3-21 #PhD : Renesas has said a fire halted production at one of its Japanese plants; Xiaomi is allegedly advancing the car manufacturing project; Samsung Electronics faces a loss of over KRW400B as its first-ever shutdown at fab in Texas; etc.

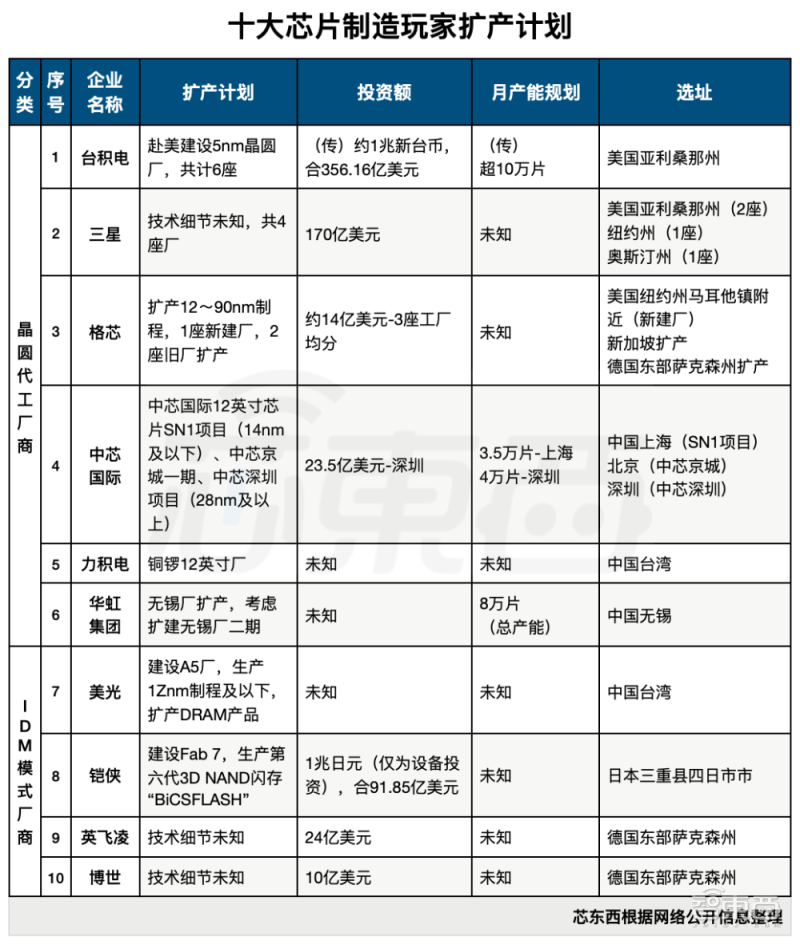

SMIC has announced that it will launch a 12” wafer production project with a 28nm and above process through SMIC Shenzhen, and plans to start production in 2022. The planned monthly production capacity of the new fab is 40,000 pieces, which is 5,000 pieces more than the planned monthly production capacity of SMIC’s 12” production project in Shanghai. (CN Beta, 36Kr, Xindongxi)

Samsung Electronics faces a loss of over KRW400B (USD353.4M) as its first-ever shutdown at fab in Texas stretches to more than a month after a power outage from an unusual cold snap in the warm state, causing interruption in its global chip supplies for IT devices. Meanwhile, NXP Semiconductors has estimated the production halt has cut its 2Q21 sales by about USD100M. (Pulse News, Laoyaoba)

According Gasgoo’s data, since 2015, the value of ICE (traditional internal combustion engine vehicles) semiconductor bicycles has increased by 23%, from USD338 to USD417. New energy and intelligence also bring new incremental opportunities, including power semiconductors for electric power systems, power management systems, MCUs for body electronic management systems, as well as intelligent sensors and ASICs. In 2019, the value of MHEV (light hybrid electric vehicle) semiconductors is USD531, PHEV (plug-in hybrid electric vehicle) is USD785, and BEV (pure electric vehicle) is USD775. According to Foresight Industry Research Institute, the global automotive semiconductor market in 2019 is USD46.5B. In 2020, due to the impact of the epidemic on global automotive sales, the automotive semiconductor market will slightly decrease to USD46B. (CITIC Securities report)

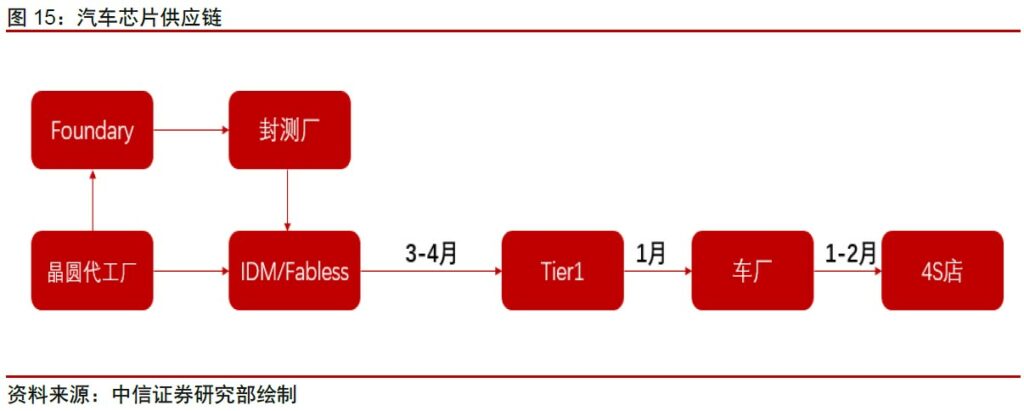

In the entire chip supply cycle, it usually takes 3-4 months for Tier-1 car vendors to receive chipsets from the upstream supplier; about 1 month for Tier-1 vendor to assembly the car components with the chipsets and deliver to the car manufacturers; about 1-2 months for car manufacturers to make the cars and deliver to the 4S shops. This implies that car chip manufacturers need to schedule production 5-6 months earlier than vehicle shipments. Therefore, once the car company makes a mistake in judging the future market demand, it will disrupt the rhythm of the upstream supply chain in a few quarters. (CITIC Securities report)

Renesas Electronics, one of the biggest makers of automotive chips, has said a fire halted production at one of its Japanese plants. The incident may exacerbate a shortage of semiconductors that has already curbed vehicle output across the industry. The company is still trying to ascertain the amount of damage in the clean room of its N3 building in Hitachinaka. (My Drivers, LTN, UDN, Sina, Nikkei, Bloomberg)

The global shortage in semiconductors is spreading to companies that provide gear used to manufacture the silicon, with one chip packaging equipment supplier warning of delays in shipments. Average delivery times of Kulicke and Soffa Industries’ packaging equipment, which require microcontrollers, have doubled to 6 months, said Executive Vice President Chan Pin Chong. The company supplies equipment to customers like ASE Technology, the world’s largest chip packaging and testing services provider. (Laoyaoba, Bloomberg)

Qualcomm CEO Steve Mollenkopf said he is “seeing improvement” in efforts to ease chip shortages that have caused disruptions across several industries, and that demand for older chips is easier to respond to. Demand has soared for chips in recent months, with panic buying further squeezing capacity and driving up costs of even the cheapest components of nearly all microchips. (My Drivers, CN Beta, Reuters, Financial Post)

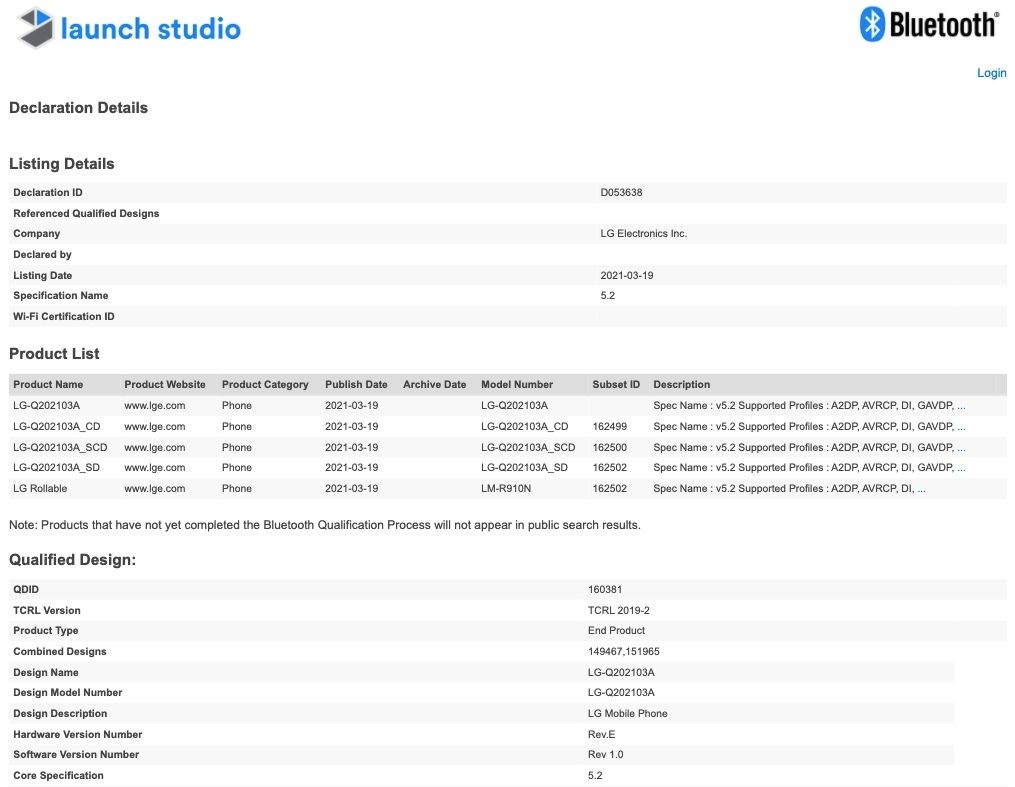

The Bluetooth SIG listing has listed LG Rollable with model number LM-R910N. The green signal from the Bluetooth SIG does suggest that the launch of the LG Rollable is imminent. (Android Central, MySmartPrice)

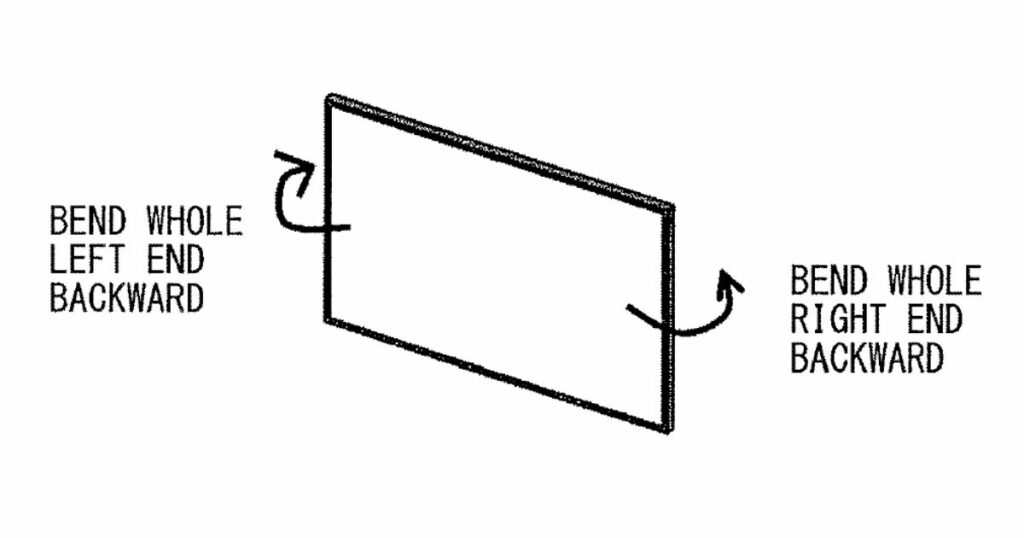

Sony’s patent shows a TV display with push and pull detection to control sound, image scaling, and more. It uses piezo elements embedded in the edge of the display to detect the push and pull. The patent also suggests that the display may be extendable on the sides. (CN Beta, 91Mobiles)

The shortage spurred by strong chip demand during the pandemic has been exacerbated by the shutdown of a Samsung plant in Texas following a winter storm. The chip fabrication plant responsible for 5% of global supply has been idled since 16 Feb 2021, causing widespread repercussions through the supply chain. The supply crunch hitting Qualcomm will affect a wide range of smartphone makers that rely on the company for key components. Apple, which procures OLED panels from Samsung, could also face disruptions in iPhone production. (MacRumors, Nikkei, My Drivers)

TCL has revealed that CSOT will launch the world’s first Mini-LED on TFT-based MLED product in Aug 2020. It is the world’s first Mini-LED array product driven by a-Si. It is now ready for mass production. TCL CSOT’s foldable display shipments currently rank second in the world, and will continue to deepen cooperation with global top brand customers in the future. (Yicai, Laoyaoba)

Winbond Electronics’ board of directors has approved a capex budget of approximately NTD13.13B (USD463.83M) to invest in the company’s new 12” wafer plant located in Kaohsiung, according to the maker of specialty DRAM and flash memory. Winbond expects to materialize pilot runs at the new plant in 2022. The Kaohsiung site will be Winbond’s second 12” plant, and will initially enter production of DRAM chips built using the second generation of the company’s in-house developed 25nm process technology. (Laoyaoba, TechNews, Yahoo, Digitimes)

The US Department of Commerce has opened an investigation into Seagate, for possible sanction-busting disk drive shipments to Huawei. The probe centers on controller chips inside the drives. Seagate has confirmed that it complies with all applicable laws including export control regulations. (Laoyaoba, Blocks & Files, Washington Times, Seeking Alpha)

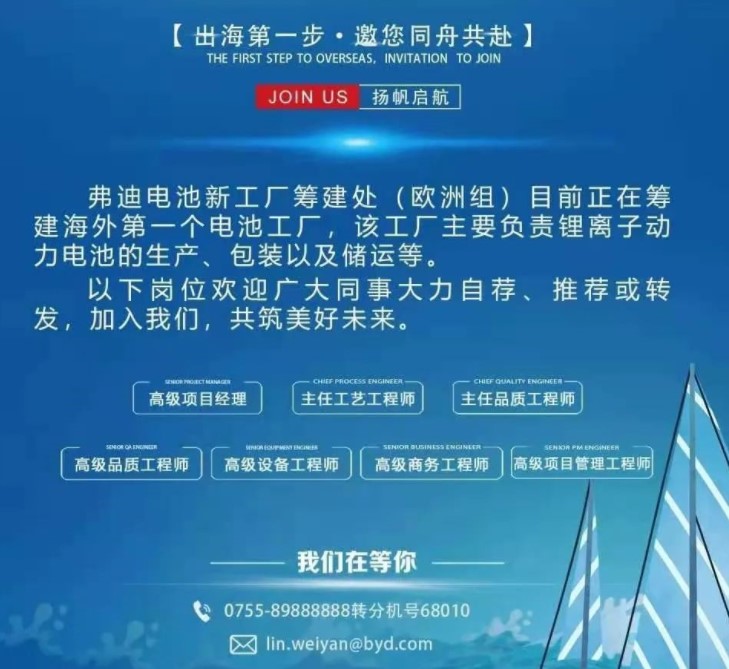

China’s electric vehicle (EV) maker BYD subsidy FinDreams Battery is hiring engineers for its first overseas battery plant in Europe, as it pushes to become an EV parts supplier. The planning of the factory is to prepare for supply to European automotive customers and to prepare for the further expansion of BYD’s overseas business. (Laoyaoba, Reuters, Auto News, Sohu)

Apple has been fined near USD2M in the Brazilian state of São Paulo over violations of the Consumer Law Code due to the lack of a charger in the box for newer iPhones. (Mac Rumors, Tilt, Sina)

A federal jury in Texas has ordered Apple to pay around USD308.5M to a local licensing firm for infringing a patent related to digital rights management. Personalized Media has sued claiming Apple infringed its patent with technology including FairPlay, which is used for the distribution of encrypted content from its iTunes, App Store and Apple Music applications. (MacRumors, Bloomberg, Sina)

OPPO A94 is introduced in Singapore – 6.43” 1080×2400 FHD+ HiD AMOLED, MediaTek Helio P95, rear quad 48MP-8MP ultrawide-2MP macro-2MP depth + front 32MP, 8+128GB, Android 11.0, fingerprint on display, 4310mAh 30W, SGDB429 (USD319). (GSM Arena, GizChina)

Micromax In 1 is announced in India – 6.67” 1080×2400 FHD+ HiD IPS, MediaTek Helio G80, rear tri 48MP-2MPmacro-2MP depth + front 8MP, 4+64 / 4+128GB, Android 10.0, rear fingerprint, 5000mAh 18W, INR9,999 (USD135) / INR11,499 (USD160). (GSM Arena, Micromax)

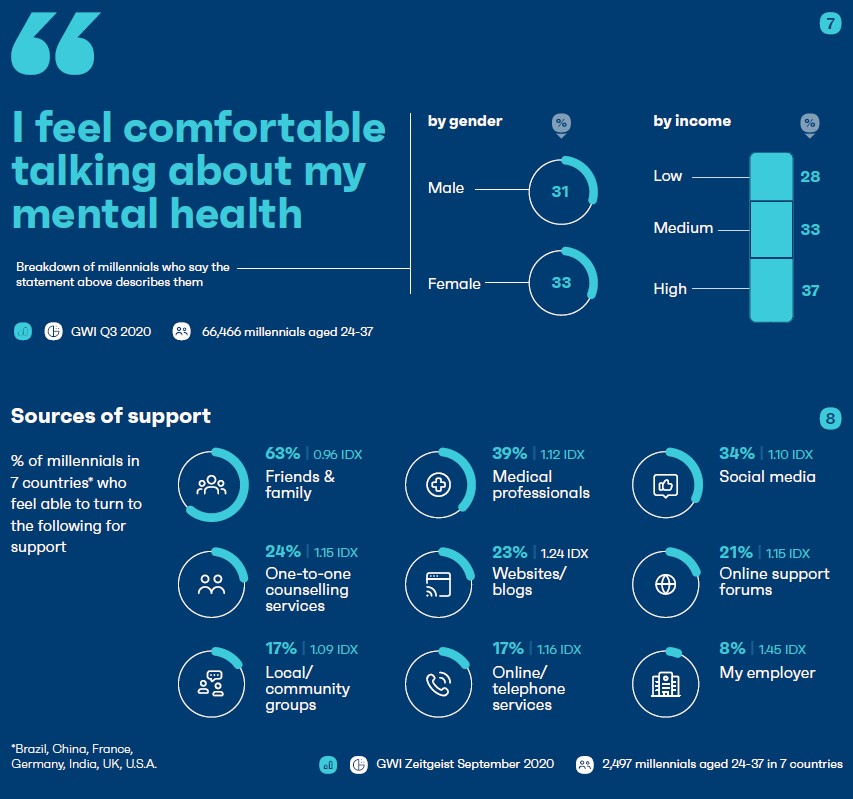

Millennials’ health-conscious mindset is not limited to their physical health. In fact, from GWI’s research in Sept 2020, they found that millennials in the UK and U.S. are more concerned with their mental and emotional wellbeing (35%) than their physical health and fitness (31%). However, there is more to be done in terms of normalizing mental health issues and enticing this cohort (especially males and lower-income groups) to talk about it. At only 32%, millennials are the least likely generation to say they are comfortable discussing mental health. (GWI report)

Xiaomi is allegedly advancing the car manufacturing project, and the project is expected to be established within 1-2 months at the earliest. The brand positioning initially discussed is similar to that of XPeng, focusing on the mid-to-high-end market with strong technological attributes. Xiaomi has contact with Borgward and Kaiyun Motors, which is positioned as an urban distribution logistics company, but the negotiations with Borgward have stopped. Xiaomi has also thought about looking for car companies such as BYD, but worried about the latter’s resource investment and controllability. (Gizmo China, 36Kr)

Job Aviation has showcased its vision for urban air travel. The eVTOL looks like a cross between a helicopter and a small plane ascends from the ground under the power of several spinning rotors. The Executive Chairman Paul Sciarra has indicated that it has got an extremely low noise profile, with less than 65 decibels at 100 meters during takeoff and land, and one that is almost near silent at 500 feet 2000 foot flight. (CN Beta, CNET, Seeking Alpha, Yahoo)

Chinese automaker Geely who also owns Volvo and has a minority stake at Daimler AG is planning to launch a new brand of electric vehicles (EV). The brand, positioned in the premium segment and named “Zeekr”, will be housed under Geely’s to-be-launched EV entity Lingling Technologies. (Gizmo China, Reuters, CNYes, Reuters)

Vietnam’s largest conglomerate Vingroup has said its car unit was in early stage talks with Foxconn about working together and that any partnership formed would focus on developing batteries and electric car parts. Foxconn has proposed acquiring EV production lines owned by the unit VinFast. (My Drivers, Reuters, Tech in Asia)

SK Holdings will join hands with China’s Geely Auto Group to invest in future mobility companies. SK Holdings established the New Mobility Fund with Geely, the No. 1 private automaker in China. The two sides invested USD30M each in the fund, whose total size is USD300M. The two companies plan to attract a variety of global investors, including European banks and pension funds in Asia. (Laoyaoba, Light Reading, Business Korea)

Volvo Cars, which is owned by China’s Geely Holding, will temporarily stop or adjust production in China and the United States for parts of Mar 2021 due to a global shortage of semiconductor chips. They expect the situation to become critical during 2Q21 and have therefore decided to take measures to minimize the impact on production while working daily to improve the situation. (Gizmo China, Yahoo)

In all but two countries, according to GWI, free delivery is the most common purchase driver among millennials. Globally, it has a substantial lead over coupons and discounts (48% vs 39%), but in South Korea it is actually the latter that is more common (63% vs 60% for free delivery). In Indonesia, on the other hand, reviews from other customers are most likely to convert millennials into buyers (1.57 IDX). (GWI report)