3-28 #NoHatred : Xiaomi has indicated that in some cases the prices of its products might rise as a result; Meitu has ended its partnership with Xiaomi and has taken back its trademarks and licenses; BOE will invest CNY3.8B to increase its large-size liquid crystal display panel production; etc.

Xiaomi’s president Wang Xiang has said that the global chip shortage was increasing the company’s costs and implied that in some cases the prices of its products might rise as a result. They will continue to optimize the costs of their hardware devices. (Reuters, Android Authority, GizChina)

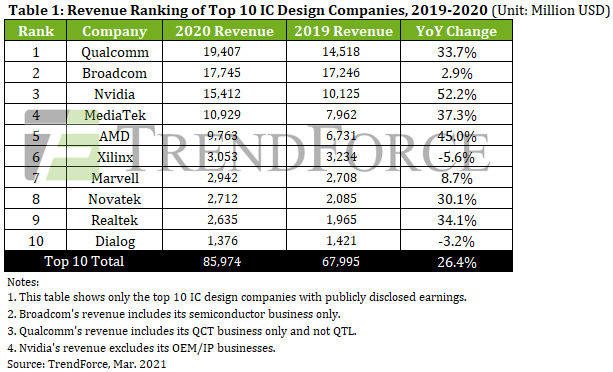

The emergence of the COVID-19 pandemic in 1H20 seemed at first poised to devastate the IC design industry. However, as WFH and distance education became the norm, TrendForce finds that the demand for notebook computers and networking products also spiked in response, in turn driving manufacturers to massively ramp up their procurement activities for components. Fabless IC design companies that supply such components therefore benefitted greatly from manufacturers’ procurement demand, and the IC design industry underwent tremendous growth in 2020. In particular, the top 3 IC design companies (Qualcomm, Broadcom, and Nvidia) all posted YoY increases in their revenues, with Nvidia registering the most impressive growth, at a staggering 52.2% increase YoY, the highest among the top 10 companies. (Laoyaoba, TrendForce, TrendForce)

PMIC is mainly produced in 8” wafer fabs, and 6” / 8” wafer foundries are the most cost-effective production of the phone chips, but it is more difficult to expand the production capacity of 6” / 8” wafer foundries. According to SEMI, the number of global 8” production lines in 2016 is 188, and by the end of 2020, it has only increased to 191. Due to the tight production capacity of 8” wafers, some PMIC production has been transferred from 8” to 12” fabs at this stage. Yet the conversion time and yield problems cannot quickly alleviate the current “core shortage” problem in the short term. (Laoyaoba, CN Beta, QQ)

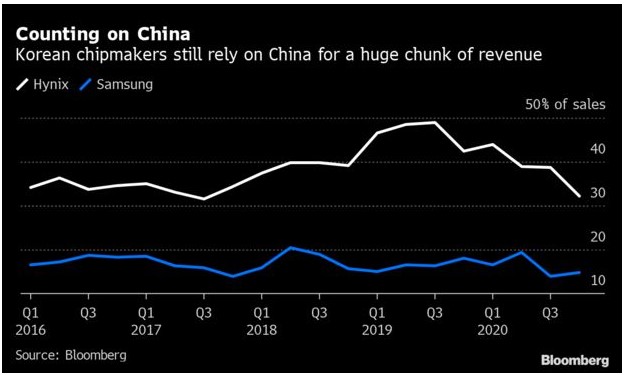

South Korea’s advanced semiconductor industry is witnessing soaring global demand as consumer electronics sell out during the pandemic, with exports by Samsung Electronics and SK Hynix leading what is shaping up to be the strongest quarter of economic growth since 2018. Yet with chips at the heart of the U.S.-China conflict, Seoul risks serious collateral damage if the superpower rivalry intensifies under presidents Joe Biden and Xi Jinping. (Bloomberg, Laoyaoba, Yahoo)

Chinese electric car start-up Nio has said it is shutting a factory for five days due to the global shortage in semiconductors. The production halt beginning 29 Mar 2021 will reduce Nio’s 1Q21 deliveries by at least 500 vehicles. That puts expected deliveries for 1Q21 at 19,500, versus the previously announced forecast of 20,000-20,500. (CN Beta, Sina, Yahoo, CNBC)

Pure-play foundries have raised their quotes to fair and reasonable levels, according to Frank Huang, chairman for Taiwan-based foundry Powerchip Semiconductor Manufacturing (PSMC). PSMC has run its 12” and 8” wafer fabrication lines at full capacity utilization, which will persist through the end of 2022. PSMC runs three 12” wafer fabs and two 8” fabs in northern Taiwan, and has just broken ground for a new 12” fab designed for an installed capacity of 100,000 12” wafers monthly. (CN Beta, Digitimes, press, Taipei Times)

The global chip shortage will become a problem for devices like iPhones and Macs requiring chips for storage, but Wedbush believes it could be beneficial to Apple and its suppliers by improving the pricing of components. The crisis could take place for an extended period, according to analyst Matt Bryson, due to the “increasingly tight availability of wafers” and a lack of “incremental mature capacity” for production. With the shortages “approaching ludicrous levels”, the problem is becoming a big issue for many smartphone and device vendors. While this is an issue in the short term, the firm believes it could be a situation that benefits device producers, as “constraints yield forward pricing leverage”. (CN Beta, Sina, Apple Insider)

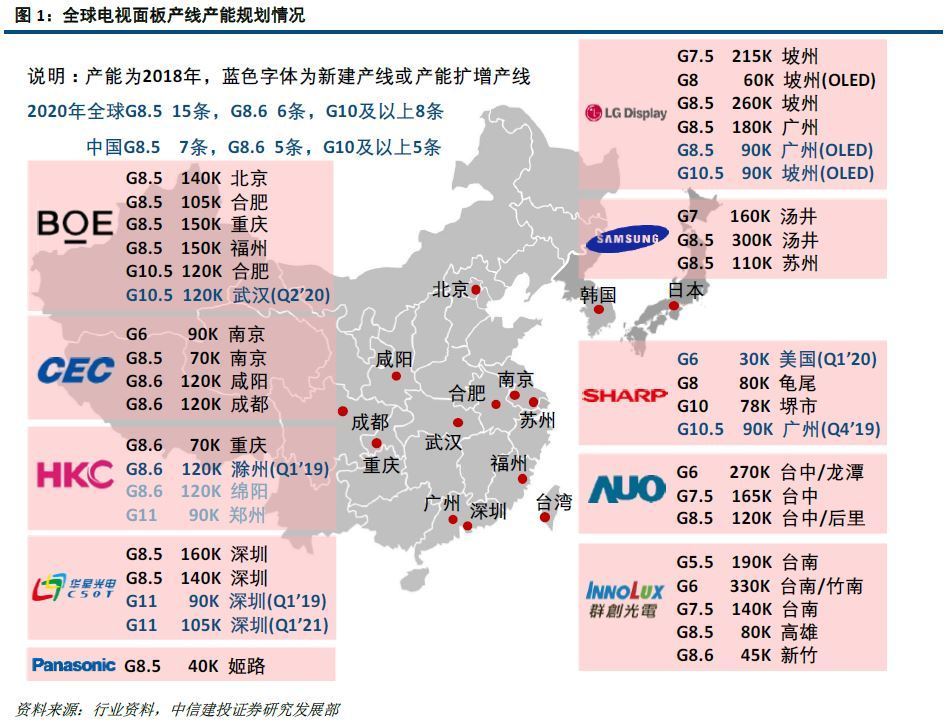

BOE Technology will invest CNY3.8B (USD583.7M) to increase its large-size liquid crystal display panel production to meet market demand. BOE will expand its Wuhan factory’s monthly capacity of 10.5th generation LCD panels to 180,000 units from the current 155,000. The goal would be reached in 2022. Besides that factory, the company has another Gen-10.5 LCD panel production line in eastern China’s Hefei with a capacity of 120,000 glass substrates per month, according to public information. (Laoyaoba, Yicai Global)

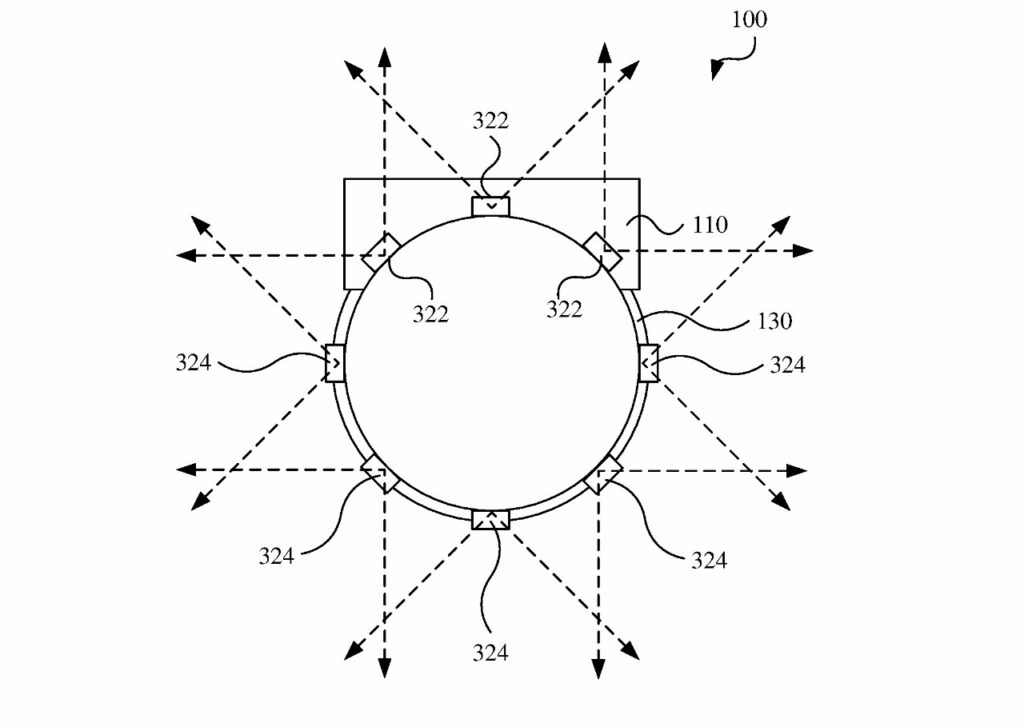

Apple’s series of augmented reality (AR) related patent applications demonstrate that Apple is researching multiple ways that “Apple Glass” wearers can control their devices and interact with or adjust what they’re viewing. A patent application “Head-Mounted Display”, concerns with how HMD will physically arrange its cameras. The cameras are each coupled to one of the display unit or the head support. The cameras have camera fields of view that overlap horizontally to cooperatively provide the head-mounted display with a head-mounted display field of view of 360º horizontal. Then others, filed separately but all newly revealed, concentrate on issues such as where controls will be placed on the device. Those controls can be real or virtual, too. (Apple Insider, CN Beta)

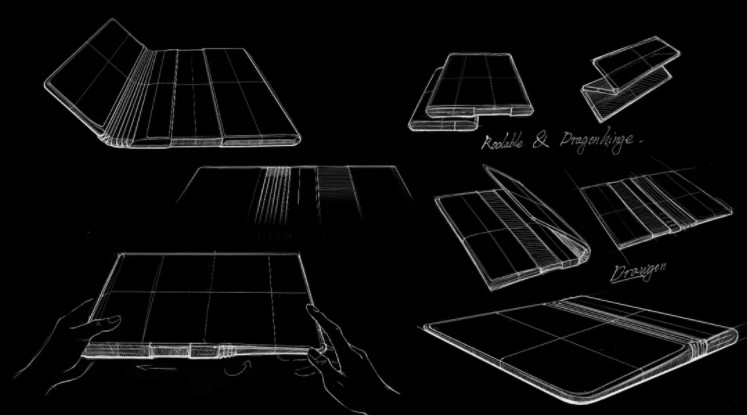

TCL sketches show how a device could incorporate both foldable and rollable displays. One of the phones bends using TCL’s DragonHinge, turning a smartphone into a small tablet. The other one shows how a user would also be able to roll out the display to turn the smaller tablet into a bigger tablet. (Neowin, CNET)

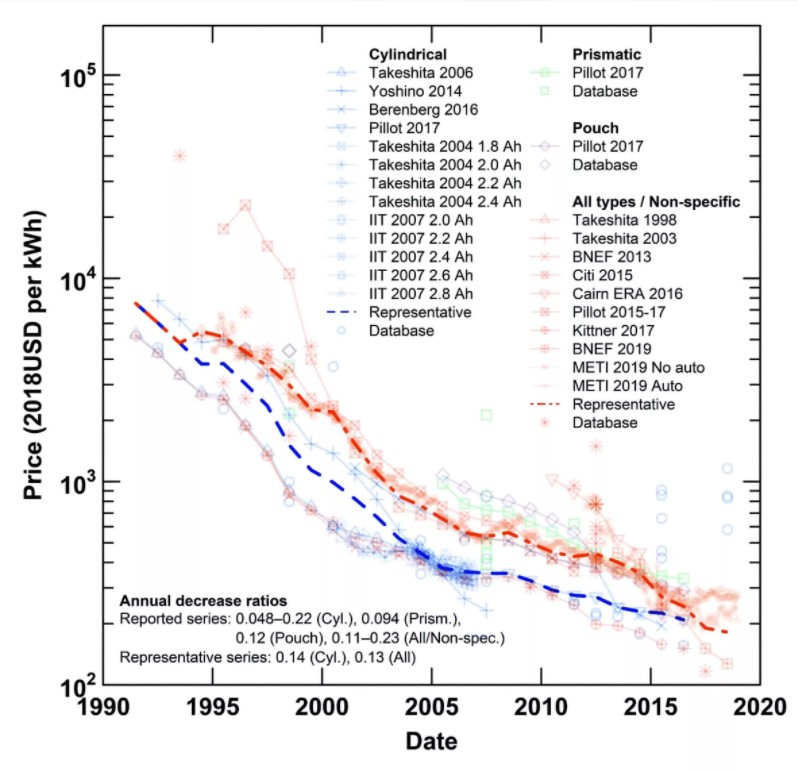

The cost of the rechargeable lithium-ion batteries used for phones, laptops, and cars has fallen dramatically over the last 30 years. MIT has found that the cost of these batteries has dropped by 97% since they were first commercially introduced in 1991. This rate of improvement is much faster than many analysts had claimed and is comparable to that of solar photovoltaic panels, which some had considered to be an exceptional case. (CN Beta, MIT, Green Car Congress)

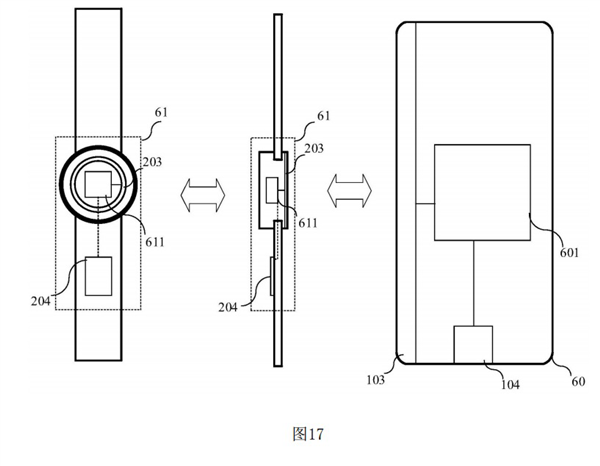

Huawei’s patent is for a new “wireless charging system”, which is capable of ranged transmission. The technology is capable of transmission while having a distance between transmitting electrode and the one receiving electrode. To put it simply, its ranged form of wireless charging technology. Looking at the patent description, it states that current wireless charging technology requires two coils to be placed directly opposite to each other, with the distance between the two being very close to transmit power. (Laoyaoba, My Drivers, Gizmo China)

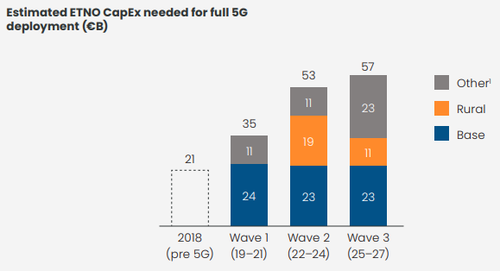

Europe’s telecom incumbents may have imbibed something more potent than the average pilsner when they signed off on the latest report from ETNO, a club whose main purpose is whingeing to European regulatory authorities. Prepared by the Boston Consulting Group (BCG), it calls for a EUR300B (USD353B) investment in Europe’s telecom infrastructure by 2025. Perhaps double vision obscured the numbers. (Laoyaoba, Telecoms, Reuters, Light Reading)

Meitu CEO, Wu Xinhong has revealed that Meitu has ended its partnership with Xiaomi and has taken back its trademarks and licenses. He has also stated that Meitu will no longer be involved in the manufacturing and sales of mobile phones. (Gizmo China, 36Kr, Sina)

Google has announced the Android Ready SE Alliance to make sure new phones have the underlying hardware to eventually replace car / home keys and wallets. Google has determined that “SE offers the best path for introducing these new consumer use cases in Android”. To “accelerate adoption,” the company and partners (Giesecke + Devrient, Kigen, NXP, STMicroelectronics, and Thales) have announced the Android Ready SE Alliance. (Engadget, 9to5Google, Google)

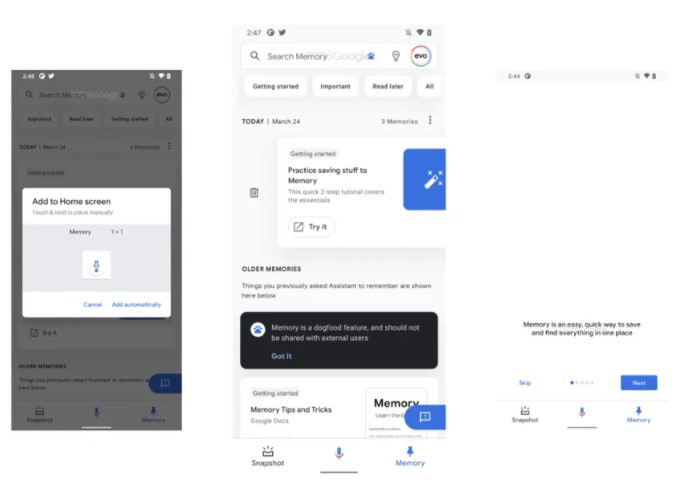

Google is reportedly working on a new feature for Assistant called Memory, a combination of a to-do list, a notes app, a Pocket-like reading list, and Pinterest-style collection board into a single overarching digital locker integrated into the broader Google Assistant app. (The Verge, 9to5Google, CN Beta)

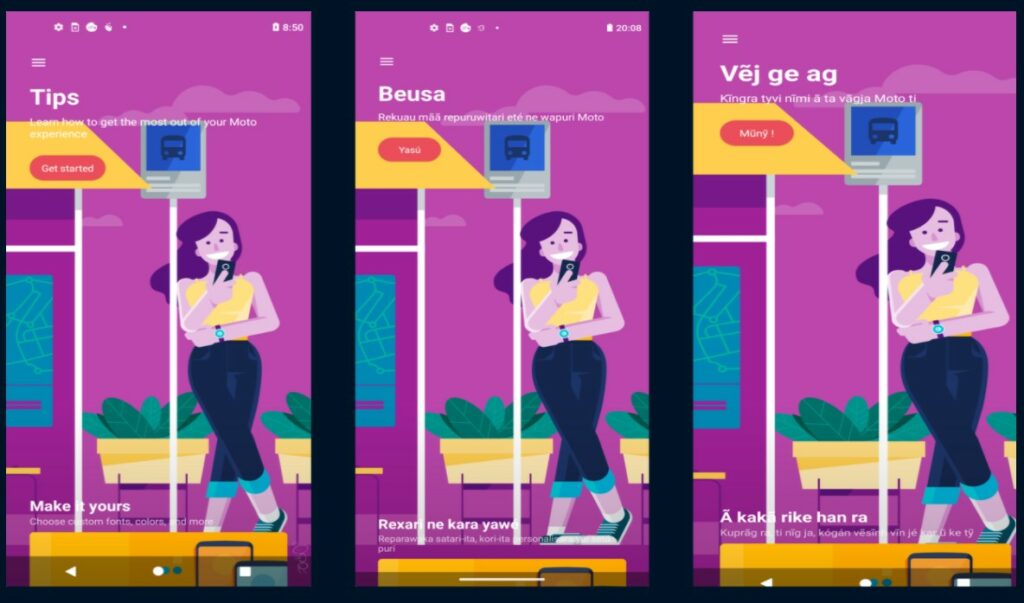

Motorola has added support for two new indigenous languages spoken in the Amazon as part of a larger effort to make technology more accessible. Beginning today, Kaingang and Nheengatu will be among the language options available on Motorola Android devices. Any Motorola phone updated to Android 11 will be able to access the new language options, not just its most expensive models. (CN Beta, Motorola, Techno Trenz)

Moto G50 is announced in Europe – 6.5” 720×1600 HD+ v-notch 90Hz, Qualcomm Snapdragon 480 5G, rear tri 48MP-5MP macro-2MP depth + front 13MP, 4+64GB, Android 11.0, rear fingerprint, 5000mAh 15W, EUR249. (GSM Arena, Liliputing, GizChina)

Moto G100 is launched in Europe – 6.7” 1080×2520 FHD+ 2xHiD 90Hz, Qualcomm Snapdragon 870 5G, rear quad 64MP-16MP ultrawide-2MP depth-3D ToF + front dual 16MP-8MP ultrawide, 8+128GB, Android 11.0, side fingerprint, 5000mAh 20W, EUR499.99. (Liliputing, GSM Arena, GizChina)

Apple is reportedly considering launching an Apple Watch with a rugged casing in 2021 or 2022 at the earlies aimed at athletes, hikers and others who use the device in more extreme environments. (MacRumors, Bloomberg, CN Beta, CN Beta)

MeetinVR has launched its app for collaborative meetings in virtual reality. It is available in the Oculus Store and can run on the Oculus Quest and Quest 2 platforms. Fortune 500 companies and private users are keen to explore the possibilities of VR collaboration. Within the past 5 years, MeetinVR has signed many multinational corporations. (VentureBeat, VR Focus)

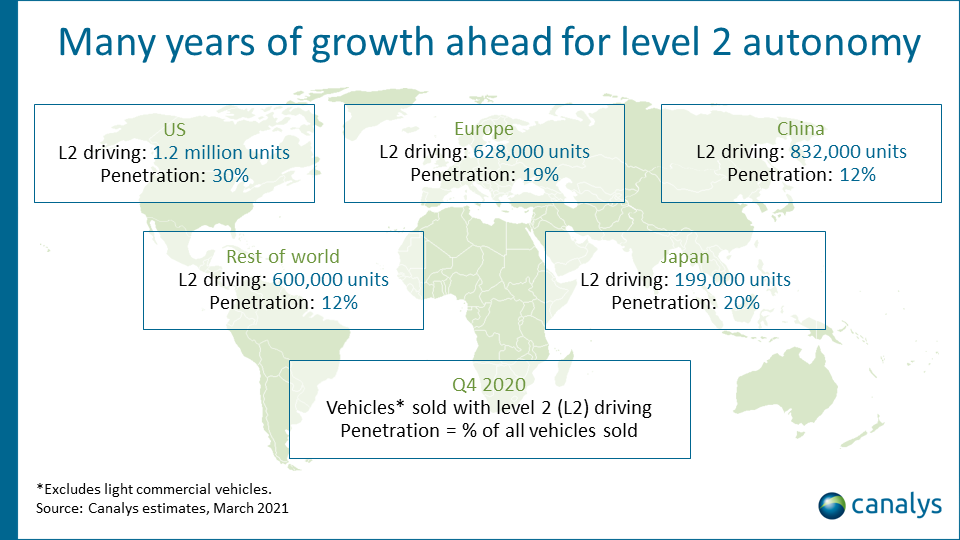

According to Canalys, 3.5M passenger cars worldwide were sold with level 2 autonomy driving features in 4Q20, growing 91% YoY. Level 2 autonomy driving features were in 30% of new vehicles sold in the US, 20% in Japan, 19% in Europe and 12% in China. For the full-year 2020 11.2M cars sold with level 2 features, a growth of 78% compared to 2019. (Neowin, Canalys)

Huawei is reportedly working on a new product that will be priced at around USD45,000. This product may be the first car of the company, which is likely to be fully electric. Earlier, Huawei has said it is not going to produce the car on its own. It will most likely be produced by a car manufacturing partner brand. The company has also recently announced that its Huawei Mobile Services (HMS) will be available in the Mercedes Benz S-Class sedans sold in China. (GizChina, IT Home)

Faraday Future (FF), a California-headquartered global shared intelligent mobility ecosystem company, has announced that it has raised approximately USD100M in debt financing commitments led by Ares, along with existing lender Birch Lake and other lenders joining the debt financing round. (CN Beta, Business Wire, Yahoo)

South Korea has announced that it plans to spend KRW1.1T (USD974M) by 2027 to speed up the development of Level 4 self-driving vehicles and boost related technologies. Under the plan, South Korea will support 84 projects to develop vehicle convergence, information and communication and road traffic technologies, as well as self-driving services and the broader ecosystem of self-driving vehicles.(Laoyaoba, YNA, Korea Herald)

Xiaomi Corp allegedly plans to make electric vehicles (EVs) using Great Wall Motor’s factory. Xiaomi has declined to comment, while Great Wall has said it had not discussed such a partnership with Xiaomi. Xiaomi allegedly plans to launch its first EV around 2023. (Neowin, Laoyaoba, Reuters)

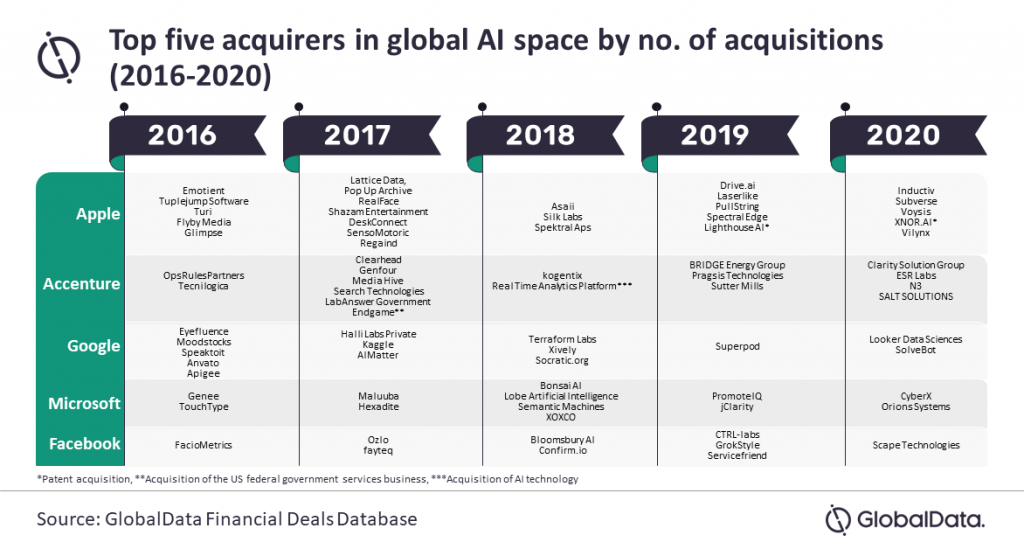

From 2016 to 2020, Apple has acquired 25 artificial intelligence (AI) firms, according to GlobalData. The rest of the list of leading AI company buyers included Ireland-based Accenture, Google, Microsoft, and Facebook. Some of the companies that Apple acquired include Silk Labs, Turi, Drive.ai, and Voysis. (Apple Insider, GlobalData)