1-4 #2021Resolution: Samsung Display plans to introduce more than 10 different AMOLED displays for the laptop market in 2021; LG is introducing 48” Bendable Cinematic Sound OLED (CSO) display; etc.

According to the resource endowment and factor distribution of its own development, the global hardware technology is divided into 3 large scales. The first is dominated by the United States, the second is dominated by Mainland China, and the third is South Korea, Japan, Taiwan Province of China, and Europe. Under external environmental pressure, China’s semiconductor design and manufacturing are facing suppression, but China’s independent development path will not change due to external suppression. With the introduction of the internal circulation policy, in the future, China will be based on the low-end manufacturing industry and carry out an internal circulation with the third quadrant. The United States, based on high-end manufacturing, has made up for its shortcomings. The third quadrant refers to Japan, South Korea, Europe, and Taiwan Province of China. Relying on their leading advantages in sub-sectors, they are independent from China and the United States and become an intermediate medium in the global hard technology market. (Founder Securities report)

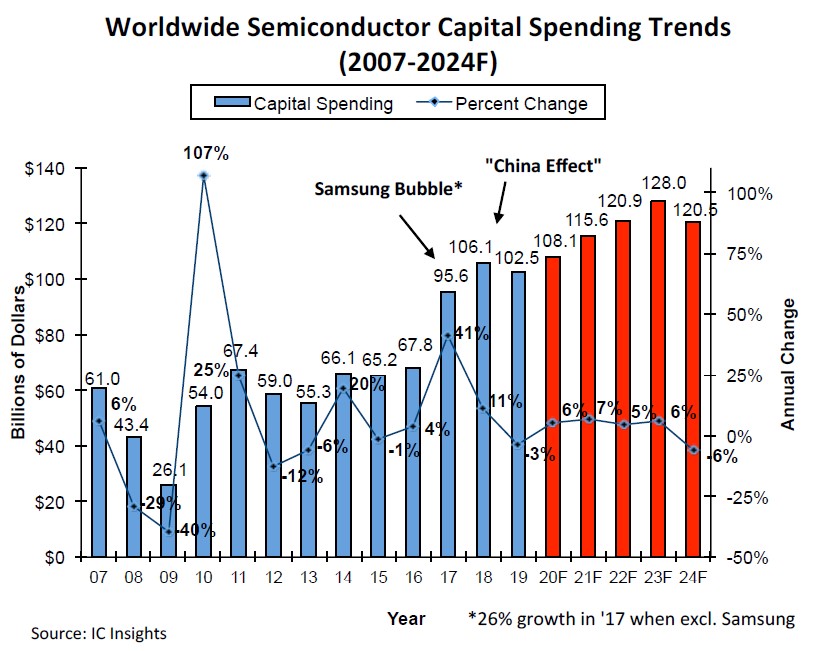

IC Insights believes that many semiconductor producers viewed the global pandemic in 2020 as a relatively short-‐term disruption and continued with their spending plans that will ultimately affect their capacity and technology roadmaps for many years to come. It could be said that the companies have been “looking over the valley” in 2020 with regard to their capex outlays and have kept their focus on their future semiconductor capacity needs 2-5 years out. For 2021, another mid-‐single-‐digit growth rate for semiconductor industry capital spending is forecast. (IC Insights report)

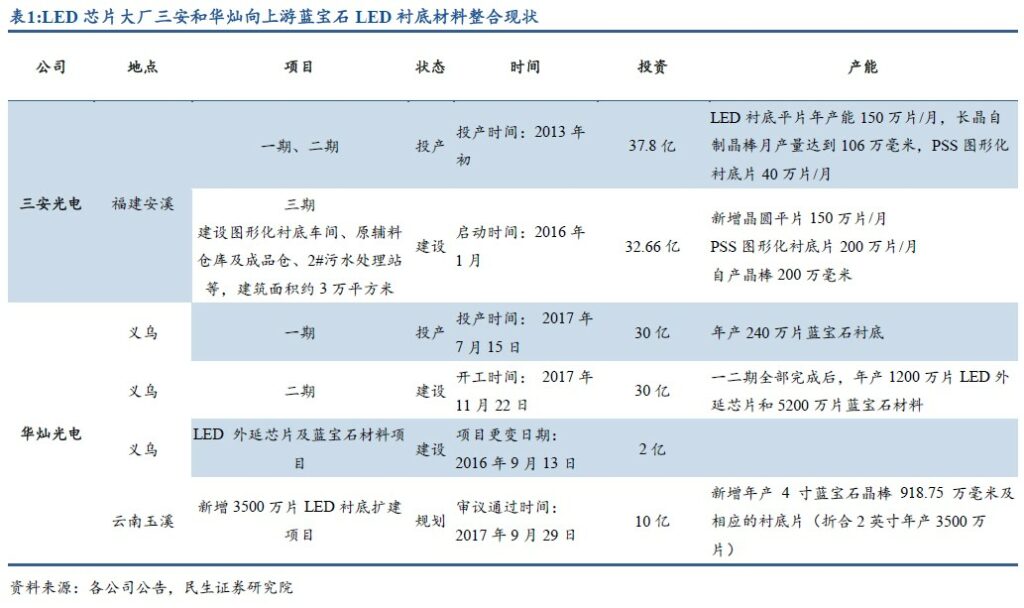

The leading LED chip company’s sapphire substrates are mainly self-made, which has less cost impact and is expected to fully benefit. Most of the major LED manufacturers in the industry use sapphire substrates and are mainly self-made. The main representatives are Nichia, OSRAM Opto, Lumileds, Seoul Semi, Epistar and Sanan Optoelectronics, etc. Sanan Optoelectronics promotes LED substrates in Anxi, Fujian. The bottom production line and related supporting facilities, with an investment of up to CNY7B, have been put into operation in 2013. Through the integration of upstream sapphire substrate materials, LED chip manufacturers can effectively integrate internal resources, accumulate technology, and form product groups. The increase in sapphire substrate prices has limited impact on the cost of chip leaders. (Minsheng Securities report)

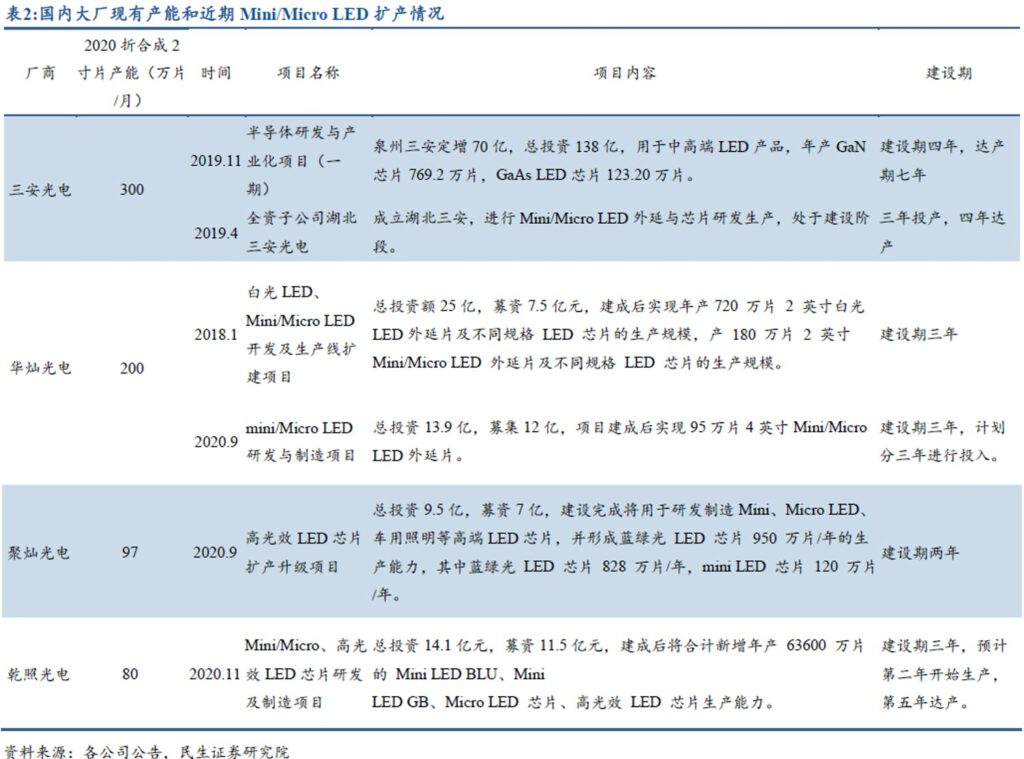

The market share of the top 5 manufacturers in 2020 is 72%, and the market share of the top 8 manufacturers is nearly 90%. The market structure tends to be concentrated. In recent years, the proportion of leading production capacity has steadily increased, and the total output value of San’an, HC Semitek, and Aoyang in China has increased from 44% in 2016 to 71% in 2018. Under the new format of the LED industry, the capacity construction of leading enterprises is mainly concentrated in high-end areas such as Mini / Micro LED. (Minsheng Securities report)

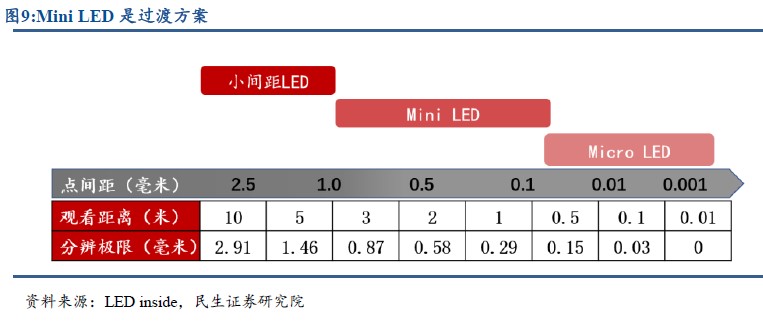

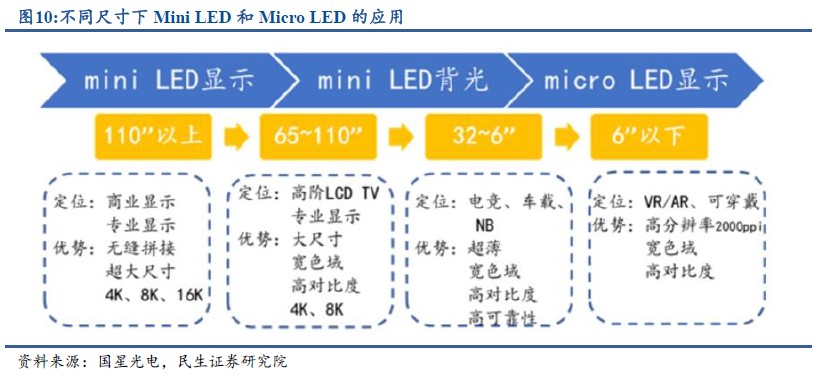

Regarding the division of Mini LED and Micro LED, there is no strict definition. The industry generally regards the size of 75μm as the boundary between the two, 75-300μm is Mini LED, and the smaller is Micro LED. Micro LED is generally used directly for LED direct display, while Mini LED is mainly used as LCD backlight source to improve display quality in addition to LED direct display. (Minsheng Securities report)

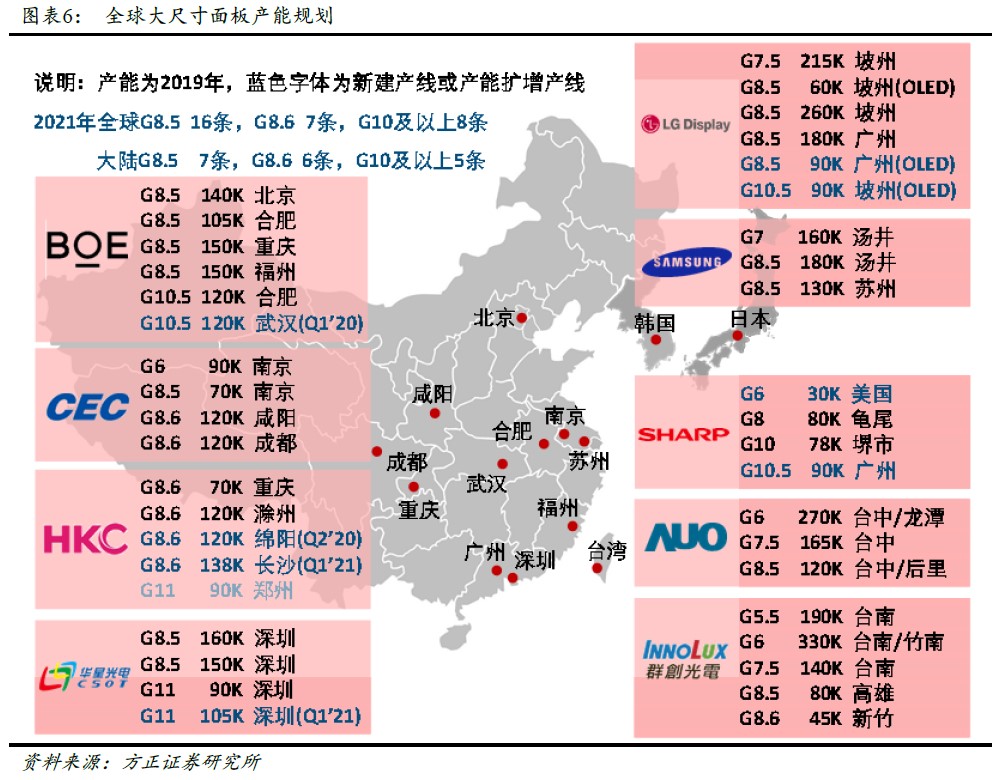

Since 2017, with the continuous investment of Mainland China in the Gen 8.5 and Gen 10.5 production lines, the global LCD panel production capacity has gradually increased. According to IHS, Mainland China has surpassed South Korea in 2018, becoming the largest source of production capacity for LCD display panels. LCD TV panel shipments are expected to rise to 57% in 2020. In the future, large-size LCD displays will be dominated by Chinese manufacturers. (Founder Securities report)

The average investment in Mini LED projects is relatively high, and domestic manufacturers have expanded their production capacity. Taking Focus Lightings as an example, in the high-performance LED chip expansion and upgrading project in 2020, the total investment is CNY949M, and the equipment purchase is CNY815M. The total price of Mini LED equipment is CNY234M, and the production capacity is 1.2M pieces/year after completion; the total price of blue and green LED equipment is CNY581M, and the production capacity is 8.28M pieces/year after completion. The equipment investment per 10,000 pieces of annual production capacity for Mini LED is CNY1.95M, and for blue and green LEDs is CNY702K. Domestic manufacturers are optimistic about the application prospects of Mini LED. Since 2020, relevant projects have been established, involving all links of the Mini LED industry chain. (Minsheng Securities report)

Samsung Display’s sales from smartphone OLED panel will exceed USD5B in 1Q21, according to Omdia. In 4Q20, 62.8% of smartphones will use OLED panels, Omdia said. LCD panels will take up 31.8%. (Gizmo China, The Elec)

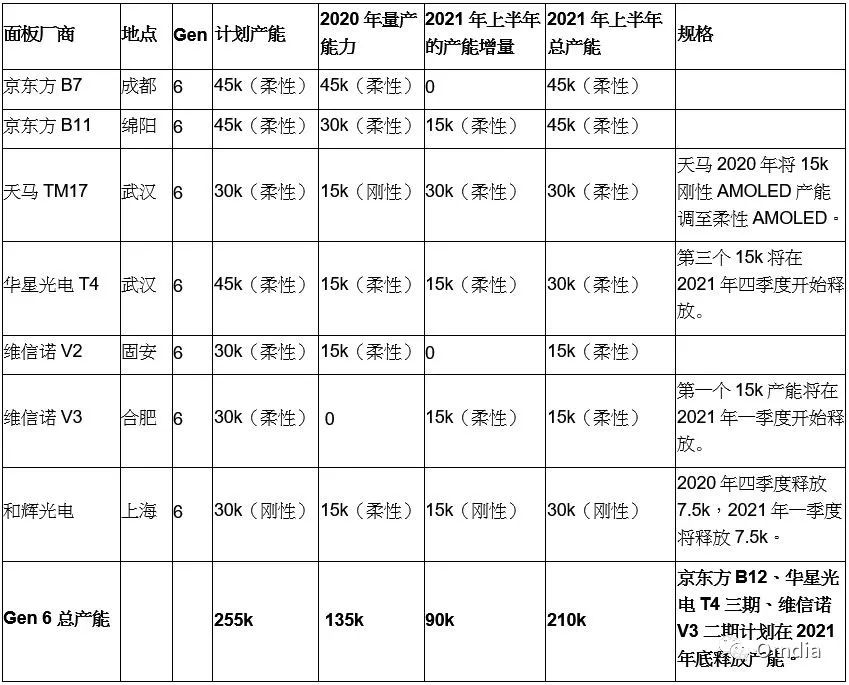

According to Omdia, based on substrate calculation, the mass production capacity of Mainland China’s Gen-6 flexible AMOLED in 2020 will be 105K pieces per month. Approximately 75K pieces of flexible AMOLED and 15K pieces of rigid AMOLED will enter the supply chain, and panel investment is planned for early 2021. Chinese rigid AMOLED suppliers will enter the supply chain of first-tier brands. At the same time, flexible AMOLED suppliers will face serious low-cost competition in 2021. (199IT)

Samsung Display has announced that the company plans to introduce more than 10 different AMOLED displays for the laptop market in 2021. The company will launch displays ranging from 13.3” to 16” to meet customer demand. (GizChina, The Elec)

LG is introducing 48” Bendable Cinematic Sound OLED (CSO) display, which can be used as a conventional flatscreen TV or transformed into a display with a curvature radius of 1,000R (bent up to a radius of 1,000mm, basically). LG claims the display has a response time of 0.1ms and a refresh rate of 120Hz, ideal for PC and next-gen console gaming. (Pocket-Lint, Business Korea, The Verge, IT Home)

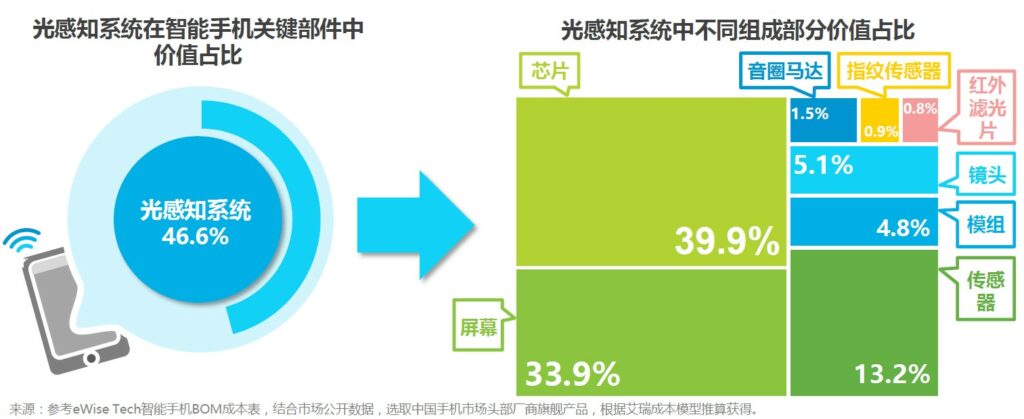

The imaging system is a high-value component of smart phones, accounting for nearly 50% of the value of key components of smartphones. The smartphone imaging system is mainly composed of chips, display, algorithms, and lens. The lens groups specifically include lenses, voice coil motors, sensors, modules, and infrared filters. The screen and lens group, which are more intuitive for consumers, account for approximately 34% and 26% of the value of the imaging system. In the future, AI capabilities with large screens, multiple cameras, and collaborative upgrades of software and hardware will help the optical perception system to become an incremental factor in breaking the deadlock in the smartphone market. (iResearch report)

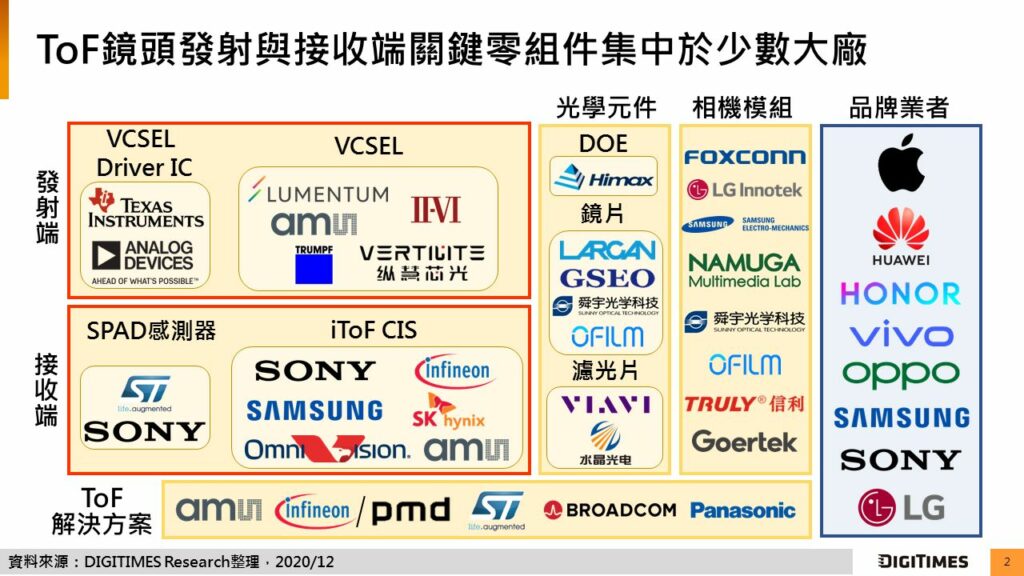

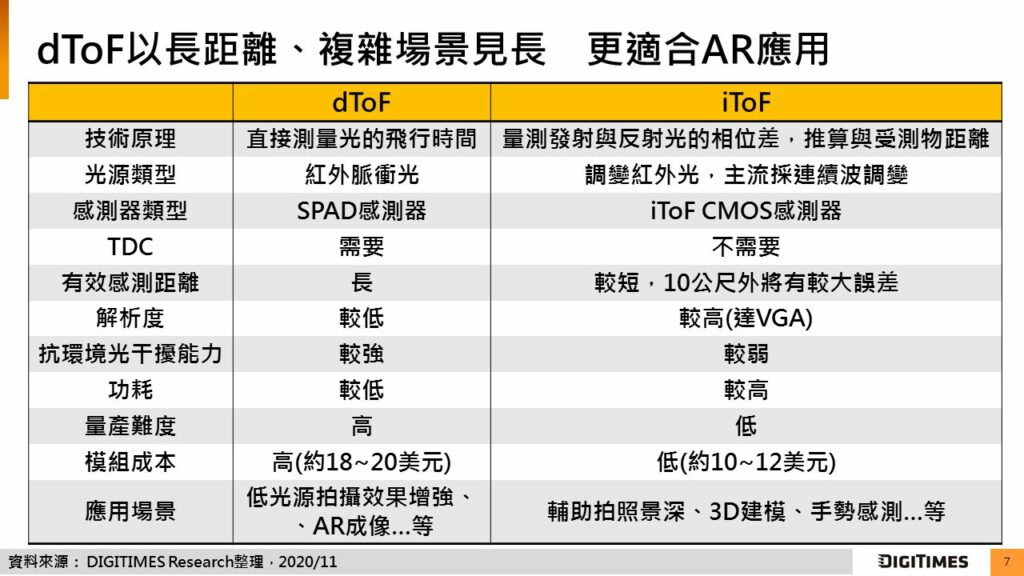

Android-camp handset vendors including Samsung Electronics are expected to follow in the footsteps of Apple in incorporating direct time-of-flight (dToF) CMOS image sensors (CIS) into their new models in 2021-2022, and Taiwan’s III-V semiconductor players including GaAs foundries Win Semiconductors and Advanced Wireless Semiconductor and epi wafer supplier Visual Photonics Epitaxy are poised to enjoy shipment pull-ins for VCSEL chips as light source for the dToF CIS devices in 2H21 at the earliest, according to Digitimes. (Digitimes, press)

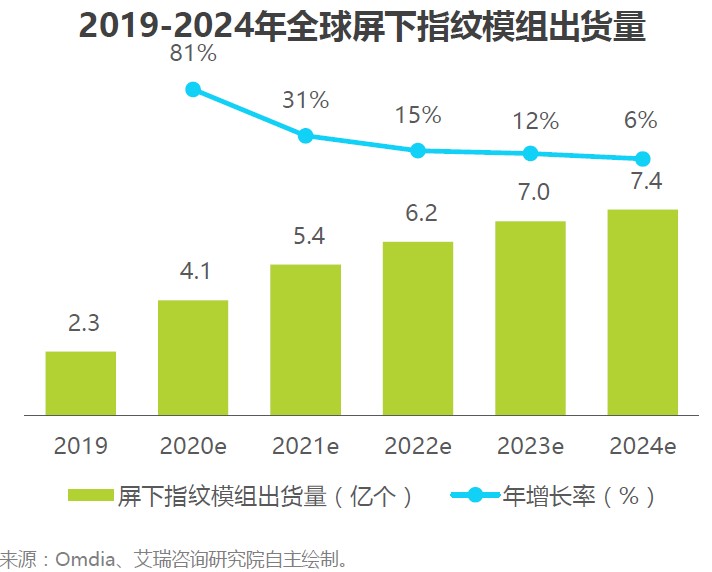

Currently, the under-screen fingerprint recognition technology represented by the optical solution and the ultrasonic solution has matured and been mass-produced. The shipment of under-screen fingerprint modules has reached 230M units in 2019 and is expected to continue to increase steadily in the future. At the same time, due to price and technical advantages, the application and popularity of optical fingerprint recognition will be higher than that of ultrasonic solutions, occupying a relatively dominant position in the under-screen recognition market. (iResearch report)

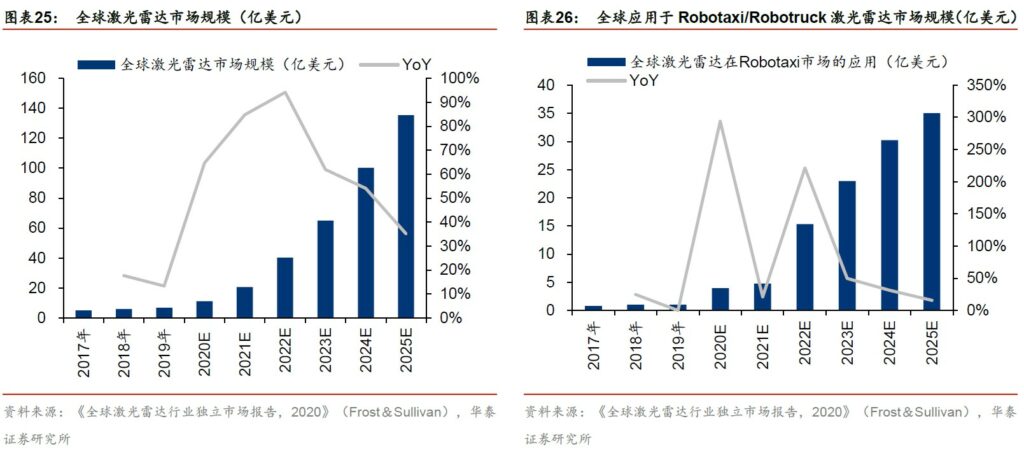

The ranging principle of lidar can be divided into ToF and FMCW. The former is more advanced in the maturity of the industry chain and has become the main method used in the current market. ToF: Time of flight method, which directly measures the time difference between the emitted laser and the echo signal. FMCW: Coherent ranging method, which linearly modulates the optical frequency of the emitted laser and obtains the frequency difference through coherent frequency rejection of the echo signal and the reference light, thereby indirectly obtaining the flight time to reverse the target distance. Aiming at the ToF principle, from the technical realization path, lidar can be divided into mechanical, mixed solid and pure solid. (Huatai Securities report)

Common light sources for lidar include 3 types: edge-emitting lasers, vertical surface-emitting lasers, and fiber lasers. The factors that need to be considered comprehensively when selecting a light source include: 1. Eye protection, 2. Detection distance, and 3. Comprehensive cost. (Huatai Securities report)

According to Frost & Sullivan’s prediction, the global lidar market will reach USD13.54B by 2025, with a compound growth rate of 64.65% from 2020 to 2025. In terms of market segmentation, in the Robotaxi / Robotruck field, with its commercialization, lidar with high-precision surveying and mapping capabilities is expected to usher in a rapid upswing period. Frost & Sullivan predicts that the global market size is expected to reach USD3.5B in 2025. The compound growth rate from 2020 to 2025 is 80.89%. (Huatai Securities report)

Consumer electronic batteries are energy storage tools that provide power for consumer electronic products. They mainly refer to lithium-ion batteries. They refer to secondary batteries that use lithium intercalation compounds as positive and negative materials. They have high energy density, long cycle life, and charge and discharge performance. Its industrial chain mainly includes upstream raw materials, battery cell composition, consumer batteries, battery packs. (Sinolink Securities report)

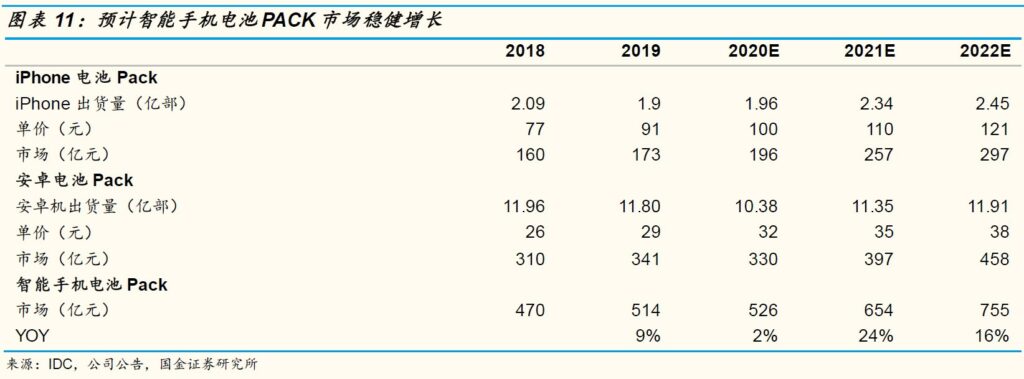

It is expected that with the easing of the epidemic and the recovery of consumption, the sales of mobile phones will resume growth in 2021; with the increase in power consumption, the proportion of dual cells and special-shaped cells will increase, and the value of single-cell batteries will increase by 10% year by year from 2020 to 2022. The smartphone battery pack market is expected to reach CNY52.6B, CNY65.4B, and CNY75.5B from 2020 to 2022, an increase of 2%, 24%, and 16%. (Sinolink Securities report)

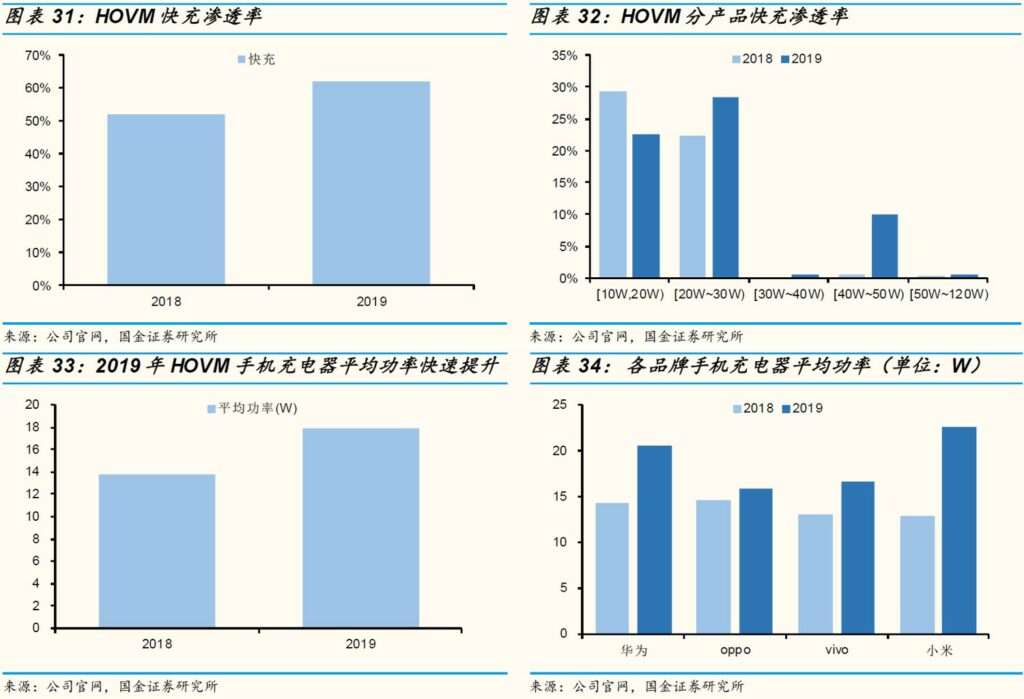

According to Sinolink Securities, Huawei, OPPO, vivo and Xiaomi fast charge penetration rates in 2018 and 2019 are 52% and 62%, of which 20W~30W fast charge penetration rates were 22% and 28%, and fast charge penetration rates above 30W is 1%, 11%, corresponding to the average power of Huawei, OPPO, vivo and Xiaomi mobile phone chargers in 2018 and 2019 are 13.8W, 17.8W, the same increase in 2019 by 29%. The average power of Huawei and Xiaomi are 20.6W, 22.6W, increase of 44%, 75%, respectively. (Sinolink Securities report)

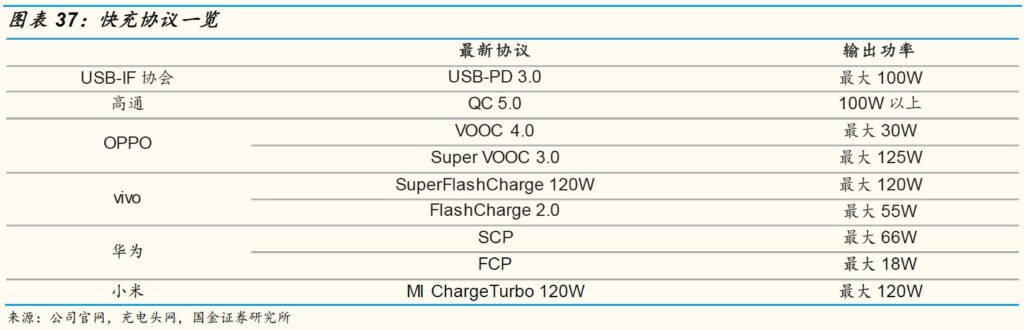

Apple uses common protocols, while Huawei, OPPO, vivo and Xiaomi use proprietary protocols. 1) The mainstream fast charging protocols in the current market include general protocols (PD protocol) and proprietary protocols (such as OPPO’s VOOC, Huawei’s FCP, SCP, vivo’s Flash Charge protocol, and Xiaomi’s fast flash charging protocol). 2) Apple has supported universal protocol PD fast charging since iPhone 8. 2) Currently, most Android smartphones are based on proprietary protocols and only support low-wattage PD fast charging. The charging efficiency of PD chargers is far less than that of original chargers. (Sinolink Securities report)

Wireless charging technology is mainly divided into 4 types: electromagnetic induction, magnetic resonance, electric field coupling, and radio wave. At present, the technology is relatively mature and widely used in the market are electromagnetic induction and magnetic resonance. (Sinolink Securities report)

China Compulsory Certificate (3C) has now certified a Huawei charger with a model HW-200675CP0 that supports charging output of 15W, 27W, 60W, 75W, 94W, and even 135W. (CN Beta, Huawei Central)

Ericsson’s CEO Borje Ekholm has pressured a Swedish minister to reverse a ban on including Huawei and ZTE in the country’s 5G roll-out. The Swedish telecom giant derives about 10% of its sales from China and is Huawei’s biggest rival in the market for cellular radio equipment. (Gizmo China, Bloomberg, DW, Sina)

Omdia has indicated that Gigabit services are now widespread, with over 300 service providers across all major regions offering at least 1Gbit/s download speeds. Omdia has seen a steady increase in 10Gbit/s operators from 29 in 2019 to 36 in 2020. Omdia expects more than 187M gigabit broadband subscribers worldwide by 2025, representing 16% of all consumer fixed broadband subscriptions. Most of these subscriptions will be in China, followed by the US, South Korea and Japan. (CN Beta, LightReading, Sina)

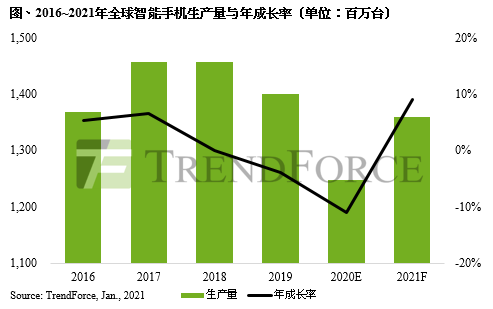

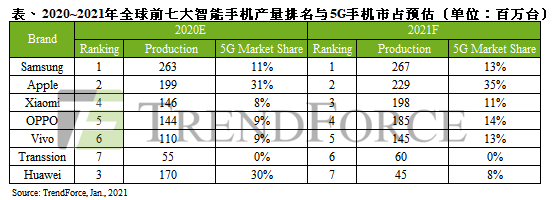

According to TrendForce, the global smartphone market in 2020 is hit by the epidemic, and the total annual production volume is only 1.25B units, a decrease of 11% on year, the largest decline in history. The top 6 brands in the world are Samsung, Apple, Huawei, Xiaomi, OPPO and vivo. Compared with 2019, the biggest difference is the change in Huawei’s market share. TrendForce has further pointed out that from early 2021, Honor will be officially split from Huawei. Looking forward to 2021, the global smartphone industry is expected to recover stably. Through periodic replacement demand and support from emerging markets, it is estimated that the total annual production will grow to 1.3B units with 9% increase on year. (My Drivers, TrendForce)

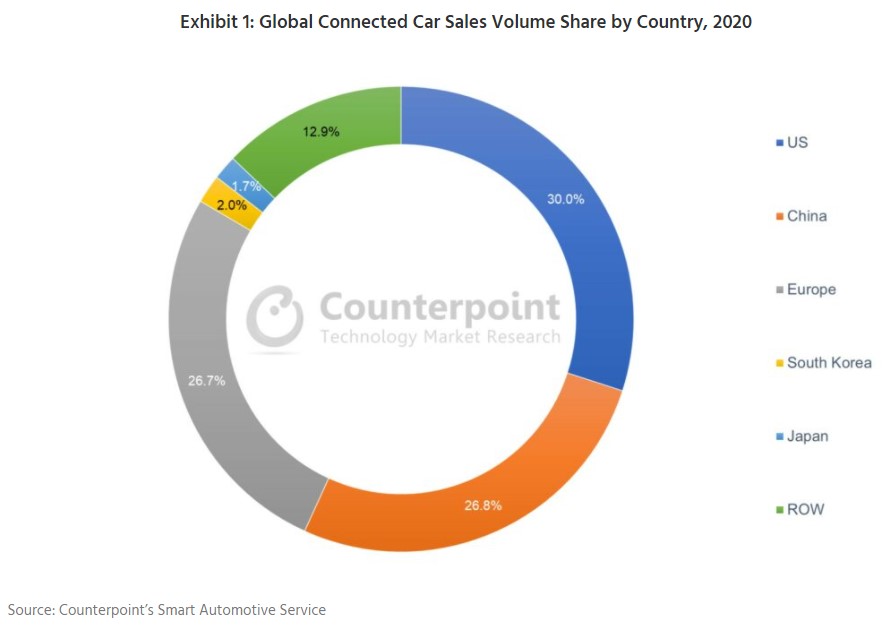

5G connected car sales volume in China will jump to 7.1M units in 2025, accounting for 40% of the country’s total connected car sales volume, according to Counterpoint Research. Currently, 4G dominates China’s connected car market. The sales volume of 4G connected cars are expected to reach 7.8M units in 2020 to account for 95% of the country’s total connected car sales volume. Government incentives such as a plan to issue USD535.6B (CNY3.7T) special-purpose bonds in 2020 to promote strategic sectors like 5G, Made in China 2025 will also drive 5G adoption by China’s automotive industry. (199IT, Counterpoint Research)

Foxconn Technology Group is reportedly in talks to invest in embattled Chinese electric-vehicle startup Byton in a deal that could mark a large bet by the iPhone assembler on the car-making business. Foxconn plans to invest around USD200M and the companies aim to start mass production of the Byton M-Byte by 1Q22. (Laoyaoba, Sohu, Sina, IT Home, Bloomberg)