11-29 #Partnership: LG Corp would spin off 5 affiliates into a new holding company in 2021; Apple iPhone 12/12 Pro shows bill of materials (BOM) costs are resuming their upward curve; etc.

According to Credit Suisse, Taiwan upstream tech sales were down 5% MoM in Oct 2020, below seasonal’s up 3%. The worse-than-seasonal sales in Oct were mainly dragged by TSMC -7% MoM (vs. seasonal +7%) following the pull-in from Huawei at the end of 3Q20 (+4% MoM in Sept vs. seasonal -4%). However, they believe the company’s sales should be flat MoM in Nov and Dec 2020 but it should still keep its recent 4Q20 sales guidance for +0-2% QoQ on track supported by the 5nm ramp for Apple’s processor and AMD CPU/GPU/gaming ramps, the Qualcomm modem from Intel and Android 5G. (Credit Suisse report)

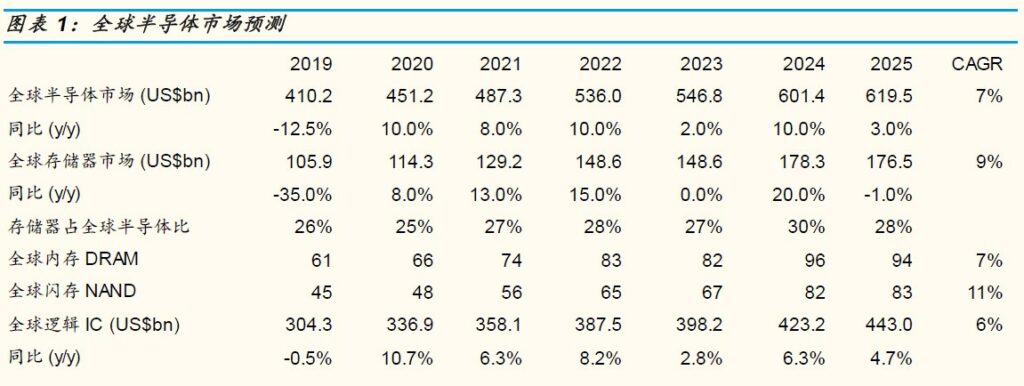

Sinolink Securities estimates that the global semiconductor market will grow by 8% / 10% year-on-year in 2021 / 2022 to reach USD487.3B / 536B, respectively. The global foundry market will slow down from 28% year-on-year revenue growth in 2020 to 2021 / 2022 of 9% / 13% year-on-year. The global memory market has accelerated from 8% year-on-year revenue growth in 2020 to 13% / 15% year-on-year growth in 2021 / 2022. (Sinolink Securities report)

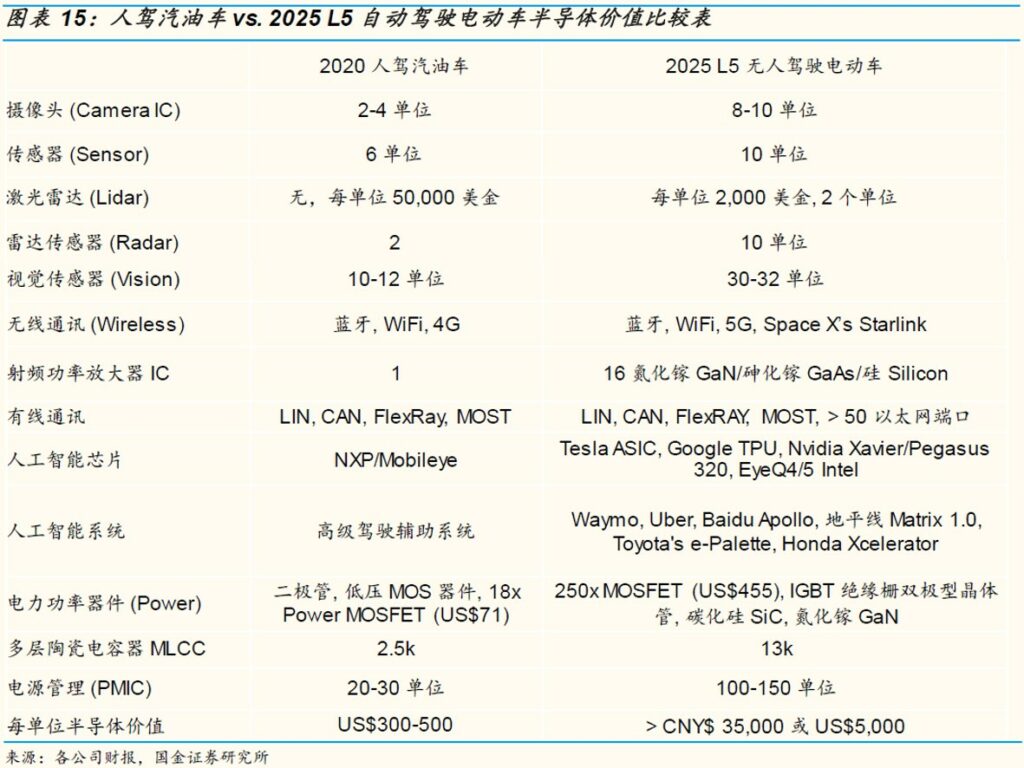

The value of semiconductors used in each Level 5 self-driving electric vehicle may be more than 10 times the value of semiconductors for human-driving gasoline cars in 2020. Sinolink Securities has initially estimated that the most basic Power MOSFET would require an increase of more than 10 times. Cameras, CIS, Radar sensors, MLCC, power management chips need 5 times increments, and there are 2 times more sensors, not to mention a large number of RF power amplifiers, wired communications, AI, and a variety of power chips. This will drive the world in the next 20 years. The automotive semiconductor market has a compound growth rate of 10%, and the value of semiconductors per vehicle will be less than 3% in 2020. The main reason for the increase year by year is that even if the global gasoline/electric vehicle shipments increase by <5% in the next 20 years. (Sinolink Securities report)

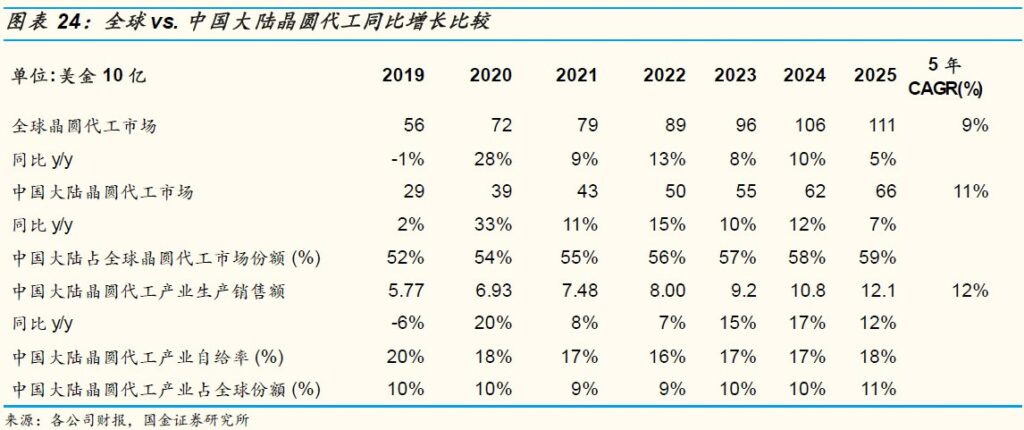

Sinolink Securities estimates that the global foundry market will grow by 9%/13% year-on-year in 2021/2022. This is because SMIC will not be able to purchase American semiconductor advanced process equipment from 2H21. It is estimated that the sales of domestic foundry production will slow down to 8%/7% in 2021/2022 YoY, and the self-sufficiency rate will slow down from 20% in 2019 to 17%/16% in 2021/2022. (Sinolink Securities report)

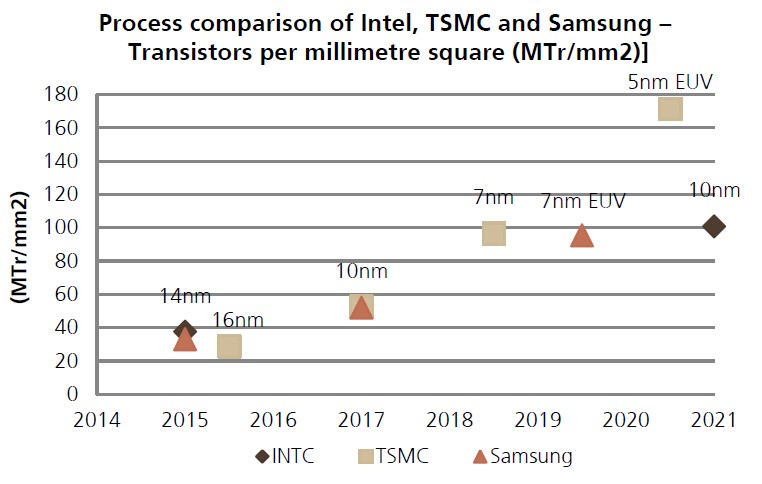

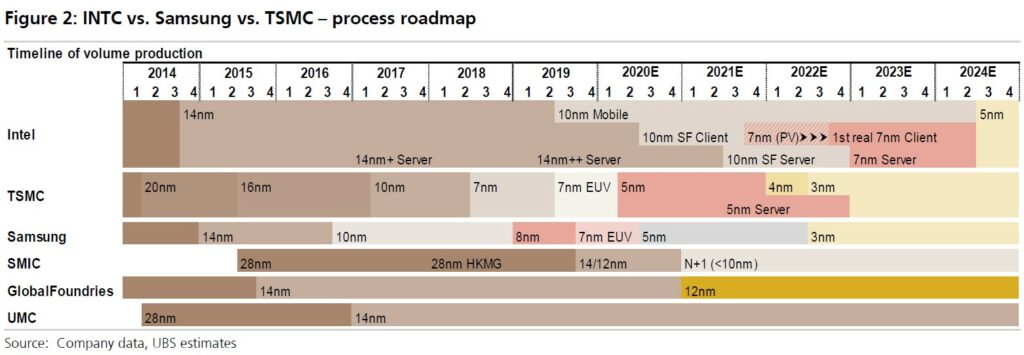

UBS expects TSMC to keep its technology leadership in 2021-2022, evidenced by its superior transistor density for 5nm and performance / power, with the next checkpoint to be in late 2022 for 3nm. That said, UBS believes TSMC could lose market share to Samsung’s 5nm in 2021 before making gains in 2022, with broader customer migration to 5nm / 4nm and Intel’s potential orders. On 3nm, Samsung could leapfrog TSMC on performance by using gate-all-around (GAA) transistors, which TSMC will likely adopt for 2nm. (UBS report)

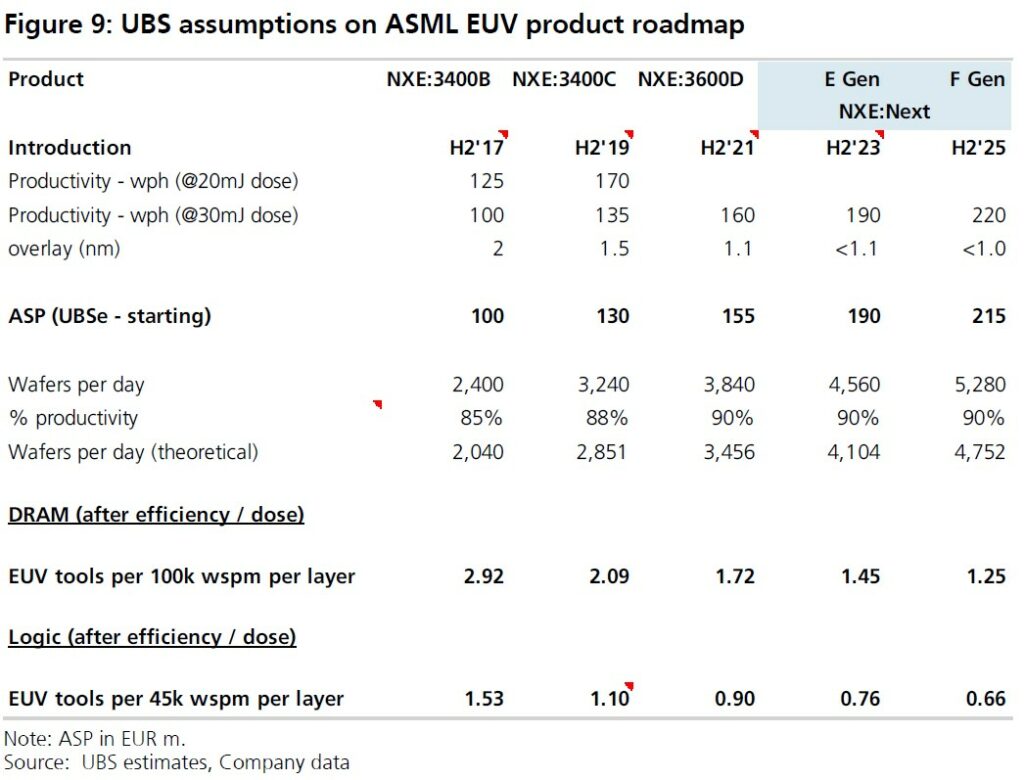

UBS assumes ASML will continue to introduce new products every 2 years and assume there will be an E-Generation 0.33 NA tool in 2023 and an F-Generation 0.33 NA tool in 2025. Essentially, if ASML is working towards 220wph, as suggested, for the NXE:Next, UBS believes each generation could offer a 15-20% productivity increase and an overlay improvement. (UBS report)

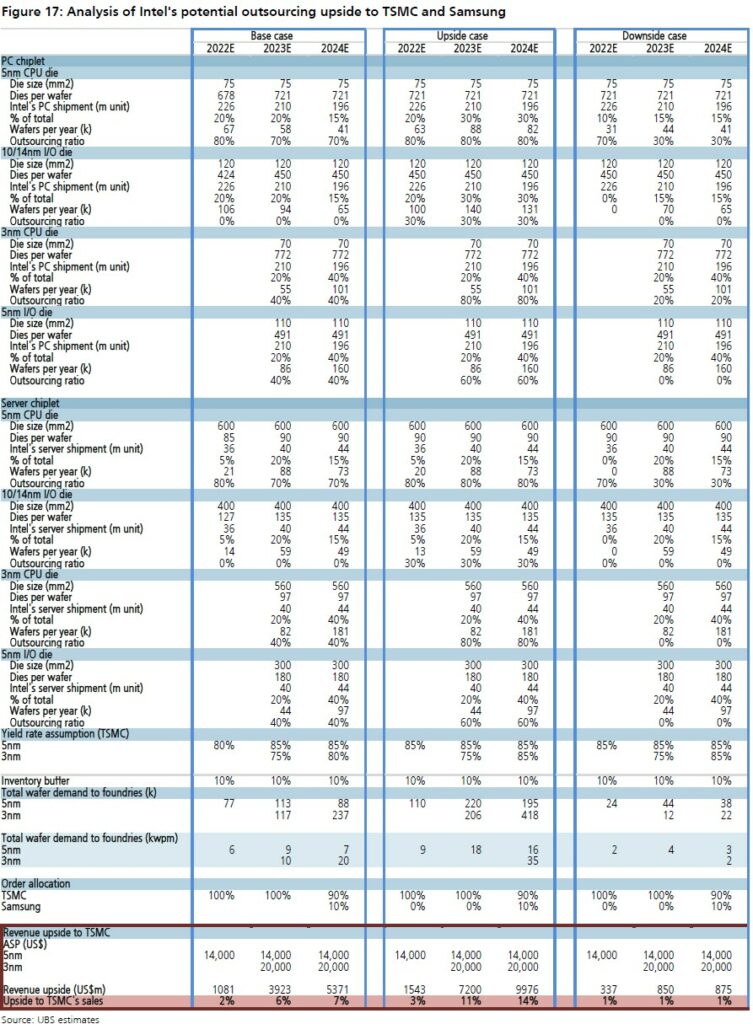

Assuming TSMC receives 100% of the outsourcing orders in 2022-2023 and 90% in 2024, UBS’ base case is for 2% revenue upside to TSMC in 2022, and 6%/7% upside in 2023/2024. In terms of Intel’s potential demand for foundry capacity, their analysis suggests 6kwpm of 5nm in 2022, and then 9kwpm/7kwpm of 5nm and 10kwpm/20kwpm of 3nm in 2023/2024. (UBS report)

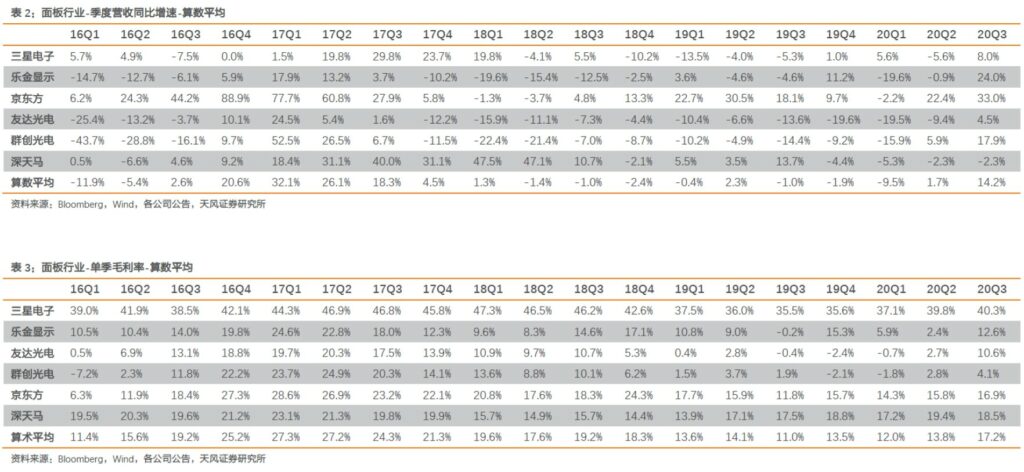

According to TF Securities, single-quarter revenue of the panel sector in 3Q20 has increased by 14.2% year-on-year, up 15.2pct from -1.0% in 3Q19; the growth rate was 1.7% in 2Q20, and the growth rate increased by 12.5pct month-on-month. All companies maintained a relatively high growth rate, with BOE’s revenue growth rate reaching 33.0% year-on-year. The average gross profit margin of the panel sector in 3Q20 was 17.2%, compared with 11.0% in 3Q19, a year-on-year increase of 6.2pct, and compared with 13.8% in 2Q20, a month-on-month increase of 3.4pct. (TF Securities report)

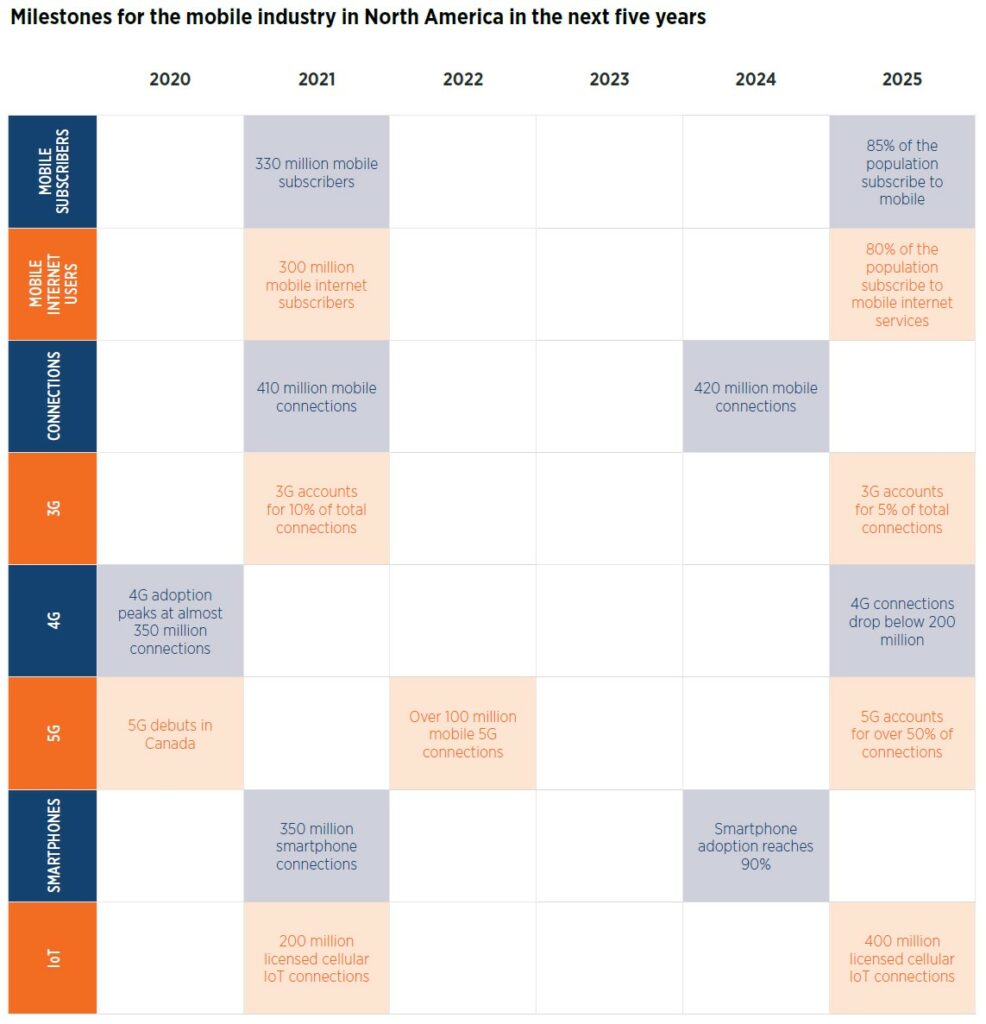

Although the rate of 5G adoption was lower than initially expected in 1H20 because of the pandemic, this is likely to be a blip. North America will reach 100M 5G connections in 2022, driven by continued network investments from operators and the expanding range of 5G smartphones at varying price points. By 2025, North America will have become the first region where 5G accounts for more than 50% of total connections. Mobile technologies and services generated 4.8% of GDP in North America in 2019, a contribution that amounted to over USD1T of economic value added. (GSMA report)

LG Corp would spin off 5 affiliates into a new holding company in 2021, the latest reorganization at one of South Korea’s family-led conglomerates as they pass to a new generation of leaders. The existing LG holding firm will have assets of KRW9.8T (USD8.85B), while the proposed new holding firm will have assets of KRW900B. (GizChina, Reuters)

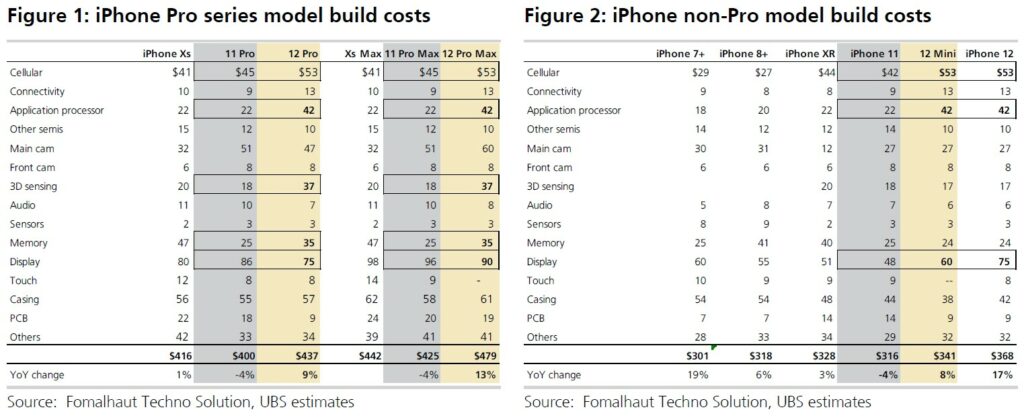

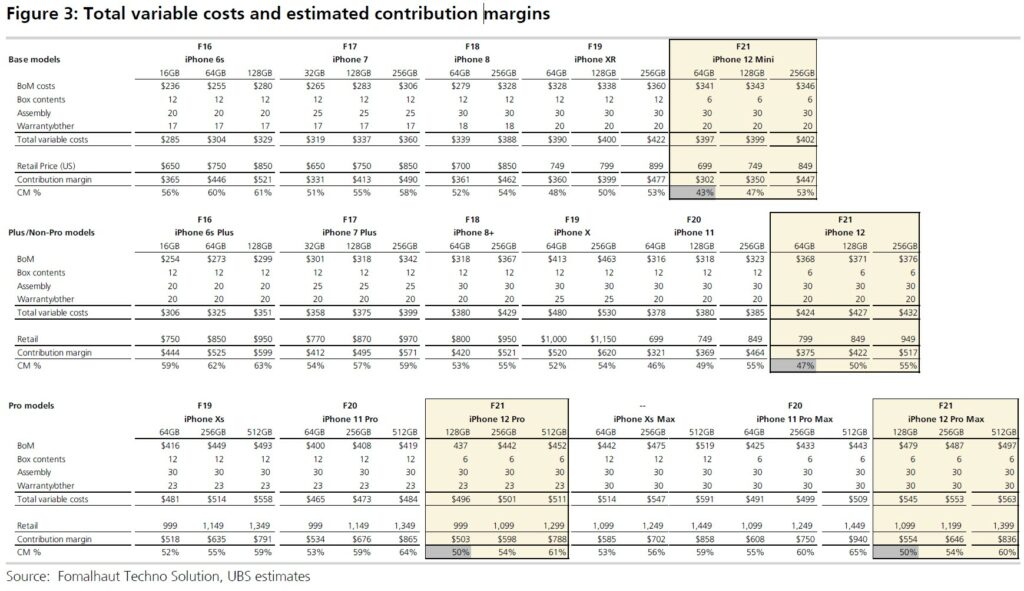

UBS proprietary Tear Down analysis (in association with Fomalhaut) of Apple iPhone 12/12 Pro shows bill of materials (BOM) costs are resuming their upward curve. UBS estimates for iPhone 12 Mini / 12 / 12 Pro/ 12 Pro Max are USD341/ 368 / 437 / 479 respectively (assuming 35% of vols being mmWave; 64GB, & 128GB for Pros), overall up by 7% vs 2019 models. Camera upgrades and 5G cellular components represent the main areas of costs increases. This is not fully offset by pricing pressure elsewhere for Display, Touch and Casing. UBS analysis indicates that the iPhone 12 series has the lowest contribution margin compared to all prior iPhone launches. (UBS report)

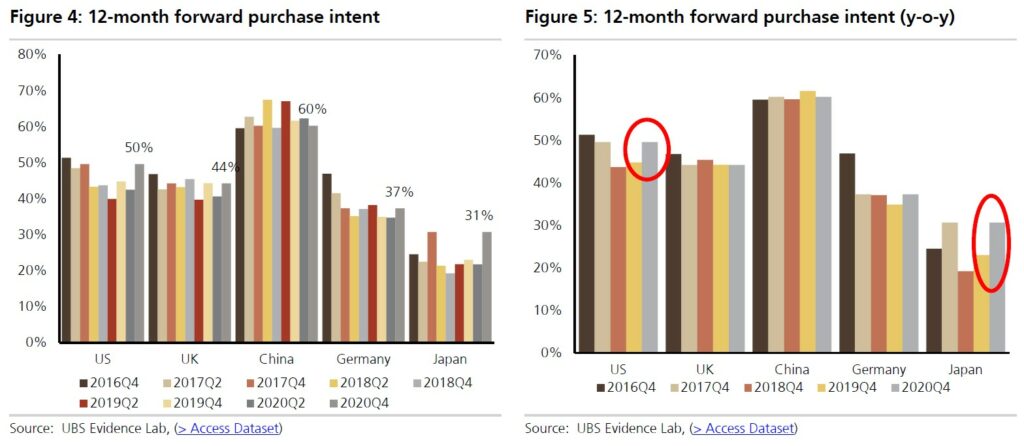

UBS has found a strengthening in next 12-month purchase intent, on average up from 42% a year ago to 44% and also showing a good improvement from the 40% in 2Q20 (although that is partly seasonal). In the US UBS has seen an increase in 12-month forward purchase intent from 45% to 50%, reaching levels not seen since the launches of Apple iPhone 7/7+ and X/8 launch years. In Japan it has risen from 23% to 31% and similarly reaching levels have not seen since the iPhone X/8 launch cycle. (UBS report)

UBS has seen over multiple surveys that the age of the installed base has been increasing, however this has also been accompanied by an increasing planned replacement cycle and hence have not seen for a number of years seen a replacement driven bump in demand. After years of increase UBS now finds the expected future replacement cycle stabilizing (2.3 years on average down from 2.5 years in 2Q20 survey). (UBS report)

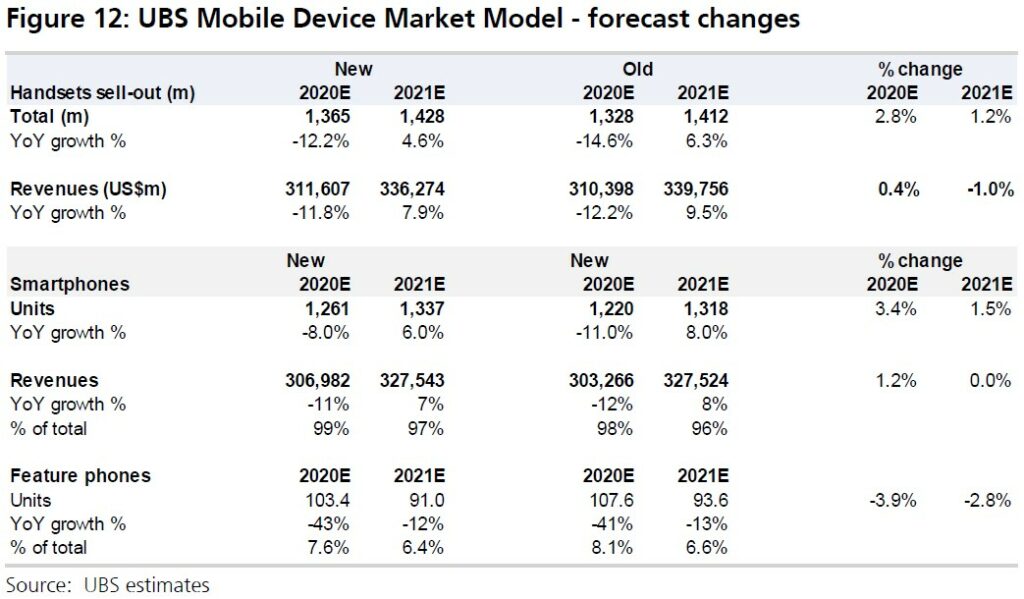

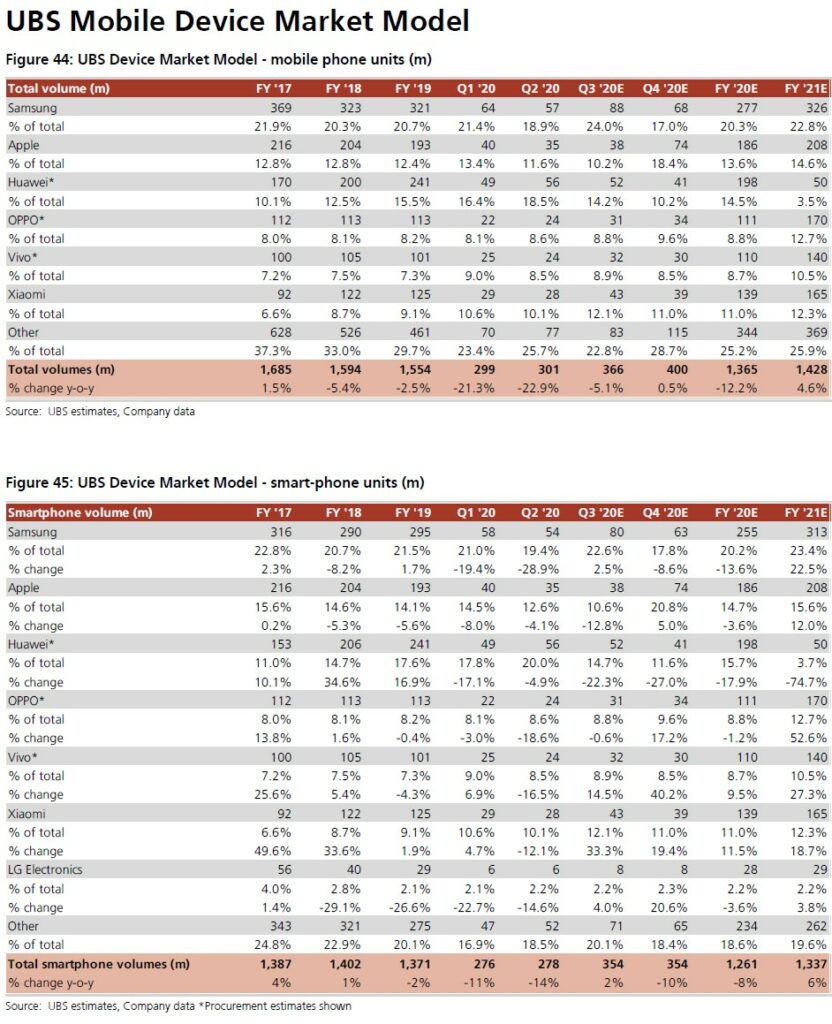

UBS has increased their smart-phone forecasts by 3.4% / 1.5% for 2020 / 2021. They now forecast -8% decline y-o-y in 2020 followed by a recovery of +6% in 2021 (was -11% / +8% respectively). Whilst they are positive on the pace of smartphone demand recovery into 2021, there is a risk that the supply chain potentially building for more than this and hence there is a clear risk of an inventory correction potentially in 1Q/2Q21. (UBS report)

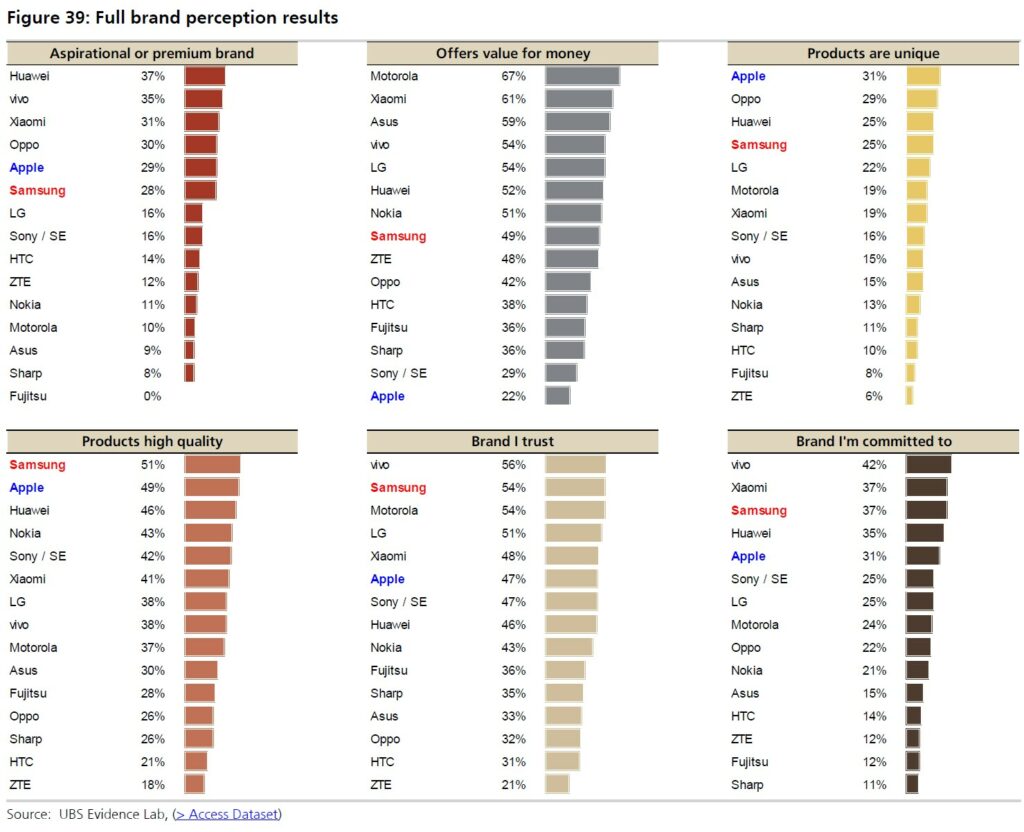

In terms of brand perception – UBS has seen something of a normalisation for Apple after some outlier high results in the 2Q20 survey. For Samsung the responses remain consistent although there is a slightly downward trend on some metrics which they believe may be something of a trend to question if Samsung is doing enough currently with new devices to continue to be seen as a differentiated brand to consumers. (UBS report)

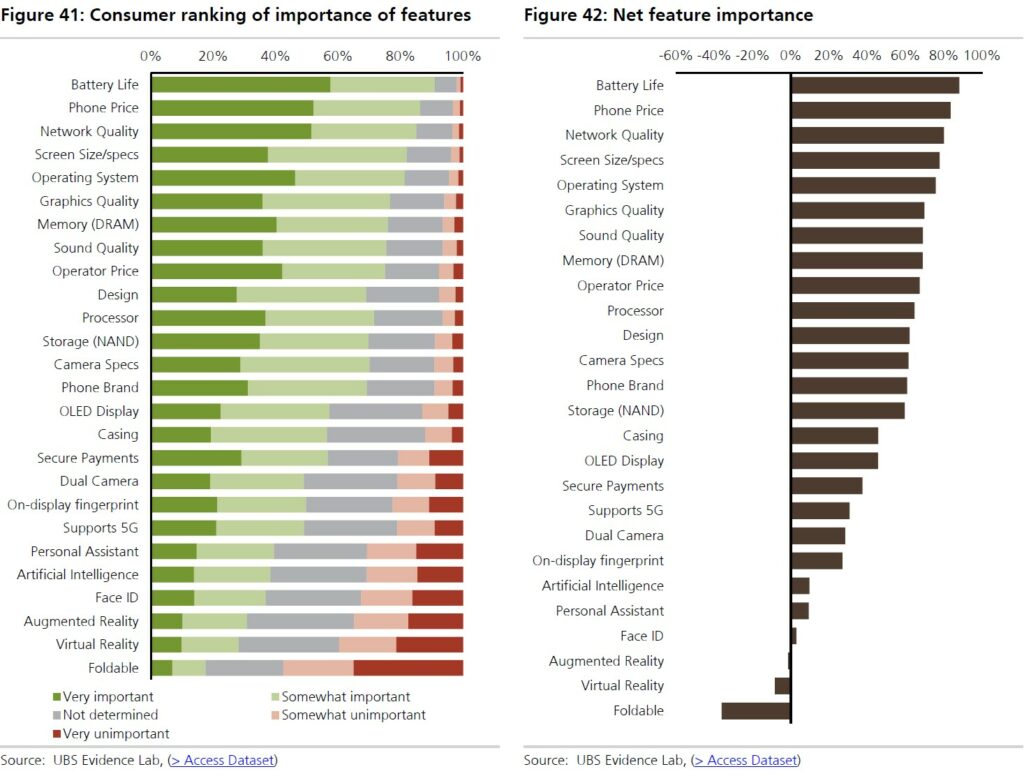

UBS has seen some significant improvements y-o-y in some features — although generally these were features that ranked quite low in prior surveys – such as Face ID, personal assistants and on-display fingerprint sensor. Most notable of increases and something that is clearly becoming a core requirement in phones is secure payments – almost reaching 50% in terms of secure payments net importance. (UBS report)

UBS has revised up their global 5G smartphone unit forecast for 2021 to 475M from 457M before. Most of the revision comes from Apple and China smartphone OEMs such as Huawei. (UBS report)

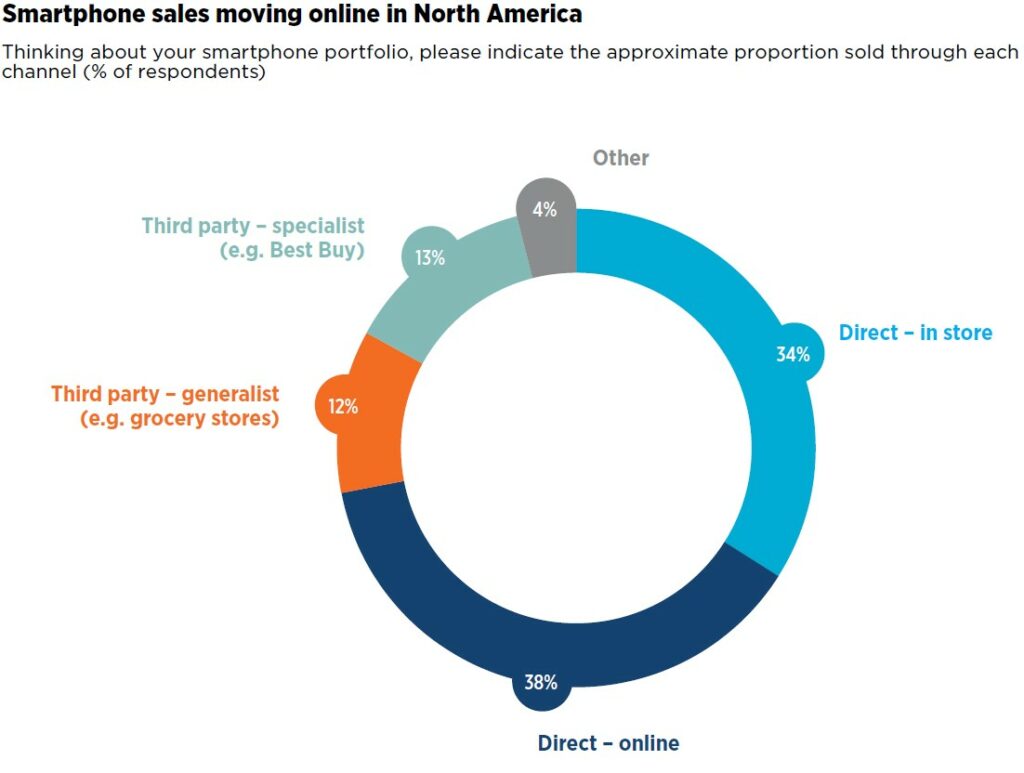

Consumers are not only changing what they do on their smartphones but also how they buy smartphones. Although in-store transactions are still the largest channel for smartphone sales, online sales are not far behind. Most operators predict growth in online smartphone sales over the next 2 years, with this trend heightened by the temporary closure of retail stores during the Covid-19 pandemic. (GSMA report)

ZTE Watch Live is announced in China – 1.3” 240×240 TFT LCD, heart rate tracking, sleep monitoring, blood oxygen saturation monitoring, 12 kinds of activity tracking as well as real-time notifications, music control, sedentary reminders and remote camera shutter functionality, IP68 rated, CNY229 (USD35). (GSM Arena, TechAndroids, ZTE)