7-3 #ReadforPleasure: LG is reportedly planning to launch a rollable smartphone early 2021; SK Hynix has begun mass production of 16GB HBM2E high-speed DRAM; T-Mobile US and Dish have announced that the deal to sell off Sprint’s prepaid business to Dish has closed; etc.

TF Securities believes that the market is too optimistic that MediaTek is supplying chips to Huawei. Since the U.S. announced the new Huawei ban on 15 May 2020, the market expects MediaTek’s supply of Huawei’s phone chips to increase significantly, and it is expected that MediaTek’s shipment of Huawei chips in 2H20 / 2021 will reach 25M~30M and more than 100M, respectively. However, the assumptions for the above optimistic prediction are: 1) TSMC cannot manufacture HiSilicon phone chips, 2) the United States does not allow Qualcomm to supply 5G mobile phone chips to Huawei, and 3) the United States allows MediaTek to supply 5G mobile phone chips to Huawei. Although the probability is low, under certain circumstances, TSMC may still help HiSilicon manufacture phone chips. (Laoyaoba, TF Securities, LTN)

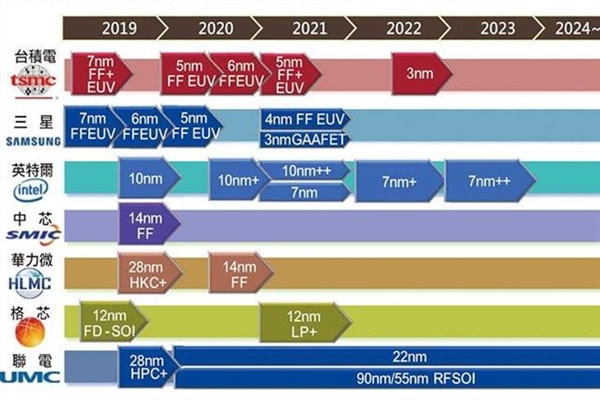

Samsung may be planning against investing in the 4nm node. Instead, Samsung will jump from the 5nm process to 3nm. That is the complete opposite of what TSMC is planning, and with its 4nm N4 process expected to be complete by 2023, it will give the Taiwanese firm’s partners ample options to choose from. Samsung is expected to maintain its 5nm production throughout 2021, which is the year when the company is rumoured to release the Exynos 1000. (My Drivers, Sam Mobile, WCCFTech, Gizmo China)

The emerging market for silicon carbide (SiC) and gallium nitride (GaN) power semiconductors is forecast to pass USD1B in 2021, energized by demand from hybrid & electric vehicles (EV), power supplies and photovoltaic (PV) inverters, according to Omdia. Worldwide revenue from sales of SiC and GaN power semiconductors is projected to rise to USD854M by the end of 2020, up from just USD571M in 2018. Market revenue is expected to increase at a double-digit annual rate for the next decade, passing USD5B by 2029. (Digitimes, press)

LG Electronics is reportedly planning to launch a rollable smartphone early 2021 and the project is called B Project. BOE is co-developing the display panel for the rollable smartphone with LG. (Android Central, The Elec, Gizmo China, IT Home)

LG Display (LGD) is planning to restart operations of its organic light emitting diode (OLED) panel plant in Guangzhou, China in Jul 2020. The company has already secured the necessary yield rate for mass production sometime during 2Q20. However, the company is mulling the issue of profitability once the factory restarts due to lower-than-expected demand for large-sized OLED panels. (Laoyaoba, The Elec)

Visionox has indicated that the company’s recently released camera under display (CuD) solution InVsee, through the development and application of new transparent OLED devices, new driving circuits and pixel structures, and the introduction of new highly transparent materials, achieving the best balance between display effect and transparency , for more high-quality display and photo effects, realizing full-screen display. Visionox has also said that phones using the InVsee CuD solution will be released soon. (My Drivers, CN Beta, GizChina)

EMS provider Lite-On Technology and LED packaging service provider Everlight Electronics have seen sharp growth in demand for UV and IR LED devices, and are poised to expand corresponding production capacities. Lite-On produces UV LED devices for disinfection applications and IR LED devices mainly for photo couplers and proximity sensors. Everlight will expand monthly packaging capacity for UV and IR LED by 80M chips, automotive LED by 50M chips and SMD LED by 50M chips in 2020. (Digitimes, press, Digitimes)

Kioxia has completed its takeover of Lite-On Technology’s SSD business – Solid State Storage Technology. Kioxia has said it plans to maintain Solid State Storage Technology’s existing operations and brands. Founded in Dec 2019, Solid State Storage is headquartered in Taipei and is led by chairman and CEO Charlie Tseng. (Digitimes, Sohu, Business Wire)

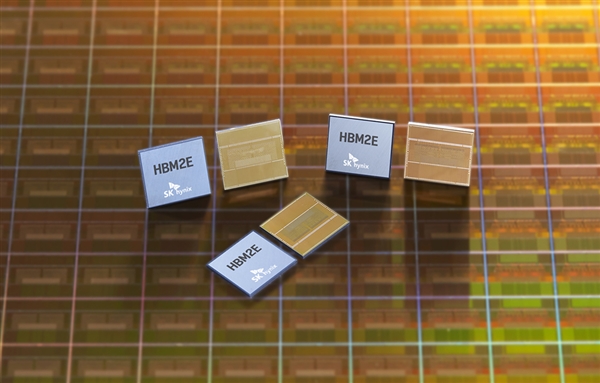

SK Hynix has begun mass production of 16GB HBM2E high-speed DRAM. It has a 3.6 gigabits per second (Gbps) per pin with 1024 I/O, which means it can process around 124 Full HD movies in a second. SK Hynix vertically stacked eight 16 gigabit (Gb) DRAM chips using through silicon via (TSV) process. It is 30% smaller and consumes 50% less power compared to existing packaging methods. (My Drivers, Gizmo China, The Elec)

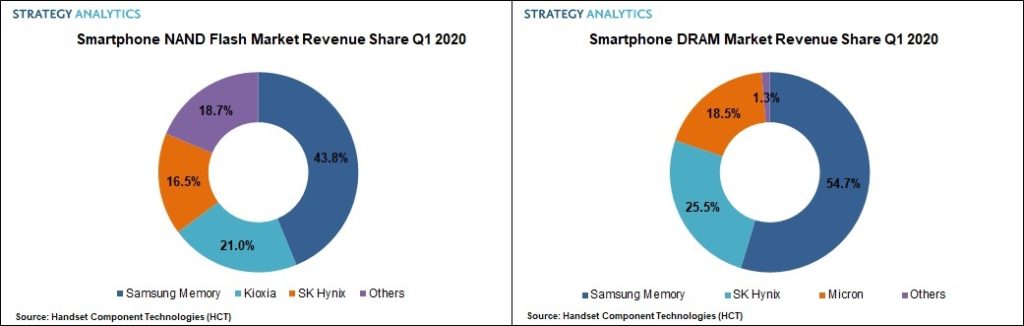

According to Strategy Analytics, the global smartphone memory market registered a total chip revenue of USD9.4B in 1Q20. Samsung Electronics has maintained its lead in the smartphone memory market with 50% revenue share in 1Q20, followed by SK Hynix and Micron Technology. Samsung, SK Hynix and Micron captured almost 84% revenue share in the global smartphone memory market during 1Q20. (Strategy Analytics, Digitimes, Laoyaoba)

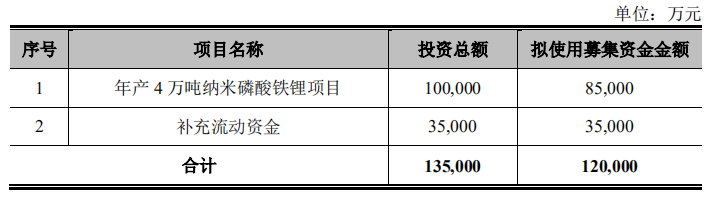

Dynanonic intends to raise no more than CNY1.2B for the annual production of 40,000 tons of nano-lithium iron phosphate project and supplementary working capital. Dynanonic has successfully developed and mass-produced carbon nanotube conductive liquid, nano lithium iron phosphate and other products. It has relatively excellent electrochemical performance and has obtained recognition from Contemporary Amperex Technology (CATL), Hyperpower Batteries, and other industry leaders. (Laoyaoba, East Money)

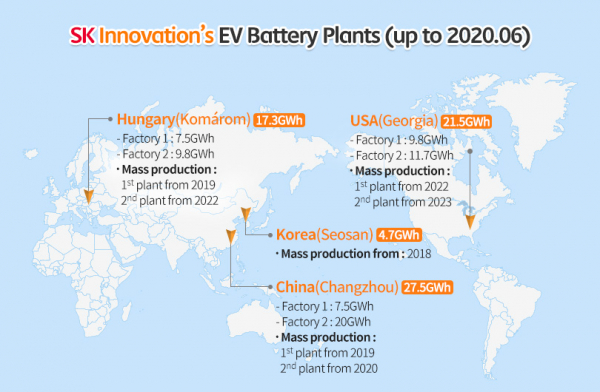

SK Innovation has made it into the global top 5 EV battery producers as of Apr 2020, citing a report released by research and consulting firm SNE Research. according to SNE Research, the global EV battery usage was recorded at 5.4GWh in Apr 2020, a 39.8% YoY decrease. (Laoyaoba, Business Korea)

SK Innovation has signed to add another USD940M investment to expand the EV battery manufacturing plant located in Commerce, Georgia, the United States. The company originally plans USD1.67B investment in the first plant. (Laoyaoba, Business Korea)

T-Mobile US and Dish have announced that the deal to sell off Sprint’s prepaid business to Dish has closed. That makes Dish, officially, the 4th largest carrier in the US. Giving the company 9.3M customers to start with. Dish has acquired Boost Mobile (Virgin Mobile too, but they were merged into one brand in 2019). (Android Headlines, Phone Arena, Business Wire)

Sprint’s legacy 5G service using 2.5GHz has been deactivated as T-Mobile continues work to reconfigure, test, and re-deploy the coveted mid-band spectrum into its new integrated 5G network. T-Mobile has been refarming 2.5GHz for its own use since closing its Sprint merger on 1 Apr 2020. (The Verge, Fierce Wireless, TechCrunch)

HMD Global announces it is acquiring assets of Valona Labs – a mobile, enterprise and cybersecurity software company. The acquisition forms part of HMD Global’s ongoing commitment to mobile security and forms the foundations of its brand-new Centre of Excellence in Tampere, Finland. (Gizmo China, HMD Global)

Apple and Google are complying with a new Indian government order to block apps developed by Chinese firms. Both companies have begun to prevent users in India from seeing the 59 blocked apps on the App Store or Google Play store. (Apple Insider, TechCrunch)

Samsung has launched a “UV Sterilizer” in Thailand, touting it as an antibacterial gadget that can charge a smartphone, smartwatch, or a pair of wireless earbuds while simultaneously disinfecting them. It is priced at THB1,590 (USD50). (Gizmo China, Samsung, Sam Mobile, CN Beta)

Honor X10 Max 5G is announced in China – 7.09” 1080×2280 FHD+ IPS u-notch, MediaTek Dimensity 800 MT6873, rear dual 48MP-2MP depth + front 8MP, 6+64 / 6+128 / 8+128GB, Android 10.0, side fingerprint scanner, 5000mAh 22.5W, CNY1,899 (USD269) / CNY2,099 (USD297) / CNY2,499 (USD354). (GSM Arena, Neowin, Weibo)

Honor 30 Lite (or Youth Edition) is announced in China – 6.5” 1080×2400 FHD+ IPS u-notch, MediaTek Dimensity 800 MT6873V, rear tri 48MP-8MP ultrawide-2MP macro + front 16MP, 6+64 / 6+128 / 8+128GB, Android 10.0, side fingerprint scanner, 4000mAh 22.5W, CNY1,699 (USD241) / CNY1,899 (USD269) / CNY2,199 (USD311). (GSM Arena, GizChina, My Drivers, Neowin)

vivo Y30 is launched in India – 6.47” 720×1560 HD+ IPS HiD, MediaTek Helio P35, rear quad 13MP-8MP ultrawide-2MP macro-2MP depth + front 8MP, 4+128GB, Android 10.0, rear fingerprint, 5000mAh 10W, INR14,990 (USD200). (Gizmo China, NDTV)

Self-driving trucks startup TuSimple has laid out a plan to create a mapped network of shipping routes and terminals designed for autonomous trucking operations that will extend across the United States by 2024. UPS, which owns a minority stake in TuSimple, carrier U.S. Xpress, Penske Truck Leasing and Berkshire Hathaway’s grocery and food service supply chain company McLane Inc. are the inaugural partners in this so-called autonomous freight network (AFN). (TechCrunch, The Verge, Vox, WSJ, Sina)

Shenzhen-based Pudu Robotics has announced that it has completed a USD15M Series B, with Beijing food services group, Meituan as the sole investor. Pudu describes itself as a “smart delivery robotics” company, with a majority of its products falling within the food services category. There are multiple robotic SKUs for food delivery and dish return, all of which are indoor models. (TechCrunch, The Capital)

SenseTime is reportedly in the process of a new round of financing of USD1B~1.5B. It is reported that this round of financing will be completed in 2020, and after this round of financing SensTime valuation will reach USD10B. (Laoyaoba, Sohu, Caijing)