8-13 #That’sTheWayItIs: Samsung has reportedly restarted its original design manufacturing (ODM) operations; Huawei has invested heavily in smart car solutions including LiDAR; Nreal will launch Light AR glasses in South Korea; etc.

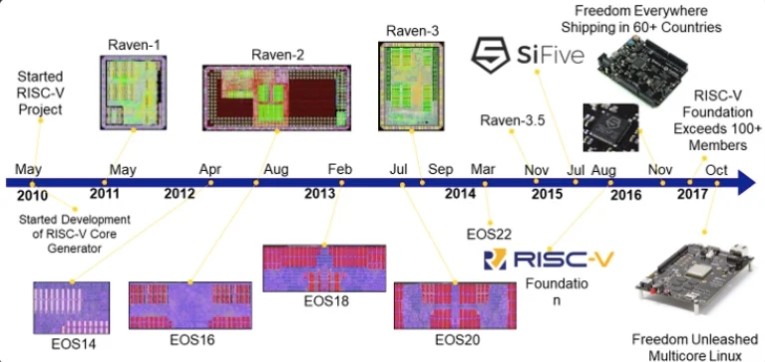

SK Hynix and Saudi Aramco have participated in the pool of investors who recently put a combined USD60M into the provider of Risc-V processor core intellectual property SiFive. The existing investors also include the venture capital arms of Intel, Qualcomm, and Western Digital. (Laoyaoba, 36Kr, Electronic Design)

Unigroup Guoxin Microelectronics and the National New Energy Vehicle Technology Innovation Center (NEVC) have signed a strategic cooperation agreement to carry out collaborative innovation in areas such as the development and update of new energy vehicle chip standards, and the development and testing of vehicle-level security chips. (Laoyaoba, Sohu)

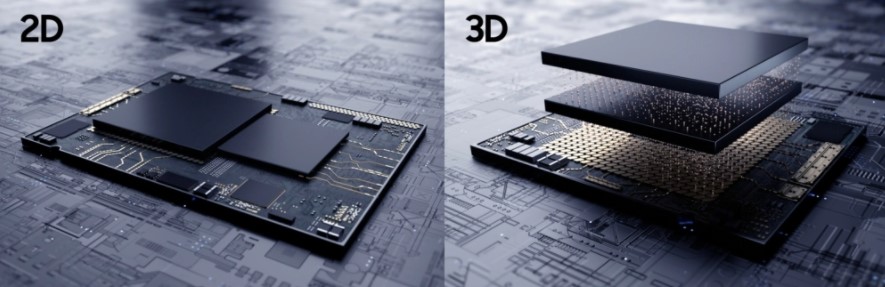

After TSMC’s CoWoS (actually 2.5D), Intel’s Foveros, Samsung has announced announced the immediate availability of its silicon-proven 3D IC packaging technology, eXtended-Cube (X-Cube). The new 3D integrated circuit chip packaging technology is now available to manufacture 7nm chips. It allows ultra-thin stacking of multiple chips to make a more compact logic semiconductor. The process uses through-silicon via (TSV) technology for vertical electrical connection instead of using wires. (CN Beta, Business Wire, Sam Mobile)

Optical film company Shinwha Intertek is entering the encapsulant market for large-sized organic light emitting diode (OLED) panels. It has already provided samples for multiple display panel makers, including LG Display. LG Display currently gets its encapsulant supply from LG Chem and Innox Advanced Materials, with each supplying half of the total volume. (Laoyaoba, The Elec)

After TCL, global TV makers including Samsung, LG are expected to roll out mini-LED (light emitting diode) TVs in earnest 2021. TV companies that are planning to release mini-LED TV models beginning 2021 include Samsung, the world’s No. 1 TV maker, and China’s TCL, Konga, and Changhong. LG is also preparing to launch mini-LED TV models. (Laoyaoba, Business Korea)

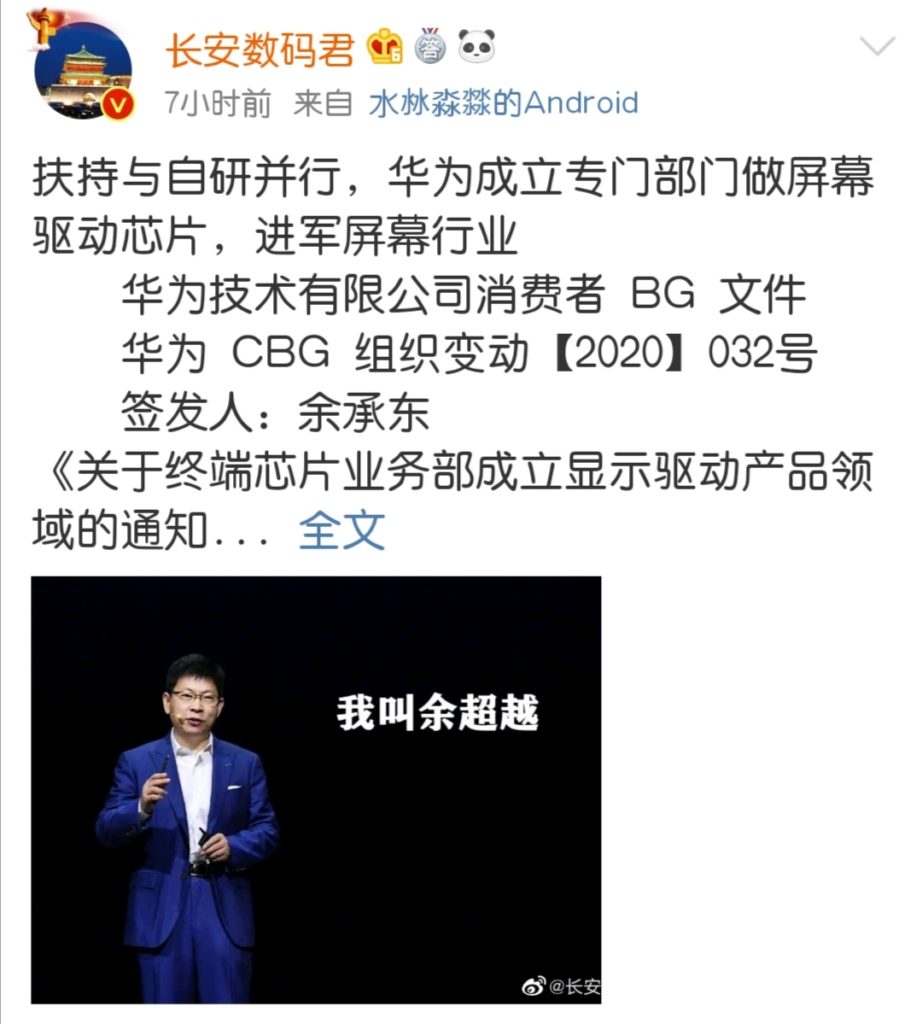

Richard Yu, CEO of Huawei’s consumer business, has recently issued a document with the title translated as “Notice on the establishment of the terminal chip business unit in the field of display driver products”. Huawei started working on related projects as early as the end of 2019. The first Huawei HiSilicon OLED Driver is already taping out. (Laoyaoba, Sohu, CN Techpost)

TCL CSOT and E Ink have jointly announced that they will cooperate in the manufacture of electronic paper TFT backplanes and the market application promotion of large-size electronic paper billboards. Among them, TCL CSOT will use the Gen-8.5 TFT panel line production line to manufacture 42” electronic paper TFT backplane, this is the world’s first large-size electronic paper backplane with the Gen-8.5 line, and it is also the largest generation factory in the world to manufacture e-paper TFT backplanes. (OLED Industry, Sohu, UDN, Led Inside)

Huawei’s auto division head Wang Jun has revealed that the company has invested heavily in smart car solutions including LiDAR. With its advanced 5G technology the company is set to reduce the cost of radar sensors to USD100 in the future. At the moment, the average price for the LiDAR sensors hovers around the USD400-500 price range. (Gizmo China, Kr-Asia, Huawei)

Ericsson has announced it has secured the company’s 100th commercial 5G agreement or contract with unique communications service providers. The Swedish vendor said that this figure includes 58 publicly announced contracts and 56 live 5G networks globally. The company’s 5G milestone was reached with announcement of a 5G agreement with Slovenian operator Telekom Slovenije. (Laoyaoba, RCR Wireless)

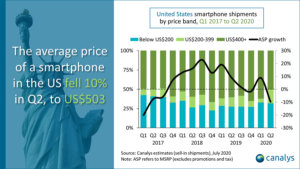

According to Canalys, vendors shipped 31.9M smartphones in the United States in 2Q20, a 5% year-on-year decline, but an 11% quarter-on-quarter increase. Resumption of Chinese factory operations at the end of Mar and stores reopening in May and Jun were key contributors to sequential market growth. Apple and Samsung accounted for 7 out of every 10 devices sold, and Apple established a new domestic record in 2Q20, shipping 15.0M iPhones. (Canalys, press, GSM Arena, CN Beta)

Samsung has reportedly restarted its original design manufacturing (ODM) operations after it was halted by the COVID-19 pandemic. Samsung is expected to produce 24M-26M units of smartphones through ODM partners in 2020, accounting for around 10% of its total annual smartphone production. Samsung has initially planned to increase that portion to 20% in 2020 but this has changed due to the virus outbreak. Its ODM partners Wingtech and Huaqin saw their factory operation rate drop to 50% from Feb to Mar 2020 when the virus was at its peak. This began to recover in 2Q20. (Gizmo China, The Elec)

ByteDance, the parent company of TikTok, is allegedly looking into gaining investment for its short video sharing platform from Indian giant, Reliance Industries. TikTok’s business in India is being valued at more than USD3B. (Gizmo China, TechCrunch, My Drivers)

vivo S1 Prime is announced for Myanmar – 6.38” 1080×2340 FHD+ AMOLED u-notch, Qualcomm Snapdragon 665, rear quad 48MP-8MP ultrawide-2MP macro-2MP depth + front 16MP, 8+128GB, Android 9.0, fingerprint on display, 4500mAh 18W, MMK389,880 (USD287). (GSM Arena, vivo, Gizmo China)

The idea behind neural radiance fields (NeRF) is to extract 3D depth data from 2D images by determining where light rays terminate, a sophisticated technique that alone can create plausible textured 3D models of landmarks. Google’s NeRF in the Wild (NeRF-W) system first uses “in-the-wild photo collections” as inputs, expanding a computer’s ability to see landmarks from multiple angles. Next, it evaluates the images to find structures, separating out photographic and environmental variations such as image exposure, scene lighting, post-processing, and weather conditions, as well as shot-to-shot object differences such as people who might be in one image but not another. Then it recreates scenes as mixes of static elements — structure geometry and textures — with transient ones that provide volumetric radiance. (VentureBeat, NeRF in the Wild, Sohu)

Varjo, the Finnish startup that has developed a virtual and mixed reality headset capable of “human-eye resolution” for use in various enterprise applications, has closed USD54M in Series C funding. The company’s most recent devices, the VR-2 and VR-2 Pro, cost EUR5,000 (USD5,900) and EUR6,000 (USD7,000), respectively, and support VR content hosted on SteamVR, as well as Valve’s OpenVR development platform. (VentureBeat, TechCrunch)

Google has added new feature on Google Lens that can allow students take a photo of a math problem or equation and access step-by-step guides to solve it and better understand the key concepts with the help of detailed explainers. The feature will be powered by the mobile learning app Socratic. Google has has also added 3D content for 100 STEM concepts across biology, chemistry, and more, which is accessible using ARCore-compatible Android or iOS devices. (Android Central, Google)

Nreal will launch Light AR glasses in South Korea, bundled with Samsung Galaxy Note20 or LG Velvet from LG Uplus. At launch, Light will be compatible with “several hundred major apps”. Additional apps from Nreal and its partners will arrive “following the launch,” including collaborative holographic conferencing app Spatial, a game called Nreal Tower, a TV app, and a third-party app beta preview collection called Nreal Studio. (VentureBeat, YNA, CNYes, VR Focus)

The healthcare industry is undergoing systematic changes driven by trends such as an aging demographic, the explosion in healthcare data, and increasingly complex administrative infrastructure. The Covid-19 outbreak has made these challenges even more urgent. Facebook, Amazon, Microsoft, Google, and Apple (FAMGA) were already leveraging their scale, user base, technology, and brand to modernize the consumer & enterprise healthcare experience. Their aim is to capture a piece of the USD3.6T US healthcare market. Covid-19 could accelerate their collective march. FAMGA can leverage scale and large active user bases. (CB Insights, report, report)

TikTok’s owner ByteDance has fully acquired online medical encyclopedia Baikemy.com, with alleged amount of CNY500M (USD72M). Baikemy, which was set up in 2010 in Beijing, is one of China’s largest medical information portals, offering professionals-generated content (PGC). (CN Beta, Sina, AVCJ)