5-18 #Depression : SK Hynix is considering doubling its foundry capacity with options; Samsung is to showcase next-generation OLED technologies; LG Group has indicated that it will invest more than USD100M for the next 3 years; etc.

The Ministry of Trade, Industry and Energy has announced that ASML would invest KRW240B (USD210M) in South Korea for four years to come and the lithography equipment manufacturer’s investment in Hwaseong, Gyeonggi Province is to build an EUV cluster including a remanufacturing plant and a training center. The remanufacturing plant in South Korea is to upgrade the EUV lithography equipment already in operation in the country. (CN Beta, Sina, Business Korea)

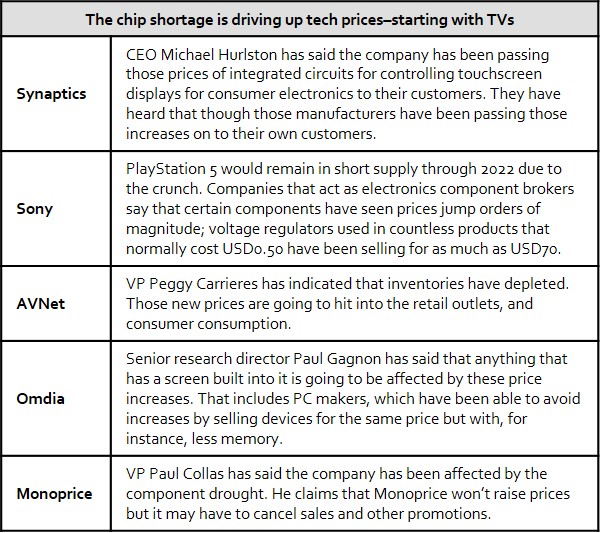

In recent months, the price of larger TV models has shot up around 30% compared to 2020 summer, according to market research company NPD. The jump is a direct result of the current chip crisis and underscores that a fix is more complicated than simply ramping up production. It may also be only a matter of time before other gadgets that use the same circuitry—laptops, tablets, and VR headsets among them—experience similar sticker shock. (CN Beta, Arcs Technica)

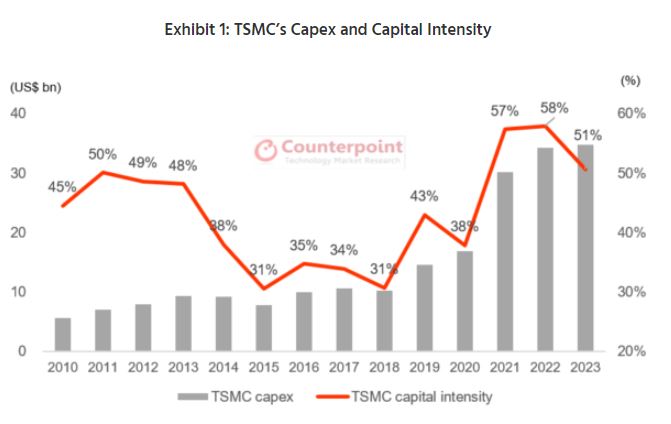

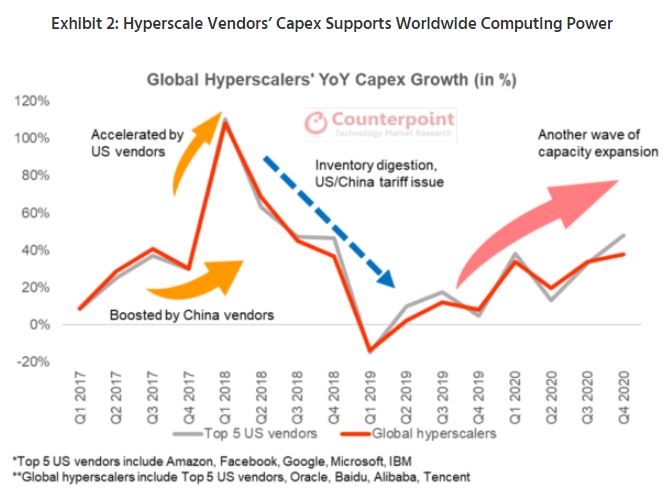

The semiconductor supply chain has been suffering capacity constraints since 2H20, with both TSMC and Intel guiding more than 18 months of supply tightness ahead. Counterpoint Research believes the shortage will be prominent at relatively mature nodes across 200mm and 300mm foundries due to strong demand from multiple sectors. Further, they expect the lingering demand-supply imbalance to continue, with prices seeing another round of hikes of at least 10-20% in 2022. To tackle the shortage, TSMC has revised up its 2021 capex guidance to USD30B while Intel will work more closely with clients to seek solutions. (Counterpoint Research, Laoyaoba)

SK Hynix is considering doubling its foundry capacity with options, including domestic facility expansion and merger and acquisition deals, according to Park Jung-ho, co-CEO and vice chairman at SK Hynix. (CN Beta, HPC Wire, Korea Bizwire)

China Mobile and Intel, Hewlett-Packard and MediaTek have announced that they will cooperate in the field of 5G mobile PCs to jointly build a new generation of fully connected PCs. “Four-party cooperation” will accelerate the innovation of 5G fully connected PC products. (CN Beta, Sina, EE World, TechNave)

In order to minimize the risk of the COVID-19, TSMC has adopted a series of new measures, including reducing face-to-face contact between operating teams and prohibiting non-core suppliers from entering TSMC’s factories. In addition to TSMC, MediaTek and Hon Hai Group have all taken similar measures. (GizChina, IT Home, Sina, ET Today, UDN)

Samsung Electronics allegedly begins construction of a planned USD17B U.S. chip plant in 3Q21 with a target to be operational in 2024. Samsung is planning to apply an advanced 5nm extreme ultraviolet (EUV) lithography chip-making process at the plant, which is expected to be in Austin, Texas. (Laoyaoba, Financial Post, US News)

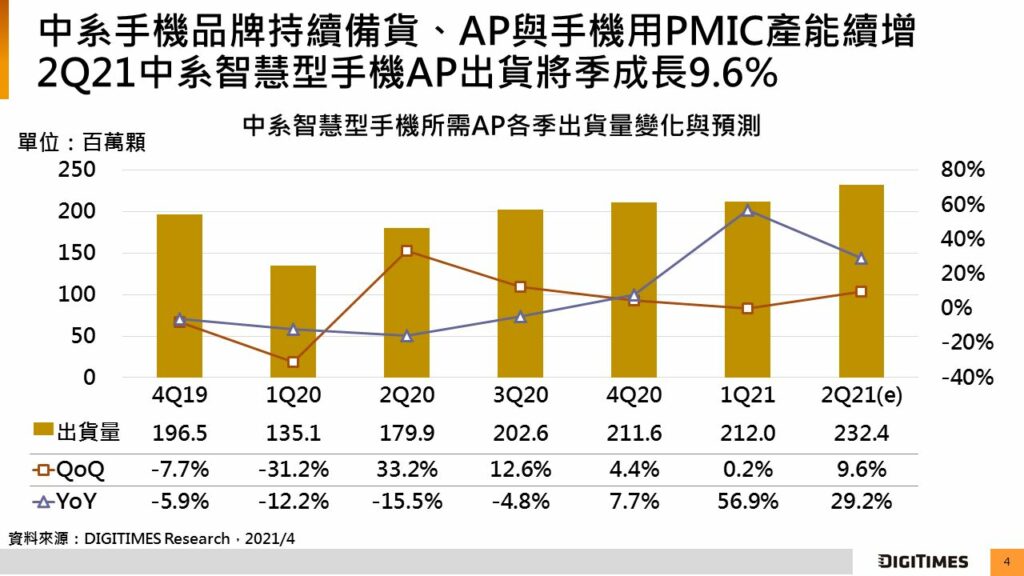

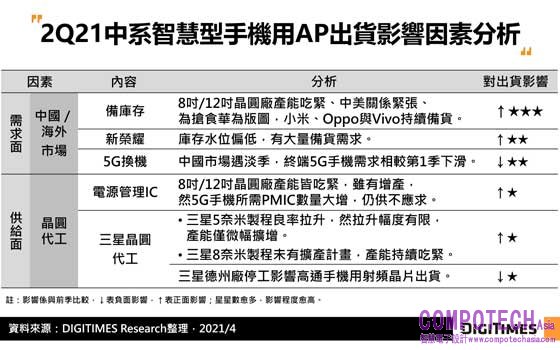

According to DIGITIMES Research, in 1Q21, Chinese brands picked high inventory levels and continued to stock up. The AP required for mid-range smartphones could increase by 212M units, a QoQ increase 0.2%, and MediaTek’s market share was significantly increased to more than half. In 2Q21, the stocking momentum of mid-range phone brands has not significantly decreased. In addition, Qualcomm and MediaTek plan to increase the production capacity of APs and power management chips for mobile phones. It is predicted that the reduction of APs for mid-range smart phones will increase by 9.6% on a quarter, 29.2% increase on year. (Compotech Asia, Digitimes)

Samsung is to showcase next-generation OLED technologies such as S-shaped foldable display (S-foldable), slidable display (Slidable), and Under Panel Camera (UPC), demonstrating its technological strength in the field of OLED. (GizChina, Sparrows News, Gizmo China, CN Beta)

Boréas Technologies has unveiled its NexusTouch sensing technology, which will give touch feedback in a new generation of smartphones (including those geared to gaming). It is a new kind of piezo sensor technology that combines gesture detection with high-definition haptic feedback. (VentureBeat, Boréas Technologies)

Google has filed a patent that describes camera under display (CuD) solution. Their solution uses a secondary display and a movable prism to either reflect the secondary display to the main display to fill in the gap, or to guide the light from the outside to the front-facing camera. The secondary display could also house sensors such as a proximity sensor or IR sensor. (CN Beta, LetsGoDigital, MS Poweruser, Peta Pixel)

Intel has announced the latest iteration of its Optane Memory sticks for laptops, the Optane Memory H20 with Solid State Storage. The Optane Memory H20 with Solid State Storage includes both the Optane Memory chip and NAND flash on a single M.2 2280 card. (Neowin, Intel)

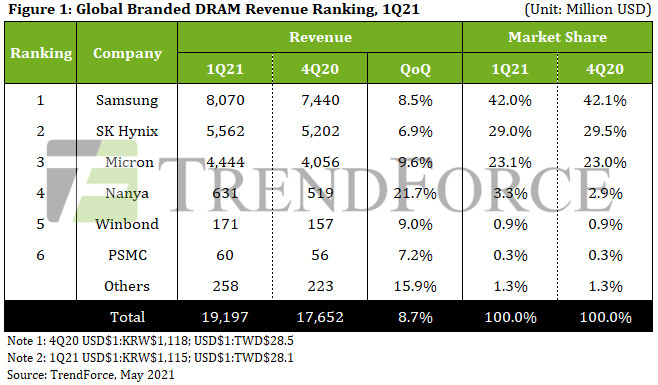

According to TrendForce, demand for DRAM exceeded expectations in 1Q21 as the proliferation of WFH and distance education resulted in high demand for notebook computers against market headwinds. All DRAM suppliers posted revenue growths in 1Q21, and overall DRAM revenue for the quarter reached USD19.2B, an 8.7% growth QoQ. In particular, Samsung, SK Hynix, and Micron saw QoQ increases of 8.5%, 6.9%, and 9.6%, respectively, in their revenues in 1Q21. Going forward, the three suppliers’ market shares will unlikely undergo drastic changes in 2Q21. (Laoyaoba, TrendForce, TrendForce)

LG Chem, South Korea’s leading car battery maker, has said it will invest KRW40B (USD35M) in a Chinese copper foil company Jiujiang DeFu Technology, China’s third-largest copper foil maker, for a stable supply of the core battery material. LG Chem has revealed that DeFu currently has a production capacity of 49,000 metric tonnes per year and is planning to expand this to 78,000 metric tonnes by 2022. (CN Beta, The Elec, YNA)

Xiaomi is reportedly researching and developing smartphone batteries that support parallel charging technology to achieve faster charging speeds and charge rates. Xiaomi is allegedly working on smartphone dual cell batteries. (Gizmo China, IT Home, Sina)

AT&T and Discovery are reportedly in talks that would combine AT&T’s media business with Discovery’s reality-TV dynasty to create a massive new entertainment entity. AT&T only recently added some major entertainment brands to its portfolio when it acquired Time Warner for USD85B, a deal that was finalized in 2018. AT&T’s WarnerMedia unit owns cable channels CNN, HBO, Cartoon Network, TBS, TNT, and the Warner Bros. movie studio. (The Verge, TechCrunch, Bloomberg, LA Times)

After several months of “short boom” in the domestic mobile phone market, it has once again entered a stage of slow development and depression. According to a China Academy of Information and Communications Technology, in Apr 2021, the overall China domestic mobile phone shipments were only 27.486M units, a YoY decrease of 34.1%. While the mobile phone market is suffering from a decline, the industry has reported that major phone vendors have cut orders to reduce shipments. Driven by new products, overall phone shipments in Mar 2021 reached 36.094M units, an increase of 65.9% YoY, and total shipments in 1Q21 were 97.973M units, an increase of 100.1% YoY. (CN Beta, CAICT, CAICT)

Apple has confirmed that its entire music catalogue of more than 75M songs will be available in high quality lossless audio using ALAC (Apple Lossless Audio Codec) up to 24-bit at 192kHz. Lossless audio is available at no extra cost than a standard Apple Music subscription. (Pocket-Lint, Neowin, GSM Arena, CN Beta)

As LG exited the smartphone business, LG employees in South Korea reportedly have the exclusive opportunity to purchase the unreleased phones Velvet 2 Pro and Rollable phone. (GSM Arena, Twitter)

Sharp AQUOS R6 is announced in Japan – 6.6” 1260×2730 WUXGA+ Pro IGZO OLED, Qualcomm Snapdragon 888,rear dual 20MP (1.0µm F1.9) co-designed by Sharp and Leica Camera-ToF + front 12MP, 12+128GB, Android 11.0, 5000mAh, price is yet unknown. (GSM Arena, Sharp, My Drivers, CN Beta)

Chinese automaker Guangzhou Automobile Group’s electric vehicle branch GAC Aion has announced that it will develop self-driving new energy vehicles with ride-hailing giant Didi Chuxing. The companies will co-develop an autonomous new energy car model for “large-scale commercial application with the aim of entering accelerated mass production”. (My Drivers, Sina, Yicai, Gasgoo, Pandaily)

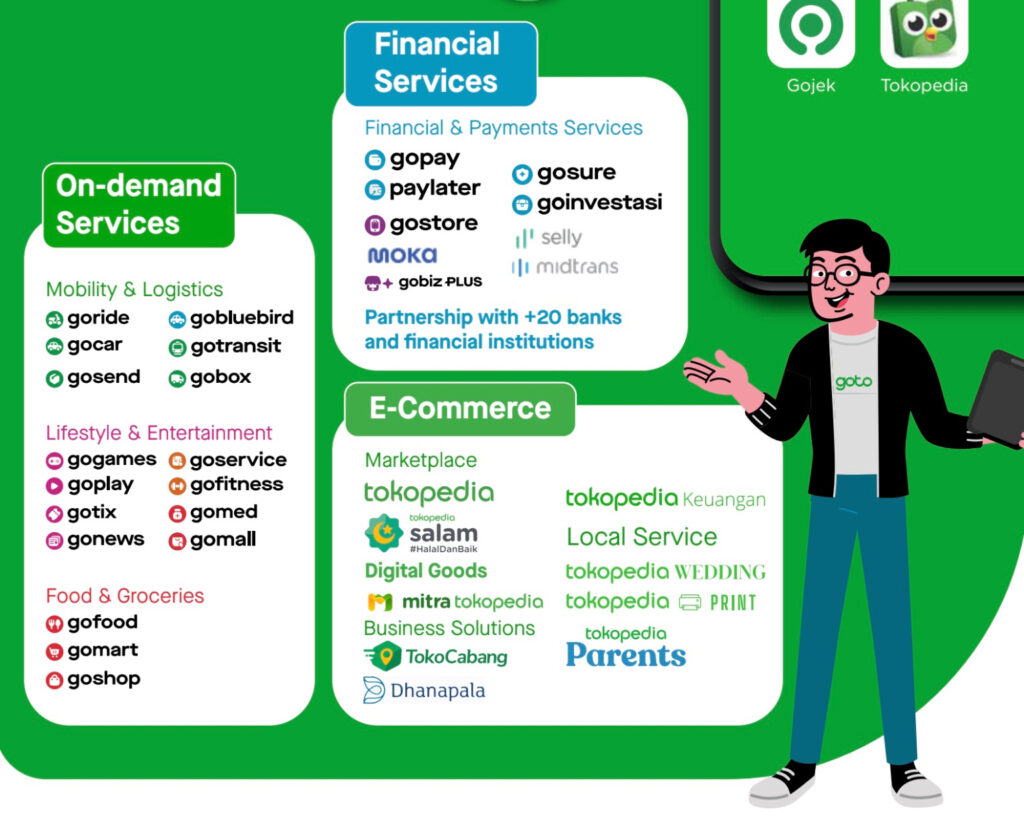

Indonesia ride-hailing and payments firm Gojek has announced its merger with e-commerce player Tokopedia to form the GoTo Group. The ultimate goal is said to be a potential IPO with an expected public markets valuation target USD35B~40B. (TechCrunch, CNBC, Reuters, Bloomberg)

The Securities and Exchange Commission has opened an investigation into newly public electric vehicle startup Canoo, according to CEO Tony Aquila. It covers Canoo’s merger with a special purpose acquisition company (or SPAC), plus its “operations, business model, revenues, revenue strategy, customer agreements, earnings and other related topics. (The Verge, SEC)

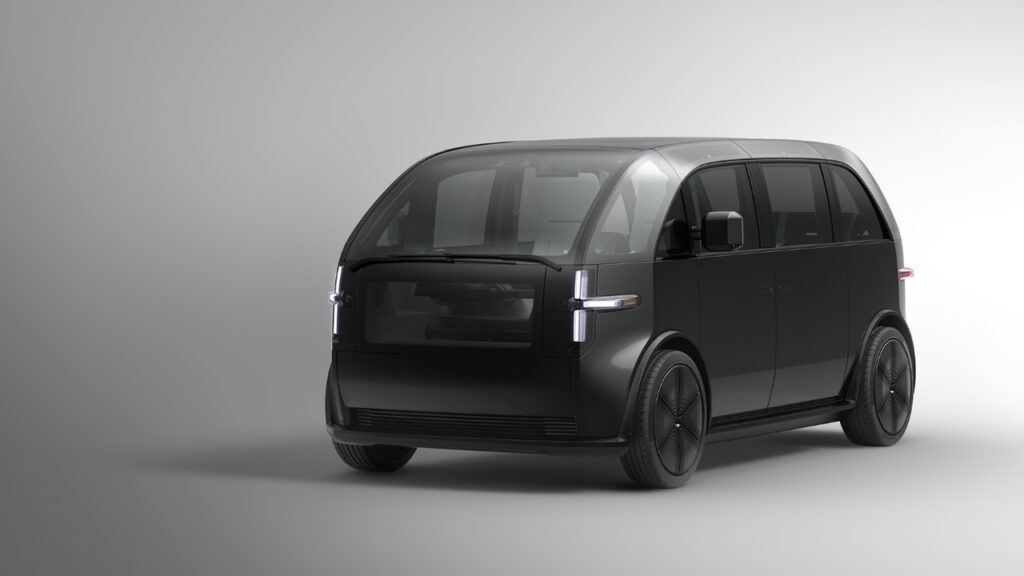

Los Angeles-based electric vehicle startup Canoo is bringing its first vehicle to market in 2022. The company has said its electric microbus-slash-van will be available to buy in 2022 at a base price of USD34,750 before tax incentives or add-ons. (CN Beta, TechCrunch)

Electric vehicle start-up Fisker does not plan to invest in bitcoin or accept the cryptocurrency as payment, according to CEO and founder Henrik Fisker. Fisker said bitcoin is not “a sustainable solution”, echoing environmental concerns raised by Tesla CEO Elon Musk. (CN Beta, CNBC)

Germany electric aviation startup Volocopter has revealed a new electric vertical take-off and landing aircraft targeting the suburban-to-city commuter. The four-seater VoloConnect is designed to have a range of 62 miles, making it well-suited for trips between the suburbs and the city. VoloCity the company’s first passenger eVTOL that is designed for shorter urban trips. (CN Beta, TechCrunch, eVTOL, Bloomberg)

LG Group has indicated that it will invest more than USD100M for the next 3 years to establish massive high-performance computing infrastructure for advanced artificial intelligence (AI) development. LG AI Research, the group’s AI R&D hub, plans to develop a “hyper-mega AI” system resembling a human brain that can conduct comprehensive and independent learning, decision-making and actions by processing massive amounts of data. (CN Beta, YNA, Korea JoongAng Daily)

Italian fashion label Gucci is partnering with online gaming platform Roblox for an interactive virtual exhibit celebrating Gucci Garden Archetypes. The new partnership brings digital items from the fashion house into the platform’s metaverse alongside a new limited-run digital experience. (TechCrunch, Roblox, The Verge, Luxury Daily, Gucci)

Amazon is reportedly weeks into negotiations on a deal to acquire MGM for about USD9B. In Dec 2020, MGM has been looking for a buyer. MGM has recruited Morgan Stanley and LionTree LLC to advise on the process of a formal sale. (CN Beta, The Verge, Variety, The Information)