8-27 #Weekend : Samsung Electronics is expected to raise foundry prices in the near term; VinTech-backed Spanish phone maker BQ files for bankruptcy; FIH Mobile and Stellantis have announced that they have entered into a joint venture agreement; etc.

The US Department of Energy’s Argonne National Laboratory has tapped Nvidia’s A100 GPUs paired with AMD’s CPUs for its new Polaris supercomputer. Polaris will employ four Nvidia A100s and two AMD CPUs per node, for a total of 2,240 Nvidia GPUs spread across 560 nodes. Polaris will deliver up to 44 PetaFLOPS of FP64 performance, meaning it will be a much less powerful machine than the planned Aurora exascale supercomputer that will deliver up to one ExaFLOP of sustained performance when it arrives in 2022-2023. (HPC Wire, DCD, Tom’s Hardware, CN Beta)

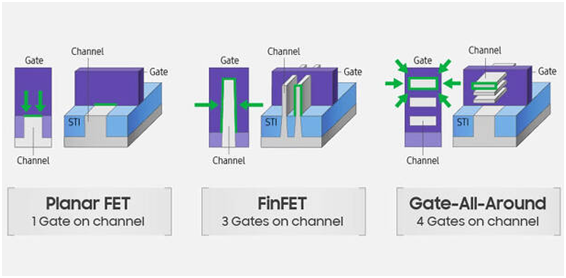

Jeong Eun-seung, CTO of Samsung Electronics’ Device Solution (DS) Business Division, has declared early commercialization of gate all around (GAA) technology, the core of a next-generation foundry micro fabrication process. GAA is considered a key part of a 3nm process, which is to be adopted by top global foundry companies in the near future. Its key point is to change the structure of a transistor, which acts as ‘current switch’ inside semiconductors, from 3D (FinFET) to 4D (GAA). (Laoyaoba, UDN, Business Korea)

Nvidia has announced that it has acquired the start-up DeepMap, a firm that specialises in building high-definition maps for autonomous vehicles so that they can navigate on our roads more safely. With the purchase, NVIDIA inherits a company that has already produced mapping solutions for autonomous vehicles plus the expertise of its employees who have many decades of collective experience in mapping technology. (CN Beta, Nvidia, Seeking Alpha, Neowin)

Loongson has rolled out their 3A5000 processors built on their own “LoongArch” ISA. While the company continues claiming that LoongArch is “not MIPS”, the Linux kernel code they continue proposing for the mainline Linux kernel points to it being a close facsimile to MIPS. While Loongson has long produced MIPS-based processor designs, with their new processors they are using LoongArch as they describe as “a new RISC ISA” for the Chinese CPU market. (CN Beta, Phoronix)

Roughly 80% of all the chips in the world are made in Northeast Asia. Politicians realize how big a problem this is, and they have started to demand local manufacturing, with U.S. President Joe Biden introducing a plan for USD50B in chip research earlier 2021. Reshoring any industry, including semiconductors, is a years long process that requires billions in capital. There will be winners andlosers. And if it goes on too long, it will filter into the prices of all kinds of goods. RBC analyst Joseph Spak argues the shortage could last for years. Part of the problem is structural, Spak says. (Barron’s, press, CN Beta)

Samsung Electronics is expected to raise foundry prices in the near term as surging demand is outpacing supply and massive investment has hurt profitability. Taiwan Semiconductor Manufacturing Co (TSMC) has decided to ramp up prices on products by as much as 20%. United Microelectronics Corp (UMC) also plans to hike prices in Sept, Nov 2021 and early 2022. Those Taiwanese chipmakers already increased prices by 10-20% in 1H21. The company expected revenue from its foundry business unit to rise more than 20% in 2021. (CN Beta, Money DJ, KED Global, LTN)

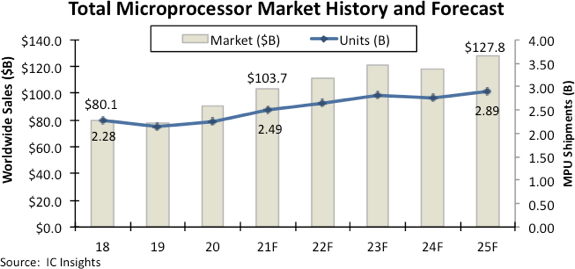

According to IC Insights, the total microprocessor MPU market is on track to exceed USD100B for the first time ever in 2021, thanks to strong increases in cellphone application processor revenues. IC Insights projects MPU sales to increase 14% in 2021, which will lift the total microprocessor market to a record-high USD103.7B, compared to a 9% increase that was expected in Jan 2021. (IC Insights, CN Beta)

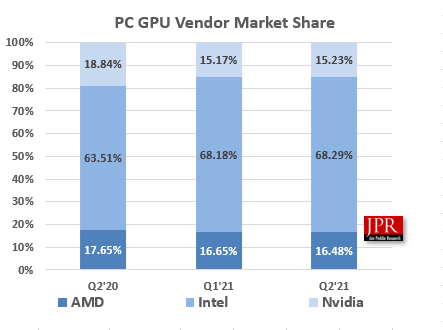

Jon Peddie Research reports the growth of the global PC-based Graphics Processor Units (GPU) market reached 123M units in 2Q21 and PC CPU shipments increased by 42% YoY. Overall, the installed base of GPUs will grow at a compound annual growth rate of 3.5% during 2020-2025 to reach a total of 3,318M units at the end of the forecast period. (CN Beta, Sina, TechPowerUp, Jon Peddie Research)

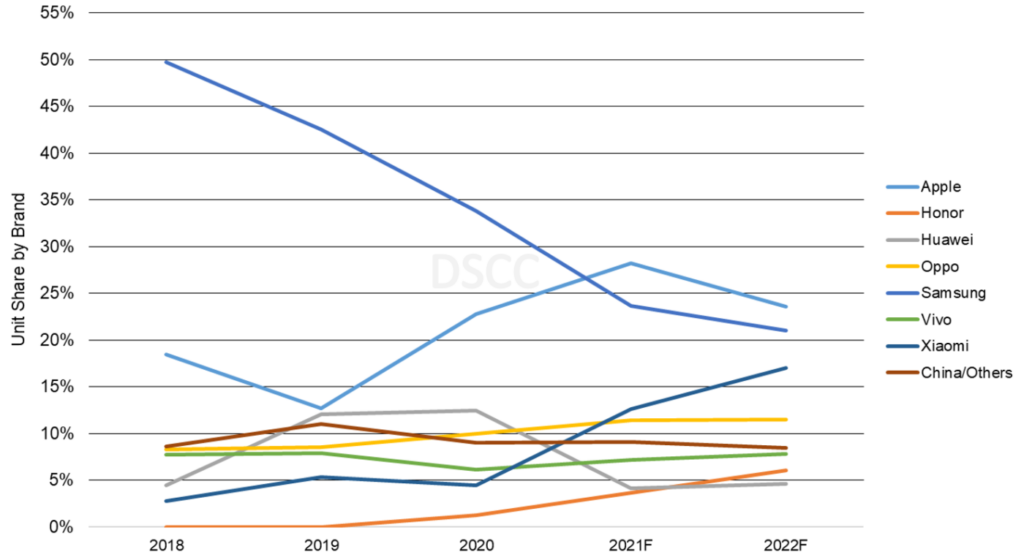

According to Display Supply Chain Consultants (DSCC), OLED smartphone shipments in 2021 are estimated to be approximately 630M units, and Apple is expected to reach the top position with 176M shipments, occupying 28% of the market. In contrast, Samsung is expected to ship about 145M OLED smartphones, with a market share of 23%. Apple’s lead is expected to continue next year. JPMorgan Chase has previously estimated that due to strong demand for iPhone 13, Apple’s shipments may reach 226M units in 2022. (CN Beta, Patently Apple, WCCFTech, The Elec, DSCC)

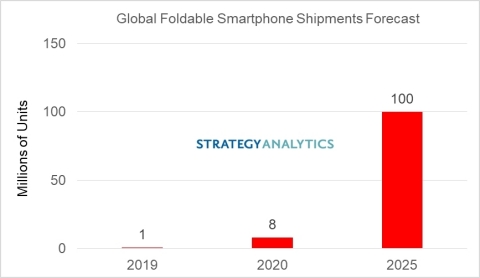

Strategy Analytics forecasts that global demand for foldable phones is expected to reach 6.5M units in 2021, three times as high as in 2020. By 2025, global shipments of foldable phones are projected to break 100M units with a CAGR at 113%. Samsung Taiwan vice president Jacob Chen has said they have doubled the budget for marketing the new foldable phones compared to that for the Note series, and expect to see the foldable phones’ sales reach the level that the flagship Note series had in 2020. (Digitimes, press, Gizmo China, Business Wire, Digitimes)

TCL’s China Star Optoelectronics Technology (CSOT) panel module factory in Tirupati, southeastern India is established on 10 Oct 2018. In Jan 2021, two small-size production lines and some production auxiliary materials are successfully delivered to the Indian factory. CSOT’s employees will all arrive in India in mid-Sept 2021 to officially start production and operation. (Laoyaoba, Sina, EET China, Digitimes)

DB HiTek, the second largest foundry in South Korea, will start supplying its self-developed OLED display driver IC to Samsung Display. According to data published by DB HiTek, by 1H21, the unit price of wafers manufactured with a 130nm process has increased from USD315-1,033 in 2020 to USD376-5,553. Thanks to its own brand of OLED DDI, the price of the most expensive wafer has risen 437% during the aforementioned period. DB HiTek’s customers mainly include LX Semicon (formerly Silicon Works), MediaTek and Texas Instruments. (Laoyaoba, Sohu, Korea Times, Business Korea, The Elec)

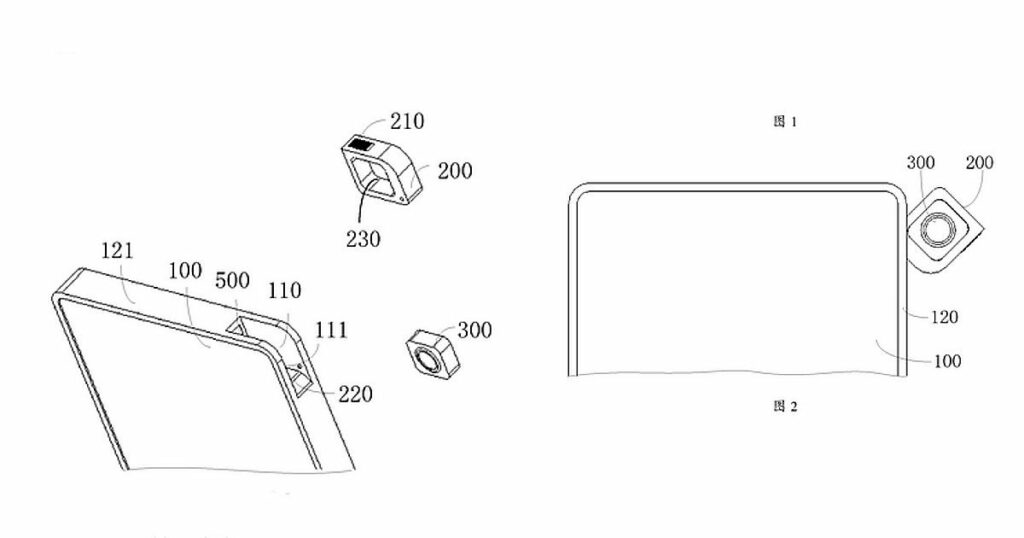

vivo has received a patent with WIPO for an innovative new design that details a detachable in display camera module. The patent details a design where the camera module itself is a detachable one, and resembles a tiny building block. The camera module can be attached to a slot at one of the top corners of a compatible smartphone, and once attached, remains entirely hidden from sight. (GizChina, MySmartPrice, WIPO)

Alphabet Inc’s self-driving unit Waymo has said that it has ended a 2-year effort to sell light detection and ranging (lidar) sensors to other companies. The company is now focusing on deploying its Waymo Driver tech across its Waymo One ride-hailing and Waymo Via trucking divisions. (TechCrunch, Reuters)

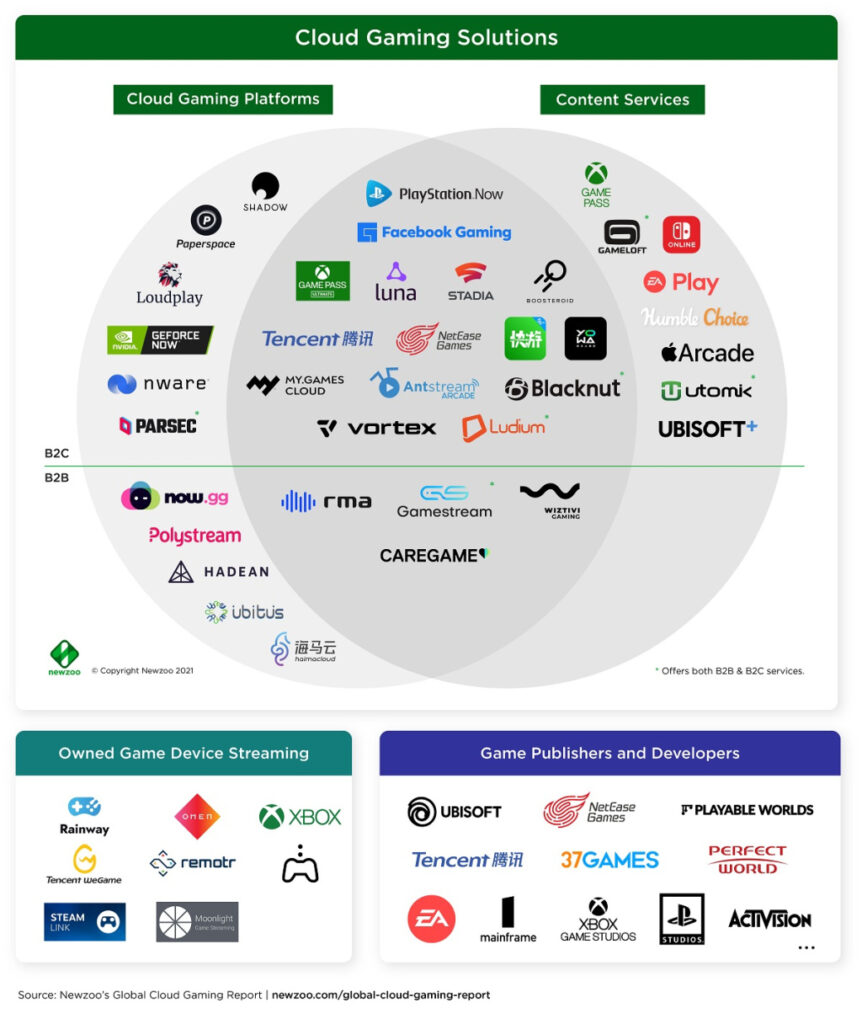

The global market for cloud gaming will hit 23.7M paying users and USD1.6B n revenues in 2021, according to Newzoo. The company forecasts the revenues will grow to USD6.53B in 2024. By that time, it will be about 3% of the USD200B global gaming market. (VentureBeat, Newzoo)

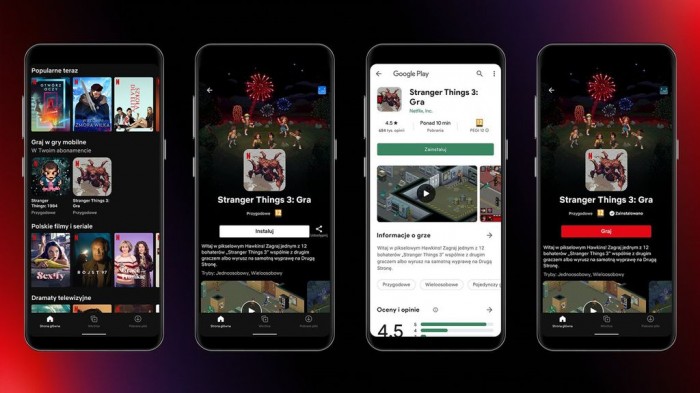

Netflix is taking its next step into gaming by allowing subscribers in Poland on Android to play two “Stranger Things” games — Stranger Things: 1984 and Stranger Things 3. Both games are displayed within the Netflix app and must be downloaded through Google Play. (CN Beta, Euro Gamer, CNET, The Verge, Twitter)

VinTech-backed Spanish phone maker BQ files for bankruptcy. BQ launched a smartphone features Ubuntu Touch in 2015. BQ is backed by a Vietnamese hardware company called Vingroup in 2019. The Bq brand is phased out in favour of Vingroup’s ‘Vsmart’ devies. Earlier 2021, the subsidiary filed for bankruptcy, and Vsmart is no longer making phones. (CN Beta, OMGUbuntu, Deal Street Asia)

Apple has announced an agreement in a lawsuit brought by U.S. developers against the company over its App Store practices, with terms including the institution of a USD100M Apple Small Developer Assistance Fund and more open communication between developers and customers regarding alternative payment methods. (The Verge, Apple Insider, Apple)

Jolla is formed in 2011 after Nokia canceled its MeeGo smartphone platform in favor of Windows Phone, with the Sailfish OS platform emerging as a result. After almost 10 years, Jolla has become profitable in 2020. The company reportedly saw revenues grow 53% year-on-year and EBITDA (earnings before interest, taxes, depreciation, and amortization) of 34%. (Android Authority, TechCrunch)

Short-form video giant TikTok is seemingly experimenting with the time limit on its uploads, potentially looking to expand videos to 5 minutes or longer. The platform already lengthened the maximum time to 3-minute uploads in Dec 2020. (Liliputing, TikTok, CNET, 9to5Mac)

Huawei nova Y60 is launched in South Africa – 6.6” 720×1600 HD+ u-notch TFT LCD, MediaTek Helio P35, rear tri 13MP-5MP ultrawide-2MP depth + front 8MP, 4+64GB, Android 11.0, side fingerprint, 5000mAh, ZAR3,099 (USD207). (Gizmo China, NDTV, Huawei)

Samsung Galaxy A21 Simple SCV49 is launched in Japan – 5.8” 720×1560 HD+ v-notch, Exynos 7884B, rear 13MP + front 5MP, 3+64GB, Android 11.0, no fingerprint scanner, 3600mAh 10W, IP68, JPY22,000 (USD200). (Gizmo China, au, Playful Droid)

vivo’s executive vice rresident Hu Baishan has revealed that the company’s tablet is set to launch in 1H22. (GizChina, IT Home)

Xiaomi Mi Notebook Pro and Mi Notebook Ultra are launched in India, powered by Intel Core i5-11300H / i7-11370H: Notebook Pro – 14” 2560×1600 60Hz Mi TrueLife Display, up to 16GB DDR4, 512GB SSD, fingerprint-power button combo, 2 x 2W stereo speakers with DTS Audio, 56Whr battery, from INR56,999 (USD770). Notebook Ultra – 15.6” 3200×3200 90Hz Mi TrueLife+ Display, up to 16GB DDR4, 512GB SSD, fingerprint-power button combo, 2 x 2W stereo speakers with DTS Audio, 70Whr battery, from INR59,999 (USD810). (GSM Arena, Mi.com, Mi.com, Twitter)

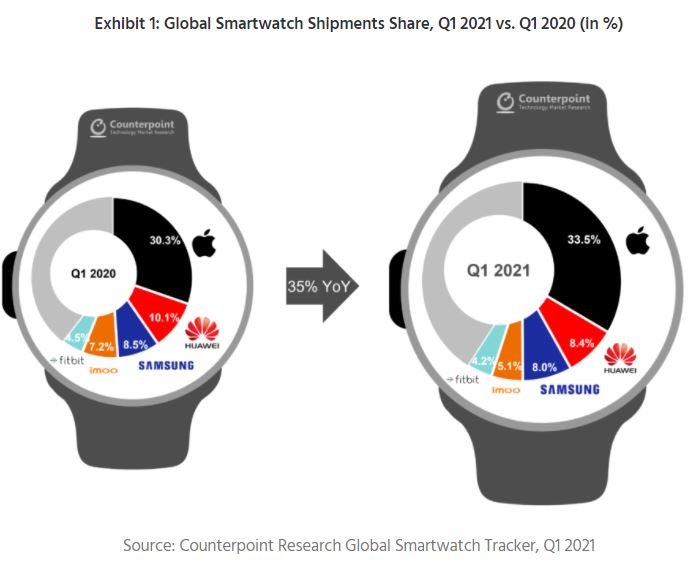

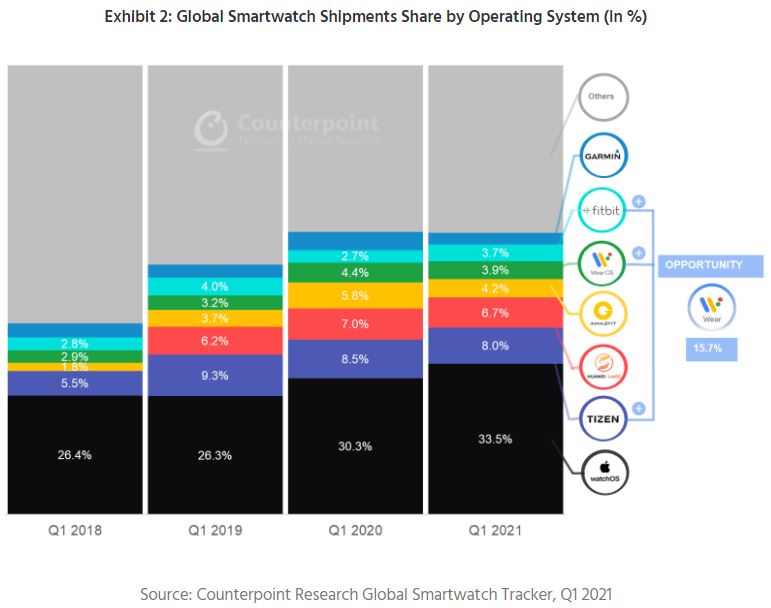

Global smartwatch shipments in 1Q21 grew 35% YoY, according to Counterpoint Research. Apple maintained its leadership position, catalyzing the overall market growth by recording a 50% YoY increase in the demand for the new Series 6 models. As a result, Apple saw its market share climb by 3% points. Samsung’s shipments also rose 27% YoY, with the popularity of the Galaxy Watch 3 and Galaxy Watch Active series. However, Samsung’s growth was below the market average and it saw a small dip in its market share. (GSM Arena, Counterpoint Research)

Hon Hai Precision Industry together with its subsidiary FIH Mobile and Stellantis have announced that they have entered into a joint venture agreement. Mobile Drive, the joint venture entity, will focus on delivering a smart cockpit solution for vehicles that will disrupt current design conventions and foster the development of intelligent connected vehicles. Mobile Drive will focus on developing infotainment and telematics solutions as well as a cloud service platform, which will aim to deliver a comprehensive smart cockpit solution. (Laoyaoba, First Post, Globe Newswire, Auto Home, 163)

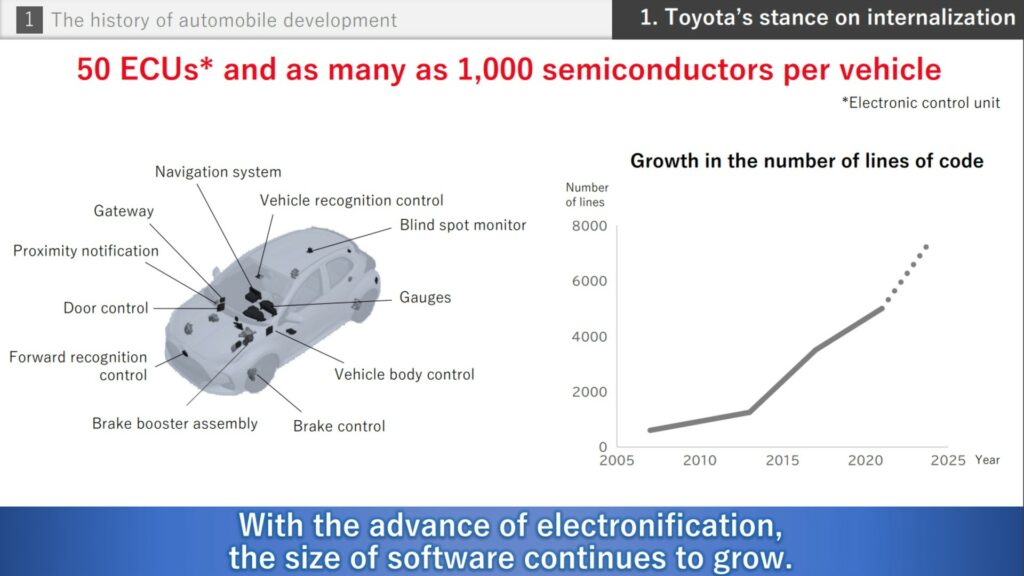

Chief Product Integration Officer at Toyota, Keiji Yamamoto, has indicated that Toyota will launch the new Arene Operating System within the next 5 years while starting from the new-generation Lexus NX in fall 2021, over-the-air updates will be offered more widely following the example of rival automakers Tesla and Volkswagen. Around 10M Lexus and Toyota vehicles manufactured to date are connected cars. (CN Beta, Auto News, Carscoops)

Data-mining firm Palantir has invested USD25M in Faraday Future (FF) shortly before the electric vehicle startup became a publicly traded company in Jul 2021, according to a previously unreported Securities and Exchange Commission (SEC) document. In addition, Faraday Future has signed a commercial contract to use Palantir’s software. (CN Beta, The Verge, Benzinga)

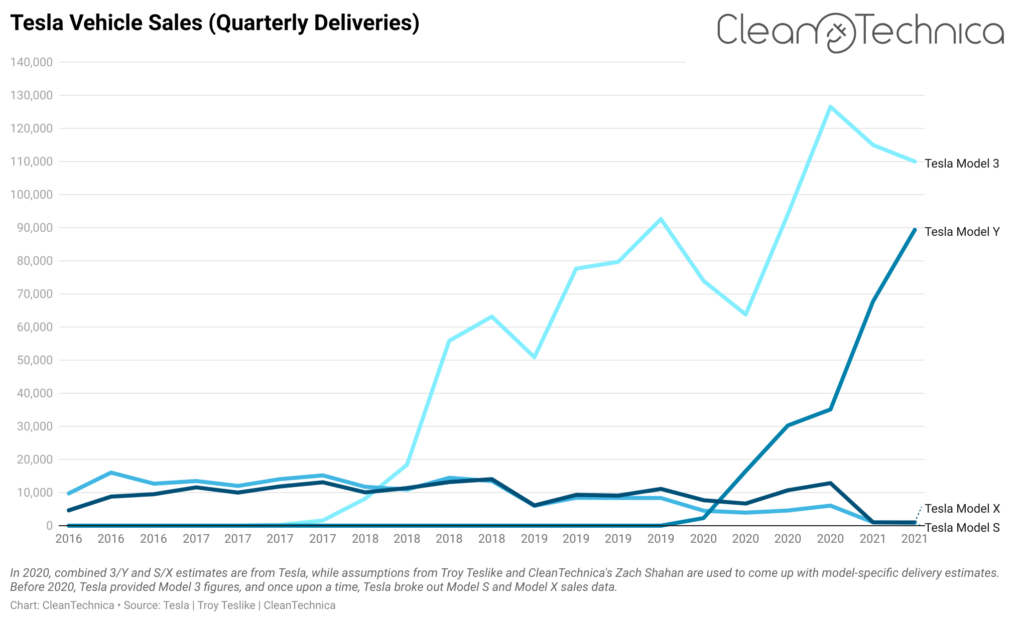

According to CleanTechnica’s long-term records, at the end of 2Q21, Tesla Model 3 has reached 1,031,588 worldwide deliveries. That makes the Model 3 the first electric car to pass 1M cumulative sales. Note that these are not 100% official figures, since Tesla reports Model 3 and Model Y deliveries combined. (CleanTechnica, CN Beta)

Xiaodu, the Baidu brand behind its DuerOS voice AI and smart device products, has closed an undisclosed Series B funding round, bringing its valuation to USD5.1B. The funding comes not long after a Nov 2020 Series A round which saw Xiaodu’s value rise to USD2.9B. (Laoyaoba, Baidu, Sohu, Voicebot.ai)