7-12 #DailyLife : Huawei has achieved the tape out of HiSilicon’s first OLED driver IC in 2H20; OPPO and vivo will reportedly be making their entry into the tablet market in 2021; etc.SEMCO has indicated that the company was researching metalens;

Google appears to have been developing Whitechapel, internally known as GS101, with Samsung. The custom silicon is expected to be made on Samsung’s 5nm LPE node. Whitechapel is expected to feature the same three-cluster design. The chipset would allegedly comprise of two Cortex-A78 cores, two Cortex-A76 cores, and three Cortex-A55 cores. (CN Beta, WCCFtech, Sam Mobile)

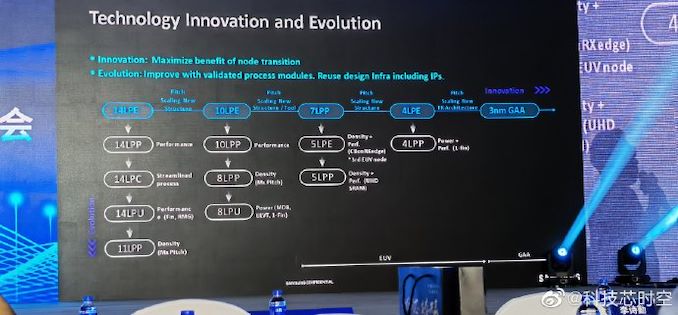

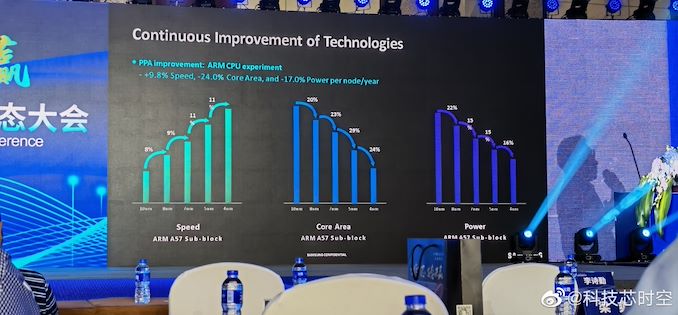

Samsung Foundry has made some changes to its plans concerning its 3nm-class process technologies that use gate-all-around (GAA) transistors, or what Samsung calls its multi-bridge channel field-effect transistors (MBCFETs). It would appear that its first version of 3nm, 3GAE (3nm gate-all-around early), is coming to high volume manufacturing a year later than expected, but also it seems to have removed this technology from its public roadmap, suggesting it may be for internal use only. Meanwhile, 3GAE’s successor 3GAP (3nm gate-all-around plus) node is still in the roadmap, it is on track for volume manufacturing in 2023. (Phone Arena, AnandTech, CN Beta)

Huami, which owns the Amazfit and Zepp brands, has indicated that its upcoming Huangshan chipset, dubbed “Huangshan 2S” would be revealed soon. It will be a dual-core chipset based on the RISC-V architecture. (CN Beta, Sohu, Gizmo China)

Huawei reportedly began to carry out panel driver IC-related research and development in 2019, and also cooperated with BOE to achieve the tape out of HiSilicon’s first OLED driver IC in 2H20. Huawei HiSilicon’s first self-developed OLED screen display driver chip has officially entered the trial production stage. It is expected to be officially delivered to suppliers by the end of 2021, and it is expected to be applied to Huawei’s products afterwards. (My Drivers, OfWeek, 163, Huawei Update)

Samsung Electro-Mechanics (SEMCO) has indicated that the company was researching metalens. Metalens is a flat lens that have nano particles aligned on its surface. Though the lens is flat, the particles bend the light to collect them. The technology allows lens to be made thinner than they are currently. Lens molds require control of materials nanometer in size. The firm has succeed in manufacturing 7P lens so far. (GizChina, The Elec, Mouldu)

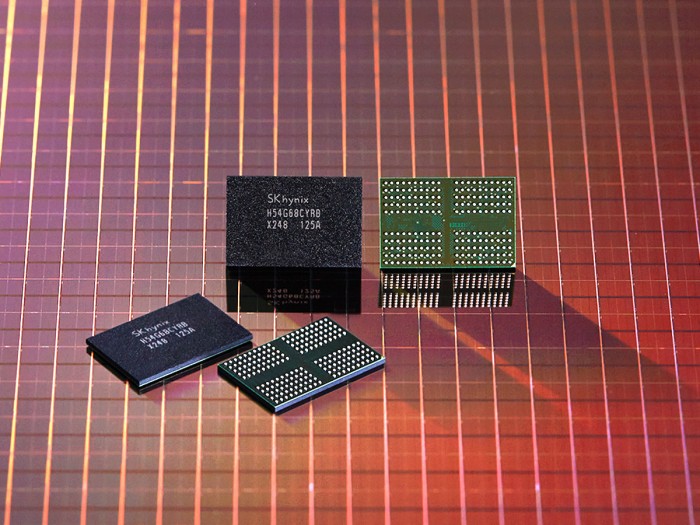

SK hynix has officially moved onto the fourth-generation of 10nm process, starting mass-production of 8Gigabit DRAM chips for mobile devices on 1anm. SK hynix has said its 8Gigabit Lower Power Double Date Rate 4 (LPDDR4) mobile DRAM is built on the 1anm node, using extreme ultraviolet (EUV) lithography technology. The 1a is the fourth generation of the 10nm DRAM process solution following the 1x, 1y and 1z. (CN Beta, Korea Herald, Pulse News)

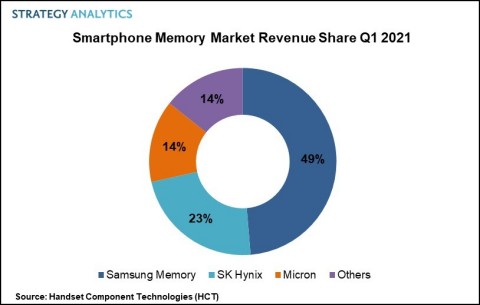

The global smartphone memory market generated revenue of USD11.4B in 1Q21, according to Strategy Analytics. Samsung led the market with a 49% revenue share. The smartphone NAND flash market posted a revenue surge of 18% on year in 1Q21, driven by the adoption of UFS NAND flash chips, especially in midrange and high-tier device. The smartphone DRAM market revenue increased 21% on year in 1Q21, owing to the increase in new 5G device launches by smartphone customers. (Strategy Analytics, Digitimes, press)

Macronix International is gearing up for a surge in shipments of its ROM memory for Nintendo’s new-generation Switch console later in 2H21, according to Digitimes. Macronix already built up ROM chip inventory in advance, gearing up for shipments for the upcoming Switch console. Nintendo is reportedly Macronix’s largest customer. (Digitimes, press, Money DJ, TTV, Apple Daily)

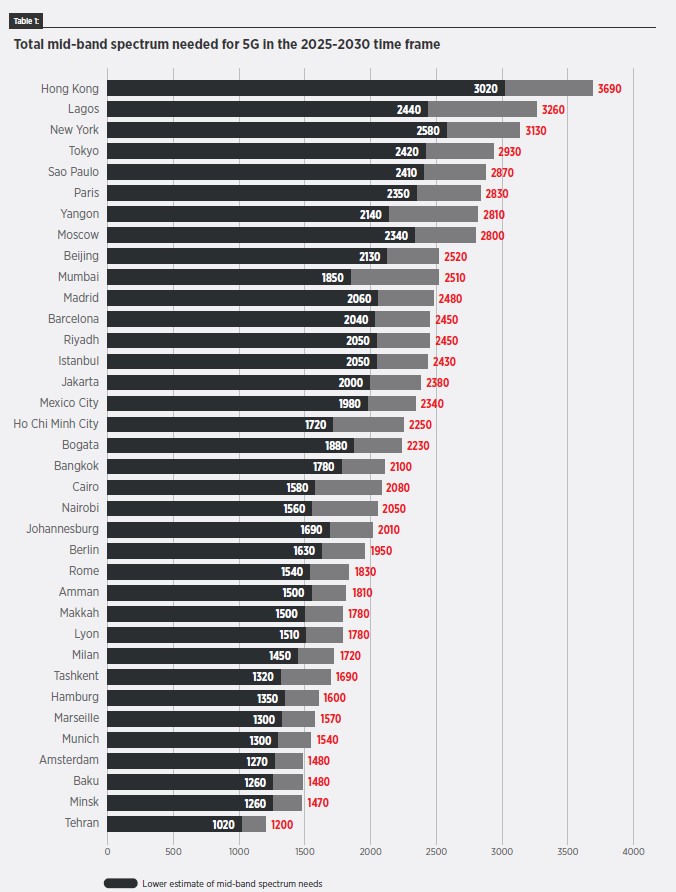

GSMA shows, as a range, the total amount of spectrum that is predicted to be needed in each city based on assumptions for the network activity factor and high-band offload. It shows that additional spectrum is needed in every city and that, on average, a total of 2GHz in mid-bands will be required. While the amount of additional spectrum is lower in some markets and/or less populated cities, it is important to note that the amount required is still far greater than what is currently planned for release. (CN Beta, GSMA)

Huawei continues to report that more devices are migrating to HarmonyOS. So, as of 8 Jul 2021, more than 30M devices are already running the operating system from Huawei. (GizChina, IT Home)

OPPO refused to renew the licensing agreement signed in 2018 and allowing the use of Nokia’s patents. Nokia claims that OPPO continues to use technology without a corresponding license agreement, which violates its rights and must answer for this. The company has initiated legal proceedings against the Chinese company in four countries: Germany, France, England and India. (Phone Arena, GizChina, Twitter)

vivo launched the vivo Y20A and Y20G in India in Jan 2021. vivo has incremented the price of vivo Y20A and vivo Y20G by up to INR1,000 in India. The cheaper vivo Y20A gets a INR500 price hike, whereas the costlier vivo Y20G receives a INR1,000 price hike. (Gizmo China, Twitter)

OPPO and vivo will reportedly be making their entry into the tablet market in 2021. Both brands will allegedly be announcing a total of 3 tablets among each other. (Gizmo China, 163, Sohu)

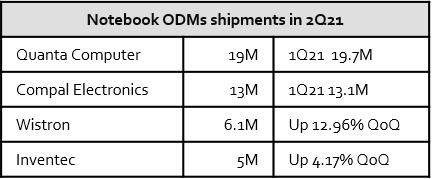

The surge in PC demand continued through 2Q21 despite global component shortages and logistics issues. Worldwide shipments of Traditional PCs, inclusive of desktops, notebooks, and workstations, reached 83.6M units in 2Q21, up 13.2% from 2Q20, according to IDC. Elevated demand for PCs combined with shortages that greatly impacted the supply of notebooks led to desktop growth outpacing that of notebooks during the quarter. (Laoyaoba, My Drivers, IDC)

Notebook ODMs expect component shortages to worsen in 3Q21, as competition to secure sufficient supply from other industry sectors such as automotive electronics, consumer electronics and servers will become fiercer. (Digitimes, Worldakkam, Laoyaoba)

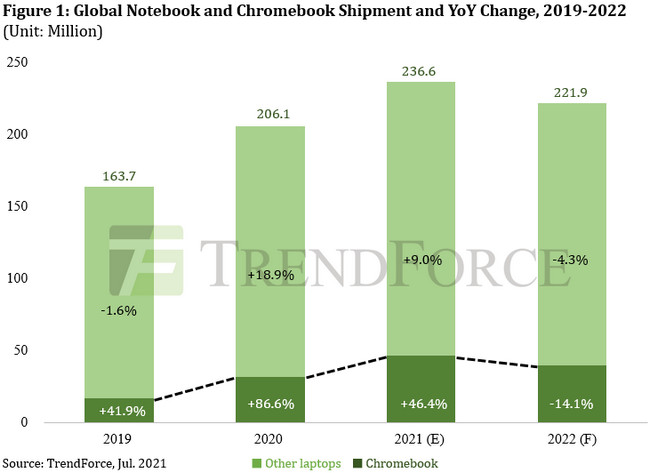

While the stay-at-home economy generated high demand for notebook computers from distance learning and WFH applications last year, global notebook shipment for 2020 underwent a nearly 26% YoY increase, which represented a significant departure from the cyclical 3% YoY increase / decrease that had historically taken place each year, according to TrendForce. The uptrend in notebook demand is expected to persist in 2021, during which notebook shipment will likely reach 236M units, a 15% YoY increase. In particular, thanks to the surging demand for education notebooks, Chromebooks will become the primary growth driver in the notebook market. (Laoyaoba, TrendForce, TrendForce)

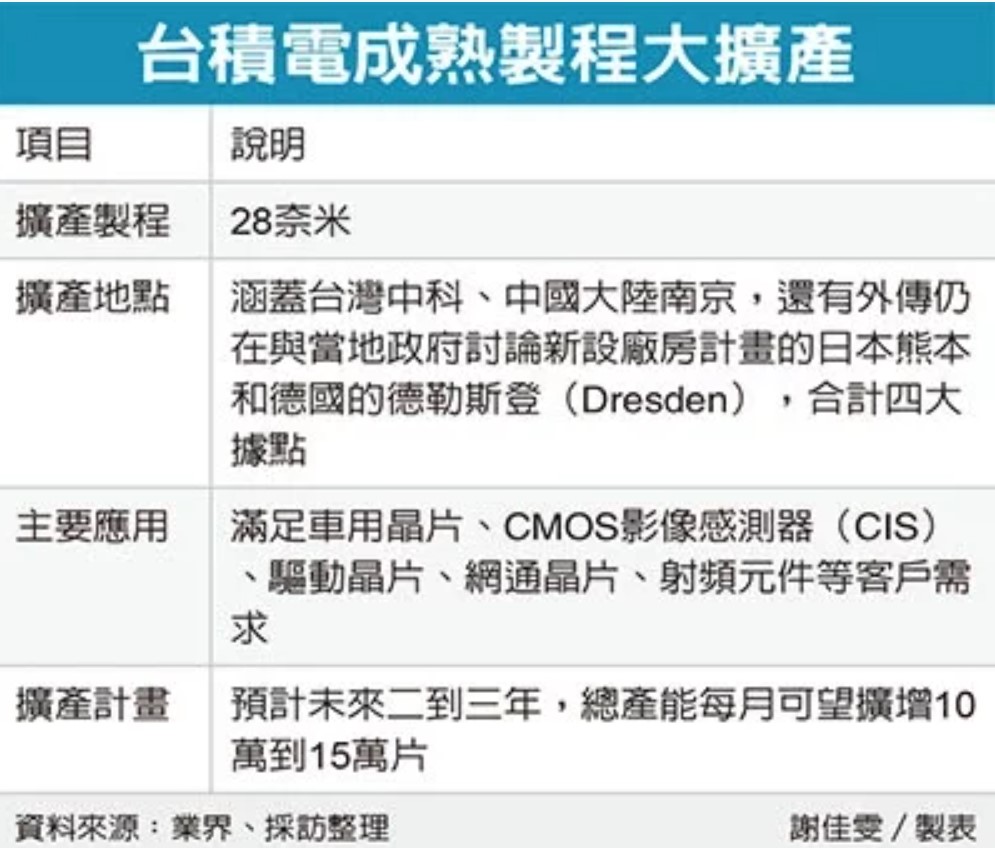

In order to meet customer needs such as car core chips, CMOS image sensors (CIS), driver chips, Netcom chips, and RF components, TSMC plans to actively expand the 28nm production capacity of mature processes. It is expected that the 28nm total will be in the next 2-3 years. The production capacity is expected to increase by 100K-150K units per month. The locations where TSMC intends to expand 28nm production capacity include the Zhongke Park in Taiwan, Nanjing in Mainland China, Kumamoto in Japan and Dresden in Germany, which are still discussing new plant plans with the local government. (CN Beta, UDN, Laoyaoba, Min.News)

Foxconn and TSMC have agreed to buy 10M COVID-19 vaccine doses for the island for Taiwan. The two companies will be paying up to USD35 a dose of the BioNTech vaccine and donating them to the government; each company has pledged to spend USD75M. (Laoyaoba, The Verge)

Intel has announced that it will spend USD20B (EUR17B) to build 2 new chip factories, called fabs, in Chandler, Arizona. Intel is investing USD20B in 2 new factories in the US and a further USD7B to double the capacity of its plant in Ireland. Currently, Intel is lobbying the European Union for this, hoping to obtain financial and political support, as well as a site covering more than 4km2 with a well-developed infrastructure to build up to 8 fabs. Intel has been looking for suitable places to build factories in Germany, the Netherlands, France, Belgium and other places, and it is expected to complete the site selection by the end of 2021. (My Drivers, CNBC, Irish Times)

Huami, which owns the Amazfit and Zepp brands, has been developing a new operating system for its smartwatches. Its new self-developed operating system is better suited for watches and can better take advantage of the health features present in wearables. (CN Beta, Gizmo China, Pandaily)

Nokia unveils the BH-805 Noise Cancelling TWS Earbuds in Europe, priced at about EUR100. The earbuds can actively cancel and modulate the noise in the environment up to 25dB. A 400mAh charging case combines with the two 45mAh batteries in each earbuds to provide up to 5 hours of playback without the charging case. (Gizmo China, Nokia)

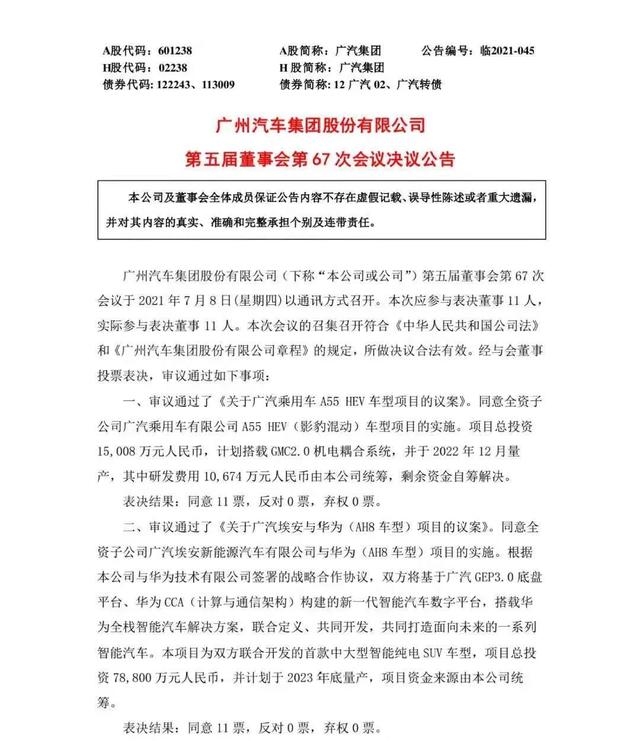

GAC Group has issued an announcement and approved the implementation of the project between the wholly-owned subsidiary GAC Aion New Energy Automobile and Huawei (AH8 model). GAC Aian and Huawei’s project will be based on GAC’s GEP3.0 chassis platform, Huawei’s CCA (computing and communication architecture) to build a new generation of smart car digital platform, equipped with Huawei’s full-stack smart car solutions. (CN Beta, Breaking News)

MIT CSAIL have developed an algorithm that redefines robotic motion safety by allowing for “safe impacts” on top of collision avoidance. This lets the robot make non-harmful contact with a human to achieve its task, as long as its impact on the human is low. For a simple dressing task, the system worked even if the person was doing other activities like checking a phone. (Engadget, News Chant, MIT)

Walmart-owned Indian online retailer Flipkart has ushered back tech investor SoftBank Group as an investor in a USD3.6B funding round, after which it will be valued at USD37.6B. (CN Beta, Bloomberg, Reuters)

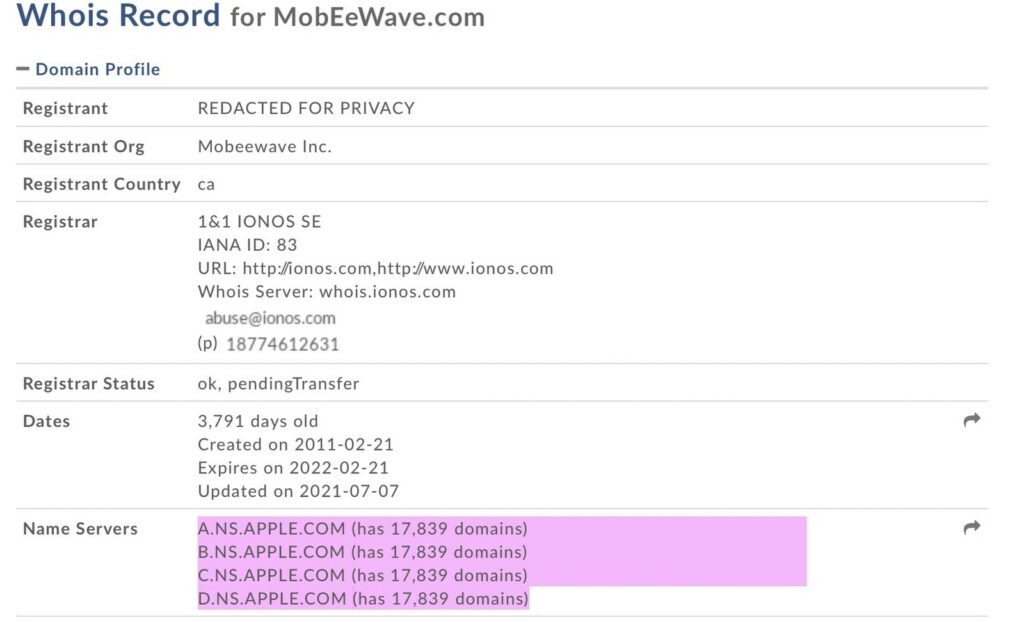

The ownership of Mobeewave.com has shifted to Apple, a sign that the year-ago acquisition has progressed internally. Mobeewave is a startup seeking to make peer-to-peer payments easier by tapping NFC-enabled credit cards to the backs of smartphones. Apple acquired the company in Aug 2020, and that process seems to be moving forward. (CN Beta, MacRumors, Apple Insider)