1-26 #CantGoHome : amsung and Tesla are joining hands to make chips using the 5nm process; Samsung has reportedly lowered its shipment expectations for the Galaxy S21 series; Huawei says it has no plans to sell its mobile phone business at all; etc.

Samsung’s System LSI Business President Dr. Inyup Kang has confirmed that the “the next flagship product” would feature an AMD GPU. The custom GPU is earlier expected to make a debut in 2022. It now appears that the two companies are working ahead of schedule. Samsung may release AMD GPUs in 2021. The plan is apparently to make an announcement by 2Q21 / 3Q21. (Phone Arena)

HiSilicon Kirin 820E is quietly released, which is Huawei’s first 6-core chip. It includes three A76 2.22GHz large cores and three A55 1.84GHz small cores. Compared with Kirin 820, there is one 2.36GHz A76 super large core and one 1.84GHz A55 small core. The manufacturing process is still 7nm, and continue to integrate Mali-G57 MP6 GPU, Barong 5000 5G baseband, Da Vinci architecture NPU core. (My Drivers, CN Beta)

Japan’s Renesas Electronics, the Netherlands’ NXP Semiconductors and other chipmakers are raising prices on semiconductors that go into cars and telecom equipment as they attempt to maneuver out of a squeeze created by soaring demand and limited foundry capacity. The prices of these automotive chips will be raised by several percent, and those of chips for servers and industrial equipment will be increased by 10%-20% on average. (CN Beta, Asia Nikkei)

Tongxin Microelectronis has announced that working with payment solutions provider Goldpac are jointly developing security chip operating system “Linkai”. Linkai’s security chip operating system has completely rewritten the core code, streamlined optimization, and has larger user space and faster running speed, avoiding waste of resources. (CN Beta, Sina)

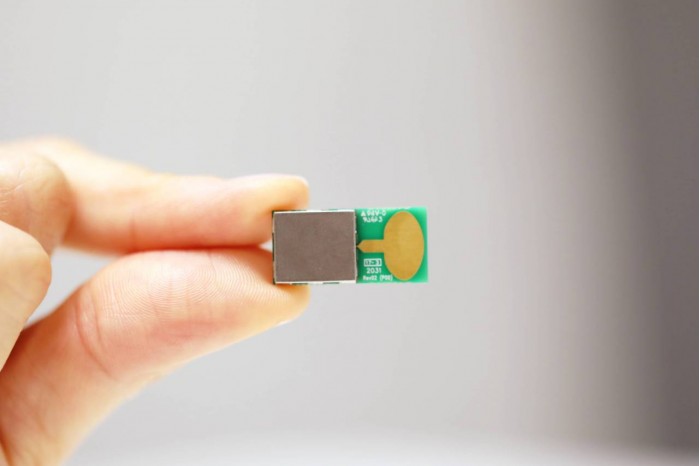

LG Innotek has developed a “digital car key module” that is five times more accurate than existing ones, making it easier for drivers to find their parked vehicles, as well as open or lock car doors and start engines using their mobile phones. (CN Beta, Korea Herald, Korea Times)

With TSMC and Samsung Electronics stepping up the development of their sub-5nm process technologies, ASML will continue to see strong extreme ultraviolet (EUV) lithography equipment sales boost its overall revenue in 2021, according to Digitimes. TSMC is expected to acquire about 18 sets of EUV equipment in 2021, adding that Samsung and Intel will also make further purchases of such tools to advance their manufacturing technologies. (WCCFtech, Digitimes, press, CN Beta)

Judging from MediaTek’s product roadmap, the chipmaker is expected to unveil the upgraded versions of its Dimensity 800 and 700 5G SoC lineups in 2Q21, according to Digitimes. MediaTek is expected to continue to emphasize the power-saving performances of its new Dimensity 700 and 800 SoCs. The two mid-tier chips will continue supporting sub-6GHz 5G, with enhanced multimedia capabilities and improved gaming performances. (Digitimes, press, Phone Arena, Digitimes)

Samsung is allegedly working on a new chipset with an aim to beat the performance of the Apple A14 Bionic. The new smartphone chipset could be launched in 1H21. (Gizmo China, IT Home)

Advanced Integrated Circuits (VIS), the automotive chipset unit or subsidiary of TSMC is reportedly considering increasing pricing by up to 15% while other foundries are also looking to do the same. If the companies decide to increase the pricing, it will be the second round of price increase since fall 2020. (Asia Nikkei, Gizmo China, My Drivers)

Taiwan’s Economic Ministry is asking domestic chip manufacturers such as TSMC to help “like-minded” economies alleviate the global shortage of automotive-related chips. The ministry has received multiple requests since the end of 2020 from several nations via diplomatic channels. The countries are asking Taiwan to help look into the lack of chips for the auto industry that has led to production cuts by leading carmakers such as Nissan, Honda, Ford, Daimler and Volkswagen. (Asia Nikkei, Gizmo China, Reuters, Wall Street CN)

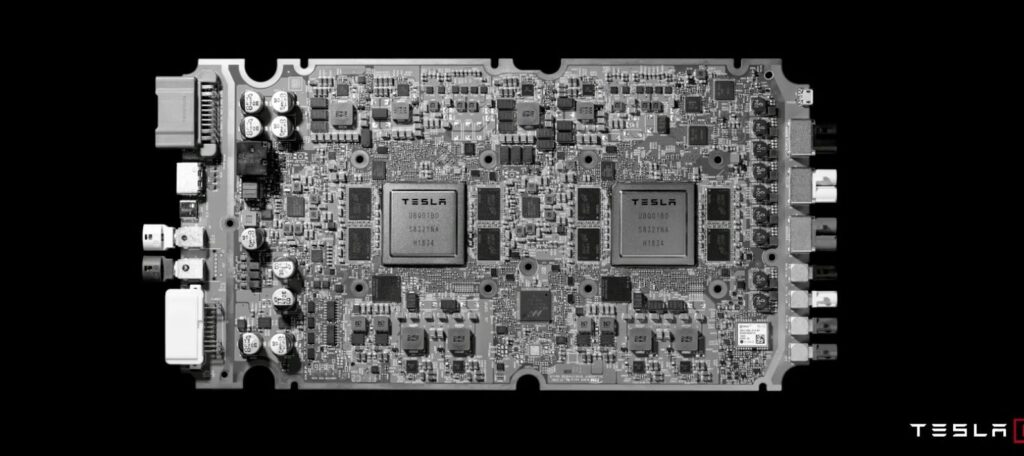

Samsung and Tesla are joining hands to make chips using the 5nm manufacturing process for autonomous driving. The chipset is being reported to be in Research & Development (R&D) stage using 5nm EUV process at the Samsung Foundry Division and it will be mounted on Tesla’s autonomous vehicles. (Gizmo China, Asiae, Electrek, Sohu, CNYES, Sina)

Xiaomi, OPPO and vivo are reportedly gearing up for the launch of a new foldable smartphone later in 2021. Samsung has apparently raised its shipments of foldable display, so there will also be a big wave of adoption of the firm’s seasoned flexible screen technology. (Gizmo China, Sohu, Sina, 163.com)

According to Omdia, automotive display shipment jumped 22% in 2020 from a year prior. It expects 351M units of automotive display 9” or larger were shipped in 2020. Growth in the area was led by center stack display (CDS), also known as center fascia. In 2020, CSD shipment jumped by 47% from the previous year, Omdia estimates. Instrument cluster display (ICD) was also propelling growth. ICD shipment increased by 11%. ICD accounted for around 30% of all automotive displays. (The Elec, Gizmo China)

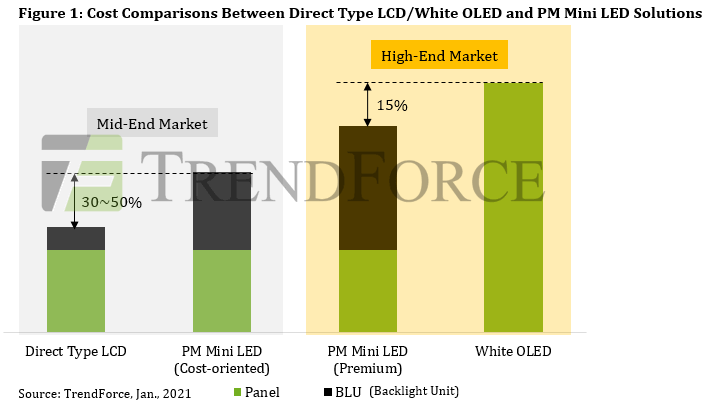

As various TV manufacturers such as Samsung, LG, and TCL announced their new models equipped with Mini LED backlights at CES 2021, TrendForce shows that total Mini LED chip revenue from Mini LED backlight TVs to potentially reach USD270M in 2021, as manufacturers gradually overcome technological bottlenecks and lower their overall manufacturing costs, according to TrendForce’s latest investigations. (TrendForce, TrendForce, Gizmo China, EET Asia)

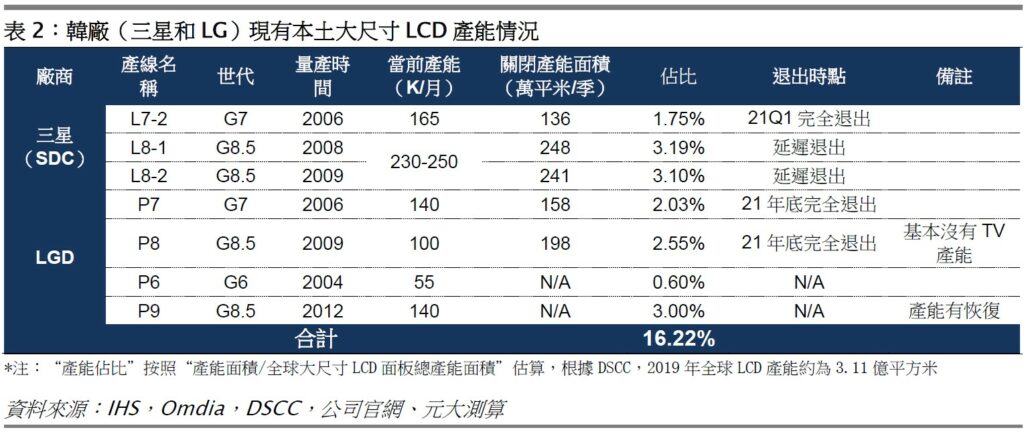

Currently the operating capacity of Korean factories (Samsung and LG’s production lines) account for approximately 16.22% of the global large-size panel capacity. It is originally planned that most of the production capacity will be withdrawn by the end of 2020. However, as the industry’s supply continues to be tight, to ensure the normal supply of their own terminal TV product panels, both Samsung and LG have announced the continue operating of their production lines. LG’s P7 and P8 production lines will definitely be delayed until the end of 2021. Samsung’s L7-2 production line will be shut down in 1Q21. The remaining two L8-1 and L8-2 production lines Samsung has not yet given a clear time to halt. (Yuanta Securities report)

According to Omdia, from the current planned production capacity, future new production capacity will come from Mainland China (AUO is the original production line expansion), including the Gen-10.5 line of BOE Wuhan (new B17, B9 is expansion of the original production line), TCL CSOT T7 Gen-10.5 line, Sharp Guangzhou Gen-10.5 line, and HKC’s three Gen-8.6 lines. Considering the expansion of the original production line, the total new capacity accounted for 16.7%, slightly higher the Korean vendors to withdraw about 4pcts of production capacity. Overall, the industry’s future net increase in production capacity is only about 5%. (Yuanta Securities report)

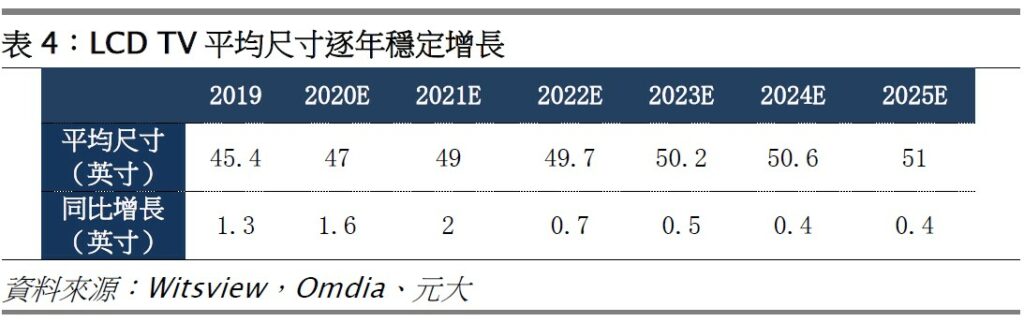

According to Omdia, the average TV size is expected to increase by 1.6” / 2” annually in 2020 and 2021. According to calculations, every 0.5” increase in the average panel size will bring an increase of 2%-3% on the demand side from the perspective of area. Therefore, if the sales volume remains unchanged, only an increase of 2” in the average size can drive an 8%-10% increase in the shipment area in 2021. In 2022 and beyond, it is expected that the trend of larger size will drive the shipment area on average. The growth rate is about 3%. (Yuanta Securities report)

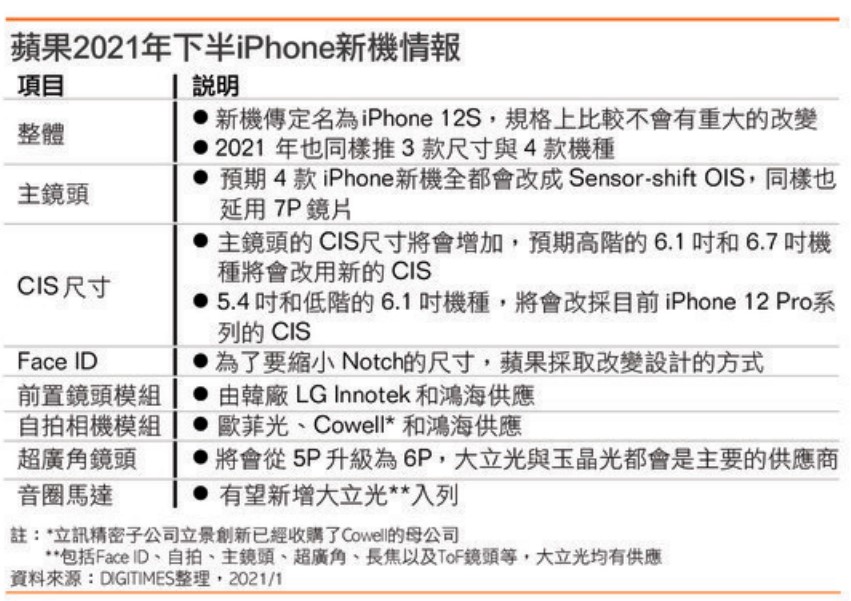

According Digitimes, Apple’s new iPhone to be launched in 2H21 would feature few upgrades—all 4 models would feature sensor-shift OIS (as compared to 1 model in iPhone 12 series); CIS of all 4 models would have bigger size. Additionally, Face ID would have different design, the notch size would shrink, and ultrawide angle lenses would be upgraded from 5P to 6P. (Mac Rumors, Digitimes, Digitimes)

Apple and Samsung are working to get blood sugar monitoring to their next smartwatch models. The feature uses an optical sensor that could detect blood glucose (sugar) levels, which is vital for people with diabetic conditions. This normally involves drawing blood and using a device that detect the amount of glucose within the sample of blood. (GSM Arena, ET News)

SpaceX has successfully launched its Transporter-1 mission earlier atop one of its Falcon 9 rockets. The mission is the first from the SmallSat Rideshare Program that lets organisations launch their satellites into different orbits for as low as USD1M. The mission broke records in terms of the number of satellites carried into space, the record was previously held by India which launched 104 satellites in 2017. (Neowin, TechCrunch, The Verge)

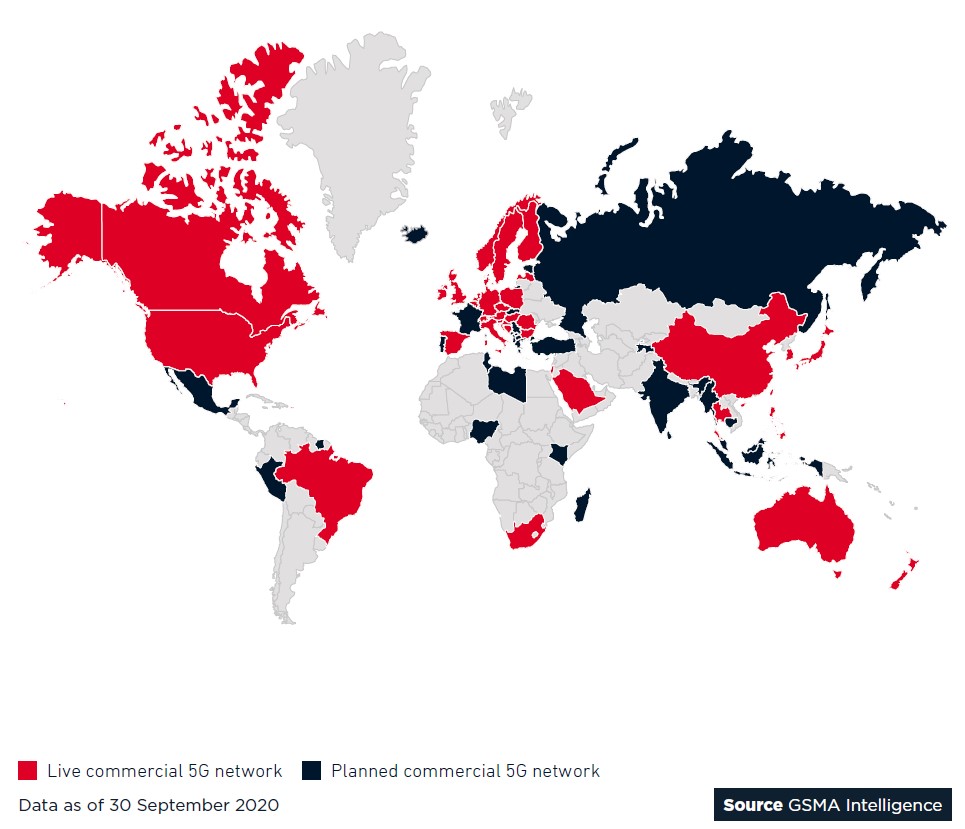

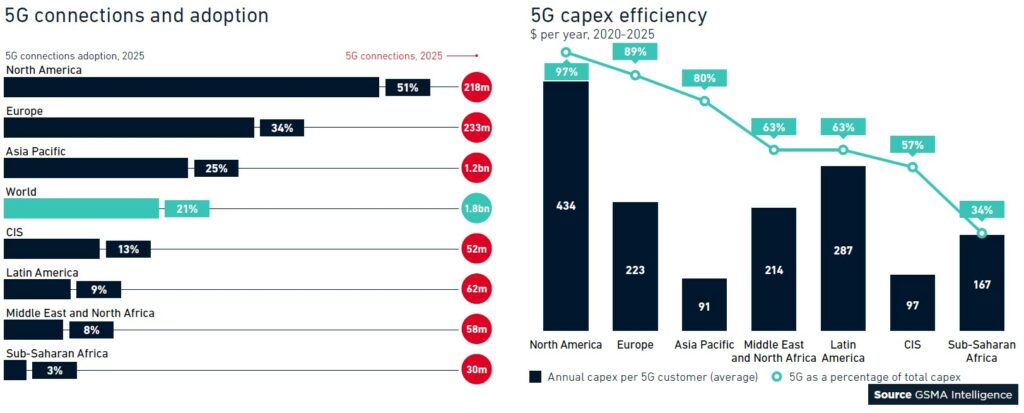

According to GSMA, there are now 113 operators with a 5G network across 48 countries. These operators collectively account for 40% of the global mobile subscriber base, presenting a large addressable audience. Launches so far have been concentrated in more mature markets, led by China, South Korea and the US. However, developing markets are now entering the 5G era – even if scale is minimal. Prominent examples include South Africa (MTN and Vodacom) and Brazil (Claro). (GSMA report)

Globally, GSMA forecasts operators will spend 80% of sector capex (USD890B) on 5G networks over the next 5 years, reaching 45% population coverage. There is an uneven regional skew to this distribution. One way of measuring this is to express capex relative to the anticipated customer base size. On this measure, the US is by far ahead of everyone else; this bodes well for quality and coverage but sets a high bar for the pricing premiums needed to recoup the investment. By contrast, Asia (mostly China) is much lower. (GSMA report)

Samsung has reportedly lowered its shipment expectations for the Galaxy S21 series. The company is estimating that it will ship a total of 26M Galaxy S21 units by the end of 2021—10M to be S21 standard version, 8M S21+, and 8M S21 Ultra. (Android Headlines, The Elec, CN Beta)

Huawei is allegedly in early-stage talks to sell its premium smartphone brands P and Mate, a move that could see the company eventually exit from the high-end smartphone-making business. According to IDC, 3Q19-3Q20 shipments of Mate and P Series phones were worth USD39.7B. (Android Authority, Reuters, My Drivers)

Huawei has responded to rumors about the sale of Mate and P series phones, saying that it has no plans to sell its mobile phone business at all and would insist on building a high-end smartphone brand. (GSM Arena, The Paper, MyFixGuide)

Huawei nova 7 SE 5G LOHAS Edition is announced in China – 6.5” 1080×2400 FHD+ HiD IPS, Kirin 820E, rear quad 64MP-8MP ultrawide-2MP macro-2MP depth + front 16MP, 8+128GB, Android 10.0 (no GMS), side fingerprint, 4000mAh 40W, CNY2,299 (USD355). (Huawei Central, Gizmo China, Huawei)

OPPO A55 5G is launched in China – 6.517” 720×1600 HD+ v-notch IPS, MediaTek Dimensity 700 5G, rear tri 13MP-2MP macro-2MP depth + front 8MP, 6+128GB, Android 11.0, side fingerprint, 5000mAh 10W, CNY1,599 (USD245). (GSM Arena, OPPO, CN Beta)

Faraday Future (FF) will allegedly push ahead with plans to produce some of its fully electric vehicles in China by opening a plant in the country and enlisting China’s Geely to provide contract manufacturing services. FF plans to locate the plant in a “tier one Chinese city” and envisions that it will have the capacity to make over 100,000 vehicles a year in its initial phase. FF is considering to add a research centre in the same city. (My Drivers, 163, Yahoo)

Boeing and NASA have set 25 Mar 2021, as the date for Starliner’s second unmanned flight test. Dubbed Orbital Flight Test- 2 (OFT-2), this will be the second major flight test for the spacecraft and a key developmental milestone for Boeing in its bid for the NASA Commercial Crew program. (CN Beta, Neowin, NASA)

Volkswagen plans to produce a new flagship next-generation electric car called “Trinity” that CEO Herbert Diess says will “revolutionize Volkswagen”. Volkswagen started building an electrification effort beyond compliance electric cars and focusing on full-fledged mass volume electric vehicles built on its new MEB platform. (Digital Trends, Twitter, Electrek)

BlackBerry has announced an expansion of its strategic partnership with Baidu, whose high-definition maps will run on the QNX Neutrino Real-time Operating System (RTOS) and will be mass-produced in the forthcoming GAC New Energy Aion models from the EV arm of GAC Group. (CN Beta, PR Newswire, TechCrunch, BlackBerry)

Wingcopter, a Darmstadt, Germany-based drone manufacturer, has raised USD22M in a funding round. The company says it will use the proceeds to expand its health care-related activities (including the distribution of COVID-19 vaccines), prepare for the launch of its next-gen drones, set up a partially automated production facility, and grow its team at a new U.S. complex. (VentureBeat, TechCrunch, EU Startups)

Alphabet CEO Sundar Pichai has announced that Google will be providing USD150M to promote COVID-19 vaccine education and to make information related to vaccination more equitably accessible to the public. Google will expand Google Search and Maps to make it easier for people to find when and where to get the COVID-19 vaccine at a local level. (GizChina, IT Home, Google, Business Today, Live Mint)