3-6 #Aging : GF will invest USD1.4B in 2021 to raise output at three factories; ASML has extended a deal to sell chip manufacturing equipment to SMIC; Samsung has submitted a proposal to the Austin asking for property tax reimbursement for 20 years; etc.

GlobalFoundries CEO Thomas Caulfield has indicated that the company will invest USD1.4B in 2021 to raise output at three factories in the United States, Singapore and Germany, as a global shortage of semiconductors has boosted demand for chips. It will begin to ramp up output through 2022 to produce chips from 12~90nm. About a third of the investment will come from clients seeking to lock in supply over several years, forecasting a 20% rise in production in 2022 following an expected 13% increase in 2021. (CN Beta, Reuters, Electronic Design, Sina)

ASML has extended a deal to sell chip manufacturing equipment to Semiconductor Manufacturing International Corp (SMIC). The company has disclosed a volume purchase agreement under which it has already spent USD1.2B with the toolmaker. (CN Beta, Reuters, Reuters)

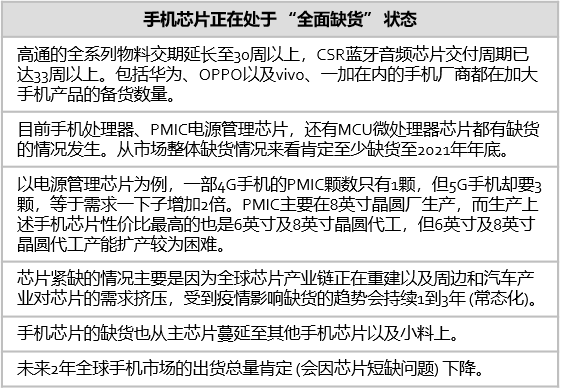

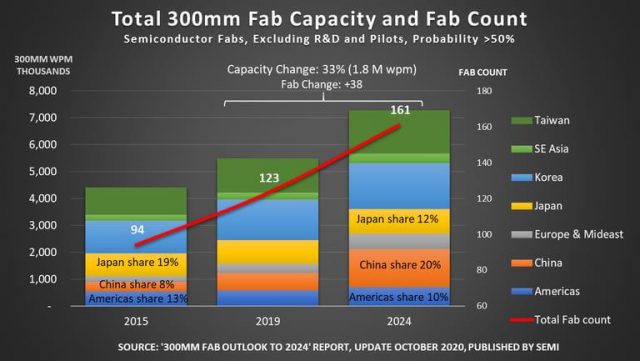

Since 2H20, chip shortages and cost up have become the main trend of the semiconductor industry. With chip shortages and cost up, the related components including upstream materials and equipment are in shortage. As the market with the largest amount of semiconductor chips, mobile phone chips are in a state of “completely out of stock”. According to SEMI report, the number of 8” production lines in the world in 2016 was 188, and by the end of 2020, the number of 8” production lines has only increased to 191. (CN Beta, Sohu, Yicai)

Samsung has submitted a proposal to the Austin city government asking for property tax reimbursement for 20 years in exchange for a large-scale investment. Currently, the Austin local government offers a 10-year tax reimbursement for investments at the most. Samsung is reportedly considering a USD17B expansion of its existing semiconductor foundry. (CN Beta, Texas, The Verge, Business Korea, Korea JoongAng Daily)

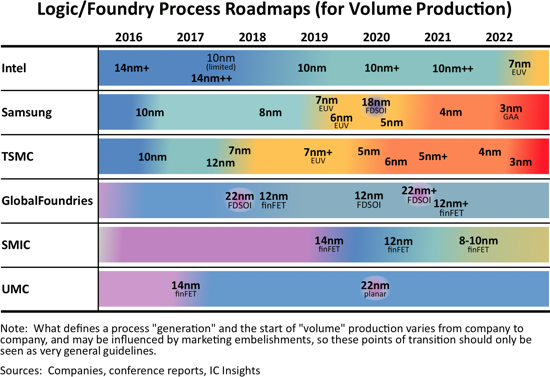

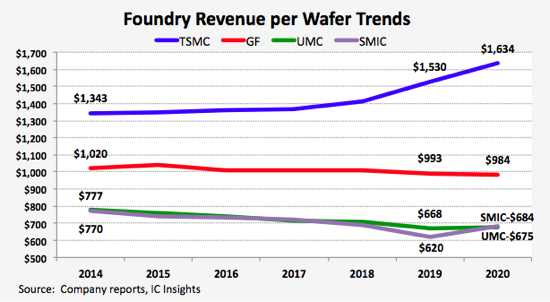

TSMC’s overall revenue per wafer increased significantly in 2020 as many of the top fabless IC suppliers—16 fabless IC companies with more than USD1.0B in 2020 revenue—lined up to have their newest designs manufactured using these most advanced processes. 3 of the 4 pure-play foundries enjoyed higher revenue-per-wafer in 2020 (GlobalFoundries’ revenue per wafer slipped 1% in 2020). TSMC’s figure of USD1,634 exceeded GlobalFoundries by 66% and is more than double the revenue per wafer value at UMC and SMIC. With estimated capital expenditures of USD27.5B in 2021, TSMC will expand its available capacity at these nodes and also begin risk production of 3nm ICs in 2021 with 3nm volume production slated to start in 2022. (My Drivers, IC Insights)

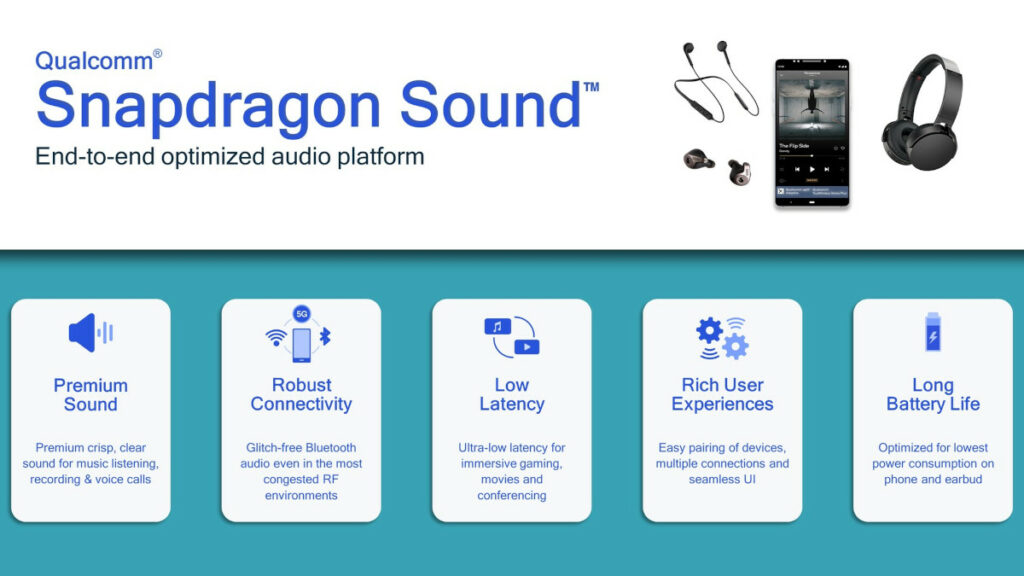

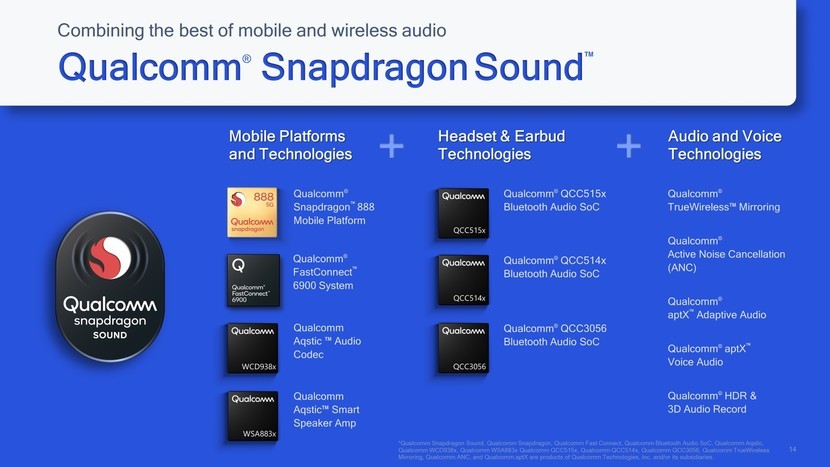

Qualcomm has announced Snapdragon Sound, an audio platform that integrates the company’s audio technologies under one roof. Qualcomm is touting 24-bit audio, lower latency, better pairing and connectivity with Snapdragon Sound-enabled devices. Xiaomi and Audio-Technica are launch partners for Snapdragon Sound, and Amazon Music HD is getting a curated Snapdragon Sound Playlist. (Android Authority, Android Central, CN Beta, Qualcomm, The Verge)

The European Union is planning to produce its own advanced semiconductors by 2030, part of the bloc’s plans to reduce “high-risk dependencies” on technology companies in the U.S. and Asia. In order to get rid of the “high-risk dependence” on American and Asian companies, the EU hopes that by 2030, at least 20% of the world’s advanced semiconductor products (calculated by value) should be manufactured in local EU factories. The EU’s plan “Digital Compass Project” covers multiple targets including semiconductors. (CN Beta, Extreme Tech, GizChina, Bloomberg)

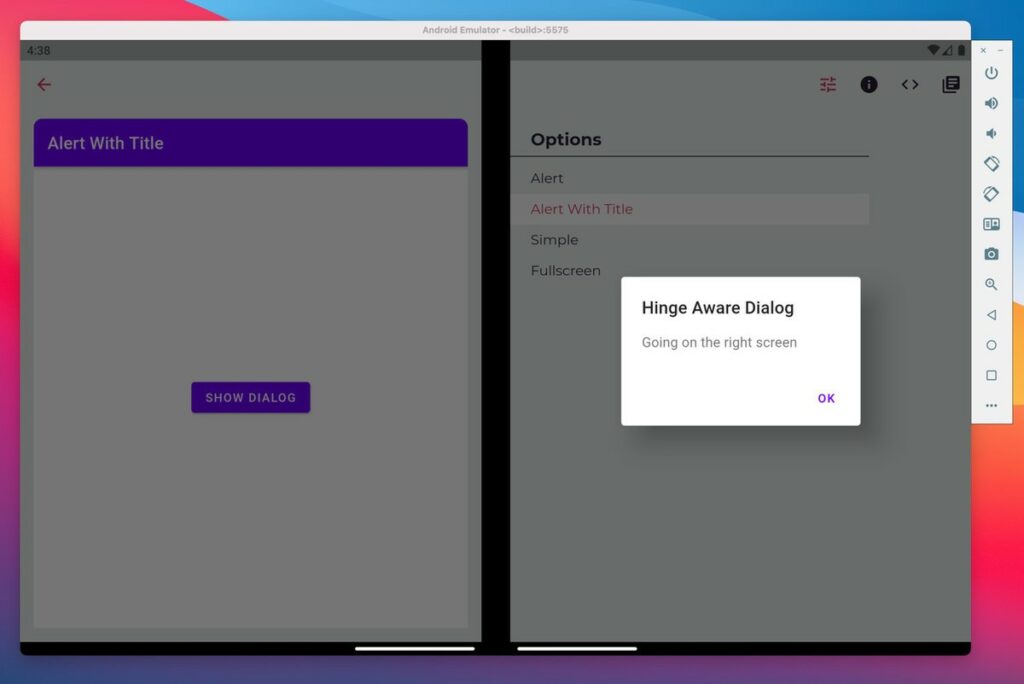

Microsoft has been working with Google on improving the dual-screen experience for foldable devices. The companies are announcing the first steps towards improving app compatibility with new Flutter support. It is a cross-platform framework that lets developers build apps for both iOS and Android using a single codebase. (Android Central, Microsoft, CN Beta)

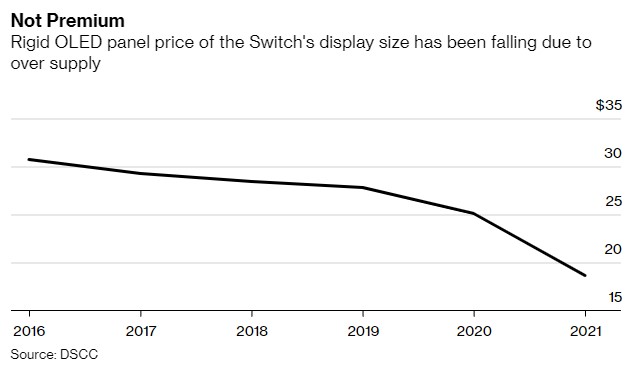

Nintendo allegedly plans to unveil a model of its Switch gaming console equipped with a bigger Samsung Display OLED display in 2021. Samsung Display will start mass production of 7”, 720p-resolution OLED panels as early as Jun 2021 with an initial monthly target of just under 1M units. (GSM Arena, Bloomberg, CN Beta)

Samsung has introduced next-level ISOCELL 2.0, which further refines the technology by replacing the metallic grid between color filters with a new material. It has replaced the lower portion of the color filter barriers with a more reflective material. It further reduces optical loss in each pixel and drastically improves light sensitivity, allowing to produce even more vivid pictures with reduced noise. (GSM Arena, Samsung, Android Authority)

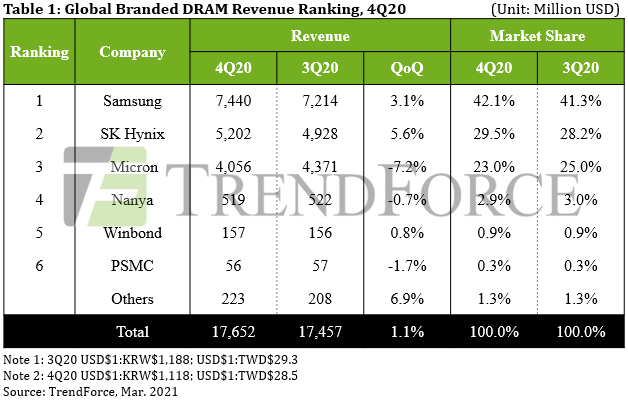

Global DRAM revenue reached USD17.65B, a 1.1% increase YoY, in 4Q20, according to TrendForce. Demand for PC, mobile, graphics, and consumer DRAM remains stable throughout 1Q21. As for clients in the server segment, they have now reinitiated a new round of procurement for server DRAM after adjusting their inventories during the two previous quarters (3Q20 and 4Q20). (CN Beta, TrendForce, TrendForce)

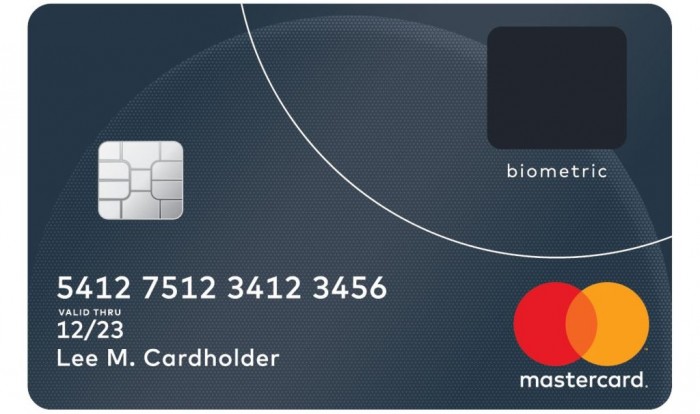

Samsung System LSI Business, Mastercard, Samsung Card, have signed a memorandum of understanding to develop a biometric card that features a built-in fingerprint scanner to authorize transactions securely at in-store payment terminals. The biometric cards will adopt a new security chipset from Samsung LSI that integrates several key discrete chips, streamlining the overall component design and enabling more efficient development. (Engadget, Business Wire, CN Beta)

Solar panels are typically made of silicon, but in the future, they could be manufactured from a different material that offers more efficiency and lower manufacturing cost. The material that could replace silicon for these next-generation solar panels is called perovskites. MIT says that perovskites offer the potential for low-cost, low-temperature manufacturing of extremely thin and lightweight, flexible cells. (CN Beta, PV Magazine, Slash Gear)

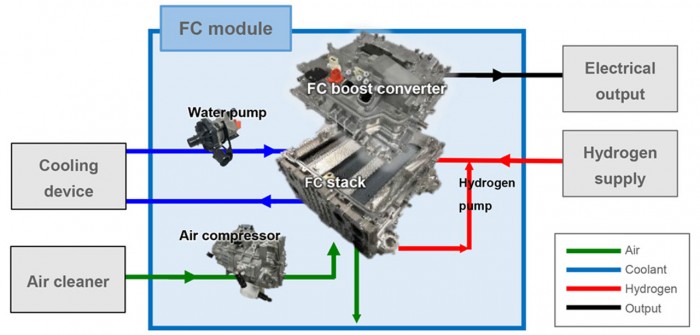

Toyota has developed a product that packages a fuel cell (FC) system into a compact module and plans to begin selling it in the spring of 2021 or later. The new module will be easily utilized by companies that are developing and manufacturing FC products for wide variety of applications, including mobility such as trucks, buses, trains and ships, as well as stationary generators. (CN Beta, Toyota, Auto Blog)

T-Mobile’s support page tells subscribers that if they are having problems with battery life on a number of models, they should turn off 5G on the phone (which is 5G enabled obviously), or turn off LTE on a phone that supports 4G LTE but not 5G, and go all the way back to 2G. (Phone Arena, T-Mobile, CN Beta)

T-Mobile announces a new platform for enterprise customers. It is launching 3 new products that leverage T-Mobile’s 5G network and a partnership with Dialpad. T-Mobile will begin offering “Home Office 5G Internet” plans that compete with cable providers. It will also be getting into the cloud-based collaboration business that can replace an office-based PBX, video and voice conferencing, and integrates with Office 365 apps. (CN Beta, GSM Arena, The Verge, T-Mobile)

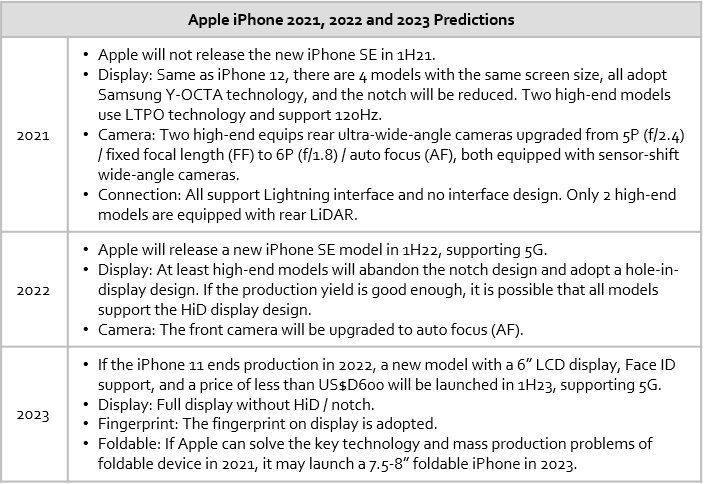

Tianfeng Securities analyst Ming-Chi Guo has made a series of forecasts for Apple iPhone in 2021, 2022 and 2023. He believes that the growth momentum of iPhone in 2021 will mainly come from the increased demand for replacement of 5G, the growth of high-end market share due to the Huawei ban and the price reduction of iPhone 11. It is predicted that iPhone shipments in 2021 will grow 15-20% YoY to approximately 230M units. (TF Securities, CN Beta, CN Beta, GSM Arena, GSM Arena)

LATAM smartphone shipments dropped 10.3% YoY in 4Q20 but increased 9.7% QoQ driven by a recovery from the pandemic and partly due to seasonality, according to Counterpoint Research. For the first time, Xiaomi emerged as the third biggest player in the region in 4Q20. The average selling price (ASP) in the region decreased by 6.4% during the quarter. Samsung remained the region’s absolute leader in 2020 with 40.5% share. In fact, it was leading in all LATAM countries during 2020. Motorola, which is a comfortable second in the LATAM market, increased its share by 3% points. (GizChina, Counterpoint Research)

Global smartphone shipments are likely to grow nearly 50% on year to 340M units in 1Q21, driven by robust sales of Apple’s iPhone 12 Pro and iPhone Pro Max as well as a ramp-up in shipments by Chinese brands to grab the market share relinquished by Huawei, according to Digitimes Research. Global shipments of 5G-enabled phones are expected to reach over 600M units in 2021 compared to 280M units shipped a year earlier, Digitimes Research estimates. Huawei, Apple and Samsung were the top-three 5G phone vendors in 2020, accounting for over 70% of global 5G phone shipments. (Digitimes, press, Sina)

OPPO has risen through the ranks to become the number 1 smartphone brand in China for the first time in Jan 2021, according to Counterpoint Research. OPPO’s market share reached 21% in Jan followed by vivo 20% and Huawei, Apple and Xiaomi at 16%. OPPO’s sales grew 33% MoM and 26% YoY during the month. 5G devices are increasingly finding their way into the sub-USD300 price band. Close to one-third of the 5G devices sold in China in January were below the USD300 mark. OPPO has been able to capitalize on this demand through its affordable A series. (Engadget, GSM Arena, Counterpoint Research)

vivo S9 5G and S9e 5G are announced in China: S9 5G – 6.44” 1080×2400 FHD+ AMOLED notch 90Hz, MediaTek Dimensity 1100, rear tri 64MP OIS-8MP ultrawide-2MP depth + front dual 44MP-8MP ultrawide, 8+128 / 12+256GB, Android 11.0, fingerprint on display, 4000mAh 33W, CNY2,999 (USD465) / CNY3,299 (USD510). S9e 5G – 6.44” FHD+ AMOLED u-notch 90Hz, MediaTek Dimensity 820, rear tri 64MP-8MP ultrawide-2MP macro + front 32MP, 8+128 / 8+256GB, Android 11.0, fingerprint on display, 4100mAh 33W, CNY2,399 (USD370) / CNY2699 (USD420). (GSM Arena, CN Beta, Weibo, First Post, vivo)

realme GT 5G is announced in China – 6.43” 1080×2400 FHD+ Super AMOLED HiD 120Hz, Qualcomm Snapdragon 888, rear tri 64MP-8MP ultrawide-2MP macro + front 16MP, 8+128 / 12+256GB, Android 11.0, fingerprint on display, 4500mAh 65W, CNY2,799 (USD430) / CNY3,299 (USD510). (GSM Arena, realme, Android Headlines)

Samsung Galaxy XCover 5 is unveiled in UK touting ruggedness – 5.3” 720×1600 HD+ 20:9, Exynos 850, rear 16MP + front 5MP, 4+64GB, Android 10.0, side fingerprint, 3000mAh 15W, IP68 rated, MIL-STD810H certified, GBP330. (GSM Arena, Android Headlines, Samsung)

Redmi Note 10 series is announced in India: 10 – 6.43” 1080×2400 FHD+ Super AMOLED HiD, Qualcomm Snapdragon 678, rear quad 48MP-8MP ultrawide-2MP macro-2MP depth + front 13MP, 4+64 / 6+128GB, Android 11.0, side fingerprint, 5000mAh 33W, INR11,999 (USD165) / INR13,999 (USD192). 10 Pro – 6.67” 1080×2400 FHD+ Super AMOLED HiD 120Hz, Qualcomm Snapdragon 732G, rear quad 64MP-8MP ultrawide-5MP macro-2MP depth + front 16MP, 6+64 / 6+128 / 8+128GB, Android 11.0, side fingerprint, 5020mAh 33W (8.1mm thick), INR15,999 (USD220) / INR16,999 (USD234) / INR18,999 (USD261). 10 Pro Max – 6.67” 1080×2400 FHD+ Super AMOLED HiD 120Hz, Qualcomm Snapdragon 732G, rear quad 108MP-8MP ultrawide-5MP macro-2MP depth + front 16MP, 6+64 / 6+128 / 8+128GB, Android 11.0, side fingerprint, 5020mAh 33W (8.1mm thick), INR18,999 (USD261) / INR19,999 (USD275) / INR21,999 (USD302). (GSM Arena, CN Beta, GizChina)

nubia Red Magic 6 series is announced in China in collaboration with Tencent, features 6.8” 1080×2400 FHD+ AMOLED 165Hz / 500Hz touch-sensing, Qualcomm Snapdragon 888, rear tri 64MP-8MP ultrawide-2MP macro + front 8MP, fingerprint on display: 6 – 8+128 / 12+128 / 12+256GB, Android 11.0, 5050mAh 66W, CNY3,799 / CNY4,099 / CNY4,399. Pro – 12+128 / 12+256 / 16+256GB, Android 11.0, 4500mAh 120W, CNY4,399 / CNY4,799 / CNY5,299. (GSM Arena, Android Authority, Sohu)

realme C21 is launched in Malaysia – 6.517” 720×1600 HD+ v-notch, MediaTek Helio G35, rear tri 13MP-2MP macro-2MP depth + front 5MP, 3+32GB, Android 10.0, rear fingerprint, 5000mAh 10W, MYR499 (USD120). (GSM Arena, realme, 91Mobiles)

Reliance Jio is planning to foray into the laptop segment as it is developing a product tentatively called the “JioBook”, which will run a customized Android skin on top dubbed as the JioOS. This device will be powered by Qualcomm’s 11nm Snapdragon 665 chipset with 4G connectivity. (Gizmo China, Android Authority, XDA-Developers)

Razer Anzu Smart Glasses are announced in US. The glasses combine the valuable protection of 35% blue light filtering lenses, 99% UVA/UVB protective polarized sunglasses, touch controls, and open-ear audio. It can last for more than 5 hours of usage, weighed about 48g. It can cut Bluetooth latency down to 60ms. It is priced at USD199.99. (Android Central, Razer, Razer, PC Home)