8-10 #HalfFull : TSMC has reported a surge in demand for its 7nm and 5nm chip manufacturing; TSMC continues to sprint 3nm and expects mass production in 2H22; TSMC has moved to maintain the prices throughout 2H21 of its 28nm; etc.

TSMC has allegedly notified customers about 15-20% price hikes for its 12” wafer fabrication services for vendors of LCD driver ICs starting Aug 2021, which in turn will prompt the vendors to raise chips quotes for terminal clients. TSMC has repeatedly reported the news of raising the price of foundry. At the end of 2020, there were reports that TSMC will cancel the 12” foundry discounts for major customers in 2021, indirectly raising prices. (CN Beta, Digitimes)

TSMC has reported a surge in demand for its 7nm and 5nm chip manufacturing since the coronavirus pandemic. The company’s 7nm and 5nm production facilities are running at maximum capacity to fulfill the demand of its customers. Even the next generation 3nm production lines are said to be completely booked. Mass production of 3nm chips will likely begin in 2H22. Since TSMC invested a lot of research and development resources into the production of 5nm chip technology, it could take about 7-8 quarters to reach the average gross profit margin. However, the profits from 5nm chip production will continue to increase from quarter to quarter. (Digitimes, press, IT Home, Android Headlines)

TSMC continues to sprint 3nm and expects mass production in 2H22. It will work closely with its customer base in the early stages of production to ensure that the film production meets the long-term needs of customers. After Intel and Apple, it comes from Europe’s leading artificial intelligence (AI) chip manufacturers. Graphcore has also negotiated a long-term 3nm cooperation plan with TSMC. (UDN, UDN, Sina)

Having already raised its quotes for 28nm process technology, TSMC has moved to maintain the prices throughout 2H21, according to Digitimes. The market generally expects that the semiconductor capacity shortage will continue until 2023. TSMC, UMC and other foundries have fully launched 28nm expansion plans to respond customer demand. (Digitimes, Laoyaoba)

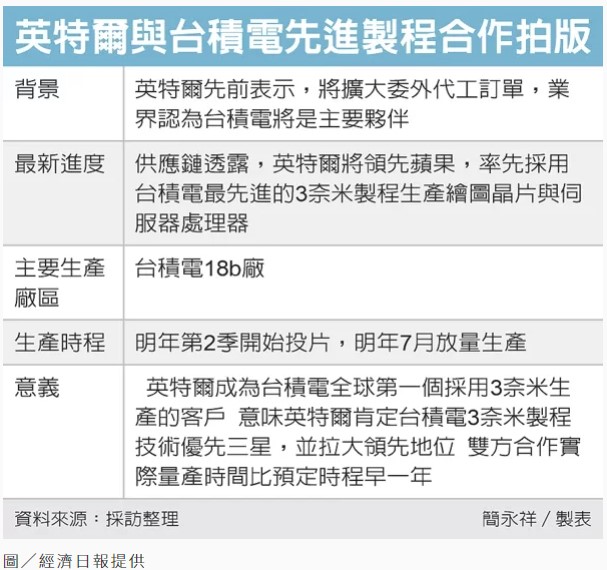

According to TSMC’s supply chain, Intel will lead Apple and be the first to use TSMC’s 3nm process to produce graphics chips and server processors. Intel will begin production at TSMC 18b factory in 2Q22, and mass production will start in Jul 2022. The actual mass production time is 1 year earlier than the original plan. Intel has planned at least 2 chips based on TSMC’s 3nm process, namely notebook CPUs and server CPUs, which will be put into mass production by the end of 2022 at the earliest. (UDN, CN Beta)

China Mobile, the world’s biggest mobile network operator, has established a wholly-owned subsidiary Xinsheng Technology, to engage in developing micro-controller and ICs for communication and security, the company announced. It marks the first major move by a Chinese carrier to further step into the semiconductor industry amid China’s nationwide drive to achieve semiconductor self-sufficiency. (Laoyaoba, Sohu, QQ)

Samsung has announced its new wearable processor, the Exynos W920, which integrates an LTE modem and is the first in the industry to be built with an advanced 5nm extreme ultra-violet (EUV) process node, offering powerful yet efficient performance demanded by next-generation wearable devices. (Engadget, Samsung, CN Beta)

Intel CEO Patrick Gelsinger stated that the new fab campus will cost between USD60B-120B. By the end of 2021, Intel will finalize the location of its upcoming major semiconductor manufacturing hub in the United States as part of its IDM 2.0 strategy. The complex will incorporate between six and eight modules that will manufacture chips by employing the avant-garde fabrication processes of the company. Furthermore, it will be capable of packaging chips by making use of Intel’s propriety techniques such as EMIB and Foveros, and will operate a dedicated power plant. (CN Beta, Tom’s Hardware, Fudzilla, Neowin)

GlobalFoundries (GF) has announced investment to expand wafer production capacity in the United States, Europe and Asia. Among them, it plans to invest USD1B in the next 2 years to invest in the existing wafer fab in Dresden, Germany. The company’s CEO Tom Caulfield has hinted that it is also possible for GF to build another large fab in Dresden, depending on the investment support that GF receives. (Laoyaoba, EENews Analog)

BOE has announced the launch of flexible OLED FDC (full display with camera) 400PPI under-screen camera technology: one drive, one-pixel circuit design, has been applied to first-tier cell phone manufacturers models. BOE has indicated that different from the market “one drive multiple” pixel circuit design, BOE FDC under-screen camera technology using a drive a pixel circuit design, FDC camera area and the surrounding screen display no difference, and there is no thin line showing the wrong line at the edge of the camera area. (CN Beta, Sparrow News, My Drivers)

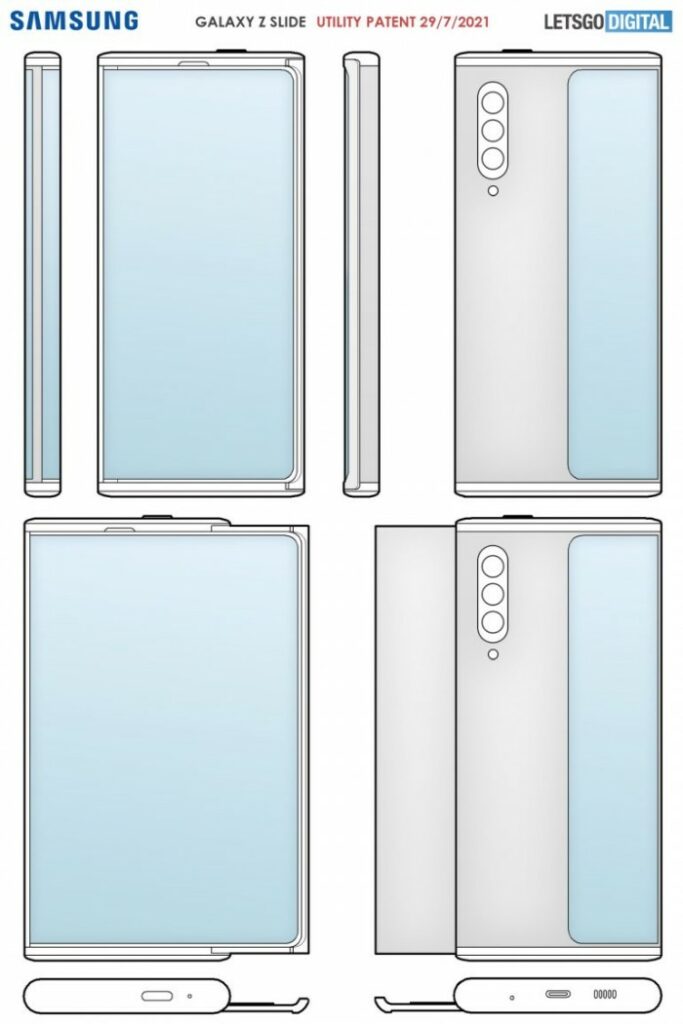

Samsung has filed a patent of “Galaxy Z Slide” titled “Elektronische Vorrichtung mit flexibler Anzeige”, which describes a rollable smartphone. In its compact mode, the device would have a rounded screen on the left, with the display wrapping around to the back. The handset will also have a narrow frame on the side so it looks like two separate displays, but it is actually one flexible screen. (CN Beta, Mobilesyrup, LetsGoDigital)

Samsung Display’s (SDC) OLED etcher suppliers have begun the development of their new dry etchers for Gen-8.5 OLED panels. Wonik IPS, ICD and Tokyo Electron will compete to win orders first from SDC’s panel maker. They have supplied their dry etchers for SDC’s Gen-6 OLED panels. The Gen-8.5 OLED reported will deliver screens first for Apple iPad refresh, and then for a later MacBook Pro with OLED display. (The Elec, Apple Insider, Mac Rumors)

A new patent suggests that Samsung is working on a movable camera design for smartphones. The camera array, in its standard setup, sits horizontally across a smartphone’s back. However, the cameras in this array can also move, forming a triangle. The primary camera resides in the middle and can move downwards from its original position. At the same time, an ultra-wide camera and a telephoto camera reside on the left and right sides of the array and can move inwards. (Gizmo China, LetsGoDigital, Android Authority)

Honor has announced that the to-be-announced Magic 3 Series collaborates with IMAX ENHANCED, bringing a master-level movie experience. Honor Magic3 Series has a total of 2 main cameras, one of which is a professional movie maker lens and has dedicated movie mode in the camera interface. (GSM Arena, Weibo, Sparrow News, Sina, IT Home)

Samsung Electronics is on track to complete the expansion of its second plant in Xi’an, China by the end of 2021. It has invested more than KRW4T in the 1H21 to install equipment before full-scale production in 2021. Samsung Electronics invested CNY23B in the Xi’an plant in 1H21. This is about 108.5% of the investment planned for the period. Samsung Electronics invested CNY2B more than planned. (CN Beta, Business Korea)

Robert Crooke, Intel GM for NAND products has revealed that SK Hynix will not just absorb Intel’s 3D NAND and SSD business after acquiring all the assets for USD9B over the coming years but will actually run it as a standalone company headquartered in the U.S. The move might help Intel’s storage business unit keep its existing US-based corporate and government customers after it changes hands. (Laoyaoba, CRN, Tom’s Hardware, The Register, Linkedin)

Samsung SDI is retooling the battery production line of its plant in Xian, China to localize production of polar plates for electric vehicle batteries. Samsung Huanxin Power Battery (SAPB), a Samsung SDI subsidiary that operates the Xi’an plant, has invested CNY1.6B (KRW280B) to turn its production line for 34Ah lithium-ion batteries into a 112Ah electrode production line. The company broke ground for the new plant in 2020 and will complete it by the end of 2021. (Laoyaoba, Business Korea)

Sony now owns both Crunchyroll and Funimation. The company’s Sony Pictures division completed the USD1.175B acquisition. Sony first announced it was acquiring Crunchyroll from AT&T at the end of 2020. At the time, the service said it had 3M subscribers and over 90M registered users across more than 200 countries. (Engadget, Sony Pictures)

SpaceX has agreed to acquire Swarm Technologies, a company that operates a smallsat constellation providing internet-of-things services. Swarm operates a constellation of 120 smallsats, each smaller than a single-unit cubesat, to provide two-way communications at low data rates for markets such as agriculture, energy and transportation. The company argues it can provide services at a fraction of the cost of legacy satellite services. (Engadget, Space News, FOC)

The UK government has announced that some hard-to-reach homes could be connected to the internet via fiber broadband cables fed through water pipes. The government has made GBP4M available to innovators to develop methods to actually deliver broadband in this way. This initiative could help with the government’s GBP5B Project Gigabit plan which aims to connect rural areas with 1-gigabit connections in areas private companies cannot serve due to financial constraints. There is also the Shared Rural Network which sees the four mobile operators collaborate to deliver 4G in rural areas. (Neowin, UK.gov)

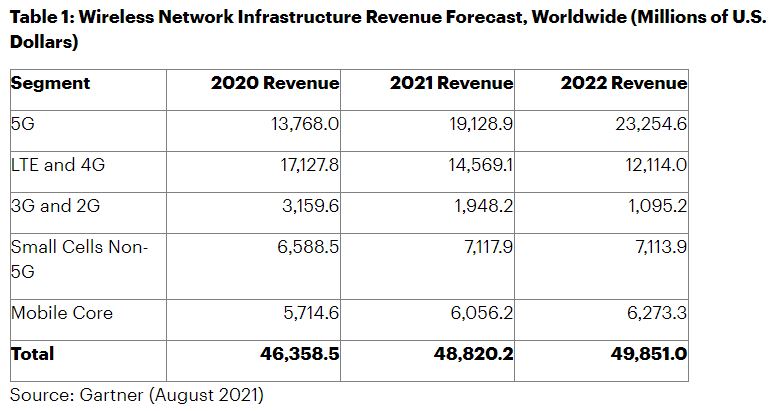

Worldwide 5G network infrastructure revenue is on pace to grow 39% to total USD19.1B in 2021, up from USD13.7B in 2020, according to Gartner. 5G is the fastest growing segment in the wireless network infrastructure market. Of the segments that comprise wireless infrastructure in this forecast, the only significant opportunity for investment growth is in 5G. Regionally, CSPs in North America are set to grow 5G revenue from USD2.9B in 2020 to USD4.3B in 2021, due, in part, to increased adoption of dynamic spectrum sharing and millimeter wave base stations. (CN Beta, Laoyaoba, Gartner)

Huawei does not intend to give up and is still maintaining mobile phone shipments. The recently released P50 series does not support 5G and it is stuck with 4G. The Huawei P50 series has with Qualcomm Snapdragon 888 and HiSilicon Kirin 9000 SoCs only support 4G network. Huawei’s rotating chairman, Hu Houkun claims that in the next few years, Huawei’s series of smartphones will remain the leader in the market. (GizChina, My Drivers)

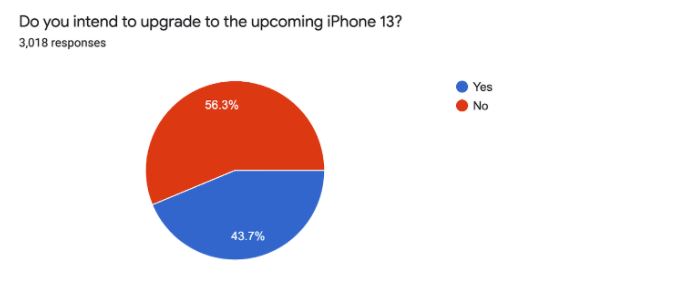

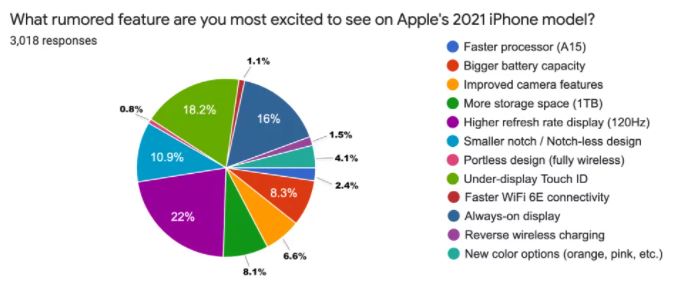

A new survey conducted by SellCell reveals that 44% of Apple’s current iPhone owners in the U.S. plan on upgrading to one of the new iPhone 13 models. Out of the 4 different options (iPhone 13, iPhone 13 mini, iPhone 13 Pro, and iPhone 13 Pro Max), the iPhone 13 was the most popular model followed by the iPhone 13 Pro Max. The survey, which surveys 3,000 U.S. iPhone users age 18 and up, has also revealed that the 120Hz variable refresh-rate display is the one that prospective buyers are most looking forward to. (Phone Arena, Sell Cell, 9to5Mac)

Beijing prosecutors have sued Tencent over claims WeChat’s restricted “youth mode” violates laws protecting children. The lawsuit is filed by Beijing’s Haidian District People’s Procuratorate. However, it did not reveal how WeChat’s “youth mode” was not complying with Chinese laws. (Neowin, Reuters, Engadget, CCTV, VoA)

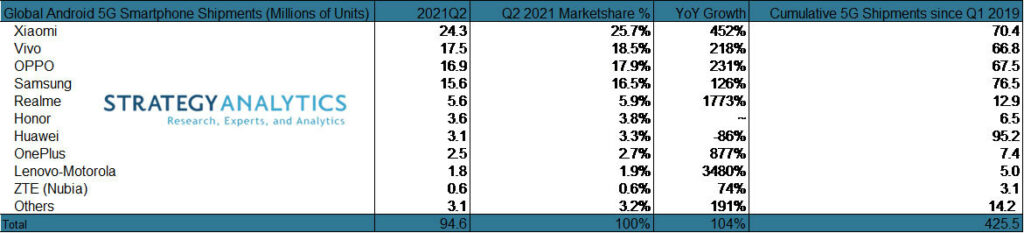

According to Strategy Analytics, Xiaomi is the world’s leading 5G Android smartphone vendor in 2Q21. On shipment volumes of 24M 5G smartphones, Xiaomi captured 26% share of all 95M 5G Android smartphones shipped globally in 2Q21. Over the past 9 quarters Xiaomi has cumulatively shipped 70M 5G smartphones. Lenovo is the 5G smartphone growth leader, with global shipments were up 3,480% annually in 2Q21, on volumes of 1.8M 5G smartphone shipments for the quarter. (Gizmo China, Strategy Analytics)

Samsung Galaxy A12 Nacho is announced in Russia – 6.5” 720×1600 HD+ v-notch, Samsung Exynos 850, rear quad 48MP-5MP ultrawide-2MP macro-2MP depth + front 8MP, 3+32 / 4+64 / 4+128GB, Android 11.0, side fingerprint, 5000mAh 15W, RUB11,990 (USD160) / RUB13,990 (USD175) / RUB16,990 (USD190). (GizChina, GSM Arena, Samsung, Gizmo China)

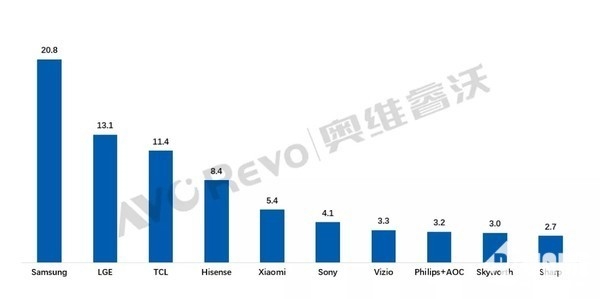

According to AVI Cloud, a total estimate of 98.3M smart TVs are shipped in 1H21, a 6.8% up YoY. It also reveals an impressive shift by consumers towards OLED TVs as an estimated 2.7M OLED TVs were shipped during this period representing a YoY increase of 133.3%. Samsung ranked first with an estimated shipment of 20.8M units, an increase of 11.9% YoY. This year makes it the 15th consecutive year Samsung has led the global smart TV market. LG comes in second place with an estimated shipment of 13.1M units. (Gizmo China, My Drivers, OfWeek)

The Chinese arm of Honda, Wuyang-Honda has added a new electric scooter to its lineup dubbed U-GO Electric Scooter in the Chinese market. The standard model has a 1.2kW continuous-rated hub motor with a peak rating of 1.8kW, and a top speed of 53km/h. The second model has a lower power rating of 0.8kW while the top speed peaks at 43km/h. The standard version priced at CNY7,499 (USD1,150) and 1.2kW version is priced CNY7,999 (USD1,233). (Gizmo China, Honda)

Siemens Mobility has signed a binding agreement to acquire the Netherlands-based rail software provider Sqills for around EUR550M (USD651.84M) including an earn out. Sqills has created a scalable platform, S3 Passenger, which enables rail and bus operators to use an online booking system instead of legacy reservation systems. (CN Beta, Sqills, Railway Technology)

Xpeng has closed flat it its USD1.8B Hong Kong dual primary listing as the company said it would develop future models based on product platforms designed for international markets. Xpeng chairman He Xiaopeng has revealed that the company is developing smart-car technologies including a smart cabin and autonomous driving. It is selling P7 and P5 sedans and G3 sport-utility vehicles. Xpeng is making its cars in two Chinese factories and is building two new plants. The company already has a vertical take-off and landing (VTOL) prototype that is undergoing testing. (CN Beta, CNA)

Apple appears to be taking steps toward the electric vehicle (EV) business, which is expected to become its future growth engine, as the company has made contact with multiple Korean EV component manufacturers. Apple has reportedly talked with LG, SK and Hanwha, but the talks are still in the early stages. (Korea Times, Apple Insider)