12-23 #OnlyRef : TSMC’s advanced 5nm production capabilities for 2021 have allegedly been “booked out”; OPPO has announced the establishment of a 5G Innovation Lab at the Hyderabad R&D Center in India; etc.

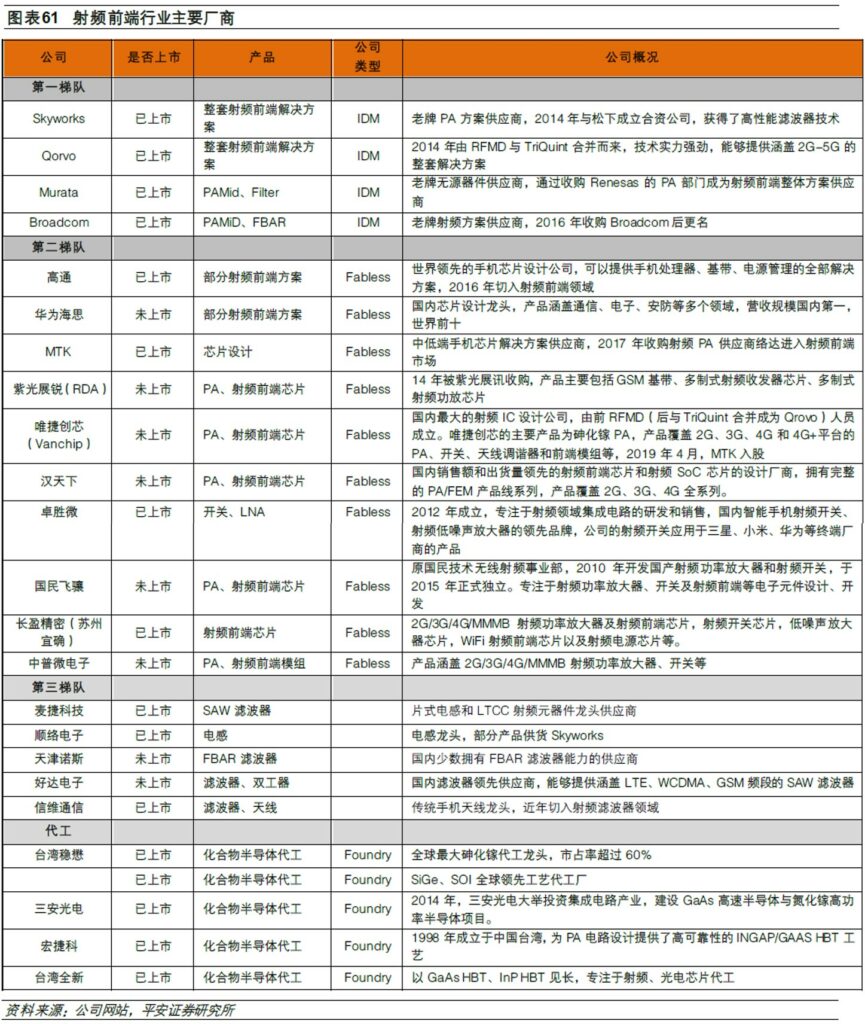

There are currently four main players in the RF front-end market: one is the established RF solution giants based on the IDM model, including Skyworks, Qorvo, Murata and Avago (Broadcom). The second is a supplier of design companies based on the fabless such as Qualcomm, HiSilicon, MediaTek, and UNISOC, which have developed rapidly in recent years and are expected to rise to the first echelon; the third echelon has some RF products, yet there is no overall solution; the fourth is foundry. For China domestic RF front-end, with the rise of domestic brands, HiSilicon and UNISOC have become substitution in some products; Maxscend, OnMicro, and Vanchip have key technologies and have entered the supply chain of well-known smartphone vendors. (Pingan Securities report)

Taiwan Semiconductor Manufacturing Co (TSMC) has received government approval to go ahead with the first phase of a new 300mm foundry plant in the U.S. state of Arizona with an initial investment of USD3.5B. It begins construction in 2021, trial production in 2023, and put into production in 1H24, directly deploy the latest 5nm process, and plan to produce 20,000 wafers per month. It is part of a plan TSMC announced in May 2020 to build a USD12B factory in Arizona. (CN Beta, My Drivers, Yahoo, GizChina)

TSMC’s advanced 5nm production capabilities for 2021 have allegedly been “booked out”. Apple has reserved 80% of this production for 5nm A14 Bionic and A15 Bionic application processor for the 2020 and 2021 iPhone models. Apple also has booked 5nm production for its ARM related M1 computer processor. With production lines in place, the company should process around 9,000 wafers every month. The company also plans to begin Risk Production of 3nm chips in 2021. (CN Beta, WCCFTech, China Times, Phone Arena)

TSMC’s initial production of chips built on the new 3nm process have allegedly been ordered by Apple for use in both its iOS and Apple Silicon devices. TSMC’s 3nm line is on course to produce 600,000 processors annually, or 50,000 per month, with mass production starting in 2022. It is estimated that TSMC must sell at least 300M processors to return a profit. (UDN, Apple Insider, TechNews)

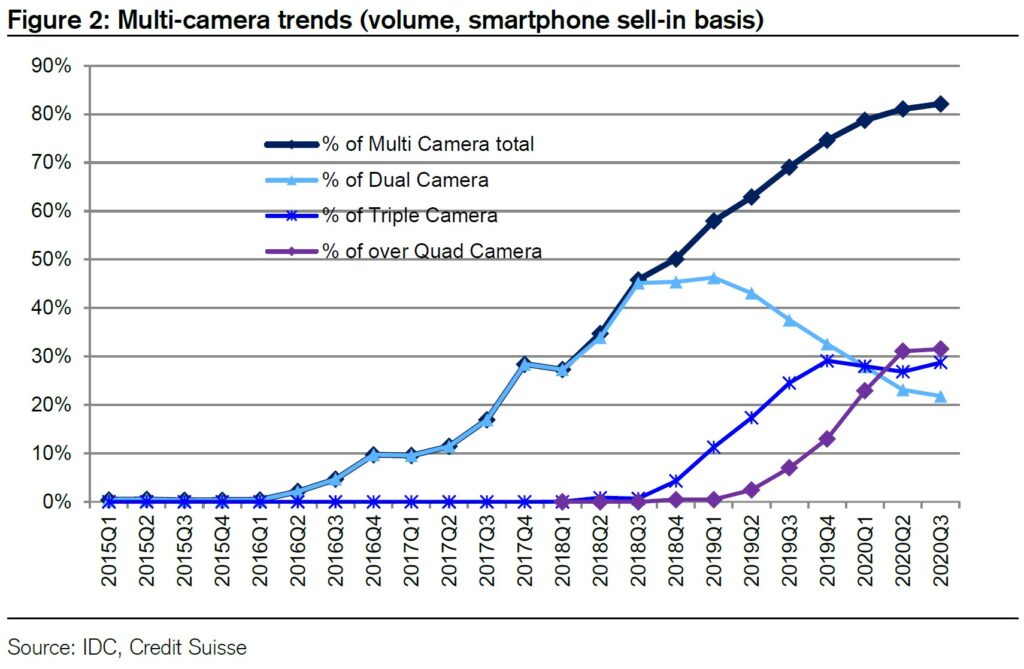

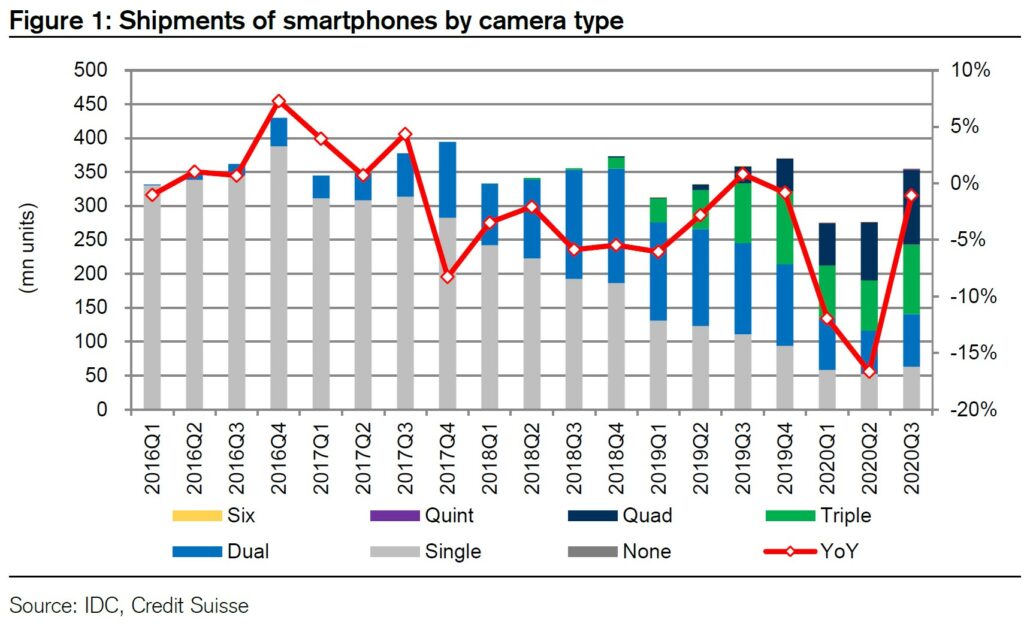

According to Credit Suisse, nearly all 5G smartphones hitting the market continue to feature at least 3 cameras. However, the ratio of quad-camera models has declined (from 62% in Apr–Jun 2020 to 45% in Jul–Sep 2020), while the ratio of triple-camera models has risen (from 38% to 50%). This is because shipments of mid-market smartphones increased. Quad-cam products continue to account for a high proportion of sales in the premium segment (USD800 models and above). In addition, the quad-cam ratio is still rising for 4G and earlier generation smartphones. (Credit Suisse report)

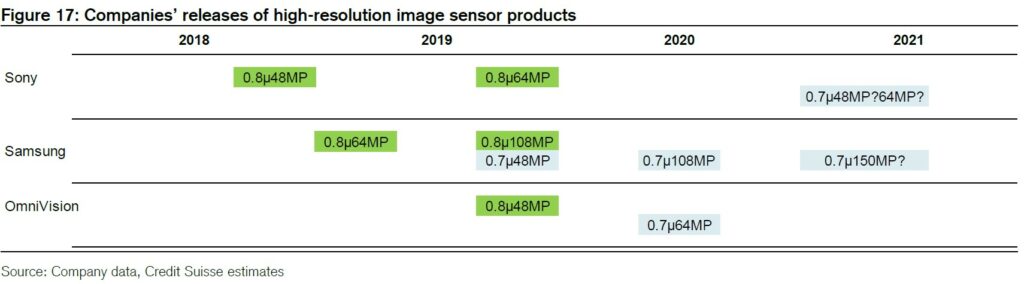

Amid competition in cell miniaturization and high resolution, companies moved from 0.8μ to0.7μ in cell pitch and from 64MP to 108MP in resolution. OmniVision has started production of 0.7μ and 64MP chips in 2020, and Samsung has begun mass production at 0.7μ and 108MP. Sony has begun mass production of 0.8μ and 64MP chips in 2019, and Credit Suisse expects the company to start mass production at 0.7μ in 2021. Samsung is developing 150MP and 600MP products to accelerate its shift to higher resolutions. SK Hynix plans to move away from its focus on low-resolution products and enter the 48MP market in 2021. GalaxyCore and Goodix are also aiming to enter high-pixel products. (Credit Suisse report)

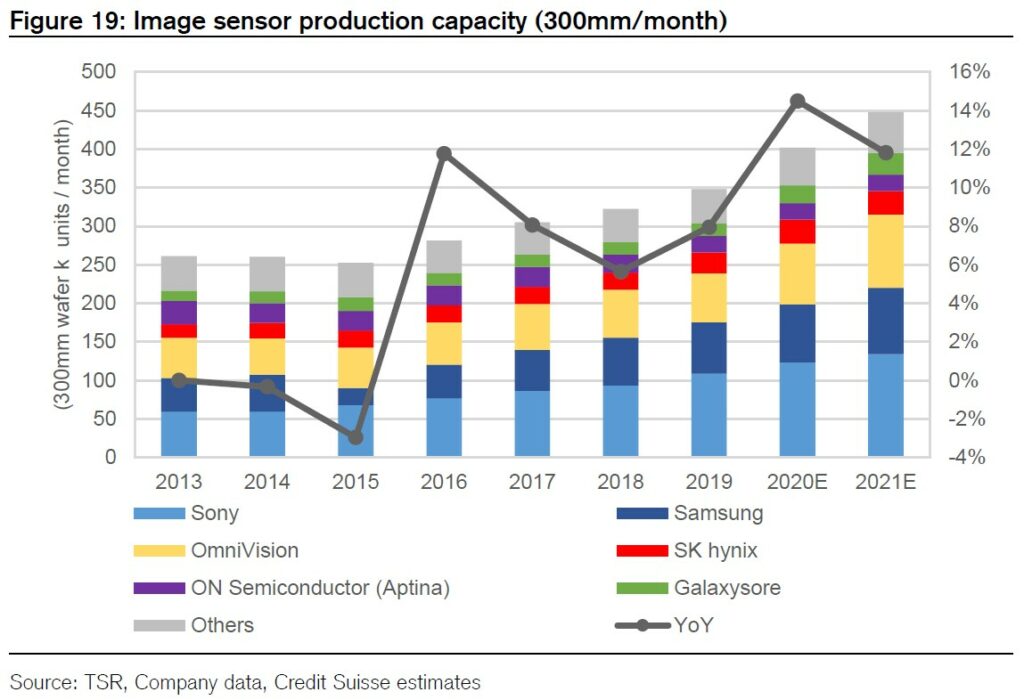

Credit Suisse estimates that production capacity will increase by an average of around 15% YoY in 2020 and that it could rise at roughly the same pace in 2021. Sony originally intended to increase capacity at its new plant in Nagasaki to 138K/month (based on 300mm wafers) at end-Mar 2021, but the Huawei issue has caused it to temporarily shelve the plan. Samsung is expanding capacity steadily by shifting from DRAM lines, while OmniVision is expanding its 12” fab from 50K/month at end-2019 to 80K/month by end-2020. (Credit Suisse report)

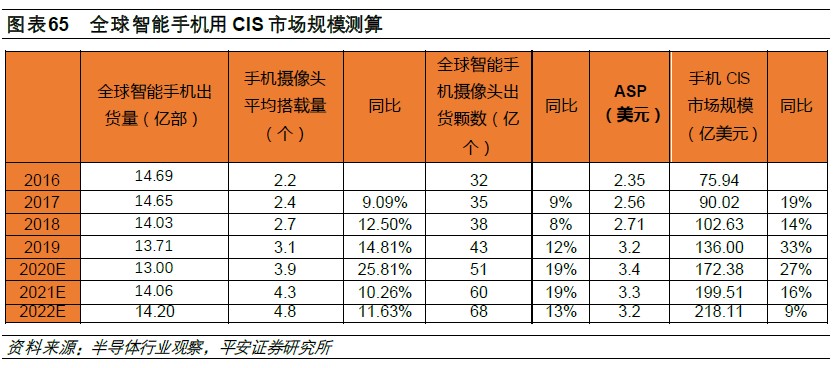

The increase in the number of smartphone cameras has gradually promoted the improvement of 3D imaging quality such as wide-angle, telephoto, macro and bokeh, and has also greatly driven the growth of the image sensor (CIS) market. In 2019, the usage of each smartphone camera is about 3.1 units, and it is expected to reach 4.3 units in 2021. The market size of CIS for smartphones in 2019 is USD13.6B, and is expected to reach USD21.8B in 2022, with a compound growth rate of 17%. (Pingan Securities report)

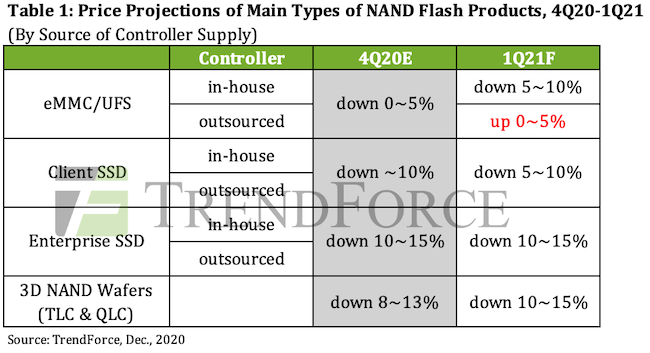

In the upstream semiconductor industry, the major foundries such as TSMC and UMC are reporting fully loaded capacities, while in the downstream, the available production capacity for OSAT is also lacking, according to TrendForce, suppliers of NAND Flash controller ICs such as Phison and Silicon Motion are now unable to meet upside demand from their clients. Not only have many controller IC suppliers temporarily stopped offering quotes for new orders, but they are also even considering raising prices soon because the negotiations between NAND Flash suppliers and module houses over 1Q21 contracts are now at the critical juncture. The potential increases in prices of controller ICs from outsourced suppliers (IC design houses) are currently estimated to be the range of 15-20%. (Laoyaoba, TrendForce, TrendForce)

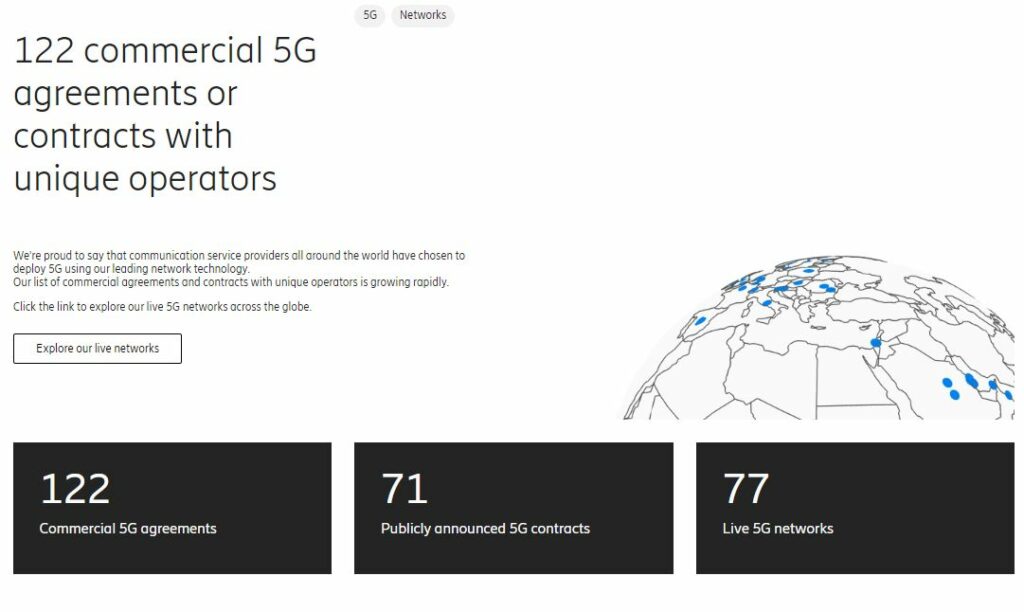

According to Ericsson’s official website, the company currently has 122 5G commercial contracts. The Swedish company has 71 publicly announced 5G contracts and 77 live 5G networks. The company predicts that by the end of 2020, 5G networks will cover more than 1B people worldwide. In 2026, the number of 5G subscriptions will reach 3.5B. 5G networks will cover 60% of the world’s population. (CN Beta, GizChina, Ericsson)

OPPO has announced the establishment of a 5G Innovation Lab at the Hyderabad R&D Center in India. This center will focus on the research and development of core product technologies under the 5G ecosystem. (IT Home, GizChina, India Today, Indian Express)

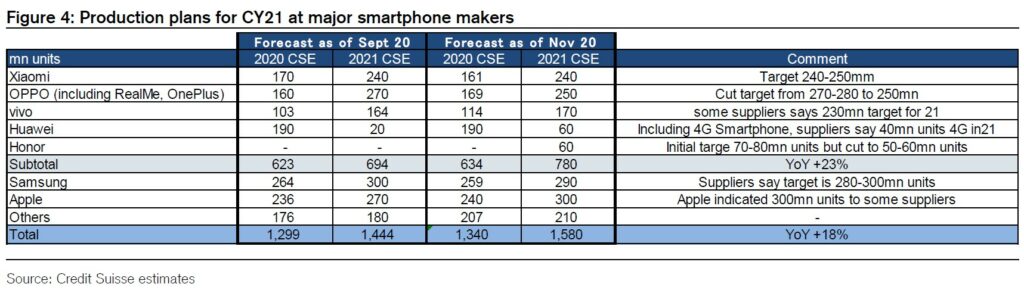

According to Credit Suisse, the 2020 production plans of manufacturers are: Xiaomi 161M units (down from 170M in the previous survey), Apple 240M units (236M), Samsung Electronics 259M (264M), Huawei 190M units (190M), OPPO (excluding realme and OnePlus) 121M units (107M), and vivo 114M units (103M). For 2021, production plans call for a total of 1,550M–1,600M units (+18% YoY), with Xiaomi at 240M units, OPPO at 250M (including realme and OnePlus; 169M units in 2020), vivo at 170M units, Huawei at 60M units, Honor at 60M units, Samsung Electronics at 290M units, Apple at 300M units, and others accounting for the rest. (Credit Suisse report)

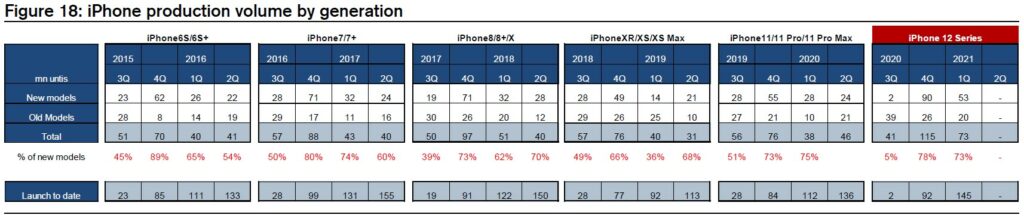

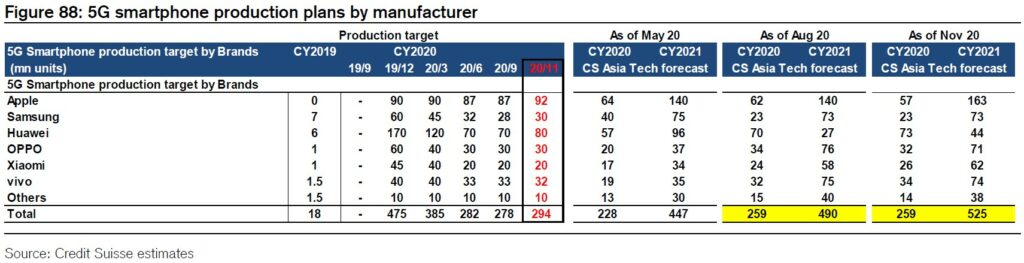

Credit Suisse’s latest survey indicates that plans call for 2M units in Jul–Sep 2020, 90M in Oct–Dec for Apple iPhone, and 53M in Jan–Mar 2021 for a 2020 total of 92M and a three-quarter total of 145M. The Jul–Sep figure is down vs. the previous survey due to the production delay, but the Oct–Dec figure is conversely up and the Jan–Mar figure unchanged. The Jul–Dec 2020 total of 92M units looks to be the upper limit of historical seasonality, while the Jul 20–Mar 21 total of 145M is larger than the iPhone 7–8 generation. (Credit Suisse report)

Samsung outsourced the production of just over 20M units to ODM partners in 2019 and apparently planned for 60M units for 2020 (as of Credit Suisse’s Nov 2019 survey). As of early Jun 2020, the company reportedly cut this target to around 40M units, but as of their previous survey (early Sept 2020) this has been raised back to over 60M units for 2020. As of their current survey, the figure was still around 60M units. However, they understand that components suppliers have received inquiries for around 70M units’ worth of components from the ODM partners. At the time of the previous survey, Credit Suisse reported that the target was increasingly likely to rise to around 90M units. (Credit Suisse report)

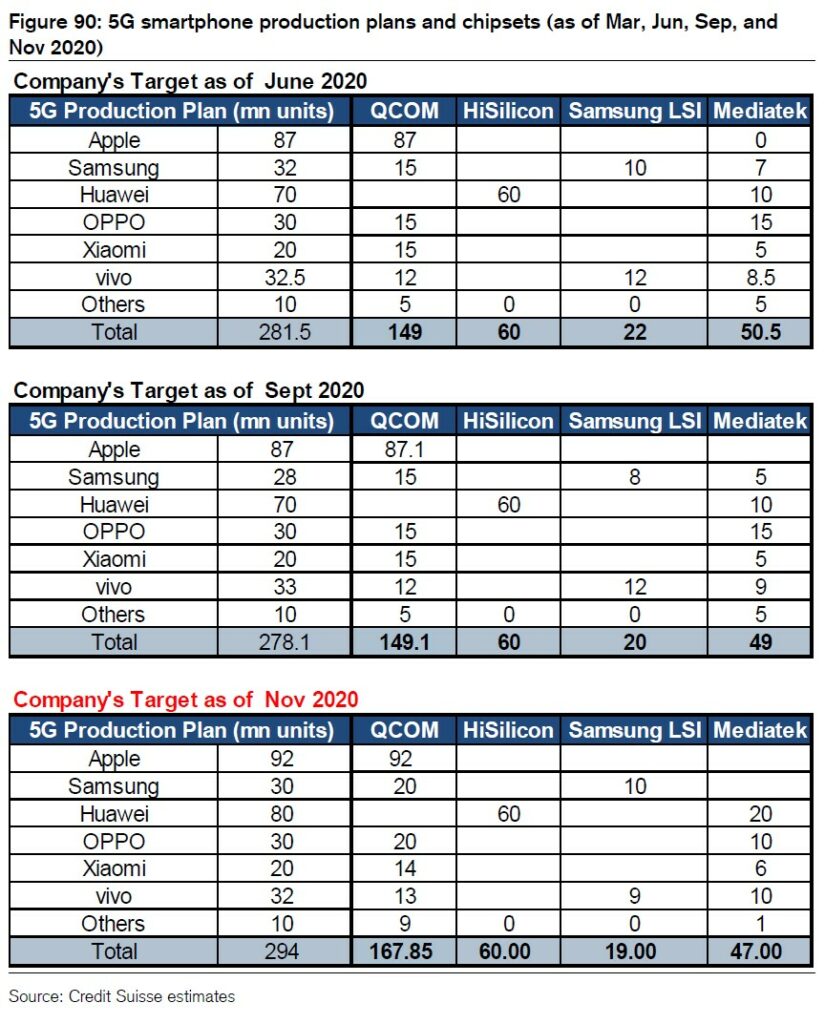

In Credit Suisse’s Mar 2020 survey, they noted that production plans, although still excessive, has declined to just under 400M units and as of Jun 2020 they reported that production plans had declined back down to around 280M units. As of survey in Sept 2020, 5G smartphone production volume for 2020 is being maintained at around 280M units. However, the most recent survey (late Nov 2020) shows targeted production slightly higher than in the previous survey, at just over 290M units. (Credit Suisse report)

The output value of Vietnam’s handset and related component industry came to USD46.9B in the first 11 months of 2020, accounting for 18.4% of the country’s total export value during the 11-month period. (Digitimes, press, Digitimes, MofCom)

Lava BeU is announced in India – 6.088” 720×1560 HD+ v-notch, UNISOC SC9863A, rear dual 13MP-2MP depth + front 8MP, 2+32GB, Android 10.0 Go, rear fingerprint, 4060mAh, INR6,888 (USD93). (GSM Arena, GizChina, Lava Mobiles)

Tecno Spark 6 Go is launched in India – 6.517” 720×1600 HD+ v-notch, MediaTek Helio A25, rear dual 13MP-AI lens + front 8MP, 4+64GB, Android 10.0, rear fingerprint, 5000mAh, INR8,499 (USD115). (Gadgets360, Gizmo China, Tecno Mobile, 91Mobiles)

Huawei nova 8 series is launched in China: nova 8 – 6.57” 1080×2340 FHD+ 90Hz HiD OLED, HiSilicon Kirin 985 5G, rear quad 64MP-8MP ultrawide-2MP depth-2MP macro + front 32MP, 8+128 / 8+256GB, Android 11.0 (HMS), fingerprint on display, 3800mAh 66W, 5W reverse charging, CNY3299 (USD505) / CNY3699 (USD566). nova 8 Pro – 6.72” 1236×2676 FHD+ 120Hz 2xHiD 80º curved OLED, HiSilicon Kirin 985 5G, rear quad 64MP-8MP ultrawide-2MP depth-2MP macro + front dual 32MP-16MP ultrawide, 8+128 / 8+256GB, Android 11.0 (HMS), fingerprint on display, 4000mAh 66W, 5W reverse charging, CNY3999 (USD612) / CNY4399 (USD673). (Gizmo China, GizChina, My Drivers)

Huawei Enjoy 20 SE is announced in China – 6.67” 1080×2400 FHD+ HiD, Kirin 710A, rear tri 13MP-8MP ultrawide-2MP macro + front 8MP, 4+128 / 8+128GB, Android 10.0 (HMS), side fingerprint, 5000mAh 22.5W, CNY1,299 (USD199) / CNY1,499 (USD229). (Gizmo China, Sohu, IT Home)

KFC has introduced the KFConsole, which it is launching in partnership with Cooler Master. It is a PC that can run intensive games, but it also promises to keep chicken warm while play. The defining feature of the KFConsole is its food tray. (Neowin, Cooler Master, Pocket-Lint, IT Home)

OnePlus CEO Pete Lau has confirmed the company has revived its smartwatch ambitions years after its first attempt, which would be launched in early 2021. (Engadget, My Drivers)

realme has officially announced the Watch S series. Watch S Pro features 1.39” 454×454 AMOLED, ARM Cortex-M4, 420mAh battery, 5ATM water resistance. It supports SpO2 monitor with heart-rate monitoring, sleep tracking, activity tracking for 15 sport modes. (My Drivers, Android Authority)

Huawei has released its first square smartwatch Watch FIT, featuring 1.64” 456×280 color OLED screen, a 180mAh battery, more than 300 watch faces, 12 fitness courses, 96 exercise modes, real-time heart rate monitoring and feedback, independent GPS, Continuous blood oxygen monitoring, convenient screening of sleep apnea risk, NFC bus access, etc., priced at CNY799. (My Drivers, Vmall, Huawei)