4-16 #InnocentLaughter : TSMC has indicated that a 7-hour power outage at Tainan Science Park on 14 Apr 2021; LG Electronics is seeking buyers for one of its key Vietnamese factories; Walmart is investing in Cruise; etc.

Taiwan Semiconductor Manufacturing Co (TSMC) has indicated that a 7-hour power outage at Tainan Science Park on 14 Apr 2021 mainly disrupted the production of 40nm, 45nm chips at one of its factories. The company is still evaluating the cost of the power outage at its Fab 14 P7 site, which according to reports is estimated at NTD1B (USD35.14M). (CN Beta, Focus Taiwan, WCCFtech)

TSMC CEO C. C. Wei has indicated that the company is doing all it can to increase productivity and alleviate a worldwide chip shortage, but that tight supplies will likely continue into 2022. TSMC has said it expects the chip shortage for its auto clients to be greatly reduced from 2Q21. (CN Beta, Sina, UDN, Reuters, The Verge)

Renesas Electronics will outsource some of its output to TSMC, following a fire at its plant in Mar 2021. TSMC has allegedly accepted requests for such supply from Japan’s government and Renesas. They say TSMC may be able to make deliveries faster than requested. (CN Beta, NHK)

Intel CEO Pat Gelsinger believes that the semiconductor shortage will not let up until 2022, and the global market may not return to full normalcy until 2023. (Digital Trends, Washington Post, Reuters)

Cadence Design Systems has announced that it has optimized the Cadence digital 20.1 full flow for Samsung Foundry’s advanced-process technologies down to 4nm. Through the collaboration, designers can use the Cadence tools to achieve optimal power, performance, and area (PPA) and deliver accurate, first-pass silicon for hyperscale computing applications. (Laoyaoba, Cadence, EE Journal)

Taiwan Semiconductor Manufacturing Company (TSMC) has reportedly suspended new orders from Phytium Information Technology, one of seven Chinese organisations related to supercomputing that was put on the US Entity List. TSMC will complete orders placed before the US Commerce Department’s Bureau of Industry and Security added the entities to the trade blacklist on national security grounds. (Gizmo China, SCMP, QQ, Zhihu)

TCL has unveiled the Fold’n Roll with 2 different ways to extend the display. The company combines next-gen DragonHinge hinges and mechanics to support both actions. It starts off with a 6.87” display, which can unfold to 8.85” and the rollable mechanism extends that to 10”. (CN Beta, GSM Arena, Hot Hardware)

Regarding domestic panel manufacturers participating in AMOLED panel market competition, TCL Technology has said that domestic opportunities are mainly due to customers’ concerns about the single supply chain, followed by cost. In the short to medium term, it is difficult for domestic manufacturers to surpass Samsung on the cost side, but the gap is narrowing sharply. The company believes that the more differentiated products such as foldable display narrows the gap with Samsung, yet the standard products still have some distance. This is also CSOT’s competitive strategy, and it is in high-end differentiation. (Laoyaoba, Sohu, QQ)

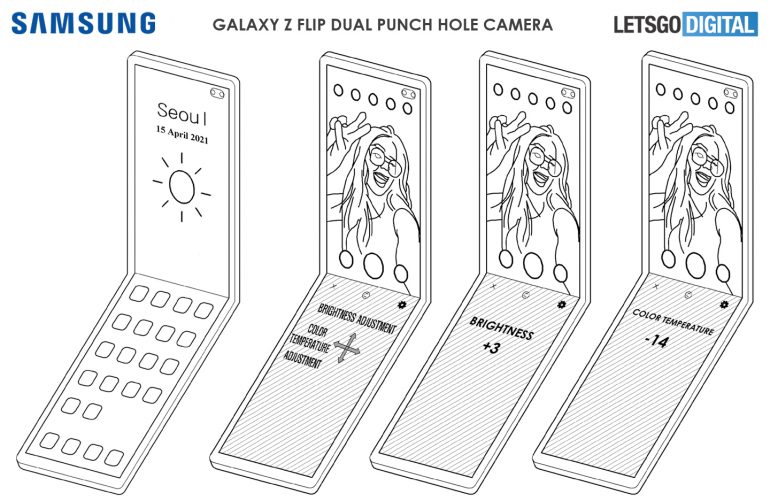

Samsung has filed a patent with WIPO, describing some new features of foldable phone. One is that the device would feature a dual selfie camera and an in-display fingerprint reader. The other, more major change, would be that the screen would be able to fold both inwards (like a clamshell) and outwards. When closed inwards the screen would be protected, and when folded outwards, it would do away with the need for a cover display. (CN Beta, LetsGoDigital, MS Poweruser)

AUO general manager Furen Ke has indicated that Micro LED products will be ready for mass production in 2021, and it is expected to enter small-scale mass production by the end of 2021, supplying TV products of 100” or more. In addition, AUO’s board of directors approved the Gen-6 LTPS line expansion plan of the Kunshan plant, which will expand from the current 25,000 to 36,000 per month. The new production capacity is expected to be launched in 3Q22. It will supply high-end notebook computer panels and Micro LED related production. (Laoyaoba, UDN, TTV)

Smartphone vendors including Xiaomi, Apple, OPPO, and vivo reportedly plan to sign a large number of OLED procurement contracts with Samsung Display in 2022. Among them, Xiaomi will purchase a large number of flexible OLED display from Samsung Display. Due to the shortage of driver chips, smartphone vendors will first seize high-quality resources. It will then have no other choice but to develop new smartphones with respect to the resources. (GizChina, My Drivers)

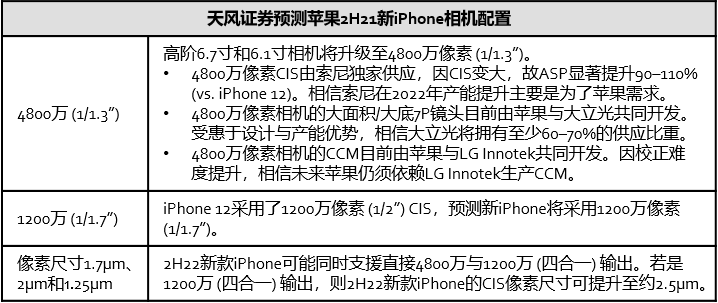

TF Securities analyst Ming-Chi Kuo has indicated that Apple’s 2H21 iPhone line up will consist of two 6.1” iPhones and two 6.7” iPhones. The premium model is expected to gain a new 48MP main camera, which can output 12MP images with a resulting large 2.5μm pixel pitch. Kuo predicts that the new iPhone will retain the 12MP resolution, but bring pixel size to 2.0μm thanks to a slight increase in sensor size. (CN Beta, GSM Arena, TF Securities)

TF Securities analyst Ming-Chi Kuo believes Apple is planning to introduce a Face ID system that sits beneath iPhone’s display, potentially nixing the TrueDepth “notch” for a truly full-display experience. He believes that an “under-display Face ID” system will debut on iPhone in 2023. (Apple Insider, TF Securities)

General Motors (GM) and LG Chem will build a second battery cell plant in Spring Hill, Tennessee. The plant will cost USD2.3B and the 2 companies will announce the plans soon. The first plant is currently under construction in Lordstown, Ohio. The plant will provide Ultium battery cells for GM’s upcoming Cadillac Lyriq electric SUV that starts production in 2022 in the Spring Hill assembly plant. (CN Beta, Reuters, Industry Week)

LG Energy Solution and SK Innovation have announced that they have agreed to settle all legal disputes relating to EV batteries in the United States and Korea. SK Innovation will pay LG Energy Solution KRW2T (USD1.8B) apportioned into lump-sum payments and a running royalty. (Laoyaoba, Business Wire, Bloomberg, Reuters)

Huawei’s rotating chairman Xu Zhijun has announced that the company will launch its 6G networks in 2030, which is 50 times faster than 5G. For this technology to work, the data transfer rate will be at least 1000Gbps. (GizChina, WCCFTech, CGTN, Yicai)

Huawei has one of its partners developed a new tool that allows developers to port GMS-apps to AppGallery quickly and effortlessly. The Choice SDK was originally developed for Raiffeisen Bank and its mobile app, but its popularity has convinced the company to open-source it and make it available to any app publisher around the world. (GSM Arena, GitHub, Sohu, CN Beta)

LG Electronics is seeking buyers for one of its key Vietnamese factories after deciding to shut its loss-making smartphone business. The company is halting smartphone production in May 2021 and terminating the business altogether in Jul 2021. The factory produces roughly 10M smartphones annually or half of LG’s global output. (CN Beta, Nikkei, VIR)

Apple, in partnership with Conservation International and Goldman Sachs, has announced a new USD200M carbon removal initiative called the Restore Fund. The initiative will make investments in forestry projects to remove carbon from the atmosphere while also generating returns for investors. It is part of Apple’s broader plan to go carbon neutral across its entire business footprint by 2030. (Apple Insider, Apple, CN Beta)

Apple is advising its authorized premium resellers and dealers to prepare for new products with 10 and 12 digital serial numbers. Apple plans to switch to randomized serial numbers for future products starting in early 2021. Apple currently utilizes a 12-digit serial number format for its products. (GizChina, MacRumors, 163, Sina)

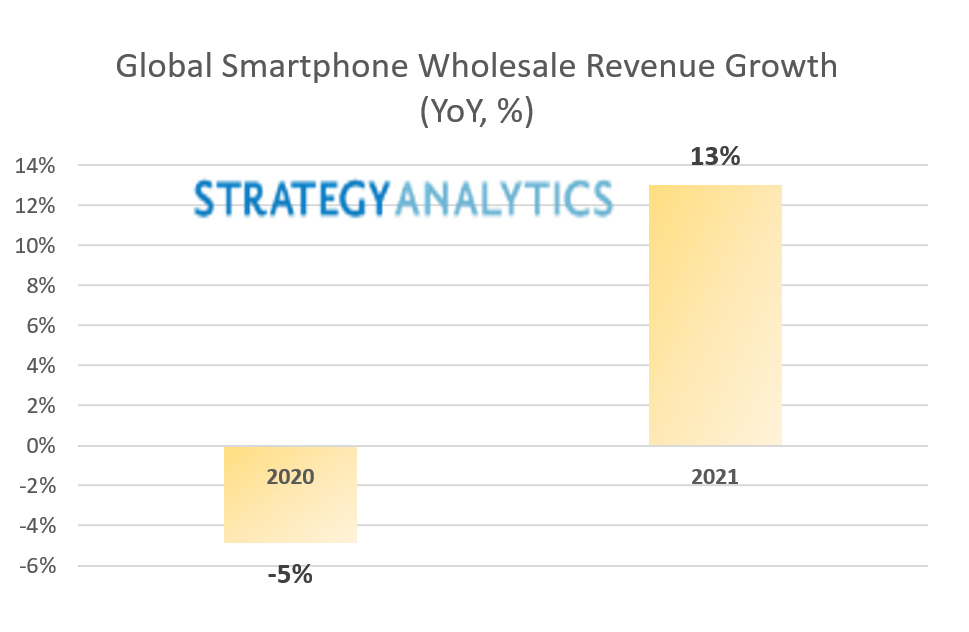

According to Strategy Analytics, global smartphone wholesale revenues will increase +13% YoY in 2021, the highest revenue growth in 6 years. Despite the economic uncertainty and dented consumer confidence caused by the coronavirus, the market will be able to bounce back in 2021, on the back of the iPhone 12 super cycle, and the migration to 5G globally. They expect global smartphone sales volume will grow + 7% YoY at 1.4B units, and global smartphone wholesale average selling price (ASP) will grow +6% to USD294 in 2021, resulting in smartphone wholesale revenue exceeding USD400B. (GizChina, Business Wire)

TCL 20 Pro 5G, 20L, and 20L+ are announced: 20 Pro 5G – 6.67” 1080×2400 FHD+ HiD AMOLED, Qualcomm Snapdragon 750G 5G, rear quad 48MP OIS-16MP ultrawide-2MP macro-2MP depth + front 32MP, 6+256GB, Android 11.0, fingerprint on display, 4500mAh 18W, fast wireless charging 15W, EUR549. 20L – 6.67” 1080×2400 FHD+ HiD IPS LCD, Qualcomm Snapdragon 662, rear quad 48MP-8MP ultrawide-2MP macro-2MP depth + front 16MP, 4+128GB, Android 11.0, side fingerprint, 5000mAh 18W, EUR229. 20L+ – 6.67” 1080×2400 FHD+ HiD IPS LCD, Qualcomm Snapdragon 662, rear quad 64MP-8MP ultrawide-2MP macro-2MP depth + front 16MP, 6+256GB, Android 11.0, side fingerprint, 5000mAh 18W, EUR269. (GSM Arena, Android Central, CN Beta)

Sony Xperia 1 III, 5 III and 10 III are announced, pricing yet to be revealed: 1 III – 6.5” 1644×3840 QHD+ 21:9 OLED 120Hz, Qualcomm Snapdragon 888 5G, rear quad 12MP OIS-12MP telephoto 3x / 4.4x optical zoom OIS-12MP ultrawide-0.3MP 3D ToF + front 8MP, 12+256 / 12+512GB, Android 11.0, side fingerprint, 4500mAh 30W, fast wireless charging, reverse wireless charging, IP65 / IP68 rated. 5 III – 6.1” 1080×2520 FHD+ 21:9 OLED 120Hz, Qualcomm Snapdragon 888 5G, rear tri 12MP OIS-12MP telephoto 3x / 4.4x optical zoom OIS-12MP ultrawide + front 8MP, 8+128 / 8+256GB, Android 11.0, side fingerprint, 4500mAh 30W, IP65 / IP68 rated. 10 III – 6.0” 1080×2520 FHD+ 21:9 IPS LCD, Qualcomm Snapdragon 690 (6350) 5G, rear tri 12MP-8MP telephoto 2x optical zoom-8MP ultrawide + front 8MP, 6+128GB, Android 11.0, side fingerprint, 4500mAh 18W, IP65 / IP68 rated. (GSM Arena, GSM Arena, The Verge, XDA-Developers)

ZTE Axon 30 Ultra is announced – 6.67” 1080×2400 FHD+ HiD AMOLED 144Hz, Qualcomm Snapdragon 888 5G, rear quad 64MP OIS-64MP-8MP periscope telephoto 5x optical zoom OIS-64MP ultrawide + front 16MP, 8+256 / 12+256GB / 16GB+1TB, Android 11.0, fingerprint on display, 4600mAh 66W, CNY4,698 (USD720) / CNY4,998 (USD766) / CNY6,666 (USD1,020). (GSM Arena, Android Authority)

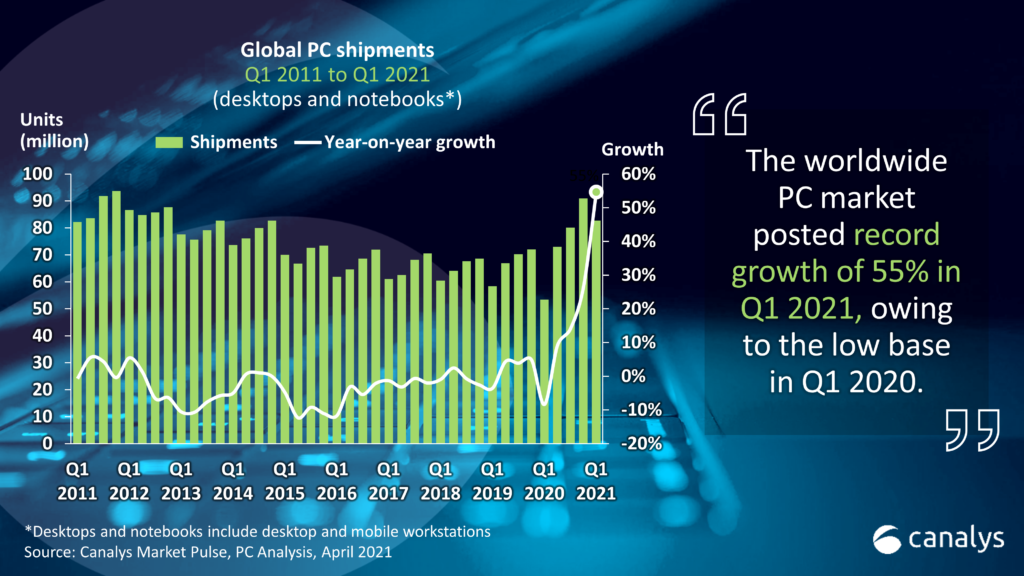

According to Canalys, the market shows continued strength in the worldwide PC market in 1Q21, with shipments of desktops and notebooks, including workstations, up 55% YoY, with total shipments of 82.7M units. Backlogs on orders from 2020, particularly for notebooks, were a key driver, though new demand is also a factor as smaller businesses begin their recoveries. Shipments of notebooks and mobile workstations increased 79% year on year to reach 67.8M units. (CN Beta, Canalys)

Apple is reportedly working on a product that would combine an Apple TV set-top box with a HomePod speaker and include a camera for video conferencing through a connected TV and other smart-home functions. Apple is also mulling the launch of a high-end speaker with a touch screen. Apple has explored connecting the iPad to the speaker with a robotic arm that can move to follow a user around a room. (CN Beta, Bloomberg, MacRumors, CN Beta)

Xiaomi has applied for registration of multiple “Mi Car” trademarks in categories of transportation, machinery and equipment etc. (CN Beta, Sina, AA Stock)

NIO and Sinopec, the Chinese state-owned oil producer, have signed an agreement for a strategic cooperation on the deployment of battery swapping stations. The duo will also carry out all-around collaboration on such spheres as new materials, smart electric vehicles, BaaS (Battery as a Service), vehicle procurement and the building of scenarios for recreation and consumption. (CN Beta, Auto News, WCCFtech)

Faraday Future (FF) has announced its new global online-to-offline (O2O) direct sales organization, strategy, and sales partners. The company has signed memoranda of understanding with sales partners including Jolta in the U.S., and China Harmony New Energy Auto (Harmony Group) in China, among others. Jolta is the first-ever electric vehicle (EV) dealership in the U.S., and Jolta’s EV dealership network plans to cover 15+ major U.S. cities by 2025 and 30+ by 2030. (CN Beta, Business Wire, Sina)

Software systems developer Apex.AI has announced a partnership with Woven Planet under Toyota to help develop and deploy a production-ready autonomy stack. Woven Planet will use Apex.OS for Arene, Toyota’s vehicle development platform to enable modern software development tools and best practices in the automotive industry. Apex.AI is based in Palo Alto and Germany and develops certified, developer-friendly software for mobility systems. (CN Beta, TechCrunch, Electrek, Yahoo)

Ford’s Blue Cruise hands-free highway driving system will hit the road in a few months, as over-the-air downloads install the system in thousands of already-sold 2021 F-150 pickups and Mustang Mach-E electric SUVs. Ford expects more than 100,000 vehicles with Blue Cruise should be on the road by the end of 2021. Blue Cruise is technically an SAE Level 2 autonomous system. (CN Beta, Auto News, Detroit Free Press)

Walmart is investing in Cruise, General Motors’ majority-owned self-driving vehicle subsidiary, as part of a new USD2.75B funding round for the company. The decision to invest comes about 5 months after the companies started developing a pilot program to use Cruise self-driving vehicles for deliveries in Scottsdale, Arizona. (Engadget, Walmart, CNBC, Sina)

DJI Air 2S is announced, equipped with a 20MP 1” CMOS with 2.4μm-sized individual pixels. It can capture up to 5.4K (5472×3078px) footage at 24/25/30fps from the full width of the sensor, and 4K up to 60fps (compared to Mavic Air’s 4K@30fps) at a slight crop. The DJI Air 2S also captures video at a higher 150Mbps.The starting price is USD999 / EUR999. (My Drivers, GSM Arena, DJI, CN Beta)

Amazon has announced a USD250M venture fund to invest in Indian startups and entrepreneurs focusing on digitization of small and medium-sized businesses (SMBs) in the key overseas market. Amazon has previously invested more than USD6.5B in its India business, faces heat from government bodies, and the small and medium-sized businesses that it purports to serve. Amazon has said it has led a USD10M investment round in M1xchange, a 3-year-old Gurgaon-headquartered startup that operates an invoice discounting marketplace exchange for MSMEs. (TechCrunch, Reuters)

Flipkart has agreed to acquire online travel and hotel ticketing firm Cleartrip for about USD40M as the Walmart-owned e-commerce firm looks to expand its offerings in the world’s second-largest internet market. (CN Beta, TechCrunch, India Times)