12-6 #Lost: Kioxia has received permission from U.S. authorities to export some products to sanctioned Huawei; China Judgment Document Network published a verdict on the illegal control of computer information systems found to have been executed on Gionee phones; etc.

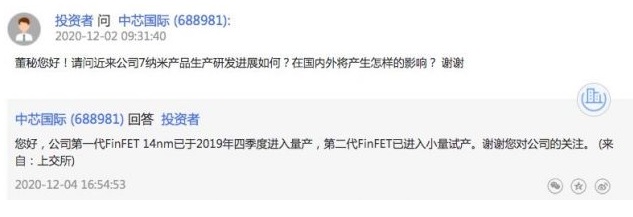

The Shanghai-based Semiconductor Manufacturing International Corp (SMIC) has hinted that it has started small-scale trial production of its second-generation N+1 FinFET process. Regarding the N+1 process, SMIC CEO Liang Mengsong revealed earlier this year that the process is very similar to the 7nm process in terms of power and stability, and does not require EUV lithography. The new N+1 process nodes are being called 8nm or an early stage 7nm process. (Gizmo China, Sohu, IT Home)

SMIC has announced that SMIC holdings, National IC Fund II and Yizhuang Guotou have signed a joint venture contract to jointly establish a joint venture. The registered capital of the joint venture is USD5B. SMIC holdings, national integrated circuit Fund II and Yizhuang Guotou agreed to contribute USD2.55B, USD1224.5B and USD1225.5B, respectively, accounting for 51%, 24.49% and 24.51% of the registered capital of the joint venture, respectively. The business scope of the joint venture includes the production of 12” integrated circuit wafers and IC package series, technical testing, etc. (CN Beta, Sina, JRJ, Equal Ocean)

E Ink Holdings, the leading innovator of electronic ink technology, and Plastic Logic, a leader in the design and manufacture of flexible, glass-free electrophoretic displays (EPDs), are partnering to provide the world’s first flexible color displays based around E Ink’s Advanced Color ePaper (ACeP) technology. (Laoyaoba, Business Wire, Liliputing)

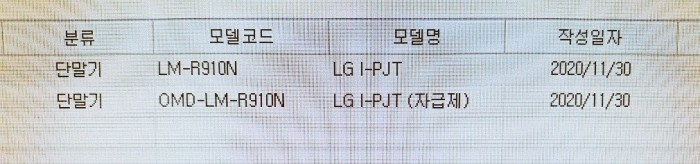

LG rollable device has now been registered with the South Korean carrier’s internal database. The device will reportedly have model number LM-RN910N and the unlocked model OMD-LM-R910N. The earlier reported specs of the device note a 7.4-inch expandable screen, 2428 × 1080 (20:9) resolution, with a video mode with 2428 × 1366 (16:9) and Productivity mode of 2428 × 1600 (3:2). (CN Beta, MS Poweruser, News Break)

After the production lines of BOE, HKC and Hon Hai Sharp are put into production in 2020, only the 2 new production lines of CSOT and HKC in 2021 and 1 new line of Laibo in 2022 will follow. Kaiyuan Securities judges that new production lines after 2022 are also expected to be very limited. It usually takes about 2 years for a new panel production line to be planned, opened and put into production. In the absence of a new planned production line, it is foreseeable that no other new production lines will be put into production in 2022. The latest LCD production line has risen from the Gen-8.5 line to Gen-10.5 line. The investment of a Gen-10.5 line is nearly CNY50B, which greatly increases the investment barriers for new production lines. (Kaiyuan Securities report)

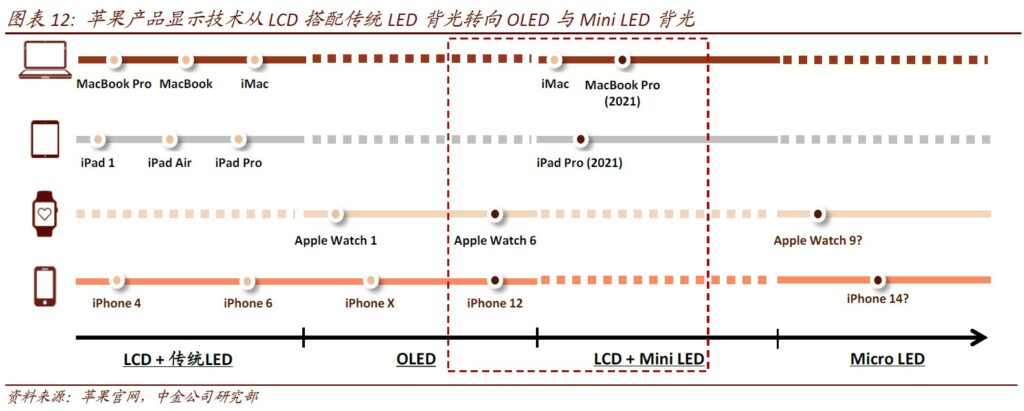

Mini LED refers to a display screen composed of tens of micrometers LED crystal, which is between Micro LED and small-pitch display. Micro LED is a new generation of display technology, namely LED miniaturization and matrix technology, which refers to the integration of high-density and small-sized LED arrays on a chip. Generally, the display screen composed of crystal grains below 100 microns in size is called Micro LED, yet above 100 microns are referred to as Mini LED, and the dot pitch is generally P0.4-P1.2. Small-pitch LED display refers to the LED display with LED dot pitch of P2.5 (2.5 mm) and below. (Kaiyuan Securities report)

Due to the huge potential of the Mini LED market, LED upstream, midstream and downstream companies have deployed one after another. Manufacturers of equipment, chips, packaging, backlight modules, panels, and terminal brands have invested a lot of money and energy in this technology in order to gain an opportunity and occupy the industry. (Kaiyuan Securities report)

Apple hopes to use LED technology iteration to break the monopoly of OLED by Japan and South Korea. Therefore, Apple has invested intensively in Taiwan, China since 2014, hoping to iterate on LED technology and complete the full replacement of OLEDs in large, medium and small sizes through the Mini / Micro LED solution. (CICC report)

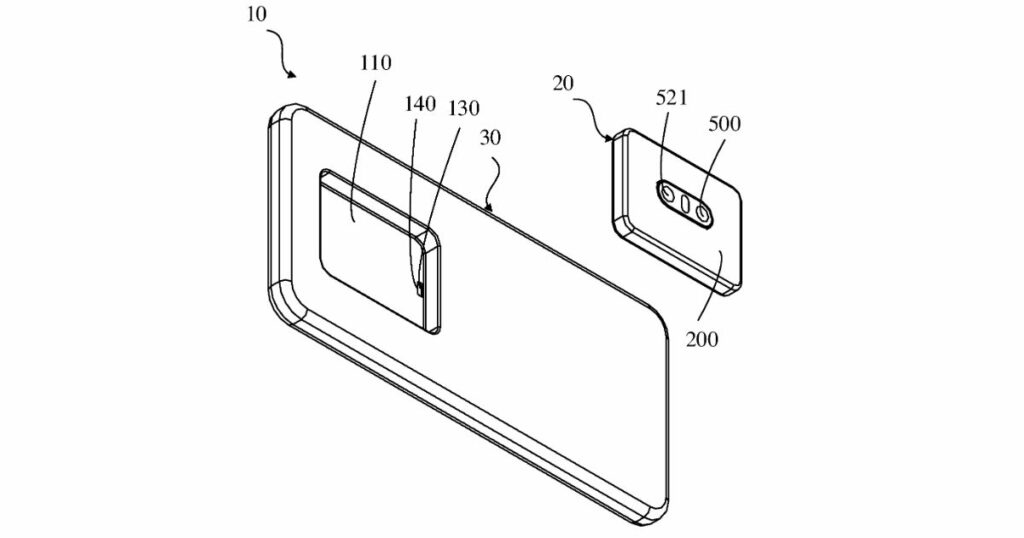

OPPO has filed a patent with WIPO showing a smartphone with a removable camera module. This potential future smartphone will have a rear camera module that can be removed from the back panel and then be used to take selfies using a USB Type-C connector. The camera module has two sensors and a pill-shaped LED flash. (Engadget, 91Mobiles)

OPPO officially brings news about the phone’s biggest selling point in terms of portrait video capture. The OPPO Reno 5 Series debuts with “FDF Full-Dimensional Human Video Technology System” (FDF). FDF consists of two engines: Portrait Sense and Image Enhancement. Portrait Sense includes algorithms such as AI Face Detection, AI Super Clear Portrait, OFL Skin Optimization, and Face Aberration Correction. (Laoyaoba, Sohu, Sparrow News)

Japanese chipmaker Kioxia has received permission from U.S. authorities to export some products to sanctioned Huawei Technologies. The license likely applies mainly to commodity chips for such applications as data center servers. It is not believed to include flash memory for smartphones, a mainstay of Kioxia, which was formerly Toshiba’s memory unit. (Laoyaoba, Asia Nikkei, Huawei Central)

The China Judgment Document Network published a verdict on the illegal control of computer information systems found to have been executed on Gionee phones. According to the court details, more than 20M Gionee phones were intentionally inflicted with Trojan horse malware via an app Dec 2018 – Oct 2019. The app becomes a tool to profit from users through unsolicited ads and other illegitimate means. (GSM Arena, CN Beta, Gizmo China)

Tecno Pova is launched in India – 6.8” 720×1640 HD+ HiD IPS LCD, MediaTek Helio G80, rear tri 13MP-2MP macro-2MP AI + front 8MP, 4+64 / 6+128GB, Android 10.0, rear fingerprint, 6000mAh 18W, INR9,999 (USD135) / INR10,999 (USD149). (Gizmo China, Tecno, NDTV)

Wristcam is launched, which is a strap for an Apple Watch equipped with front- and rear-facing cameras. The Wristcam has an 8-megapixel camera that can shoot 1080p video and take stills in 4K resolution and a 2-megapixel camera for selfies. Using a single button below the camera, a tap will snap a picture while a long press records video, while a double-tap switches which camera is in use. (My Drivers, The Verge, Fast Company, Apple Insider)

Self-driving car startup AutoX has announced that a portion of its robo-taxi fleet in Shenzhen, China is ferrying customers without teleoperators or safety drivers behind the wheel. The company claims it is the first set of fully driverless cars to be deployed in China and perhaps only the second in operation following the launch of Waymo’s fully driverless program in Phoenix, Arizona in 2019. (VentureBeat, TechCrunch, CNN, The Paper, Jiemian)

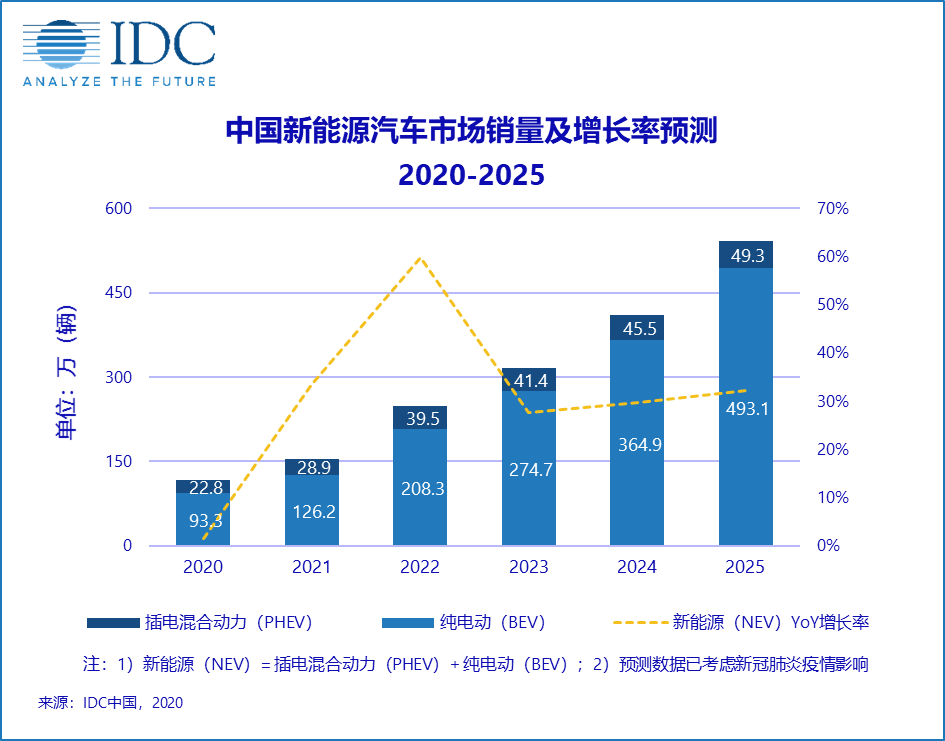

IDC believes that under the influence of policy promotion and other factors, China’s new energy vehicle market will usher in strong growth in the next 5 years, with a compound annual growth rate (CAGR) of 36.1% from 2020 to 2025. IDC predicts that China’s new energy vehicle sales in 2020 will be about 1.16M; benefit from the rebound in the auto market after the epidemic and the extension of the fiscal subsidy period from 2021 to 2022, the sales of new energy vehicles will achieve substantial growth; after 2023, with subsidies reducing, the market will fall back to a relatively stable growth level; by 2025 the sales of new energy vehicles will reach approximately 5.42M. (IDC, Laoyaoba)

Chinese e-commerce company JD.com Inc has become the country’s first virtual platform to accept Beijing’s homegrown digital currency. JD Digits, the company’s fintech arm, will accept digital yuan as payment for some products on its online mall, as part of an experimental giveaway of digital yuan to citizens of Suzhou, near Shanghai. (Gizmo China, Reuters, Sina, Sohu)

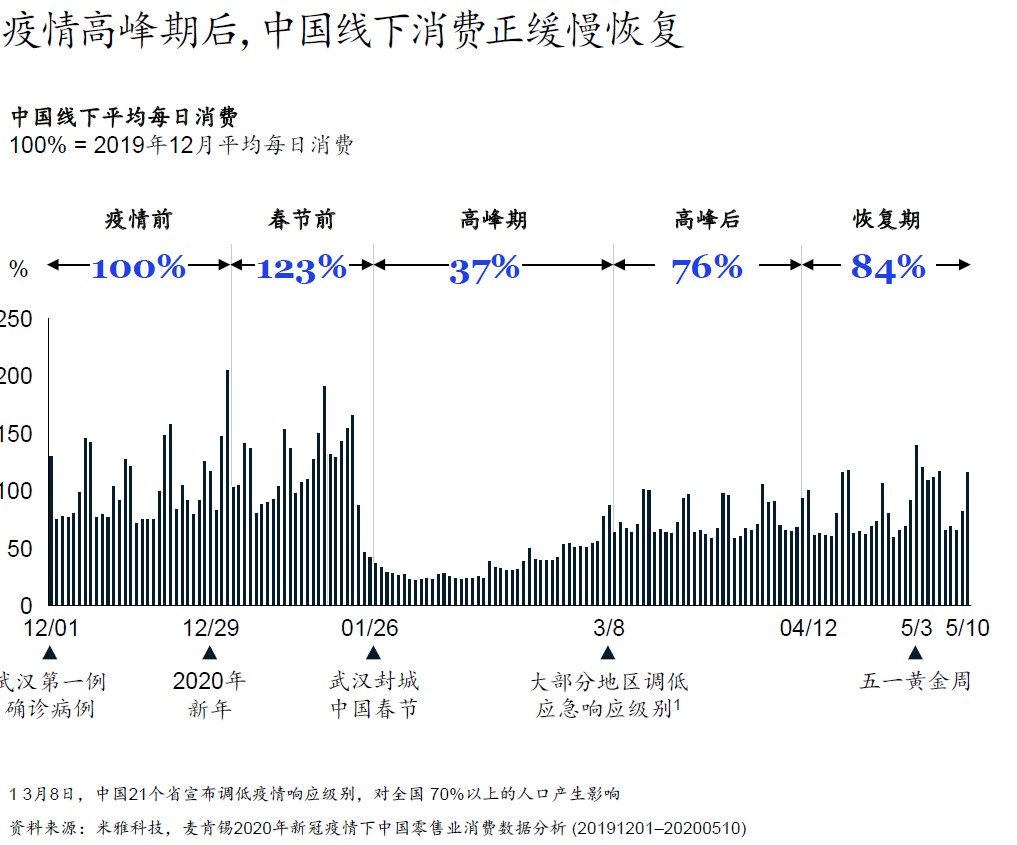

According to McKinsey, at the peak of the epidemic, offline consumption in China dropped to about 37% of normal levels. In the first week of Mar 2020, a number of local governments eased restrictions, allowing merchants to receive consumers who have been at home for 6 weeks. As of May 10, business activities have reached the level of 84% before the epidemic. Driven by the May Day holiday, it has returned to the level of 105% before the epidemic in the next 2 weeks. (McKinsey report)

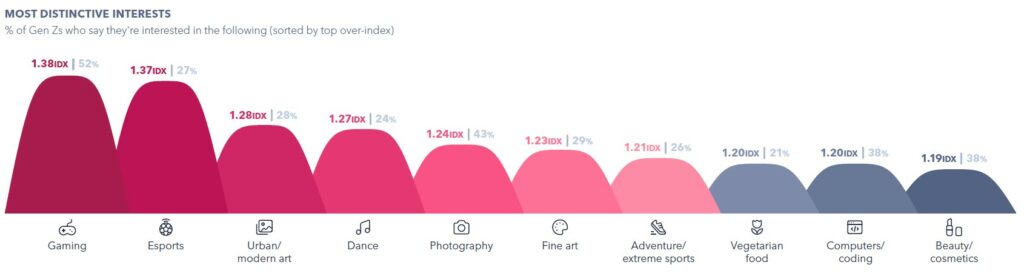

According to GlobalWebIndex, in general, Gen Z’s interests convey a creative and competitive nature. They are more likely to be interested in esports and urban / modern art, while enthusiastic about cooking (49%) and playing sport (43%). In Europe, Gen Zs are 52% more likely to be interested in playing sport – even more so than gaming (IDX 1.39) – while in North America they’re 10% less likely to say this. Gaming is a staple of theirs – 63% are interested in the activity, 12 percentage points ahead of millennials. (GlobalWebIndex report)

Commonplace among Gen Zs is their desire to see the world, but a top priority is doing so in their own way – 27% say standing out in a crowd is important to them, meaning brands should reciprocate their desire for exclusivity. They are highly entrepreneurial, describing themselves as money-driven (28%), ambitious (39%) and career-focused (42%). They are also 17% more likely than average to say they take risks. But this should not be mistaken for self-centeredness; they want to better the world just as much as they want to better themselves. (GlobalWebIndex report)

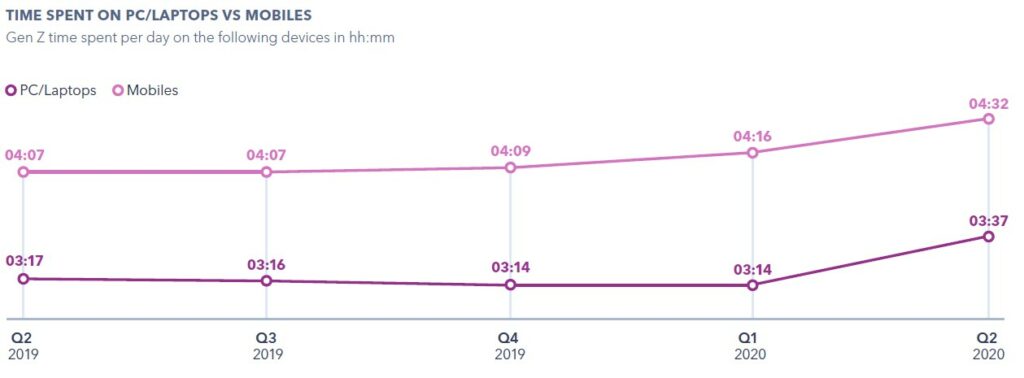

Gen Zs generally keep smaller device portfolios compared to their older counterparts, with many devices unable to compete with smartphones’ versatility. But there are small shifts at play thanks to the pandemic, particularly for PC/laptops. Increased time at home brought with it increased time spent on PCs and laptops per day, jumping from 3.25 hours in 1Q210 to well over 3.5 hours in 2Q20. (GlobalWebIndex report)

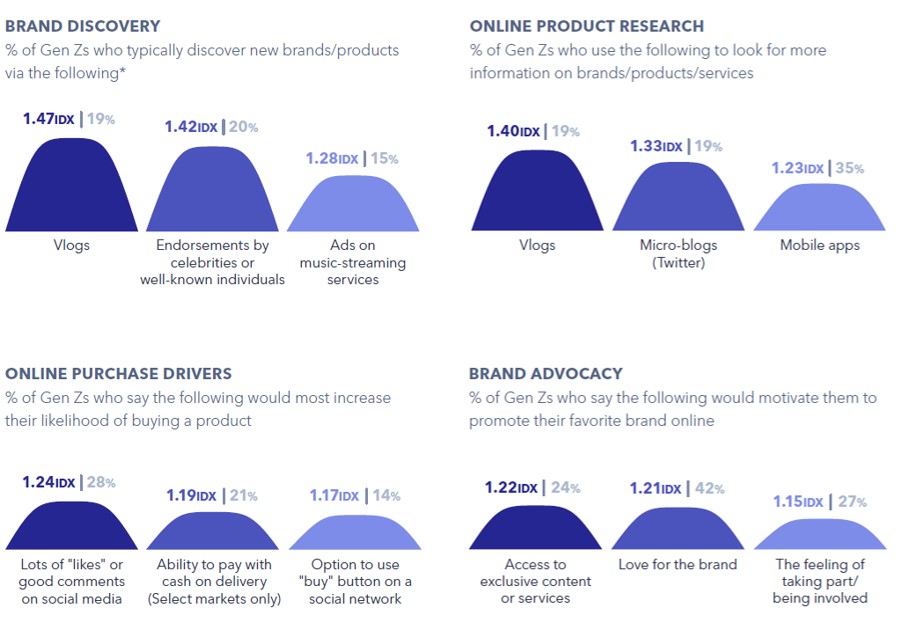

Among most other demographics, brand discovery is still predominantly governed by search engines and TV, and it is the mix of other top channels that typically provides insight into an audience’s characteristics. But for Gen Zs, social media (29%) is now on par with those channels. Beyond search, social and TV, Gen Zs discover products through much of the content they most associate with on social media. Gen Zs are likely to research products in the same way they discover them, with vlogs the stand-out method (IDX 1.40). (GlobalWebIndex report)