed a new type of lightweight sensor that can be integrated into flexible fabrics, including the kinds of polyesters often used in athletic wear, to provide constant monitoring of vital signs including body temperature, heart rate and respiratory rate. These sensors are machine-washable and can be integrated into clothing that appears totally normal on the outside, and they can also be removed and re-used in different garments. (TechCrunch, MIT, CN Beta)

Battery

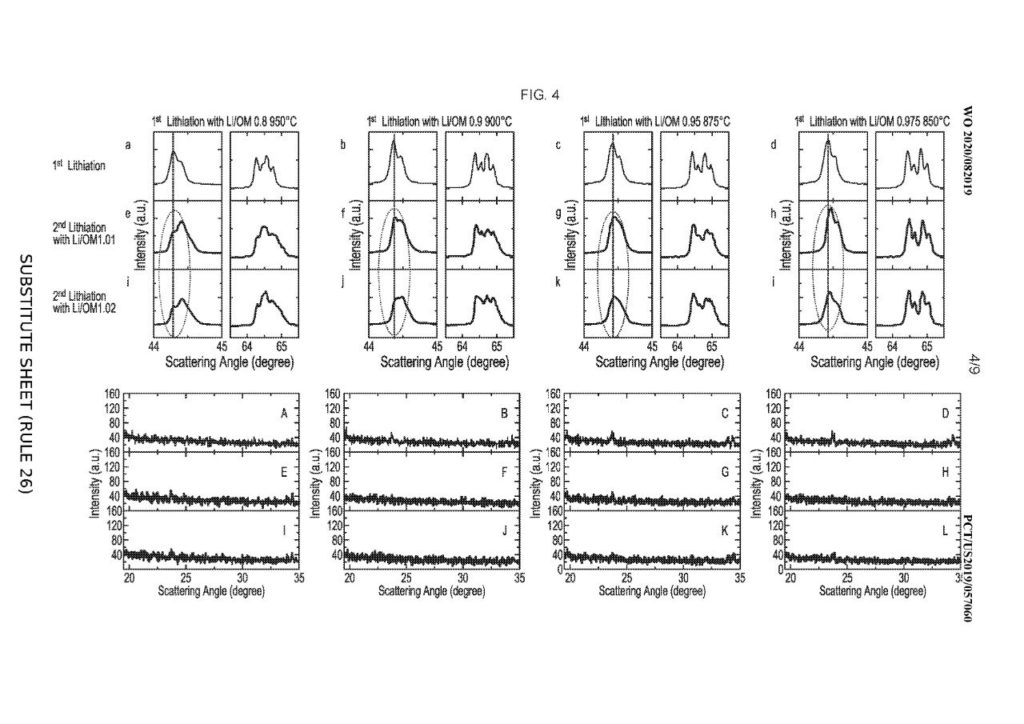

Tesla has submitted a patent titled “Method for Synthesizing Nickel-Cobalt-Aluminum Electrodes”. The patent outlines a new electrode synthesizing method that could be used for battery cell production. The proposed application defines an efficient heating process for Nickel-Cobalt-Aluminum (NCA) electrodes. The use of NCA electrodes in batteries would allow for single-crystal materials to present themselves without impurities. The lack of contaminants could lead to an increased lifespan of the cells altogether, helping Tesla take a giant leap forward in its quest to produce a 1-million-mile battery for its vehicles. (Laoyaoba, Teslarati)

Phone

Facebook is planning to introduce a new video calling feature that will allow users of its Facebook Dating service to connect and video call over Messenger, as an alternative to going on a real-world date. (TechCrunch, Digital Ariq)

Facebook is adding 50-person video chatrooms called Messenger Rooms. The new feature reflects how people have turned to video-calling to stay in contact amid the pandemic. (VentureBeat, CNBC, Facebook, Business Insider)

Many regional offices of OnePlus, namely UK, France and Germany, have allegedly been downsized by as much as 80%, leaving skeletal teams of around 3 people in some countries. OnePlus has referred those as part of a “normal restructuring” in Europe in order to focus on key markets. (GSM Arena, Engadget, CN Beta)

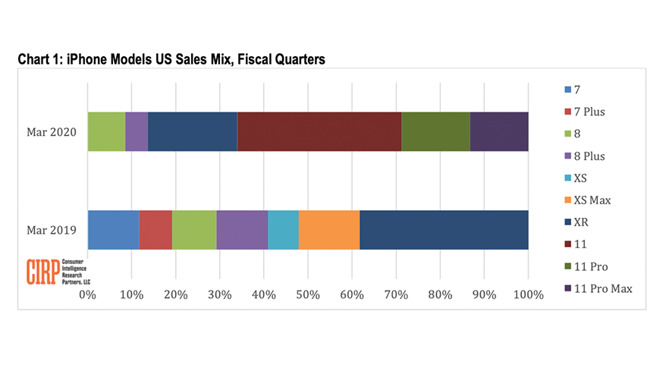

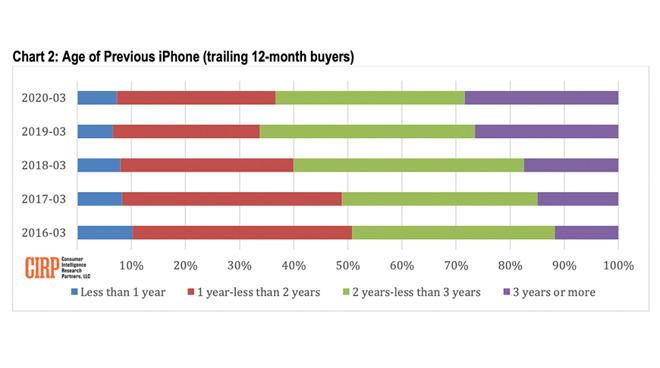

Consumer Intelligence Research Partners (CIRP) has released a study showing that the Apple iPhone 11, iPhone 11 Pro, and iPhone 11 Pro Max models account for 66% of iPhone sales in the United States during 1Q20. The iPhone 11 accounted for 37% of the U.S. sales, likely driven by its lower price point. The iPhone 11 had also lead iPhone sales for the 3 months ending in Dec 2019. (Apple Insider, 199IT, Laoyaoba)

uBreakiFix has announced a partnership with Google to offer free repairs to Pixel phones for healthcare workers and others who are directly fighting COVID-19. Samsung has also launched a similar partnership with uBreakiFix to offer free repairs for their Galaxy phones to support those on the frontlines. (The Verge, 9to5Google, Samsung)

PC Tablet

HiSense Q5 Tablet is announced – 10.5” HD monochrome RLCD (reflective LCD), UNISOC Tiger T610, rear 5MP + front 2MP, 4+64GB, Android 10.0, 4G LTE, 5050mAh 10W, CNY2,299 (USD324). (Gizmo China, Sina)

Automotive

China’s air mobility company EHang has announced plans to fly into Europe and set up shop in Seville, Spain. Now the firm has partnered with the City of Hezhou in Guangxi Province, China, to build a tourism-focused terminal for its air taxis. (CN Beta, Aviation Post, New Atlas, EHang)

Tesla has released a new, highly anticipated Traffic Light and Stop Sign Control feature. Tesla has started to push an Autopilot update with the actual ability to handle intersections to some drivers in its “early access fleet,” a group of owners who beta test new software update from Tesla. (Laoyaoba, Electrek)

Didi Chuxing has set up a special fund of CNY100M in China to install a protective film inside the car for free, in order to prevent the spread of droplets as much as possible. Didi has invested more than CNY300M special anti-epidemic funds in China. In other countries around the world, Didi set up a USD10M special assistance fund. (CN Beta, Business Wire, TechNode)

Alibaba DAMO Academy has released the world’s first autonomous driving “hybrid simulation test platform”, which uses a combination of virtual and real simulation technology to introduce real drive test scenarios and cloud trainers. It only takes 30s to simulate an extreme scene, and the system’s daily virtual test mileage can exceed 8Mkm, which greatly improves the training efficiency of autonomous driving AI models. (Laoyaoba, Tech Post, Yicai Global)

Robotics

Robot maker Boston Dynamics has announced that its quadruped Spot robot is already in use at one Boston hospital to help with coronavirus treatment. The company now has ambitious plans to expand use of its robots to assist healthcare workers during the pandemic, and it is also open sourcing the hardware and software it is using so other hospitals and robot makers may be able to do follow its lead. (The Verge, GitHub, CN Beta)

Artificial Intelligence

Peak.AI, a startup developing AI solutions for enterprise customers, has announced that it has raised USD12M in extended series A funding. The fresh capital will fuel Peak’s growth, commercial expansion, and R&D, according to CEO Richard Potter, and will come as up to 25% of companies report experiencing a 50% failure rate in deploying AI models. (VentureBeat, Peak.AI, CrunchBase)

Cybersecurity startup Randori has announced that it secured USD20M in equity financing, bringing the startup’s total raised to USD29.75M. Randori’s attack platform promises to safely launch attacks on organizations to help them understand how to prevent or mitigate the effects of data breaches and other compromises, in part by leveraging machine learning to asses the exploitability of vulnerabilities. (VentureBeat, PR Newswire)

Fintech

Sony has announced the development of a common database platform (Blockchain Common Database, BCDB) utilizing blockchain technology for MaaS (Mobility as a Service), a next-generation mobility service integrating multiple transportation systems. This will enable more than 7M users per day to record and share anonymized travel history and revenue allocation. (Neowin, Sony, CN Beta)