9-18 #EveryDay: Huawei HiSilicon and HopeRun Information Technology have created the HiSpark series of development kits; Huawei has about 10M units of HiSilicon Kirin 9000 SoC; The gross profit margin of MediaTek’s 5G chips would be reduced to 30% in 2021; etc.

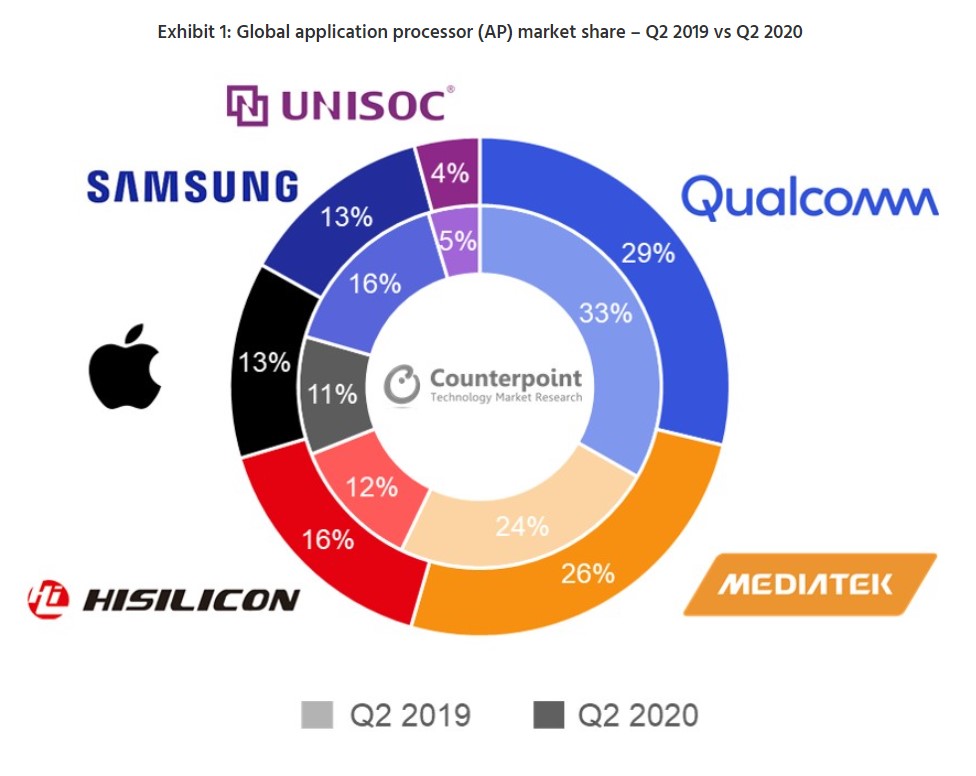

According to Counterpoint Research, the smartphone application processor (AP) market declined 26% in 2Q20 as smartphone sales plummeted due to the COVID-19 pandemic and resulting restrictions. Qualcomm led the market with 29% market share, a drop of 3 percentage points compared to 2019. (CN Beta, Counterpoint Research)

Huawei HiSilicon and HopeRun Information Technology have created the HiSpark series of development kits, including hardware development boards, SDK packages, reference engineering, documentation. HiSpark development boards are based on the HiSilicon chip development platform and include the HiSpark WiFi IoT, HiSpark AI Camera, and HiSpark IPC DIY smart hardware development kits. (CN Beta, Leiphone, CN Techpost)

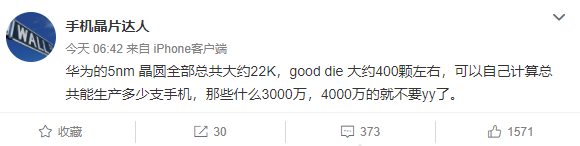

According to independent analyst Wang Haifeng, Huawei has about 10M units of HiSilicon Kirin 9000 SoC, so there could be 10M units of Mate 40 series phones available for purchase. However, when the inventory is used up, Huawei’s mobile phone business, especially the high-end mobile phone business, will soon encounter huge challenges. (Gizmo China, My Drivers)

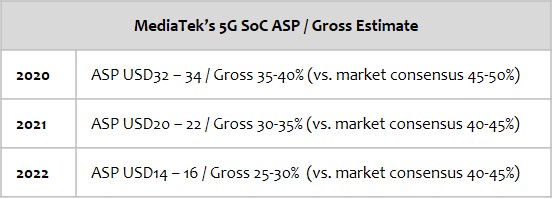

TF Securities analyst analyst Ming-Chi Guo has indicated that after MediaTek lost Huawei’s order, the proportion of low-end 5G chip shipments has increased. In addition, it has no bargaining power with TSMC and has no price advantage when competing with Qualcomm. The gross profit margin of MediaTek’s 5G chips would be reduced to 30% in 2021. He believes that MediaTek’s OPPO, vivo, Xiaomi and other customers’ shipments cannot offset Huawei’s lost orders. It is estimated that non-Huawei customers’ order demand is only 70% of Huawei’s previous orders. (TF Securities, Laoyaoba)

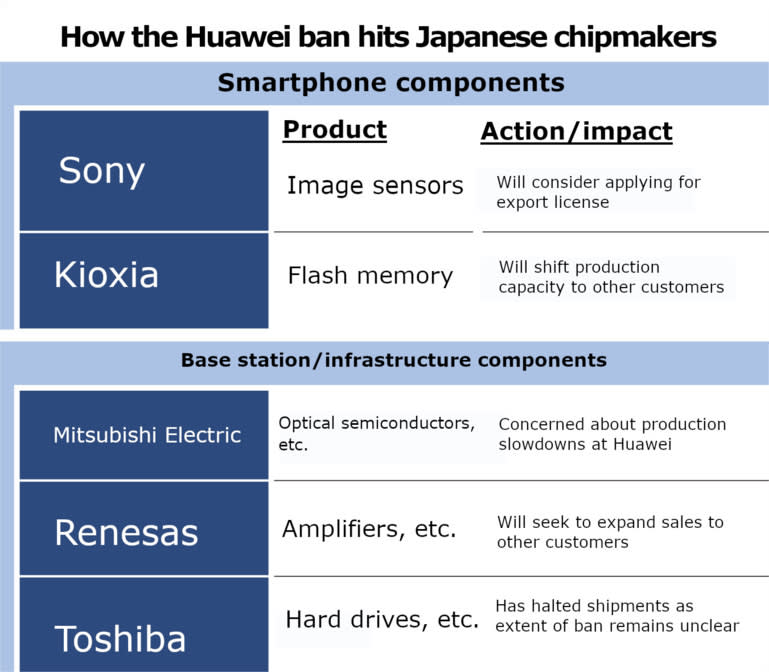

The U.S. Commerce Department has banned all exports to Huawei of semiconductors made with American technology, exempting only shipments that are already en route. Japanese companies have supplied about JPY1.1T (USD10.4B) in parts to Huawei in 2019, according to Omdia. U.S. sanctions against Huawei have forced Japanese chipmakers to cast a wider net for business to fill the gap left by a loss of sales to Huawei. (Asia Nikkei, article)

SiFive says Nvidia’s USD40B agreement to acquire ARM has sparked fresh interest from customers about deepening ties with the young firm. California startup SiFive is where several of the creators of RISC-V now work, selling designs based on RISC-V that are tested and ready to turn into silicon. (Reuters, TechNews, Laoyaoba)

Forrest Norrod, Senior Vice President at AMD has confirmed that the company has been granted a license to sell its products to some of the companies in the US Entity List. Many companies have started lobbying with the United States government to reconsider some of the restrictions placed on Huawei, arguing that it impacts American businesses, both in terms of innovation and finance. (Gizmo China, Seeking Alpha, Sina)

Companies that supply the chip sector with sophisticated and expensive equipment plan to warn the Trump administration against a proposal to blacklist China’s top chipmaker Semiconductor Manufacturing International Corporation (SMIC), arguing it would be “detrimental” to U.S. industry. The companies are represented by the semiconductor and electronics manufacturing suppliers industry group SEMI. (Semi Insights, Reuters, CN Beta)

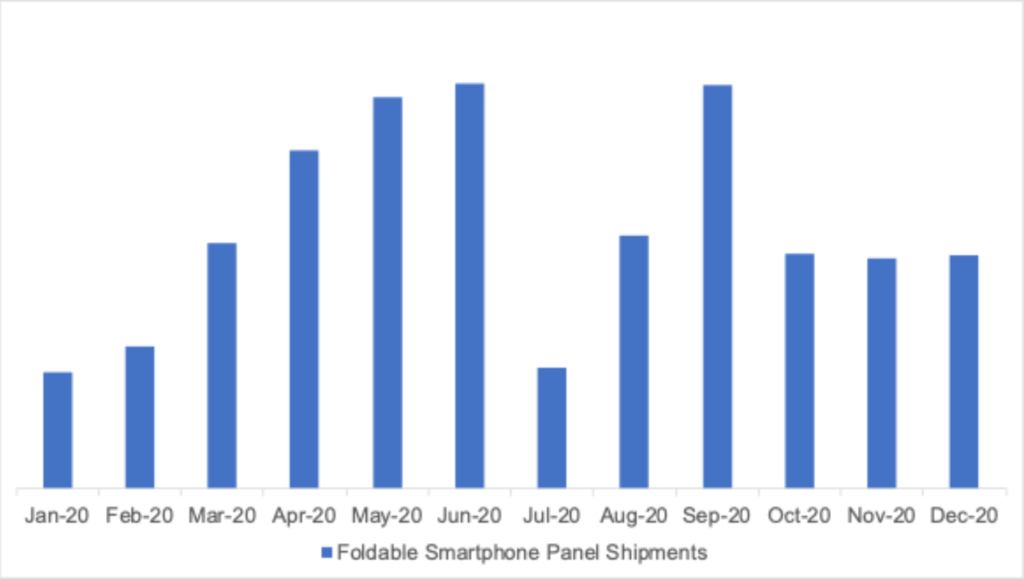

According to DSCC, 2Q20 is expected to be the record period for foldable panel shipments in 2020. It forecasts Galaxy Z Flip to the top-selling foldable of the entire 2020, followed by Galaxy Z Fold2, Motorola razr, and Galaxy Z Flip 5G. By brand, Samsung will command more than an 80% share. This is higher than previously forecast. (GSM Arena, YNA, Sam Mobile, Gizmo China, DSCC)

Taiwan-based PlayNitride plans to kick off construction at its second micro LED chip production line soon, having secured the first part of the funds for its USD50M expansion project. The second production line is slated for completion and volume production during 2Q21 / 3Q21, expanding the company’s capacity by 2-3 folds. (Digitimes, press)

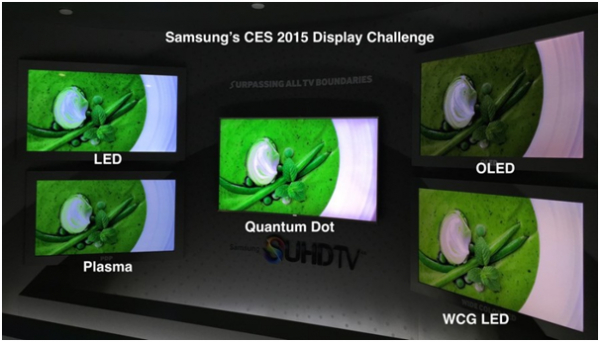

Samsung Display will supply quantum dot (QD) TV panels to Chinese companies ahead of Samsung Electronics as the company will not use QD panels in 2021. In Oct 2019 Samsung Display formally announced its decision to invest USD10.85B in QD-OLED TV R&D and production lines. The company is already starting to produce prototypes, and is on track to start mass production in 3Q21. (CN Beta, My Drivers, Business Korea)

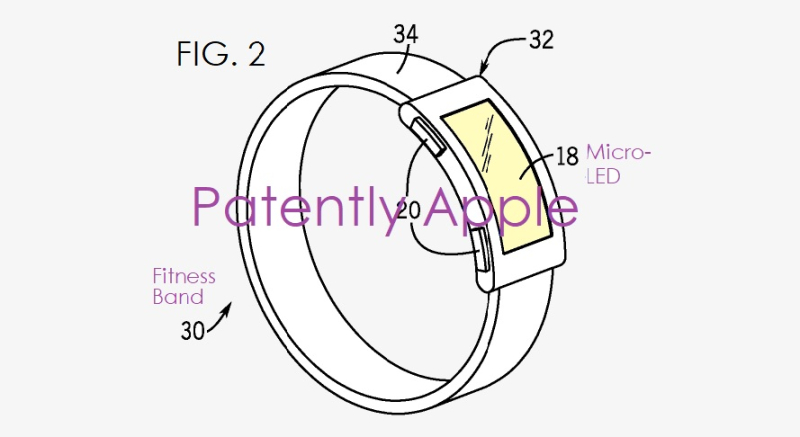

Apple has been granted a new patent for Micro-LED display, which the company is planning to use for future MacBook, iPads, and a Fitness Band. Apple is reportedly investing around USD330M in a Taiwan-based company for Micro LED factory that will manufacture displays for future iPhones, iPads, MacBooks, and other devices. (Gizmo China, Patently Apple)

BOE will reattempt to supply Apple its OLED panels starting Sept 2020. If BOE succeeds, it will be able to supply OLED panels for refurbished iPhone 12 smartphones. BOE is attempting to win Apple’s order this time through its B7 factory in Chengdu, Sichuan Province. (Laoyaoba, The Elec)

Shenzhen-based HGTECH has revealed that the mobile phone periscope prism is one of the optical components used in mobile phone cameras, which can meet the needs of higher-power optical zoom products of mobile phones. Currently, the company’s products are in the stage of sending samples to customers. The business of HGTECH basically based on laser technology. (Laoyaoba, Sohu)

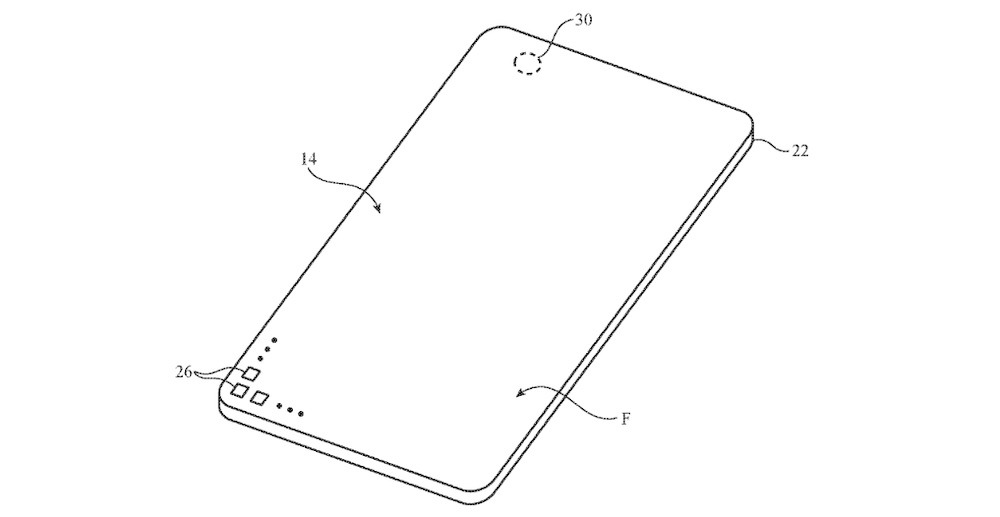

Apple has filed a patent describing an ambient light sensor that could be embedded underneath an iPhone display. Apple notes that an array of pixels installed over an ambient light sensor could be controlled while the sensor was gathering measurements. (Apple Insider, CN Beta)

Kioxia Holdings, the world’s second-largest maker of flash memory chips, has warned that tighter U.S. restrictions on Huawei could cause memory chip oversupply and drive down market prices. Kioxia has also said in a regulatory filing that all or most of its chip sales to Huawei are highly likely to be subject to the tighter restrictions that came into force. (Laoyaoba, CNYES, Reuters)

Samsung Electronics and SK Hynix are looking to start a new era of semiconductor manufacturing process. While Samsung Electronics is planning to mass-produce the industry’s first “Gate-All-Around (GAA)”, SK Hynix is getting ready to manufacture DRAM based on the extreme ultraviolet (EUV) process. (Laoyaoba, ET News)

LG Chem, an electric car battery supplier for Tesla and General Motor plans to separate its battery business into a new company as the electric vehicle market takes off. LG Chem has revealed that the new business, to be launched in December, aims to achieve a revenue of KRW30T (USD25.5B) or more in 2024, from an expected revenue of KRW13T in 2020. (CN Beta, Auto News, Reuters)

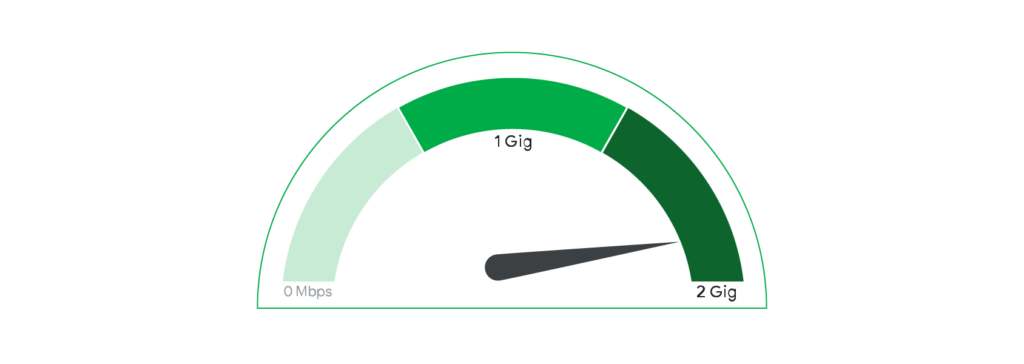

Google Fiber is to start testing a new 2Gbps internet service in 2 cities with the plan to launch it widely in 2021. The plan will cost USD100 per month, or USD30 more than the current 1Gbps service. The company is calling for “super users” and others in Nashville, Tennessee and Huntsville, Alabama to join its Trusted Tester program and help it work out the bugs. (Engadget, Google)

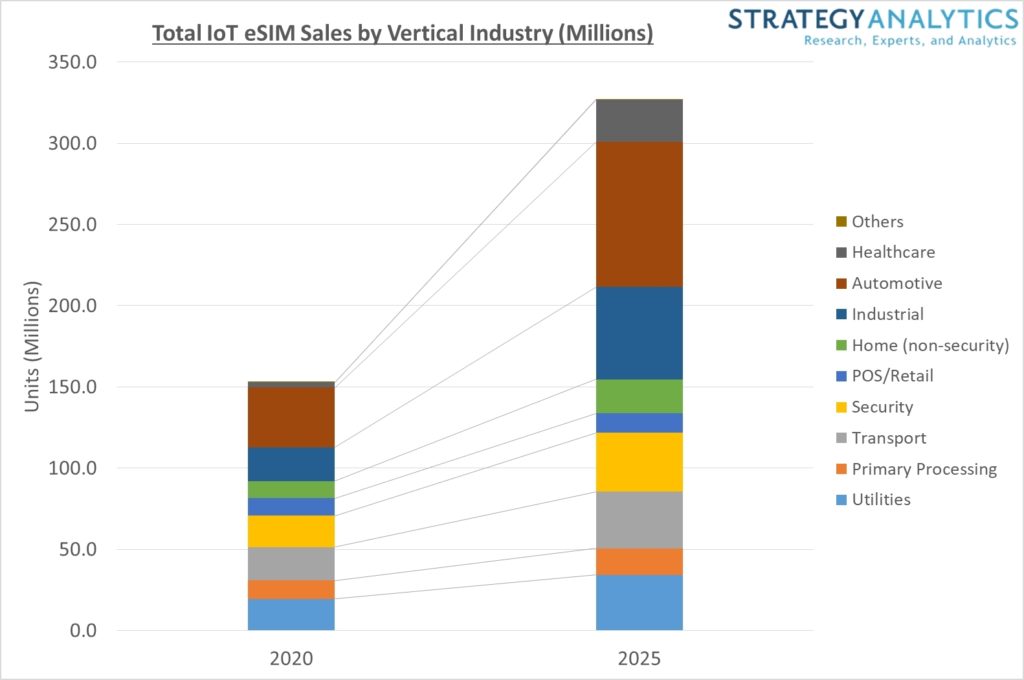

Strategy Analytics forecasts that sales of eSIMs for IoT applications will grow to 326M by 2025. eSIM developments are now ramping-up. After years of non-interoperable eUICCs (Embedded Universal Integrated Circuit Card), the industry is now aligned with clear standards and a broad ecosystem of partners, with over 200 carriers supporting eSIM. (Business Wire, Laoyaoba)

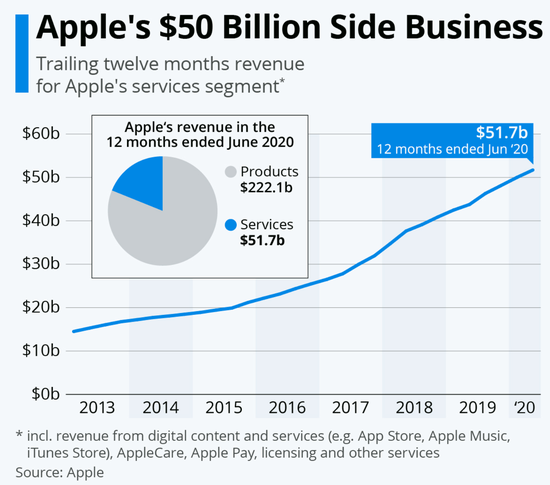

Apple has launched two subscription services, Fitness+ and Apple One bundled service, which further expanded its ambitions in the service business. With Apple TV+, Apple Music, Apple Arcade, iCloud and Apple Care, Apple’s service and subscription business has developed rapidly in recent years. Since 2013, the company’s service business revenue has more than tripled, from USD1.35B in the 12 months ending in Mar 2013 to the current (12 months ending in Jun 2020) of USD5.17B. (The Information, Chron, Yahoo, CN Beta)

16 years ago, OPPO officially began its journey. Now OPPO currently operates in over 40 countries and regions and owns 6 Research Institutes and 4 R&D Centers. A combined 350M people around the world use OPPO’s products. The company’s phone journey started in 2008 with the OPPO A103 (Smiley Face) and its memorable design. (GSM Arena, Sohu, QQ)

realme 7i is introduced in Indonesia – 6.49” 720×1600 HD+ IPS HiD 90Hz, Qualcomm Snapdragon 662, rear quad 64MP-8MP ultrawide-2MP macro-2MP depth + front 16MP, 8+128GB, Android 10.0, rear fingerprint scanner, 5000mAh 18W, IDR3.199M (USD215). (GSM Arena, realme)

Sony Xperia 5 II 5G is announced in US and Europe – 6.1” 1080×2520 FHD+21:9 OLED 120Hz, Qualcomm Snapdragon 865, rear tri 12MP OIS-12MP telephoto OIS-12MP ultrawide + front 8MP, 8+128 / 8+256GB, Android 10.0, side fingerprint scanner, 4000mAh 21W, IP65 / IP68 rated, USD950. (GSM Arena, Phone Arena)

Facebook has announced a research project that will gather data for a pair of AR glasses created in partnership with Luxottica, the makers of Ray-Ban. Project Aria is a research project aimed at helping Facebook develop the first generation of AR wearables. The physical product is a device that Facebook says “will help us understand how to build the software and hardware necessary for AR glasses”. (CN Beta, Apple Insider, Facebook)

Facebook has announced the Oculus Quest 2 virtual reality (VR) headset – dual 1832×1920 LCD 90Hz displays, Qualcomm Snapdragon XR2, 6+64 / 6+256GB, priced from USD299. (Liliputing, Oculus, VentureBeat, CNBC, Road to VR)

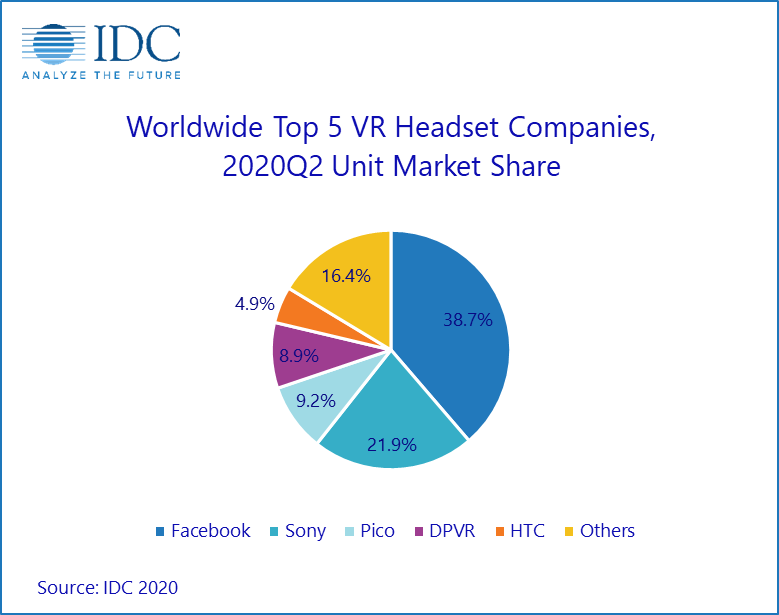

As the world continues to deal with the pandemic, the market for virtual reality (VR) headsets is expected to decline 6.7% in 2020 before returning to double-digit growth of 46.2% in 2021, according to IDC. The market has faced a temporary setback in 2020 as supply chain disruptions impacted volumes in the early months and expected product transitions have slowed the market mid-year. However, IDC expects shipments of VR headsets to grow rapidly with a compound annual growth rate (CAGR) of 48% from 2020 to 2024 as consumer and enterprise audiences continue to invest in the technology. (CN Beta, IDC)

Tidal and Facebook have announced a partnership that is set to bring live music gigs into home using the power of virtual reality later in 2020. That will mean VR concerts for those who own the Oculus Quest headsets, and 2D video within Tidal’s service, with simultaneous access to the live performances on each platform. (Pocket-Lint, Billboard)

Volocopter, the pioneer of Urban Air Mobility (UAM), has announced that the world’s first public sale for electrical air taxi flight reservations has started. Effective immediately, Volocopter fans world-wide can reserve their tickets online and be amongst the very first to take this new form of mobility. The VoloFirst costs EUR300 and can be reserved with a 10% deposit. There are only 1000 presale reservations available for a limited time. (CN Beta, Volocopter, EVTOL, TechCrunch)