7-1 #Pressure : SK Hynix will set out at M16 facility investment of KRW800B (about USD709M); MediaTek has announced the Dimensity 5G Open Resource Architecture; TI has announced it has signed an agreement to acquire Micron’s 300mm semiconductor factory in Lehi; etc.

Advanced Micro Devices (AMD) has won unconditional approval from the European Union for its planned USD35B acquisition of Xilinx. The UK’s Competition and Markets Authority approved the deal. The UK’s Competition and Markets Authority approved the deal. (CN Beta, AMD, Seeking Alpha)

Apple reportedly has enlisted AT&S as a new supplier of BT-based AiP (antenna in package) substrates for new 5G mmWave iPhones to be released later in 2021, expanding to 5 the number of suppliers of the substrates (in addition to Semco, LG Innotek, Kinsus Interconnect Technology and Unimicron Technology), according to Digitimes. Apple is expected to sharply boost the ratio of 5G mmWave devices to 60% of its new iPhone lineup in 2021, with such models estimated to approach 90M units. (Digitimes, press, Digitimes, Sina)

MediaTek has announced the Dimensity 5G Open Resource Architecture that provides brands with more flexibility to customize key 5G mobile device features to address different market segments. The open resource architecture gives smartphone brands closer-to-metal access to customize features for cameras, displays, graphics, artificial intelligence (AI) processing units (APUs), sensors and connectivity sub-systems within the Dimensity 1200 chipset. (Digital Trends, GizChina, PR Newswire, Laoyaoba)

TF Securities analyst Ming-Chi Kuo pointed out that Apple’s to be released new true wireless headset (TWS) Beats Studio Buds uses MediaTek’s 22nm TWS chip, not its own 16nm H1 chip. He believes that Apple’s adoption of MediaTek’s TWS chip solution and a clear positioning of Android device users as its target customers will help Apple increase its market share in TWS. He believes that Apple’s adoption of MediaTek’s TWS chip will significantly help MediaTek to promote TWS chip solutions to other brand customers and further cooperation with Apple in the future. (TF Securities)

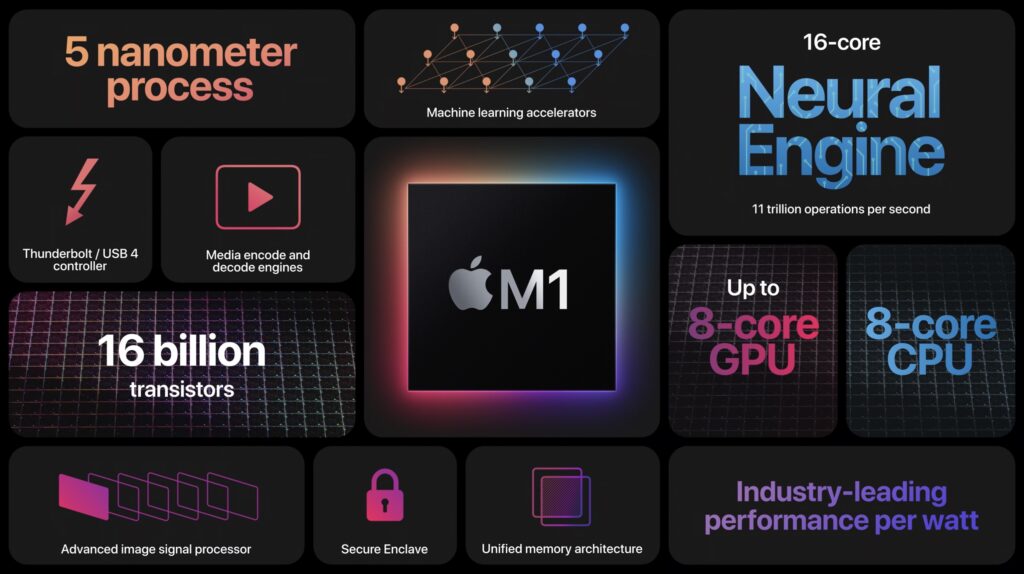

According to Strategy Analytics, Apple’s in-house A-series and M-series chip shipments and revenue saw solid double-digit unit and revenue growth in 1Q21. Apple’s revenue from A-series and M-series applications processors jumped 54% to USD2B in 1Q21. Strategy Analytics estimates that cumulatively Apple shipped USD51.0B worth of A-series and M-series APs through the end of 1Q21. (Strategy Analytics, CN Beta)

AMD is reportedly releasing 2 brand new AMD CPU families, a 5nm Zen 4 powered EPYC lineup and a 7nm Zen 3 powered Athlon APU lineup. The AMD EPYC Genoa lineup features TSMC’s 5nm process-based Zen 4 cores and a total of 96 of them. AMD is expected to launch another Zen 4 based server lineup known as EPYC Bergamo, which will be featuring up to 128 cores. The Athlon Monet will utilize the 12nm Zen 3 core architecture and will power entry-level mobile solutions such as ultra-thin laptops. The company is claimed to utilize the GlobalFoundries 12LP+ process. (CN Beta, WCCFTech)

SK Hynix will set out at M16 facility investment of KRW800B (about USD709M). M16 is SK’s latest semiconductor factory (fab) completed in Feb 2021, preparing for memory production using the extreme ultraviolet (EUV) process. SK Hynix plans to equip the M16 factory with a capacity of 18,000 sheets (18K) per month based on 12” wafer input in 2H21. (Laoyaoba, ET News)

Apple is reportedly preparing 3 upcoming iPads featuring OLED display – one of which to be released in 2022 with 10.86” size, and two of which to be released in 2023 with 12.9” and 11.0” 120Hz LTPO panels. Apple would use Thin-Film Encapsulation (TFE) method to protect the OLED panel from moisture and oxygen. (GSM Arena, The Elec, Apple Insider)

Apple is taking a significant step to improve the production of mini-LED displays for its upcoming redesigned 14” and 16” MacBook Pros. Apple will spend USD200M on procuring additional surface mounting-technology (SMT) equipment to create 4 brand new assembly lines dedicated to mini-LED production for its upcoming MacBook Pros. The investment and purchase Apple hopes will provide an additional monthly SMT capacity of 700K-800K mini-LED MacBook Pro devices. (Mac Rumors, Mac Rumors, Digitimes, Digitimes)

Japan Sharp’s president and CEO Jeng-Wu Tai has revealed that Sharp has joined the MIH alliance platform promoted by Hon Hai Group. It is generally believed that Sharp is likely to supply products such as automotive displays and lenses. After Hon Hai announced the MIH alliance in Oct 2020, more than 1,600 companies have joined in just 6 months, including many world-renowned auto parts and software manufacturers. (Laoyaoba, CNYES, MoneyDJ)

Tianma is reportedly developing TFT LCD-based camera under display and fingerprint on display. Unfortunately, this solution is not cheaper than OLED-based solution, and most manufacturers will still choose relatively mature OLED solutions. In 2020, Tianma released the world’s first in-screen multi-point fingerprint identification solution (TED Fingerprint, TFP), which integrates the identification module into the LCD panel, so it is called in-screen fingerprint. (CN Beta, East Money, Min. News)

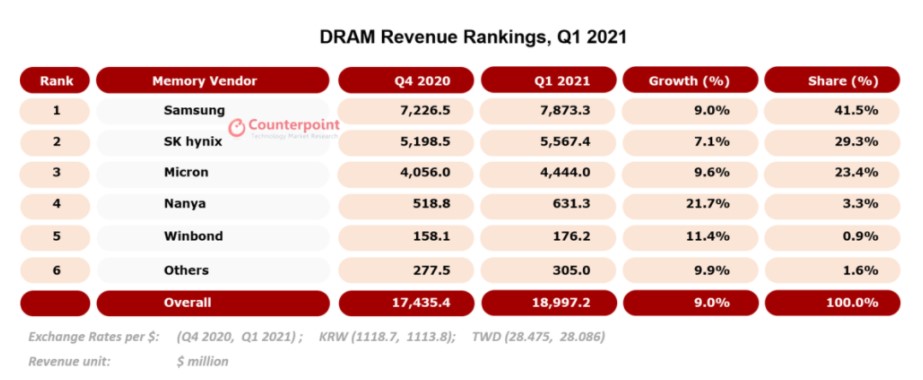

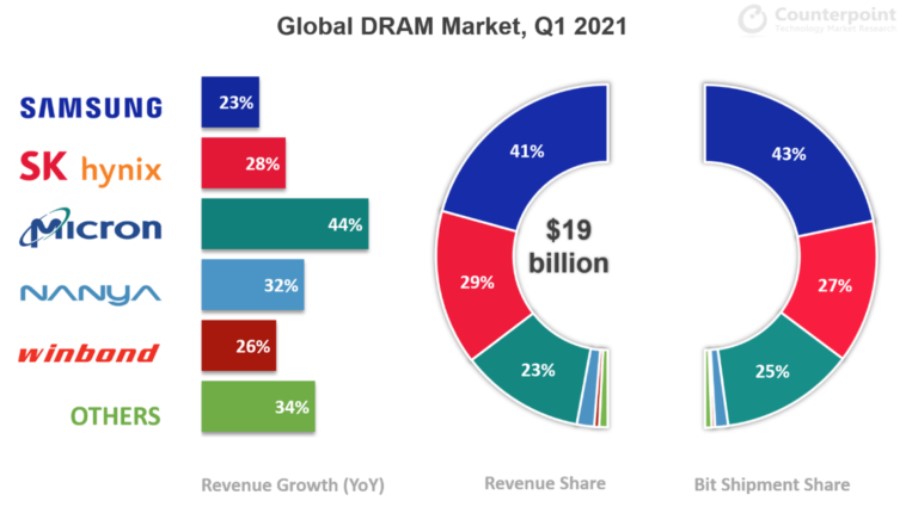

According to Counterpoint Research, global DRAM revenues rose to USD19B in 1Q21, increasing by a solid 30% YoY and 9% QoQ. Distance education and work from home (WFH) continued propelling a substantial demand for smartphone and laptop DRAM, resulting in a 6% growth in bit shipment and a 3% rise in ASP over the previous quarter. (Counterpoint Research, Digitimes)

Texas Instruments (TI) has announced it has signed an agreement to acquire Micron Technology’s 300mm semiconductor factory in Lehi, Utah, for USD900M. The Lehi fab will be TI’s 4th 300-mm fab, joining DMOS6, RFAB1 and soon-to-be-completed RFAB2 in TI’s wafer fab manufacturing operations. (My Drivers, Laoyaoba, Reuters, PR Newswire)

OPPO has introduced RAM expansion technology to MEA users for the first time on its Reno5 series of smartphones from Jun 2021. The technology, RAM+, operates as an auxiliary function that allows OPPO Reno5 series users to temporarily convert a small portion of their smartphone’s read-only memory (ROM) into virtual random-access memory (RAM). (Phone Arena, PR Newswire)

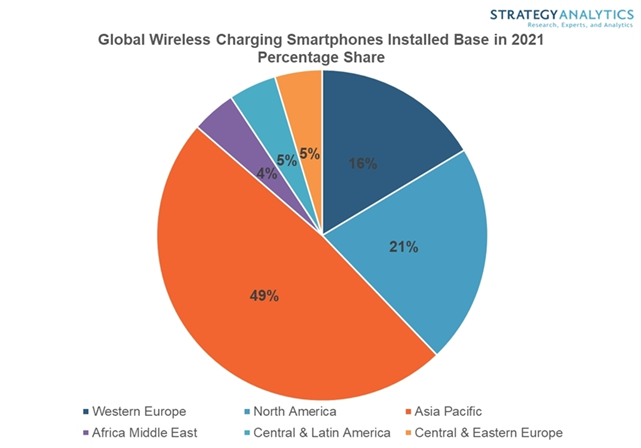

According to Strategy Analytics, the installed base of wireless charging capable smartphones will reach the record setting 1B mark by the end of 2021. Smartphone vendors such as Samsung, Xiaomi and OPPO and technology suppliers like Infineon, MediaTek, Samsung SDI and Qualcomm are powering the rise of wireless charging with proprietary solutions that top off a battery faster than ever. By 2026 Strategy Analytics forecasts it will top 2.2B wireless charging enabled smartphones. (Laoyaoba, Strategy Analytics)

China’s CATL supplied the most number of electric car batteries in the world Jan-May 2021, according to SNE Research. Usage of CATL batteries during the time period increased 272% from the same time period in 2020. LG Energy Solution’s was used the second most, followed by Panasonic of Japan and BYD of China. South Korean companies Samsung SDI and SK Innovation ranked fifth and sixth, respectively. Chinese battery firms recorded the strongest growth. BYD and CALB each recorded 207% and 417% growth from the same time period a year ago. (Laoyaoba, 199IT, The Elec)

Ericsson, Deutsche Telekom, and Samsung have successfully completed the world’s first 5G end-to-end (E2E) network slicing trial, which was carried out at Deutsche Telekom’s Bonn lab on a Samsung Galaxy S21 tethered to a VR headset. The trial used a commercial-grade 5G standalone (SA) infrastructure provided by Ericsson, including Radio Access Network (RAN), 5G Cloud Core, slice orchestration and ordering automation. (CN Beta, Ericsson)

Vietnam’s Ministry of Information and Communication (MIC) has decided to start phasing out 2G and 3G technologies within the country in 2022. The Vietnamese government said its new policy – as stated in Circular 43 – will take effect on 1 Jul 2021, which stipulates that terminal devices for mobile communication that are made in Vietnam or imported must support 4G technology. (Laoyaoba, Digitimes, Vietnam Net)

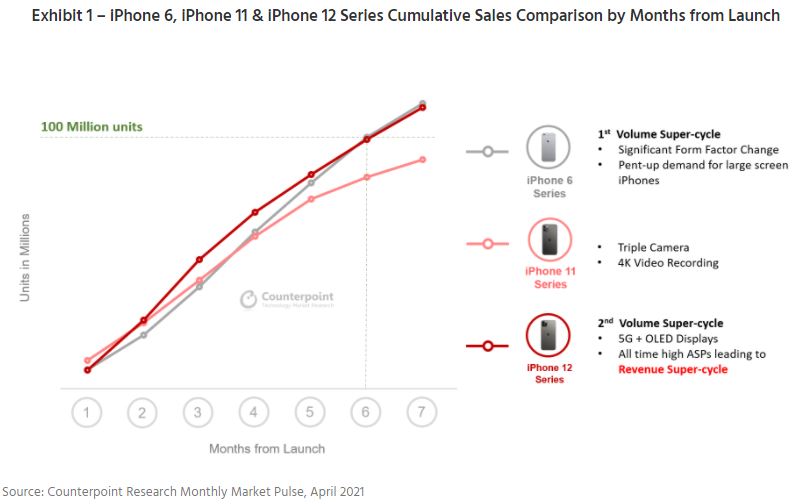

Apple iPhone 12 series’ cumulative global sales crossed the 100M units mark in Apr 2021, according to Counterpoint Research. The series is able to achieve this feat in the seventh month after its launch, which is 2 months earlier than the iPhone 11 series and almost the same as the iPhone 6 series that helped Apple achieve its first volume super-cycle at the cusp of 4G transition. (Mac Rumors, Apple Insider, Counterpoint Research)

Samsung Electronics paid a total of KRW11.1T (USD9.8B) in taxes and dues 2020, up 14.4% from a year ago, with the majority going to its homeland. Samsung paid KRW8.1T, or 73% of its total tax bills, to the South Korean government in 2020, according to its 2021 sustainability report. The Americas and Europe followed with 14% and Asia with 11%. (Laoyaoba, Korea Herald)

Honor X20 SE is launched in China – 6.6” 1080×2400 FHD+ HiD IPS LCD, MediaTek Dimensity 700 5G, rear tri 64MP-2MP macro-2MP depth + front 16MP, 6+128 / 8+128GB, Android 11.0, side fingerprint, 4000mAh 22.5W, CNY1,799 (USD280) / CNY1,999 (USD310). (GSM Arena, Neowin, Laoyaoba, Honor)

TF Securities analyst Ming-Chi Kuo has revised Apple AirPods forecast to 70-75M in 2021, compared to earlier forecast of 75-85M. That is due to the “lower-than-expected” demand of AirPods in 2Q21. Although Apple is still a leader in the TWS market, its market share continues to decline. He believes that Apple’s strategy of launching new TWS Beats models for Android device users is expected to improve the mediocre TWS market share decline in the short term (2H21–1H22). Even if the AirPods Pro 2 launched in 2022 does not have an innovative experience, Apple’s total TWS shipments will return to more than 100M units in 2022. (Mac Rumors, GSM Arena, TF Securities)

Renault’s Chief Executive Luca de Meo has revealed that it would launch 10 new EVs by 2025 and that all-electric vehicles would account for up to 90% of its models by 2030, dropping its reliance on hybrids to hit the target under a previous plan. By 2030, Renault and its alliance partners, Nissan and Mitsubishi, will be producing 1M EVs globally a year, up from the 200,000 they made in 2020. (Engadget, Yahoo, Reuters)

Volvo boss Håkan Samuelsson has indicated that the company has committed to becoming an electric-only company in 2030, is aiming to further grow its share of the premium EV market through a commitment to new systems. By 2030, the company would like to be 100% electric, which suggests at least 1.2M electric cars annually. (CN Beta, Auto Car, CNBC, Inside EVs)

Matterport, the spatial data company leading the digital transformation of the built world, which has entered into a definitive agreement to enter into a business combination with Gores Holdings VI and GHVIW, have announced a collaboration with Facebook AI Research (FAIR) through which it will make the largest-ever dataset of 3D indoor spaces available exclusively for academic, non-commercial uses. (CN Beta, TechCrunch, Matterport)

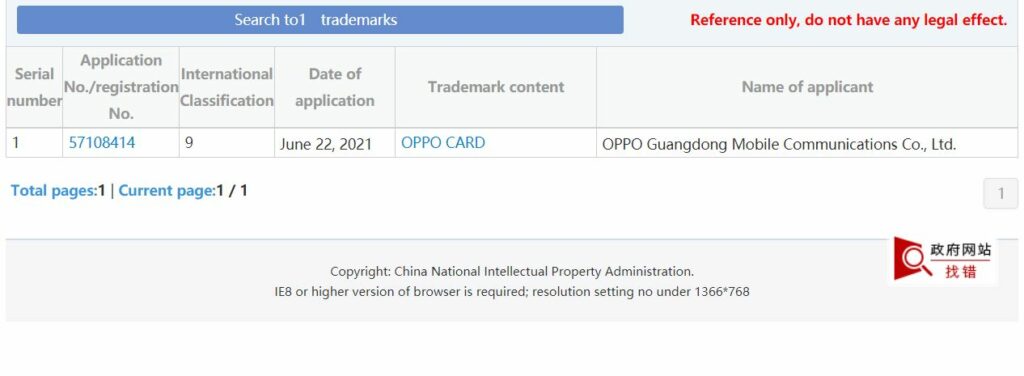

OPPO has filed a trademark named “OPPO Card” under International Classification – 9. This trademark is awaiting acceptance, and detailed information is temporarily unavailable. This may imply that OPPO is planning to launch OPPO Card similar to Apple Card. (Android Headlines, Droidmaze)

Samsung Electronics has announced the expanded launch of an all-inclusive Kiosk that provides contactless payment and ordering features for the customers. This all-in-one solution comes with a protective coating and install options that are easier to understand. Furthermore, it employs 3-layer security protection that is powered by Samsung Knox technology. (Neowin, Samsung)

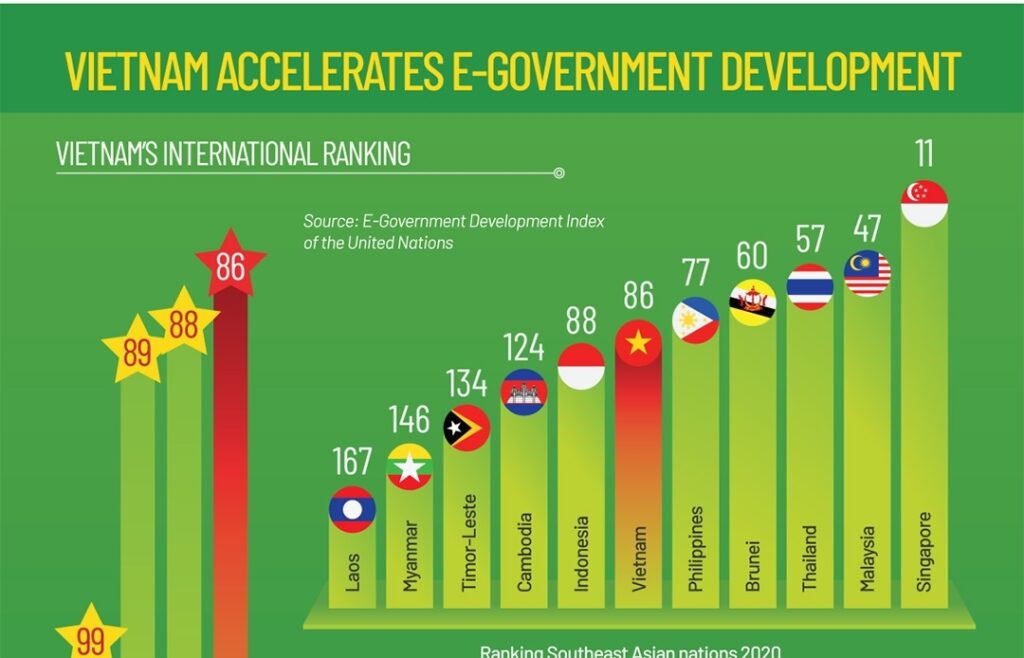

The Vietnamese government is looking to transform into a digital government by 2025 and to become a top-50 digital nation within the United Nations (UN) in 2025 and in the top-30 by 2030. The first is to offer high-quality services to its people with all the administration processes to be done via online services. The second is to encourage social participation by Vietnamese people, with all ministerial and provincial government bodies to publish their data for the people to use. (Digitimes, VN Express, World Akkam, VIR)