5-12 #SuperMom : UMC allegedly plans to raise its 12” foundry estimate for 28nm process; SDC is officially selling one of its production lines of Gen-7.5 and Gen-8.5; Vingroup JSC is shuttering its electronics devices unit VinSmart; etc.

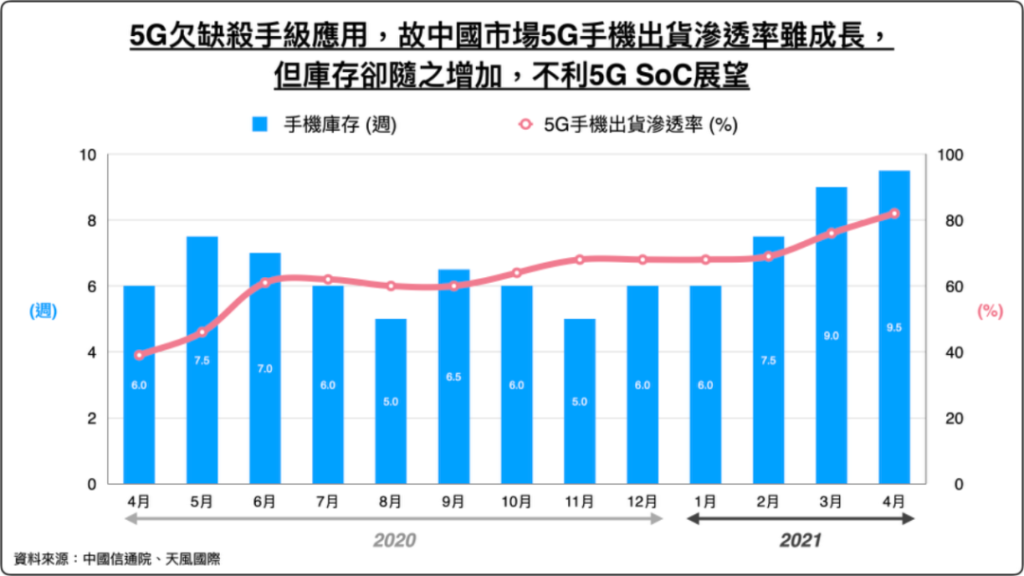

TF Securities analyst Ming-Chi Kuo has said that though the penetration rate of 5G phones in the China market in April 2021 has reached more than 80%, the channel inventory has also reached a historical high of about 9.5 weeks, which is significantly higher than normal 4-6 weeks. He believes this is due to the sluggish demand for Android 5G phones. The rapid decline in the price of Android 5G phones has driven the growth of China’s 5G phone penetration rate. During the May-Day holiday, Android phone shipments declined by 10-15% YoY, so it is expected that inventory levels in May will remain high or higher. The outbreak of Covid-19 in India also has a negative impact on short-term demand for Android phones. Samsung, OPPO, vivo and Xiaomi have all decreased 10-20% of orders in the Indian market in 2Q21. He believes that major Chinese Android vendors will tend to be conservative in their orders for 2H21 and 2022, and 5G SoC shipments may be lower than market expectations. (TF Securities)

TF Securities analyst Ming-Chi Kuo predicts that the iPhone will adopt Apple’s own design 5G baseband chips in 2023 at the earliest. As Android sales in the high-end 5G phone market are sluggish, Qualcomm will be forced to compete for more orders in the low-end market to compensate for Apple’s order loss. (TF Securities, Apple Insider, GSM Arena)

Samsung is reportedly launching a laptop version of its flagship mobile application processor (AP) chip Exynos in 2H21, which is built with 5nm process. The new Exynos chip for laptops will use the graphics processing unit (GPU) jointly developed with Advanced Micro Devices (AMD) to offer improved graphical technology. (CN Beta, WCCFTech, Sam Mobile, Korea Economic Daily)

United Microelectronics Corp (UMC) allegedly plans to raise its 12” foundry estimate for 28nm process technology by about 13% from Jul 2021 to USD1,800 each, which is about 20% increase from 2Q21. With MediaTek’s target for all-inclusive production capacity regardless of price, 1Q22 will soar more than USD2,300. UMC has released the average foundry price of 40nm wafers in 1Q22 will reach USD2,500 per wafer, which is slightly higher than that of 28nm. The reason is that UMC hopes the customers to transfer to the 28nm process. (My Drivers, Digitimes, Money Link)

Some of the world’s biggest chip buyers, including Apple, Microsoft and Alphabet’s Google, are joining top chip-makers such as Intel to create a new lobbying group to press for government chip manufacturing subsidies. The newly formed Semiconductors in America Coalition, which also includes Amazon.com’s Amazon Web Services, has asked U.S. lawmakers to provide funding for the CHIPS for America Act, for which President Joe Biden has asked Congress to provide USD50B. (Apple Insider, Reuters, CHIPS)

According to the upstream and downstream of Runto’s industry chain, Samsung Display (SDC) is officially selling one of its production lines of Gen-7.5 and Gen-8.5, with production capacities of 30K and 100K respectively. The transaction is handled by Samsung C&T (SCT) with full authority, and it is planned to close the registration for purchase applications in late May 2021. SDC has commissioned Samsung C&T to sell the Gen-7.5 and Gen-8.5 LCD panel production lines in the Asan campus. (Laoyaoba, 51Touch, Sohu)

Apple is awarding USD45M from its Advanced Manufacturing Fund to Corning, a supplier of precision glass for iPhone, Apple Watch, and iPad. The investment will “expand Corning’s manufacturing capacity in the US and drive research and development into innovative new technologies that support durability and long-lasting product life”. Corning has already received USD450M from Apple’s USD5B Advanced Manufacturing Fund over the last 4 years. (CN Beta, Apple, The Verge, 9to5Mac)

Apple has decided to expand its partnerships with South Korean companies that manufacture camera parts. Besides LG Innotek, which is Apple’s biggest partner when it comes to optical parts, Apple is currently looking for many new partners that can potentially supply camera parts for its products. Apple has severed a tie with O-Film in Mar 2021 when the United States Department of Commerce placed OFilm on its list of sanctioned companies in Jul 2020. (CN Beta, Sina, The Elec)

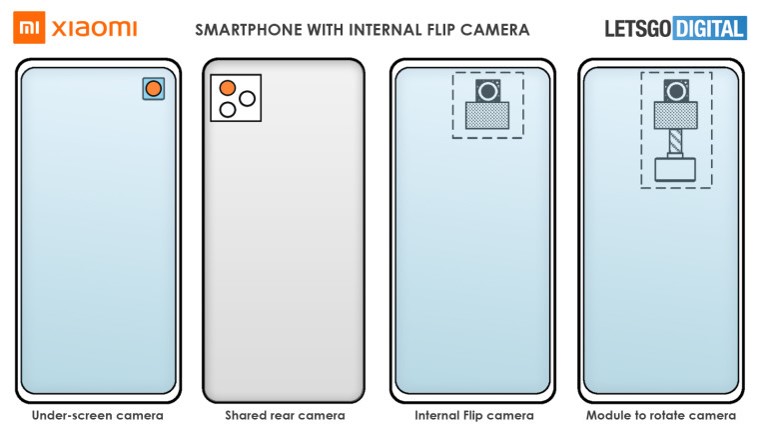

Xiaomi has filed a patent describing its new under-display camera. The patent says the new flip camera design will allow it to rotate so that it can function both as a selfie camera as well as a rear camera. A magnetic rotating module will be deployed with which such a mechanism can be carried out. (Neowin, LetsGoDigital, Sohu, My Drivers)

OmniVision has announced OV60A. The 1/2.8” 60MP OV60A is the world’s first 0.61µm image sensor for mobile phone front and rear cameras. The four-in-one CFA allows near-pixel merging to deliver 15MP images with 4x the sensitivity, providing the equivalent performance of 1.22 microns for preview and native 4K video, with the additional pixels needed for EIS. (Laoyaoba, Sparrow News, Image Sensors World)

Samsung has announced the industry’s first DDR5 memory solution to run on the Compute Express Link (CXL) interface. High-performance computing has been gradually trending towards heterogeneity where the host and the co-processors have to work together efficiently and a coherent interconnect standard is essential. Compute Express Link (CXL) provides this capability. (Neowin, Samsung, CN Beta)

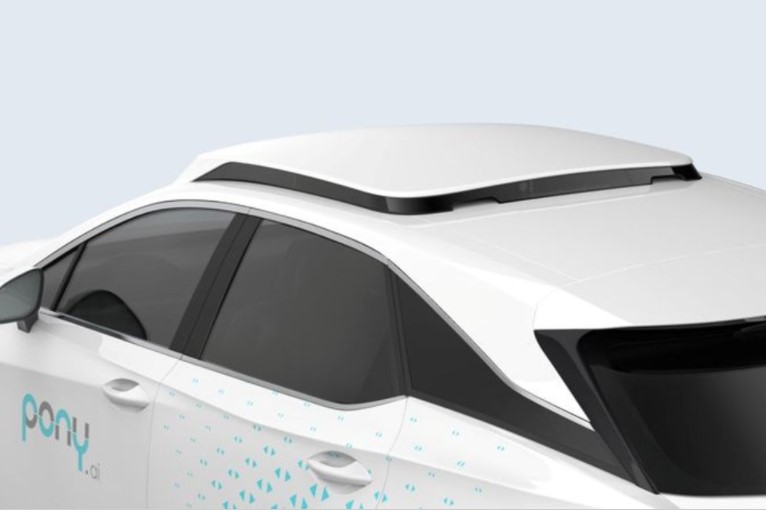

Self-driving tech company Pony.ai, backed by Toyota Motor, has revealed that its next-generation technology for robotaxis will be using lidars made by Luminar Technologies. Pony.ai CEO James Peng has explained that Luminar’s Iris lidar is about 10cm high and 4 of them will be mounted on top of the car for 360º views. Pony.ai is aiming for automotive-grade production of autonomous fleets in 2023 globally. (The Verge, US News, Business Wire, Reuters, Sina, Business Wire)

Lidar sensor maker Innovusion has raised USD64M in funding to ramp up production to supply Chinese electric vehicle (EV) maker Nio Inc’s ET7 sedan, which is scheduled to start deliveries in early 2022. The funding includes new investments from Singapore state investor Temasek and venture capital firm Joy Capital. (TechCrunch, Reuters, Financial Post)

Tesla’s Supercharger network has now reached a total of 25,000 chargers. In Nov 2020, the number of stalls reached 20,000. As of the end of Mar 2021, there were 24,515 individual connectors (stalls) and around 2,700 stations, which means that on average there are over 9 stalls per station. (CN Beta, Inside EVs, Electrek)

Toyota has tapped Japanese company ENEOS to help develop the hydrogen fuel cell system that will power its futuristic prototype city Woven City. The vision for the 175-acre city, where people will live and work amongst all of Toyota’s projects, including its autonomous e-Palette shuttles and robots, is to build a fully connected ecosystem powered by hydrogen fuel cells. Woven Planet, the innovation-focused subsidiary of Toyota that is in charge of the project. (CN Beta, TechCrunch)

A pair of facilities in India operated by Apple supply chain partners Wistron and Foxconn are affected by COVID-19 in May 2021, with a total of 13 employees confirmed to be infected. (Apple Insider, Taiwan News, CNA)

Production of the Apple iPhone 12 at a Foxconn factory in India has slumped by more than 50% because workers infected with COVID-19 have had to leave their posts. The Foxconn facility in the southern state of Tamil Nadu produces iPhones specifically for India. (Apple Insider, Reuters, Sina, IT Home)

Huawei’s HarmonyOS is reportedly being looked at by other phone manufacturers in China for possible adoption. OPPO, Xiaomi, vivo and Meizu are each said to have been in contact with Huawei about the potential for HarmonyOS on their respective smartphones. (Liliputing, SlashGear, MyFixGuide, 163)

vivo has announced that it is expanding its software support for the flagship X series, committing to provide three years of major Android OS upgrades and security updates for selected models launching after Jul 2021. (The Verge, PR Newswire)

OPPO has officially launched its e-store in India, which sells over 80 products across smartphones, wearables, and IoT products. It is being referred to as the OPPO E-Store and the company is offering free shipments on all orders above INR499. (Gizmo China, MySmartPrice, Money Control)

Vingroup JSC is shuttering its electronics devices unit VinSmart just months after exporting smartphones to the U.S. as it ramps up production of electric vehicles. The closure of VinSmart is to “mobilize all resources” for developing of VinFast – Vingroup’s carmaker unit. The move comes as Vingroup weighs a U.S. initial public offering for its VinFast auto unit that could raise about USD2B. (Bloomberg, VSmart, Gizmo China, 163, UDN)

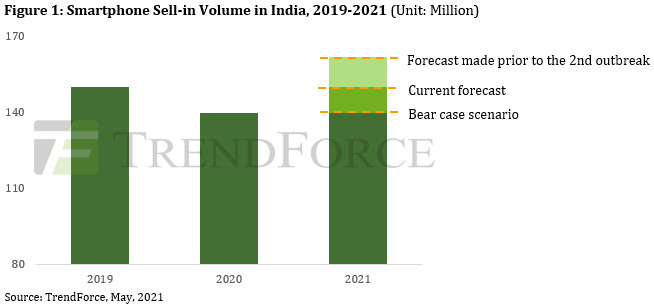

TrendForce finds that India has become the second largest market for smartphones since 2019. However, the recent worsening of the COVID-19 pandemic in the country has severely impaired India’s domestic economy and subsequently dampened various smartphone brands’ production volume and sales (sell-in) performances there. TrendForce is therefore revising the forecasted YoY growth in global smartphone production for 2021 from 9.4% down to 8.5%, with a yearly production volume of 1.36B units and potential for further decreases going forward. (CN Beta, TrendForce, TrendForce)

Tecno Camon 17P and 17 Pro are launched in Nigeria and Kenya, featuring 6.8” 1080×2460 FHD+ HiD IPS: Camon 17P – MediaTek Helio G85, rear quad 64MP-2MP macro-2MP depth-AI lens + front 16MP, 6+128GB, Android 11.0, 5000mAh 18W, NGN97,000 (USD236). Camon 17 Pro – MediaTek Helio G95, rear quad 64MP-8MP ultrawide-2MP depth-2MP mono + front 48MP, 8+256GB, Android 11.0, 5000mAh 25W, NGN130,000 (USD317). (GizChina, Gizmo China)

Infinix Hot 10T is launched in Kenya – 6.82” 720×1640 HD+ v-notch IPS TFT, MediaTek Helio G70, rear tri 48MP-2MP macro-AI lens + front 8MP, 4+64 / 4+128GB, Android 11.0, rear fingerprint scanner, 5000mAh 10W, KSH15,499 (USD147) / KSH17,499 (USD164). (GizChina, Gizmo China, Infinix)

Walmart Health and MeMD, a multi-specialty telehealth provider, have entered into an agreement for Walmart Health to acquire MeMD. This allows Walmart Health to provide access to virtual care across the nation including urgent, behavioral and primary care, complementing our in-person Walmart Health centers. (CN Beta, Walmart, Fierce Healthcare)

China domestic network security company Qihoo 360 is entering automotive industry. The company will work with China’s EV startup Hozon New Energy Automobile, which has raised about CNY3B for its series D funding. (My Drivers, Bloomberg, Sohu, IT Home)

China’s GAC plans to roll out its first vehicle model with autonomous driving functions developed with Huawei Technologies after 2024. However, GAC has not indicated if the models will be sold by Huawei. (Laoyaoba, India Times)

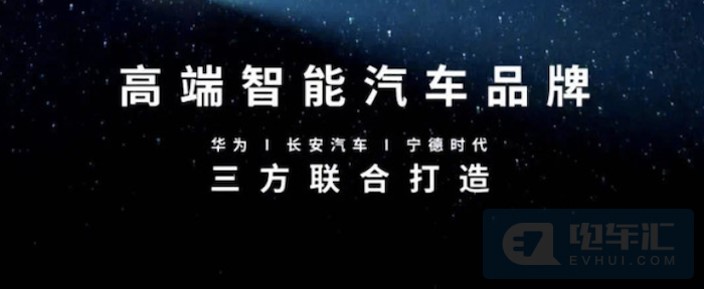

The cooperation between Changan Automobile, Huawei and CATL has started in 4Q20, and the internal code is “CHN Project”. It aims to jointly research platform technologies such as automotive application ecology, Vehicle OS, computing and communication architecture, high-voltage systems, and chassis machinery based. The 3 parties plan to jointly build a high-end smart car brand, a smart electric car platform, a series of smart car products, and a smart energy ecosystem. (Sina, Laoyaoba, IT Home)

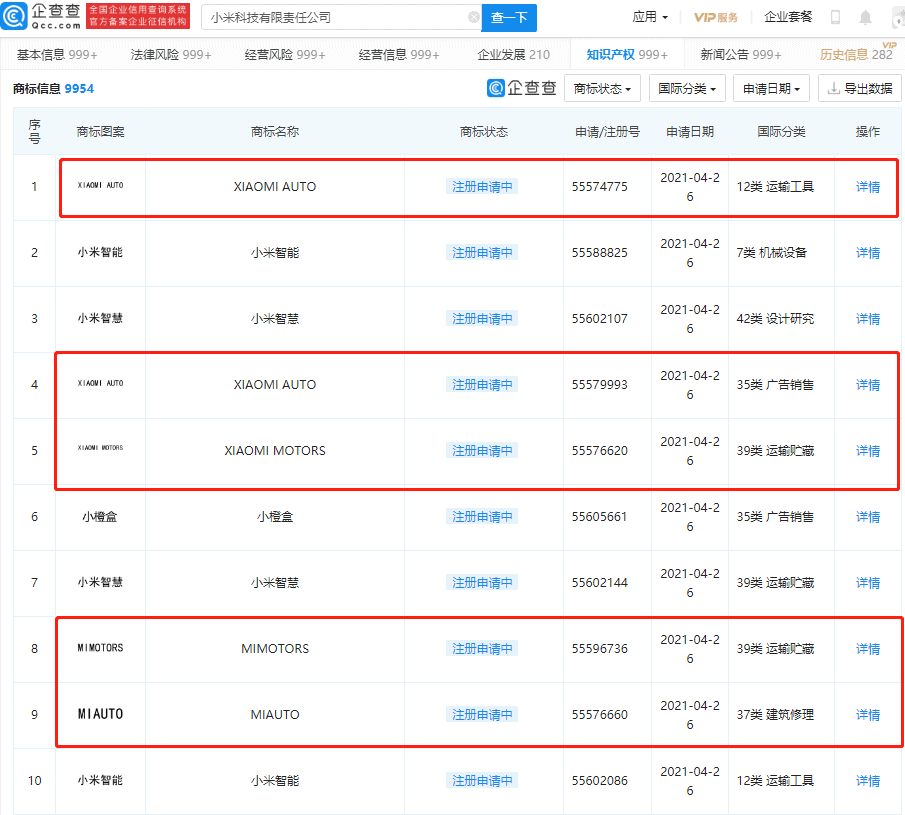

Xiaomi has recently added a number of trademark applications for “XIAOMI MOTORS”, “XIAOMI AUTO”, “MIMOTORS” and “MIAUTO”. The description of the trademark reads “transportation”, “storage”, “advertising sales” etc. (GizChina, IT Home)

Uber and Lyft will provide free rides to any user traveling to get the COVID-19 vaccine through an agreement reached with the White House. Lyft and Uber will cover the costs of the free rides. (CN Beta, TechCrunch)