9-2 #Merdeka : TSMC will seek the equipment and material suppliers to reduce the price by at least 15%; Google reportedly plans to roll out the CPUs for laptops and tablets; OPPO’s ISP of its chip subsidiary ZEKU has already been taped out in early 2021; etc.

Xiaomi has invested in Motorcomm through the Hubei Xiaomi Yangtze River Industrial Fund. Motorcomm is working with research and the development of core communications chips that are found in vehicles. The firm is established in 2017 and its business scope includes technology development, industrial automation, automobiles, consulting, and other technical services as well. (Gizmo China, IT Home)

According to Digitimes, TSMC will increase its quotations for all manufactured products by 20% from 2022 in order to maintain its profitability. At the same time, TSMC also plans to negotiate with fab equipment manufacturers and material suppliers in 4Q21 on the price of 2022, and seeks to significantly reduce the price. TSMC will seek the equipment and material suppliers to reduce the price by at least 15%. (Digitimes, China Hot, CNYES)

Google reportedly plans to roll out the CPUs for laptops and tablets, which run on the company’s Chrome operating system, in around 2023. Google is also ramping up its efforts to build mobile processors for its Pixel smartphones and other devices after announcing it will use in-house processor chips for the first time in its upcoming Pixel 6 series. (Android Authority, Asia Nikkei, article)

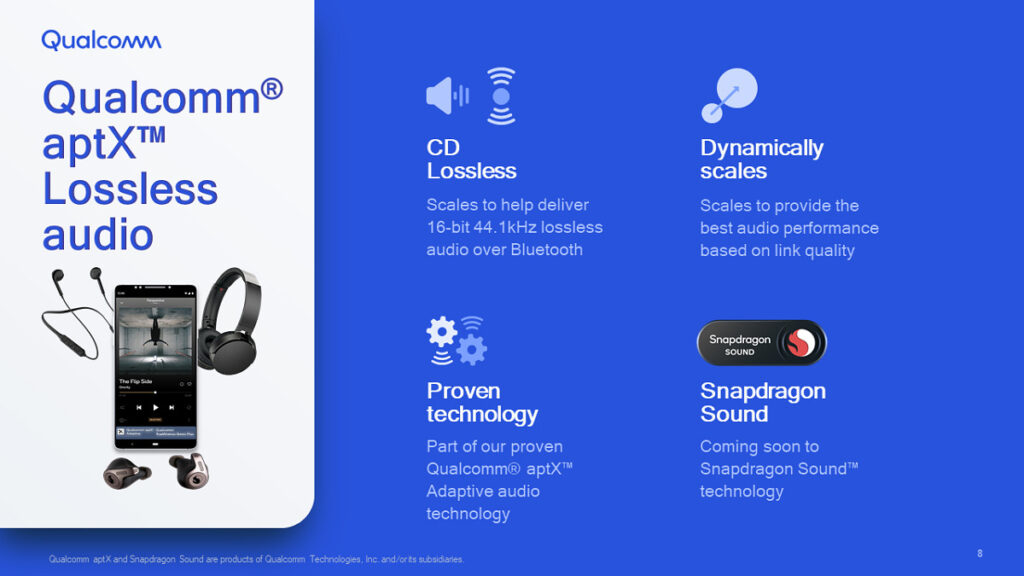

Qualcomm has announced the next generation of Bluetooth audio with its new aptX Lossless Technology. It is coming to next-generation earbuds equipped with Snapdragon Sound technology and will enable CD-quality audio over a Bluetooth connection. With aptX Lossless, users will experience CD-quality 16-bit 44.1kHz lossless audio from their Bluetooth earbuds and headphones. (CN Beta, Android Central, Qualcomm)

ASML’s next EUV system, a part of which is being built in Wilton, Connecticut, will use a new trick to minimize the wavelength of light it uses—shrinking the size of features on the resulting chips and boosting their performance—more than ever before. Each EUV machine is roughly the size of a bus and costs USD150M. It contains 100,000 parts and 2 kilometers of cabling. Shipping the components requires 40 freight containers, three cargo planes, and 20 trucks. (CN Beta, Wired, Asia Times)

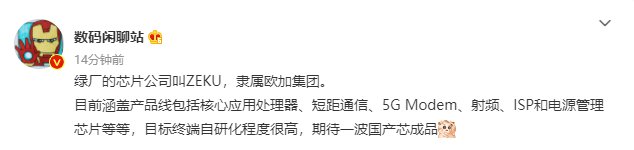

The Image Signal Processor (ISP) of OPPO’s chip subsidiary ZEKU has already been taped out in early 2021. The chip may be used on the Find X5 to be released in 1H22. In addition to ISP, the company is also developing phone SoC (System on Chip). (Sina, Semi Insights, Late Post, Laoyaoba)

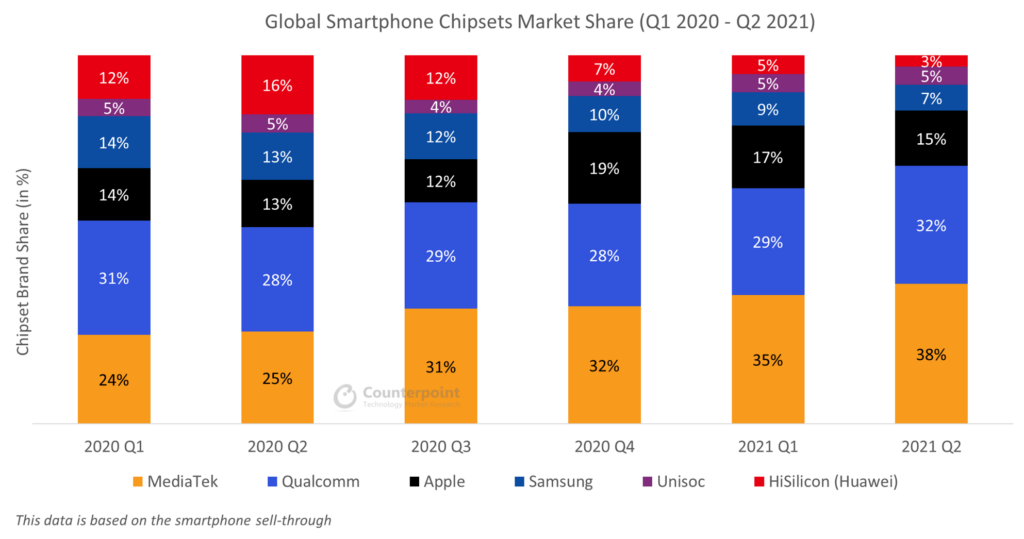

According to Counterpoint Research, MediaTek continues to be the leader in the smartphone market with a 38% share. Dimensity 700 series was dominating the 5G volume and Helio P35 and G80 are popular in the LTE segment. Qualcomm gained a share to reach 32% share, due to high-mid end 5G. The brand is focusing on a dual sourcing strategy from foundries to balance its offerings. (Laoyaoba, Counterpoint Research)

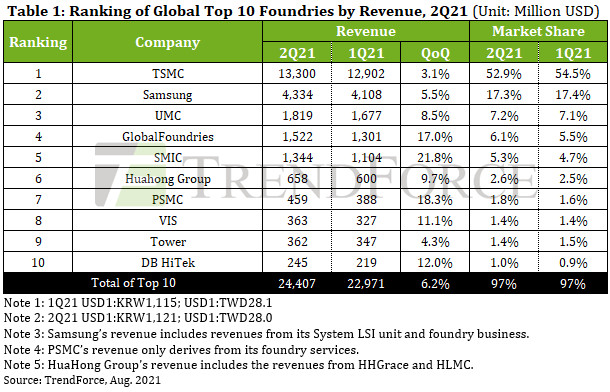

The panic buying of chips persisted in 2Q21 owing to factors such as post-pandemic demand, industry-wide shift to 5G telecom technology, geopolitical tensions, and chronic chip shortages, according to TrendForce. Chip demand from ODMs/OEMs remained high, as they were unable to meet shipment targets for various end-products due to the shortage of foundry capacities. In addition, wafers inputted in 1Q21 underwent a price hike and were subsequently outputted in 2Q21. Foundry revenue for the quarter reached USD24.407B, representing a 6.2% QoQ increase and yet another record high for the eighth consecutive quarter since 3Q19. (Laoyaoba, TrendForce, TrendForce)

OPPO’s first foldable phone will be released soon. It will use a Low Temperature Polycrystalline Oxide (LTPO) display. LTPO can realize the adaptive refresh rate adjustment function of 1-120Hz, which can be switched according to the usage scenarios, taking into account the needs of high refresh rate and low power consumption. (CN Beta, My Drivers, Sparrow News)

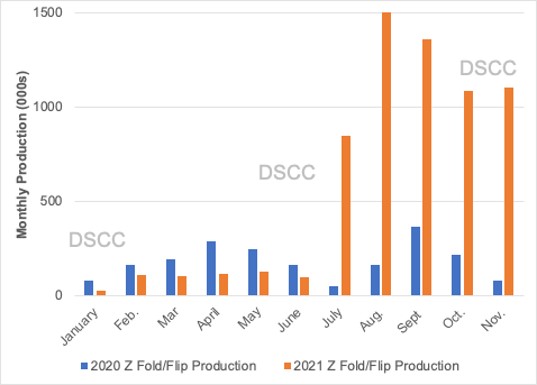

Samsung Display will increase its annual production capacity of foldables by 47% from the current 17M to 25M. Samsung will kick off the expansion project at its Bac Ninh plant in Vietnam within 2H21, targeting full operation by the end of 2021 or early 2022 at the latest. Once Samsung completes the expansion, the company will be able to produce 10M units of Z Fold models and 15M units of Z Flip models a year. (Android Authority, Korea Economic Daily, CN Beta)

Samsung reportedly has a foldable laptop dubbed “Galaxy Book Fold 17” in the pipeline. It implies a 17” display when unfolded. Samsung has showcased 17” foldable laptop (17.3” unfolded with 4:3 aspect ratio) before. (Android Headlines, Twitter)

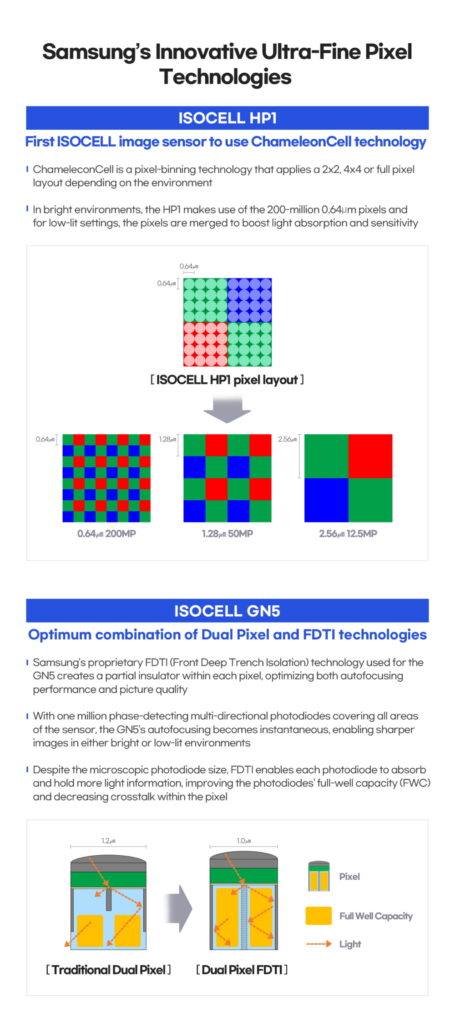

Samsung has introduced the ISOCELL HP1, the industry’s first 200MP image sensor with 0.64μm pixels, and ISOCELL GN5, the first image sensor to adopt all-directional focusing Dual Pixel Pro technology with two photodiodes in a single 1.0μm pixel. (Android Authority, Android Central, GSM Arena, Gizmo China, Samsung, Laoyaoba)

Kingston Digital has announced it is shipping DataTraveler Max, a high performance Type-C 1 USB leveraging the latest USB 3.2 Gen 2 standard. Seamlessly transfer and store large digital files such as HD photos, 4K/8K videos, music and more with top speeds and high capacities up to 1TB. Featuring a USB 3.2 Gen 2 interface, it can achieve speeds of up to 1,000MB/s read and 900MB/s write. (CN Beta, Business Wire, Beta News)

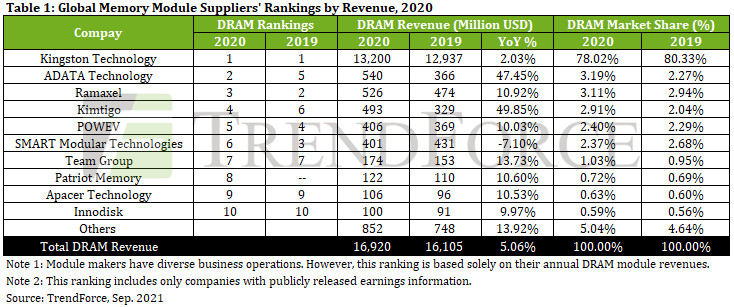

Annual shipment of notebook computers and desktop PCs underwent a massive increase in 2020 thanks to the proliferation of the stay-at-home economy brought about by the COVID-19 pandemic last year, according to TrendForce. In particular, notebook shipment increased by a staggering 26% YoY, thereby generating a corresponding demand for DRAM chips. Although the movement of DRAM prices remained stable in 2020, there was a palpable growth in actual DRAM bit demand. Hence, global DRAM module revenue increased by about 5% YoY to USD16.9B for 2020. (TrendForce, TrendForce)

Tesla’s installation of solar panels to Gigafactory Nevada has been ongoing since Feb 2018, though the expansion of the project has been very intermittent. The company set a concrete goal for the facility’s solar panel installations in its 2020 Impact Report, however, with Tesla stating that Gigafactory Nevada’s roof should be fully covered by solar panels by the end of 2022. (CN Beta, Teslarati, Industry Week)

Xiaomi is reportedly testing a device with a low-power photochromic / electrochromic back panel. Xiaomi is in the testing phase already. No confirmation if Xiaomi plans to launch this phone with a photochromic / electrochromic back panel or if it will just be a concept phone. (Android Headlines, Gizmo China, Sohu)

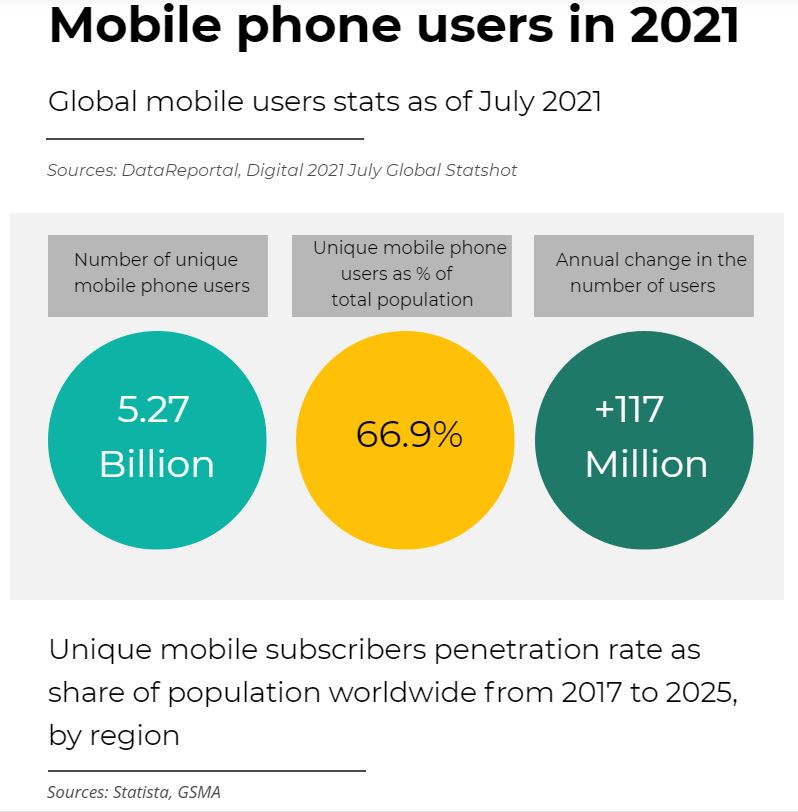

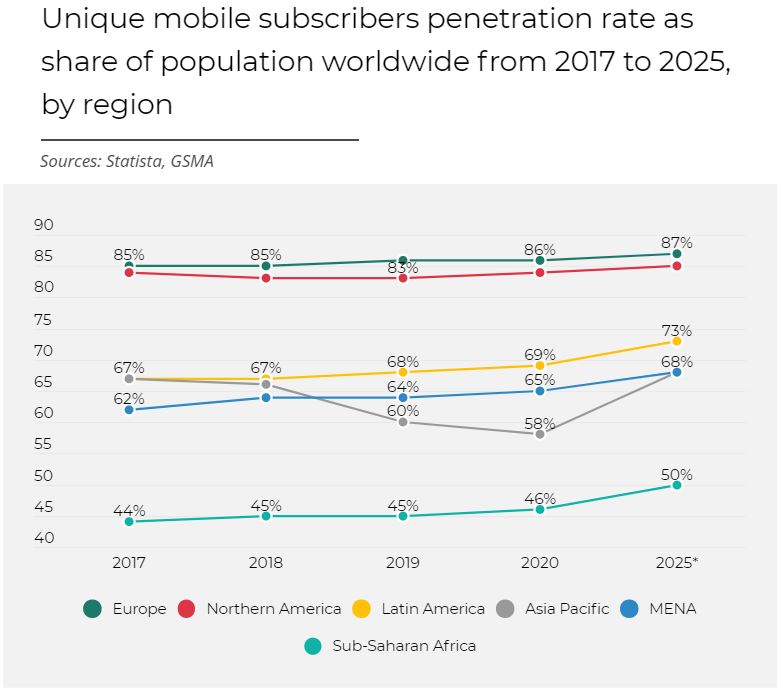

Although the COVID-19 caused the worst smartphone market contraction in history, the total number of mobile phone users continues growing with no signs of stopping any time soon. According to data presented by Stock Apps, the number of people using mobile phones hit nearly 5.3B in Jul 2021 or 67% of the world’s population. Analyzed by regions, Europe has by far the highest number of citizens using mobile phones. In 2020, 86% of Europeans had a mobile phone. By 2025, the penetration rate in the European market is expected to rise to 87%. (GSM Arena, Stock Apps)

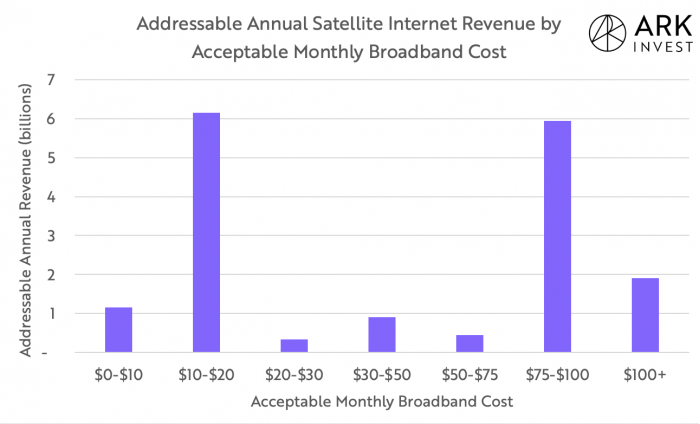

Space Exploration Technologies Corp’s (SpaceX) Starlink satellite internet constellation will have an addressable market of USD6B, believes Cathie Wood’s investment management firm, Ark Invest. Ark Invest bases its conclusions on a 12,000 Starlink satellite constellation, which will take years for SpaceX to deploy through its Falcon 9 rocket. (CN Beta, WCCFtech, Medium)

Apple has announced it has acquired Primephonic, the renowned classical music streaming service that offers an outstanding listening experience with search and browse functionality optimized for classical, premium-quality audio, handpicked expert recommendations, and extensive contextual details on repertoire and recordings. (MacRumors, Apple, CN Beta)

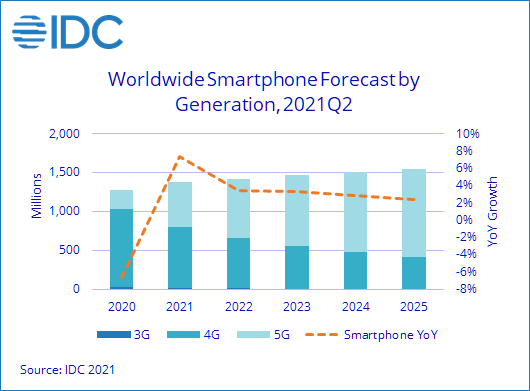

While the supply chain situation has not drastically improved, the smartphone market has shown positive results in recent quarters. According to IDC, shipments of smartphones are expected to grow 7.4% in 2021, reaching 1.37B units, followed by 3.4% growth in 2022 and 2023, respectively. The 7.4% growth can be attributed to a healthy 13.8% growth from iOS devices combined with 6.2% growth from Android. (Apple Insider, IDC, CN Beta)

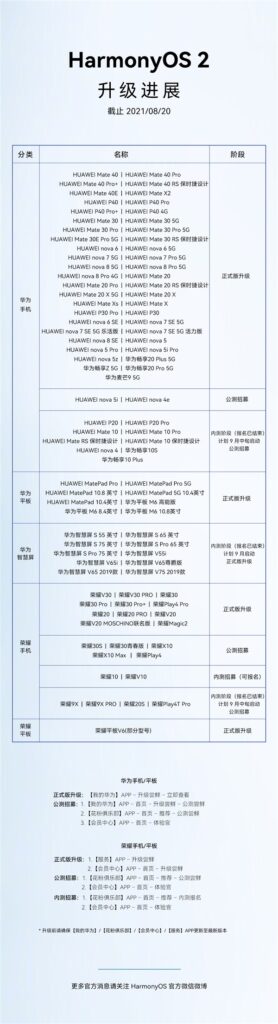

Huawei has celebrated 70M devices switching to Harmony OS, and reports also claimed “nearly” 100 models are eligible for the update. The 70M mark was reached in just under 3 months, and that is primarily Huawei and Honor devices in China. (GSM Arena, My Drivers)

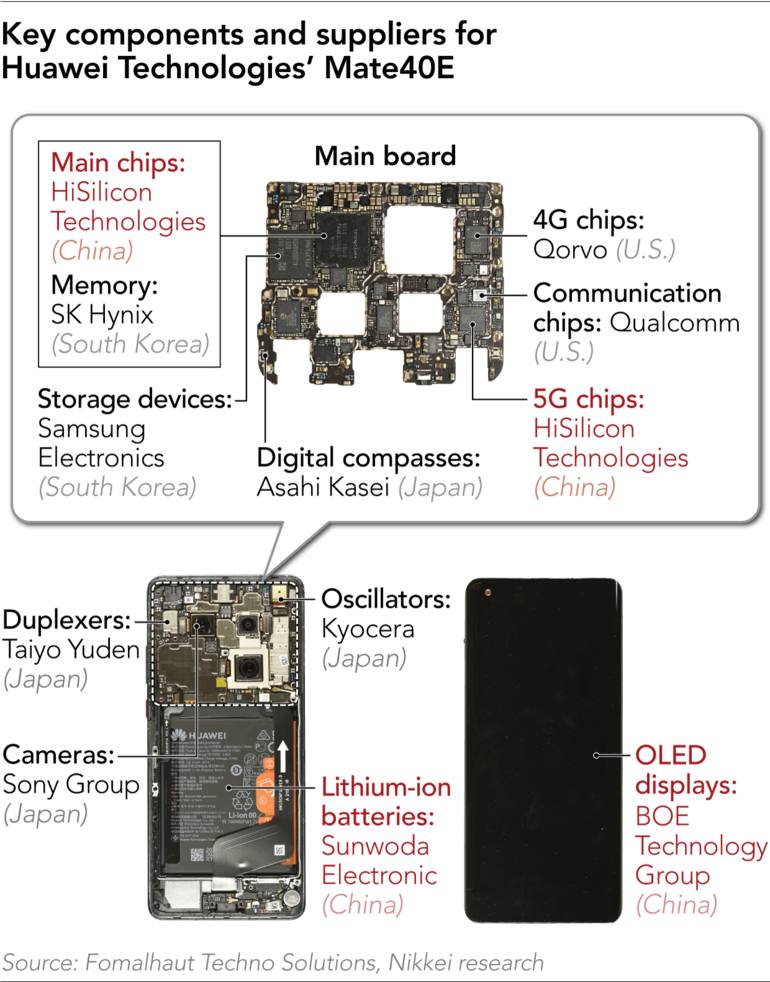

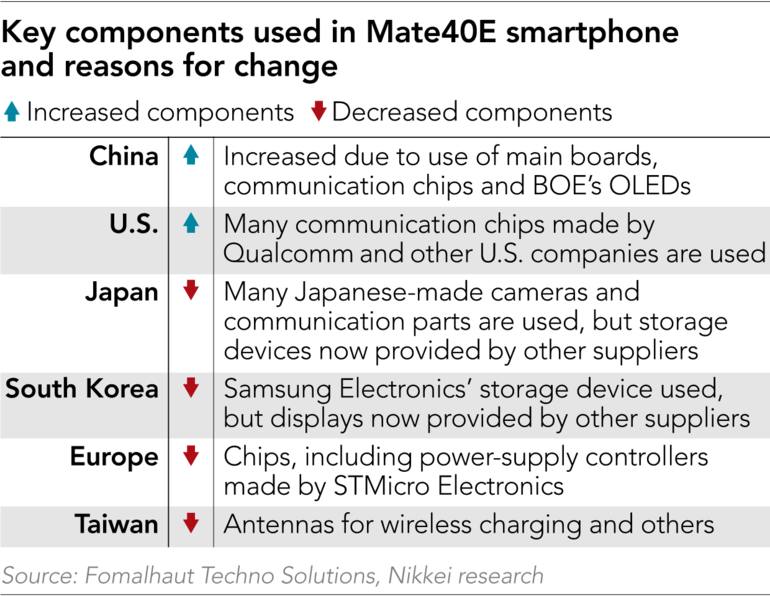

Huawei Technologies has sharply increased the use of parts made in China in its latest smartphone as U.S. sanctions banning American companies from selling to the Chinese telecommunications group continue. Fomalhaut has estimated the manufacturing cost of the Huawei Mate 40E to be USD367 — virtually the same as the Mate 30, which is launched in Sept 2019. The value of Chinese components was 56.6% in the Mate 40E, up from 30.0% previously. (Gizmo China, Asia Nikkei)

For more than 1 year now, Zoom has been on a mission to transform from an application into a platform. It made 3 announcements in 2020: Zoom Apps development tools, the Zoom Apps marketplace and a USD100M development fund to invest in some of the more promising startups building tools on top of their platform. The company has now announced the first roster of companies to receive cash injections from the fund. (VentureBeat, Zoom, TechCrunch)

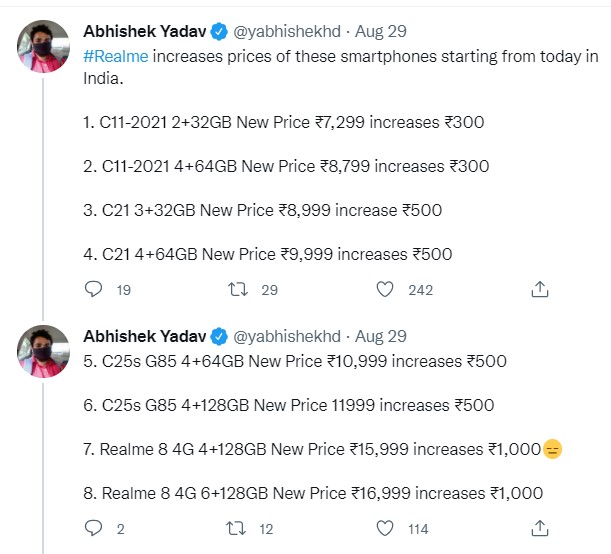

Starting from 30 Aug 2021, realme has officially raised the prices for a dozen smartphone models in India. The price hike arrives as other brands also raise their product price tags in the region due to component shortages. (Gizmo China, Twitter)

Open Invention Network (OIN), the largest patent non-aggression community in history, has announced that Xiaomi Corporation has become a licensee and community member of OIN. As a leading global smartphone, smart device and IoT platform provider, Xiaomi is reinforcing its commitment to open source software (OSS) as an enabler of advanced smartphones, smart devices and advanced IoT platforms. (CN Beta, Laoyaoba, Globe Newswire)

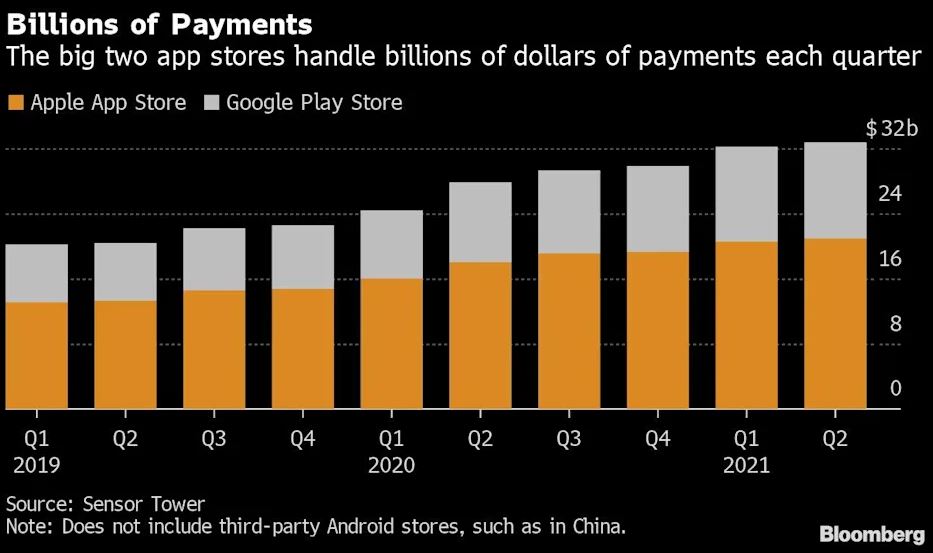

A new bill passed by South Korea’s National Assembly could significantly reduce Google and Apple’s dominance over app store payments. Companies could be fined up to 3% of their South Korea revenue if they fail to comply with new rules. The bill is expected to soon be signed into law by President Moon Jae-in. (Android Central, WSJ,Yahoo)

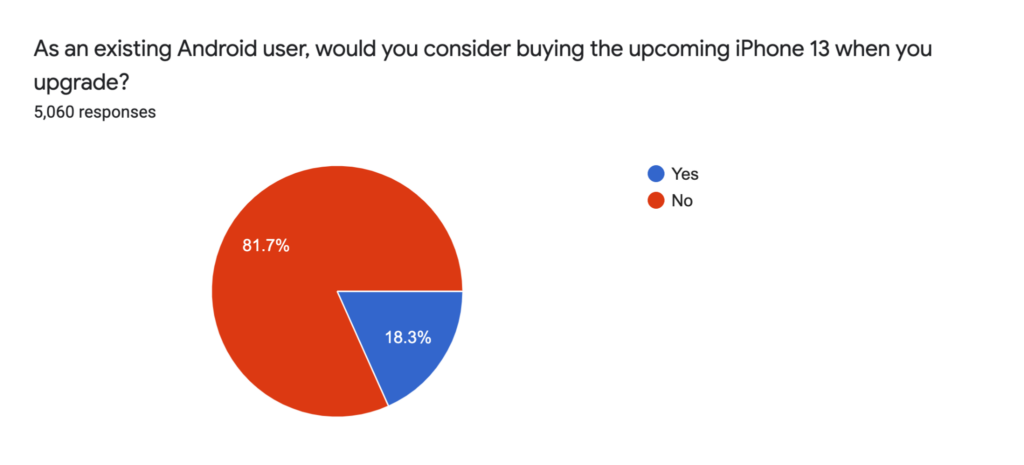

Online smartphone marketplace and comparison site SellCell has surveyed more than 5000 US-based Android users aged 18 and older. Around 82% of the respondents are not interested in switching to Apple iPhone 13 (expected to launch in 2H21). Only 18% has said they might consider getting the new iPhone. (GizChina, Phone Arena, SellCell)

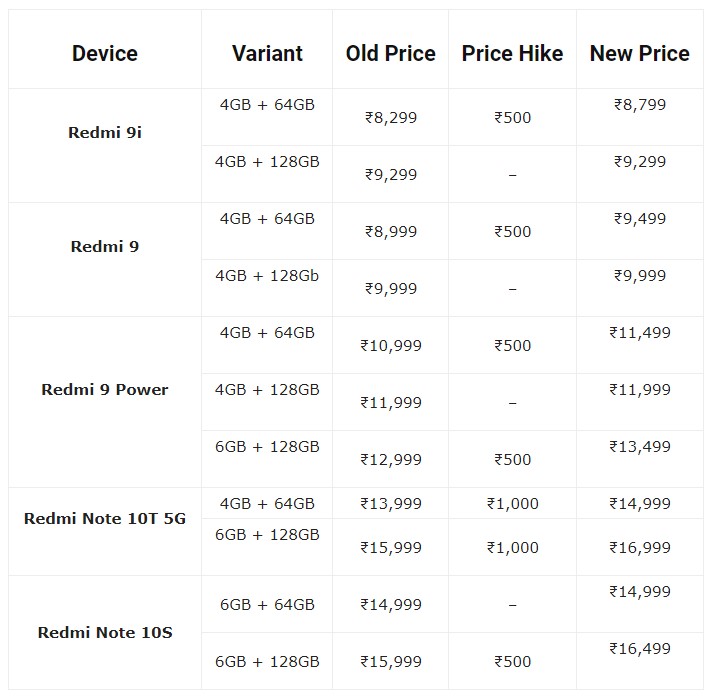

Xiaomi has quietly hiked the price of the Redmi 9 series and Redmi Note 10 series smartphones in India. (Gizmo China, MySmartPrice, Financial Express)

Tecno Spark 8 is launched in Nigeria – 6.5” 720×1600 HD+ v-notch, MediaTek Helio P22, rear dual 16MP-QVGA + front 8MP, 2+64GB, Android 11.0 Go, rear fingerprint scanner, microUSB, 5000mAh 10W, NGN50,000 (USD130). (GSM Arena, Gizmo China)

Fossil has announced its fall 2021 smartwatch lineup running Wear OS, Gen 6 Touchscreen. It comes with 44mm and 42mm cases, features 1.28” touchscreen, Qualcomm Snapdragon Wear 4100+, 1GB RAM, 8GB storage, up to 3ATM (30m) water proof, cost in USD299-319. (The Verge, Pocket-Lint, Phone Arena)

Apple is reportedly planning to add a raft of new health features to the Apple Watch, including blood-pressure trends, a thermometer for fertility and sleep tracking, sleep apnea detection, and diabetes detection, as well as a number of updates for existing models. Most of these new health monitoring functions are not expected to arrive before 2022. (MacRumors, WSJ)

Jabra is introducing 3 new models of TWS and phasing out both the Elite 65t and 75t by the end of 2021; the Elite 85t will remain part of the product family. Jabra says its latest devices — the Elite 7 Pro, Elite 7 Active, and Elite 3 — build upon “six generations worth of learnings” in the true wireless market. (Engadget, Engadget, The Verge)

Philips has announced Fidelio T1 is a high-spec pair of ANC-equipped TWS (true wireless) earbuds. They feature such as active noise-cancelling, Bluetooth 5.2 with hi-res LDAC codec support, 35-hour battery life and an IPX4 water-resistant rating helping to justify that. (Pocket-Lint, What HiFi)

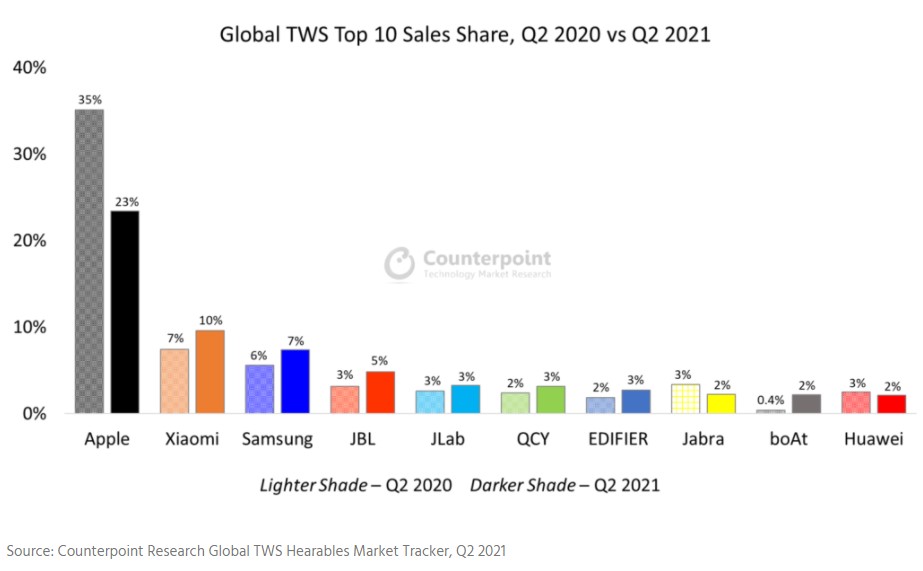

The global market for TWS hearables saw tepid QoQ growth in 2Q21, as typically strong spring sales waned across the US and Asia ex-China markets, resulting in overall unit sales and value rising by only 1% and 9%, respectively. On a YoY basis, although the market enjoyed 27% growth compared with 2020’s COVID impacted 2Q21, the rankings saw few new developments, although significant change did arise in terms of market share. (Counterpoint Research)

TikTok’s parent company ByteDance has acquired Chinese virtual reality headset maker Pico. ByteDance has claimed that Pico’s “comprehensive suite of software and hardware technologies, as well as the talent and deep expertise of the team, will support both their entry to the VR space and long-term investment in this emerging field”. (The Verge, CNBC, Upload VR)

Signify has announced that Philips Hue has created the first deep integration of lighting and music, providing consumers around the globe with an immersive light and music experience like no other. Thanks to Philips Hue + Spotify, the Philips Hue system is enriched with a new algorithm that analyzes the metadata of each song in real time to make the lights flash, dim, brighten, and color change right along with the beat, mood, genre and tempo of any music on Spotify. (CN Beta, Apple Insider, The Verge, Signify)

Philips Hue parent company Signify has refreshed much of its Philips Hue portfolio with several new smart bulbs, new multi-color gradient lamps and new software features designed to push the boundaries of the smart home ecosystem. The new Philips Hue Play Gradient Light Tube is designed to sit above or below a TV, adding a blend of multiple lighting colors in a single lighting fixture. The Light Tube comes in either black or white to match home theater setups. (Apple Insider, The Verge, MacRumors)

According to Morgan Stanley analysts Adam Jonas and Katy Huberty, Apple’s car strategy will likely focus on vertical integration, with the company having a hand in details such as the vehicle’s design, software and hardware communications, and even the car’s internal components and technologies. It is likely that Apple will focus on bringing services to the “Apple Car” and creating a new user base. (CN Beta, Apple Insider, MacRumors)

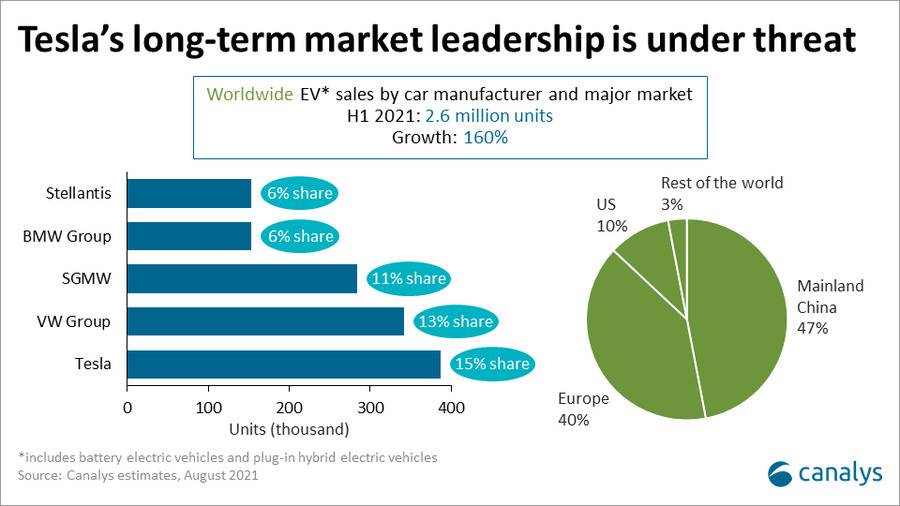

Canalys estimates that during 1H21, 2.6M electric vehicles (EVs) were sold on a global basis, up 160% on 1H20. EVs include fully electric vehicles and plug-in hybrid electric vehicles. Tesla led the worldwide market with a 15% share. With production in Mainland China in its second year, sales there remained strong. Tesla has been overtaken in Europe but continues to dominate in the US. Volkswagen Group was second with a 13% market share, and it led in Europe. (Laoyaoba, Canalys)

After a number of players including Toggle, Dusty, Scaled and SkyMul, founded in 2018, Houston-based Rugged Robotics raised a USD2.5M seed round back in 2019. It has already begun to roll out its technology in early pilots, including a partnership with Massachusetts-based construction-firm Consigli. Rugged’s self-described “layout Roomba” was used to help build a 10-story building in Cambridge, Massachusetts, effectively drawing blueprints on the ground of the space that amounted to around 40,000 square feet per floor. (CN Beta, TechCrunch, Construction)

To foster seamless communication in all areas of business, education, telemedicine, entertainment and more, Sanas will officially roll out the world’s first real-time speech accent translation technology. Their solution will be used by seven BPOs (Business Process Outsourcers) globally starting in the fall of this year. The company is also announcing its USD5.5M seed round of funding. (CN Beta, TechCrunch, Yahoo)

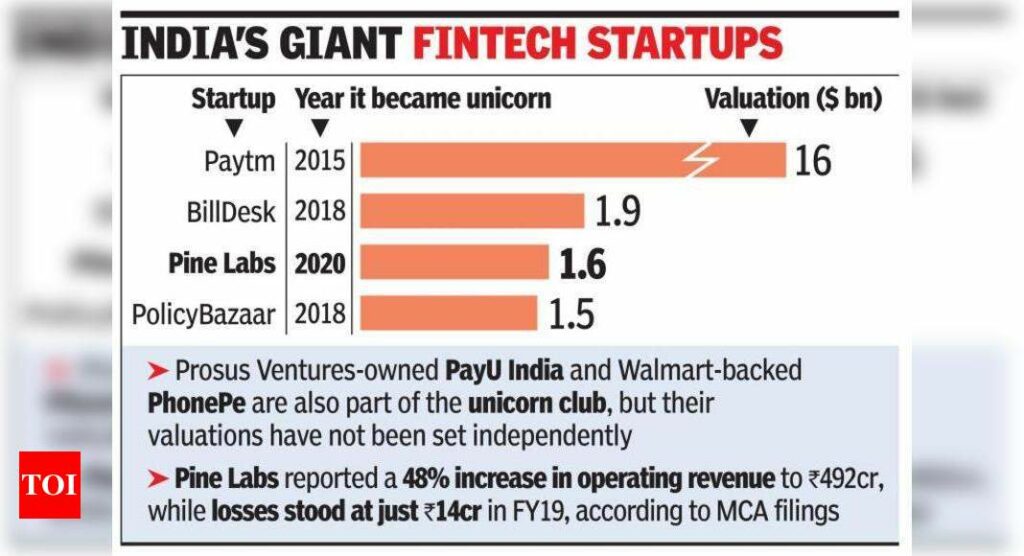

Prosus, the Dutch company that bundles together Naspers’ fintech, e-commerce and other international investments and businesses outside of South Africa (including a big stake in Tencent), has announced that it would pay USD4.7B to acquire BillDesk, a payments provider based in India. Prosus plans to combine BillDesk with PayU, its existing global fintech and payments business, which already has a strong presence in India. (TechCrunch, Reuters, Business Wire)

Samsung Pay is launched in India 4 years ago with support for credit cards and debit cards from various banks and financial institutions. American Express is among those banks that brought Samsung Pay support in the first phase. However, the bank has now announced that it will end Samsung Pay support in the country. (Sammy Hub, Sam Mobile, American Express)