8-13 #Life : MediaTek has announced Dimensity 920 and 810; TCL CSOT will have 9 production lines in 2024; Foxconn is reportedly in negotiations with three states in the U.S. to build EV plants; etc.

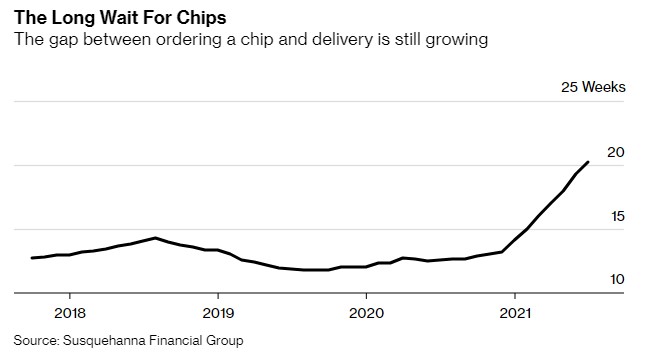

The amount of time it is taking for chip-starved companies to get orders filled has stretched to more than 20 weeks, indicating the shortages that have held back automakers and computer manufacturers are getting worse. Chip lead times, the gap between ordering a semiconductor and taking delivery, increased by more than 8 days to 20.2 weeks in Jul 2021 from the previous month, according to Susquehanna Financial Group. (CN Beta, Bloomberg)

MediaTek has announced that the Dimensity series of 5G mobile chips will launch 2 new products, namely Dimensity 920 and 810. The phone with the new platforms will be launched in 3Q21. Dimensity 920 is built with 6nm process, which improves game performance by 9% compared with Dimensity 900, and supports smart display technology and hardware-level 4K HDR imaging technology. Dimensity 810 is also built with 6nm process. The CPU is equipped with an ARM Cortex-A76 core clocked at 2.4GHz. It supports advanced camera features, including AI-Color technology in cooperation with ArcSoft, and in low-light environments with noise reduction technology. (CN Beta, GizChina, MediaTek, MediaTek)

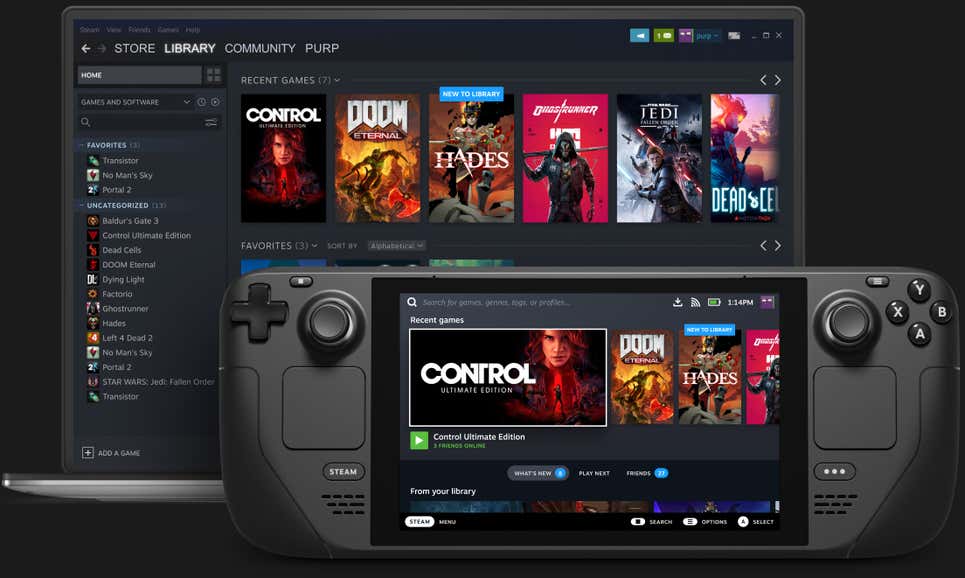

Valve is aiming to make its Steam Deck handheld gaming PC ready for Microsoft Windows 11. Valve has confirmed it has been heavily focused on Windows support. Valve is working with AMD to make sure that TPM is supported at a BIOS level, and that the Steam Deck is ready for Windows 11. (CN Beta, The Verge, Gizmodo)

TF Securities analyst Ming-Chi Kuo has revealed that Apple plans to launch a new MacBook Air with a mini-LED display and several color options around mid-2022. These new models are expected to feature a mini-LED display and flatter top and bottom edges. BOE will supply the mini-LED displays for the new MacBook Air, whereas LG, Sharp, and Foxconn subsidiary GIS will supply mini-LED displays for the upcoming MacBook Pro models. He predicts that the total MacBook Air shipments in 2021 will be about 5.5-6M units. He also predicts that thanks to the Mini LED MacBook Air, total shipments of MacBook Air will reach 8M or more in 2022. (CN Beta, Mac Rumors, TF Securities)

Jilin Oled Material Tech has indicated that as an organic light-emitting (OLED) material manufacturer, it has provided OLED materials to well-known OLED panel manufacturers such as Visionox, EverDisplay, TCL CSOT, BOE, Tianma and Truly Group, and maintains a good cooperative relationship. OLED Material Tech main business mainly includes terminal materials of organic light-emitting materials and evaporation source equipment. (Laoyaoba, FPDisplay)

TCL’s panel production capacity is growing, and there will be 9 production lines in 2024. In 2025, TCL will also have 6 high-generation lines. TCL’s t1, t2, and t6 factories maintained full production, the t7 ramps up as planned, and the acquisition of the t10 (formerly Samsung LCD factory in Suzhou) production line further expands its production capacity. The first phase of the t4 flexible AMOLED production line is completed, and the second and third phases of equipment were moved in. With differentiated technical reserves such as folding, camera under display, and LTPO, product development and customer cooperation in the high-end market were accelerated, and shipments doubled YoY growth. (Laoyaoba, 163, STCN)

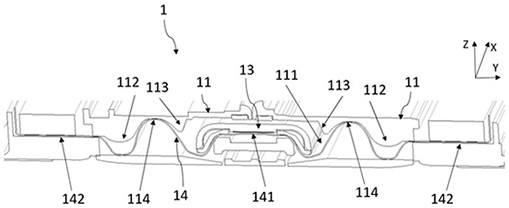

Honor has received a number of patents, including a utility model patent for “foldable device”. The device includes two frame bodies, a rotating shaft assembly hinged to the two frame bodies, and an electrical connection line; the two frame bodies can be rotated around the rotating shaft of the rotating shaft assembly to be folded or opened, and the two frame bodies are provided with accommodating cavities. (Laoyaoba)

Hyvision System will supply Foxconn with camera module inspection equipment. The kit inspections whether the wide, ultra wide and telephoto cameras’ optical axis and image sensors are aligned correctly. Hyvision will be supplying its inspection kits for camera and 3D time of flight modules to LG InnoTek, while providing alignment inspection kits to Foxconn. Its main customer LG InnoTek is seeing its share in Apple’s camera supply chain increase from O’Film being knocked out. (Mac Rumors, The Elec)

According to TrendForce, server DRAM contract prices are much more varied than before. Regarding the price trend in Jul 2021, contract quotes for the mainstream 32GB RDIMMs rose by 5-7% MoM. However, the price hikes have led to a reduction in demand, and there are indications that server DRAM sales bits will register some decline for 3Q21. The release of server CPUs based on the new platforms is driving the procurement of higher-density 64GB RDIMMs, but this has not resulted in a significant corresponding increase in content per unit. The general trend for buyers is to replace two 32GB modules with one 64GB module, rather than a one-to-one replacement as DRAM suppliers previously expected. (CN Beta, TrendForce, TrendForce)

Synopsys has recently created a new physical interface for its DDR5 and DDR4 and next gen system-on-chips controllers using 5nm fab technology. This will allow creators of SoCs to acquire added support for both DDR5 and DDR4 memory utilizing the 5nm nodes. Synopsys is currently the leader in this interface, offering data transfer rates up to 6400MT/s. (CN Beta, WCCFtech, Synopsys)

Illinois Senator Dick Durbin has revealed that Samsung SDI is considering building a battery plant in central Illinois. Electric-vehicle startup Rivian has a factory in Normal and said in Apr 2021 that Samsung SDI would supply battery cells for its vehicles. One of the candidates left in the running is located in central Illinois near Rivian’s production facility in Normal. Samsung SDI states that it has been selected to be the main battery supplier for more than 30 vehicle electrification projects and counting. (CN Beta, Reuters, Reuters, Teslarati)

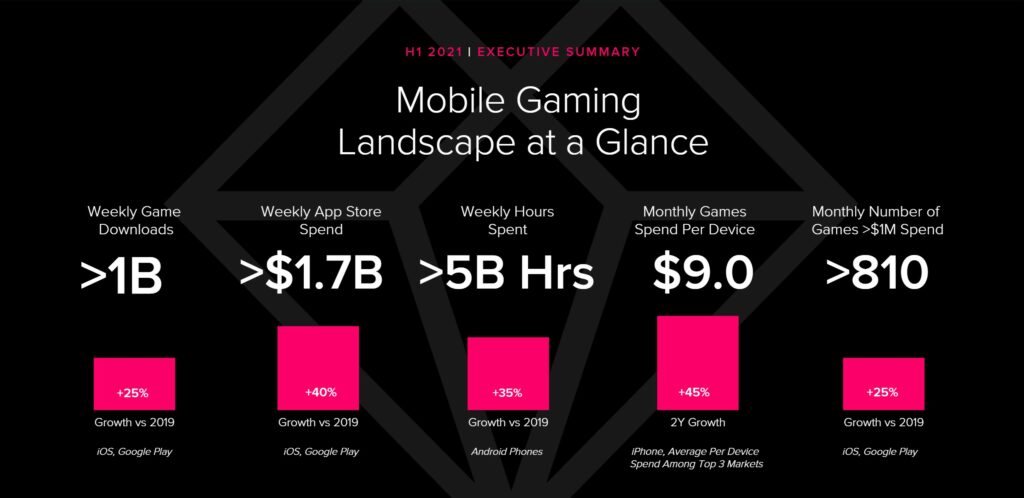

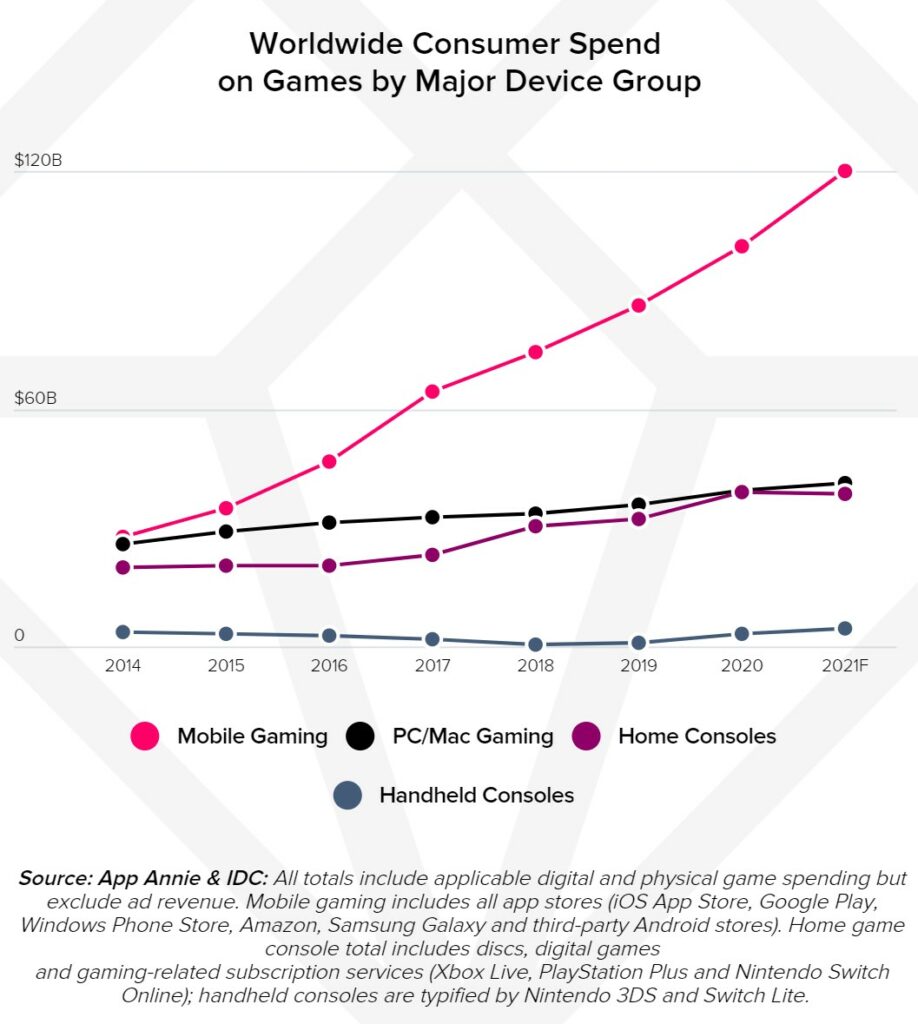

Mobile games are on track to surpass USD120B in spending in 2021, growing 20% over USD100B in 2020, according to an analysis of 1H21 results by App Annie. The growth of mobile gaming is impressive, but it is even more eye-opening to see how it compares to other gaming channels — 3.1x consumer spend on home game consoles in 2021. The console and mobile experiences are merging; mobile devices are now capable of offering console-like graphics and gameplay experiences along with cross-platform competitive and social gaming features. (VentureBeat, App Annie)

Samsung Electronics has unveiled Galaxy for the Planet, the sustainability platform for its Mobile Communications Business powered by its scale, innovation and spirit of open collaboration, to take tangible climate actions across its business. Samsung has established an initial set of targets to be reached by 2025 to reduce its environmental footprint and lessen resource depletion from production to disposal of its Galaxy products. (Laoyaoba, Samsung)

Xiaomi Mix 4 is announced – 6.67” 1080×2400 FHD+ CuD curved AMOLED 120Hz, Qualcomm Snapdragon 888+, rear tri 108MP OIS-8MP periscope telephoto 5x optical zoom OIS-13MP ultrawide + front 20MP CuD, fingerprint on display, UWB support, 8+128 / 12+512GB, Android 11.0, 4500mAh 120W, 50W fast wireless charging, CNY4,999 (USD770) / CNY6,299 (USD970). (Android Authority, Android Central, GSM Arena)

Samsung Galaxy Z Fold3 5G and Z Flip3 5G are announced: Fold3 – 7.2” 1768×2208 Foldable Dynamic AMOLED 2X 120Hz + 6.2” 1768×2208 Dynamic AMOLED 2X 120Hz, Qualcomm Snapdragon 888 5G, rear tri camera 12MP OIS-12MP telephoto 2x optical zoom OIS-12MP ultrawide, front camera 16MP camera under display, cover camera 10MP, 12+256 / 12+512GB, Android 11.0, side fingerprint, 4400mAh 25W, 11W fast wireless charging, 4.5W reverse wireless charging, supports S Pen, from USD1,799. Flip3 – 6.7” 1080×2640 Foldable Dynamic AMOLED 2X 120Hz + 1.9” cover display 260×512 Super AMOLED, Qualcomm Snapdragon 888 5G, rear dual 12MP OIS-12MP ultrawide + front 10MP, 8+128 / 8+256GB, Android 11.0, side fingerprint, 3300mAh 25W, 11W fast wireless charging, 4.5W reverse wireless charging, from USD999. (Android Headlines, Apple Insider, GSM Arena, Sammy Hub, CN Beta)

Moto G60S is official in Brazil – 6.8” 1080×2460 FHD+ HiD 120Hz, MediaTek Helio G90, rear quad 64MP-8MP ultrawide-5MP macro-2MP depth + front 16MP, 6+128GB, rear fingerprint, Android 11.0, 5000mAh 50W, BRL2,249 (USD430). (GSM Arena, Android Authority, Motorola)

Honor Magic3 series is announced, features 6.76” 1344×2772 HiD Super Curved OLED 120Hz, fingerprint on display, supports “iMAX ENHANCED” cinematic videograph and UWB: Magic3 – Qualcomm Snapdragon 888, rear tri 50MP-64MP monochrome-13MP ultrawide + front 13MP, 8+256GB, Android 11.0, 4600mAh 66W, stereo speakers, EUR899. Magic3 Pro – Qualcomm Snapdragon 888+, rear quad 50MP-64MP monochrome-13MP ultrawide-64MP periscope telephoto 3.5x optical zoom OIS + front dual 13MP-3D ToF, 8+256, Android 11.0, 4600mAh 66W, 50W wireless charging, IP68, stereo speakers, EUR1,099. Magic3 Pro+ – Qualcomm Snapdragon 888+, rear quad 50MP-64MP monochrome-64MP ultrawide-64MP periscope telephoto 3.5x optical zoom, 12+512GB, Android 11.0, 4600mAh 66W, 50W wireless charging, IP68, stereo speakers, EUR1,499. (GSM Arena, My Drivers, Android Headlines, 9to5Google, TechAdvisor)

Xiaomi Mi Pad 5 and Mi Pad 5 Pro are announced features 11.0” 2560×1600 WQHD+ Dolby Vision 120Hz, Dolby Atmos, supporting keyboard case and stylus, priced at CNY399 (USD62) / CNY349 (USD54), respectively: Pad 5 – Qualcomm Snapdragon 860, rear dual 13MP-5MP ultrawide + front 8MP, 6+128 / 6+256GB, Android 11.0, 4 speakers, 8720mAh 33W, Wi-Fi version CNY1,999 (USD308) / CNY2,299 (USD354). Pad 5 Pro – Qualcomm Snapdragon 870, rear dual 50MP-5MP ultrawide + front 8MP, 6+128 / 6+256 / 8+256GB, Android 11.0, 8 speakers, 8600mAh 67W, Wi-Fi version CNY2,499 (USD385) / CNY2,799 (USD431) / CNY3,499 (USD539). (GSM Arena, GizChina, Mi.com, Mi.com, Fonearena)

In 2020, Microsoft partnered up with EY to build an end-to-end COVID vaccines’ distribution solution. The U.K.-based firm has collaborated with Microsoft on other fronts too, such as using intelligent automation through leveraging Microsoft AI. Microsoft will be expanding its collaboration with EY, with the aim of creating USD15B in growth opportunity for their clients over a period of 5 years. (Neowin, Microsoft, Microsoft)

Samsung Galaxy Watch4 and Watch4 Classic are official, powered by Samsung Exynos W920, having Bluetooth and LTE versions. The Watch4 series centers on health with plenty of new features and an entirely redesigned 3-in-1 sensor. The Samsung bioactive sensor on the back of the Galaxy Watch4 devices measures PPG (a technique detecting volume and blood flow), ECG (heart rhythm), and BIA (method of assessing body composition). The Watch4 series starts from USD249. (GSM Arena, Samsung Mobile Express)

Samsung Galaxy Buds2 is announced, priced at USD150 featuring Active Noise Cancellation (ANC). The buds have a dynamic two-way speaker. It is split into a woofer and a tweeter, promising clear high notes and deep atmospheric lows. A dedicated Voice pickup unit (VPU) helps filter in only your voice to the other party and not external noises. (Android Headlines, GSM Arena)

Xiaomi CEO Lei Jun has showcased the company’s first quadruped robot named CyberDog. CyberDog’s “brain” consists of Nvidia’s hefty Jetson Xavier NX module, which packs 384 CUDA cores, 48 Tensor cores, six Carmel CPU cores, and two cores dedicated to deep learning. This module grabs and crunches information from CyberDog’s 11 sensors which enables and informs the robot’s movement through the world. That movement uses Xiaomi’s custom-developed servos to perform tricks like backflips and other “high-speed movements” at up to 3.2m/s (11.5 km/h or 7.15 mph). (My Drivers, The Verge, Mi.com, Android Authority)

As part of a broad-reaching partnership to advance 5G-powered drone technology, T-Mobile and The Drone Racing League (DRL), the global, professional drone racing property, have launched their first 5G-enabled drone. The Magenta 5G Drone is a compact quadcopter that delivers over 2.4kg of thrust. It has a flight time of 5 minutes per charge of its lithium-polymer battery, which is reportedly sufficient for it to fly through an entire mile-long course at speeds of over 96.5km/h. (CN Beta, T-Mobile, New Atlas)

Hermeus, the aerospace company developing Mach 5 aircraft, has announced the signing of a USD60M U.S. Air Force partnership for flight testing its first aircraft, Quarterhorse. Quarterhorse will validate the company’s proprietary turbine-based combined cycle (TBCC) engine, based around the GE J85 turbojet engine, and is the first in a line of autonomous high-speed aircraft. (CN Beta, Flight Global, PR Newswire)

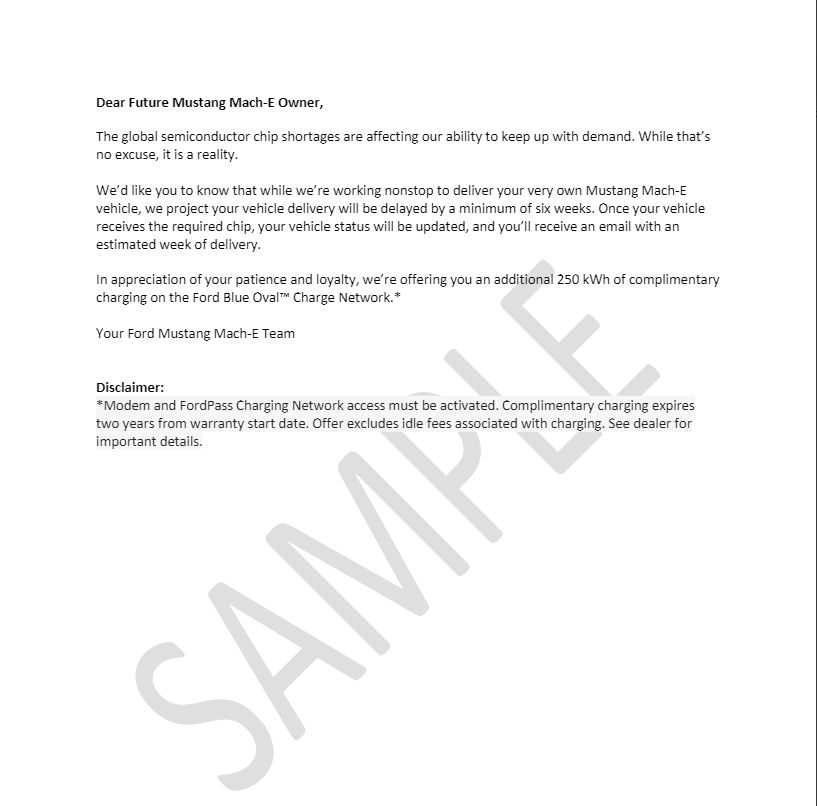

Ford has sent out an email to future Mach-E owners warning of a 6-week delay in delivery times for orders produced or scheduled in 5 Jul – 1 Oct. To compensate affected customers, Ford will provide an additional 250kWh (about 700 miles) worth of complimentary charging to affected owners. Ford blames the delay on the global semiconductor shortages that are plaguing much of the industry right now. (The Verge, Mache Form, Electrek)

Autonomous driving startup Pony.ai has put on hold plans to go public in New York through a merger with a blank-check firm at a USD12B valuation, after it failed to gain assurances from Beijing that it would not become a target of a crackdown against Chinese technology companies. (CN Beta, Reuters, Sina, Caixing Global)

BYD has successfully delivered an additional 76 BYD eBuses to major Nordic public transport operator, Nobina, for use in the Finnish capital, Helsinki. The fulfilment completes Finland’s largest ever electric bus order – a 119-unit order for Nobina – and represents BYD’s second-ever delivery to Finland following the arrival of 43 units to Turku in Jun 2021. (CN Beta, BYD, Electrive)

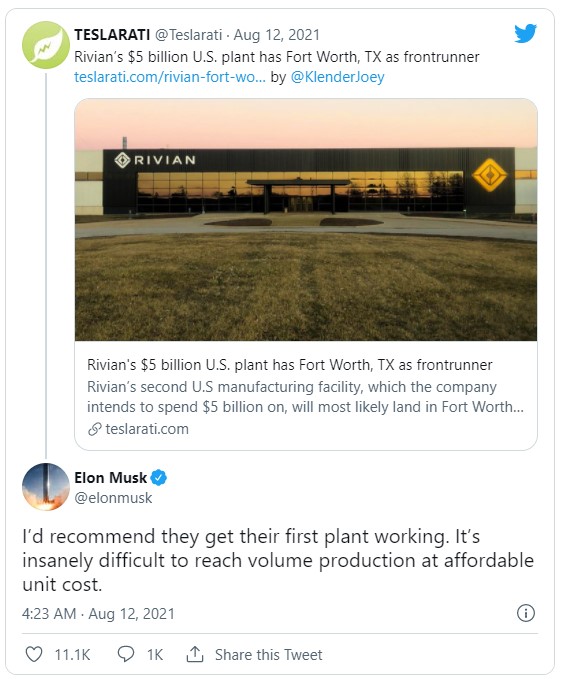

Amazon backed electric vehicle (EV) company Rivian is in discussions to invest at least USD5B in a new vehicle plant near Fort Worth, Texas. Tesla CEO Elon Musk has offered his advice to Rivian that in his experience, it is better to ensure your first production location is not only running but to also reach volume production while keeping the cost down. (CN Beta, Inside EVs, Bloomberg, Reuters)

Foxconn is reportedly in negotiations with three states in the U.S. to build EV plants, and one of those states is Wisconsin. In Thailand, Foxconn has partnered with Thai oil and gas conglomerate PTT to develop a platform for EV and component production. The U.S. plant will serve clients such as Fisker by the end of 2023. (Apple Insider, Asia Nikkei)