2-3 #GoingHome : MediaTek has entered Apple’s supply chain for Beats headphones; Visionox will receive large AMOLED orders from Huawei and Honor in 2021; Apple and Kia are allegedly close to reaching a deal; etc.

MediaTek has entered Apple’s supply chain for headphones, and the former will start supply starting from Feb / Mar 2021. Since Apple owns Beats and its headset factories, the company has chosen MediaTek to make some of the components for the headphones. (CN Beta, GizChina, GSM Arena, UDN)

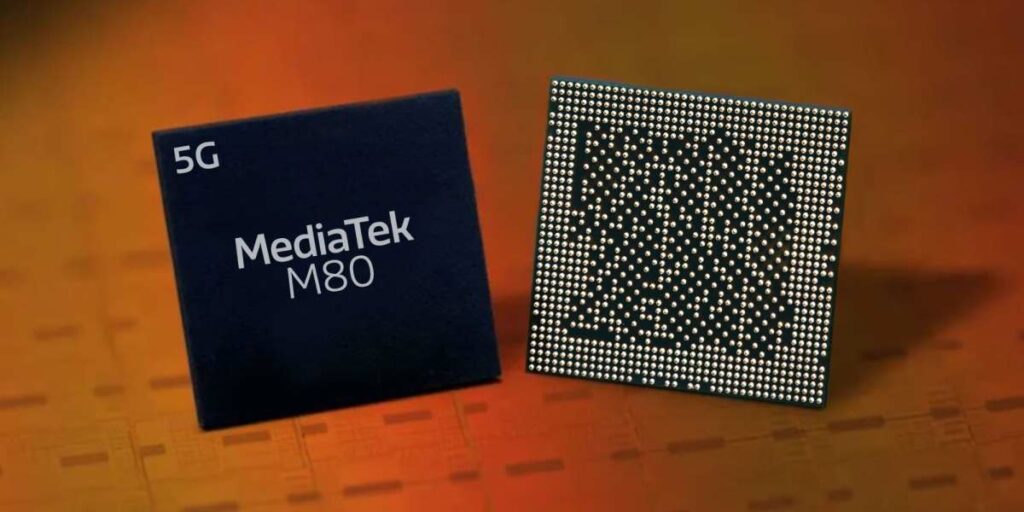

MediaTek is launching its latest 5G modem for smartphones, which is its first modem to support mmWave connectivity. The new M80 5G modem supports download and upload speeds of up to 7.67Gbps and 3.76Gbps, respectively. Devices equipped with the new 5G modem are expected to launch later in 2021. (Android Authority, Android Central, VentureBeat, PRNAsia)

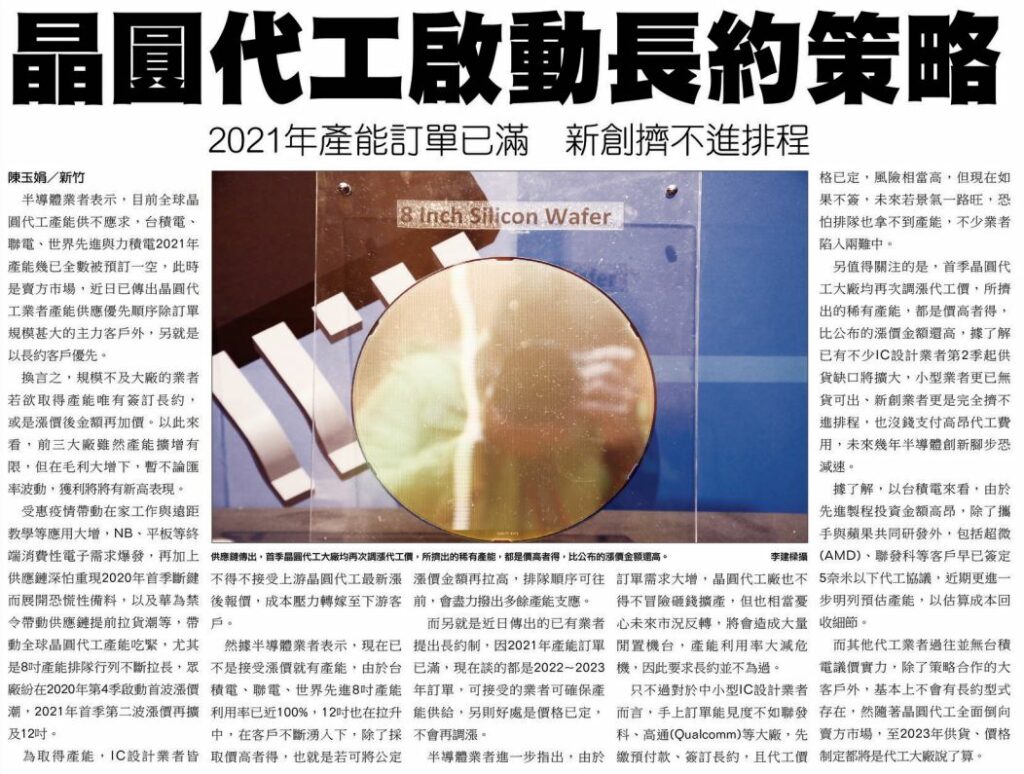

Pure-play foundry TSMC is aggressively looking for growth beyond demand from Apple, which is currently its biggest client, according to Digitimes. TSMC, which intends to rely less on orders placed by Apple, has been stepping up its deployments in the 5G, automotive electronics and high-performance computing fields. (Digitimes, press, Apple Insider, Digitimes)

Qualcomm has announced its plan to open a 5G R&D facility in France. The company hopes to expand its efforts in the local and global development of next-generation networks. With this addition, Qualcomm has 4 R&D centers in France. (GizChina, Qualcomm)

Honor is reportedly launching a foldable smartphone under the Honor’s Magic series in 2021. Honor CEO Zhao Ming has also revealed that the company would have its own “Mate” and “P” series. (Android Headlines, Pocket Now, Sina, IT Home)

Xiaomi’s foldable smartphone will reportedly adopt an internal folding design similar to that of the Samsung Galaxy Z Fold2, but the main screen does not have any openings. It would be the cheapest foldable smartphone. (CN Beta, Sohu)

According to information from Huawei’s supply chain, Visionox will receive large AMOLED orders from Huawei and Honor in 2021. For Huawei, it will order over 5M display panels. Honor will place an order of over 10M units. Visionox’s display orders for Huawei alone will exceed CNY6B (USD855M) in 2021. (GizChina, IT Home, C114, ZOL)

BOE has patented a new display solution that allows the visually impaired feel images. The solution is made up of two devices: the main device is a touch display that works with a smaller device that is worn on the finger. When the user wears the smaller tactile device and passes their hand over the touch device which is displaying an image, a sensor transmits information to the tactile device in form of haptic feedback that allows the user to “feel” what is being displayed. (CN Beta, Gizmo China, IT Home)

Corning has indicated that it is expanding production at its Gen 10.5 (2,940×3,370) liquid crystal display (LCD) glass substrate factories in China. Demand for 75” TV grew over 60% in 2020 from the previous year. Corning also has Gen 8.5 glass substrate plants in Beijing and Chongqing. (Gizmo China, The Elec, Sina)

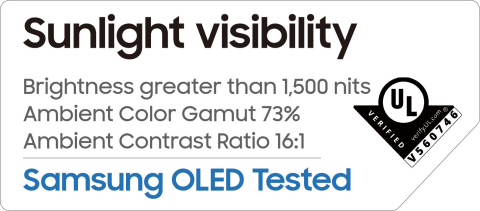

Samsung Display’s CEO Joo Sun Choi has unveiled a striking new OLED display that delivers bright and clear outdoor visibility. The new OLED panel achieved an ‘Ambient Color Gamut’ rating of 73% of the DCI (Digital Cinema Initiatives)-P3 standard, and a peak brightness of more than 1,500 nits (the maximum brightness that a single display can now provide). (GizChina, Business Wire, Sohu)

Lu Weibing, the General Manager of Redmi, has hinted at the arrival of more Redmi phones with a 108MP camera. He has revealed that more phones released in 2021 will have 100MP cameras. (Gizmo China, Sohu)

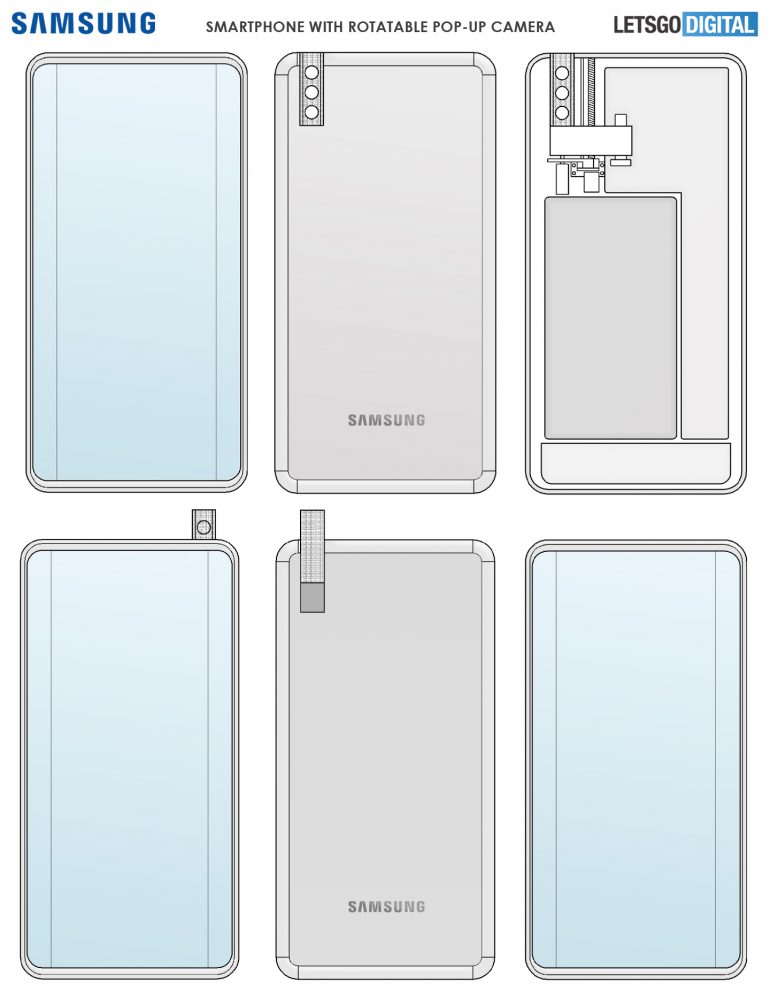

Samsung’s patent envisions a phone with a rotating pop-up rear camera array. The design describes a phone that may sport a triple rear camera with no dedicated selfie camera. However, if the user wants to snap a selfie, that rear camera array slides up and rotates 180-degrees to face the user. (Android Headlines, LetsGoDigital, Gizmo China, Android Authority)

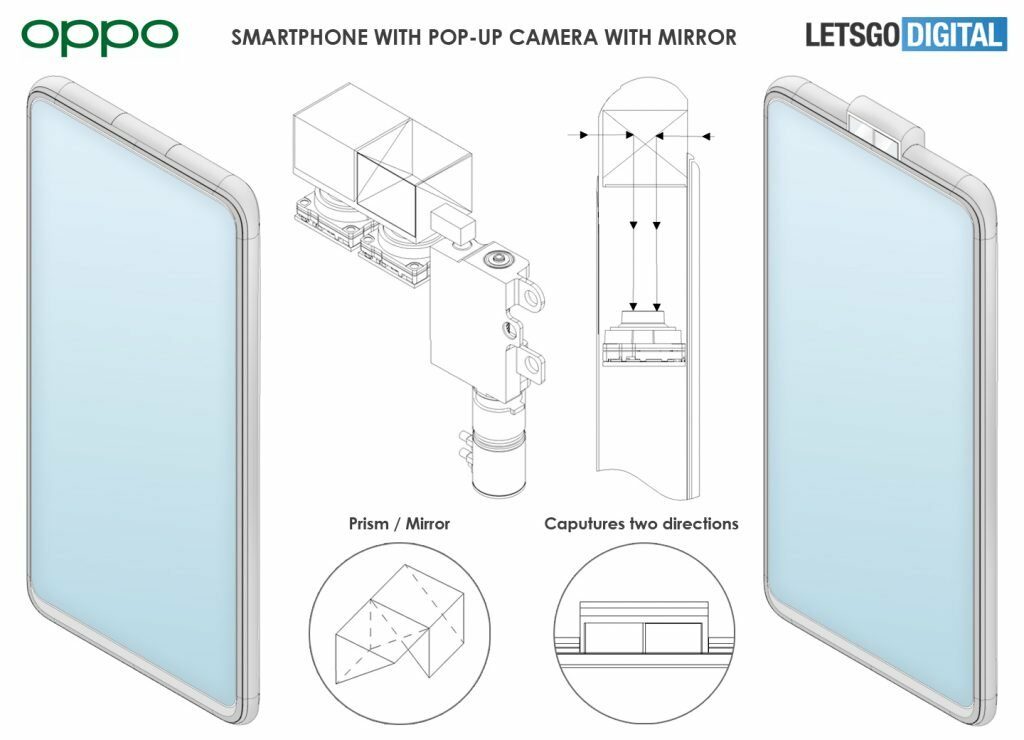

OPPO has filed a patent describing a double-sided pop-up camera with design with a reflective mirror. The patent shows two mirrors (shape of mirror / prism Δ). Additionally, OPPO is making only the reflective mirrors move up and down so as to keep the cameras intact. (Gizmo China, LetsGoDigital)

Noh Jong-won, executive vice president at SK Hynix has indicated that the company estimates for the DRAM market in 2021, demand growth is expected to be about 17-20%. In addition, the company expects that the demand for server products will increase by more than 30% in 2021, thanks to global investment in new data centers. The company also predicts that, in the context of increasing 5G smartphone shipments, demand for mobile DRAM will grow by more than 20% in 2021. The company expects global 5G smartphone shipments to double to 500M units in 2021. (SK Hynix, YNA, CN Beta, Korea Herald)

SK Hynix has completed the construction of its M16 fab, which will produce next-generation DRAM using extreme ultraviolet (EUV) process. The fab will begin producing Gen 4 10-nm (1a) DRAM in the second half of 2021. Construction for the factory began in Nov 2018 and the company invested KRW3.5T (USD310M) in its construction. (CN Beta, The Elec, SK Hynix)

Apple’s next iPhone could feature both Face ID and a version of Touch ID using an optical fingerprint scanner built into the display. The company is reportedly testing the in-display Touch ID. (Gizmo China, Apple Insider, WSJ)

Panasonic will reportedly withdraw from solar cells and panel production, as the former leading maker now faces fierce competition from Chinese rivals that can produce the items at a lower cost. Panasonic will quit manufacturing as early as Mar 2022 at factories in Malaysia and Japan’s Shimane Prefecture. (Gizmo China, Asia Nikkei, Sina)

Tesla will be granted at least EUR1B (USD1.2B) in public subsidies to continue developing battery cells. At the moment Tesla is building a factory, located near the national capital of Berlin, to manufacture such components. Germany’s Federal Ministry of Economics is encouraging in-country battery cell production by awarding funds from its Important Projects of Common European Interest (IPCEI) to manufacturers. (CN Beta, Electrive, Business Insider, NASDAQ)

Liu Bo, VP of OPPO and President of China Region, has announced a number of customer support policies to promote a comprehensive upgrade of channel strategies. Looking forward to the phone industry in 2021, it is one of OPPO’s important strategies to drive the overall brand into high-end. In addition to high-end brands, a channel strategy to support high-end products is also needed. (CN Beta, Sina, Sohu)

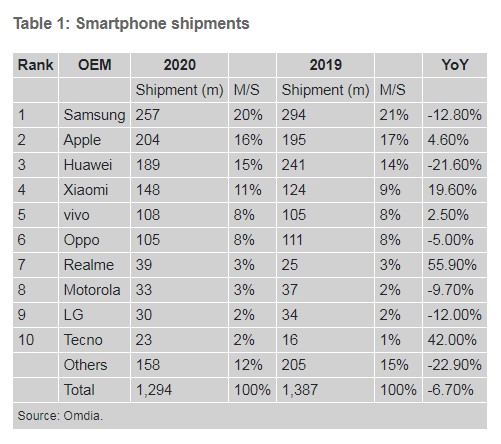

According Omdia, the smartphone market grew 4.7% year-on-year in 4Q20 – the first time since 3Q19 that the smartphone market has achieved year-on-year growth in a quarter. Global shipments reached 381.1M units in 4Q20 – up from 364M units in 4Q19. Compared to 3Q20, shipments increased 6.7% from 357.3M units. In the year as a whole, shipments reached 1.294B units, down 6.7% from the 1.387B units shipped in 2019. (CN Beta, Light Reading, Computer Weekly, Omdia)

Stadia Games and Entertainment is Google’s first-party development studios for Stadia. Google has also acquired Typhoon Games, creators of Journey to the Savage Planet, for further first-party growth. Google announces it is closing its Stadia game studio, but the company is still committed to cloud gaming. (GSM Arena, Android Central, Google, CN Beta)

Samsung Galaxy M02 is announced in India – 6.517” 720×1600 HD+ v-notch IPS, MediaTek MT6739W, rear dual 13MP-2MP macro + front 5MP, 2+32 / 3+32GB, Android 10.0, no fingerprint, 5000mAh, microUSB, INR6,999 (USD96) for 2+32GB. (GSM Arena, Amazon)

Xiaomi POCO M3 is launched in India – 6.53” 1080×2340 FHD+ u-notch IPS, Qualcomm Snapdragon 662, rear tri 48MP-2MP macro-2MP depth + front 8MP, 6+64 / 6+128GB, Android 10.0, side fingerprint, 6000mAh 18W, INR10,999 (USD151) / INR11,999 (USD165). (GSM Arena, CN Beta, Flipkart)

Nokia 1.4 is announced in Europe – 6.52” 720×1600 HD+ v-notch IPS, Qualcomm Snapdragon 215, rear dual 8MP-2MP macro + front 5MP, 1+16 / 1+32 / 3+64GB, Android 10 Go, rear fingerprint, 4000mAh, from EUR99. (GSM Arena, Neowin, HMD Global)

Ford and Google have joined together to create unique services and capabilities for Ford and Lincoln customers. Ford has also named Google Cloud its preferred cloud provider to leverage Google’s world-class expertise in data, artificial intelligence (AI), and machine learning (ML). As part of this new, 6-year partnership—and beginning in 2023—millions of future Ford and Lincoln vehicles at all price points will be powered by Android, with Google apps and services built-in. (TechCrunch, Ford, CNBC, The Guardian, Sina, Sohu)

Apple and Kia are allegedly close to reaching a deal that will see Apple invest some KRW4T (about USD3.6B) on a collaborative effort to bring “Apple Car” to life. Apple will invest KRW4T to secure access to Kia’s U.S. facilities in Georgia. The companies are planning a production run in 2024 with an initial capacity of 100,000 cars per year. The plant can ramp up to a maximum of 400,000 units a year. (CN Beta, Apple Insider, Bloomberg)

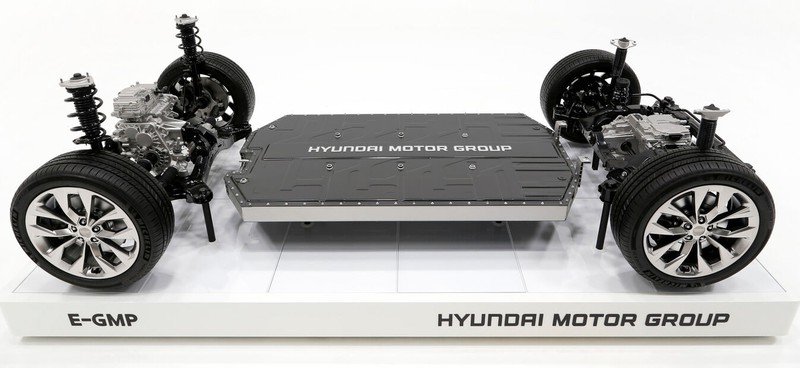

According to TF Securities analyst Ming-chi Kuo, Apple‘s first vehicle chassis will be based on Hyundai’s E-GMP battery electric vehicle (BEV) platform. Apple could work with General Motors and European manufacturer PSA for subsequent models or in other markets. He predicts that Apple will launch the Apple Car in 2025 at the earliest. (CN Beta, Gizmo China, Mac Rumors)