3-30 #LifeGoesOn : The US FTC has announced to give up on its antitrust case against Qualcomm; Xiaomi plans to invest CNY100B in EV manufacturing over the next decade; Foxconn Electronics is allegedly developing LFP and solid-state batteries for use in EVs; etc.

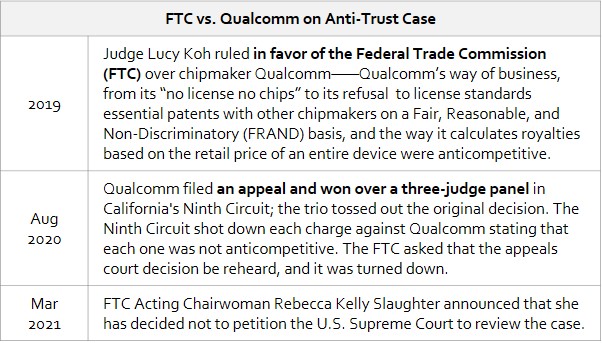

The US Federal Trade Commission (FTC) has announced to give up on its antitrust case against Qualcomm, dropping it rather than asking the Supreme Court to weigh in. In a statement, Acting FTC Chairwoman Rebecca Kelly Slaughter has said she still believes Qualcomm violated antitrust laws. (Phone Arena, Reuters, FTC, ZDNet)

Renesas Electronics now believes damage from a fire at its chip-making plant was more extensive than first thought. The company has initially said 11 machines were damaged, but the number of inoperable machines is now believed to be around 17. The company has said it will take at least a month to resume production at its 300mm wafer line but replacing damaged machines could take several months. (CN Beta, Reuters, ITNews)

A global shortage of chips that has rattled production lines at car companies and squeezed stockpiles at gadget makers is now leaving home appliance makers unable to meet demand, according to Jason Ai, the president of Whirlpool in China. The U.S. based company, one of the world’s largest white goods firm, saw chip deliveries fall short of its orders by about 10% in Mar 2021. (Reuters, NDTV, Gizmo China, LTN)

Samsung Electronics has stated that the production of chips in the company’s Austin chip plant in Texas, US, has returned to nearly normal levels as of end-Mar 2021. The U.S. chip facility is forced to halt its operations in mid-Feb 2021 after a severe winter storm caused a power outage in the region. Industry sources estimated that the monthlong production halt may have cost Samsung over KRW300B (USD264M). (CN Beta, Channel News Asia, Korea Bizwire, Gizmo China, Reuters)

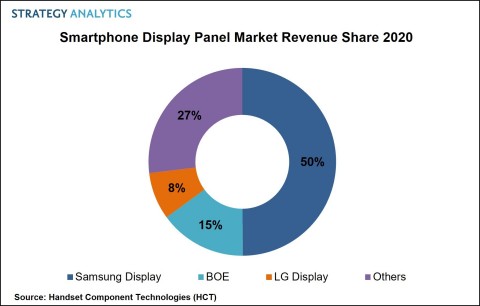

The global smartphone display panel market clocked total revenue of USD43B in 2020, according to the Strategy Analytics. Samsung Display took the leadership in the smartphone display panel market with 50% revenue share followed by BOE Technology with 15% and LG Display with 8% in 2020. The top-three display panel vendors took almost 73% revenue share in the global smartphone display panel market in 2020. (CN Beta, Strategy Analytics)

O-Film has announced that WingTech intends to acquire 100% of the equity of Guangzhou Delta Imaging Technology and Jiangxi Jingrun Optical in cast at a total transaction price of CNY2.42B. WingTech’s acquisition of this part of business hopes to enter Apple’s supply chain, but there is still uncertainty about this matter. It will only be possible after Apple’s evaluation. (My Drivers, Sina, NBD)

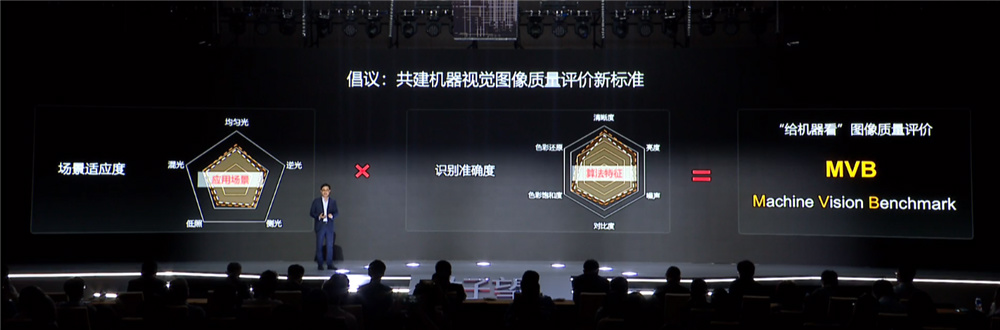

President of Huawei’s Machine Vision Duan Aiguo has announced 3 new technologies along with 7 new products. The company has released SuperColor, SuperCoding, and AI Turbo technologies as well as a new generation of cameras. Huawei has proposed the Machine Vision Benchmark (MVB). The standard mainly focuses on two aspects: 1. Scene adaptability. 2. Recognition accuracy. (Gizmo China, IT Home, Zhihu)

Xiaomi has announced a wireless charging pad that is capable of charging three devices, each up to 20W simultaneously, for a total of 60W across the pad. Xiaomi says the charging pad includes 19 wireless charging coils, enabling devices to be charged anywhere they are placed on the pad. It is priced at CNY599 (USD91). (MacRumors, Phone Arena, IT Home, ChinaZ)

Foxconn Electronics is allegedly developing LFP (lithium iron phosphate) and solid-state batteries for use in electric vehicles (EVs). For EVs, Foxconn and Hua-chuang Automotive Information Technical Center under Yulon Motor have established Foxtron Vehicle Technologies, a joint venture to operate MIH which is an open hardware/software-integrated platform for developing EVs. (CN Beta, Digitimes, press)

Redwood Materials is teaming up with electric commercial vehicle manufacturer Proterra in a deal that may help boost the domestic battery supply chain. All Proterra batteries will be sent to Redwood’s facilities for recycling in Carson City, Nevada. Proterra has sent around 26,000 pounds of battery material to Nevada for recycling since entering the partnership, though this does not represent the pace of future deliveries. Overall, Redwood receives 60 tons per day, or 20,000 tons of batteries per year. (CN Beta, TechCrunch, Sina, Online EV)

T-Mobile has announced it would shut down TVision’s three bundles of live channels at end of Apr 2021. The development comes as part of T-Mobile’s new partnership with Google and YouTube. The carrier says YouTube TV will now fill the role of its “live TV solution”. (Android Headlines, The Verge, CN Beta)

T-Mobile has announced plans to expand its collaboration with Google across a wide array of customer experiences later in 2021, including establishing Messages by Google as the default rich messaging solution. (Phone Arena, T-Mobile)

Apple’s Independent Repair Provider program will soon be available in more than 200 countries, nearly every country where Apple products are sold. Launched originally in 2019 and expanded to Europe and Canada last year, the program enables repair providers of all sizes access to genuine Apple parts, tools, repair manuals, and diagnostics to offer safe and reliable repairs for Apple products. (CN Beta, Apple, Neowin)

Xiaomi has unveiled a new visual identity that includes a redesigned logo and new typography. The new logo was designed by Kenya Hara, a professor of Musashino Art University and the President of the Nippon Design Center (NDC). (CN Beta, Gizmo China)

Xiaomi Mi 11 Ultra is launched in China – 6.81” 1440×3200 QHD+ HiD AMOLED 120Hz + 1.1” AMOLED selfie display, Qualcomm Snapdragon 888, rear tri 50MP OIS-48MP periscope telephoto 5x optical zoom OIS-48MP ultrawide + front 20MP, 8+256 / 12+256 / 12+512GB, Android 11.0, fingerprint on display, 5000mAh 67W, fast wireless charging 67W, reverse wireless charging 10W, CNY5,999 (USD913) / CNY6,499 (USD989) / CNY6,999 (USD1,065). (CN Beta, GSM Arena, Gizchina, Android Authority)

Xiaomi Mi 11 Pro is launched in China – 6.81” 1440×3200 QHD+ HiD AMOLED 120Hz, Qualcomm Snapdragon 888, rear tri 50MP OIS-8MP periscope telephoto 5x optical zoom OIS-13MP ultrawide + front 20MP, 8+128 / 8+256 / 12+256GB, Android 11.0, fingerprint on display, 5000mAh 67W, fast wireless charging 67W, reverse wireless charging 10W, CNY4,999 (USD762) / CNY5,299 (USD807) / CNY5,699 (USD868). (CN Beta, Android Authority, GizChina, GSM Arena)

Xiaomi Mi 11i 5G is announced in Europe – 6.67” 1080×2400 FHD+ HiD Super AMOLED 120Hz, Qualcomm Snapdragon 888, rear tri 108MP-8MP ultrawide-5MP macro + front 20MP, 8+128 / 8+256GB, Android 11.0, side fingerprint, 4520mAh 33W, EUR649 / EUR699. (GSM Arena, Xiaomi)

Xiaomi Mi 11 Lite 5G is official in China – 6.55” 1080×2400 FHD+ HiD AMOLED 90Hz, Qualcomm Snapdragon 780, rear tri 64MP-8MP ultrawide-5MP macro + front 20MP, 8+128 / 8+256GB, Android 11.0, side fingerprint, 4250mAh 33W, CNY2,999 (USD350) / CNY2,599 (USD396). (GSM Arena, GizChina, Gizmo China)

Xiaomi Mi Mix Fold is announced in China – 8.01” 1440×3040 19:9 2K OLED Dolby Vision + 6.5” 840×2520 AMOLED 90Hz cover display, Qualcomm Snapdragon 888, rear tri 108MP-8MP telephoto 3x optical zoom-13MP ultrawide + front 20MP, 12+256 / 12+512 / 16+512GB, Android 10.0, side fingerprint, 5020mAh 67W, quad speakers by Harmon Kardon, CNY9,999 (USD1,521) / CNY10,999 (USD1,674) / CNY12,999 (USD1,977). (Android Authority, GSM Arena, CN Beta)

OPPO A54 is launched in Indonesia – 6.51” 720×1600 HD+ HiD, MediaTek Helio P35, rear tri 13MP-2MP macro-2MP depth + front 16MP, 4+128GB, Android 10.0, side fingerprint, 5000mAh 18W, IDR2.699M (USD185). (GSM Arena, Sina, OPPO, Gizmo China)

Orders are full and the quotations of key upstream components continue to increase. Therefore, Acer and Asus will increase the price of notebooks in 2Q21. Asus and Acer laptops will become 5%-10% more expensive in 2Q21. It will be the first substantial increase in the segment in 10 years. Acer has stated that currently the company can only deliver 1 of 3 orders from customers, and the conversion gap is nearly 70%. Asus currently has a supply gap of 25% -30%. (GizChina, IT Home, UDN)

Xiaomi Mi Smart Band 6 is launched globally – 1.56” 152×486 2.5D curved AMOLED, support up to to 30 exercise modes and can auto-detect some, supports 24×7 heart rate monitoring (PPG), SpO2 (Blood Oxygen measurement), sleep tracking, stress monitoring, 5ATM water-resistant, 125mAh LiPo battery, CNY229 (non-NFC) / CNY279 (NFC) / EUR45 (standard non-NFC). (Gizmo China, GizChina, GSM Arena, CN Beta)

Xiaomi has now diversified its interests into electric vehicles (EV) — with plans to invest CNY100B (USD10B) in EV manufacturing over the next decade. It will set up a wholly-owned subsidiary to operate in the smart electric vehicles business with an initial investment of CNY10B (~USD1.5B). (Android Authority, Gizmo China, Engadget, CN Beta, Twitter)

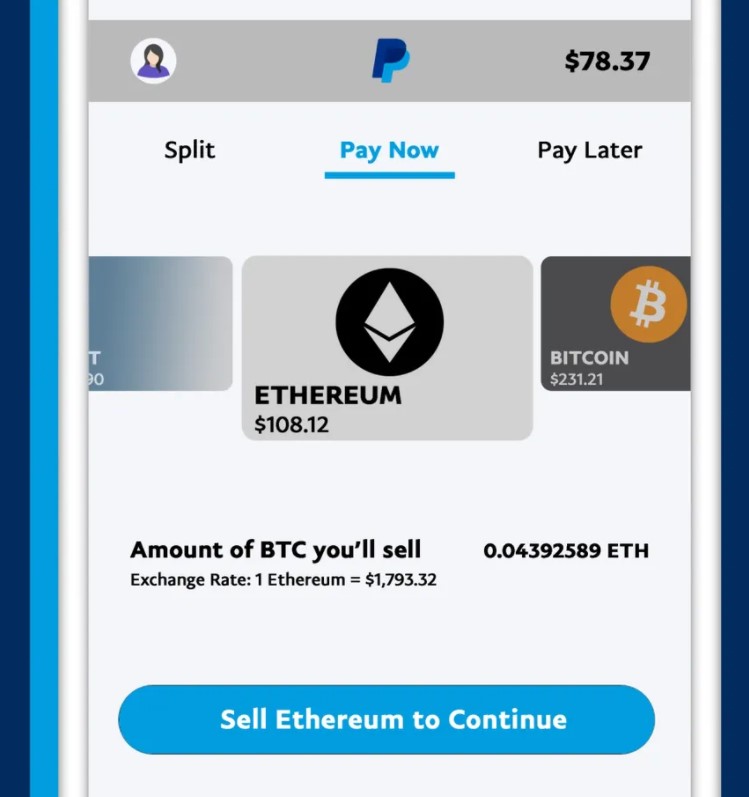

PayPal has started allowing U.S. consumers to use their cryptocurrency holdings to pay at millions of its online merchants globally. Customers who hold bitcoin, ether, bitcoin cash and litecoin in PayPal digital wallets will now be able to convert their holdings into fiat currencies at checkouts to make purchases. The service will be available at all of its 29M merchants in the coming months. (CN Beta, The Verge, CNBC)