Gartner: 1Q16 Mobile Devices Market Trends

Using Gartner’s latest data, the following are the market trends in regards to mobile devices in 1Q16:

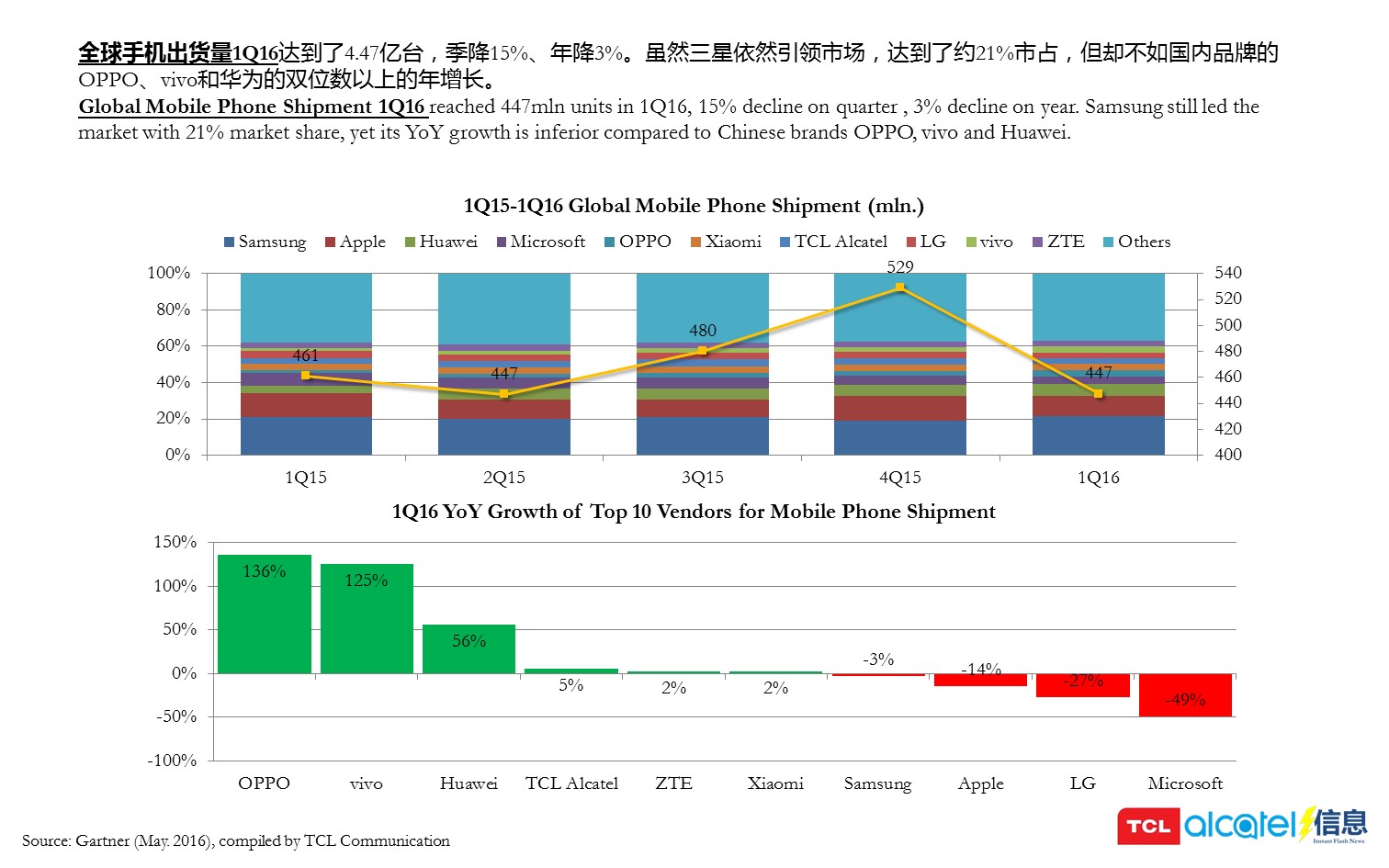

- Global Mobile Phone Shipment 1Q16 reached 447mln units in 1Q16, 15% decline on quarter , 3% decline on year. Samsung still led the market with 21% market share, yet its YoY growth is inferior compared to Chinese brands OPPO, vivo and Huawei.

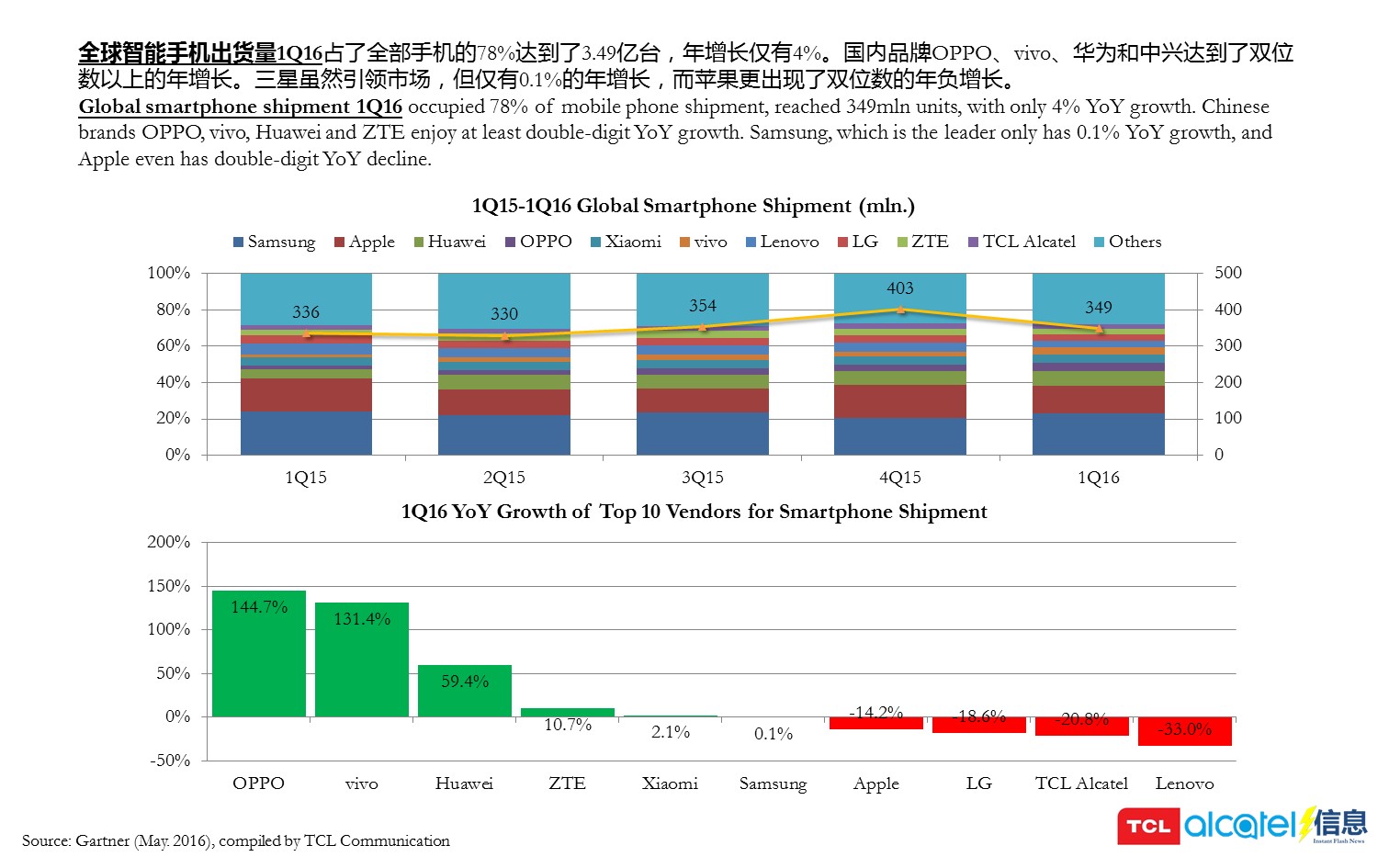

- Global smartphone shipment 1Q16 occupied 78% of mobile phone shipment, reached 349mln units, with only 4% YoY growth. Chinese brands OPPO, vivo, Huawei and ZTE enjoy at least double-digit YoY growth. Samsung, which is the leader only has 0.1% YoY growth, and Apple even has double-digit YoY decline.

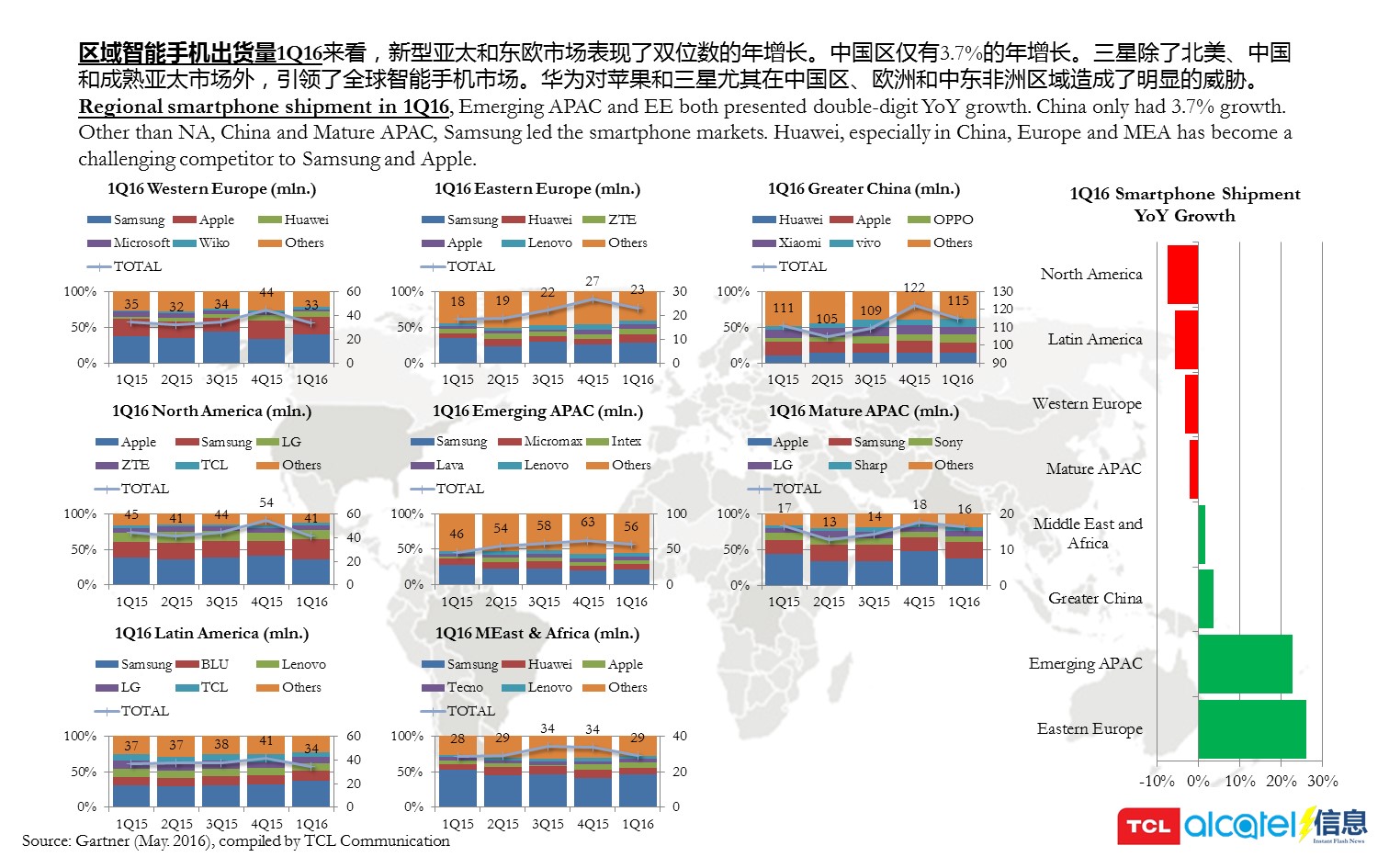

- Regional smartphone shipment in 1Q16, Emerging APAC and EE both presented double-digit YoY growth. China only had 3.7% growth. Other than NA, China and Mature APAC, Samsung led the smartphone markets. Huawei, especially in China, Europe and MEA has become a challenging competitor to Samsung and Apple.

- Global feature phone shipment 1Q16 reached 98mln units, 21% decline on year and 22% decline on quarter. TCL Alcatel is the only brand that has achieved double-digit YoY growth with more than 7.3mln units shipped. And thanks to feature phone, mobile phone overall YoY growth of TCL Alcatel is positive 5%.

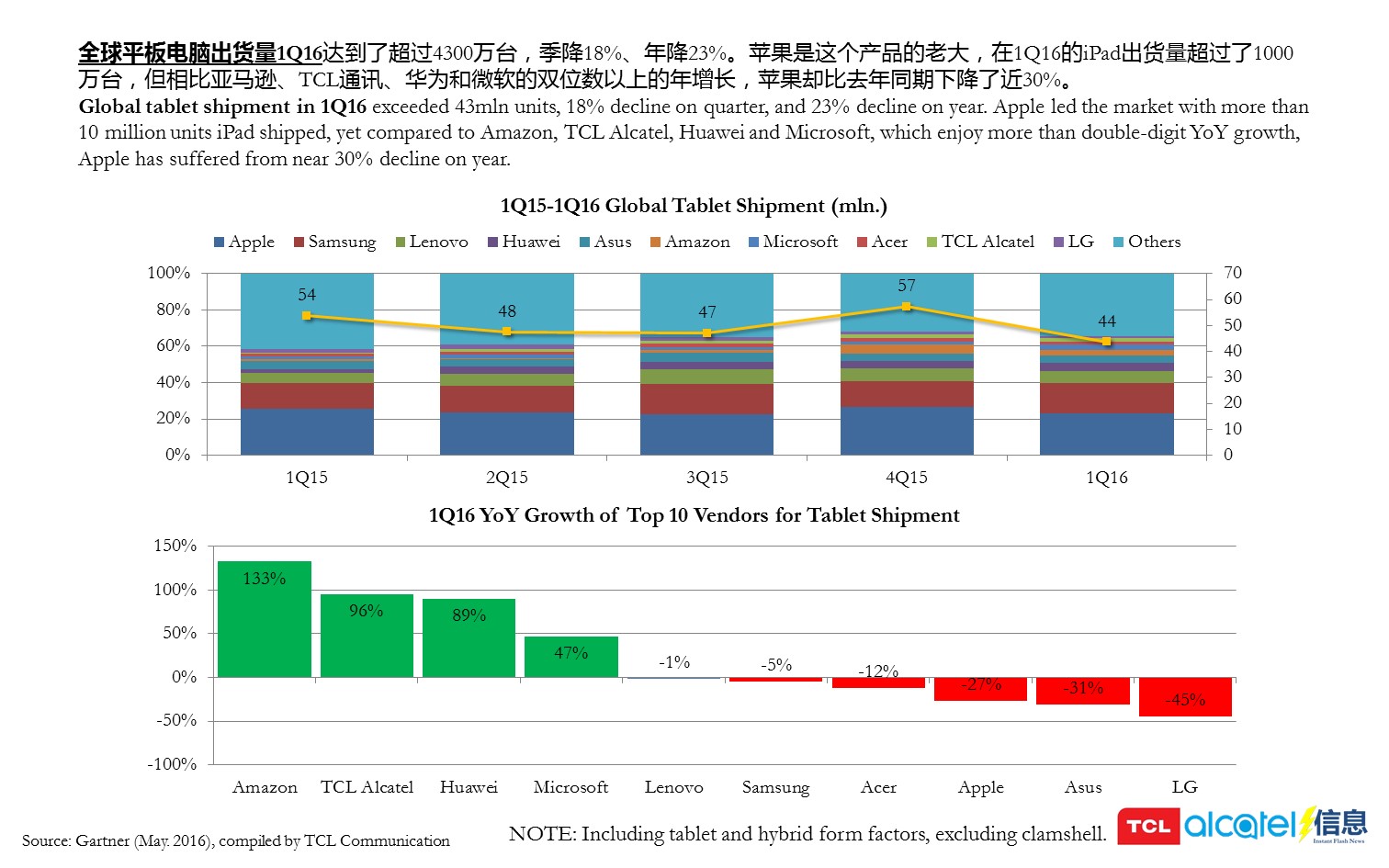

- Global tablet shipment in 1Q16 exceeded 43mln units, 18% decline on quarter, and 23% decline on year. Apple led the market with more than 10 million units iPad shipped, yet compared to Amazon, TCL Alcatel, Huawei and Microsoft, which enjoy more than double-digit YoY growth, Apple has suffered from near 30% decline on year.

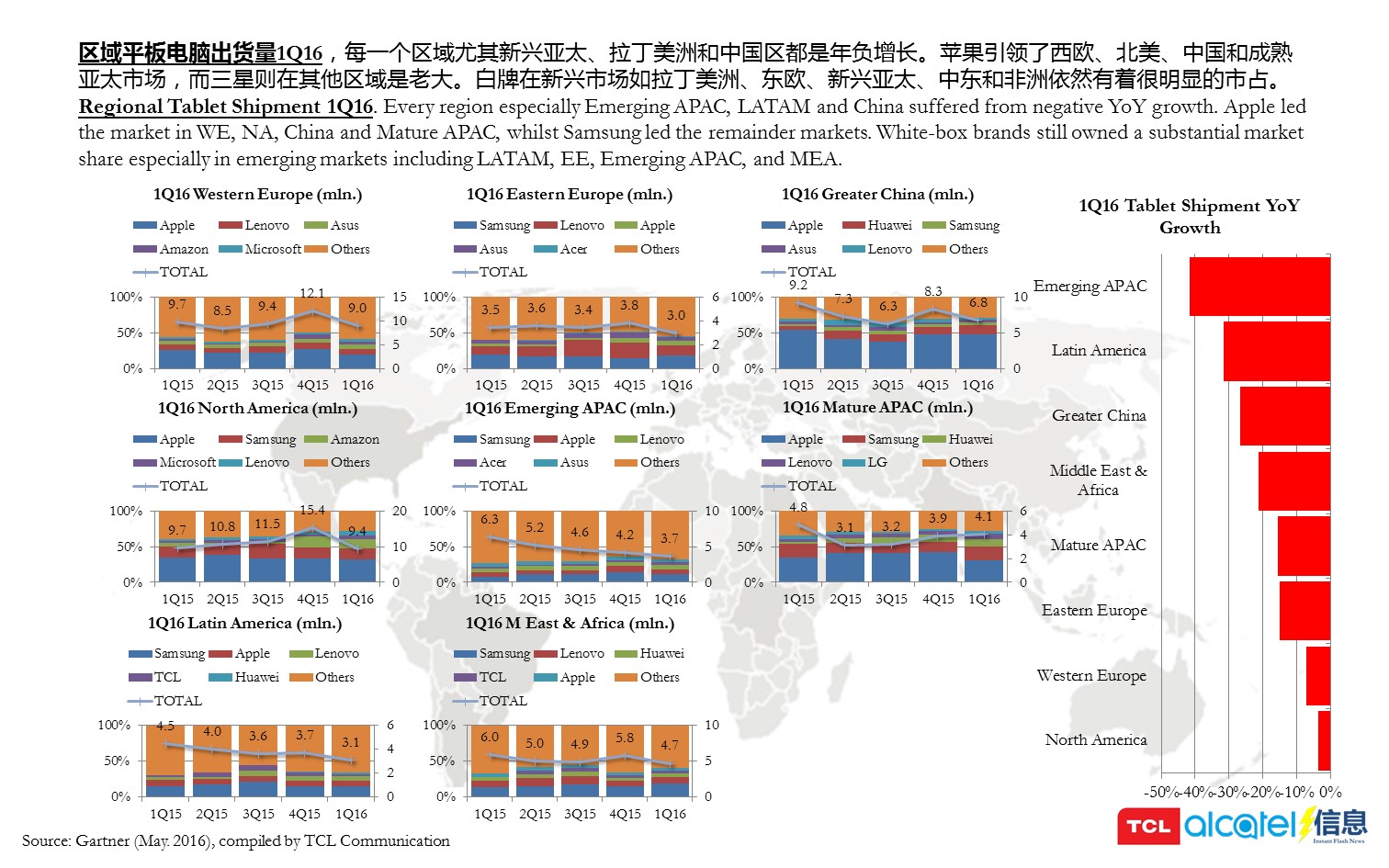

- Regional Tablet Shipment 1Q16. Every region especially Emerging APAC, LATAM and China suffered from negative YoY growth. Apple led the market in WE, NA, China and Mature APAC, whilst Samsung led the remainder markets. White-box brands still owned a substantial market share especially in emerging markets including LATAM, EE, Emerging APAC, and MEA.

Please download the PDF version via this link. Thank you!