7-10 #FxxkDelta : Tsinghua Unigroup has confirmed that one of its creditors has asked a court to begin bankruptcy proceedings for the group; OnePlus expects to sell 25M smartphones of the Nord series before the end of 2023; etc.

In Dec 2020, Qualcomm officially released its latest flagship processer, Snapdragon 888. According to the chairman of Qualcomm China, Mr. Pu, as of now, there are more than 130 smartphones that use the Snapdragon 888 SoC. (GizChina, My Drivers)

Tsinghua Unigroup has confirmed that one of its creditors has asked a court to begin bankruptcy proceedings for the group. It has received a notice from the First Intermediate People’s Court of Beijing Municipality. A creditor has requested the court to support the bankruptcy protection for the conglomerate, saying the group has failed to repay debt. Tsinghua Unigroup has said a court-led restructuring would not affect the company’s legal entity status or its production and other operations. The group also downplayed the impact on its subsidiaries’ business. (CN Beta, CN Beta, Yicai, Guancha, Asia Nikkei, Yicai)

Apple plans to add a Mini LED screen to the 11” iPad Pro in 2022, following the introduction of the technology on 2021’s 12.9” model, according to TF Securities analyst Ming-Chi Kuo. Mini LED is a new screen technology that involves using thousands of tiny LEDs to create focused local dimming zones, allowing for better contrast and HDR performance. (Apple Insider, The Verge, TF Securities)

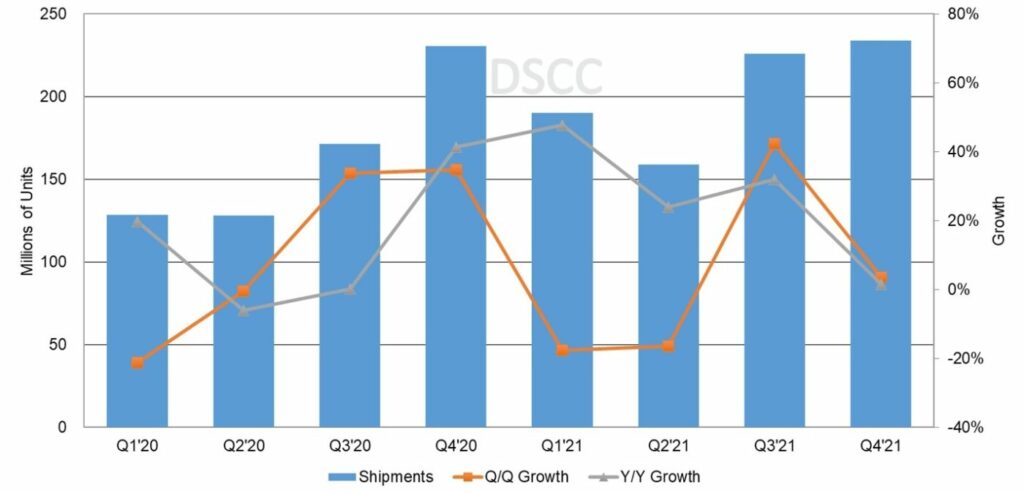

According to Display Supply Chain Consultant, by mobile application, smartphones continue to dominate OLED volumes with an 82% share in 1Q21 and 76% share in 2Q21. Samsung Display (SDC) continued to lead with a unit share of 75.2% in 1Q21 up from 74.5% in 4Q20. LG Display (LGD) was the #2 supplier with an 8% unit share, down from 11% in 4Q20, followed by BOE with 6.6% unit share, down from 7.0% in 4Q20. In 1Q21, Tianma’s shipments increased by 55% to a 1.7% shipment unit share. EverDisplay (EDO)’s share increased by >200% rising from 0.8% in 4Q20 to 2.8% in 1Q21 due to an increase in rigid OLED capacity and design wins for products such as the new Honor Play5 5G smartphone.(DSCC, article)

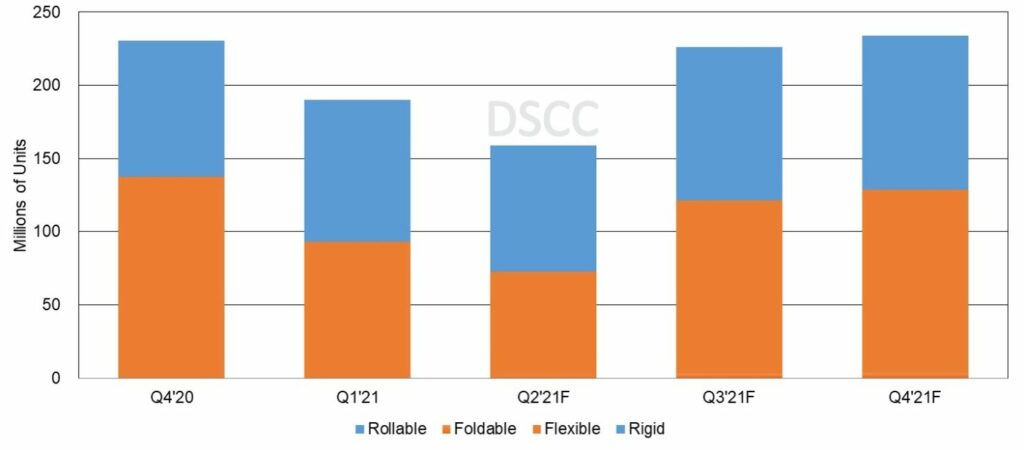

According to Display Supply Chain Consultant, rigid OLED accounted for 51% of shipments for mobile applications, followed by flexible OLED at 48.5% in 1Q21. DSCC expects flexible OLED to take >50% unit share in 3Q21 due to surplus flexible capacity at Chinese panel suppliers as they are expected to offer lower pricing to other brands. Foldable will increase to a 1.4% unit share in 3Q21, as a result of new foldable launches from Samsung, Xiaomi, OPPO and vivo. For rigid OLEDs for mobile applications in 2021, DSCC expects Samsung to account for 23% unit share followed by Xiaomi with 16% unit share. For flexible OLEDs for mobile applications in 2021, DSCC expects Apple to account for 53% unit share followed by Samsung with 19% unit share. (DSCC, article)

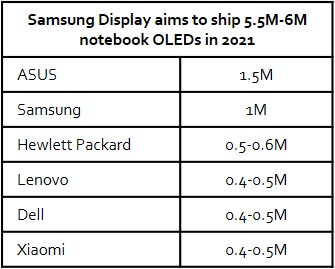

Samsung Display has reportedly increased its shipment target for notebook OLED panels in 2021. The company originally aimed to ship over 4M units but increased this to 5.5M-6M units. This is 40-50% higher than its initial target. (Laoyaoba, The Elec)

Tianma has indicated that the company produces diversified customized products. At present, according to the company’s M+3 order forecast, the demand for orders continues to be full, and the supply of products in the fields of smartphones and vehicles is in short supply. At present, the company’s automotive product supply scope has covered major automakers such as Chinese, European, American, Japanese, and Korean. Among them, the coverage rate of global international customers (Top-24 Tier-1) reaches 92%. Continental, Visteon, Bosch and other world-renowned automotive electronics manufacturers are highly recognized; China’s brands (Top-10) coverage rate of 100%. (Laoyaoba, Sohu)

Xiaomi’s design patent filed at WIPO shows an inwardly foldable phone that will sport a large flexible screen, covering the inside, as well as the front of the device. A device that can be folded in the middle is displayed in the patent. On the front, it has a pill-shaped cutout to house two selfie snappers or one selfie camera and an LED flash. (LetsGoDigital, GizChina, 91Mobiles)

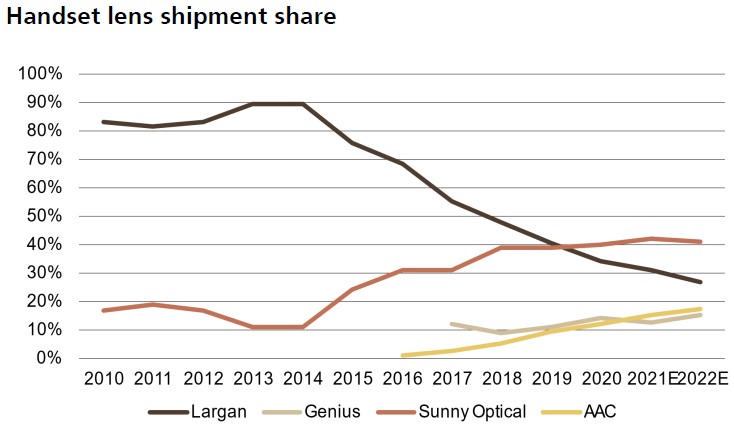

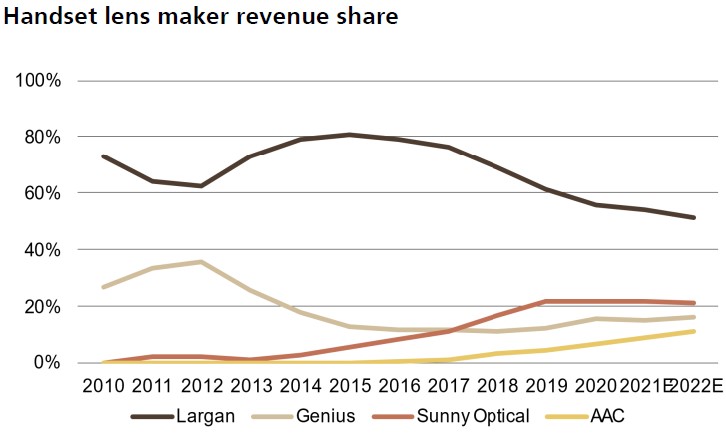

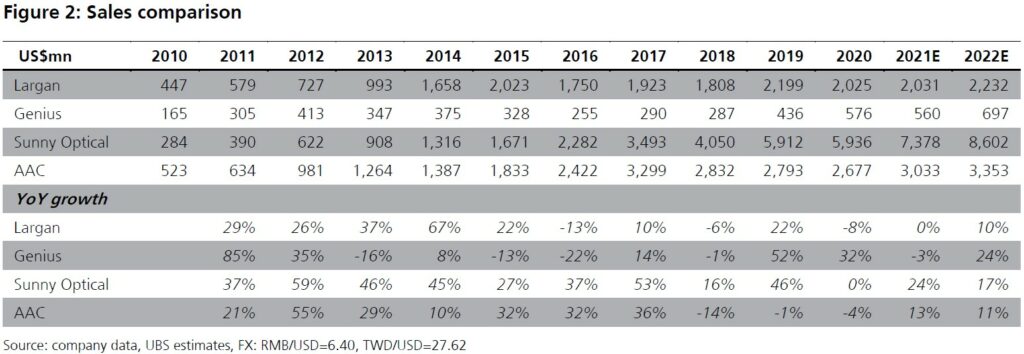

UBS expects Sunny Optical to secure its leadership in handset-lens shipment share after it took over the top position from Largan in 2020. UBS expects Largan to remain the largest camera lens supplier in terms of sales; they estimate its lens ASP is 2.5x above Sunny’s due to its strategic high-end focus. (UBS report)

UBS estimates vehicle camera shipments to grow 17% YoY to reach 200M units globally versus their forecast of 11% YoY growth (5.6B units) for global smartphone cameras in 2021. (UBS report)

UBS forecasts the combined handset lens sales of Largan, Sunny, Genius and AAC to grow 6% YoY in 2021E and 20% YoY in 2022 versus 9% YoY in 2020. They project their combined handset lens profit to grow 4% YoY in 2021 and 20% in 2022, driven by a ramp-up of new models and a resumption of spec upgrades, improving from 3% in 2020 when they suffered from a de-spec and soft demand amid the COVID pandemic. (UBS report)

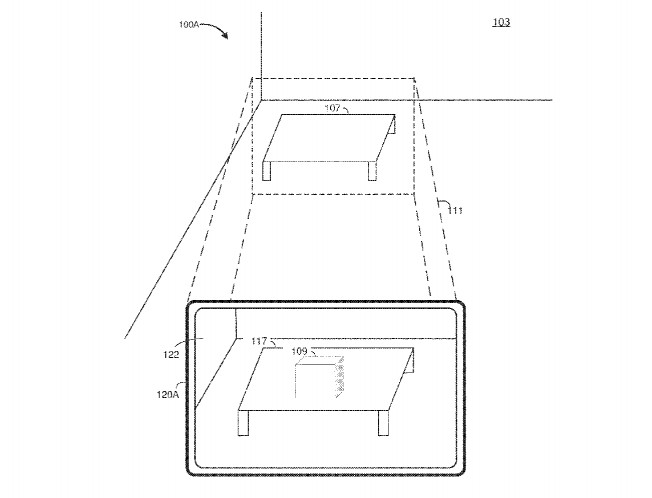

Apple is working on developing a system that could integrate spatial audio experiences into virtual or mixed reality platforms. Apple’s patent application details an interface system that could present a “synthesized reality” to users. However, the patent application details how this reality could go beyond visual and include other senses, such as hearing. A synthesized reality, in this case, is defined as an entirely or partly computer-generated setting that a user could interact with or sense. (Apple Insider, USPTO)

Samsung Electronics reportedly is reconsidering adopting vapor chambers for its new smartphones for 2022, which could benefit cooling solution providers’ sales, according to Digitimes. Samsung is the earliest adopter of vapor chambers in smartphones, with other first-tier smartphone brands such as Huawei, Xiaomi, OPPO and vivo following suit later. (Digitimes, press, Android Headlines, Digitimes)

OnePlus founder Pete Lau has revealed that OnePlus expects to sell 25M smartphones of the Nord series before the end of 2023. OnePlus has offered a major update every year, then expanded out to offer a ’T’ update after 6 months, the introduction of the ‘Pro’ line-up, and now the mid- and low-end Nord family.(Gizmo China, Forbes)

Samsung Galaxy F02s, M02s, and A12 have received a price hike in India. They are now INR500 more expensive across their variants. Samsung has not issued an official statement announcing the increase in prices, but the new prices are now reflecting on the Samsung India website. (SamMobile, Gizmo China, NDTV)

vivo Y53s 4G is launched in Vietnam – 6.58” 1080×2408 FHD+ v-notch 60Hz, MediaTek Helio G80, rear tri 64MP-2MP macro-2MP depth + front 16MP, 8+128GB, Android 11.0, side fingerprint, 5000mAh 33W, VND6.99M (USD305). (GSM Arena, Gizmo China)

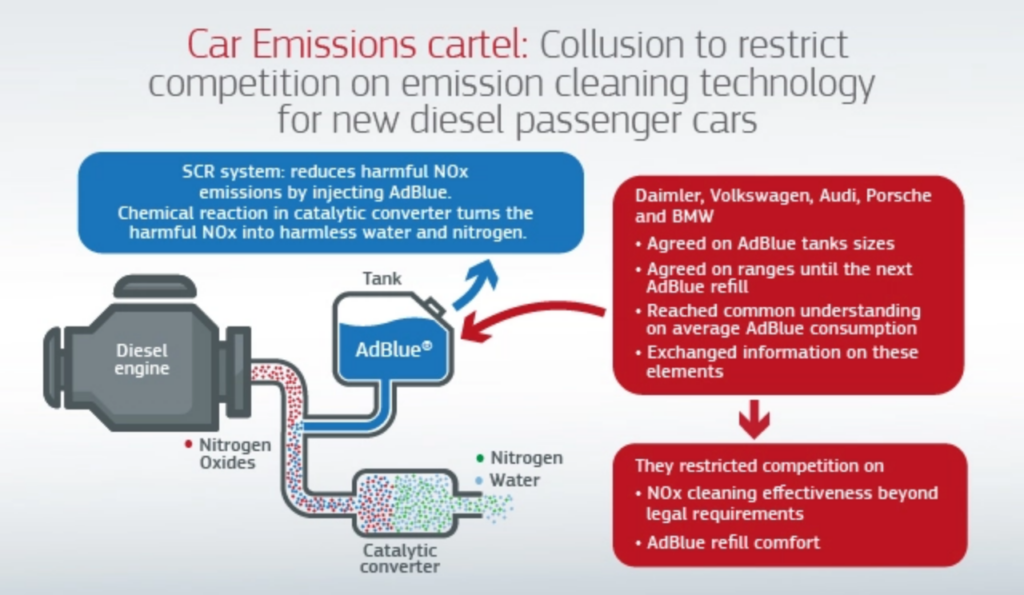

The European Commission has fined Volkswagen Group and BMW EUR1B for colluding with Daimler to hold back the development of technology that could have reduced harmful emissions from their vehicles. The Commission has said the 3 German carmakers, along with Volkswagen subsidiaries Audi and Porsche, breached EU antitrust rules by agreeing to avoid competing on technical development in the area of nitrogen oxide cleaning. (CN Beta, Reuters, CNN)

Foxconn Technology Group and Fisker, a California car maker, are talking with the Wisconsin Economic Development Corp about building electric vehicles in the state. Foxconn and Fisker announced a partnership in May 2021 for Fisker’s Project PEAR. The two companies plan to build parts for electric vehicles, particularly chipsets and semiconductors. (CN Beta, The Verge, Milwaukee JS, Reuters)

Stellantis plans to invest at least EUR30B (USD35.5B) in vehicle electrification and new software / technologies through 2025. Stellantis joins automakers such as Volkswagen, General Motors and Ford Motor in announcing investments of tens of billions of dollars in EVs. The automaker has 14 brands including Jeep, Ram, Opel, Fiat, Peugeot and Maserati. (CN Beta, Stellantis, CNBC, CNN)

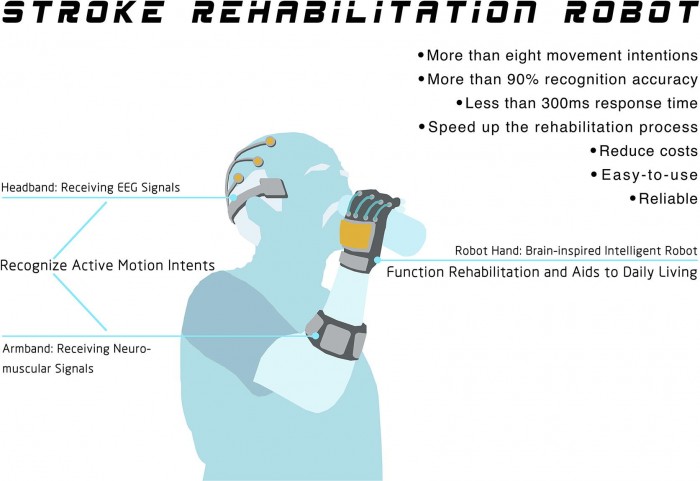

A new robotic system, known as NCyborg, may one day help patients who have suffered from stroke regain the ability to relaying commands from their brain to other parts of their body. NCyborg is currently being developed via a collaboration between China’s Tongji Hospital (which is affiliated with the Huazhong University of Science and Technology) and Harvard-affiliated brain-computer interface company BrainCo. It will consist of 3 main components: an EEG (electroencephalography) headband that reads electrical signals from the brain, an armband that reads neuromuscular signals from the forearm, and a powered robotic glove worn on the hand. (CN Beta, Science Times, New Atlas)