6-24 #Filled : Intel has also announced that it would adopt SiFive designs for use in its future 7nm Horse Creek platforms; GF is starting with the construction of phase one of its 300mm fab expansion in Singapore; Samsung has unveiled a range of new chipsets that will be embedded into the company’s next generation 5G solutions; etc.

SiFive, the leading designer of chips based on the open source RISC-V architecture, has announced its new SiFive Performance line of chips that support 64-bit operating systems, like Linux. The company claims the P550’s processors are the fastest RISC-V cores on the market and beat ARM’s Cortex-A75 chips in terms of area efficiency. Intel, which has reportedly offered USD2B to acquire the startup, has also announced that it would adopt the designs for use in its future 7nm Horse Creek platforms. (AnandTech, Tom’s Hardware, Reuters, CN Beta)

GlobalFoundries (GF) is increasing its production capacity in Singapore with a hefty USD4B (SGD5.4B) investment. To meet that demand, GF has planned capacity expansions at all its manufacturing sites in the U.S., Germany and, starting with the construction of phase one of its 300mm fab expansion, Singapore. When complete, GF will add capacity for 450,000 wafers per year, bringing GF’s Singapore campus up to approximately 1.5M (300mm) wafers per year. (CN Beta, Globalfoundries, CNBC, Strait Times)

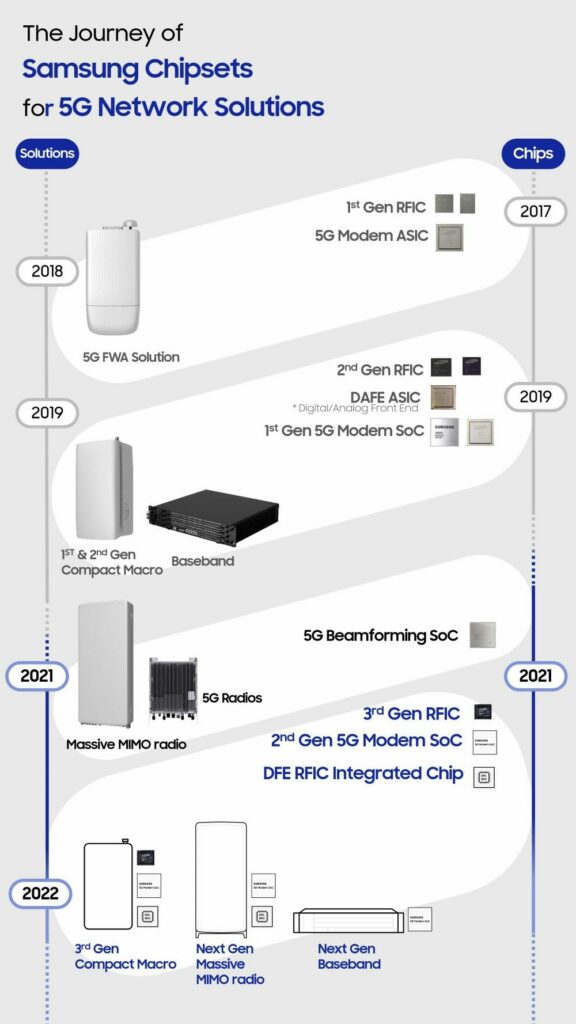

Samsung has unveiled a range of new chipsets that will be embedded into the company’s next generation 5G solutions. The new 3GPP Rel.16 compliant chipsets consist of a third generation mmWave Radio Frequency Integrated Circuit (RFIC) chip, a second generation 5G modem System-on-Chip (SoC) and a Digital Front End (DFE)-RFIC integrated chip. The company’s latest chips will power Samsung’s next-generation products for 5G build out, including the next generation 5G Compact Macro, Massive MIMO radios and baseband units, which will all be commercially available in 2022. (Neowin, Samsung, Android Authority)

Intel is restructuring its Data Platform Group into 2 new units: the Datacenter and AI unit and the Network and Edge Group. The company is also creating 2 new business units: the Software and Advanced Technology Group and the Accelerated Computing Systems and Graphics Group. (VentureBeat, Intel, Seeking Alpha)

MediaTek intends to present a flagship processor, produced by TSMC using 4nm technology in 1H22. It would be adopted by OPPO, vivo, Xiaomi and other vendors. The new chip is runs the ARM v9 architecture; and will include the latest Cortex-X2 and Cortex-A510 cores. (GizChina, My Drivers, 163)

SK Hynix has started hiring experienced foundry workers in a move to bolster its foundry business. The company appears to be aiming to provide 8” foundry services for small and medium-sized fabless companies. SK Hynix is seeking to fully acquire Key Foundry where it currently has a 49.8% stake. It made an equity investment in the company through a private equity fund. (Laoyaoba, Sohu, Business Korea)

Samsung has denied rumors of purchasing OLED panels from LG Display (LGD), claiming that its QLED technology is better than OLED technology for TVs. Jong-hee Han, President of Visual Display (VD) business, has denied the rumors multiple times. There are rumors that Samsung might order 2-3M OLED panels from LGD and that it might launch its first OLED TVs sometime in 2H21 / 1H22. Samsung is taking this step due to lowering profits from its LCD TVs and rising competition from Chinese TV firms like HiSense, TCL and Xiaomi. (CN Beta, Gizmo China, Sam Mobile, Chosun)

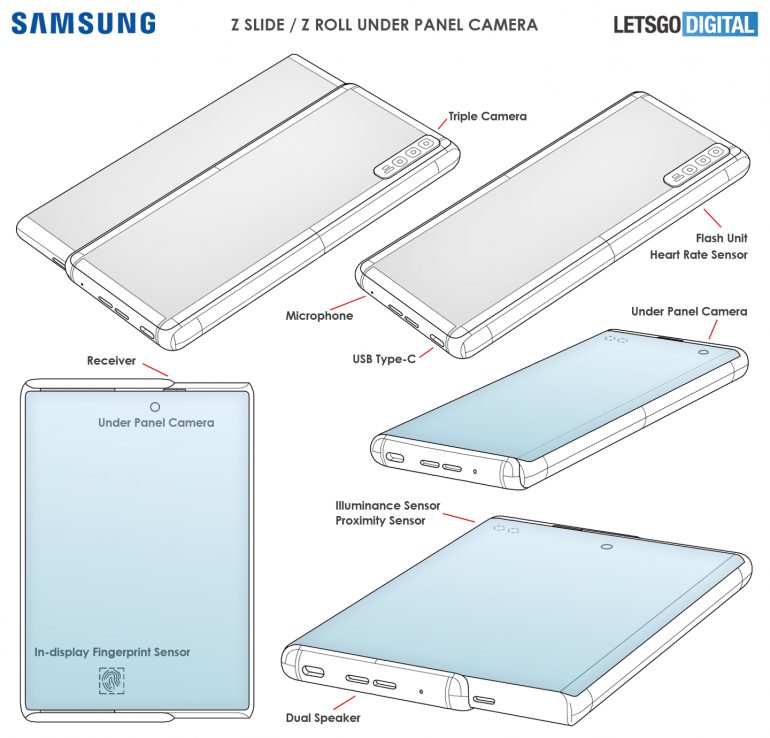

Samsung has filed a patent with USPTO and WIPO, detailing a rollable smartphone with hidden selfie camera. When folded, the device resembles a traditional all-in-one smartphone. If necessary, the user can expand the case, transforming the device into a small tablet. At the same time, the flexible display, twisted inside, will increase in area by about a third. (GizChina, LetsGoDigital)

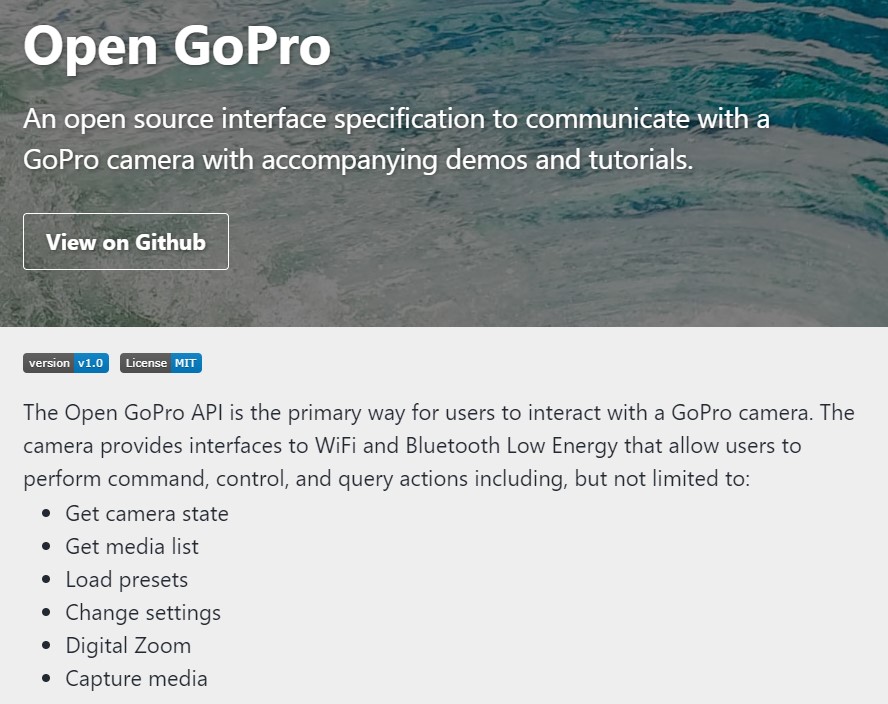

GoPro has recently opened its camera system with GoPro Labs, allowing users to add experimental features like footage capture with motion detection. The company is introducing the Open GoPro API for the Hero 9 Black, which allows developers access the Hero 9 Black features including, wireless connectivity, camera command and control, camera status, camera preview and SD card media review and transfer. (Engadget, GoPro)

Western Digital (WD) has unveiled its second-generation UFS 3.1 storage products for a new generation of 5G smartphones. WD spent USD18B on factories over the past decade, and it is on its 10th generation of flash memory. Every flash manufacturer licenses tech from WD. The WD iNAND MC EU551 delivers the high-performance storage. (VentureBeat, Western Digital)

Tianfeng Securities analyst Ming-Chi Kuo has reiterated his previous forecast of the main specifications of Apple’s new iPhone in 2H22, that is, Apple will launch 2 high-end iPhones (6.1” and 6.7”) and two lower-end iPhones (6.1” and 6.7”) in 2H22. He believes that the growth momentum of the new 2H22 iPhone comes from: 1) it may support fingerprint on display (using Apple’s own technology), 2) the lowest-priced large-size (6.7”) iPhone ever (predicted to be less than USD900) , And 3) High-end models of wide-angle cameras upgraded to 48MP resolution. (TF Securities, My Drivers, Laoyaoba, Mac Rumors)

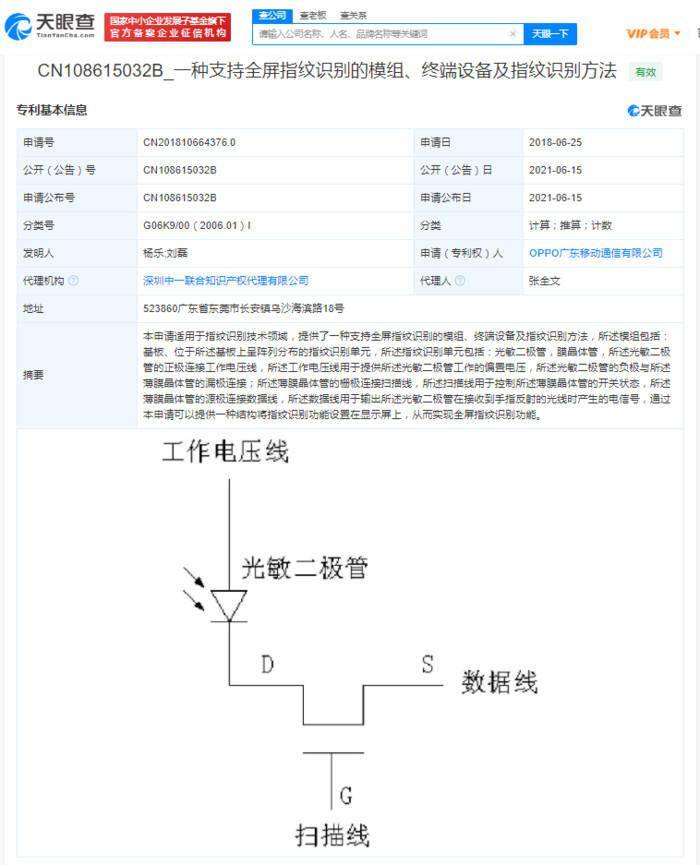

OPPO has added a number of new patent information, one of which is related to full display fingerprint scanner technology, and the title is “a module, terminal device and fingerprint identification method that supports full-display fingerprint recognition”. The patent abstract shows that this application is suitable for the field of fingerprint identification technology, and provides a module, terminal equipment and fingerprint identification method that support full-screen fingerprint identification. (Laoyaoba, Sohu, Sina)

Quanergy Systems, the Sunnyvale, California-based lidar company, has agreed to merge with special purpose acquisition fund CITIC Capital Acquisition Corp. The deal, which puts an implied valuation on Quanergy at USD1.4B, is expected to close in 2H21. After closing, the transaction will inject the lidar company with around USD278M in pro forma net cash. (TechCrunch, Reuters, Reuters, Business Wire, 163)

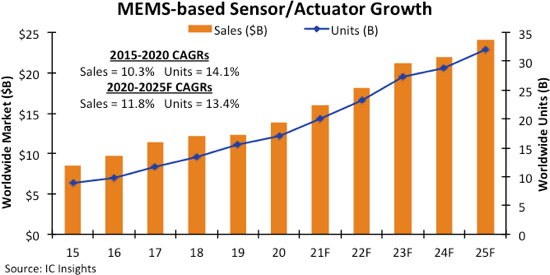

Sales of semiconductor sensors and actuators made with microelectromechanical systems (MEMS) technology are expected to grow about 16% in 2021 to a record-high USD15.9B after an 11% increase in 2020 during the economic havoc caused by the Covid-19 virus pandemic and the automotive industry’s worst year in decades, according to IC Insights. Sales of MEMS-based sensors and actuators are expected to increase by a compound annual growth rate (CAGR) of 11.8% to USD24.1B with shipments rising by a CAGR of 13.4% to 32.1B units in 2020-2025. (IC Insights, Laoyaoba)

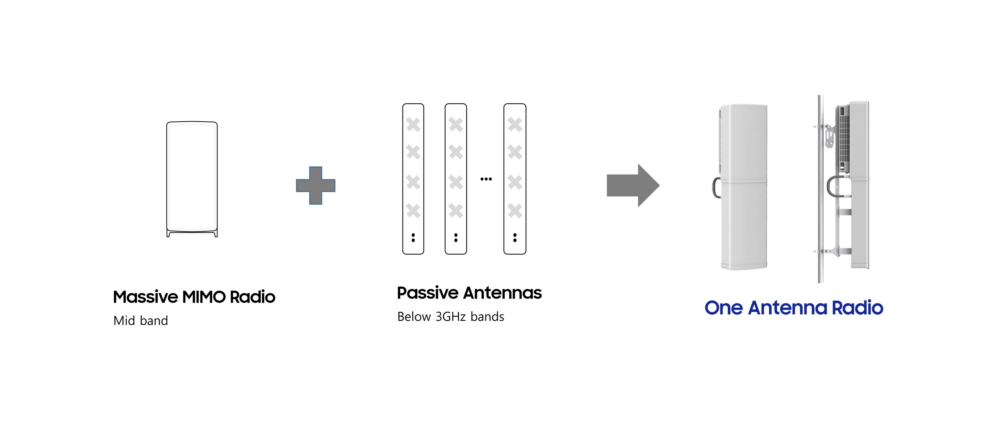

Samsung Electronics has unveiled a new radio designed to help mobile operators overcome the challenges they face in deploying 5G networks. The new One Antenna Radio features integrated antennas, providing operators with the ability to simplify and speed up 5G installations by consolidating a 3.5GHz Massive MIMO radio with low-band and mid-band passive antennas into a single form factor. (CN Beta, Samsung)

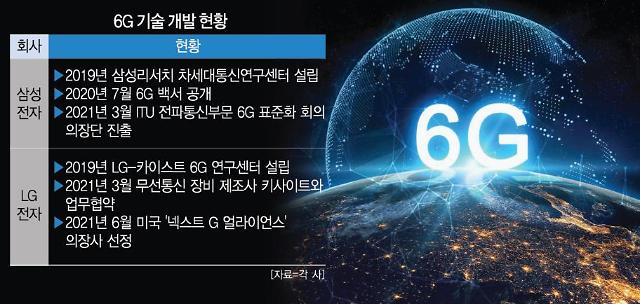

South Korea has unveiled a 5-year state project to spend some KRW220B (USD193M) on the development of core technologies for 6G telecommunication while stepping up joint research and cooperation with the United States. South Korea aims to achieve the world’s first commercialization of 6G mobile telecommunication in 2028. (Gizmo China, Ajudaily, Sina, IT Home)

realme is encouraging more of its suppliers and manufacturing partners to open local factories in India and is working on manufacturing expansion on Internet of Things (IoT) product categories having achieved 100% local manufacturing of smartphone and smart TVs. Madhav Sheth, realme’s VP and CEO has indicated the company is targeting tier 3 and 4 cities to expand their presence and are strengthening micro-distribution there. (Laoyaoba, Sohu, Digitimes, India Times)

The world’s most valuable brands have experienced record growth according to the Kantar BrandZ Most Valuable Global Brands 2021 ranking, with the total worth reaching USD7.1T – equivalent to the combined GDP of France and Germany. The 42% increase; more than 4 times the study’s annual average percentage increase over the past 15 years, has been driven by confidence derived from vaccine availability, economic stimulus packages and improving GDP outlooks. US brands account for 56 of the Top 100 brands, with Amazon and Apple leading the way – each now worth over USD0.5T. (GSM Arena, Kantar, report, Business Wire)

Tianfeng Securities analyst Ming-Chi Kuo is looking at Apple’s future iPhone product strategy. He expects that the iPhone will ship 230-240M and 250-260M units in 2021 and 2022, respectively (vs. about 195M units in 2020). The growth momentum of the 2H21 new iPhone is mainly derived from the upgrade of specifications and the increase in market share of the high-end market due to the US ban on Huawei. He estimates that the new iPhone will be shipped in 2H21 at 83-88M units (vs. 75M in 2H20). He has reiterated his previous prediction that Apple will launch the new iPhone SE in 1H22. (TF Securities, Mac Rumors, CN Beta, CN Beta, My Drivers, Phone Arena)

Lava Benco V80 is launched in Thailand – 6.517” 720×1600 HD+ v-notch, Unisoc SC9863, rear 8MP + front 8MP, 4+64GB, Android 11.0, rear fingerprint, 5000mAh 10W, THB2,890 (USD90). (Gizmo China, Britstar Mobile, VIC Shacks)

vivo will be entering the tablet market, and the first product will be launched in 4Q21. vivo has registered the trademark vivo Pad with the European Union Intellectual Property Office. The patent images showcase that the device will come with a full-screen display without any notches on top for the front-facing camera. (Gizmo China, IT Home, Laoyaoba)

Xiaomi launches kid smartwatch Mitu Watch 5C, priced at CNY399. It supports 9 positioning functions (GPS, Beidou, Wi-Fi, LBS, G-sensor, A-GPS, AI positioning, indoor positioning and camera-assisted positioning), real-time tracking location. The watch is equipped with a 1.4” color display, AF anti-fingerprint oleophobic coating, and a front 2MP wide-angle camera, which can take bigger and clearer shots. (My Drivers, Gizmo China)

Audi AG will be gradually phasing out production of internal-combustion engines by 2033, in a push to achieve net-zero emissions by 2050 at the latest. The Volkswagen AG subsidiary would only launch new all-electric models from 2026, confirming it is already launching more electric cars than models with combustion engines in 2021. (My Drivers, Teslarati, Market Watch, Electrek)

WeRide, a China-based autonomous-driving startup that counts Renault-Nissan-Mitsubishi Alliance as one of its strategic investors, has said that it would deepen development with Nissan on autonomous technology for the China market as it raised further funding on top of USD310M it received in Jan 2021. The latest move gave the company a USD3.3B valuation. (TechCrunch, Reuters, Channel News Asia, WeRide, NBD)

LG will complete its exit from the phone business by the end of Jul 2021. During the same month, LG will spin off its EV drive system segment. Canada’s Magna International, one of the world’s leading auto parts suppliers, will buy a 49% stake in that unit to create a new joint venture, LG Magna e-Powertrain, which will be headquartered in Incheon. Preparations are underway to establish bases in the U.S. state of Michigan and in Nanjing, China, aiming to secure customers in 2 countries that are major markets for EVs. Magna’s customers include General Motors, BMW and Ford Motor. LG forecasts the vehicle components division to turn a profit for the first time in 6 years in 2021. The company aims to expand sales at an annual pace of 15%. (Gizmo China, Nikkei)

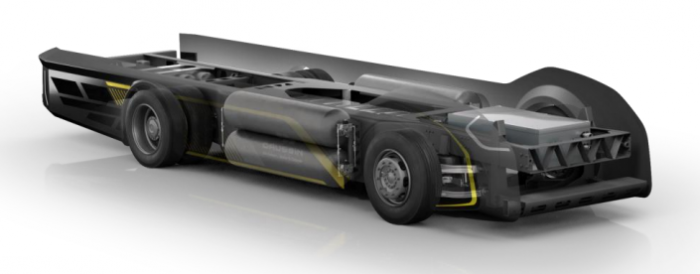

Gaussin, a French manufacturer that already is known for all-electric “shifters”, announced that its upcoming next-generation skateboard road truck platform will be powered by Microvast batteries. The Gaussin skateboard is envisioned for class 8 tractor or straight trucks (from 18t to 44t) that will be 100% battery-electric or hydrogen fuel cell. A key partner in the project appears to be Magna. Gaussin is offering two versions of its skateboard platform. (CN Beta, Inside EVs, New Atlas)

Bird has announced the launch of shared e-bikes to its fleet of e-scooters, which it says can be found in over 250 cities around the world. The shared micromobility provider is also launching a so-called “Smart Bikeshare” platform that allows local shared bike and e-moped providers and transit apps to integrate with Bird’s app. (TechCrunch, CN Beta)

Spin, Ford’s micromobility subsidiary, has launched its first custom designed and built electric scooter. The company says the S-100T scooters are its safest and longest-lasting, two qualities that it hopes will attract the attention of cities as it aims its strategy at exclusive partnerships. When the company launches its service in Sacramento in Jul 2021, it will deploy 25 of the new S-100T scooters along with its existing fleet. (CN Beta, TechCrunch, Seeking Alpha)

Embark Trucks, a leading developer of autonomous software technology for the trucking industry and Northern Genesis Acquisition Corp. II, a publicly-traded special purpose acquisition company, have jointly announced that they have entered into a definitive business combination agreement that will result in Embark becoming a publicly listed company. (CN Beta, Business Wire, Seeking Alpha)

The Federal Trade Commission (FTC) will be the agency to review Amazon.com’s proposed acquisition of Hollywood studio MGM. Amazon announced in May 2021 its deal for MGM for USD8.45B, which would boost its Prime Video streaming platform in a market that includes rivals such as Netflix and Walt Disney. (GizChina, Bloomberg, WSJ, Yale Law Journal)

Mollie, an Amsterdam-based startup that provides a way for businesses to integrate payments into sites, documents and other services by way of an API, is announcing that it has raised EUR665M (USD800M) in an all-equity round that values the company at EUR5.4B (USD6.5B). (TechCrunch, CNBC, Mollie)