10-29 #Light: US has allegedly started allowing chip companies to supply components to Huawei; Sony and Omnivisionhave allegedly been granted licenses by US to resume some shipments to Huawei; etc.

Fabless chipmakers, component suppliers and IC distributors have been aggressively scaling up their inventory levels, raising concerns of the semiconductor market having to undergo an inventory correction during 1H21. (Digitimes, Digitimes)

The US Department of Commerce has allegedly started allowing chip companies to supply components to Huawei. The only caveat is that the components should not be used for the Huawei’s 5G business. The chipmaker was reportedly referring to Huawei’s 5G infrastructure business. (Financial Times, Gizmo China, AA Stock, Android Authority)

China-based CMOS image sensor (CIS) developer SmartSens Technology has just raised CNY1.5B (USD225M) in a funding round led by the country’s second-phase National IC Industry Investment Fund (Big Fund), Xiaomi Changing Industrial Fund, and China Merchants Bank’s CMB International. SmartSens has focused more on video surveillance applications since its inception in 2011, with its products widely used in security monitoring, vehicle-mounted imaging, machine vision, and consumer electronics including sports cameras, drones, robot cleaners and smart home cameras. (Digitimes, press, Zhihu, Sohu)

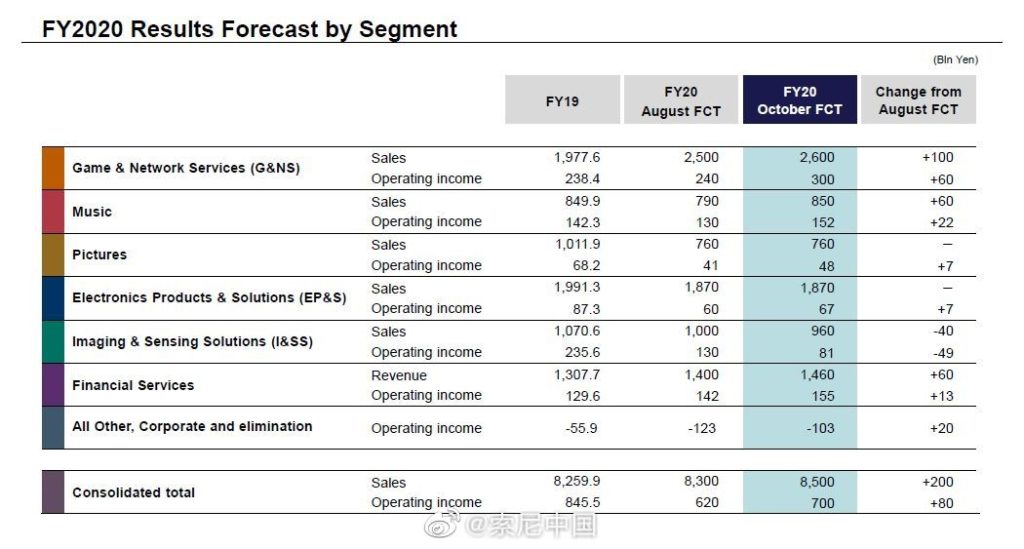

Sony has announced it has cut the FY2020 profit outlook for its sensor business by 38% to JPY81B due to the United States banning Sony from supplying chips to Huawei. In Aug 2020, the United States issued sanctions that ban Huawei from procuring chips made by foreign manufacturers using US technology, like Sony. Due to this impact, CFO Hiroki Totoki anticipates the sensor business will not make a full recovery in profitability until the fiscal year ended March 2023. (ZDNet, CN Beta, Reuters)

Sony and Omnivision, the world’s two leading camera imaging sensor providers, have allegedly been granted licenses by the U.S. government to resume some shipments to China’s embattled Huawei, which is cut off from vital global chip supplies by Washington’s crackdown. While the sanctions would still pose a grave challenge to Huawei’s 5G business, the company’s important smartphone arm might have a chance to recover. (Asia Nikkei, Financial Times, My Drivers)

Apple is poised to increase its orders for VCSEL chips for ToF-based LiDAR scanners used by the just released iPhone 12 Pro due to strong demand for the model, particularly in the US, according to Digitimes. Taiwan-based GaAs foundry Win Semiconductor, which is reportedly engaged in production of VCSEL chips for the iPhone 12 Pro, now says its business prospects for 4Q20 will be brighter than those seen in the previous quarter, thanks to the strong demand. (Digitimes, Mac Rumors, CN Beta)

LandMark Optoelectronics, a specialist for epitaxial wafers and VCSEL components, is expected to see its revenues hit new highs in two years in 4Q20. Its shipments of VCSEL chips for ToF applications grew slowly in 3Q20, and the company expects shipments of ToF products to account for 5%-10% of its total sales in 1H21. (Digitimes, press, LTN)

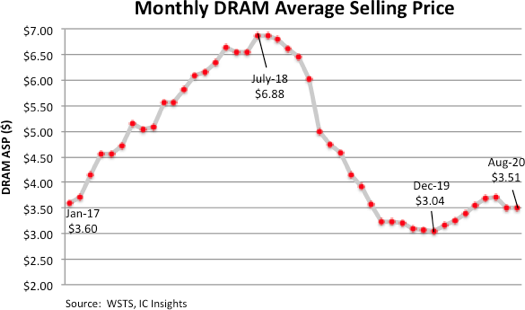

DRAM ASPs climbed to USD3.70 in Jun 2020 before tapering off to USD3.51 in Jul / Aug 2020, according to IC Insights, which expects modest price erosion through the end of 2020. DRAM prices rebounded in 1H20, driven by demand for PCs and other devices enabling remote work, distance learning and other stay-at-home activities amid the COVID-19 pandemic. DRAM demand also came from datacenter and server applications that were needed to handle the surge of online activity, IC Insights indicated. (Laoyaoba, IC Insights, press, Digitimes)

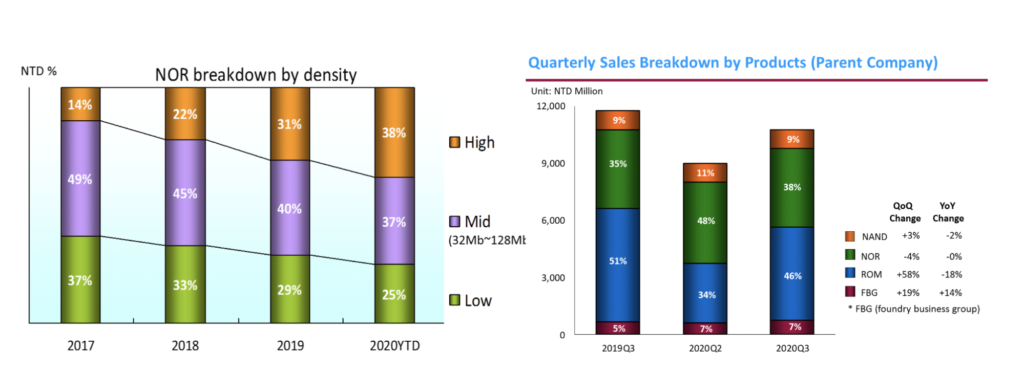

Macronix International, a supplier of mask ROM and flash memory, expects its in-house developed 48-layer 3D NAND products to start generating revenue in 2021. Macronix will kick off commercial shipments of 48-layer 3D NAND flash chips to its biggest client next year, according to company chairman Miin Wu. Chip samples have already been delivered since Oct 2020. (Digitimes, LTN, Digitimes)

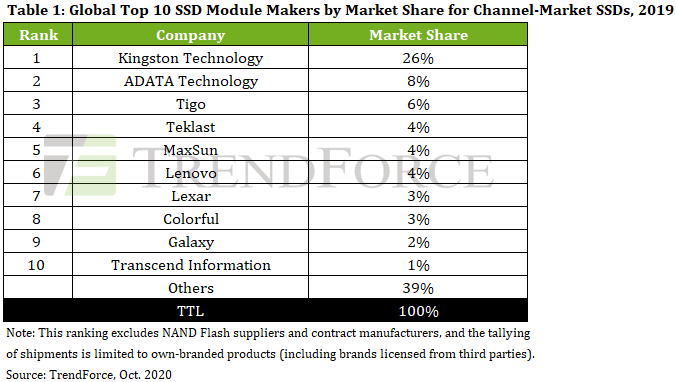

The total worldwide shipments of branded SSDs bound for the channel (retail) market in 2019 reached 131M units, showing an increase of almost 60% from 2018, according to TrendForce. This result also indicated a further and substantial growth in SSD adoption. Kingston, ADATA, and Tigo remained first, second, and third place respectively in the global ranking of branded SSD module makers (excluding NAND Flash suppliers) by shipment market share for retail SSDs. (TrendForce, TrendForce, Laoyaoba)

Former Toshiba memory unit Kioxia will build a new JPY1 T (USD9.5B) factory to lift its production of cutting-edge NAND flash memory, as it aims to meet rising demand spurred by the growth of 5G networks. The chipmaker plans to construct the new factory at its Yokkaichi complex in central Japan’s Mie Prefecture. The investment will be made with U.S. partner Western Digital. The factory will be built in two phases, starting spring 2021. (My Drivers, Yahoo, Digitimes, Asia Nikkei)

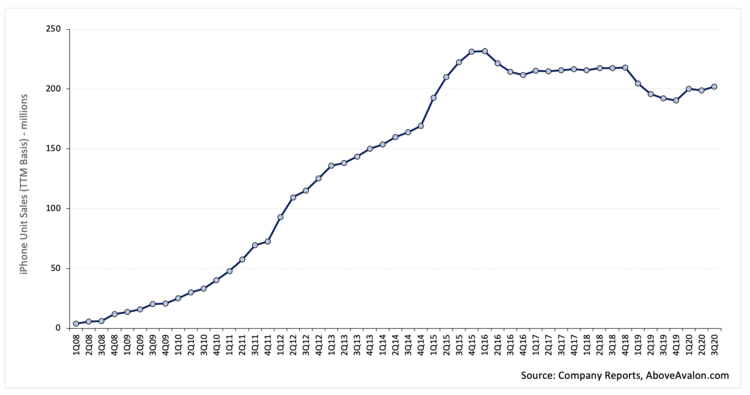

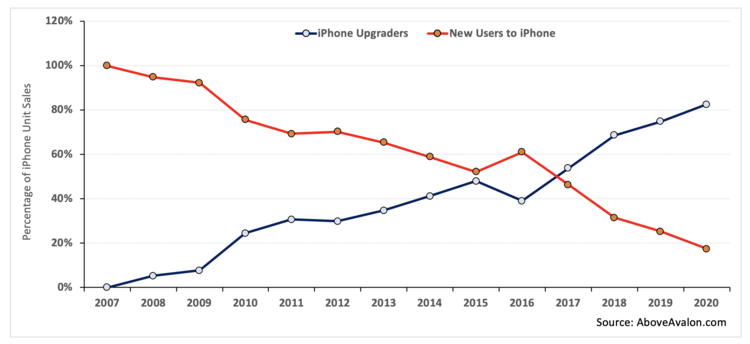

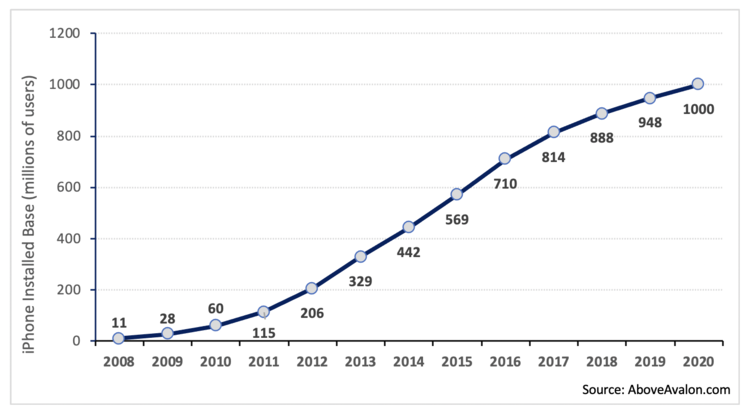

According to Above Avalon founder Neil Cybart, Apple has reached 1B active iPhones milestone in 2020. In the past 3 years, there are also fewer new users to iPhone and in 2020 expectations are 80% to be upgrades of an older iPhone and only 1 of every 5 phones to be in the hands of a new user. (GSM Arena, Above Avalon, GizChina)

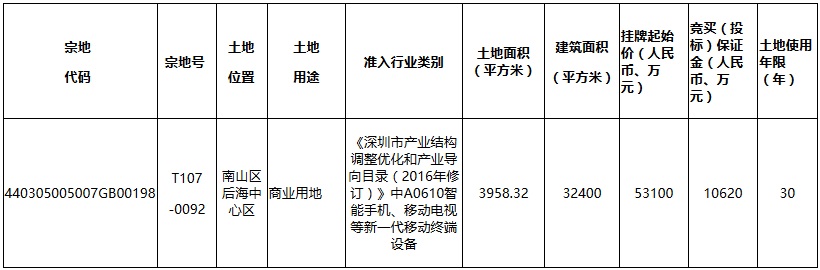

China Shenzhen city has put on the sale of 3 commercial lands with a total starting price of CNY731M. Shenzhen Xiaomi has won the T107-0092 plot of CNY531M. Xiaomi Group plans to invest CNY7.76B in Shenzhen to build Xiaomi’s international headquarters. It is estimated that the accumulated operating income will be about CNY51B from 2020 to 2024, and the local financial resources will be about CNY600M. (My Drivers, IT Home, Sina)

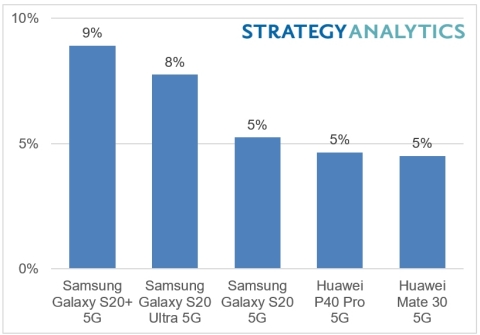

According to Strategy Analytics, Samsung Galaxy S20+ 5G is the world’s bestselling 5G smartphone model by revenue in 1H20. Apple iPhone 12 is expected to take the 5G crown in 2H20. Global 5G smartphone industry revenue hit a record USD34B in 1H20. Despite coronavirus headwinds, the 5G smartphone market has soared to an all-time high. The 5G engine continues to drive smartphone growth, led by Samsung and Huawei. (Strategy Analytics, My Drivers)

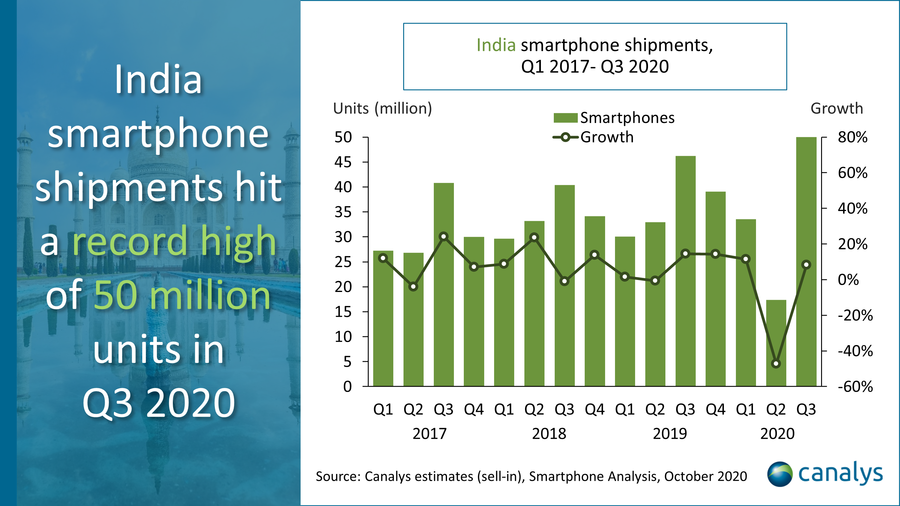

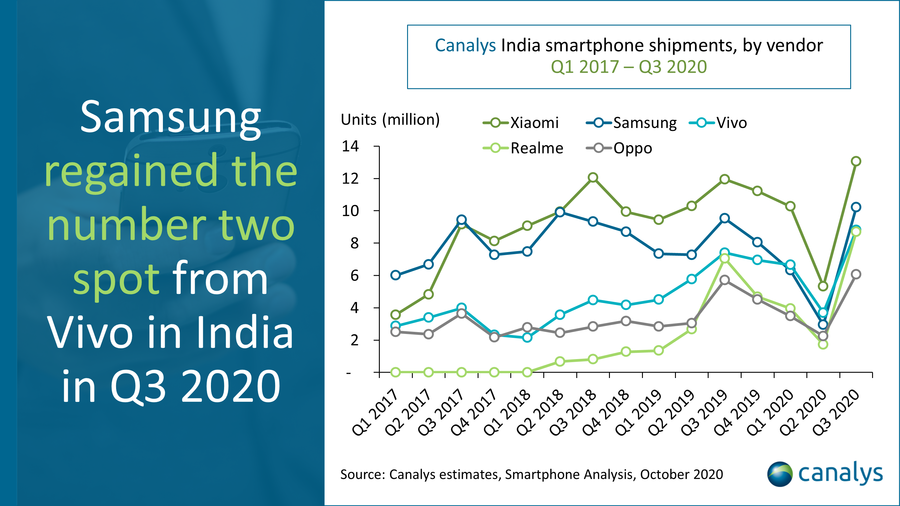

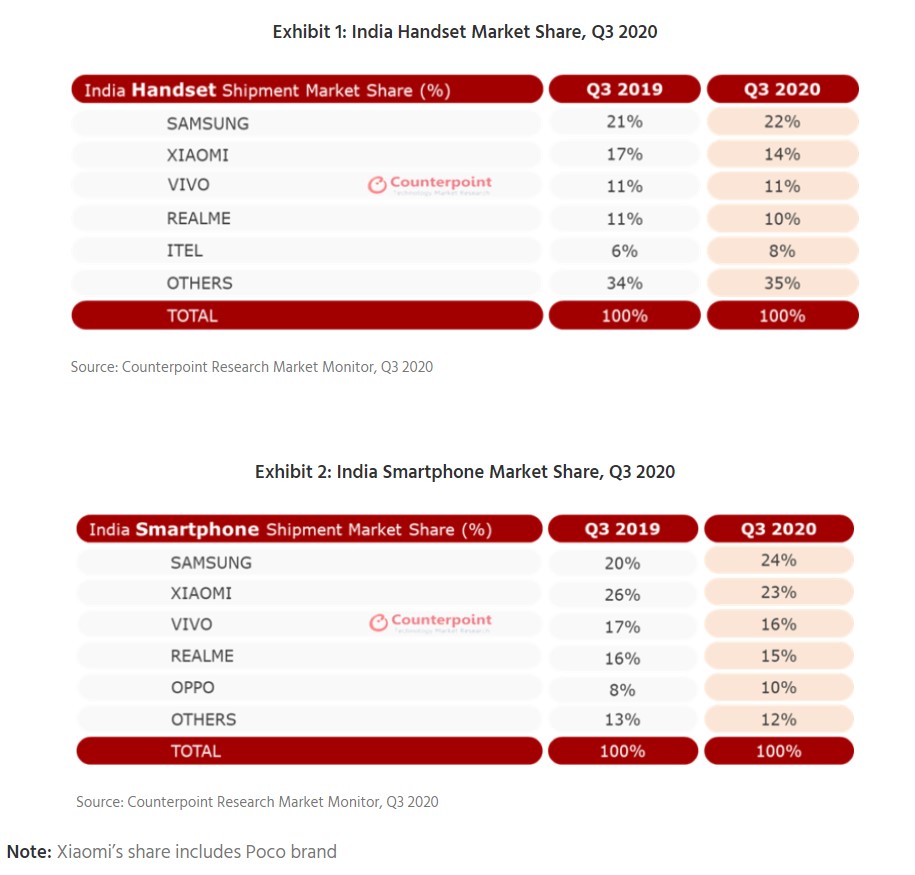

Smartphone shipments in India recovered in 3Q20, posting 8% growth to 50M units. This is an all-time record for smartphone shipments in a single quarter in India. Xiaomi remains the market leader, growing 9% to ship 13.1M units. Samsung has regained second place from vivo, with 10.2M units, up 7%. (Canalys, Android Central)

India’s smartphone shipments grew 9% YoY to reach over 53M units in 3Q20, according to Counterpoint Research. This is the highest-ever shipment in a quarter for the Indian smartphone market. Samsung became the leading brand in the India smartphone market after two years with 32% YoY growth. It was also the fastest to recover, surpassing the pre-COVID levels in 3Q20. Xiaomi slipped to number two position for the first time since 3Q18 with 4% YoY decline. (Android Central, Counterpoint Research)

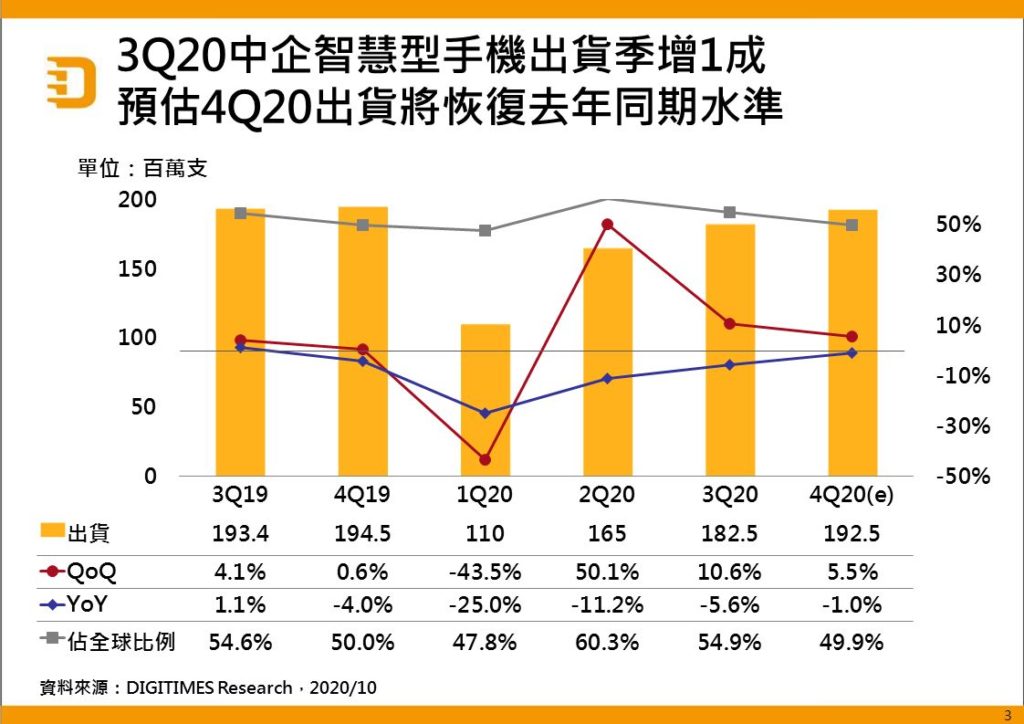

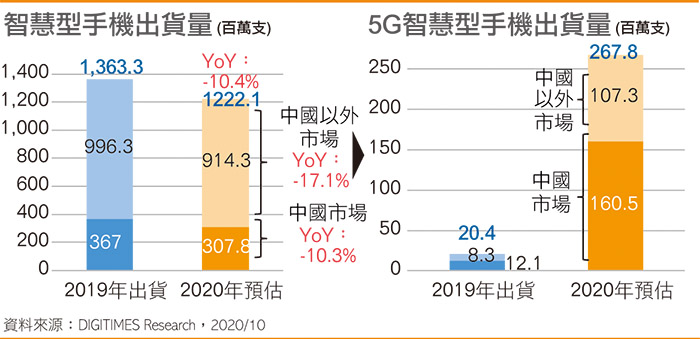

China’s handset vendors shipped a total of 182M smartphones globally in 3Q20, up 10.6% sequentially but down 5.6% on year, Digitimes Research has found. The sequential gains come as Chinese brands, with the exception of Huawei, were able to ramp up overseas shipments to meet inventory replenishment demand by channel operators outside China, offsetting sluggish sales in the domestic market. (Digitimes, press, Digitimes)

China’s handset vendors shipped a total of 182M smartphones globally in 3Q20, up 10.6% sequentially but down 5.6% on year, Digitimes Research has found. The sequential gains come as Chinese brands, with the exception of Huawei, were able to ramp up overseas shipments to meet inventory replenishment demand by channel operators outside China, offsetting sluggish sales in the domestic market. (Digitimes, press, Digitimes)

realme C15 Qualcomm Edition is unveiled in India – 6.517” 720×1600 HD+ IPS LCD v-notch, Qualcomm Snapdragon 460, rear quad 13MP-8MP ultrawide-2MP black-white-2MP “AI lens” + front 8MP, 3+32 / 4+64GB, Android 10.0, rear fingerprint, 6000mAh 18W, INR9,999 (USD134) / INR10,999 (USD148). (GSM Arena, realme, Gizmo China)

Lenovo has unveiled its first self-developed industrial robot dubbed Daystar industrial robot. The robot deploys edge computing power and intelligence and enables workers to accurately carry out remote painting works using the robot. The robot is controlled by AR glasses and handle to spray paint synchronously, which is equivalent to visiting the scene. (CN Beta, My Drivers, China Daily, Gizmo China)

Google and the Mayo Clinic will build an artificial intelligence (AI) tool to guide the targeting of radiation therapy in cancer patients. Google says AI could possibly help speed up the “time-consuming and manual” preparation needed for radiotherapy treatment, which is “one of the most common cancer treatments—used to treat over half of cancers in the United States”. (CN Beta, 9to5Google, Google, Stat+)