1-19 #InnerPeace : Trump administration asks Huawei suppliers to revoke certain licenses; Samsung is gradually removing the accessories from its phones; Smartisan would not be making smartphones in the future; etc.

Samsung is allegedly releasing the Exynos PC processor in 4Q21. The processor will be based on Samsung’s latest Exynos 2100 design and use a 5nm process technology. It would also use AMD GPU. (GizChina, WCCFTech, Twitter)

The Trump administration has allegedly notified Huawei suppliers, including Intel, that it is revoking certain licenses to sell to the Chinese company and intends to reject dozens of other applications to supply the telecommunications firm. The Commerce Department intends to reject several other applications to supply to Huawei. (Reuters, Android Central, Laoyaoba)

Samsung Electronics’ Foundry Business Department is expected to be unable to meet demand for its 5nm mobile application processor Exynos 2100 from the company’s Wireless Business Department. The Foundry Business Department needs to allocate production volume to customers as it cannot meet all orders. As the company has to adjust the output of the Exynos, it may reduce the production volume of Qualcomm chips. (Laoyaoba, Business Korea)

Ford has ordered a month-long production halt at one of its plants in Germany, the latest sign that a global shortage of computer chips is putting carmakers under increasing pressure and threatening their recovery from the pandemic. Volkswagen, Fiat Chrysler, Toyota, Nissan and Honda are among the other automakers suffering from the shortage of chips, which are used in a growing number of applications including driver assistance systems and navigation control. The average car has between 50-150 chips. (CN Beta, CNN, Bloomberg, IHS Markit)

The American Automotive Policy Council — a lobbying organization for General Motors, Ford Motor and the U.S. operations of Fiat Chrysler Automobiles — is agitating with the U.S. Commerce Department and the incoming administration of President-elect Joe Biden to press Asian semiconductor makers to reallocate output away from consumer electronics and build essential chips for cars. (Laoyaoba, Bloomberg)

Honda will shut its UK factory for 4 days in mid-Jan 2021 as global supply chain problems caused by the coronavirus pandemic continue to plague the Japanese carmaker. The shortage of semiconductors has affected carmakers across the world with Volkswagen, Nissan and General Motors all tapering production because of difficulties in sourcing parts. (CN Beta, Auto Car, Financial Times, The Guardian)

BOE and Changan Automobile have signed a strategic cooperation agreement. Based on their own advantageous resources, both companies will carry out in-depth cooperation in the field of intelligent travel, establish joint innovation laboratory, and jointly build a world leading intelligent cockpit solution. (Laoyaoba, Sohu)

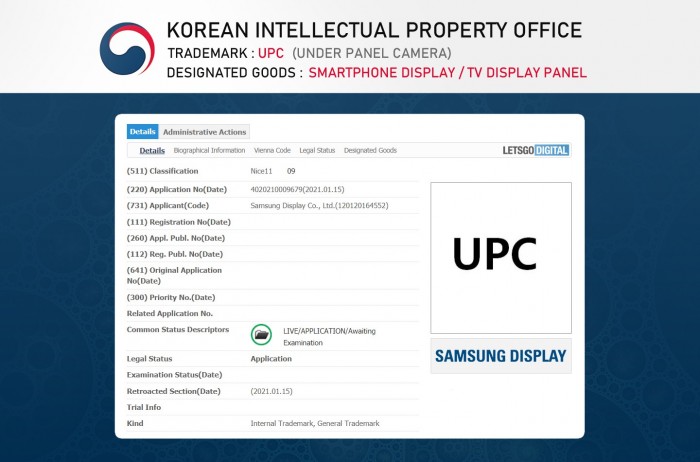

Samsung Display has applied for trademark registration of “UPC” (Under Panel Camera) in South Korea. The trademark description states that Samsung wants to use the name in new smartphones, laptops and smart TVs. It is not yet clear which Galaxy smartphone will first feature this technology. (CN Beta, LetsGoDigital, GizChina)

Huawei has applied for a new patent for a smartphone that features an under screen selfie camera along with a bezel display. Huawei has managed to house a thin strip display on the top bezel of the screen. The purpose of this tiny screen is to display basic information like the time, network status and signals. (My Drivers, Gizmo China)

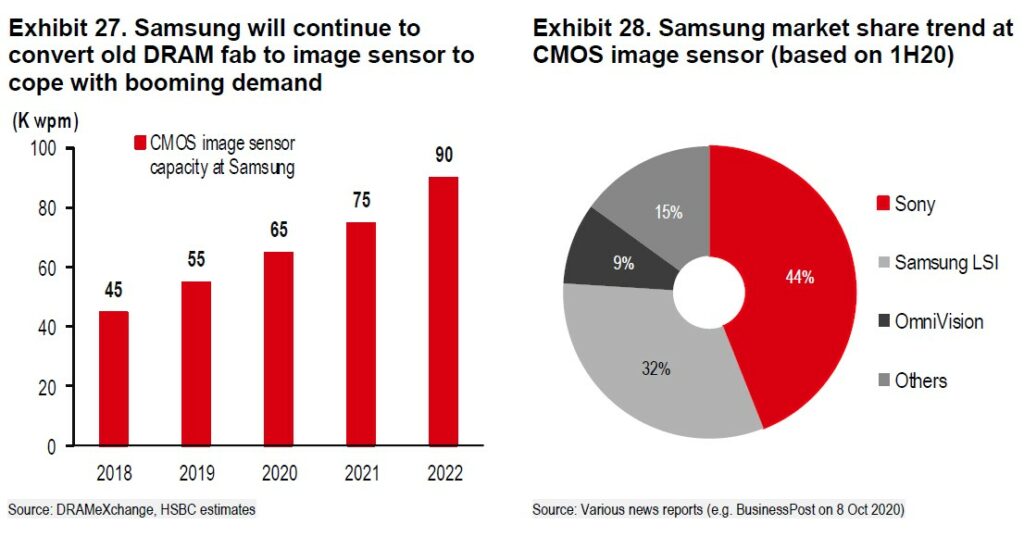

Considering the CMOS image sensor conversion from old DRAM at Samsung by 30-50k wpm capacity, real capex will show a slight YoY decline even in 2021 if there is no additional capex implementation during 2H21. UBS assumes DRAM capacity will show around 4% YoY growth in 4Q21. Overall, DRAM makers’ capex policies still look to be conservative and capital intensity of DRAM industry will likely hover in a 19-23% range during 2020-2022, which would be below the 10-year average of 25%. There is about a 6-month lead time between capex implementation and output increase. (HSBC report)

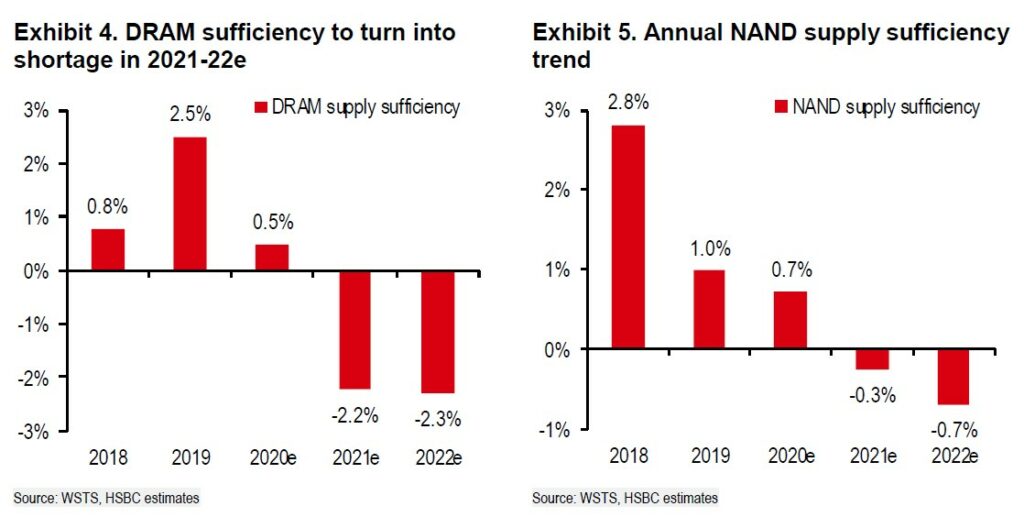

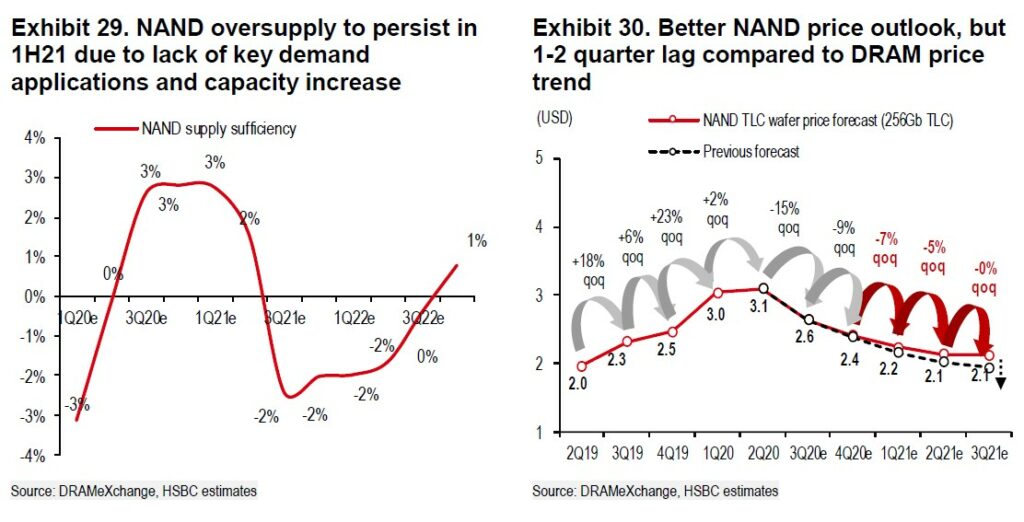

HSBC forecasts the DRAM market to grow 26% YoY to USD82.4B in 2021 after 5% YoY growth in 2020. As they see another 3% ASP hike and expect the DRAM upcycle to continue until 2022, the DRAM market should show 23% YoY growth, reaching USD101B. HSBC forecasts the NAND market to grow only 7% YoY to USD54.6B in 2021 after 27% y-o-y growth in 2020. However, as they see a more balanced market with a 3% ASP hike in 2022, they forecast the NAND market will expand 34% YoY to USD72.9B. (HSBC report)

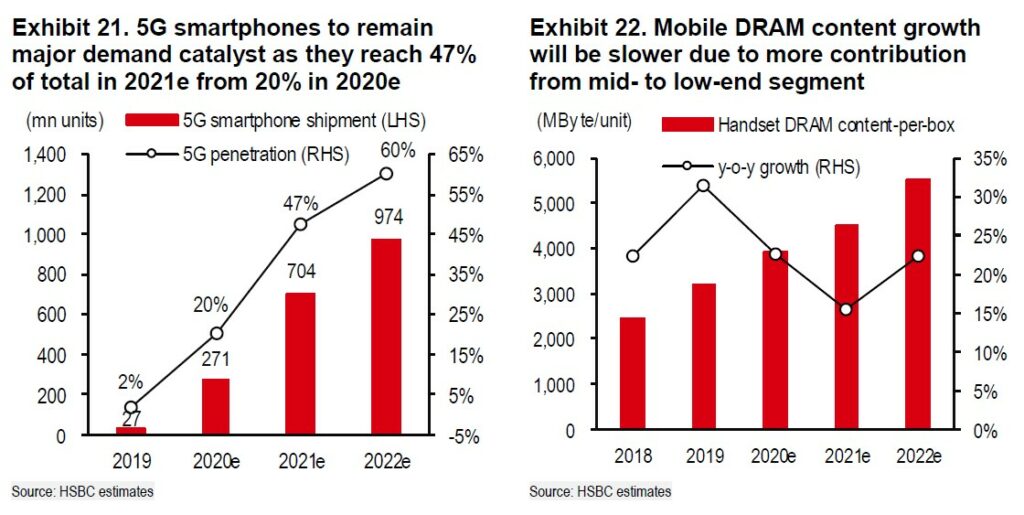

UBS expects proliferation of 5G smartphones will be a major demand catalyst for DRAM in 2021, consuming 20-24% of DRAM (from 2% in 2019). UBS sees a marginal DRAM demand increase of 6% from faster rollout of 5G services than they have previously expected, and faster 5G smartphone sales should result in a 2-3% DRAM shortage in 2021. Their estimates are based on: 1) 704M unit shipments of 5G smartphones (47% of total); and 2) average 6-8GB mobile DRAM content per 5G smartphone (vs. average 5.4GB per smartphone in 2021). (HSBC report)

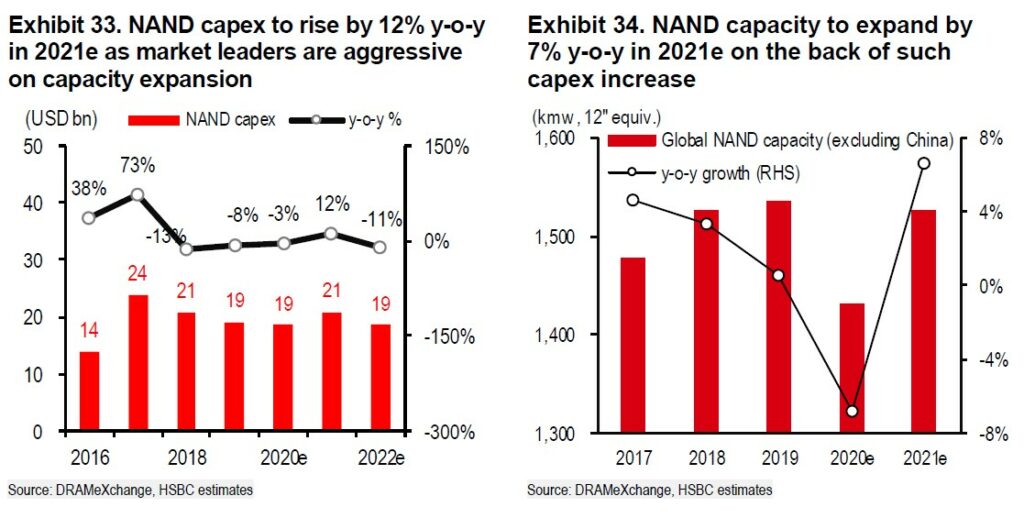

The NAND market growth will be weaker as HSBC expects the timing of a price rebound will be 1-2 quarters later than DRAM given 1) relatively aggressive NAND capex and capacity increases at +12% and +7% YoY during 2020-2021, respectively; 2) prolonged oversupply from lack of key applications to cause relatively weaker demand than for DRAM; and 3) slower NAND content increase in PCs and smartphones amid demand growth mainly coming from mid-to-low segments. During down-cycles, Samsung is usually more aggressive than others for cost curve by moving ahead. (HSBC report)

HSBC expects NAND capex to surge in 2021 by 12% YoY even during a continued NAND price decline. Industry leaders’ appetite to gain market share will likely accelerate output increase and expect this trend will persist throughout 2021. The announced consolidation between Intel NAND and Hynix is generating the appetite to improve economies of scale further before large competitors come into the market. Slower yield ramp-up at leading-edge tech such as 128L and 176L is another reason for aggressive investment in capacity in order to achieve market average NAND bit growth of 30-40% YoY. (HSBC report)

Samsung says it believes gradually removing the accessories from its phones could help make them more sustainable. Samsung’s President and Head of Mobile Communications Business TM Roh has confirmed that his company is working on gradually removing not just chargers, but also earphones from retail packages of its smartphones. (The Verge, Gizmo China, Sina, Samsung, Phone Arena)

ByteDance has suspended the mobile phone hardware business. The Chinese company, which owns TikTok has announced that it has integrated the R&D team established by Smartisan into its own educational hardware team. In other words, Smartisan would not be making smartphones in the future. (CN Beta, Sina, 36Kr, East Money, Gizmo China)

According to Digitimes, OPPO, vivo and Xiaomi have stepped up their purchases of ICs and basic components for their smartphones as part of their efforts to expand presence in the China market in 2021, with 30% more than in 4Q20. (Digitimes, Digitimes, Laoyaoba)

Meizu and Suning.com have signed a strategic cooperation agreement launching collaborative services. Meizu plans to add 300 + service outlets in Suning stores, and 4 new Meizu original service centers in Suning logistics base. (My Drivers, Sina)

Google has disputed claims from a group of attorneys general, led by Texas’ Ken Paxton, that its ad-buying arrangement with Facebook was anticompetitive. Google’s director of economic policy Adam Cohen has called the lawsuit from 10 Republican-led states “misleading.” (CN Beta, CNBC, Google)

Honor is reportedly working on a new line of smartphones that can run Google Services. The change is likely to affect the Honor X11 and Honor 40 phones. (GSM Arena, Kommersant, Sputniknews)

Vietnam has awarded a license to a unit of Taiwan’s Foxconn Technology to build a USD270M plant to produce laptops and tablets. The plant, to be developed by Fukang Technology, will be located in the northern province of Bac Giang and will annually produce 8M units. (Laoyaoba, Financial Post, Gizmo China, Reuters)

Self-driving startup Aurora has announced a partnership with PacCar to build and deploy autonomous trucks. It is Aurora’s first commercial application in trucking, and the company says it will combine its engineering teams around an “accelerated development program” to create driverless-capable trucks starting with the Peterbilt 479 and the Kenworth T680. (VentureBeat, Aroged)

General Motors (GM) has presented a futuristic flying Cadillac — a self-driving vehicle which takes off and lands vertically and carries the passenger above the streets and through the air. The single-passenger Cadillac – technically, a vertical take-off and landing (VTOL) drone – will be able to travel from urban rooftop to urban rooftop at speeds up to 55 miles/hour. (Gizmo China, Reuters, Sina)

Sony has announced that the company has completed the prototype of VISION-S and has begun trial on the public roads in Europe. Sony has been teaming up with Austrian contract car-builders Magna-Steyr, longtime builders of the Mercedes-Benz G-Wagen and many, many other models from the new Toyota Supra to the Jaguar I-Pace. (My Drivers, Sony, Green Car, Auto Car, The Drive)

Postmates X, the robotics division of the on-demand delivery startup that Uber acquired in 2020 for USD2.65B, is seeking investors in its bid to become a separate company. The startup is being referred to as Serve Robotics, a nod to the yellow and black-emblazoned autonomous sidewalk delivery bot that was developed and piloted by Postmates X. The Serve robot, which recently partnered with Pink Dot Stores for deliveries in West Hollywood, will likely be the centerpiece of the new startup. (CN Beta, TechCrunch, Fool)

Douyin, TikTok’s Chinese version, is launching “Douyin Pay” in China. The company claims that the set-up of Douyin Pay (“Douyin Zhifu”) is to supplement the existing major payment options, and to ultimately enhance user experience on Douyin. (TechCrunch, Sina, Fortune China)