8-3 #Life : Intel has revealed detailed process and packaging technology roadmap through 2025 and beyond; Google has revealed its own system-on-chip (SoC) Tensor; LGD has announced that it will continue its LCD business; etc.

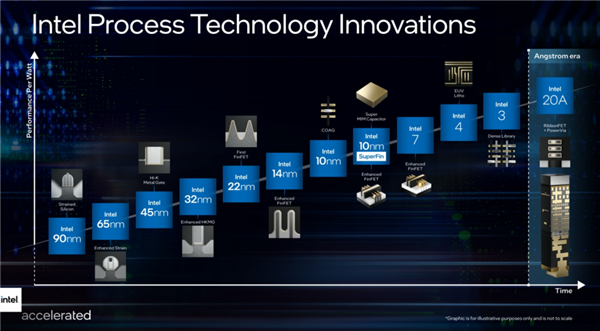

Intel has revealed detailed process and packaging technology roadmaps through 2025 and beyond. In addition to announcing RibbonFET, its first new transistor architecture in more than a decade, and PowerVia, an industry-first new backside power delivery method, the company highlighted its planned swift adoption of next-generation extreme ultraviolet lithography (EUV), referred to as High Numerical Aperture (High NA) EUV. Intel’s next is 18A, which is expected to start production in early 2025 in cooperation with ASML. Intel’s 2nm process Fab20 is approved a few days ago. The Fab20 plant will be divided into 4 phases of plant construction gradually. The first 2 phases of the plant are expected to be completed and installed in 2H23. It is expected to enter the mass production stage in 2H24. The completion of the 4th phase of the 2nm process plant will be completed by 2025-2026. In 2015, the total monthly production capacity will exceed 100,000 pieces. (My Drivers, CN Beta, PC Mag, AnandTech, Intel, Guru3D)

LG Electronics and Magna International have signed the transaction agreement which establishes a joint venture between the two companies. The new company, to be called LG Magna e-Powertrain, is headquartered in Incheon, South Korea. (Laoyaoba, Globe Newswire, LG)

HiSilicon, the Huawei chip subsidiary, has announced its new self developed low latency image transmission technology in China. This technology is aimed to empower multi screen smart terminals and will support low memory usage and 4K UHD image quality on HiSilicon chips. One of the highlighting features of HiAir is its ultra low latency transmission technology. Furthermore, this technology will also be integrated with Huawei Cast+, supports automatic device discovery. It will also arrive with deep protocol optimization for Cast+, DLNA, Miracast, Lelink, and more. (Gizmo China, Sohu, IT Bear, Sina)

Google has revealed its own system-on-chip (SoC), Tensor. Google CEO Sundar Pichai has indicated that the company “has been at this about 5 years”. One prominent feature of this chip is its AI and machine learning capabilities. Some of these smart features will be used in the new camera system. Google Pixel 6 and 6 Pro would adopt Tensor, and will be announced soon. (CN Beta, Engadget, GSM Arena, Google)

Nvidia is tracking more than 8,500 AI startups through its Inception AI startup program. Those companies have raised more than USD60B in funding and come from 90 countries. NVIDIA Inception figures show the United States leads the world in terms of both the number of AI startups, representing nearly 27%, and the amount of secured funding, accounting for over USD27B in cumulative funding. (VentureBeat, Nvidia, East Money)

LG Display (LGD) has announced that it will continue its LCD business. LGD is planning to boost the competitiveness of its LCD business by differentiating its LCD panel products instead of putting an end to it. Specifically, the company has already converted part of the production lines for TV panels to those for LCDs for IT devices and will continue such conversion in the future. It will also reduce production of LCD TV panels by half and focus on more profitable commercial and large-sized products. LCD TV panels account for about 15% of the company’s total sales income. (CN Beta, Business Korea)

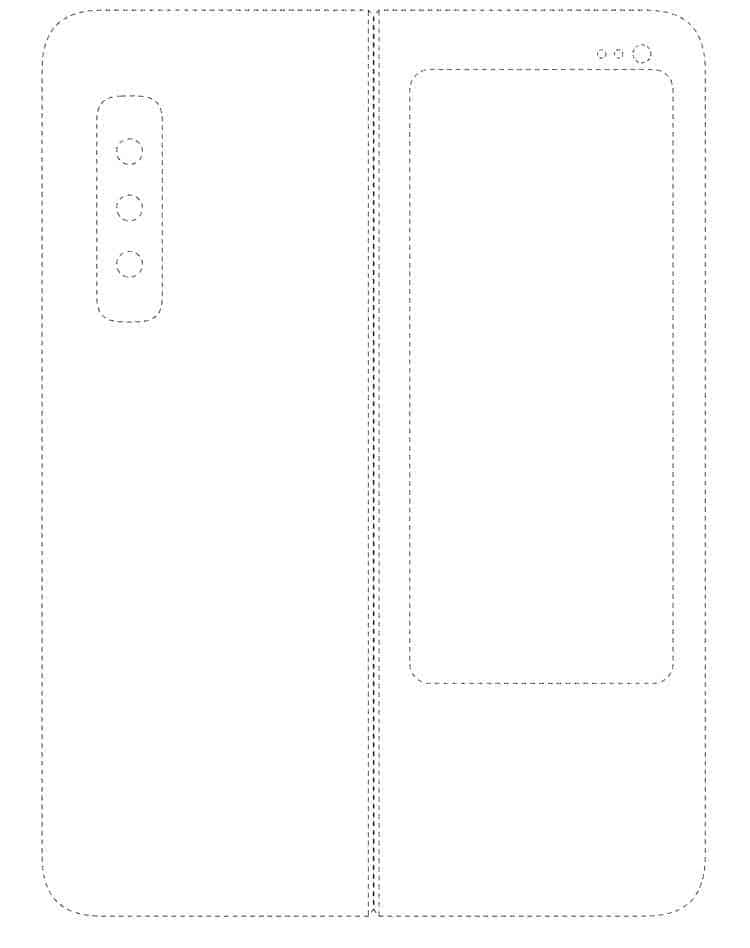

Samsung has filed 2 patents for mobile devices with large flexible display. The patent titled “tablet computer” describes a tablet with a screen that folds into the body. In the central area of the side parts, there will be connectors, in particular a USB Type-C port. The second patent is entitled “Foldable mobile phone with transitional graphical user interface”. Both patents belong to the design category. (GizChina, USPTO)

Huawei’s self-developed OLED screen driver chip has allegedly completed trial production, and it is expected to officially complete mass production and delivery to suppliers by the end of 2021, and it is expected to be applied to Huawei’s products afterwards. Huawei HiSilicon’s first flexible OLED driver chip uses a 40nm process technology and plans to mass produce in 1H22, with a monthly capacity of 200-300 wafers. The samples have been sent to BOE, Huawei, and Honor for testing. (My Drivers, CN Beta, Global Times, Min.news)

Tianma has indicated that the company currently operates and manages 3 AMOELD mass production lines. Among them, Xiamen TM18 has now completed the topping of the main plant. It is expected that the equipment will be moved in from 2H21 and the production capacity will be released in 2022. The production line focuses on advanced cutting-edge technologies such as self-developed HTD technology, CFOT (polarizer replacement technology), under-screen camera technology, under-screen fingerprint technology, and in-cell touch technology. (Laoyaoba, Sohu, Sina)

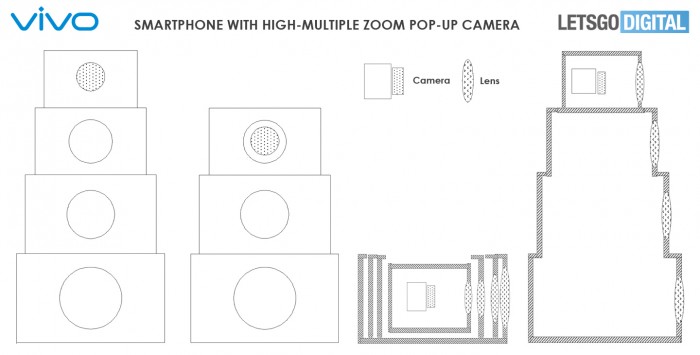

vivo’s patent titled “Camera Module, Electronic Device and Camera Module Control Method” describes a superzoom pop-up camera system has four expandable modules, similar to a trapezoidal structure, with an additional lens popping up each time. The lower lens will always be available, and users can further expand the lens as needed to achieve a larger zoom range. The patent states that current smartphones only support “low zoom functionality” and that the new Vivo patent enables “high zoom functionality”. (CN Beta, LetsGoDigital, Sparrows News)

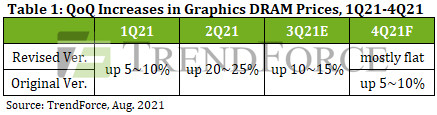

The values of cryptocurrencies have plummeted in the past 2 months because of active interventions from many governments, with the graphics DRAM market entering a bearish turn in 3Q21 as a result. While graphics DRAM prices in the spot market will likely show the most severe fluctuations, contract prices of graphics DRAM are expected to increase by 10-15% QoQ in 3Q21 since DRAM suppliers still prioritize the production of server DRAM over other product categories, and the vast majority of graphics DRAM supply is still cornered by major purchasers. TrendForce expects prices in 4Q21 to largely hold flat compared to 3Q21. (TrendForce, TrendForce, CN Beta)

Longsys has revealed that two PCIe 4.0 SSD products with FORESEE brand sequence will be launched in 2H21. One is the flagship XP3000, the main controller supports cache, and the peak sequential read speed can reach 7GB/s. The second is the mainstream XP2100. , No cache master, sequential read can exceed 5GB/s. Longsys has released the FORESEE XP1000 of PCIe 3.0. It adopts M.2 2280 standard form and supports PCIe 3.0 x4. (My Drivers, CN Beta)

Toyota auto parts manufacturer Tokai Rika has announced that in order to prevent car theft, it has developed an engine switch with fingerprint recognition function. Rand Cruiser will be the first Japanese car equipped with this feature. Tokai Rika has been developing, designing and manufacturing various security products, such as steering gear locks and anti-theft devices. The newly developed start switch uses the fingerprint sensor in the switching center to verify the user. The engine can only be started when the fingerprint matches the fingerprint of the user registered in advance. (CN Beta, Japan Times, Autobala, Kyodo News)

Hyundai Motor Group to partner with LG Energy Solution to build an EV battery cell plant in Karawang, near the Indonesian capital Jakarta. Factory to begin production in 2024 with an annual capacity of 10GWh worth of battery cells, enough for over 150,000 battery electric vehicles based on E-GMP. Hyundai Motor Group and LG Energy Solution to invest USD1.1B in the plant and each to own a 50% stake in the joint venture. (Laoyaoba, Reuters, Hyundai)

According to Lei Jun, the founder, chairman and CEO of Xiaomi Group, the first phase of Xiaomi Smart Factory will be put into operation in early 2020, with a fully automated production line with an annual output of 1M ultra-high-end phones; the second phase will start in July 2021, and it is expected to be put into operation at the end of 2022, with an annual output of 10M high-end smartphones. Lei Jun believes that in the next 10 years, the digital economy will become the core new driving force for development, helping Chinese companies to rise in the global market. (CN Beta, Sohu, 52RD, Sina)

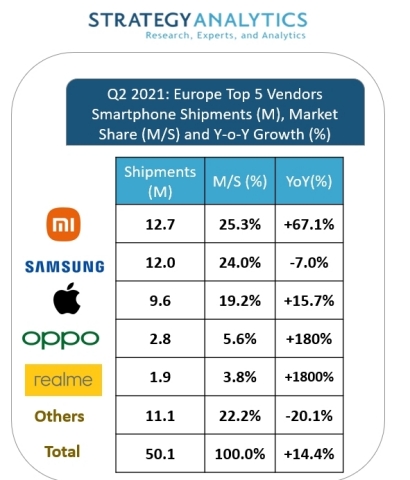

According to Strategy Analytics, Xiaomi topped all vendors with 25% market share as European smartphone shipments posted strong growth +14% YoY to 50M units. The smartphone market rebound was driven by the continued economic recovery, a healthy demand from consumers with aging devices and appealing value priced 5G devices. (CN Beta, Strategy Analytics)

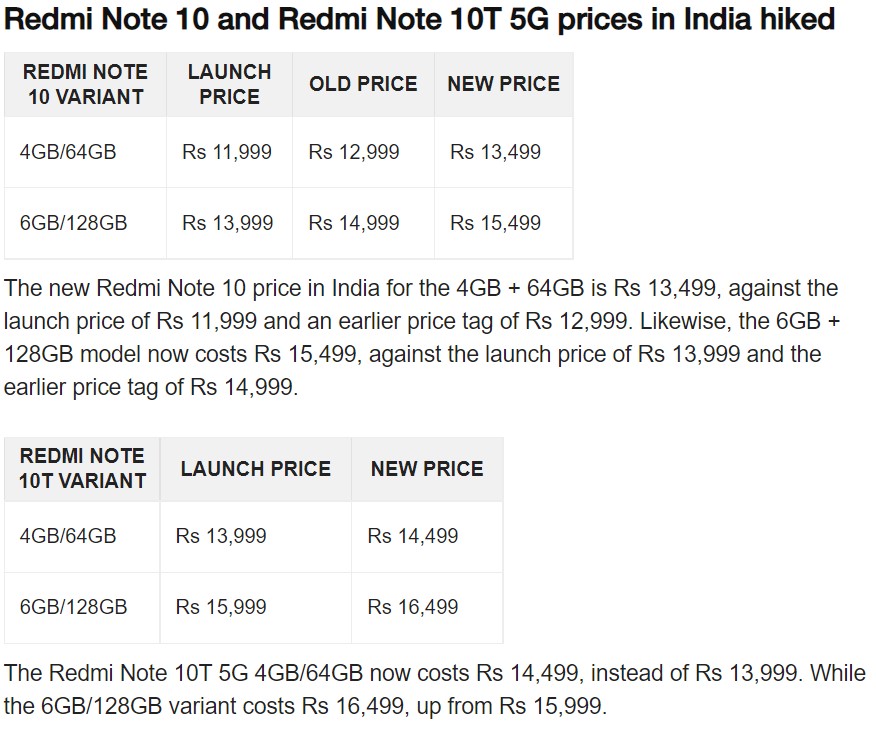

Redmi Note 10 and Note 10T 5G prices have been hiked in India. Redmi Note 10 now starts at INR13,499, while the Note 10T 5G costs INR14,499 for the base model. Redmi Note 10 price in India has been hike yet again, making it the third price hike of the smartphone. The new price hike makes the device costlier by INR500. (Gizmo China, 91Mobiles, MySmartPrice)

Redmi Note 10 Japan Edition is announced in Japan – 6.5” 1080×2400 FHD+ HiD LCD 90Hz, Qualcomm Snapdragon 480, rear tri 48MP-2MP macro-2MP depth + front 8MP, 4+64GB, Android 11.0, side fingerprint, IP68 rated, NFC-Felica, 4800mAh 18W, JPY28,765 (USD262). (GSM Arena, Mi.com, Twitter, au, GizChina)

Tecno POVA 2 is launched in India – 6.9” 1080×2460 FHD+ HiD, MediaTek Helio G85, rear quad 48MP-2MP macro-2MP depth-2MP mono + front 8MP, 4+64 / 6+128GB, Android 11.0, side fingerprint, 7000mAh 18W, INR10,499 (USD141) / INR12,499 (USD168). (GizChina, Gizmo China, NDTV)

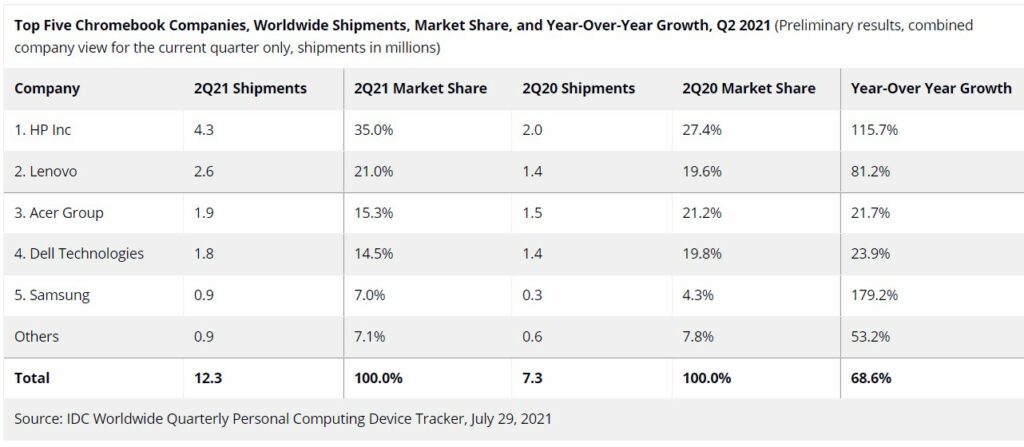

According to IDC, 2Q21 is another strong quarter for both Chromebooks and tablets with both device categories recording growth despite a challenging YoY comparison. Chromebook shipments grew 68.6% YoY with volumes reaching 12.3M units. While this is not a record quarter for Chromebooks, it is not far off the prior 2 quarters, which shattered previous highs. The tablet segment is a bit more tempered than Chromebooks but still managed to grow 4.2% YoY with shipments totaling 40.5M units. (CN Beta, IDC)

FENIX, a United Arab Emirates-based e-scooter company backed by Israeli venture capital funding, has acquired Turkish scooter company PALM for USD5M, as the start-up expands across the Middle East into its fifth country. With almost 10,000 e-scooters in 13 cities, FENIX has the largest fleet in the Middle East and North Africa. (TechCrunch, Reuters)

XPeng has announced the start of the construction for its Wuhan manufacturing plant. the Wuhan-based plant covers an area of 1,500 mu where workshops dedicated to stamping, welding, painting, assembly, battery, and electric drive system will be built. It will have an annual capacity of 100,000 new vehicles and is expected to generate a production value of over CNY30B (USD4.64B) per year. (Laoyaoba, Xpeng, Gasgoo)

Tesla’s Gigafactory in Texas, USA, seems to be ready to start producing the Model Y. The facility may be tested in production early Aug 2021 at the earliest, and will be officially put into production in the next few months. Tesla is expected to produce the first Model Y for testing as early as early Aug 2021. (CN Beta, Clean Technica, Teslarati)

Square is expanding its online payments options for consumers. The company has announced its plan to acquire Afterpay, a “buy now, pay later” (BNPL) platform for USD29B. The planned acquisition will give Square a huge chunk in the digital payments space, if approved, as well as expand access for users. (Neowin, Reuters, Square, CNBC, Financial Times)