3-24 #ComfortZone : Qualcomm has announced Snapdragon 860; BOE is preparing to provide Samsung’s smartphones with its flexible OLED panels for the first time; LG Electronics may shutter its mobile communication business rather than sell it; etc.

Two upstart manufacturers of semiconductor wafers in Japan, Ferrotec and RS Technologies, are expanding their presence in China, looking to ride Beijing’s efforts to achieve chip self-sufficiency and tap into the money the government is pouring into the sector. Though Zhonghuan Semiconductor and Zing Semiconductor mass-produce wafers, no Chinese manufacturers can compete against the heavyweights. Ferrotec and RS Technologies are counting on subsidies the Chinese government will extend to the sector. Even if Ferrotec and RS achieve steady footing in Chinese production, their scales would not compare with the big players, each of which produces about 2M units of 12” wafers a month. (CN Beta, Nikkei)

Qualcomm has announced Snapdragon 860, which is a revised version of Snapdragon 855. The SoC features an octa-core processor with Qualcomm’s Kryo 485 CPU cores clocking up to 2.96GHz, up from the 2.84GHz in the Snapdragon 855, and the same clock speeds as the Snapdragon 855+, as well as an Adreno 640 GPU. It is also fabricated on a 7nm process. (XDA-Developers, Liliputing, CN Beta)

Qualcomm is reportedly making an Android-based console similar to the Nintendo Switch. It would include detachable controllers and output to a TV, and might even come with the Epic Games Store. A launch is tentatively slated for 1Q22 for around USD300. (Android Authority, Android Police, Android Central, Sina, IT Home)

Huawei’s HiSilicon may launch the Kirin 9000L mobile platform. It is said to be manufactured using Samsung’s 5nm EUV process. The Kirin 9000L’s large CPU core will see its frequency reduced to 2.86GHz as against 3.13GHz for both the Kirin 9000 and 9000E. The GPU is an 18-core Mali-G78 while the 9000 and 9000E GPU cores are 24 cores and 22 cores, respectively. (Phone Arena, Gizmo China, Huawei Central, Huawei Update, CN Beta, Sina)

Samsung Display’s OLED panel shipment dropped 9% in Jan 2021 from the previous month to 45M units, according to market research firm Omdia. In Jan 2021, worldwide total smartphone OLED panel shipment was 53M units, a decline of 9% from the previous month. LG Display shipped 6M units in the same month, which were supplied to Apple iPhone 12. Total smartphone panel shipment, which combines OLED and liquid crystal display (LCD), for Jan 2021 was 164M units, a decline of 4% from the previous month but a surge of 35% from the previous year. (Gizmo China, The Elec)

BOE is preparing to provide Samsung’s smartphones with its flexible OLED panels for the first time. Samsung plans to use BOE’s flexible OLEDs for some of the Galaxy M series models, which will be official in 2H21. In addition, Samsung may also expand its cooperation with BOE to ensure its competitive advantage in product prices. (GizChina, IT Home)

Samsung Display will convert its OLED line dedicated to Apple into one that makes low-temperature polycrystalline oxide (LTPO) thin-film transistor (TFT) within 1H21, according to UBI Research. Its A3 factory line has been manufacturing low-temperature polycrystalline silicon (LTPS) TFT OLED panels. Samsung Display has secured 30,000 Gen 6 substrates per month capacity for LTPO TFT OLED panels on its Apple-dedicated production line in 2020. Once the whole conversion to LTPO TFT is finished within 1H21, the production capacity of line will be dropped to 70,000 substrates per month from the previous 105,000. (Apple Insider, The Elec)

Samsung Electronics is betting heavily on foldable smartphones, with plans to sharply increase production and a new, double-folding model under development. Samsung plans to release the new generations of its Galaxy Z Flip and Galaxy Z Fold phones in 2021 and is also working on a double-folding phone that could be unveiled as early as the end of 2021. (Pocket-Lint, Nikkei, 163)

Samsung hints at 200MP camera smartphone with 6 sensors. Moreover, the company also shows a dual-camera on the front. All these cameras should be working under the control of a Samsung Exynos chip. (GizChina, Twitter)

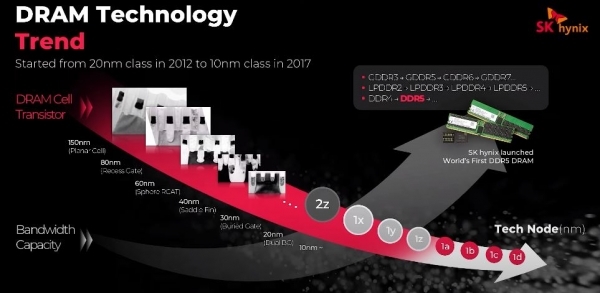

SK Hynix CEO Seok-Hee Lee has delivered his vision for the future of memory and the industries that rely on it. He has predicted that there will be a convergence of memory and logic. The concept is to add a few computing functions of CPU to DRAM. As the speed was increased in high-bandwidth memory by increasing the number of channels between the CPU and the memory, the speed will increase further in Processing Near Memory (PNM), where both the CPU and the memory exist within a single module. (My Drivers, SK Hynix, The Register, YNA)

LG Electronics has joined forces with two other partners to develop next-generation 6G network technology. LG has signed a partnership with Keysight Technologies, a U.S.-based electronics test and measurement firm, and the Korea Advanced Institute of Science & Technology (KAIST), South Korea’s leading research university. The 3 sides will cooperate in developing technologies related to terahertz, a key frequency band for 6G communications. They target to complete 6G research by 2024. (CN Beta, Telecom Paper, YNA)

LG Electronics may shutter its mobile communication business rather than sell it. Negotiations with Germany’s Volkswagen AG and Vietnam’s Vingroup JSC on possible sale of the smartphone business seemed to have failed. (Gizmo China, DongA, Bloomberg, CN Beta)

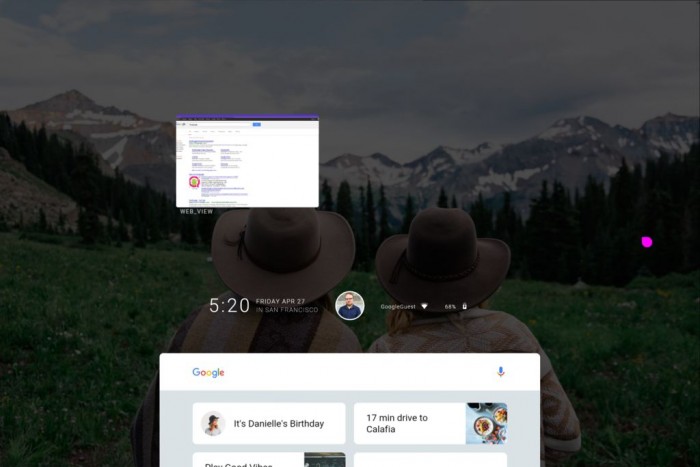

Google is preparing for Fuchsia’s first developer releases. The Fuchsia team has recently opened the door for developers to contribute to the project, which aims to create a secure operating system not built on Linux. Google has recently unveiled a proposal for how Fuchsia could still run apps written for Linux platforms, including Android apps. (CN Beta, 9to5Google, GizChina)

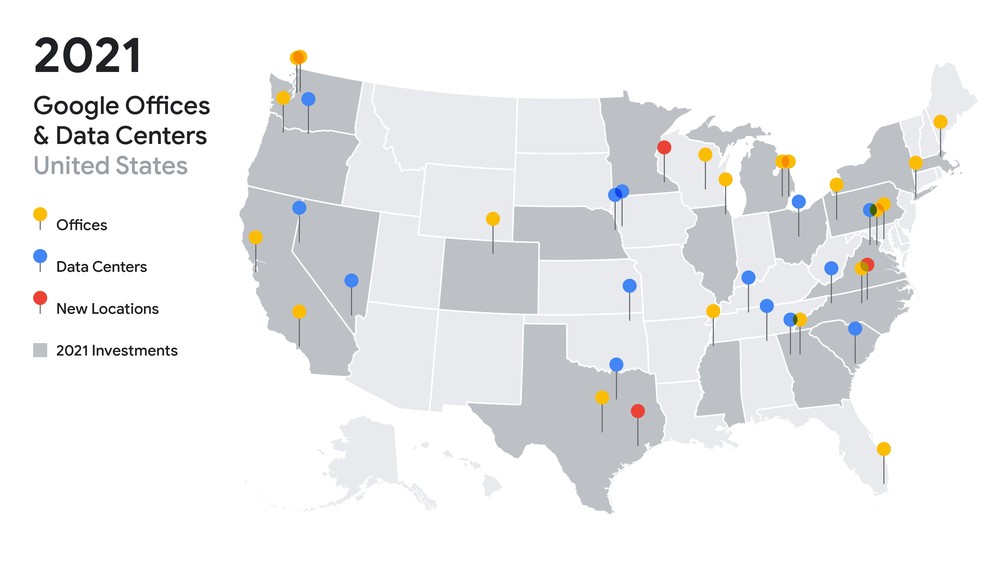

Google will spend over USD7B for new offices and data centers, as well as expansions, across the country in 2021. In total, there will be at least 10,000 new full-time Google jobs stateside. (Android Headlines, 9to5Google, Google, 163.com, Reuters)

Meizu may reportedly adopt Huawei Mobile Services (HMS) on its smartphones. The latest version of the HMS Core 5.0 might arrive in Meizu devices soon. (CN Beta, Gizmo China, Baidu)

vivo iQOO U3X 5G is announced in China – 6.58” 1080×2408 FHD+ v-notch 90Hz, Qualcomm Snapdragon 480 5G, rear dual 13MP-2MP depth + front 8MP, 4+128 / 6+64 / 8+128GB, Android 11.0, side fingerprint, 5000mAh 18W, start from CNY1,199 (USD185). (GizChina, GSM Arena, JD.com)

vivo Y72 5G is announced in Thailand – 6.58” 1080×2480 FHD+ v-notch, MediaTek Dimensity 700 5G, rear tri 64MP-8MP ultrawide-2MP macro + front 16MP, 8+128GB, Android 11.0, side fingerprint, 5000mAh 18W, THB9,999 (USD323). (Gizmo China, GSM Arena)

Xiaomi POCO X3 Pro and F3 are debut in Europe: X3 Pro – 6.67” 1080×2400 FHD+ HiD IPS LCD 120Hz, Qualcomm Snapdragon 860, rear quad 48MP-8MP ultrawide-2MP macro-2MP depth + front 20MP, 6+128 / 8+256GB, Android 11.0, side fingerprint, 5160mAh 33W, EUR249 / EUR299. F3 – 6.67” 1080×2400 FHD+ HiD AMOLED 120Hz, Qualcomm Snapdragon 870 5G, rear tri 48MP-8MP ultrawide-5MP macro + front 20MP, 6+128 / 8+256GB, Android 11.0, side fingerprint, 4520mAh 33W, EUR349 / EUR399. (Android Authority, GSM Arena, POCO, POCO)

Honor V40 Lite is announced in China – 6.57” 1080×2340 FHD+ HiD OLED 90Hz, MediaTek Dimensity 800U 5G, rear quad 64MP-8MP ultrawide-2MP macro-2MP depth + front 32MP, 8+128 / 8+256GB, Android 10.0, fingerprint on display, 3800mAh 66W, reverse charging 5W, CNY2,999 (USD460) / CNY3,299 (USD506). (My Drivers, GSM Arena)

realme C25 is launched in Indonesia – 6.5” 720×1600 HD+ v-notch, MediaTek Helio G70, rear tri 48MP-2MP macro-2MP mono + front 8MP, 4+64 / 4+128GB, Android 11.0, rear fingerprint, 6000mAh 18W, reverse charging, starts from IDR2.3M (USD160). (GSM Arena, CN Beta, realme)

vivo X60 5G and X60 Pro 5G are launched in Malaysia (with slight differences from the China version), featuring Qualcomm Snapdragon 870 5G, Android 11.0, fingerprint on display: X60 5G – 6.56” 1080×2376 FHD+ HiD flat AMOLED 120Hz, rear tri 48MP OIS-13MP portrait-13MP ultrawide + front 32MP, 12+256GB, 4300mAh 33W, MYR2,700 (USD655). X60 Pro 5G – 6.56” 1080×2376 FHD+ HiD curved AMOLED 120Hz, rear tri 48MP gimbal stabilization-13MP portrait-13MP ultrawide + front 32MP, 12+256GB, 4200mAh 33W, MYR3,300 (USD800). (GSM Arena, vivo, vivo)

Black Shark 4 and 4 Pro are announced in China featuring 6.67” 1080×2400 FHD+ HiD Super AMOLED 144Hz, side fingerprint, 4500mAh 120W, physical pop-up gaming triggers: 4 – Qualcomm Snapdragon 870 5G, rear tri 48MP-8MP ultrawide-5MP macro + front 20MP, 6+128 / 8+128 / 12+128 / 12+256GB, CNY2,499 (USD383) / CNY2,699 (USD415) / CNY2,999 (USD460) / CNY3,299 (USD505). 4 Pro – Qualcomm Snapdragon 888 5G, rear tri 64MP-8MP ultrawide-5MP macro + front 20MP, 8+256 / 12+256 / 16+512GB, CNY3,999 (USD615) / CNY4,499 (USD690) / CNY5,299 (USD815). (GSM Arena, BlackShark, CN Beta)

OnePlus 9 series is announced globally, with camera in collaboration with Hasselblad, featuring Qualcomm Snapdragon 888, fingerprint on display, Android 11.0: 9 Pro – 6.7” 1440×3216 QHD+ HiD LTPO Fluid2 AMOLED 120Hz, rear quad 48MP OIS-8MP telephoto 3x optical zoom OIS-50MP ultrawide-2MP depth + front 16MP, 8+128 / 12+256GB, 4500mAh 65W, fast wireless charging 50W, EUR899 (USD969) / EUR999 (USD1,069). 9 – 6.55” 1080×2400 FHD+ HiD Fluid AMOLED 120Hz, rear tri 48MP-50MP ultrawide-2MP depth + front 16MP, 8+128 / 12+256GB, 4500mAh 65W, fast wireless charging 15W, EUR699 (USD729) / EUR799 (USD829).(Android Central, GSM Arena, CN Beta)

OnePlus 9R is announced for India – 6.55” 1080×2400 FHD+ HiD Fluid AMOLED 120Hz, Qualcomm Snapdragon 870 5G, rear quad 48MP OIS-16MP ultrawide-5MP macro-2MP depth + front 16MP, 8+128 / 12+256GB, Android 11.0, fingerprint on display, 4500mAh 65W, INR39,999 (USD550) / INR43,999 (USD605). (Android Central, GSM Arena, GizChina)

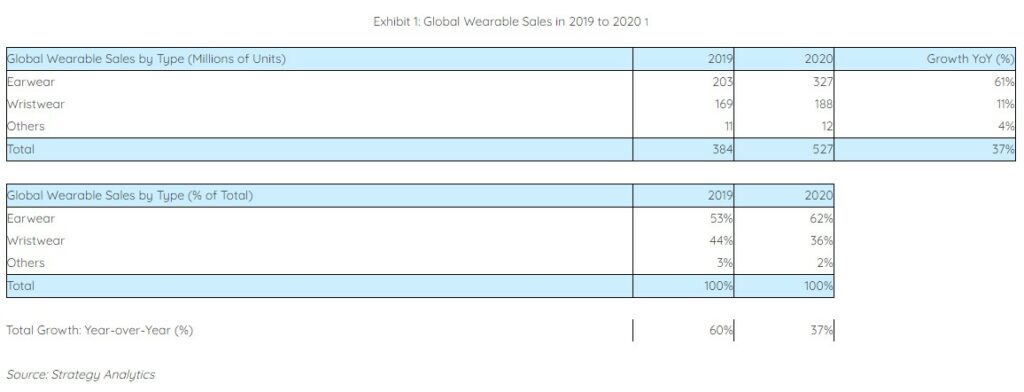

According to Strategy Analytics, more than a 0.5B wearables are sold worldwide for the first time ever in 2020. TWS Bluetooth earbuds and smartwatches from Apple, Xiaomi and others were among the main drivers of wearables growth. Strategy Analytics estimates global wearable sales grew a healthy 37% from 384M units in 2019 to a record 527M in 2020. (GizChina, Strategy Analytics)

AR technology company Niantic and Nintendo are partnering together to jointly develop apps that combine Niantic’s real-world AR technology with Nintendo’s beloved characters. The first title the two companies are developing together is based on the Pikmin franchise. (Neowin, Nintendo, TechCrunch, Sina, IT Home)