4-7 #BusinessTrip : Samsung Display has signed a new 7-year deal with Corning; LG Electronics has announced that it is closing its mobile business unit; Samsung Electronics has announced that it will invest more than KRW46.4B for 27 research projects; etc.

Samsung Display has signed a new 7-year deal with Corning. The two companies have been in partnership for the last 7 years and have decided to prolong that partnership for 7 years more. As part of this new partnership, Samsung Display will maintain its ownership stake at Corning until 2028, at the very least. The company will also convert all of its preferred shares into 115M common shares. (Android Headlines, SamMobile, Corning, CN Beta)

OPPO and vivo are reportedly developing foldable smartphones. Specifically, OPPO has 2 foldable smartphones in development— one is 8” folding left-right, and one is 7” folding up-down. vivo is also towing the internal folding design path with 8” unfolded, and 6.5” folded. (GizChina, Weibo)

LG has announced that it is shutting its smartphone business, which means the LG V60 and LG Wing are the last high-end smartphones released by the company. LG has confirmed that it will no longer develop the Rainbow and rollable phones. (Android Authority)

E Ink has announced the launch of four-color E Ink Spectra 3100, a next generation ink platform to support Electronic Shelf Labels (ESL) and retail signage. The new 4-particle electronic ink, E Ink Spectra 3100, incorporates retailer’s requests for additional color functionality, by utilizing black, white, red and yellow particles to offer vibrant color rich content. (CN Beta, Business Wire)

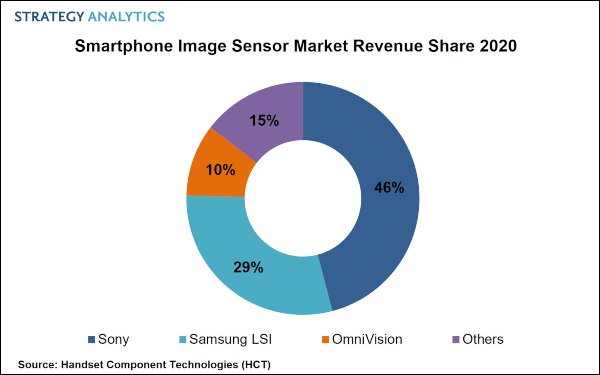

According to Strategy Analytics, the global smartphone image sensor market recorded total revenue of USD15B in 2020, up by 13% YoY. Sony managed to take the top position in the market, with 46% revenue share, followed by Samsung System LSI and OmniVision Technologies. The top-3 vendors captured almost 85% revenue share in the smartphone image sensor market in 2020. (GSM Arena, EET Asia)

Ericsson has announced its partnership with Deutsche Telekom and the Greek mobile network operator Cosmote to improve capacity on 5G networks. The firm has revealed that the 3 has successfully proved the viability of frequency bands above 100GHz for use in the backhaul portion of 5G networks. (Neowin, Ericsson, Sina, CN Beta)

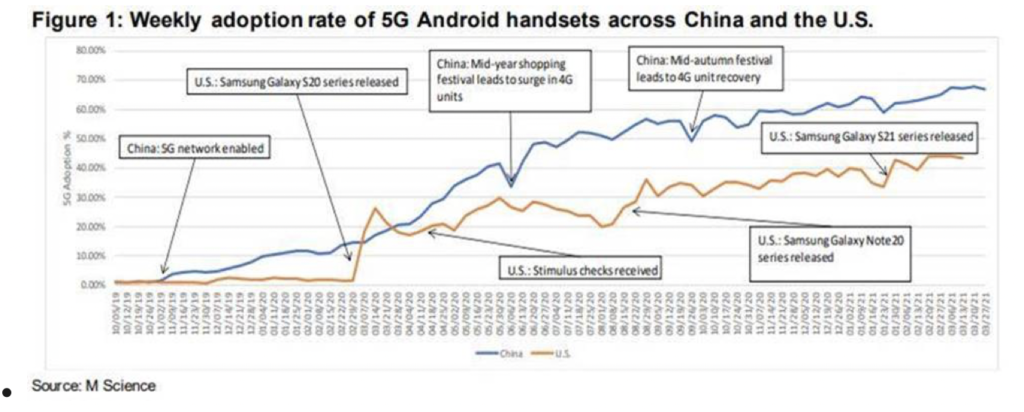

According to MScience, the adoption rate of 5G enabled devices for OPPO has surpassed Huawei. The launch of Samsung Galaxy S20 series has initially led to the rise of 5G handset adoption in the US, meanwhile, China already has a steady growth. Meanwhile, China, despite being ahead of the US in 5G smartphone adoption rates, saw a moderation in its growth due to 4G devices seeing a rise in demand in the region around the middle of the year. During this time, OPPO has managed to surpass Huawei in 5G adoption. This would likely be due to Huawei suffering from the impacts of the US trade restrictions. (Gizmo China, GearBytes)

LG Electronics has announced that it is closing its mobile business unit. LG’s strategic decision to exit the incredibly competitive mobile phone sector will enable the company to focus resources in growth areas such as electric vehicle components, connected devices, smart homes, robotics, artificial intelligence and business-to-business solutions, as well as platforms and services. (Android Authority, LG, CN Beta)

According to TrendForce, with LG exiting the smartphone business, its original market is most likely to be grabbed by Samsung and OPPO. LG’s main markets for mobile phone products are in South Korea, Europe, and Southeast Asia. The expectations are that Samsung will claim its European and South Korean markets. However, OPPO will claim its emerging mid-and low-end mobile phone market in Southeast Asia. (GizChina, IT Home, UDN, TechNews)

Xiaomi has officially opened its newest Mi Home in China located in the city of Shenyang. This store opening marks a milestone for the brand as it is the 5000th Mi Home store. (My Drivers, CN Beta, Sohu, Gizmo China)

ByteDance has told an Indian court that a government freeze on its bank accounts in a probe of possible tax evasion amounts to harassment and was done illegally. An Indian tax intelligence unit in mid-Mar 2021 ordered HSBC and Citibank in Mumbai to freeze bank accounts of ByteDance India as it probed some of the unit’s financial dealings. (Reuters, Reuters, Gizmo China, DW)

Samsung Electronics has announced that it will invest more than KRW46.4B (USD41M) for 27 research projects in the areas of basic science, materials engineering and information and communication technology (ICT). The funding will be used in 1H21 for future technologies including machine learning, artificial intelligence (AI) and DNA sequencing. (Android Headlines, SamMobile, Korea Times, YNA)

Samsung Galaxy F12 and F02s is introduced in India: F12 – 6.5” 720×1600 HD+ v-notch 90Hz, Exynos 850, rear quad 48MP-5MP ultrawide-2MP macro-2MP depth + front 8MP, 4+64 / 4+128GB, Android 11.0, side fingerprint, 6000mAh 15W, INR10,999 (USD150) / INR11,999 (USD163). F02s – 6.5” 720×1600 HD+ v-notch, Qualcomm Snapdragon 450, rear tri 13MP-2MP macro-2MP depth + front 5MP, 3+32 / 4+64GB, Android 10.0, no fingerprint scanner, 5000mAh 15W, INR8,999 (USD123) / INR9,999 (USD136). (GSM Arena, Android Central, Android Authority)

OPPO A74 5G and A74 4G are launched in Thailand and Philippines, respectively: A74 5G – 6.5” 1080×2400 FHD+ HiD IPS 90Hz, Qualcomm Snapdragon 480, rear quad 48MP-8MP ultrawide-2MP macro-2MP depth + front 16MP, 6+128GB, Android 11.0, side fingerprint, 5000mAh 18W, THB9,000 (USD285). A74 4G – 6.43” 1080×2400 FHD+ HiD AMOLED, Qualcomm Snapdragon 662, rear tri 48MP-2MP macro-2MP depth + front 16MP, 6+128GB, Android 11.0, fingerprint on display, 5000mAh 33W, PHP11,999 (USD255). (GSM Arena, OPPO, Hungry Geeks)

OPPO Reno5 Z 5G is launched in Singapore – 6.43” 1080×2400 FHD+ HiD Super AMOLED, MediaTek Dimensity 800U 5G, rear quad 48MP-8MP ultrawide-2MP macro-2MP depth + front 16MP, 8+128GB, Android 11.0, fingerprint on display, 4310mAh 30W, SGD529 (USD395). (GSM Arena, OPPO, OPPO)

Gionee M3 is announced in China – 6.53” 720×1600 HD+ v-notch IPS, MediaTek Helio P60, rear quad 16MP-5MP ultrawide-2MP macro-2MP depth + front 8MP, 6+128 / 8+128 / 8+256GB, Android 10.0, side fingerprint, 5000mAh 18W, CNY899 (USD137) / CNY959 (USD147) / CNY1,059 (USD162). (Suning, SeekDevice, GSM Arena)

Sunnto has introduced the Suunto 7 Titanium and 9 Baro Titanium, which have a new “minimalistic” design with titanium bezels that are lighter without compromising on toughness: 7 Titanium – It features Wear OS, enhanced sleep tracking tools that include new tiles for tracking sleep stages, managing body resources, and obtaining heart rate feedback. Priced at USD499. 9 Baro Titanium – It is built for heavy-duty outdoor use with military-grade water, dust, and shock resistance as well as 170 hours of GPS battery life through a special Tour Mode. Priced at USD599. (Android Authority, Suunto, Suunto)

Huawei Band 6 is launched in Malaysia – 1.47” AMOLED display, 180mAh battery, it supports continuous blood oxygen monitoring, TruSeen TM 4.0 Heart rate monitoring, TruSleepTM 2.0 sleep monitoring, TruRelaxTM 2.0 pressure monitoring, heart health management, sleep apnea risk screening, etc. It is priced at MYR219 (USD53). (GizChina, NDTV, IT Home)

Xiaomi CEO Lei Jun has disclosed that Xiaomi’s first car will either be a sedan or an SUV. He has also disclosed that the car which is expected to be an electric vehicle will retail within the price range of CNY100,000 (around USD15,000) to CNY300,000 (around USD45,000). This means the car will be positioned in the mid-to-high-end range. (CN Beta, Gizmo China)

Amazon has explored opening discount retail stores selling a mix of home goods and electronics, a potentially significant expansion of the company’s growing portfolio of brick-and-mortar locations. Amazon operates 96 physical stores and 7 mall pop-ups under its own brand, according to its website. Whole Foods Market, acquired in 2017, has more than 500 grocery stores. (Digital Trends, Bloomberg)

South Korea’s third-largest conglomerate, SK Group, has announced that it has agreed to acquire a 16.3% stake in Vietnam’s VinCommerce, a retail affiliate of Masan Group, for USD410M. VinCommerce operates about 2,300 convenience stores and supermarkets in Vietnam, with a roughly 50% market share in the country’s consumer retail sector. (Gizmo China, Reuters, Donga, Sina)