10-11 #NewGen: Huawei has opened a research center dedicated to fundamental research in mathematics and computing in France; Google has unveiled a new security feature that arrives in the form of new alerts; etc.

UNISOC, a China-based supplier of mobile communications chipsets and IoT chipsets, has announced the Tiger T710 development board, an octa-core high-performance artificial intelligence motherboard powered by Unisoc AI processor Tiger T710. It has a built-in neural network processor NPU and powerful AI computing performance of up to 3.2 TOPS. (CN Beta, CN Techpost, IT Home)

OPPO has filed this patent with the CNIPA (China National Intellectual Property Office), which details a super curved display smartphone. OPPO has patented 4 different smartphone designs with minor differences in their display curves. (Gizmo China, LetsGoDigital)

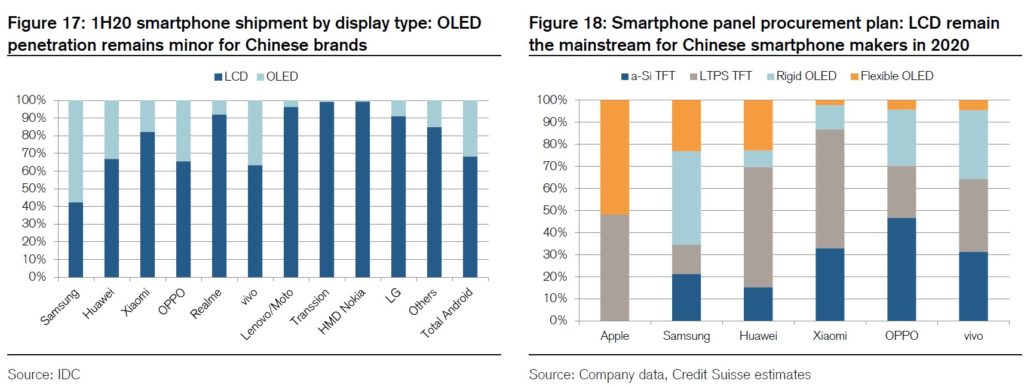

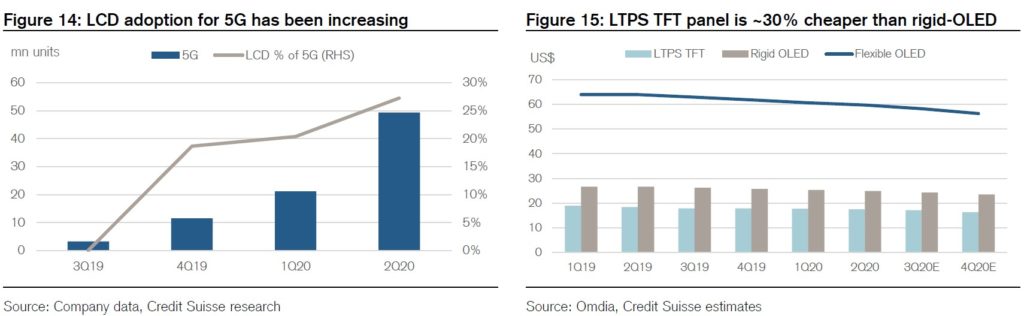

For 2H20 models, Credit Suisse suggests multiple Chinese brands including Huawei, ZTE, OPPO, vivo, Xiaomi, etc., have launched 5G models with LCD panels in the past few months, likely due to cheaper cost structure for adopting LCD panel to offset the increasing cost from antenna, AP, RF, etc., amid the migration to 5G. (Credit Suisse report)

Credit Suisse believes the Huawei restriction will also lead to slower adoption of OLED in the next 6-9 months as Chinese brands’ (OPPO, vivo and Xiaomi) current plans are to adopt more LCD as the display for their 1H21 models, given lower cost structure and as they meet their product segmentation. Net-net, Credit Suisse believes LCD panels are likely to remain over 55% of overall smartphone display at least until 2022. (Credit Suisse report)

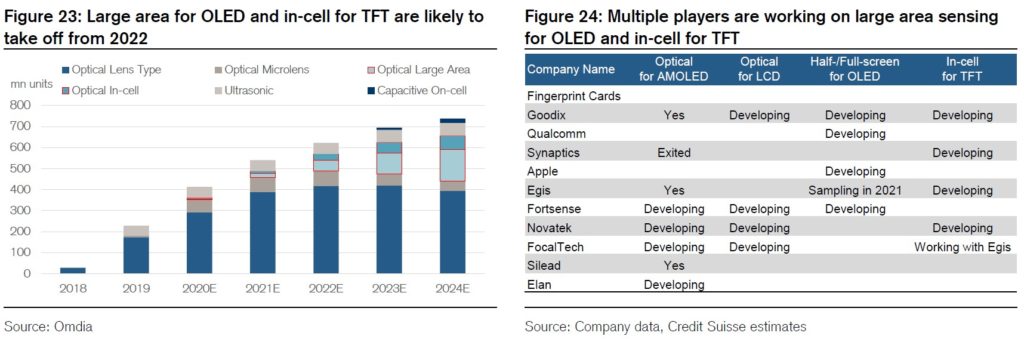

There have been attempts by several companies (Fortsense, Novatek, FocalTech, etc.) on developing the under-display solution for LCD panels, but Credit Suisse does not expect a breakthrough in the near-term given higher cost structure and sensitivity issues. Instead, several fingerprint and DDI fabless have been working with panel makers on developing in-cell full screen fingerprint sensors for LCD panels by building photo sensing circuits on the LTPS backplane, while also integrating the fingerprint read-out IC with the TDDI for FTDDI solution. Credit Suisse suggests Novatek and Egis / FocalTech are more ahead of others (Synaptics and Goodix) on FTDDI development. Credit Suisse believes this will take a few more quarters before the product is ready for mass production (more likely in 2022). (Credit Suisse report)

Orange and Proximus have picked Nokia to help build 5G networks in Belgium as they drop Huawei amid U.S. pressure to exclude the Chinese firm from supplying key telecoms equipment. The United States welcomed the decisions by Orange Belgium and Proximus, which have a network sharing agreement. (Laoyaoba, Reuters, Mobile World Live)

ZTE Corporation has signed a partnership with MTN Zambia, a leading telecommunications operator in the Middle East and Africa, to construct a cross-border Optical Transmission Network backbone in Zambia. ZTE will provide MTN Zambia with an industry-leading customized Optical Transmission Network solution, using ZTE’s ZXONE 9700 G2K system based on its in-house chipsets. (Laoyaoba, ZTE, Communications Africa)

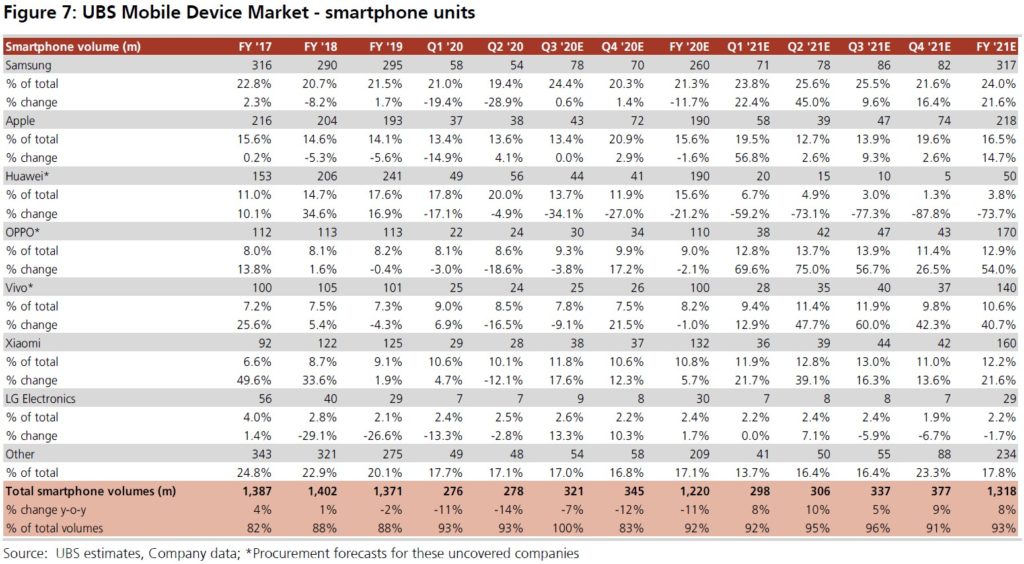

According to SWS Research analysis, the price range is the first consideration for consumers to switch brands, ignoring the difference in the share of each brand in the regional market segment. OPPO / vivo / Samsung is believed to become the biggest winner with Huawei’s exit, which would result in positive growth of 27%, 26%, and 23% in the sales, respectively; and the increase is mainly concentrated on models with USD200-600 segment. Xiaomi is expected to welcome a 21% growth in shipments, with the increase mainly coming from the USD100-400 model segment. Apple is expected to welcome 18% shipment growth, mainly benefiting from a market share of USD400-800. (SWS Research report)

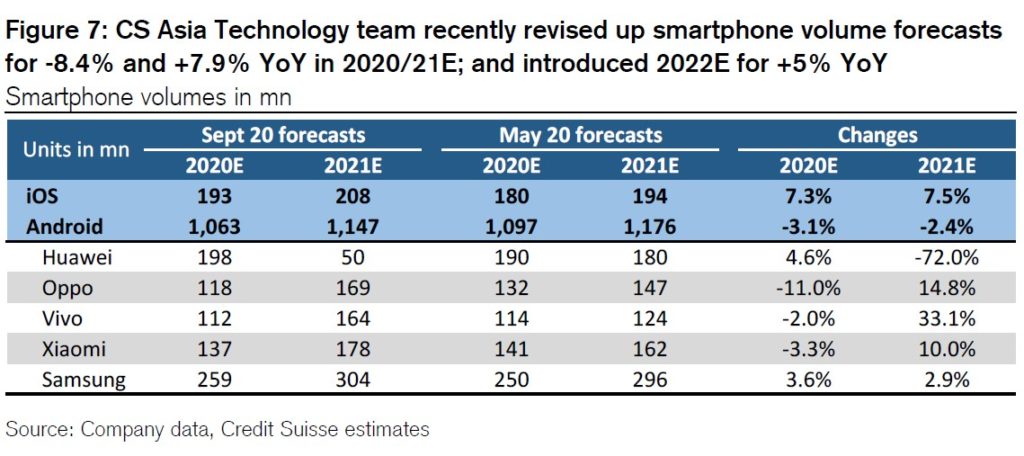

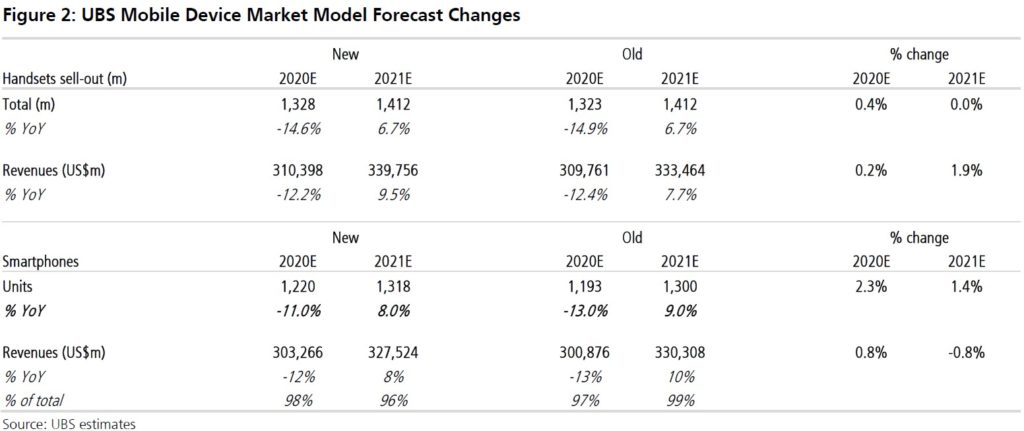

Credit Suisse believes the full impact of the US ban on Huawei will likely kick-in from 2021. This is because of inventory depletion after the more aggressive pull-in recently before the 15 Sept 2020 deadline, leading to Huawei’s smartphone sell-in volumes likely to come down by 18% and 75% in 2020 / 2021 to 198.2M and 50.4M units. (Credit Suisse report)

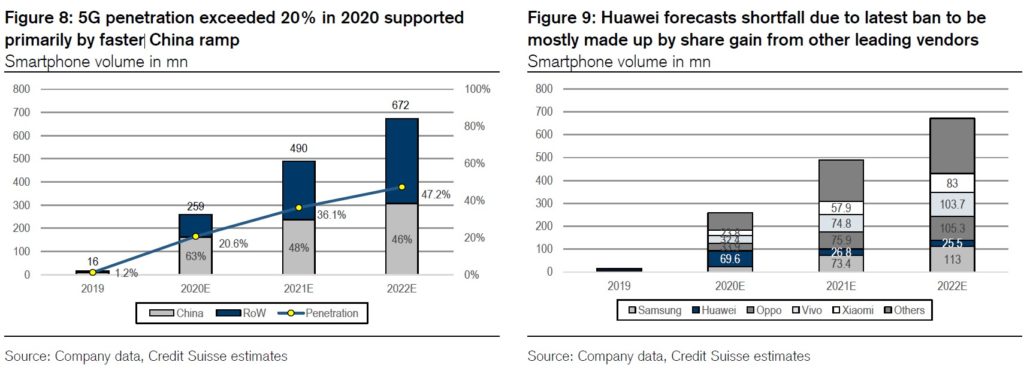

Despite the softer smartphone momentum in 1H20 amid COVID-19, 5G smartphone ramp in China has been faring much faster than expected as data suggest 1H20 penetration in China reached 49% of the total smartphone volumes, given the acceleration of budget 5G models launch. Comparatively, the pace of 5G smartphone adoption internationally has been impacted by COVID-19 and a softening macro environment. Credit Suisse has revised down total 5G smartphone volumes outside of China by 15% in 2020 but kept 2021 volumes largely unchanged. Overall, the total 5G smartphone volumes forecasts have been revised up by 13.5% / 9.6% in 2020 / 2021 to 259.1M and 489.6M units, respectively, representing 20.6% and 36.1% of the total smartphone units, and is expected to reach 672.3M in 2022 (+37% YoY) accounting for 47.2% of the total smartphones. (Credit Suisse report)

Smartphones demand has continued to recover, notably in Western Europe, North America but also more recently Latin America and South East Asia. UBS hence increases their global smartphones units forecast by 2% to 1.22B (-11% YoY) for 2020 and by 1% in 2021 to 1.32B (+8%) for 2021. (UBS report)

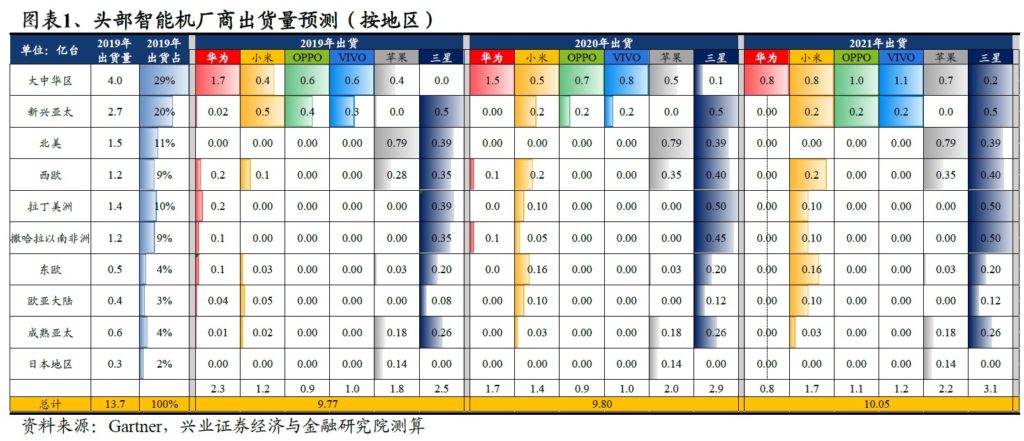

Huawei’s loss of overseas share may accelerate, with the domestic market has stabilized, domestic vendors have increased their competitiveness in the European market. Apple may give priority to taking over Huawei’s high-end market share (Huawei’s share in ASP 500+ is 51%); vivo, OPPO, and Xiaomi may take over Huawei’s mid-to-low-end market share (Huawei’s share in ASP <500 is 48%). Due to its high consumption level (ASP USD400+), Europe has become a key overseas market for vendors such as Xiaomi and OPPO. (Industrial Securities report)

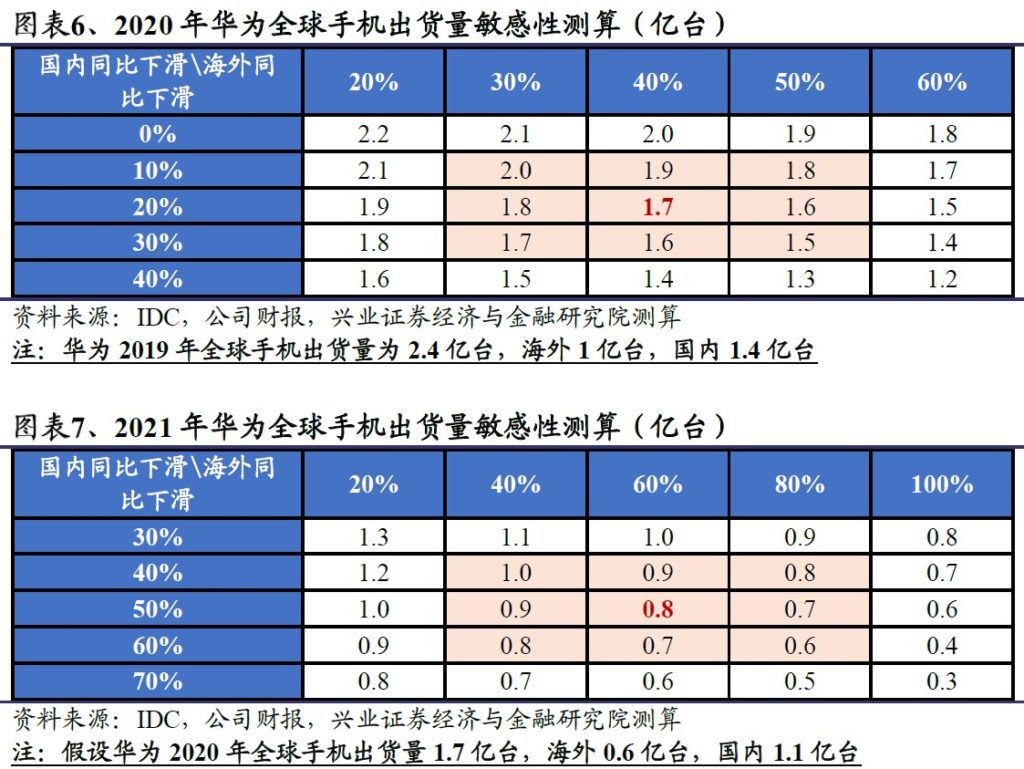

According to conservative calculations of Industrial Securities, if Huawei’s domestic / overseas shipments in 2020 decline by 20% / 40% year-on-year, overall shipments will fall 28% year-on-year to 170 million units; if domestic / overseas shipments in 2021 decline by 50% year-on-year % / 60%, the overall shipments fell 53% year-on-year to 80M units. (Industrial Securities report)

Google has unveiled a new security feature that arrives in the form of new alerts. These alerts are designed to function as security alerts that notify the user if a hacker has broken into their account. A notification will be displayed via the Google app itself to alert one of a possible hacker breaking into account. After receiving this notification, users can choose to lock down access to the account and even remove the hacker. (Gizmo China, PC Mag)

Huawei has opened a research center dedicated to fundamental research in mathematics and computing. Named after the Franco-Italian mathematician Joseph-Louis Lagrange, the new center located in central Paris is the company’s 6th research center in France. (CN Beta, Xinhuanet, Letigaro)

Samsung Galaxy M31 Prime is announced in India – 6.4” 1080×2340 FHD+ Super AMOLED u-notch, Samsung Exynos 9611, rear quad 64MP-8MP ultrawide-5MP macro-5MP depth + front 32MP, 6+64 / 6+128GB, Android 10.0, rear fingerprint scanner, 6000mAh 15W, INR16,499 (USD225) / INR17,999 (USD247). (GizChina, GSM Arena, Amazon)

vivo Y73s 5G is announced in China – 6.44” 1080×2400 FHD+ AMOLED u-notch, MediaTek Dimensity 720, rear tri 48MP-8MP ultrawide-2MP depth + front 16MP, 8+128GB, Android 10.0, fingerprint on display, 4100mAh 18W, CNY1,998 (USD299). (GSM Arena, vivo, Gizmo China)

Tecno Camon 16 is announced in India – 6.8” HD+ HiD, MediaTek Helio G70, rear quad 64MP-2MP macro-2MP depth-2MP AI lens + front 16MP, 4+64GB, Android 10.0, rear fingerprint scanner, 5000mAh 18W, INR10,999 (USD150). (GSM Arena, NDTV)

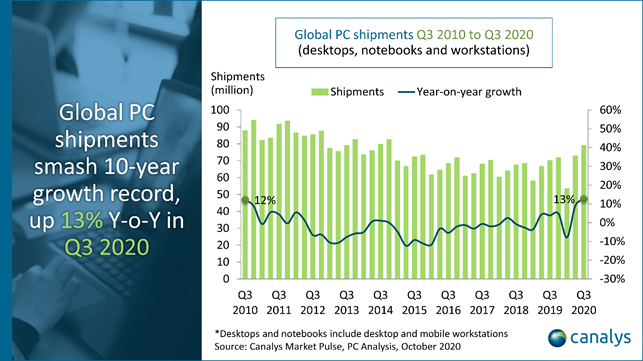

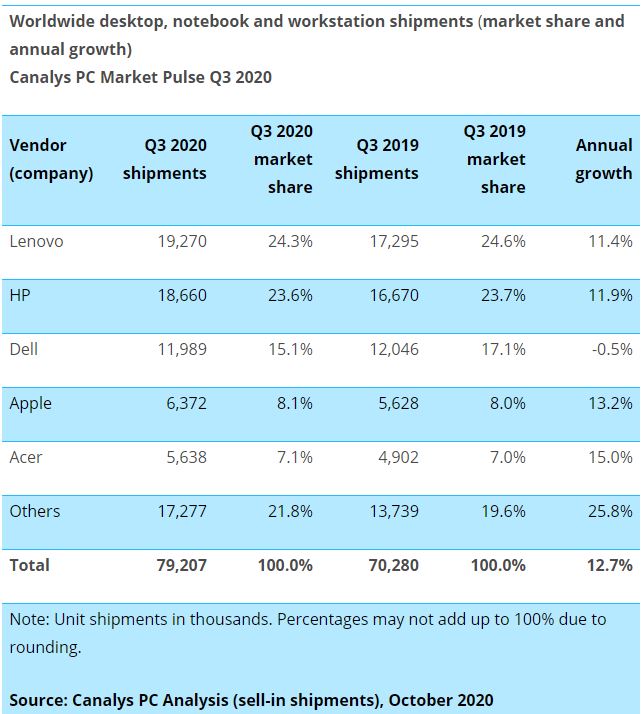

Canalys data shows the global PC market climbed 12.7% from a year ago to reach 79.2M units in 3Q20 as it continued to benefit hugely from the COVID-19 crisis. This is the highest growth the market has seen in the past 10 years. Global notebook shipments touched 64M units (almost as much as the record high of 4Q11 when notebook shipments were 64.6M) as demand continued to surge due to second waves of COVID-19 in many countries and companies continued to invest in longer-term transitions to remote working. (Canalys)

Aqara has launched the “G2H” home security camera with HomeKit Secure Video support. HomeKit Secure Video allows the G2H to stream end-to-end encrypted video via Apple’s Home app, and the camera will store up to 10 days of footage on iCloud accounts with at least 200GB of space. (Mac Rumors, Aqara)

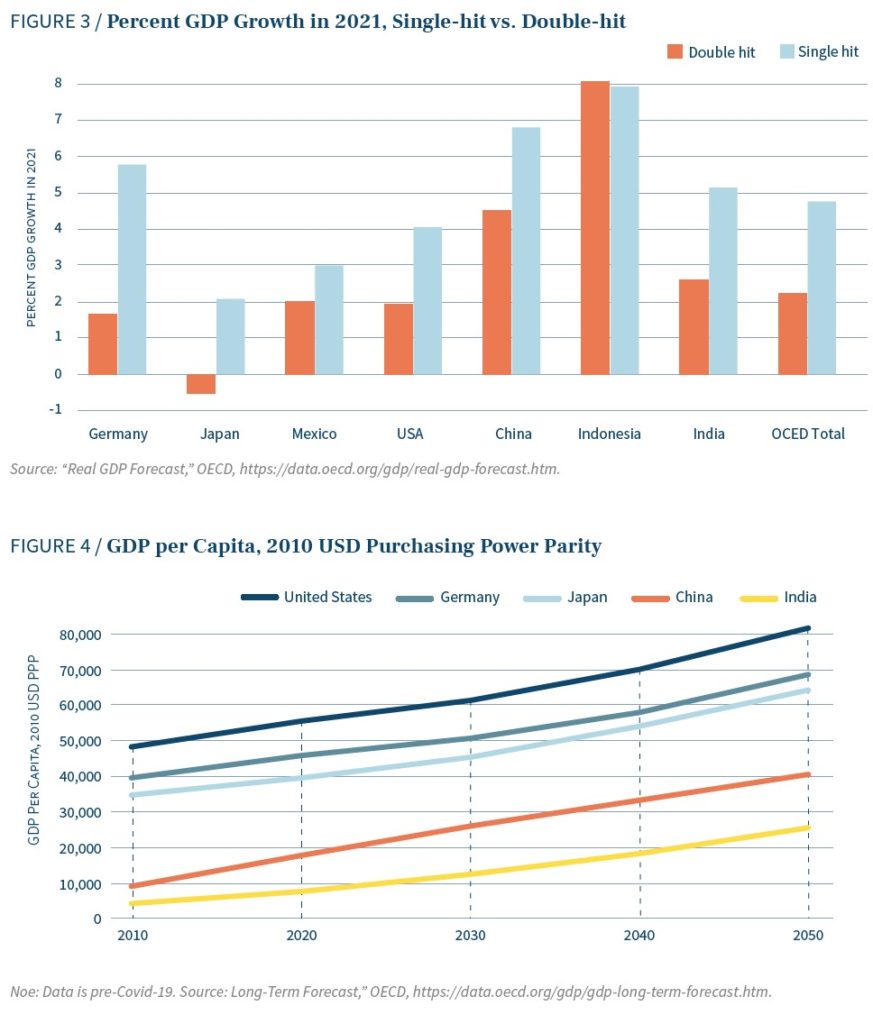

According to PwC’s The World in 2050 report, the United States has already fallen behind China in GDP in terms of purchasing power parity and will be behind India by 2050. The U.S. share of global GDP will fall from 16% to 12% during the same time frame. Prior to the pandemic, the International Monetary Fund (IMF) projected U.S. real GDP growth to slow from 2.9% in 2018 to 1.6% in 2024. Most advanced economies shared this trend, including the European Union, Japan, South Korea, and Canada. Emerging economies in Latin America, the Caribbean, the Middle East, and Africa were on track to see growth accelerate. While China’s real GDP growth rate was also predicted to decrease, it was estimated to remain well above that of OECD countries, at 5.6%. (CSIS report)