5-9 #HappyMother’sDay : Tianma’s Gen-6 flexible AMOLED production line project has a total investment of CNY48B; Ericsson and Samsung have reached a multi-year agreement on global patent licenses; Huawei and Qualcomm are allegedly working together to ensure that HarmonyOS is compatible with Qualcomm’s platform; etc.

BMW CEO Oliver Zipse has indicated that he expects chipsets supply and demand to be back in balance within 2 years at the latest. While Ford Motor has estimated the scarcity of semiconductors would slash earnings by USD2.5B in 2021, BMW has only reported limited stoppages at 2 European plants thus far. BMW has said it expected to have 2M fully-electric cars on the road by 2025. (Laoyaoba, Reuters, Taipei Times, Yahoo, BMW Blog)

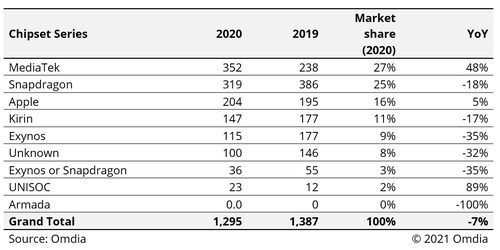

After suffered from shortages in 1H21, Qualcomm will reportedly mass-produce TSMC’s mid-stage 5G chips in 6nm process in 3Q21. It is ready to regain its lost market share with MediaTek. Xiaomi, OPPO, and vvio are all in trial production, and MediaTek’s pressure will be very obvious in 3Q21. MediaTek ranks first in smartphone SoC shipments thanks to the success of Dimensity 720, Dimensity 800 and Dimensity 1000+. (My Drivers, CN Beta, Sohu, Sina)

U.S. Commerce Secretary Gina Raimondo has said that the semiconductor shortage was a factor in jobs report that showed hiring unexpectedly slowed in Apr 2021. The Bureau of Labor Statistics said the auto sector shed 27,000 jobs in Apr 2021 as automakers were forced to cancel production shifts and furlough workers amid the chips shortage. (C114, Reuters, Laoyaoba)

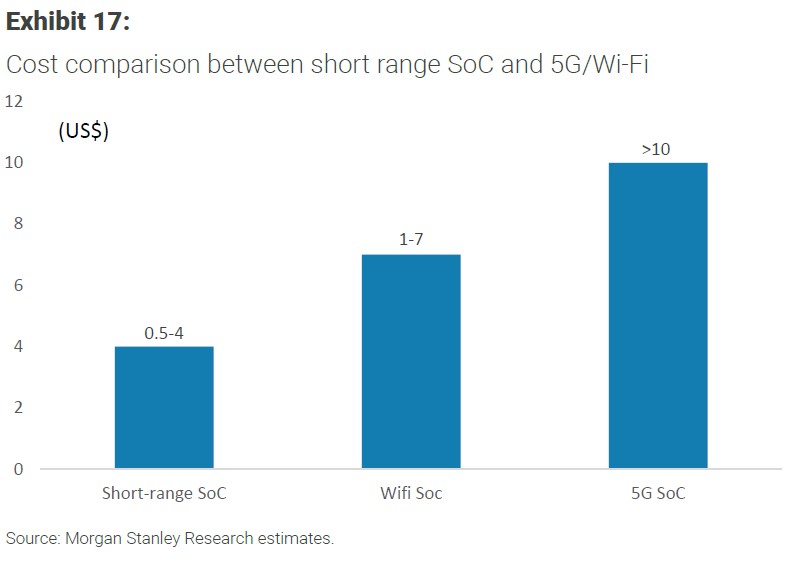

Morgan Stanley expects the penetration of Wi-Fi 6 in key end devices (smartphones, notebooks, routers, and smart homes) to increase to more than 80% by 2024. The key component that needs to be upgraded is the Wi-Fi SoC. Wi-Fi 5 SoC pricing is currently close to USD2/unit, and the Wi-Fi 6 SoC ASP is above USD4/unit and even as high as USD8/unit. They expect the Wi-Fi 6 SoC ASP will come down over time but still be more than double Wi-Fi 5 by 2024, thanks to fast adoption within end devices. (Morgan Stanley report)

Tianma’s Gen-6 flexible AMOLED production line project has a total investment of CNY48B. The design capacity of the project is to process 48,000 flexible display substrates per month. Currently the overall construction work of Tianma’s Gen-6 flexible AMOLED production line project is progressing very smoothly. It is expected that the equipment will be moved in 2H21 and the production capacity will be released in 2022. (Laoyaoba, FPDisplay, OLED-A)

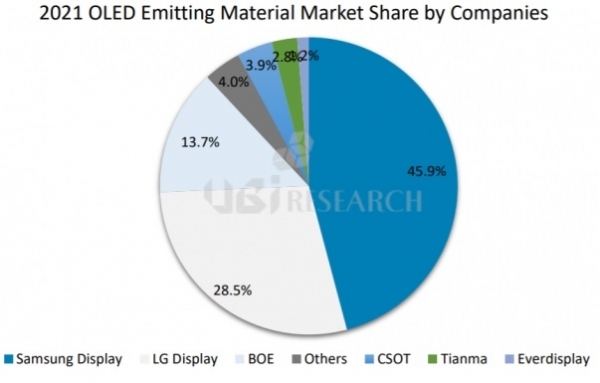

The global OLED emitting material market will grow 17% in 2021 compared to last year to be worth USD1.52B, according to market research firm UBI Research. South Korean panel companies will buy 74.3% of the total material, while their Chinese counterparts will account for 25.7%. By company, Samsung Display will be the biggest buyer at 45.9%. This will be followed by LG Display’s 28.5% and BOE’s 13.7%. (Laoyaoba, The Elec)

LG InnoTek will sell its patents and equipment related to its LED business to a Chinese LED company. The component maker will clean out equipment related to LED at its Paju plant within the month. LG InnoTek will handover some 10,000 patents related to LED to its Chinese counterpart. (Laoyaoba, The Elec)

According UBI Research CEO Choong Hoon Yi, Samsung Display is aiming to ship 2M notebook OLED panels in 2201, but likely will only manufacture 1.5M of them. This means the portion Samsung Electronics will get from its affiliate will be around 500K units. (The Elec)

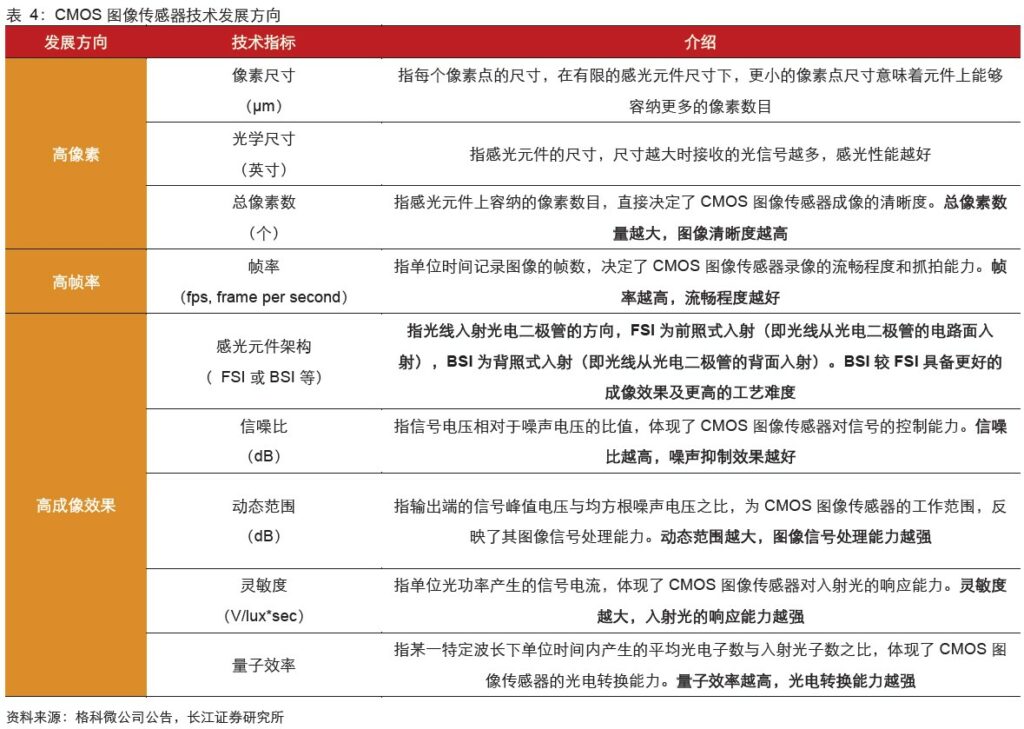

Nowadays, the improvement of smartphone image effects highly depends on the technological innovation and upgrade of CMOS image sensors. Even if it can leverage the later algorithms to save a large amount of optical information of the original image to the maximum extent, it is of great benefit to enhance the tolerance of post-processing. The current 3 major upgrade directions for CMOS images are high pixels, high frame rate and high imaging effects, covering many technical indicators such as pixel size, CIS size, number of pixels, architecture, quantum efficiency, sensitivity, etc. (Changjiang Securities report)

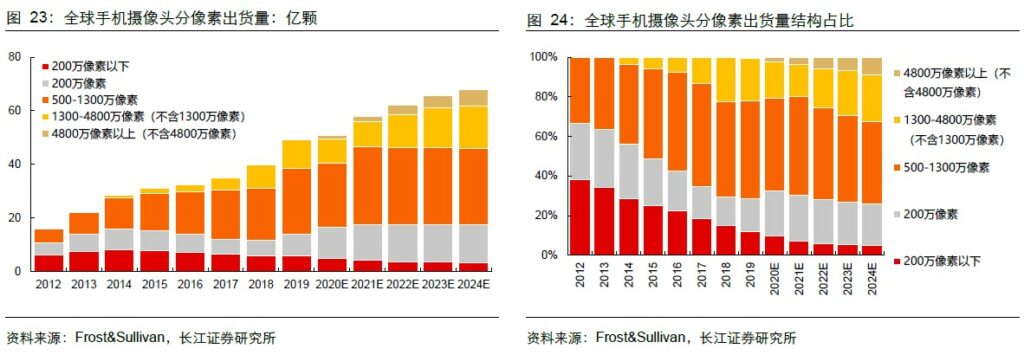

The camera’s pixels have been upgraded from 8MP to 12MP, and smartphone photography has entered the era of high definition. With the continuous innovation of the leading brands in the Android camp, the flagship smartphone has entered a new stage of ultra-clear shooting. In 2019, high-end flagship phones will use the 48MP rear main camera as one of the main selling points. In 2020, brands such as Samsung and Xiaomi will continue to use billion-level pixels as a marketing selling-points. From the perspective of changes in the pixel structure of global phone lenses, the proportion of low-pixel ranges has dropped significantly, while the penetration rate of products in the high-pixel range has gradually increased. In addition, the ceiling of pixel specifications has been continuously broken. (Changjiang Securities report)

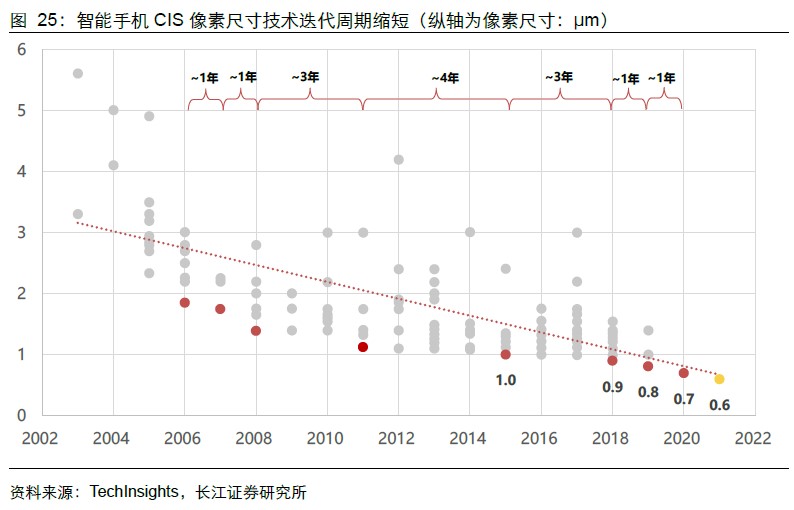

With smartphones, the increase in the number of pixels will inevitably bring about an increase in the size of the CIS chip, so it is urgent to reduce the size of a single pixel, which has formed an industry technology development trend. In the early years, the pixel size was rapidly reduced from 2.0μm to 1.7μm, and the technology iteration was fast. Micron was the leader of the industry’s technology development. Since 2010, benefiting from the advent of back-illuminated (BSI) CIS technology, CIS manufacturers represented by Sony have upgraded their product specifications from 1.4μm to 1.1μm, realizing the upgrade of smartphone main camera to 8MP. From 2011 to 2018, due to the decrease in the sensitivity of individual pixels and the crosstalk problem between pixels, the pixel size reduction speed has slowed down. Samsung used DTI (Deep Trench Isolation) technology to reduce the crosstalk problem between pixels and launched 1.0μm technology products. Since 2018, with the advent of the QUAD pixel structure, the CIS pixel size has shrunk and the arms race has accelerated, and the industry has maintained the pace of upgrading every year. Samsung is not tired of small pixel technology. (Changjiang Securities report)

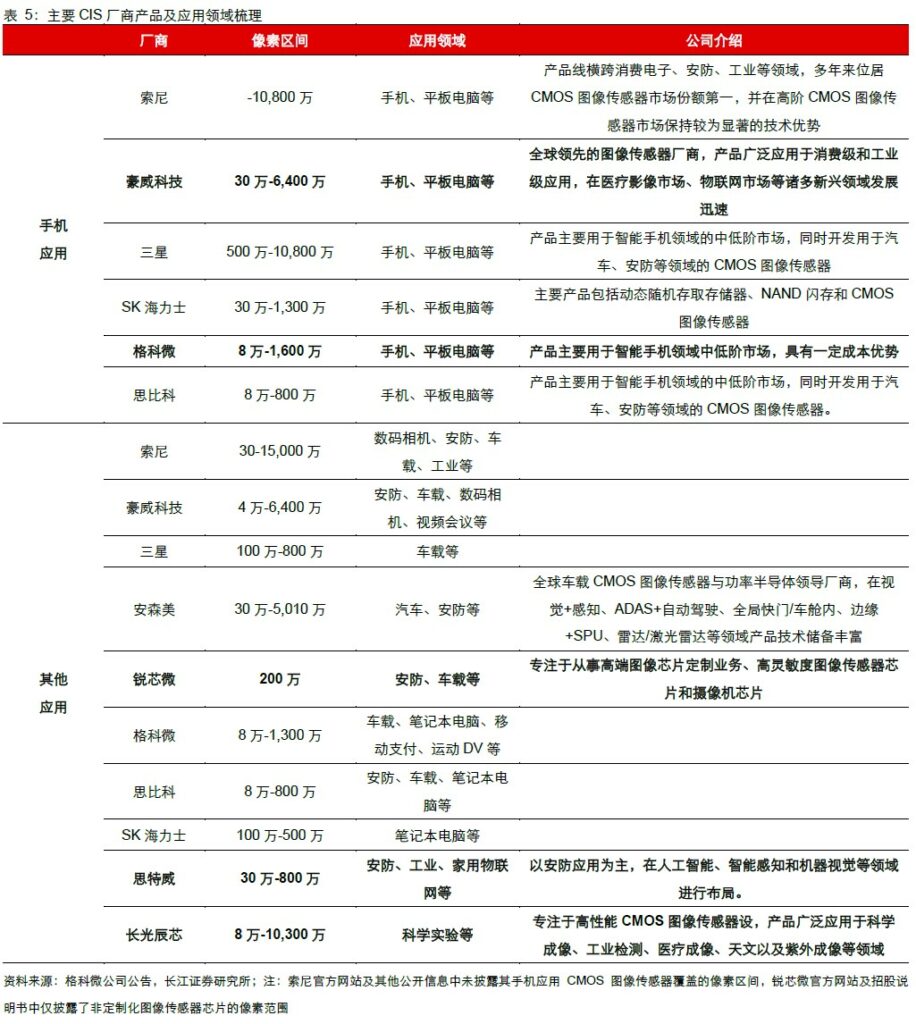

Changjiang Securities consolidates the current main CIS vendors. (Changjiang Securities report)

Seagate Technology has announced the new Seagate One Touch SSD offering NVMe-competitive performance. It delivers maximum sequential read/write speeds (up to 1030 MB/s) and up to 2 TB of storage. It is priced at USD94.99 (500GB), USD169.99 (1TB) and USD309.99 (2TB). (Seagate, CN Beta, Tech Powerup)

NI has announced it has acquired monoDrive, a leader in ultra-high fidelity simulation software for advanced driver-assistance systems (ADAS) and autonomous vehicle development. The acquisition expands NI’s reach in the ADAS and simulation markets and will enable NI’s transportation customers to accelerate the development, test, and deployment of safer autonomous systems. (Laoyaoba, NI, ZDNet)

Samsung’s 2 new foldable phones Galaxy Z Fold 3 and Z Flip 3 reportedly to equip with stronger UTG glass, and the display also has a certain level of IP protection. Additionally, both foldable phones will use batteries made by China’s Amperex Technology Limited (ATL). Besides the Galaxy S series, Samsung also uses ATL’s batteries for Galaxy A, Galaxy M, Galaxy Watch and Galaxy Buds brands. The Galaxy Fold, Z Flip, Z Fold 2, and Z Flip 5G all used Samsung SDI batteries. (Laoyaoba, The Elec, 9to5Google)

Sono Motors has announced it has signed a letter of intent with MAN Truck & Bus to explore integration of Sono’s solar technology into MAN’s eTGE electric transporter van. The companies will begin with three separate applications surrounding the eTGE, including air-conditioning and refrigeration systems. (CN Beta, Sono Motors, Electrek)

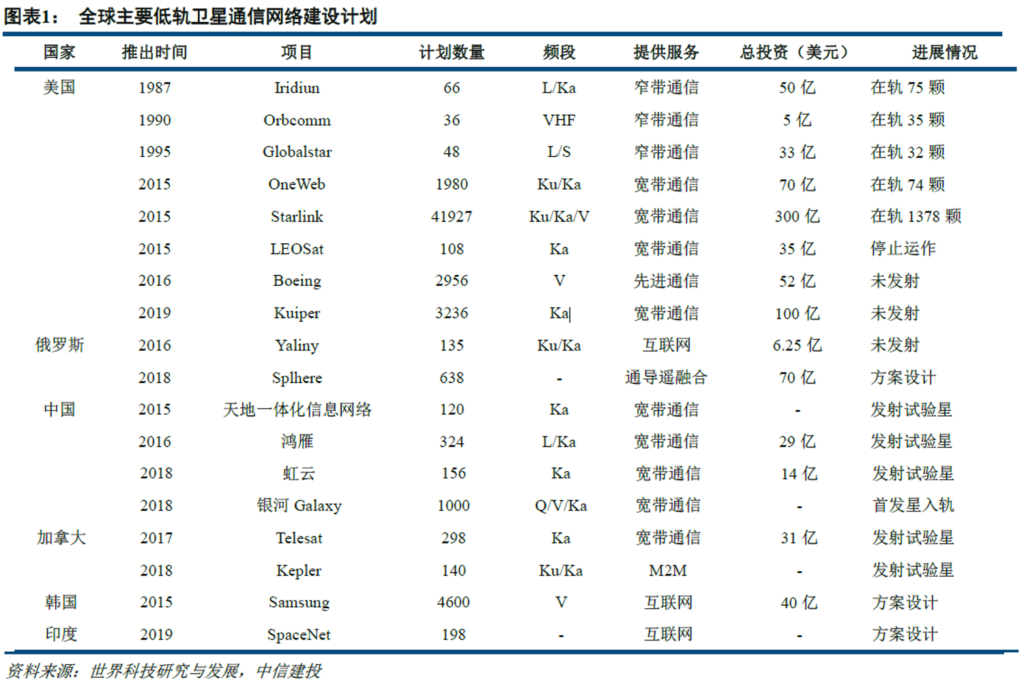

Currently, there are nearly 30 companies in the world that have released low-orbit satellite constellation construction plans, and SpaceX is leading the way. The U.S. government has strengthened its policy and financial support for the development of the commercial aerospace industry. The U.S. military is an early investor in the “Starlink” program and provided USD215M in special funds in 2019 to support military high-speed Internet programs based on commercial aerospace. In Aug2019, the FCC simplified the licensing process for small satellite launches to ensure that small satellite operators can accelerate their frequency licensing. (China Securities report)

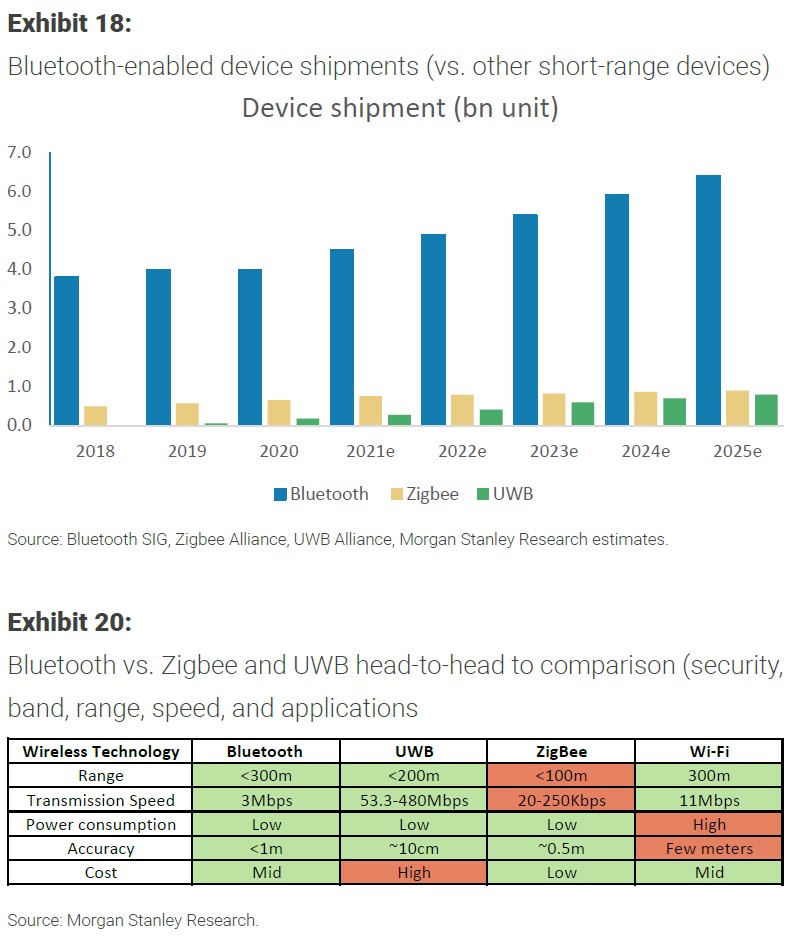

Morgan Stanley believes it will be applied more broadly than other short-range communication technologies given the following advantages: 1) Longer distance; 2) Faster speed; 3) Security; and 4) Ongoing specs migration. They expect shipments of Bluetooth devices to reach 6.4B units in 2025 from 4B units now. (Morgan Stanley report)

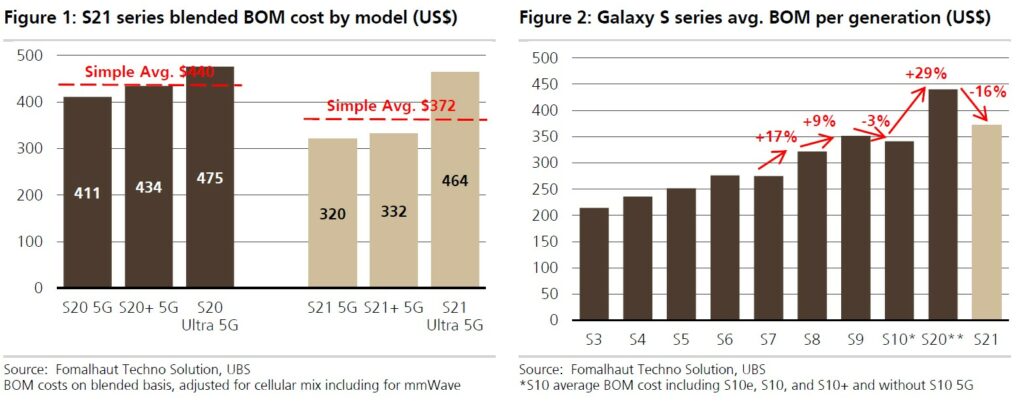

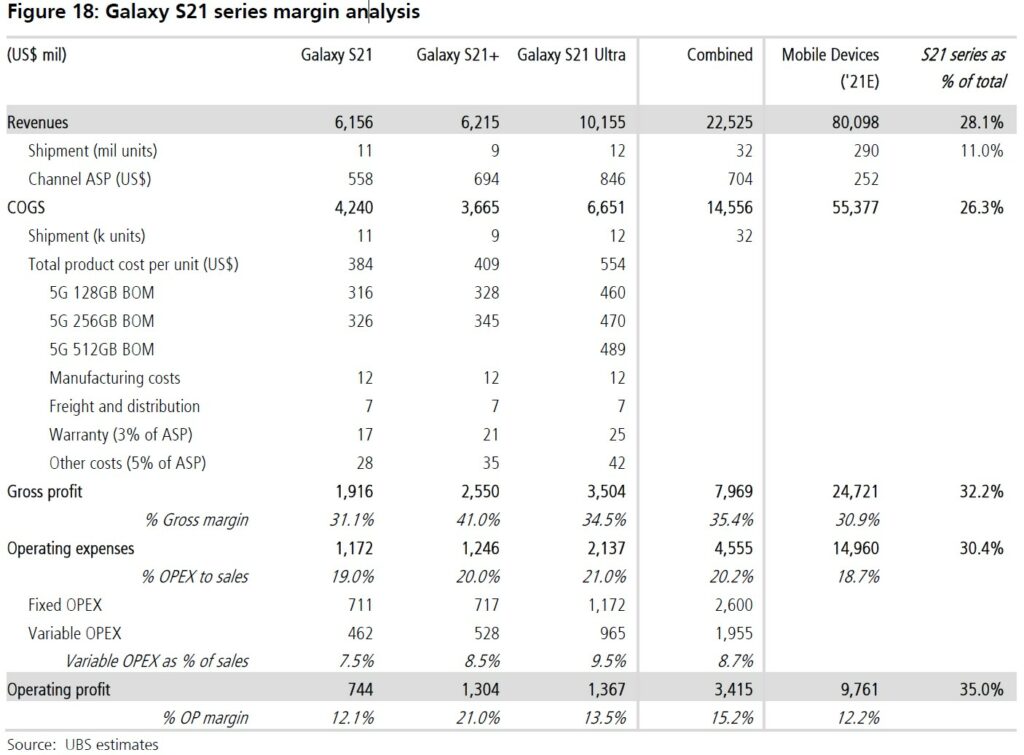

UBS estimates the Bill of Materials (BOM) for Samsung Galaxy S21 (sub-6GHz 128GB) at USD316, S21+ (sub-6GHz 128GB) at USD328, and S21 Ultra (mmWave, 128GB) at USD500. This compares to UBS’ estimate of USD407 / 430 / 472 for the sub-6GHz S20 / S20+ / S20 Ultra (128GB storage), respectively. UBS estimates the S21 series average BOM cost to be USD372, indicating a 16% reduction vs the Galaxy S20 5G series. (UBS report)

Based on UBS BOM cost analysis and their current forecast of 32M unit sell-in as base case, UBS estimates that Samsung Galaxy S21 series would generate 15.2% operating margins or USD3.4B in absolute profit terms (c. 35% of total Samsung Mobile Devices OP) for the full year in 2021. This suggests that the S21 will be c. 3pp accretive to overall Mobile Devices margin (UBSe 12.2%), and contribute meaningfully higher margins compared to 10% OP margin they estimate for S20 series. (UBS report)

Huawei and Qualcomm are allegedly working together to ensure that HarmonyOS is compatible with Qualcomm’s platform. Huawei mobile service (HMS) plans to adopt Qualcomm’s platform. (GizChina, CN Beta, IT Home)

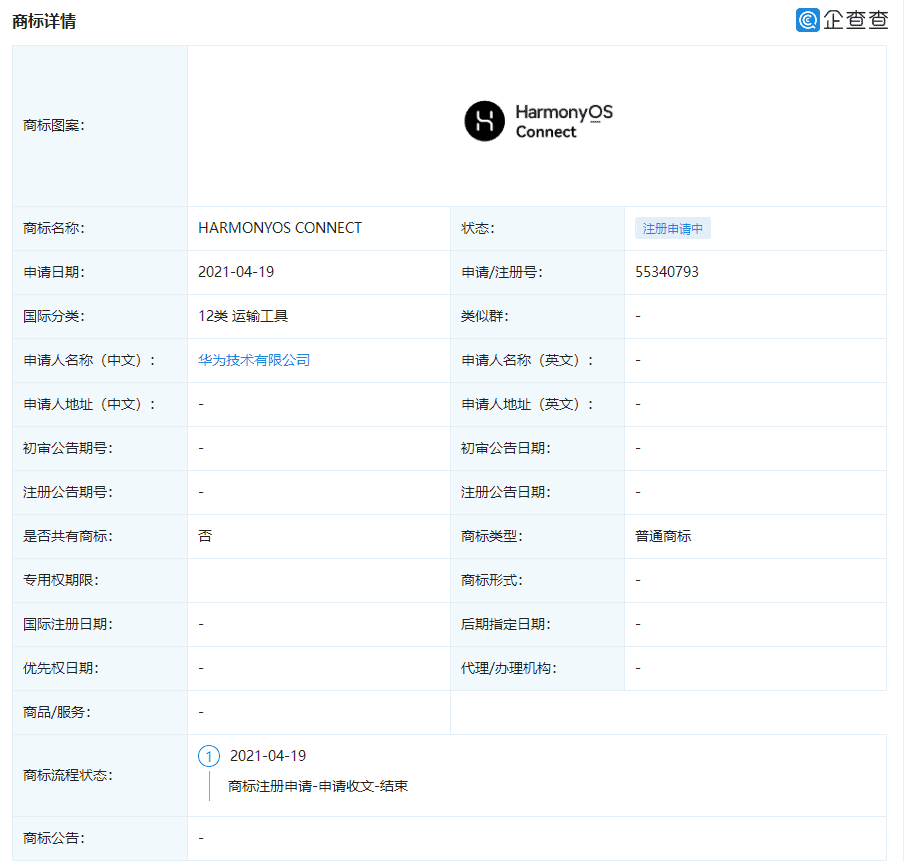

Huawei has recently applied for the registration of “HarmonyOS Connect”, a graphic trademark. The company also applied for the Chinese version of this trademark “Hongmeng Zhilian”. (GizChina, IT Home)

Ericsson and Samsung have reached a multi-year agreement on global patent licenses between the two companies, including patents relating to all cellular technologies. The cross-license agreement covers sales of network infrastructure and handsets from 1 Jan 2021. (CN Beta, Ericsson, Reuters)

India has suspended approval of the import of WiFi devices from China. The suspension has been on for several months and it is delaying many companies. The likes of Dell, HP, Xiaomi, OPPO, vivo, and Lenovo can not ship their devices for this reason. In fact, all companies that uses WiFi modules from China can not ship their products to India presently. India has postponed the import of finished electronic equipment from China that contains WiFi modules. These WiFi devices include Bluetooth speakers, wireless headsets, smartphones, smart watches and laptops. (GizChina, IT Home, Aljazeera, Reuters)

OPPO has announced a new commitment to offer 3 years of software support for the recently launched flagship Find X3 series, including Oppo Find X3 Pro, Find X3 Neo, and Find X3 Lite. (Phone Arena, GSM Arena, Android Planet, Ruan Can)

Amazon has partnered with Tile and smart lock maker Level to beef up its mesh network for tracking items. Amazon’s partnership will allow it beef up its tracking network, called Sidewalk, by letting Tile and Level devices tap into the Bluetooth networks created by millions of its Echo products. (CN Beta, Amazon, CNBC)

Sonova, the world’s biggest hearing aid maker, has revealed that it will buy the consumer unit of German headphone and microphone maker Sennheiser for EUR200M (USD241M) to reach younger customers through the emerging segment of in-ear wearables. Under the Sennheiser name, Sonova will initially add “headphones and soundbars to its hearing care portfolio”. (Android Authority, Reuters, Sennheiser, IT Home, CN Beta)

Toshiba and Amazon have announced a new series of TVs based on Amazon’s Fire TV interface for the US market. There are five screen sizes – 43”, 50”, 55”, 65” and 75”, while the key thing is a revised design from the older models featuring a much smaller bezel. They are priced from USD350. (Engadget, Amazon, Liliputing)

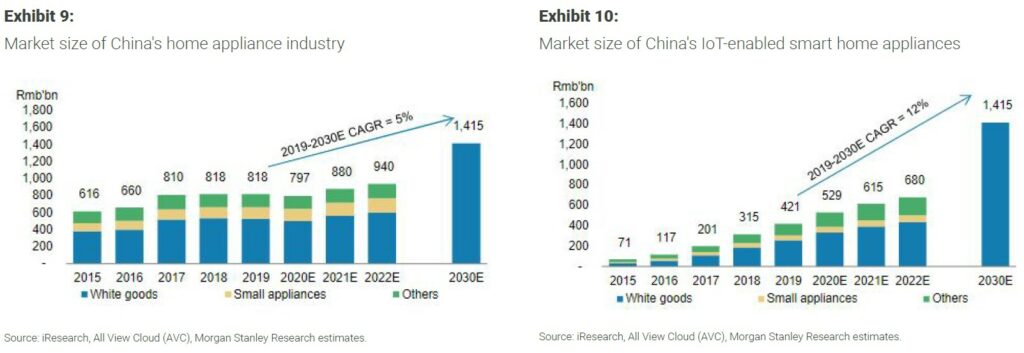

Morgan Stanley forecast 12% annual growth for smart appliances through 2030, based on their forecast that 100% penetration will be achieved by then. This compares with a 2019-2030 CAGR of 5% for the overall home appliances segment. In turn, they project the number of IoT appliances per household will rise to 7 units by 2030 from just 1 today. (Morgan Stanley report)

General Motors (GM) CEO Mary Barra sees the automaker selling personal autonomous vehicles by the end of the decade by leveraging technology from its self-driving subsidiary Cruise. GM has showcased a personal autonomous vehicle concept car for its Cadillac brand. The vehicle was based on the Origin, an autonomous shuttle from Cruise. (TechCrunch, CNBC)

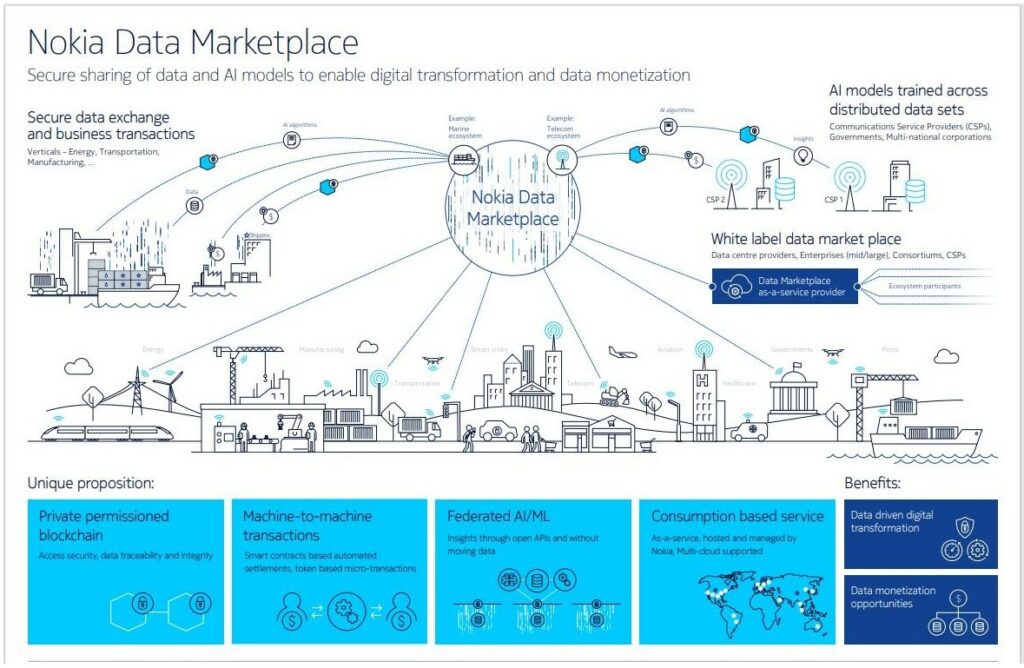

Nokia has announced the launch of Nokia Data Market – the company’s enterprise-level blockchain-based data market infrastructure service. Nokia revealed that the new blockchain service provides data transactions and analysis functions within the framework of a secure, private, and authorized blockchain infrastructure. (GizChina, Nokia, Sina, TechWeb)

GajiGesa, a fintech startup that provides earned wage access (EWA) and other services for workers in Indonesia, has added strategic investors to help it launch new services and expand its user base. Its new backers include OCBC NISP Ventura, the venture capital arm of one of Indonesia’s largest banks, and the founders of grab-and-go coffee chain Kopi Kenangan. (TechCrunch, Techno Hoop, Spread)