12-27 #ProtectThem : Intel currently manufactures 10 nm products in high volumes at its 3 fabs; Samsung is reportedly considering not to provide chargers with its Galaxy S21 series; Xiaomi has confirmed that the company would be ditching the bundled power brick in the Mi 11; etc.

Intel’s foundry business has doubled its 10nm and 14nm capacity over the last 3 years. The company has also ramped its new 10 nm process in 2020. Intel currently manufactures 10 nm products in high volumes at its Oregon and Arizona sites in the U.S. and its site in Israel. (Guru3D, Laoyaoba, Hardware Times, WCCFtech, Twitter)

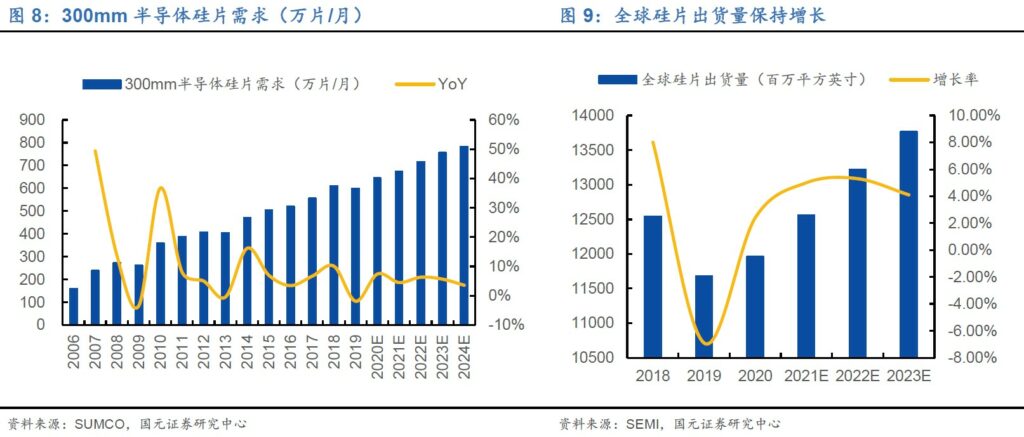

Since 2000, the shipment area of 12” silicon wafers has shown an obvious growth trend. In 2008, it exceeded 8” silicon wafers and became the mainstream product in the global silicon wafer market. It is expected that the market demand for 12” silicon wafers will continue to be strong in the future. By 2020, the market will account for more than 75%. China’s 12” silicon wafers are basically dependent on imports. To make up for the supply gap of silicon wafers and reduce dependence, China is actively investing in the production of 12” silicon wafers. Many companies have launched large-scale production projects. According to Guoyuan Securities, the total investment of the announced projects reached CNY142.9B, and the 12” wafer production capacity is expected to be close to 6M pieces/month around 2023.(Guoyuan Securities report)

According to SUMCO data, global silicon wafer demand is expected to maintain a compound growth rate of 5.1% from 2020 to 2024. According to the latest SEMI report, the demand for 12” silicon wafers in 2020 is 6.5M pieces/month, and it is expected to reach 7.56M pieces/month in 2023. Global silicon wafer shipments in 2020 will increase by 2.4% year-on-year, and will increase to 5% in 2021. (Guoyuan Securities report)

According to SUMCO, compared to the 1.25 sqi/unit of 4G mobile phones, the average silicon usage of 5G mobile phones will increase by 1.7 times to 2.1sqi/unit. In 2019, smartphones will drive the demand for large 12” silicon wafers to reach 1.36M pieces per month. In the future, as the penetration rate of 5G mobile phones will increase, silicon wafer shipments will continue to grow. The demand is expected to reach every month 1.4M, 1.55M, 1.65M, and 1.8M pieces in 2021-2024, respectively. (Guoyuan Securities report)

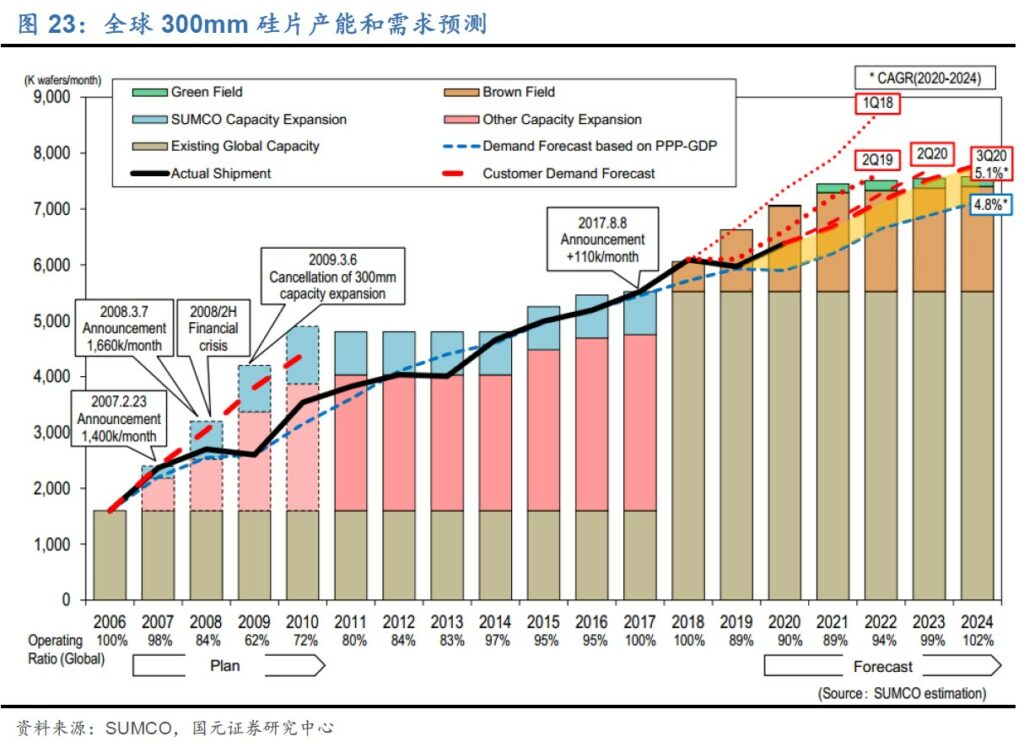

SUMCO predicts that the global 12” capacity utilization rate will be 90%, 89%, 94%, 99%, and 102% in 2020-2024. It is estimated that there will be a demand gap of 170K wafers per month in 2024, which will further push up the price of silicon wafers. It can be seen that the current expansion plans of various silicon wafer factories are still relatively cautious. For silicon wafer factories, steady expansion of production and continuous rise in wafer prices have become the consensus of the industry. (Guoyuan Securities report)

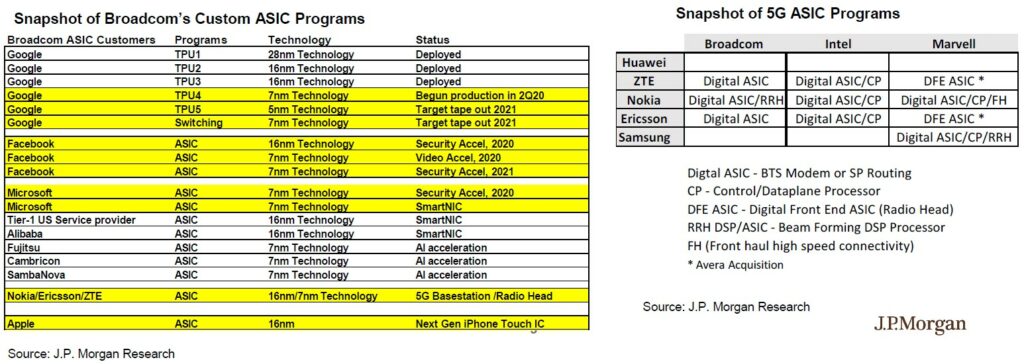

According to JP Morgan, the digital custom ASIC chip market is a ~USD10B-12B per year market opportunity. Demand is rising for custom ASICs because many of the large OEMs/CSPs/Hyperscalers are looking for more differentiation, better performance, lower power consumption, and overall lower cost of ownership versus off-the-shelf chip solutions (or ASSPs). (JP Morgan report)

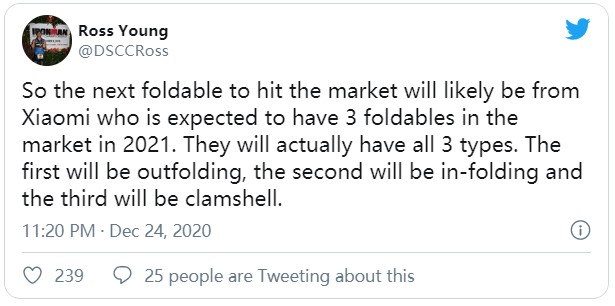

Ross Young, founder of research companies Display Supply Chain Consultants and DisplaySearch, has revealed that Xiaomi is planning to release 3 foldable phones in 2021. The first will be outfolding, the second will be in-folding and the third will be clamshell. (GizChina, Twitter, CN Beta)

OPPO, has advanced plans to release an elegantly designed slider phone with a rollable display soon. The initiative is in collaboration with US fashion designer Tom Ford, who designs the phone. The phone comes with a retractable screen, which increases the display area by 80% when opened vertically. (Gizmo China, GSM Arena, LetsGoDigital, CN Beta)

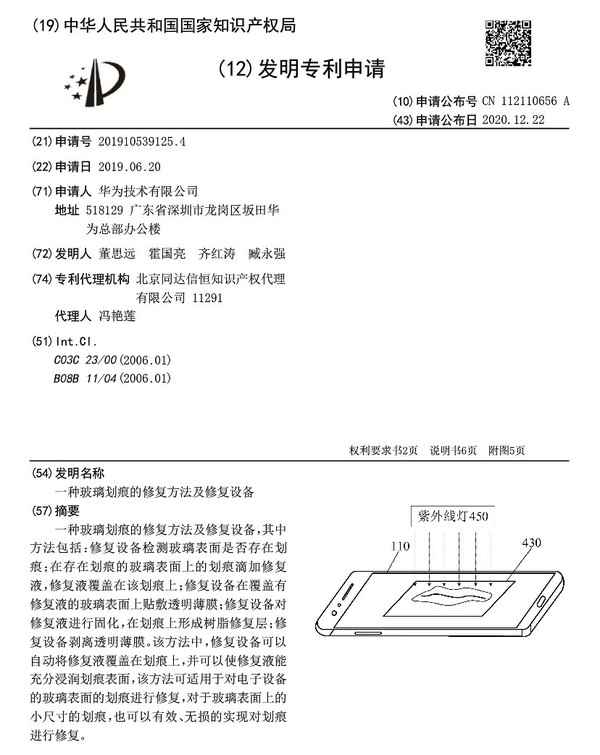

Huawei has applied for a new patent at CNIPA (China National Intellectual Property Administration). The new patent is for “method and equipment for repairing glass scratches”. The patent shows the repairing method of scratched screen glass. First, the preparing equipment detects the scratch on screen glass. If the scratch detects on the main screen then it will be cleaned with alcohol or if on the back screen cleaned with an ultrasonic cleaner. (CN Beta, My Drivers, Huawei Central)

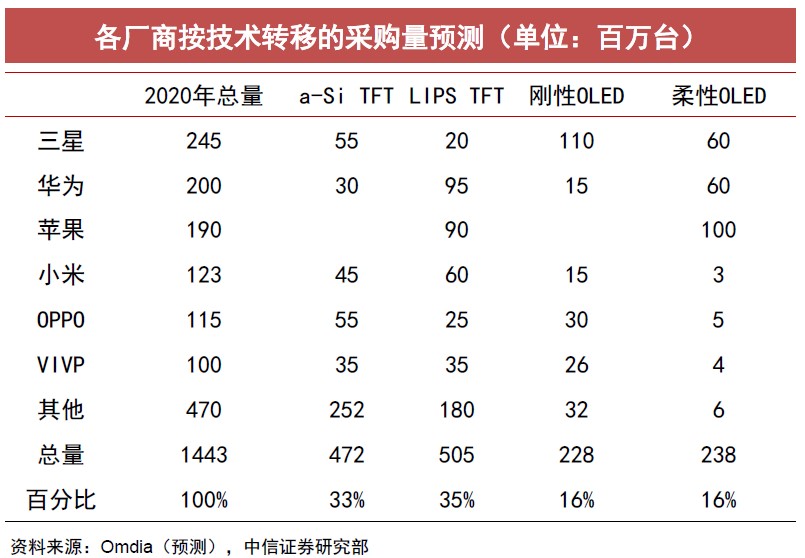

From the supply side, Samsung is still in an absolute leading position. All 4 flexible AMOLED production lines have achieved mass production, with a total production capacity of 490k/month. Leading domestic manufacturers are also actively deploying flexible fields. BOE has planned a total of 4 flexible AMOLED production lines with a design capacity of 48K/month. Among Visionox’s 3 flexible production lines, the Hefei production line has a designed capacity of 30K/month. (CITIC Securities report)

Currently optical lens manufacturers that can provide 7P phone lenses mainly include Largan, Sunny Optical, GSEO, and O-Film have also achieved small-volume production recently. Among them, Largan has the highest technological maturity in the field of multiple chips. Largan achieved mass production of 7P lenses in 2018, and shipments of 8P lenses in 2019. CITIC Securities believes that in the future, Largan and other lead manufacturers are expected to continue to maintain a leading position in the field of multi-piece plastic lenses with the help of years of accumulated technological advantages and patent layouts, and the trend of industry powerhouses will remain unchanged. (CITIC Securities report)

Samsung is reportedly considering not to provide chargers with its Galaxy S21 series. Samsung has reportedly deleted the articles mocking Apple’s iPhone12 without a charger. (ChinaZ, The Verge, 9to5Google, iMore)

Xiaomi CEO Lei Jun has confirmed that the company would be ditching the bundled power brick in the Mi 11 citing environmental concerns. Users already have a surplus of chargers and that the charger would be “canceled” for the Mi 11 device. (Apple Insider, CN Beta, The Verge)

Panasonic will begin production as early as 2021 of prototypes of a new, cheaper type of battery for Tesla electric vehicles. The cylindrical cell, plans for which were announced in Sept 2020 by Tesla CEO Elon Musk, was developed in-house by Panasonic at Tesla’s request. Panasonic will set up a prototype production line at existing facilities. The cost of the project is expected to run into the tens of millions of dollars. (Laoyaoba, Asia Nikkei)

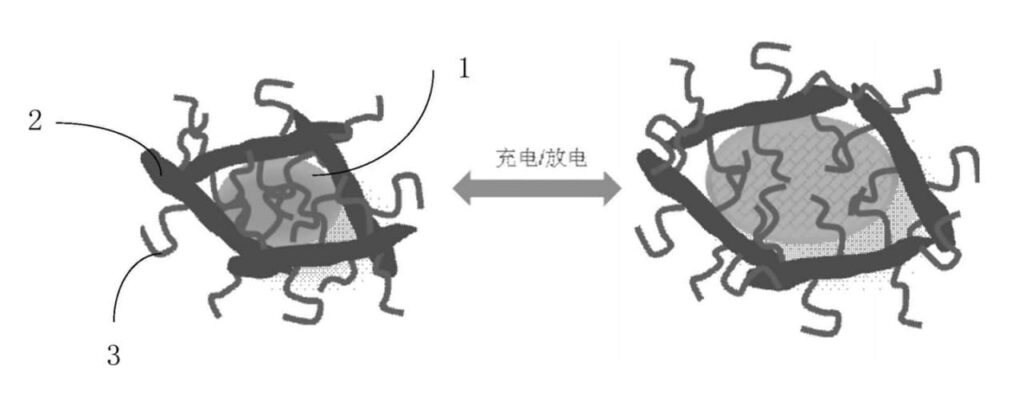

Huawei has filed a patent of lithium-ion battery titled “a conductive binder for lithium-ion batteries and its preparation method, lithium-ion battery electrode pole and preparation method, and a lithium-ion battery”. The technology uses polyvinyl alcohol, polyethylene glycol, polystyrene, starch, sodium alginate, etc. as a binder, and graphene as a conductive material. The amount of graphene is 0.1%-10% of the total mass, while the thickness of the graphene particles is 5nm-50nm, and the D50 particle size is 50nm-5000nm. (My Drivers, IT Home, Huawei Central)

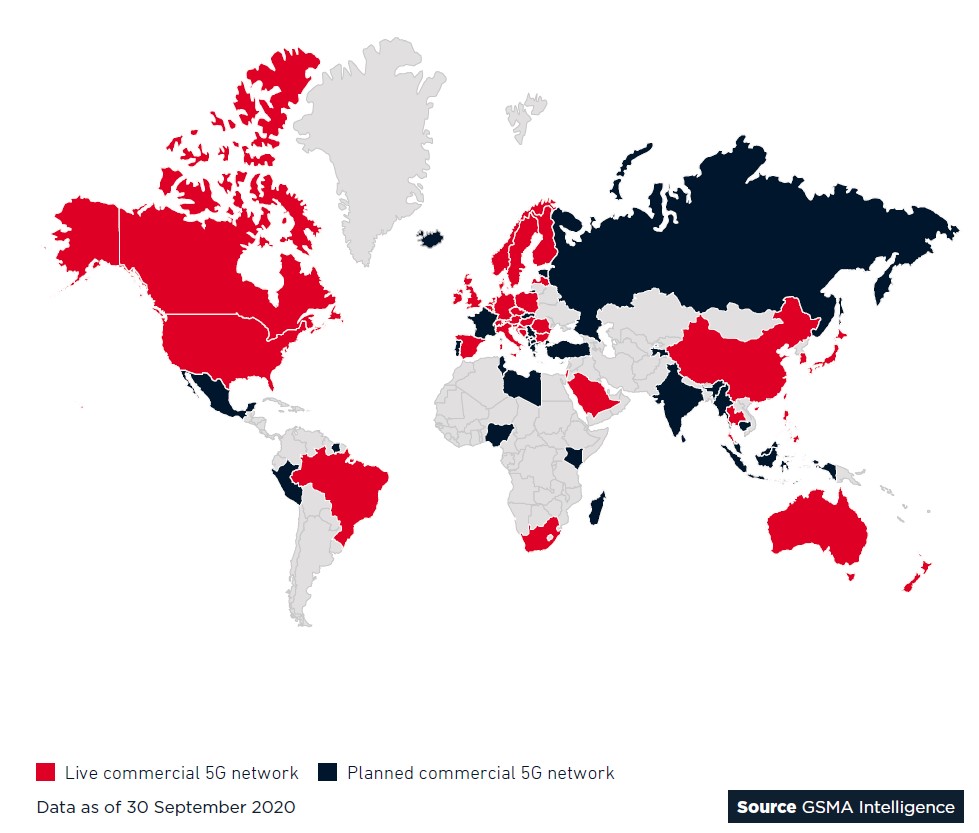

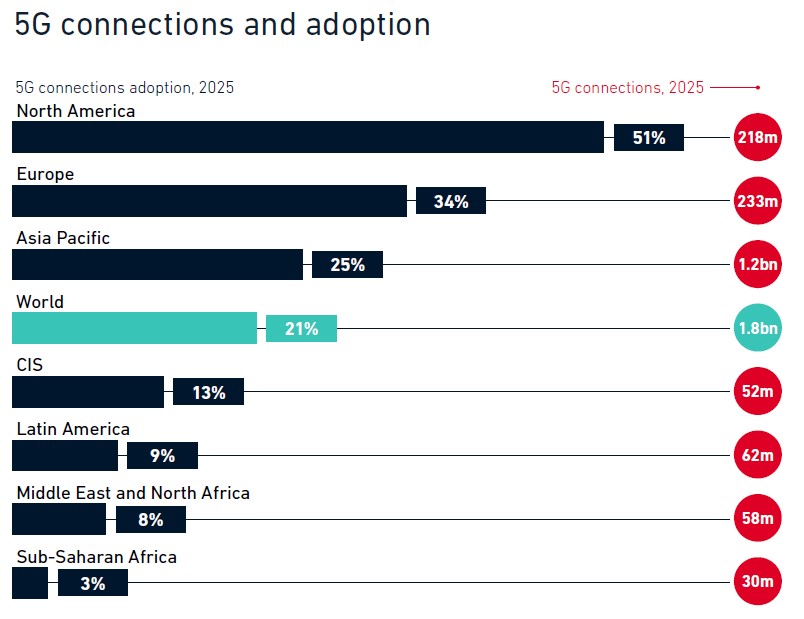

According to GSMA, there are now 113 operators with a 5G network across 48 countries. These operators collectively account for 40% of the global mobile subscriber base, presenting a large addressable audience. India has notably delayed its spectrum auction to 2021. Globally, GSMA forecast operators will spend 80% of sector capex (USD890B) on 5G networks over the next 5 years, reaching 45% population coverage. (GSMA report)

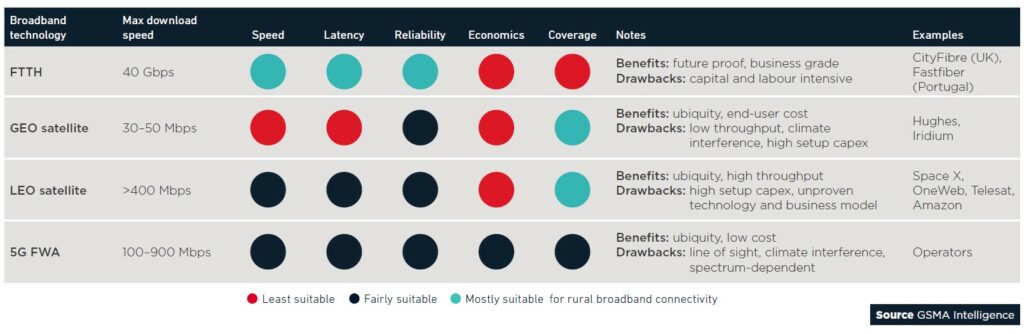

Open RAN’s coming of age has dominated much of the network agenda in 2020. However, one should not lose sight of parallel developments in rural broadband. Despite fixed broadband coverage being prevalent in high-income countries, availability in the final 10% of rural households remains stubbornly low. This is an economics issue. A range of new entrants using different technologies and business models have come in to alleviate this problem, including fiber wholesalers, new satellite operators and the potential use of 5G fixed wireless access. (GSMA report)

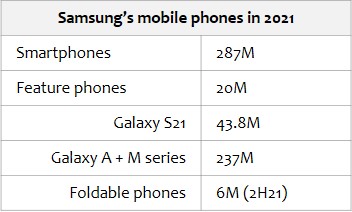

Due to the global pandemic, Samsung’s mobile phone sales dipped below 300M for the first time in 9 years in 2020. Samsung Electronics reportedly plans to ship 307M mobile phones in 2021. Out of 307M, 287M of them will be smartphones while the rest will be feature phones. It is estimated that 55M smartphones will be manufactured by joint development manufacturers (JDM). (GizChina, Laoyaoba, ET News, IT Home)

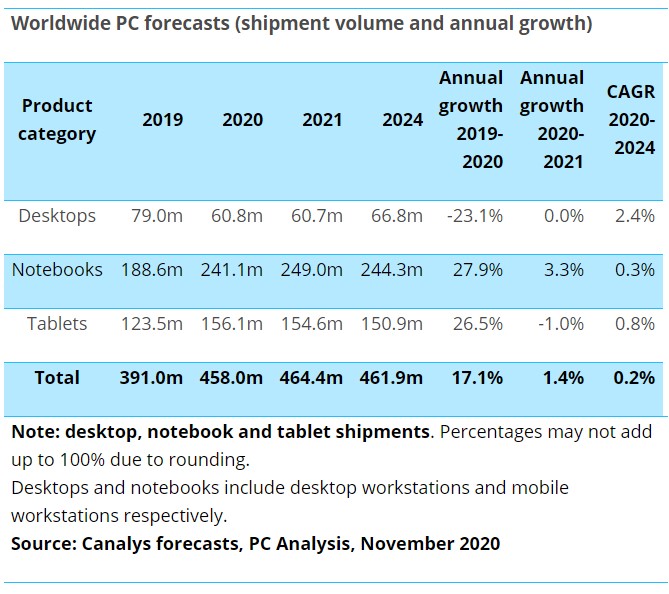

According to Canalys, PC shipments (including desktops, notebooks and tablets) are expected to hit 143M units in 4Q20, up 35% year on year. This will bring total PC shipments in 2020 to 458M units, a remarkable annual increase of 17%. Growth in this sector will spill over into 2021, with shipments in the first quarter expected to be up 43% year on year on a weak 1Q20. Shipments for full-year 2021 are expected to increase a further 1.4% following an extraordinary year for PCs in 2020. (Phone Arena, Reuters, Canalys)

Foxconn (Hon Hai Precision) and Yulon Group’s joint venture, Honghua Advanced, is expected to be supplied to Apple. Their new MIH electric vehicle open sharing platform is expected to supply to Apple. Foxconn and Taiwan local carmaker Yulon Group have formed a joint venture to manufacture vehicles. Yulon, founded in the 1950s, has manufactured Nissan and Mitsubishi cars as well as its own brand Luxgen. (Laoyaoba, Electronic Design, The Elec)

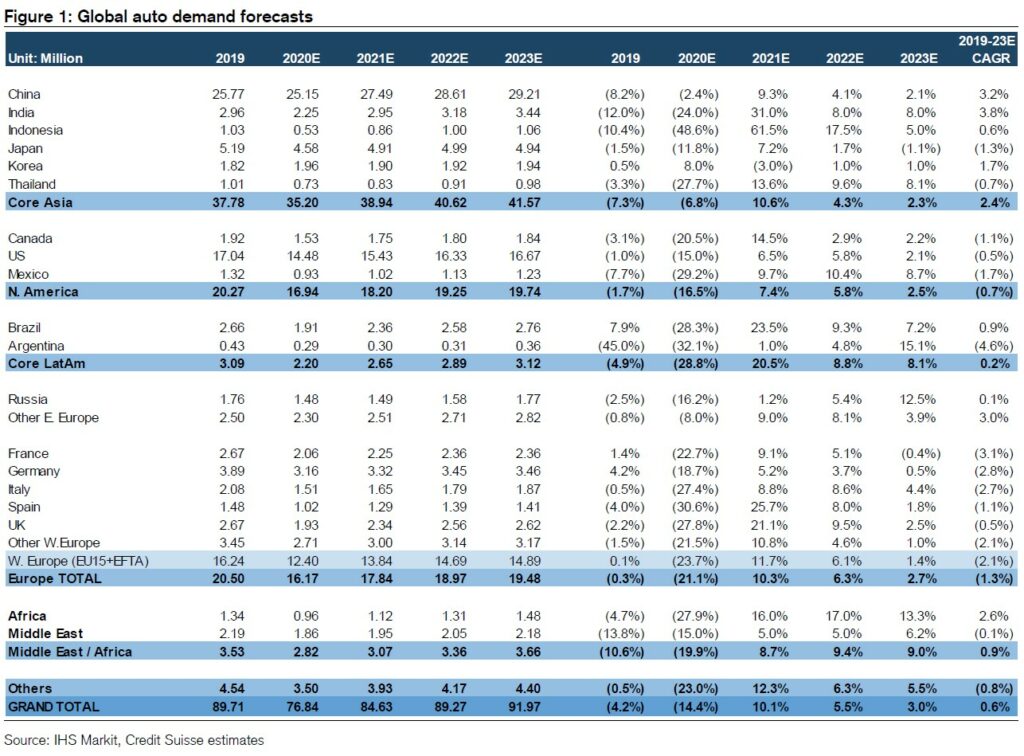

Global auto demand in 2020 faced an even sharper downturn from COVID-19 following 2019, and Credit Suisse forecast full-year global demand will end up dropping 14.4% YoY. Meanwhile, as global demand catches its breath, they think that demand in 2021 will return to growth, forecasting +10.1% YoY growth with solid recoveries in the US and China while maintaining a cautious stance on Europe, followed by +5.5% YoY and +3.0% in 2022 and 2023. Credit Suisse expects each of the core Asian markets to either maintain solid levels or recover following the sharp downturn in 2020. (Credit Suisse report)

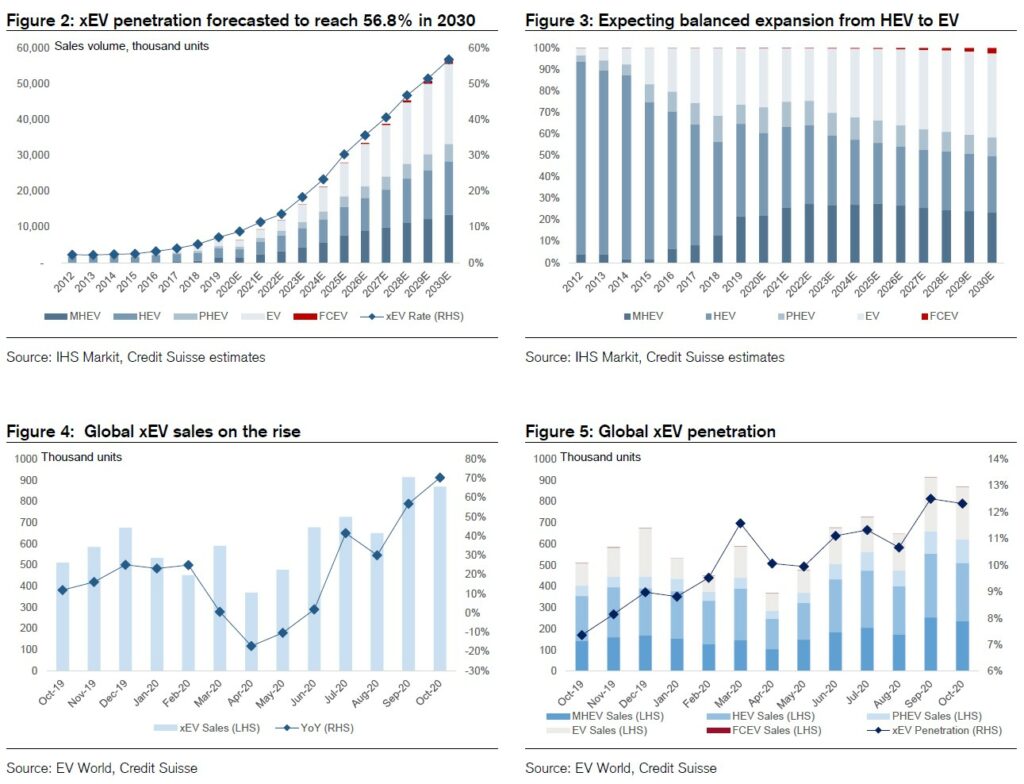

Credit Suisse forecasts global electrified vehicles (xEV) penetration in the auto space to continue escalating and reach 56.8% in 2030, compared to 8% in 2019. Carmakers globally are facing stricter environmental regulations and regional xEV targets, and Credit Suisse expects them to strategically allocate more resources to expand their xEV product line to cope with such targets. They view that the trend in auto electrification, which has entered an expansion phase, has started to materialize in recent auto sales despite impact from COVID-19 still present in some markets. (Credit Suisse report)